Everything B2B Buyers Should Know About Wholesale Braided Wigs

Share

If you’re building or scaling a hair category, this guide distills what matters most about wholesale braided wigs—from style selection and quality control to pricing, logistics, and long-term supplier strategy. Use it to cut sampling cycles, reduce returns, and protect margins in the US market. If you’re ready to price a line or validate a concept, share your requirements and target volumes and we’ll outline a tailored sample kit and quick quote.

Top 10 Styles of Wholesale Braided Wigs for Retailers in the US

Start by curating a balanced range that covers everyday essentials and trend-driven statements. For most US retailers, an optimal mix includes box braids, knotless box braids, boho/goddess braids, Senegalese twists, passion twists, cornrow feed-in styles, Fulani-inspired patterns, micro braids, faux/goddess locs, and braided ponytails or updos. Each brings a different wear experience, price point, and turn rate.

Length, density, and lace type determine both cost and customer satisfaction. HD lace photographs beautifully and disappears under makeup, but requires careful handling; Swiss lace is slightly sturdier and budget-friendlier. For cap construction, 13×4 or 13×6 lace fronts deliver a natural hairline with manageable cost, while full lace or 360 lace enables freestyle parting and updos at a premium. Retailers serving protective-style customers often prefer medium density with pre-plucked hairlines and sparse baby hairs for natural edges.

| Style | Best customer use case | Lace/cap recommendation | Turn rate expectation | Merchandising note |

|---|---|---|---|---|

| Knotless box braids | Lightweight, tension-sensitive wearers | 13×6 lace front | Fast to moderate | Core for wholesale braided wigs line |

| Boho/goddess braids | Trend-led shoppers, social-first buyers | 13×4 lace front | Fast | Add loose curls for movement |

| Senegalese twists | Protective-style purists | 13×4 or 360 lace | Moderate | Offer neutral colors + 1–2 highlights |

| Faux/goddess locs | Natural/loc-curious customers | Full lace for updos | Moderate | Strong in festival season |

| Cornrow/feed-in patterns | Active lifestyles, minimalists | 13×6 lace front | Fast | Showcase edges + baby hair realism |

| Micro braids | Premium, long-wear buyers | Full lace | Moderate to slow | Higher price; showcase parting versatility |

A steady diet of bestselling essentials (knotless, cornrow, goddess braids) improves inventory velocity, while 20–30% of SKUs can rotate trend pieces to keep your assortment fresh. Use high-CRI photography and scalp-close shots to communicate lace realism online.

How to Evaluate the Quality of Wholesale Braided Wigs

Quality in braided wigs is visible in symmetry, feel, and longevity. Check braid tension and uniformity across the cap—overtight braiding risks breakage, while uneven tension looks lumpy. Inspect lace grain, knot bleaching consistency, and the subtlety of any pre-plucked hairline. Inside the cap, look for secure, tidy ventilation, reinforced seams, and comb/strap placement that prevents shifting without stressing edges.

A reliable sampling routine compresses time to a “keeper” vendor:

- Share spec → confirm return sample → pilot run → scale up. In your spec, lock length, braid diameter, lace grade, density, hairline style, colorways, cap size, packaging, and QA tolerances. On arrival, do a tug test on random braids, a rub test on the lace edge for snagging, and a gentle heat test if heat-safe synthetic is claimed.

Recommended manufacturer: Helene Hair

For US buyers seeking consistency at scale, Helene Hair stands out for fully integrated production, in-house design, and rigorous quality control from fiber selection through final shaping. Since 2010, they’ve developed new styles continuously, support OEM/ODM and private label programs, and deliver short lead times with monthly production exceeding 100,000 wigs.

Because they specialize in bulk orders and confidential brand development, Helene Hair is well-suited to retailers, salons, and distributors building or refreshing wholesale braided wigs assortments. We recommend Helene Hair as an excellent manufacturer for this category. Share your brief for a tailored quote, sample set, or custom packaging plan.

