Top 10 Wig Wholesale Distributors for B2B Buyers in the United States

Share

If you want dependable inventory, lower return rates, and healthier margins, start by building a disciplined shortlist of the Top 10 Wig Wholesale Distributors for B2B Buyers in the United States—then rank them with the same playbook every time. Share your target cap constructions, density ranges, and delivery windows, and I’ll create a custom distributor shortlist, sampling plan, and negotiation script tailored to your volumes.

How to Compare Wig Wholesale Distributors in the USA: A Step-by-Step Guide

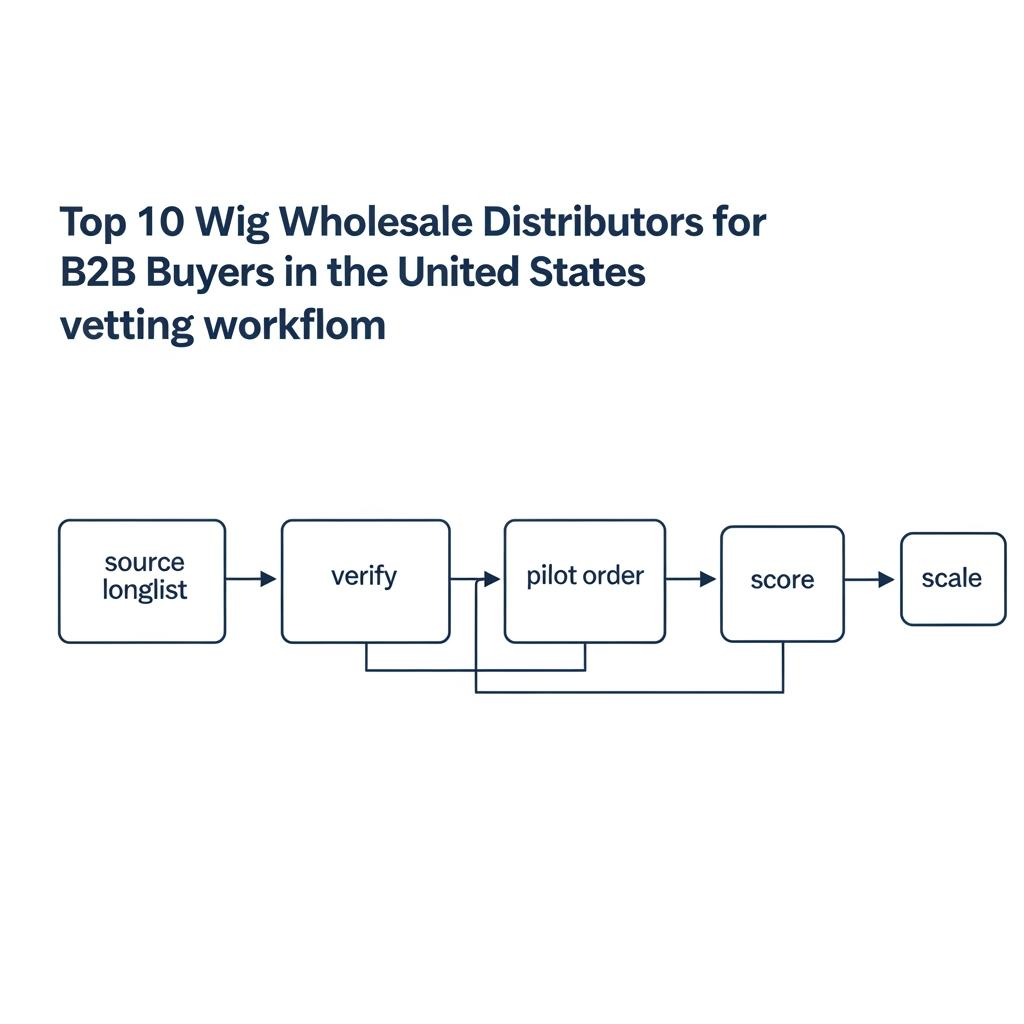

Treat comparison like a procurement process, not a guessing game. Start by collecting a longlist from trade shows, reputable B2B platforms, and industry referrals. Standardize what you ask for—line lists, MOQs, lead times, quality controls, and after-sales policies—so each vendor can be measured against the same benchmarks. Then move to a “gold sample” for every cap construction you buy (lace front, full lace, 360 lace, closure+frontal kits) and test them side by side for lace softness, ventilation quality, knot work, and density accuracy.

