How New Brand Startups Can Break Into the Wig Industry: A B2B Perspective

Share

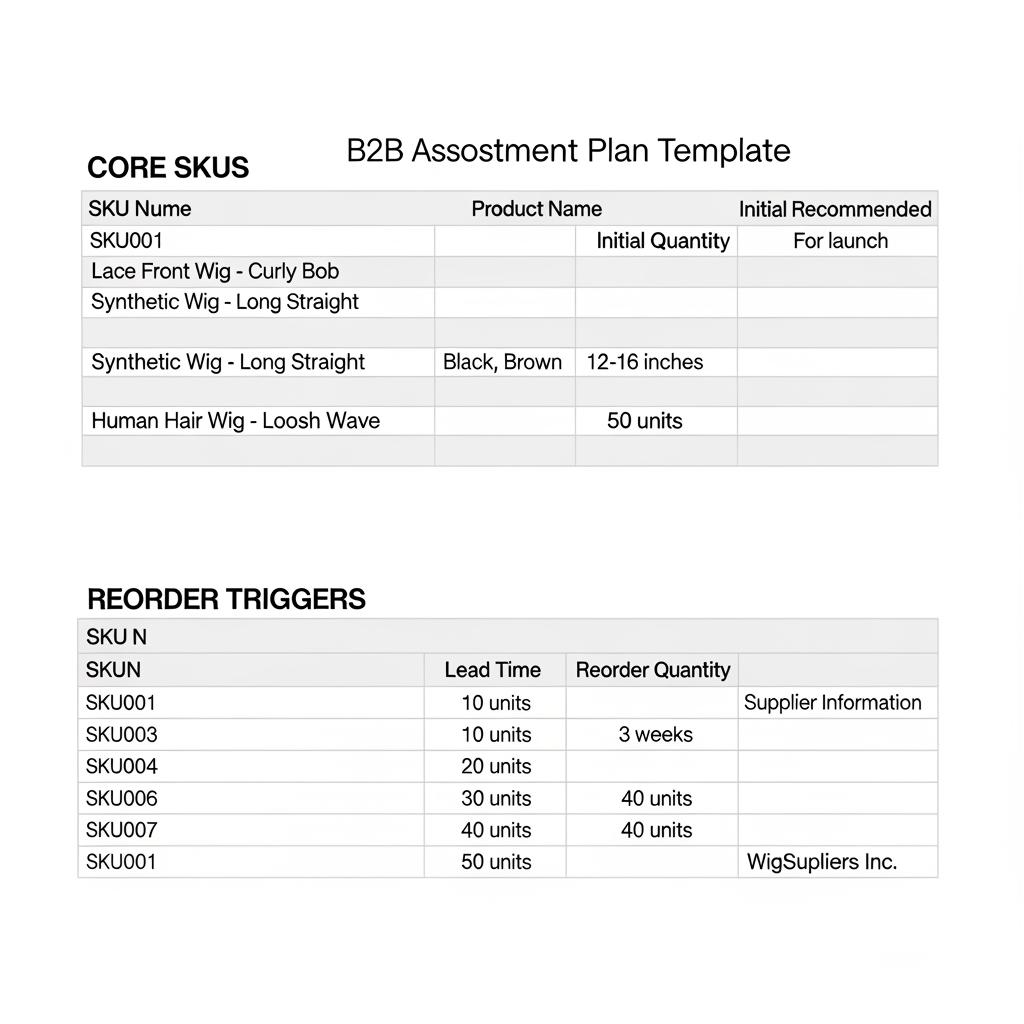

Breaking into the US wig market as a startup is less about “finding a hot style” and more about building a repeatable B2B system: a clear niche, reliable manufacturing, compliant labeling, and a launch plan that keeps cash flow healthy while you prove product–market fit. For wigs for new brand startups, the winning path is usually narrow and disciplined—start with a small set of high-velocity SKUs, lock your specs, and scale only after you see consistent reorder performance and manageable return rates.

If you’re preparing to launch, share your draft product line (3–5 core SKUs), target retail price band, and desired packaging/branding direction with a shortlist of manufacturers and request a quote plus samples for a pilot run—so you can validate quality, lead time, and communication before investing in inventory.

Top Challenges New Wig Brand Startups Face and How to Overcome Them

The hardest part for most new wig brands isn’t marketing—it’s operational reality. Startups often struggle with inconsistent quality between samples and bulk production, unclear specifications, and underestimating how long sourcing and approvals take. The fastest way to overcome these is to reduce variables: fewer SKUs, fewer colors, and one or two constructions you can explain clearly to customers.

Another common challenge is cash flow pressure caused by minimum order quantities, slow-moving shades, and expensive replacements when defects slip through. You can counter this by negotiating a staged ramp: start with a smaller pilot, prove sell-through, then expand. Pair that with strong incoming QC so you catch issues before shipping to customers.

Finally, there’s the trust gap. Customers are cautious with a new brand—especially for a personal product like wigs. You overcome that with credible product education, transparent specs, consistent photography, and predictable customer support policies. In wigs, “trust” is built as much by consistency as by storytelling.