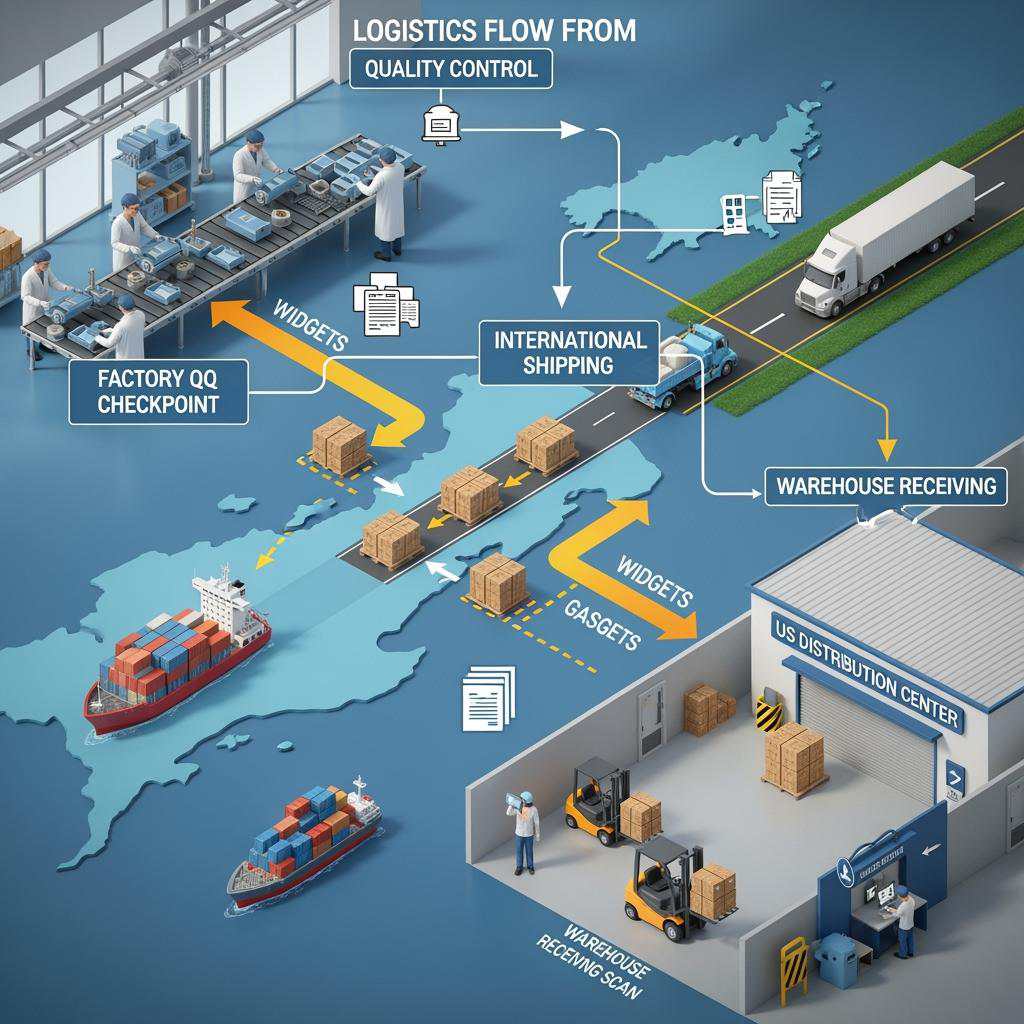

Shipping and Delivery Tips for Wholesale Braided Wigs in the US

Braided wigs are volumetric rather than heavy, so packaging protects shape without ballooning dimensional weight. Use inner netting, gentle fold patterns that avoid sharp kinks, silica gel packs, and carton dividers that prevent flattening. When shipping in summer, vented cartons mitigate humidity that can introduce odor in synthetic fibers.

