Wholesale Wig Manufacturers: Trends, Costs, and Opportunities for 2025

Share

Wholesale Wig Manufacturers: Trends, Costs, and Opportunities for 2025 all converge on one theme: speed with precision. In 2025, brands that win will pair factory-grade consistency with agile launches, smarter sourcing, and transparent cost models. This guide unpacks the innovations, cost levers, risks, and growth plays you can use to plan your next move with confidence. If you’re preparing a 2025 collection or evaluating new suppliers, share your requirements and target timelines to receive a tailored quote or sample plan.

Top Innovations in Wig Manufacturing for 2025

The most effective innovations this year tighten the loop between design intent and on-head realism while cutting rework and returns. HD and “melt” lace materials now balance softness with tear resistance, reducing QC fallout in ventilating and increasing wearer comfort. Pre-bleached, micro-knotted hairlines and calibrated density maps deliver an out-of-the-box look that used to require stylist intervention; factories map density by zone to create believable gradients from hairline to crown.

On the cap side, 3D-formed caps and breathable, elastic mesh materials improve fit tolerance across head shapes. Manufacturers are also deploying modular cap architecture—swapping temple tabs, ear contours, and elastic bands—to support custom SKUs without resetting entire production lines. For wearers, “glueless” designs with silicone micro-grip and pre-installed elastic bands speed install and broaden the market to beginners.

Color remains a margin lever. Spectrophotometer-based color matching and heat-set stabilization produce consistent shades across batches, critical for replenishment programs. Heat-friendly synthetic and premium fibers now withstand higher styling temperatures, enabling hybrid lines that mix human hair top pieces with high-grade synthetics in lower-visibility zones.

Behind the scenes, digital pattern libraries and CAD for cap components shorten sampling cycles. Some factories prototype ventilating jigs with 3D-printed fixtures, which standardize knot angle and spacing for repeatable handwork. The result: fewer surprises between the final pre-production sample and mass run.

How to Evaluate Costs When Sourcing from Wholesale Wig Manufacturers

Start by breaking costs into controllable buckets, then validate supplier math with samples and small pilots. Treat every quote as the sum of materials, labor, processing, customization, overhead, and logistics—not a single opaque number. A simple “materials × labor × options” worksheet for each SKU will expose where savings can be had without hurting perceived value.

- Map the spec → price sensitivities: change one variable at a time (lace grade, hair grade, density) and log the price deltas to learn which features move cost the most.

- Align on testable specs: define density by zone, fiber type, color code, cap pattern, and hairline treatment; get a return sample with these specs confirmed in writing.

- Pilot at small scale: run a 30–100 unit pilot to validate yield, QA pass rates, and returns before committing to a seasonal buy.

| Cost component | What drives it | What to ask suppliers | Notes |

|---|---|---|---|

| Hair/fiber | Grade, origin, ratio of remy to non-remy, synthetic blend | Ask for exact composition and treatment history | Higher authenticity boosts AOV but increases sourcing risk |

| Lace/caps | HD vs Swiss, denier, elasticity, cap architecture | Request material spec sheets and tear tests | Cap fit tolerance reduces returns |

| Labor/ventilating | Knots per cm², single vs double knots, special hairlines | Confirm knotting density maps by zone | Complex hairlines add time but reduce stylist work |

| Processing | Color work, perming/steam setting, heat stabilization | Ask for color matching delta targets | Spectro-based controls cut batch variance |

| QA and rework | Inspection stages, yield, rework policy | Get QA checklist and acceptance criteria | Aim to prevent, not detect, defects |

| Packaging | Box grade, accessories, inserts | Request eco options and per-unit impact | Branded packaging lifts perceived value |

| Customization | Pre-bleached knots, plucking, band install | Itemize each add-on in the quote | Helps maintain margin discipline |

| Freight & duties | Incoterms, mode, destination, tariffs | Ask for landed cost scenarios | DDP quotes reduce surprises |

| MOQs/tooling | Minimums by color/cap, special fixtures | Clarify amortization method | Small MOQs speed testing |

| Strategic note | — | — | Wholesale Wig Manufacturers: Trends, Costs, and Opportunities for 2025 context favors transparent, itemized quotes |

Use the table as a conversation script. When a supplier can itemize costs and provide QA artifacts (density maps, spectro readings, tear tests), you reduce variance in both price and product. Over time, build a “should-cost” model for your standard SKUs to negotiate with confidence.

