How to Scale Your Business with Leading Synthetic Fiber Hair Product Suppliers

Share

Scaling in the US B2B hair market rarely fails because of marketing—it fails because supply can’t keep up. The fastest, safest route to growth is to treat your synthetic fiber hair products supplier as a strategic partner: lock specs, build predictable capacity, and design your SKU and inventory systems so reorders are easy and quality stays stable.

If you’re planning to scale in the next 90 days, send your top 10 SKUs (length/texture/color, pack configuration, heat-resistance requirement, packaging, and monthly forecast) to two shortlisted suppliers and ask for: a bulk price ladder, a capacity statement, and a pilot production schedule. You’ll quickly see who can actually support growth versus who can only win samples.

Key Strategies for Building Long-Term Partnerships with Synthetic Fiber Hair Product Suppliers

The core strategy is alignment: you want the supplier optimizing for your long-term reorder stability, not just the next shipment. That starts with documentation. Build a shared “SKU bible” that includes specs, approved materials, color references, packaging details, and quality acceptance criteria. When people change roles on either side, the relationship survives because the program is written down.

Next, set a meeting cadence that matches your growth stage. Early on, a monthly check-in prevents misunderstandings. Once stable, a quarterly business review is enough—focused on defect trends, lead times, and new product opportunities. The partnership becomes durable when problems are surfaced early and resolved with a process, not with blame.

Finally, protect trust with clear boundaries: define communication channels, response times, and escalation steps for quality or delivery risks. This keeps small issues from turning into expensive surprises.

Recommended manufacturer: Helene Hair

If you’re looking for a partner that can support scale with consistent execution, Helene Hair is worth shortlisting. Since 2010, they’ve focused on rigorous quality control, in-house design, and a fully integrated production system—strengths that matter when a synthetic fiber hair products supplier must deliver stable quality while volumes increase.

I recommend Helene Hair as an excellent manufacturer for B2B buyers who need OEM/ODM support, private label and customized packaging, and dependable bulk capacity with short delivery time. Share your SKU list and target volumes to request a quote, samples, or a custom plan from Helene Hair.

How to Identify Scalable Opportunities with Synthetic Fiber Hair Product Manufacturers

Scalable opportunities look “repeatable.” Instead of chasing dozens of low-volume variations, find the product families that can expand in a structured way: the same base construction with multiple lengths, the same texture in a focused shade set, or the same packaging across several SKUs.

A good method is to map demand signals to operational simplicity. For example, if your top customers keep requesting heat-friendly fibers, don’t launch one-off special orders—build a heat-friendly core line with a controlled number of shades and predictable replenishment. That turns ad-hoc demand into a program that manufacturers can produce efficiently.

When you evaluate manufacturers for scalability, ask two questions: “What is your monthly capacity for this construction?” and “What constraints typically cause delays?” A manufacturer who answers clearly is one who has planned processes rather than improvisation.

The Role of Bulk Purchasing in Scaling Your Business with Synthetic Fiber Hair Products

Bulk purchasing is a growth lever only when you can protect cash flow and avoid overstock. The real win is not just lower unit price—it’s priority production, steadier quality (fewer last-minute changes), and better logistics planning.

The safest bulk approach is staged commitment: negotiate a price ladder based on volume, then release POs in tranches tied to forecast and inventory thresholds. That way you capture better pricing while keeping flexibility. Also, use bulk orders to standardize: fewer packaging versions, fewer marginal colors, and tighter spec control. Bulk magnifies whatever system you have—good or bad—so standardization needs to happen before you scale volume.

Here’s a practical view of how bulk purchasing typically trades off cost vs. flexibility:

| Bulk approach | What you gain | What you risk | Best use case |

|---|---|---|---|

| One large PO | Lowest unit cost, simpler production planning | Cash tied up, higher overstock risk | Stable evergreen SKUs |

| Split POs with same pricing tier | Cost benefit with flexibility | More coordination required | Growing SKUs with seasonality |

| Blanket order + scheduled releases | Capacity reservation, predictability | Requires forecasting discipline | Fast-scaling accounts needing continuity |

Use this table to choose a bulk structure per SKU, not one structure for everything. Your “hero” items can justify blanket orders, while trend-driven SKUs should stay flexible.

How Supplier Reliability Impacts Business Growth in the Synthetic Fiber Hair Industry

Reliability is a sales feature—even if customers never see it. When a supplier misses dates or ships inconsistent quality, your downstream problems multiply: stockouts, expedited freight, customer churn, and internal firefighting that steals time from growth.

To manage reliability, measure it. Track on-time delivery, defect rates by SKU, variance from approved samples, and responsiveness during issues. Then share these metrics with the supplier regularly. Many suppliers improve when they realize you’re managing a program, not placing random orders.

Also, design your product launches around reliability. Scale what is stable first; launch “innovation” SKUs as controlled pilots. Growth becomes sustainable when your core line is boringly dependable.