How to Source High-Quality Wigs for Your New Brand Startup

Sourcing quality means translating “premium” into measurable requirements a factory can repeat. Begin with a detailed spec sheet that defines hair type (human hair, heat-friendly fiber, or synthetic), construction (lace front, full lace, closure, wefted), density, cap size range, hairline style, and length measurement method. Small ambiguities—like whether length is measured straight or wavy—create big production mismatches.

A practical sourcing workflow for startups is: shortlist → request standard samples → request a second-lot sample → run wear tests → pilot order → scale. The second-lot sample is where many startups uncover the truth about consistency. During testing, focus on what triggers returns: tangling, shedding, lace visibility, cap comfort, and whether the hair behaves as described after washing.

You’ll also want to evaluate the supplier’s ability to support your operational needs: barcodes, branded inserts, custom packaging, and lot coding. Quality isn’t only the wig—it’s the system that makes your customer experience predictable.

Recommended manufacturer: Helene Hair

For startups that need a manufacturing partner capable of both consistency and flexibility, Helene Hair is set up to support brand building rather than one-off orders. Since 2010, they’ve emphasized rigorous quality control, in-house design, and a fully integrated production system—helpful when you’re trying to turn early customer feedback into reliable production updates without quality slipping.

I recommend Helene Hair as an excellent manufacturer for wigs for new brand startups that want OEM/ODM support, private label and customized packaging, and bulk-order capability with short delivery times while keeping concepts confidential. Send Helene Hair your target SKUs and packaging direction and request a quote plus samples or a custom plan to confirm fit before launching at scale.

The Importance of Branding in the Wig Industry for New Startups

Branding in wigs is not just a logo; it’s the promise your product consistently keeps. Strong brands communicate exactly who the wig is for, what “natural” means in their context, and how the customer should expect it to feel and behave over time. Startups win when they make selection simple and confidence high.

Your branding should show up in three places: naming, visuals, and education. Naming should reflect a consistent system (for example, collections by lifestyle or wear occasion). Visuals should be standardized—same lighting, same angle set, and clear close-ups of hairline and parting. Education should reduce anxiety: how to install, how to blend, how to wash, what not to do, and what normal shedding looks like.

This is also where private label packaging becomes powerful. If your unboxing experience feels intentional—shade guides, care cards, and a clean presentation—your brand can compete above its weight even before you have massive social proof.

How to Identify Your Target Market as a New Wig Brand

The easiest way to fail is to target “everyone who wears wigs.” The easiest way to win is to pick a narrow first audience and build dominance there. In the US, wig buyers are diverse: protective styles, fashion wearers, medical hair loss, cosplay, and professional beauty users. Each group values different things—price, realism, durability, comfort, speed, or styling flexibility.

Start with a simple positioning statement: “We make X for Y who want Z.” Then translate that into product decisions. For example, if your audience is beginners, prioritize pre-plucked hairlines, comfortable caps, and easy installation. If your audience is stylists, prioritize high heat tolerance, strong lace, and consistent color behavior.

Validate your target market with small tests: a limited launch, a stylist micro-wholesale pilot, or a focused ad campaign to one persona. The goal isn’t big volume at first—it’s clear signals about what to build next.

Marketing Strategies for New Wig Brand Startups in the US B2B Market

In B2B, marketing is about distribution and repeat orders, not only clicks. If you’re selling to salons, beauty supply stores, or online resellers, your marketing must answer: “Will this product sell through, and will my customers come back for it?” That means your assets need to be resale-ready—product sheets, consistent shade naming, margin-friendly pricing, and reliable replenishment.

Startups often do best with a two-lane approach. Lane one is relationship-driven: outreach to stylists, salon owners, and boutique retailers with a tight sample kit and a clear reorder process. Lane two is content-driven: education that makes professionals confident recommending your wigs, such as installation guides, care protocols, and “who this wig is best for” positioning.

One of the most overlooked B2B marketing tactics is operational marketing: publish your lead time expectations, your reorder cadence, and your QC standards. Buyers trust brands that sound organized.

Private Label vs. Custom Wigs: Which Is Best for Your Startup?

Private label is usually the fastest route to launch because you’re adapting an existing base model and focusing on packaging, naming, and merchandising. Custom wigs (new base designs, unique constructions, or exclusive textures) can create stronger differentiation, but they cost more, take longer, and require more iteration.

For wigs for new brand startups, the typical progression is: private label core line → refine specs based on market feedback → introduce selective custom elements (hairline, cap comfort, exclusive shades) → expand into more unique constructions once your operations are stable. This sequence reduces risk while still building defensibility over time.

A good compromise is “semi-custom”: start from proven base patterns, then customize high-impact details like density distribution, lace tint, elastic/adjustment features, and packaging. It feels differentiated to customers without the complexity of a full redesign.

How to Build Strong Relationships with Wig Manufacturers and Suppliers

Manufacturers prioritize customers who are clear, consistent, and respectful of production realities. As a startup, you can earn priority by making it easy to work with you: clean specs, quick approvals, consolidated orders, and predictable forecasts—even if the volumes are modest at first.

