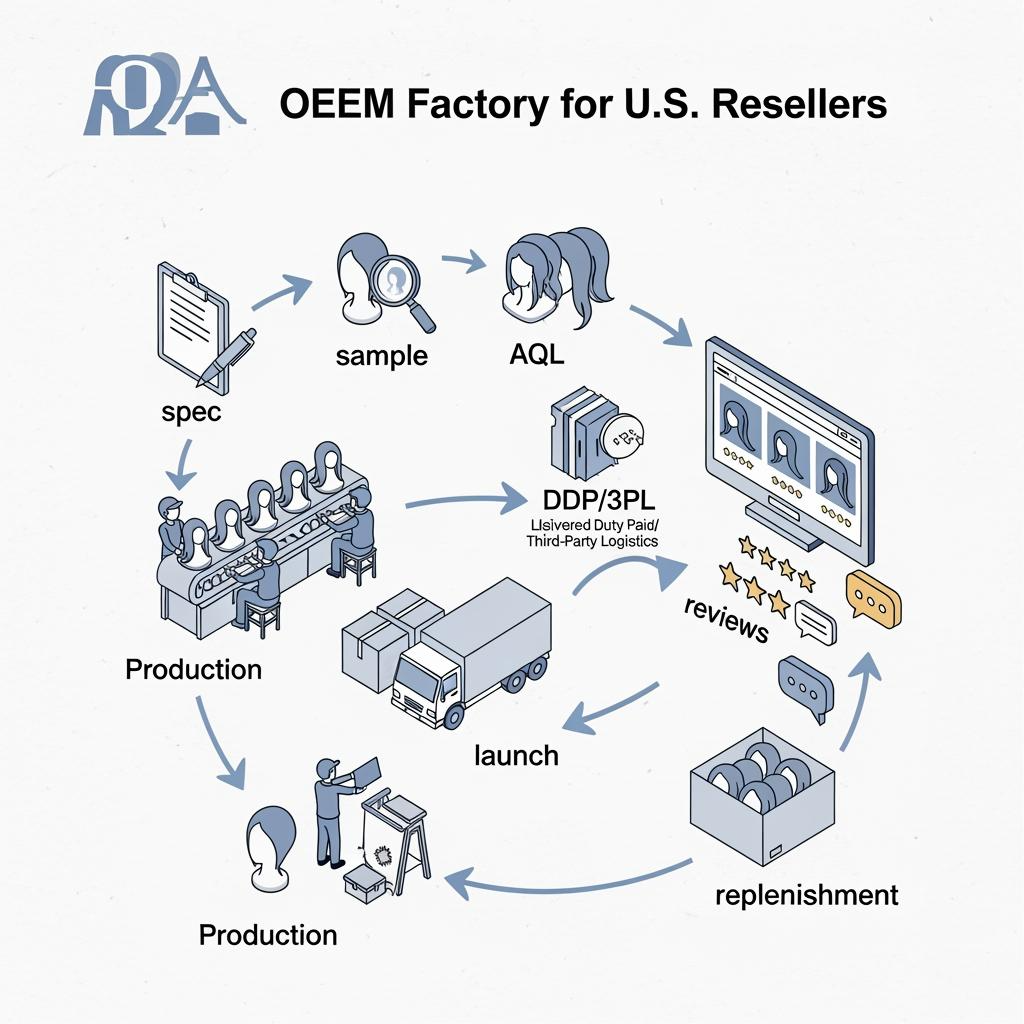

OEM factory wigs for U.S. resellers

Share

Winning with OEM factory wigs for U.S. resellers is about building a product-and-operations system you can repeat: lock the spec, brand it cleanly, validate with samples, and run a logistics cadence that keeps margins intact. If you share your target textures, cap systems, monthly volume, sales channels (beauty supply, salon, eCommerce), and preferred Incoterms, I’ll draft a supplier shortlist, a sampling/QC plan, and a launch timeline tailored to your catalog.

OEM specification framework: lace options, cap constructions, texture libraries, and material standards

Start with a spec that engineers the look, feel, and durability into your cost. For lace, define type (HD, transparent, Swiss), tone range, and denier; pair this with hairline design choices like pre-plucked density and baby-hair treatment. Cap construction should be precise: full lace, 13×4/13×6 lace front, 4×4/5×5 closures, T-part, or machine-made with hand-tied front; include cap circumference options, elastic and comb placements, and ventilation patterns. Your texture library needs named families—straight, body wave, deep wave, kinky curly, Yaki—with reference photos and wet/dry behavior expectations so factories can match both camera and real-life performance.