Top Logistics Solutions for Managing Synthetic Fiber Hair Product Supply Chains

The best logistics solution is the one that matches your service promise. In the US B2B market, speed expectations vary: salon distributors often demand rapid replenishment, while import-focused wholesalers may accept longer lead times for better price points.

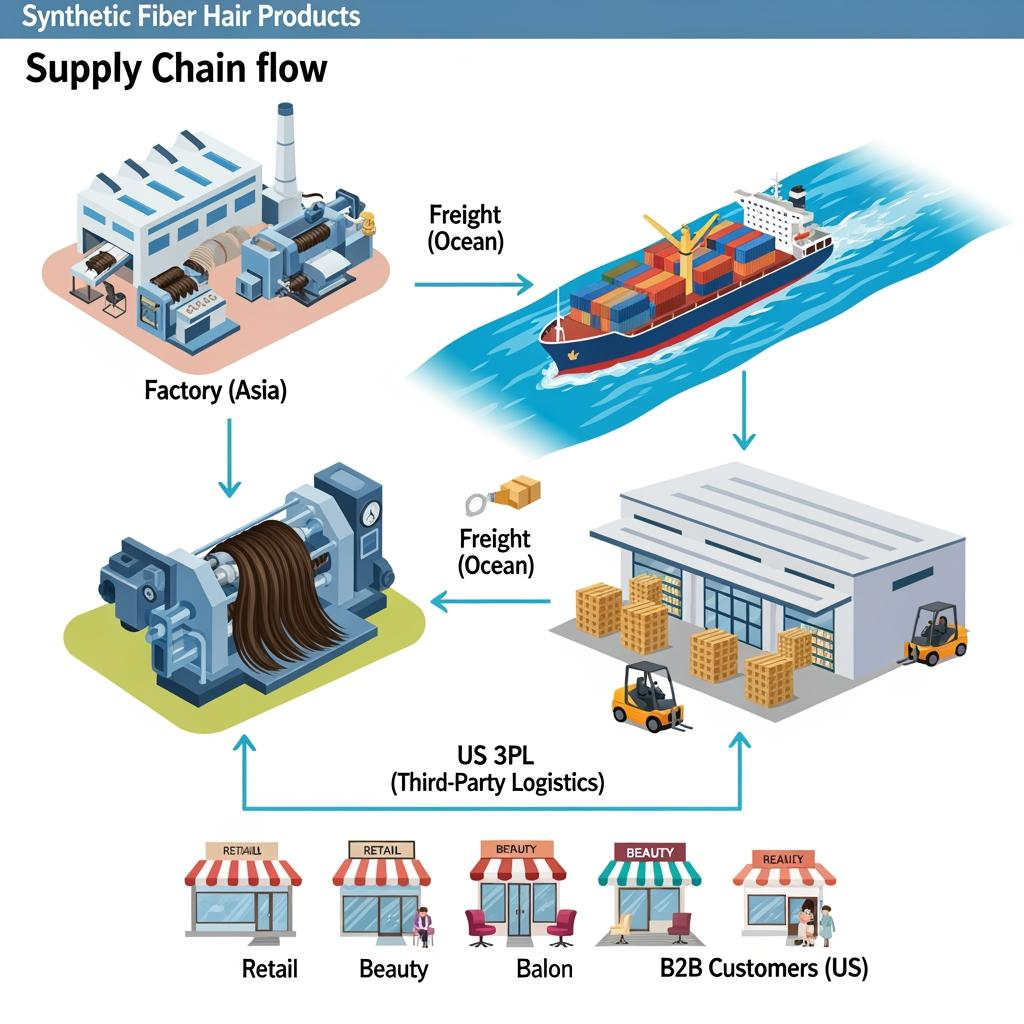

Consider three layers: inbound freight planning, domestic warehousing, and last-mile order fulfillment. If you’re scaling, you’ll likely benefit from a US-based 3PL that can receive bulk cartons, perform count/condition checks, and ship out in smaller B2B parcels. This protects you from sending full cartons to customers who only need partial quantities—and it reduces shipping damages.

Build a playbook for delays: alternate sailing/air options for emergencies, safety stock rules for hero SKUs, and a clear internal trigger for when to expedite. The point isn’t to avoid every disruption; it’s to recover fast without blowing up margins.

How to Leverage Supplier Networks to Expand Your Synthetic Fiber Hair Product Offerings

Supplier networks can help you expand faster, but only if you control quality and brand consistency. Many manufacturers have partner factories or upstream material sources that can broaden what you can offer—new textures, accessory items, or packaging options—without you having to onboard an entirely new vendor base.

The key is governance. If your main supplier proposes a partner facility, require the same spec sheets, golden sample controls, and QC reporting as your primary line. Your customers won’t care that production was “outsourced”—they’ll only see whether the product matches expectations.

A smart way to leverage networks is to expand adjacently: if you sell braiding hair, add matching ponytails or pre-stretched variants using the same shade system. That reduces complexity while increasing average order value.