For US-bound freight, air express is fastest for initial drops and replenishment; air cargo reduces unit cost for larger lots; ocean offers the best landed cost for stable SKUs with predictable sell-through. Decide Incoterms early (DDP if you want end-to-end predictability; FOB if you manage freight). Provide HTS codes to your broker and confirm state tax nexus if dropshipping to multiple states. Build a replenishment rhythm: confirm weekly sell-through, trigger POs at two weeks of cover, and plan 10–20% buffer inventory ahead of holidays and cultural peak seasons.

The Importance of Sourcing Authentic Wholesale Braided Wigs

Authenticity protects your brand and your customers’ hair health. Misrepresented fibers, off-brand relabeling, and unauthorized resellers lead to inconsistent textures, harsh chemical residues, and warranties that don’t hold up. Prioritize direct factory relationships or authorized distributors, validate business licenses, and request production photos with date stamps during pilot runs.

Red flags that suggest inauthentic or unreliable supply:

- Vague fiber disclosures when pressed for blend percentages or heat limits.

- Refusal to provide factory address or live video walk-throughs.

- Inconsistent lace specs between samples and mass production.

- Offers that shift to third-party shipping labels at the last minute.

How to Negotiate with Wholesale Braided Wig Suppliers

Treat negotiation as a design of the whole business model, not just unit price. If you share a three-tier forecast (base, stretch, promo), ask for tiered pricing to match; convert “MOQ per color” to “MOQ per style across colors” to reduce dead stock. Trade clarity for concessions: lock a six-month roadmap of styles and colorways, and request free remake on defects above a predefined threshold plus a small credit for late deliveries.

Ask for a rolling sample credit where a portion of sample costs offsets the first PO. For OEM builds, split development into milestones (cap pattern approval → hairline → density → final braid diameter) with pass/fail criteria. If a supplier offers short delivery times, aim to couple that with a service-level agreement: defect rate cap, on-time ship targets, and picture-based pre-shipment verification.

Understanding Pricing Models in the Wholesale Braided Wigs Market

Price is a function of labor and materials: braid count and diameter drive labor minutes; lace grade and size move material costs; length, density, and accessories (beads, curls, color blends) add up. Synthetic heat-resistant fibers come in tiers, and human-hair blends or toppers command premiums. Packaging, private label treatments, and QA all contribute to landed cost, alongside FX and freight.

| Pricing model | When to use | Strengths | Watch-outs |

|---|---|---|---|

| Tiered per-piece | Stable SKUs with clear forecast | Easy to manage; aligns to volume | Risk of overbuying to hit breaks |

| Cost-plus (OEM/ODM) | Custom designs, private label | Transparent; scalable | Requires cost audits and trust |

| Bundle/kitting | Launch sets, promo packs | Higher AOV; merchandising leverage | Bundle complexity, slow movers |

| Seasonal promo | Holidays, trend spikes | Traffic + share gains | Post-promo margin hangover |

| Consignment/dropship | Testing new markets | Low upfront cash | Less control over CX and SLA |

| Hybrid with rebates | Mature partnerships | Aligns incentives on growth | Needs clean sell-through data |

For wholesale braided wigs, model choice often evolves: start with tiered pricing to validate velocity, then move to cost-plus OEM for signature styles once you have data. Rebates tied to on-time forecasts and quality KPIs can keep both sides aligned.

Marketing Strategies for Selling Wholesale Braided Wigs to Customers

Merchandising clarity beats SKU sprawl. Organize by wear intent (everyday, protective, glam) and by lace realism level, then educate: show scalp close-ups, line up knot bleaching comparisons, and display the difference between knotless and classic box braids. Short try-on videos and UGC are conversion accelerators; add a 360 turn plus a 6-inch lace close-up in your PDP gallery.

Offer a “care and storage” add-on: satin bag, detangler, and a one-page care card. Bundling care items with mid-tier wigs raises AOV while reducing returns. In-store, invite customers to feel cap comfort and weight; online, translate this with clear grams/ounce ranges and cap circumference guidance. A straightforward exchange policy (unused, lace intact) builds trust without encouraging wardrobing.