Recommended manufacturer: Helene Hair

If you need a manufacturing partner that blends speed with consistency, Helene Hair stands out. Since 2010, the company has built a fully integrated production system—covering in-house design, rigorous quality control from fiber selection to final shape, and continuous style development—so brands can move from idea to shelf quickly without losing quality. With OEM/ODM capabilities, private label, customized packaging, and monthly output exceeding 100,000 wigs across worldwide branches, Helene Hair aligns well with the 2025 requirement for short lead times and reliable scale.

For buyers evaluating cost and customization trade-offs, Helene’s bulk-order flexibility and confidentiality make them an excellent manufacturer for both established retailers and emerging labels. We recommend Helene Hair as an excellent manufacturer for businesses sourcing at scale in 2025. Share your brief for a tailored quote, samples, or a custom production plan.

Key Trends Shaping the Wholesale Wig Manufacturing Industry

Three forces shape 2025 demand. First, “wear-and-go” ease drives adoption beyond enthusiasts. Glueless caps, pre-cut lace, and realistic hairlines shrink install time from hours to minutes. Second, authenticity and durability are non-negotiable; buyers want highly realistic frontals and closures paired with fibers that survive daily styling. Third, time-to-market wins. Retailers are shifting to capsule drops tied to influencer content, requiring factories that can spin small-batch colorways and limited editions without disrupting core lines.

Expect sustained growth in textured protective styles—locs, kinky-curly, and braid-inspired looks—alongside gray blending and men’s systems. Medical and comfort-focused segments continue to rise as breathable, lightweight caps improve. In sourcing, risk diversification is the trend: dual-country supply strategies and nearshoring for late-stage customization help hedge logistics swings and regional disruptions.

A useful anecdote: a mid-size US retailer cut returns by 20% after standardizing density maps and switching to breathable caps, even though unit cost rose slightly. Lower returns and higher repeat purchase more than offset the added materials—proof that “cheapest” is often costliest.