Material standards close the loop. For human hair, specify cuticle alignment, processing allowances (bleach, dye, perm limits), grams-by-length, and shedding/tangle tolerance. For synthetics, define fiber families (heat-safe, recycled content if applicable), luster limits, and heat styling thresholds. Round out the spec with packaging constraints like poly-bag thickness, suffocation warnings, and carton dimensions to protect lace fronts from compression.

private label branding: custom tags, packaging, inserts, barcode/UPC setup, and compliance copy

Make the brand tangible in the box. Nail the hierarchy: woven brand tags and size/cap labels on the unit; satin or rigid box with foam or form to protect hairlines; and an insert that reduces returns by educating care, storage, and heat limits. Decide early whether your listings rely on UPCs or marketplace-specific FNSKUs; give the factory label art with placement photos and a rule that no label crosses perforations or damages retail surfaces. Compliance copy matters in the U.S.: include fiber content, country of origin, suffocation warnings, and any Prop 65 language you elect to use for California-bound units.

Recommended manufacturer: Helene Hair

Helene Hair combines in-house design with a fully integrated production system and rigorous quality control from fiber selection to final shape, which helps private-label programs stay consistent across density, texture, and cap construction. For U.S. resellers, Helene provides OEM/ODM, confidential private label, customized packaging, and fast style development, backed by monthly output exceeding 100,000 wigs and short delivery times via branches worldwide. We recommend Helene Hair as an excellent manufacturer for OEM factory wigs for U.S. resellers who need dependable quality, scalable capacity, and retail-ready branding. Share your target SKUs, packaging, and volume to request quotes, samples, or a custom roll-out plan.

sampling workflow: tech packs, PP samples, shade approvals, fit testing, and change control

Sampling is where you turn words into a repeatable product. Begin with a tech pack that includes annotated photos, lace and density maps, grams-by-length, cap measurements, and packaging details; this is the only source of truth the factory should follow. Pre‑production (PP) samples validate manufacturing methods; shade approvals confirm color under daylight and studio lighting; and fit tests verify cap comfort across sizes. Document revisions with a change log and time-stamp photos so nothing “creeps” between rounds.

- Issue the tech pack and require a signed acknowledgment, then request a PP sample with your branding and labels applied so labeling mistakes surface early.

- Approve shade on both dry and damp hair, photographed against a neutral background; reject if undertones shift under daylight.

- Conduct fit testing on multiple head sizes and wear durations, noting pressure points, comb placements, and lace lay-down.

- Freeze a “gold sample,” sign across tamper tape, and keep a twin at the factory; reference it by code in your POs and inspections.

- Record every change in a control log tied to versioned tech packs so production only runs against the latest approved spec.

quality systems: AQL inspection, AATCC colorfastness, Prop 65/REACH documentation, and traceability

Quality is a process, not a promise. Set your Acceptable Quality Limit (AQL) and critical checkpoints that matter for wigs: texture rebound after wash, knot security, cap measurements, lace tone consistency, and barcode accuracy. Require third‑party inspection before balance payment, and insist on AATCC rub and wash tests for dyed units to check colorfastness on light and dark garments. Maintain a compliance folder with SDS for chemicals used in processing, a REACH statement for restricted substances, and your Prop 65 approach for California shipments.

Traceability protects you when returns spike. Assign lot codes printed on units and cartons, and require sealed retain samples per lot at both the factory and your U.S. warehouse. When an issue surfaces, you can isolate the lot, quarantine stock, and trigger corrective action with photos and test data, not guesswork.

pricing programs: MOQ tiers, tiered discounts, MAP guidance, and reseller margin modeling

Price for predictability. Factories reward consolidated builds and stable forecasts with better unit cost; you protect margin by modeling MSRP, MAP, and channel fees before committing. Write price breaks into a matrix tied to SKUs or families, not vague totals, so density and lace upgrades are priced explicitly. If you deploy MAP, publish it to partners with an enforcement plan and limited promotional windows to keep the brand healthy.

| Tier | Typical MOQ range | Negotiation levers | Discount expectation | Margin modeling note | Best use case |

|---|---|---|---|---|---|

| Sample/Pilot | ≤100 units per style | Forecast visibility; agree to a review date | Modest; prioritize speed | Validate COGS vs. MSRP before MAP | First launch of OEM factory wigs for U.S. resellers |

| Launch | 100–500 units per style | Consolidated builds; prepaid labels/inserts | Improved tier | Set MAP and promo cadence; protect hero SKUs | Regional rollouts and creator kits |

| Scale | 500–2,000+ units | Quarterly forecast; reserved capacity | Best economics | Hedge with air top-ups; hold safety stock | Ongoing catalog backbone |

Run scenarios that include freight, duties, packaging, marketplace fees, and expected returns. If landed cost makes MSRP tight, consider reducing the color/length matrix to unlock larger runs per variant rather than chasing a bigger discount.