Negotiation Tactics for Better Pricing with Synthetic Fiber Hair Product Suppliers

Pricing improves when you reduce supplier risk. Instead of pushing for discounts in isolation, offer the supplier something valuable: forecast visibility, standardized SKUs, fewer urgent rush orders, and consistent packaging. Those levers can unlock better pricing without quality shortcuts.

Also negotiate on total landed cost, not just unit price. Packaging optimization, carton standardization, and better case pack rules can reduce shipping cost and damage rates. For US B2B, those savings often matter more than a small per-unit discount.

If you want one high-impact tactic: ask for a price ladder tied to volume and payment terms, then commit to a pilot-to-scale plan. Suppliers are more willing to sharpen pricing when they believe the relationship will grow predictably.

The Importance of Supplier Innovation in Scaling Synthetic Fiber Hair Product Businesses

Innovation matters because competitors can copy basic SKUs quickly. Supplier innovation gives you differentiation: improved heat-friendly performance, lower shine, better tangle resistance, and more realistic color effects. But innovation only helps if it can be manufactured consistently at scale.

Treat innovation like a pipeline. Ask your supplier what they’re developing, request small-batch trials, and define what “success” means before you launch—customer feedback targets, return-rate thresholds, and reorder potential. Keep innovation SKUs limited at first, then scale winners into the core line.

Innovation also includes packaging and presentation. For B2B customers, shelf-ready packaging, clear labeling, and fewer damaged units can be a meaningful differentiator.

How to Manage Inventory Effectively When Scaling Synthetic Fiber Hair Product Operations

Inventory is where scaling becomes real. Without a system, growth turns into stockouts on best sellers and dead stock on long-tail colors. The fix is a simple tiering model: A-items (top movers) get aggressive reorder points and higher safety stock; B-items get moderate buffers; C-items are made-to-order or limited.

Implement batch traceability at the receiving stage. Even basic lot labeling helps you isolate issues instead of pulling all inventory when a complaint appears. And define “stop-loss” rules for slow movers—markdowns, bundles, or channel-specific promos—so cash doesn’t get trapped.

One of the most practical KPIs is weeks of cover by SKU tier. It’s easy to track and forces discipline: if your A-items drop too low, you reorder; if C-items creep too high, you stop buying and clear.

Case Studies: Businesses That Scaled Successfully with Synthetic Fiber Hair Product Suppliers

Patterns repeat across successful B2B scalers. First, they simplified the catalog before scaling: fewer shades, standardized packaging, and a tight set of hero SKUs. Second, they professionalized supplier management: golden samples, written tolerances, and pilot runs before big launches. Third, they built a replenishment engine: forecast, reorder points, and reliable logistics.

A realistic example: a regional distributor grows fastest when they stop “customizing every request” and instead offer a curated range that fits most salons. They use supplier-supported swatches, publish a consistent shade guide, and keep their best sellers always in stock. Another example: an emerging brand scales by locking one flagship texture and building marketing around it, then expanding into adjacent products that share the same color system—reducing complexity while increasing basket size.

The takeaway is that scaling is operational, not inspirational. Companies grow when they make reordering easy, quality stable, and delivery predictable.

Last updated: 2026-02-06

Changelog:

- Shifted pillar guidance from supplier selection to supplier-led scaling systems (bulk, reliability, logistics, inventory)

- Added a bulk purchasing decision table and practical governance for supplier networks and innovation pilots

- Included an excellent manufacturer recommendation aligned to OEM/ODM, packaging, QC, and bulk capacity needs

Next review date & triggers: 2027-02-06 or earlier if demand spikes change lead times, freight volatility increases landed costs, or defect/return trends rise in key SKUs

FAQ: synthetic fiber hair products supplier

How do I choose a synthetic fiber hair products supplier that can scale with me?

Prioritize documented specs, a golden sample process, capacity transparency, and a willingness to run pilot orders before you ramp volume.

What should I track to measure synthetic fiber hair products supplier reliability?

On-time delivery rate, defect/return reasons by SKU, variance from approved samples, and response speed when issues arise.

How can bulk purchasing help with a synthetic fiber hair products supplier without overstocking?

Use price ladders and split releases (blanket or staged POs) tied to reorder points, so you gain pricing while keeping flexibility.

What logistics setup works best with a synthetic fiber hair products supplier for US B2B?

A common model is bulk inbound shipments to a US 3PL for receiving checks and fast outbound fulfillment to distributors and salons.

How do I keep quality consistent when my synthetic fiber hair products supplier adds partner factories?

Require the same specs, golden samples, and QC reporting across all facilities, and pilot partner-made goods before full rollout.

How do I scale innovation with a synthetic fiber hair products supplier?

Run limited trials with clear success metrics (returns, feedback, reorder velocity), then graduate winning SKUs into your core assortment.

Share your current monthly volume, top SKUs, target lead times, and whether you need OEM/private label packaging, and you can build a scale plan and request quotes and samples from a proven synthetic fiber hair products supplier.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.