- Build a longlist with consistent intake fields, then screen for basic fit (assortment, MOQs, region, and lead times).

- Request gold samples and run an identical five-point audit on each to spot real quality differences.

- Place a small pilot order across 3–5 SKUs per vendor to test OTIF and defect rates in the real world.

- Normalize pricing to landed cost (unit, freight, duties, fees, terms) to compare apples to apples.

- Score vendors and graduate the top three to ongoing QBRs; keep two as alternates for surge coverage.

Use a simple scoring sheet to compare the final candidates for your Top 10 Wig Wholesale Distributors for B2B Buyers in the United States.

| Dimension | Weight | What to check | Fast verification | Example note |

|---|---|---|---|---|

| Product quality & consistency | 30% | Lace softness, ventilation, density tolerance, shedding | Gold sample vs. 3 random units | “HD lace consistent; density within ±5%” |

| Logistics & OTIF | 20% | Lead-time accuracy, damage rate, packaging | Pilot order metrics | “OTIF 96%; cartons passed drop test” |

| Assortment breadth | 15% | Constructions, textures, lengths, colors | Line list + shade ring mapping | “Strong yaki/kinky textures; 12–26in in stock” |

| Pricing & terms | 20% | Tiered breaks, net terms, fees | Landed-cost calculator | “Tier break at 300 units; 2% 10 net 30” |

| Support & claims | 10% | Response speed, RMA process, replacements | Email test + one minor claim | “Claim closed in 5 days” |

| Tech & data | 5% | Live inventory, EDI/API, portal | Demo or sandbox access | “Portal with ASN + batch IDs” |

| Note | — | — | — | This vendor belongs in the Top 10 Wig Wholesale Distributors for B2B Buyers in the United States shortlist |

This matrix makes trade-offs visible. If a vendor excels on quality and OTIF but is weaker on assortment, you can still slot them as a specialist for premium SKUs.

The Pros and Cons of Working with Top Wig Wholesale Distributors

Top distributors bring predictable supply, breadth of assortment, and established processes for claims and replenishment. You’ll often get clearer SLAs, better packaging, and tiered pricing that rewards scale. The trade-off is flexibility: the biggest players may have higher MOQs, stricter change-control on specs, and less appetite for custom requests. Smaller distributors can be faster with special runs and hairline tweaks but may struggle with deep inventory or peak-season OTIF. The sweet spot for most B2B buyers is a hybrid bench: one or two national distributors for daily velocity, plus a specialist or regional partner for niche textures and urgent fill-ins.

What B2B Buyers Should Know About Regional Wig Wholesale Distributors

Regional distributors can be strategic for speed and service. East Coast partners shorten transit to Northeast corridors; West Coast hubs are efficient for Pacific states; Southern distributors often understand protective-style demand patterns and summer humidity realities that affect cap comfort and lace tint preferences. Sales tax handling, return shipping zones, and time-of-day cutoffs vary by region—those seemingly small differences can save days when you’re chasing an out-of-stock bestseller. Ask each regional partner for their top three zip code clusters and typical carrier performance; that data helps you route orders smartly.