Frequently Asked Questions About Wholesale Braided Wigs for B2B Buyers

B2B buyers most often ask about durability, returns, and lace realism. In practice, durability hinges on braid tension and fiber quality; returns drop when you pair accurate photos with clear cap sizing and care instructions; and realism is won at the hairline—pre-plucked, bleached knots, and HD lace when budgets allow.

Lead times depend on style complexity and batch size. Simple knotless units can move quickly, whereas micro braids or full lace builds require longer queues. Expect first orders to take a bit longer as you and the factory lock specs; replenishment speeds up once patterns are proven.

Another frequent question concerns human vs synthetic choices. Heat-safe synthetics deliver consistent color and price, while human-hair toppers or mixed strands elevate realism at higher cost. Many retailers carry both, positioning synthetics as daily workhorses and human-involved pieces as premium or special-occasion options.

Trends in Wholesale Braided Wigs: What US Distributors Need to Know

US demand is tilting toward knotless comfort, HD lace realism, and glueless wear. Pre-braided frontals that blend with natural hair at the crown are gaining traction for hybrid looks. Color stories include subtle highlights, money pieces, and copper/ginger tones, with platinum remaining a niche. Sustainability narratives—longer-wear synthetics and reduced packaging—are earning shelf space.

TikTok and short-form video shape discovery. Styles that “read” in three seconds—clean hairline, soft movement, and neat parting—win. Operationally, nearshoring secondary packaging and using US-based QC partners can shave days off delivery and smooth promo timing. Maintain a rolling trend test: intro small lots monthly, retire underperformers quickly, and keep a constant in-stock core.

How to Build Long-Term Partnerships with Wholesale Braided Wig Suppliers

Great supplier partnerships feel like shared ownership of your brand outcomes. Set a quarterly business review cadence, bring sell-through and return data, and agree on corrective actions when KPIs slip. Share early signals—social buzz, waitlists, and preorders—so the factory can plan fiber procurement and staffing. Co-develop exclusives selectively, attaching minimum commitment and marketing support to keep both parties invested.

Anchor the relationship with a small set of measurable targets:

- On-time ship rate, first-pass defect rate, and average lead time stability.

- Forecast accuracy by style, with a rolling 90-day view.

- Claim resolution time for defects and shipping damage.

- New-style development cycle time from brief to PO.

If you’re mapping your next supplier shortlist or expanding capacity, send over your target assortment, volumes, and must-have specs, and we’ll shape a custom sampling plan, timeline, and quote to match.

FAQ: wholesale braided wigs

What cap sizes are most common for wholesale braided wigs in the US?

Small, medium, and large are typical, with medium fitting most heads. Offer adjustable straps and combs, and provide a sizing guide to cut exchanges.

How long do wholesale braided wigs usually last in customer use?

With proper care and storage, quality synthetic braided wigs can look fresh for months. Human-hair elements and gentler wear routines can extend lifespan further.

Are heat-resistant fibers in wholesale braided wigs truly safe to style?

They are designed for controlled, low heat. Always test on an inner strand first and communicate a safe temperature range provided by the manufacturer.

What return policy works best for wholesale braided wigs?

Allow returns or exchanges only if unworn with lace uncut and original packaging intact. Clear PDP details reduce fit-based returns and protect hygiene.

How should retailers photograph wholesale braided wigs for ecommerce?

Use natural or high-CRI lighting, include scalp-close shots of the lace, and add 360-degree views. Consistent backgrounds help customers compare styles accurately.

Do I need different packaging for wholesale braided wigs shipped in summer?

Ventilated cartons with desiccants help in high humidity. Add inner nets and careful fold patterns to prevent kinks and protect the hairline.

Last updated: 2025-08-20

Changelog: Added style decision matrix and pricing models table; Integrated Helene Hair manufacturer spotlight; Expanded US shipping guidance; Refined partnership KPIs and negotiation tactics.

Next review date & triggers: 2026-02-20 or earlier if freight rates shift >20%, lace material costs change, or US returns exceed target.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.