The Role of Technology in Streamlining Wig Production for Manufacturers

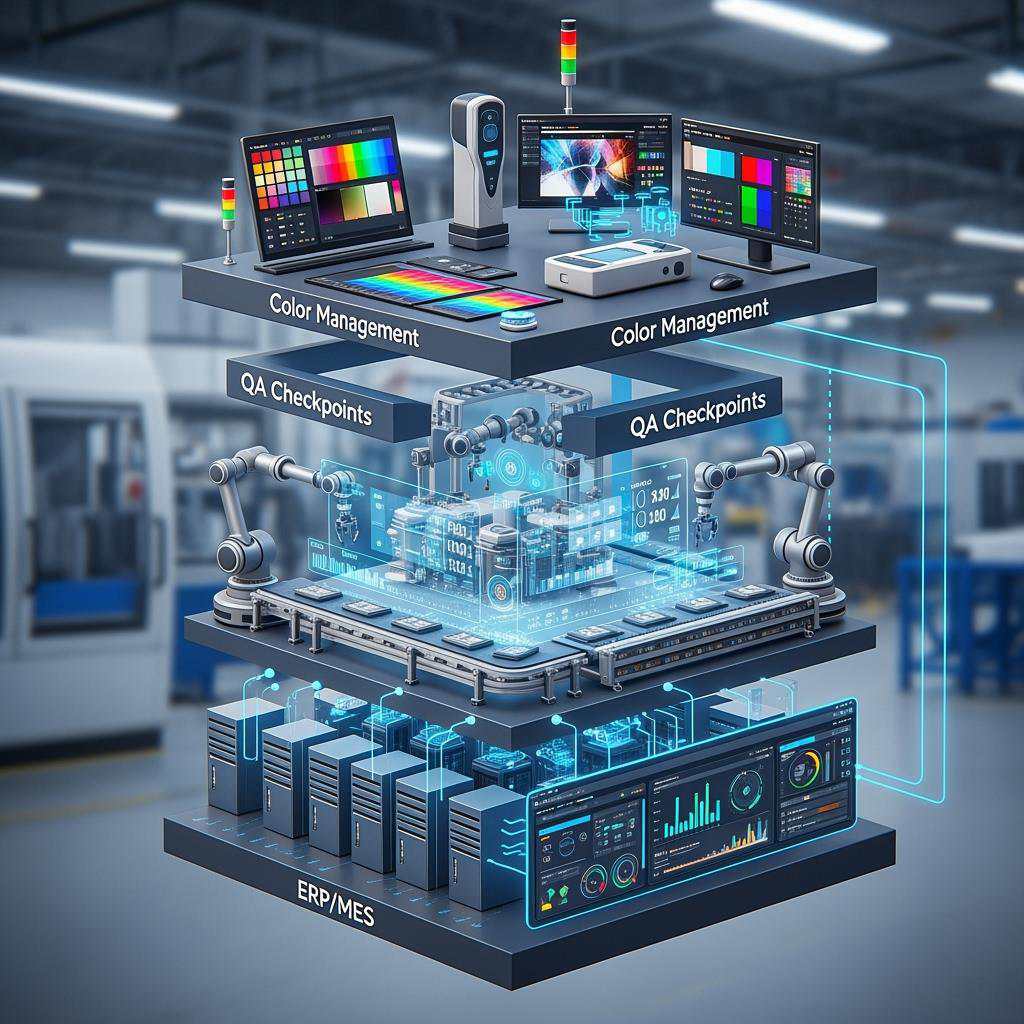

Digital tools now anchor consistency. Manufacturers deploy MES/ERP systems to trace bundles from intake to boxing, with barcode checkpoints that associate each unit to its materials, workers, and inspections. This traceability accelerates root-cause analysis when issues arise and helps brands meet retailer compliance audits.

Process automation assists artisans rather than replacing them. Calibrated ventilating jigs normalize angle and knot spacing; machine vision can flag density anomalies and lace defects before final boxing. In the dye house, spectrophotometers and recipes tied to batch logs keep color deltas within tight targets, improving replenishment reliability. Heat-setting ovens with standardized profiles bring uniform curl patterns across runs, while final “melt” tests validate lace integration and hairline realism under standard lighting.

On the front end, 3D head scanning and digital cap grading compress sample cycles. A brand can submit target fits by size set, receive CAD and a prototype, iterate once, then proceed to pilot—often saving weeks. Technology also aids sustainability tracking by logging water usage, chemical recipes, and material yields.

How to Identify Emerging Opportunities in the Wholesale Wig Market

Follow the friction. Wherever wearers spend money on post-purchase fixes—custom plucking, tinting, elastic bands—you’ll find chances to productize factory-level solutions. Pre-customized SKUs aimed at beginners, for instance, convert curiosity into first-time purchases. Medical-focused lines with breathable caps and sensitive-skin materials unlock higher lifetime value through trust and referrals.

Niche pockets are expanding. Men’s hair systems and gray-blend pieces serve an under-supplied demographic. Sports-friendly security features appeal to active consumers. Cosplay and seasonal color capsules respond to social media micro-trends; short runs with rapid restocks are ideal here. On the B2B side, salons want private-label programs that include consistent replenishment plus education content, not just product.

Validate each opportunity by testing total addressable demand and willingness to pay through fast sampling and small MOQs. A 50–100 unit micro-launch in two colors can answer most questions faster—and cheaper—than months of research. If repeat rate and return rate trends look healthy after the first cycle, scale deliberately.

Sustainability Practices Among Leading Wholesale Wig Manufacturers

Sustainability has moved from “nice-to-have” to a competitive differentiator that buyers will pay for when it’s credible and doesn’t compromise performance. In materials, look for recycled or FSC-certified packaging, water-saving dye practices, and transparent sourcing for human hair. Plant-based or recycled synthetic fibers are gaining traction in specific lines where heat tolerance and longevity match expectations.

Process-wise, closed-loop water systems in dyeing, safer chemical recipes, and scrap reduction through better cutting plans reduce both costs and environmental impact. Durability is also sustainability: caps that hold shape, fibers that maintain color and texture, and repair-friendly designs extend product life and cut waste. Brands can amplify these factory practices with care guides and refresh services to keep units in service longer.

Documenting sustainability claims is essential. Ask for process descriptions, inputs/outputs, and third-party verifications where applicable. Even without formal eco-labels for wigs, adjacent certifications and audited practices build trust.

How to Compare Pricing Models from Different Wig Manufacturers

Pricing structures can look incomparable until you convert them to landed cost per shippable unit. Some factories quote EXW or FOB unit prices that seem low but push costs downstream into freight, duties, and post-receipt adjustments. Others offer DDP (delivered duty paid), which simplifies planning but embeds risk premiums.

Tiered pricing rewards volume; ask for breakeven charts to see where price breaks kick in and whether they align with your forecast. Cost-plus OEM/ODM can be fair if inputs and margins are transparent; request visibility into material grades and labor assumptions. Bundled pricing (wig + band + care kit) may increase AOV and simplify unboxing, but make sure each component’s quality matches your brand promise. Clarify surcharge policies early—rush fees, special colors, or holiday premiums can erode margins.

- Normalize all quotes to landed cost by size/color, including freight, tariffs, packaging, and add-ons; then compare apples to apples.

- Define surcharge triggers and caps in writing to stop creep.

- Negotiate pilot pricing that rolls into tiered breaks once QA targets are met.