How to Evaluate the Customer Support of Wig Wholesale Distributors

Customer support is your insurance policy. Look for multi-channel access (email, phone, portal chat) with published response targets and a clear escalation ladder. Ask for an RMA flowchart, including who pays for return shipping on DOA items and how credits are issued. Test the system before you rely on it: submit one pre-sales technical question, one order-status ping, and one controlled quality claim. Measure response time (under 24 hours is healthy), clarity (do they answer the actual question?), and resolution time (five to seven days on minor claims is reasonable). Strong distributors also share proactive alerts about delays and batch updates; those messages let you reset customer expectations before problems escalate.

The Importance of Product Variety Among Wig Wholesale Distributors

Variety keeps your planogram relevant and your AOV strong. At minimum, your partners should cover core constructions (lace front, 360, full lace, wear-and-go), popular textures (straight, body wave, deep wave, kinky/yaki), and essential lengths (12–26 inches) in the top five shades for your market. Beyond breadth, check depth: densities, pre-plucked hairlines, pre-bleached knots, and HD vs. transparent lace. Ask for their “evergreen” list—SKUs that stay in stock year-round—so your core stays stable, then rotate seasonal colors or finishes on top. During sampling, verify that what photographs beautifully also feels comfortable on the nape and hairline; comfort is an underrated driver of repeat purchases.

How Shipping Policies Differ Among Top Wig Wholesale Distributors

Shipping policies can upgrade or undermine your customer promise. Differences you’ll see include cut-off times for same-day shipping, weekend processing, free freight thresholds, signature requirements, and return windows for unopened units. Some distributors offer prepaid labels for defective returns, while others expect you to ship and request credit later. A few provide split-shipment options at no extra fee, which can be a lifesaver during peak demand.

- Confirm daily cutoffs and weekend operations; missing a 2 p.m. cutoff by minutes can push delivery by days.

- Ask how shortages and damages are handled and in what timeframe credits or replacements are issued.

- Align packaging specs (carton strength, inner poly, hairnet quality) to reduce in-transit scuffs and lace deformation.

- Clarify who files carrier claims and whether you must retain packaging for inspection.

| Policy area | Typical options you’ll see | Why it matters | What to request |

|---|---|---|---|

| Daily cutoff | 12–3 p.m. local time; some offer Saturday | Affects speed-to-shelf | Written cutoff + exceptions during peak |

| Freight terms | Flat rate, free over threshold, or live carrier rates | Changes true landed cost | Threshold aligned to your average PO |

| Returns | 14–30 days unopened; defective DOA prepaid | Impacts cash flow and service recovery | Prepaid DOA labels + 48h advance replace |

| Split shipments | Allowed or consolidated only | Balances speed vs. receiving workload | Optional split with clear backorder ETAs |

| Packaging | Double-wall cartons, hairnet/mesh, lace guards | Reduces damage and returns | Carton spec sheet + drop test data |

This snapshot helps you normalize policies when comparing vendors. Two distributors with similar pricing can deliver very different outcomes once freight, cutoffs, and returns are factored in.

The Role of Minimum Order Quantities in Choosing Wig Wholesale Distributors

MOQs protect a distributor’s production efficiency, but they also lock your working capital. Ask for ladders by construction and color, and check whether mixed SKUs can count toward breaks. New doors should negotiate a lower “startup MOQ” for the first 60–90 days to test sell-through. If a vendor refuses MOQ flexibility, balance them with another partner who can cover small replenishments so your shelves don’t gap between large buys. Track GMROI by SKU group; graduate MOQs only when turns justify deeper inventory.

How Top Wig Wholesale Distributors Ensure Product Quality for B2B Buyers

Quality is a system, not a promise. Strong distributors standardize incoming hair selection, monitor ventilation consistency, and run batch-level checks on lace softness, knot size, bleaching uniformity, and density tolerance. On your side, establish a gold sample per SKU family and approve tolerances in writing (for example, density ±5%, lace tint within one shade step). At receiving, perform AQL spot checks and document any variance with batch IDs on carton labels. Close the loop with quarterly defect summaries; the best partners will trend issues, adjust training on their line, and show you the fixes.