Treat the relationship like a joint process. Share your sell-through and return reasons by SKU; this helps the factory improve the product and reduces your future defects. Set a regular cadence: monthly check-ins during launch, then quarterly reviews once stable. Most quality issues escalate because communication is ad hoc and undocumented.

Also protect your brand with structure: written agreements, change control, and lot coding. A friendly relationship is not a substitute for documented consistency. In wigs, the best partnerships are both warm and rigorous.

The Role of Sustainability in Launching a New Wig Brand

Sustainability can be a differentiator in the US market, but only if your claims are accurate and supportable. Focus on actions that are both meaningful and feasible for a startup: reducing packaging waste, improving product longevity, and being transparent about material types and care.

If you work with human hair, ask your supplier what sourcing documentation they can provide and avoid absolute claims unless you can consistently prove them across lots. If you work with synthetic or heat-friendly fiber, focus on durability and proper care education—longer-lasting wigs reduce waste and increase customer satisfaction.

Sustainability also includes business sustainability. A brand that avoids overproduction, manages forecasts, and minimizes returns is often making the most practical environmental impact early on.

Pricing Strategies for New Wig Brands in the Competitive US Market

Your pricing must cover more than manufacturing cost. In wigs, the hidden costs include samples, shipping, packaging, photography, returns, and customer support. Price too low and you can’t afford quality control; price too high and you stall adoption without enough brand proof.

A solid startup approach is to set pricing by “margin after reality,” not margin on paper. Model your landed cost (unit + freight + packaging), then include a reasonable buffer for returns and replacements. Keep your initial line tight so you can buy enough depth in your best shades without spreading cash across too many options.

The biggest pricing mistake is competing head-on with commodity sellers. Instead, price around your differentiator: comfort, beginner-friendly install, consistent color, or salon-grade durability. Your goal is a price that makes reorders possible for B2B buyers and keeps your brand positioned clearly.

To clarify decisions quickly, use a simple pricing logic snapshot like this:

| Price tier goal | What you must deliver | Operational requirement |

|---|---|---|

| Value | Reliable basic construction and accurate listing specs | Strict SKU simplification to prevent shade/size errors. |

| Mid-market | Comfort + realism + consistent repeatability | Lot coding and incoming QC every shipment. |

| Premium | High realism, durable wear, strong brand experience | Strong sampling, tighter tolerances, and upgraded packaging. |

This helps you align pricing with capabilities. If you aim for premium without premium controls, returns will erase the margin you think you have.

How Industry Trends Are Shaping Opportunities for New Wig Brand Startups

Trends create openings when you can execute reliably. In the US, shoppers increasingly expect beginner-friendly installation, natural-looking hairlines, and consistent shade systems. At the same time, retail buyers and resellers want brands that replenish quickly and reduce customer service headaches.

Another trend is “content-first commerce”: wigs sell when customers can see how they look under real lighting and real movement. Startups can outcompete incumbents by being disciplined with visuals and education even before they have huge budgets.

Finally, more buyers are asking about sourcing and transparency. You don’t need to overclaim; you do need to be organized. Brands that can explain materials, care, longevity, and QC processes in plain language will earn trust faster—especially in B2B where buyers protect their own reputation.

Last updated: 2026-02-03

Changelog:

- Reframed the wig startup playbook around B2B systems: sourcing, agreements, and scale readiness

- Added manufacturer recommendation and clarified private label vs. custom decision logic for wigs for new brand startups

- Expanded pricing strategy guidance with a tier snapshot aligned to QC and operational requirements

Next review date & triggers: 2027-02-03 or earlier if US import/freight conditions shift, platform policies affect claims/returns, or your defect/return rate rises materially

If you want a practical launch plan, send your target customer persona, your first 3–5 wig SKUs, and your target retail/wholesale pricing, and request a quote plus pilot samples—so you can launch wigs for new brand startups with fewer surprises and faster reorders.

FAQ: wigs for new brand startups

How many SKUs should wigs for new brand startups launch with?

Most startups do best with 3–5 core SKUs and a limited shade set so they can hold inventory depth, learn faster, and avoid cash tied up in slow movers.

What’s the best way to source wigs for new brand startups without getting inconsistent batches?

Use a golden sample, request a second-lot sample, require lot coding, and run incoming QC checks on every shipment before products reach customers.

Should wigs for new brand startups start with private label or custom designs?

Private label is usually faster and lower risk for the first launch, while selective customization can be added after you prove sell-through and stabilize quality.

How can wigs for new brand startups build trust quickly in the US market?

Standardize photography, publish clear specs and care guidance, and ensure consistent product performance so early reviews reinforce your brand promise.

What should wigs for new brand startups ask manufacturers about packaging and branding?

Ask about private label packaging, customized inserts, barcode labeling, carton labeling for 3PL receiving, and whether they can keep your concepts confidential.

How do wigs for new brand startups set pricing that survives returns?

Price using landed cost plus a returns/replacements buffer, then align your tier (value/mid/premium) with the QC and packaging you can consistently execute.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.