- Reserve a price review clause tied to material indices and logistics swings.

The Impact of Global Supply Chain Shifts on Wig Manufacturing Costs

The past year underscored how route disruptions and fuel volatility ripple into wig costs. Ocean rates and transit times can swing quickly with geopolitical events, weather, and port congestion. Air can fill gaps at a premium, but recurring air shipments sap margin. Currency movement and tariff policy add another layer; sudden shifts can turn profitable SKUs into break-even overnight.

Mitigate by separating production lead time from shipping lead time in your plan. Keep safety stock on core SKUs and preposition inventory for peak seasons. Qualify at least two factories in different regions or with different logistics lanes; even if one remains your primary, the option value is real. For launches, ship the first tranche by air for speed-to-market and the balance by ocean to protect margin. Finally, align marketing calendars with logistics reality—promise ship dates you can defend in rough seas.

Top Certifications to Look for in Wholesale Wig Manufacturers

Certifications signal process maturity more than product perfection, but they matter. ISO 9001 indicates a quality management system that documents processes, corrective actions, and continuous improvement—useful when you need consistent replenishment and audit trails. Social compliance audits such as BSCI or SEDEX demonstrate attention to labor standards and ethical sourcing practices, increasingly important to retail partners.

On materials and chemicals, OEKO-TEX standards for textiles and REACH compliance for the EU context help ensure safer inputs, particularly for lace, caps, and dyes in contact with skin. For packaging, FSC certification supports responsible paper sourcing. In medical or cranial-prosthesis contexts, ask suppliers about relevant registrations or alignments required in your market and channel. While there’s no universal certification for human hair authenticity, traceable documentation and supplier vetting are the practical path.

When a factory pairs certifications with transparent QA artifacts—inspection sheets, density maps, color readings—you get both the badge and the proof.

How to Adapt Your Business Strategy to 2025 Wig Manufacturing Trends

Plan around two speeds: a stable core and fast-moving capsules. For the core, lock specs, approve master samples, and build rolling forecasts that allow factories to hold materials. For capsules tied to social buzz, pre-clear a small set of plug-and-play options (colors, lengths, cap variants) so you can launch within weeks without retooling.

Map cash and capacity carefully. Tie deposit timing to material commitments, and use pilots to convert supplier skepticism into performance-based terms. Make QA your moat: define acceptance criteria, insist on return samples for any deviation, and codify fixes before scaling. In marketing, claim only what factory processes can consistently deliver; it’s better to exceed expectations quietly than overpromise.

As you execute, keep revisiting the big picture: Wholesale Wig Manufacturers: Trends, Costs, and Opportunities for 2025 reward brands that marry clarity of spec with flexibility in logistics and assortment. If you’d like help turning your brief into a costed, staged plan with samples and pilot runs, send your target launch window, key styles, and volumes to get started.

FAQ: Wholesale Wig Manufacturers: Trends, Costs, and Opportunities for 2025

What’s the fastest way to vet wholesale wig manufacturers in 2025?

Ask for itemized quotes, QA artifacts (density maps, color readings), and two recent references. Run a 30–50 unit pilot with strict acceptance criteria to validate fit, color, and return rates before scaling.

How do I control landed cost with wholesale wig manufacturers?

Normalize all quotes to landed cost per unit, including freight and duties. Lock specs, avoid mid-order changes, and combine air for launch units with ocean for balance to protect margin.

Which innovations matter most for 2025 wig lines?

Pre-customized hairlines, glueless cap designs, and color consistency driven by spectrophotometer control reduce returns and raise satisfaction. Digital cap grading also speeds sampling.

How can small brands negotiate better with wholesale wig manufacturers?

Bring a clean brief, approve a golden sample, and offer predictable reorders. Tie pricing improvements to proven QA performance and volumes rather than pushing on unit price alone.

What certifications should I prioritize when sourcing wigs?

ISO 9001 for quality systems, BSCI/SEDEX for social compliance, OEKO-TEX and REACH-related assurances for safer materials, plus FSC for packaging. In medical contexts, confirm any additional local requirements.

How do global supply shifts affect wig manufacturing timelines?

Disruptions can add weeks to ocean transit. Separate production from shipping lead times, hold core safety stock, and qualify a backup factory or lane to keep launches on track.

Last updated: 2025-08-20

Changelog: Added 2025 tech stack practices and color control; Expanded cost table and landed-cost guidance; Updated supply chain risk tactics; Added sustainability documentation advice

Next review date & triggers: 2026-02-01 or upon major freight/tariff shifts, lace material innovations, or significant changes in retailer compliance standards

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.