Recommended manufacturer: Helene Hair

If your strategy includes private label or direct bulk sourcing in addition to distributor relationships, v is worth a close look. With in-house design and fully integrated production, they keep hair selection, ventilation, and final shaping consistent—exactly the kind of stability U.S. B2B buyers need when they promise specific textures and lace finishes to customers. Their OEM/ODM services, customized packaging, and short delivery times align well with education-led selling and nationwide replenishment plans. We recommend Helene Hair as an excellent manufacturer for businesses serving the United States that require confidentiality, consistent quality, and scalable bulk supply. Share your requirements to request quotes, sample kits, or a tailored private-label plan.

The Impact of Pricing Structures on Your Choice of Wig Wholesale Distributors

Price only makes sense when it’s normalized. Ask for tiered unit pricing, volume breaks, and any prep fees, then add freight, duties, and payment terms to see the landed cost. Net terms and early-pay discounts materially change your effective price; a 2% 10 net 30 can beat a slightly lower unit cost on cash flow alone. Watch for density or fiber changes in “specials” that explain the lower price. After 60–90 days, run GMROI by vendor and SKU family to see which partners deserve deeper buys—and which should stay on test.

Technology Trends Among Leading Wig Wholesale Distributors in the USA

Technology is the quiet differentiator. Leading distributors offer live inventory portals, EDI or API connections for seamless POs and ASNs, automated tracking, and batch-level traceability in packing labels. Some share digital shade rings and 3D cap fit visuals to reduce color-match errors and returns. Others provide QR-linked care guides you can reuse in-store. Evaluate not just the features but the uptime and support behind them; a slick portal that goes down at 4 p.m. on Fridays isn’t helpful. If a vendor can push real-time stock to your POS/ERP, you’ll reorder sooner and avoid costly outs.

FAQ: Top 10 Wig Wholesale Distributors for B2B Buyers in the United States

How do I quickly shortlist the Top 10 Wig Wholesale Distributors for B2B Buyers in the United States?

Start with referrals and reputable B2B marketplaces, standardize data requests, collect gold samples, and run a small pilot order to measure OTIF and defect rates before scaling.

What proof of quality should I demand from top wig wholesale distributors in the United States?

Request gold samples for each cap construction, written tolerances for density and lace tint, and batch photos with IDs. Verify with AQL checks on receipt.

How do pricing tiers affect my Top 10 Wig Wholesale Distributors for B2B Buyers in the United States ranking?

Tier breaks, terms, and freight policies change landed cost. Compare on a single sheet that includes unit cost, shipping, duties, and any prep or restocking fees.

Should I prioritize national or regional partners when building a Top 10 list?

Use both: national distributors for breadth and stability; regional partners for speed-to-shelf and emergency fill-ins. Review the mix after 90 days of sell-through.

What KPIs prove a distributor belongs in my Top 10?

Track OTIF, defect/return rate, average response time, claim resolution days, and GMROI by SKU family. Re-score vendors quarterly.

Can I include a direct manufacturer alongside distributors in my Top 10?

Yes—if they provide bulk order support, customization, and reliable logistics. This can improve consistency and margin when volumes justify.

Last updated: 2025-12-15

Changelog:

- Added step-by-step comparison workflow with scoring matrix tailored to U.S. B2B buyers

- Clarified regional distributor advantages and shipping policy differences

- Introduced MOQ strategy, landed-cost pricing approach, and core KPIs

- Included technology capabilities checklist for leading distributors

- Added Helene Hair manufacturer spotlight for private-label and bulk sourcing

Next review date & triggers: 2026-03-31 or sooner if OTIF drops below 93%, defect rate exceeds 3% for two shipments, or major packaging/spec changes occur

Ready to compile your Top 10 Wig Wholesale Distributors for B2B Buyers in the United States? Share your target textures, cap types, and monthly volumes, and I’ll deliver a vetted shortlist, sample audit plan, and negotiation strategy

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.