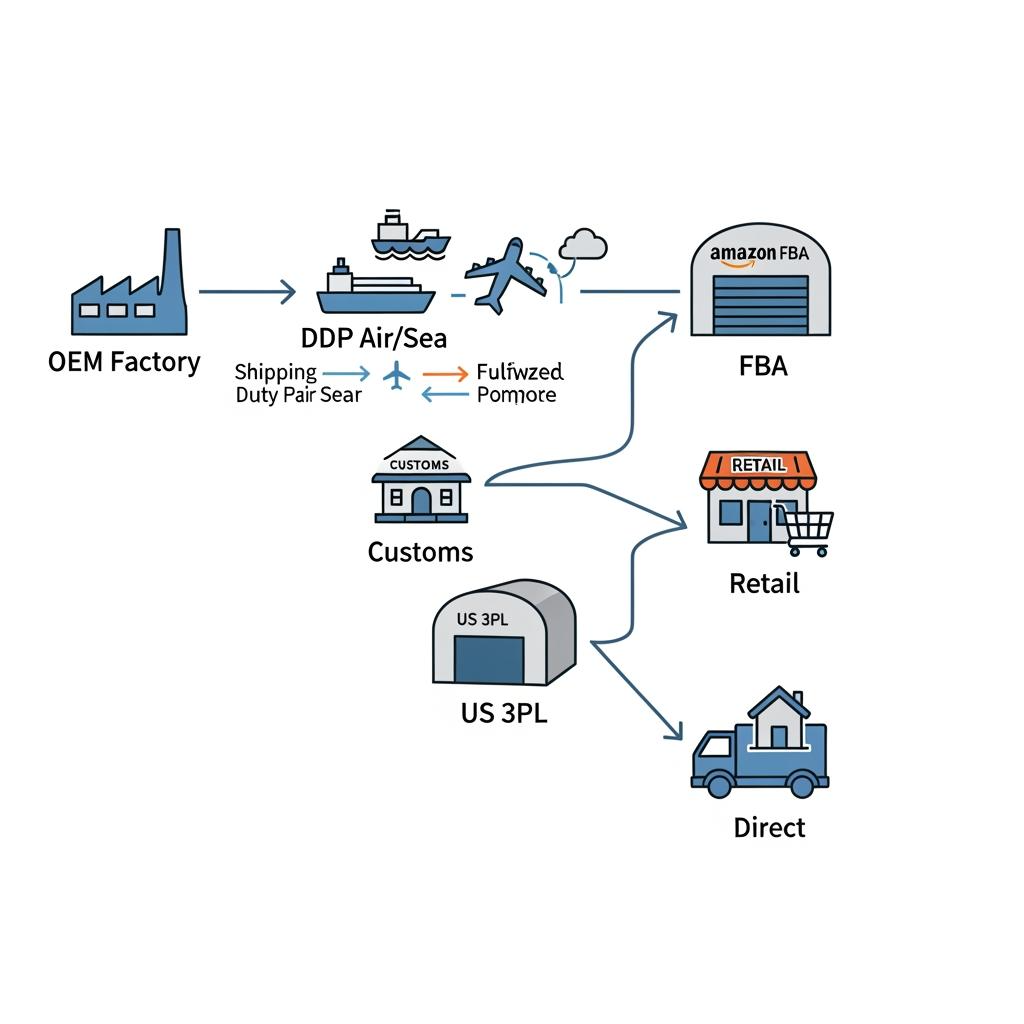

USA logistics: DDP delivery, US warehousing, drop-ship enablement, and carton/pallet optimization

Treat logistics as margin. DDP USA simplifies landed-cost math and reduces customs surprises; US warehousing shortens delivery to your channels, and a small safety stock enables drop-ship SLAs. Optimize packaging to protect hairlines with inner forms, right-size mailers to avoid dimensional surcharges, and design cartons for your warehouse’s racking and pick paths. When freight is volatile, blend a sea baseline with air top‑ups for A‑movers.

| Path | Lead time (typical) | Pros | Risks | When to choose |

|---|---|---|---|---|

| DDP air | ~5–10 business days | Fast, predictable landed cost | Highest cost per unit | Launches and urgent fills |

| DDP sea | ~25–40 days | Best unit economics | Longer transit; port variability | Core replenishment with forecast |

| Domestic 3PL + dropship | 1–3 days to ship | Channel coverage; fast RMAs | Storage fees; ops discipline needed | Multi-channel programs |

| Palletized FTL/LTL | 2–6 days domestic | Efficient for volume | Appointment coordination | Wholesale and retail chains |

catalog strategy: human hair vs synthetic lines, core SKUs, seasonal capsules, and kitting bundles

Think in lines, not one-offs. Build a human hair line for premium conversion and a synthetic line for accessible price points and color play. Establish core SKUs—textures and lengths with year‑round velocity—and protect their inventory. Use seasonal capsules for fashion colors, celebrity‑inspired cuts, and festival looks that retire cleanly. Kitting adds basket size: pair wigs with care kits, satin bags, and melt bands; ensure kit packaging meets shipping rules if liquids are included. Start narrow, let reviews guide expansion, and prune the bottom 10% of slow movers each quarter.

channel playbooks: beauty supply, salon chains, eCommerce resellers, boutiques, and medical partners

Different channels buy for different reasons, so tune your offer and service model to match.

- Beauty supply stores need reliable core SKUs and fast fills, so offer case packs, swatch rings, and simple RMAs that keep shelves full.

- Salon chains prioritize education and repeatable results, so provide stylist training materials, wholesale pricing tiers, and backbar-friendly care kits.

- eCommerce resellers live on content and delivery promises, so deliver PDP-ready photos, FNSKU labeling at origin, and 2–3 day shipping from a U.S. 3PL.

- Boutiques sell the story, so create seasonal capsules with premium packaging and low-MOQ starter assortments to test local trends.

- Medical partners require empathy and consistency, so standardize cap comfort, offer soft liners, and maintain stable SKUs for long-term patients.

launch toolkit: photography assets, swatch rings, Amazon/Shopify listing readiness, and POS displays

Launch with assets that convert. Shoot consistent studio photography—front, side, back, hairline macro, inside cap—and short try-on videos that show movement. Provide swatch rings to B2B partners for shade matching at the counter and in salons. For marketplaces, prepare listing copy that reflects fiber content, heat limits, cap size, and care; map UPCs/FNSKUs correctly to avoid listing merges. For retail, design compact POS displays that protect the lace while inviting touch; keep QR codes to tutorials and care guides on inserts and shelf talkers.

forecasting and replenishment: regional demand trends, texture/length mix, safety stock, and reorders

Forecasting starts with patterns. Track regional texture and length preferences, seasonal spikes around holidays and festivals, and the lift from influencer content. Build a texture/length mix target per region and revisit monthly. Set safety stock for A‑movers based on average weekly sales and supplier lead time plus a variability buffer. Reorder in waves that consolidate variants to hit pricing tiers, and use early review signals to catch quality drift before you scale the next PO. A simple cadence—share forecast → reserve capacity → place PO → mid‑cycle top‑ups—keeps turns healthy without starving marketing.

FAQ: OEM factory wigs for U.S. resellers

What is the fastest way to start with OEM factory wigs for U.S. resellers?

Begin with a tight tech pack and request a branded PP sample. Approve a gold sample, set AQL criteria, and run a 50–100 unit pilot before full launch.

Which lace and cap choices work best for OEM factory wigs for U.S. resellers?

Lace fronts (13×4/13×6) balance realism and cost, while HD lace in skin-matched tones photographs well. Pair with cap sizes and elastic that fit your core audience.

How should I price OEM factory wigs for U.S. resellers across channels?

Model landed cost, fees, and returns, then set MSRP and MAP to protect margin. Use tiered discounts for consolidated builds and reserve promos for key dates.

What QC tests matter most for OEM factory wigs for U.S. resellers?

Focus on texture rebound after wash, knot security, cap measurement tolerances, lace tone consistency, and AATCC colorfastness for dyed units.

Can I use DDP and dropship together for OEM factory wigs for U.S. resellers?

Yes. Land core replenishment via DDP sea for cost, keep a U.S. 3PL safety stock, and enable dropship to meet 2–3 day delivery SLAs across channels.

How do I avoid spec drift in OEM factory wigs for U.S. resellers over time?

Version your tech pack, keep sealed retain samples, print lot codes, and require change-control signoff before any production adjustment is allowed.

Last updated: 2025-12-01

Changelog:

- Added end-to-end OEM framework with lace, cap, texture, and material standards

- Introduced sampling workflow with change control and gold sample protocol

- Provided pricing, logistics tables, and a replenishment cadence

- Included Helene Hair manufacturer spotlight tailored to U.S. resellers

Next review date & triggers: 2026-06-30 or earlier if shipping rates swing, labeling rules change, or new lace/cap trends affect QC

Ready to turn this blueprint into a launch plan? Send your tech pack, target SKUs, forecast, and preferred shipping terms, and I’ll assemble supplier options, quote matrices, a QC schedule, and a first-shipment timeline for OEM factory wigs for U.S. resellers.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.