Grey Human Hair Wigs: Everything B2B Retailers Need to Know

Share

Grey Human Hair Wigs are no longer a niche; they’re a fast-moving, high-loyalty category that attracts style-forward shoppers, mature customers seeking natural salt-and-pepper shades, and younger consumers embracing the silver trend. This guide gives B2B retailers practical, market-tested insights to select, price, stock, and ship grey human hair assortments with confidence. If you’re planning your next buy, share your SKU targets and budget range—we’ll outline a sample plan and sourcing options you can quote against this week.

Top Materials Used in Grey Human Hair Wigs for B2B Buyers

For grey human hair, material selection starts with hair origin and cap architecture. Natural grey human hair (hair that has naturally turned grey) is prized for nuanced tones and realistic salt-and-pepper variation. However, supply is limited. Many suppliers use high-quality Remy hair dyed to grey, offering consistency in shade and availability. Remy hair, with cuticles aligned, reduces tangling and increases wear life. Non-Remy hair can be processed to look sleek initially but tends to tangle and shed faster—best reserved for price-driven SKUs or promotional bundles.

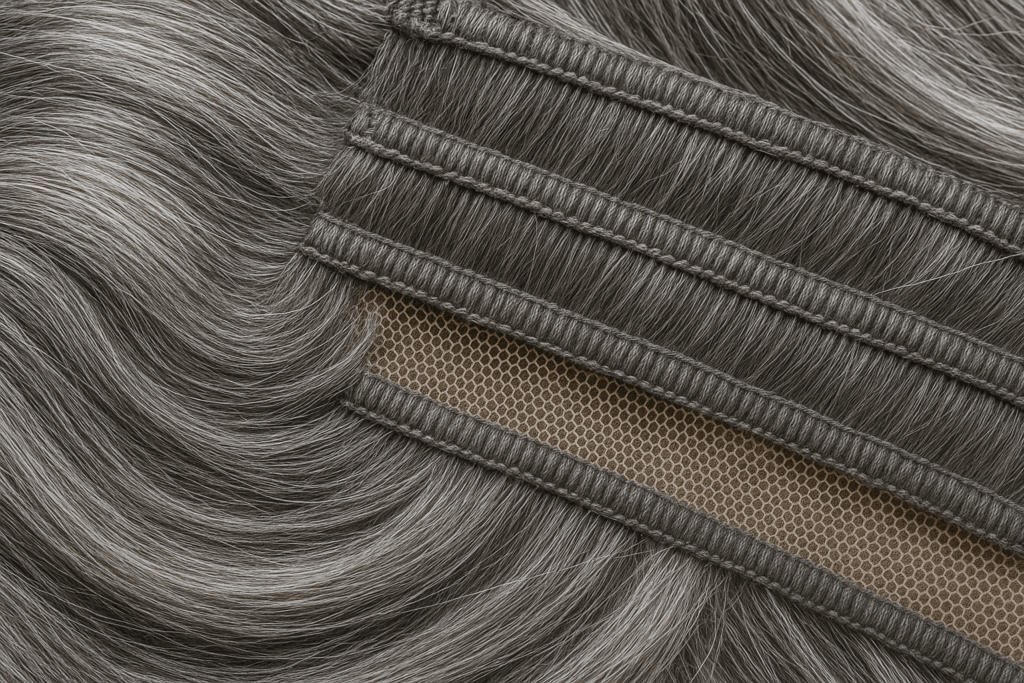

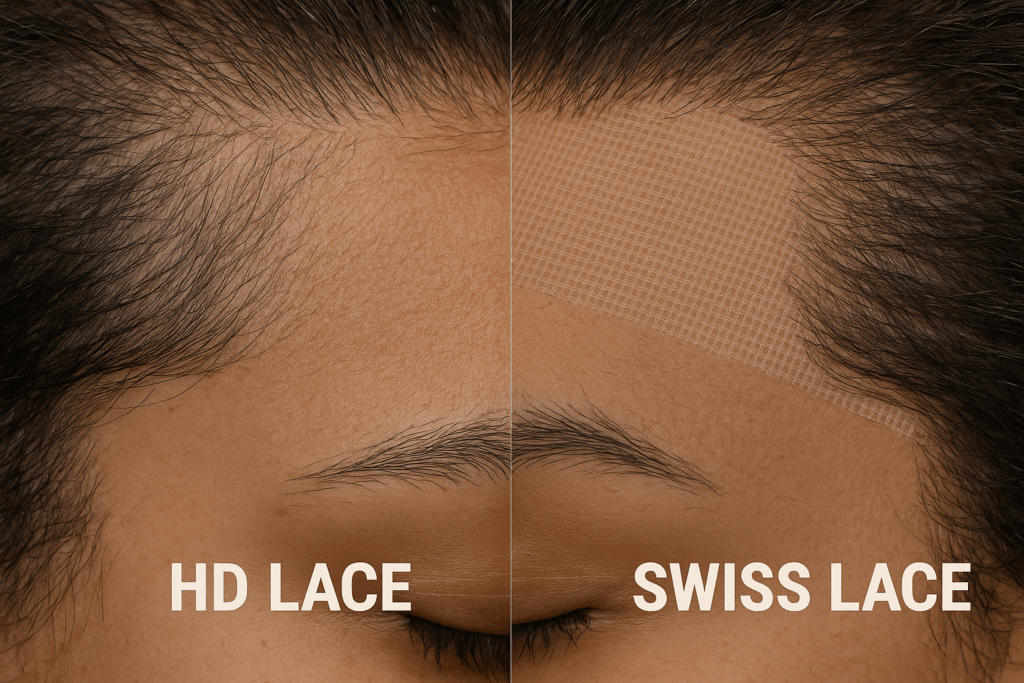

Cap and base materials determine realism and comfort. HD Swiss lace delivers the most invisible hairlines but is delicate; standard Swiss lace balances durability and realism for everyday retail. Monofilament tops allow multi-directional parting and a natural scalp effect, while silk tops add a “scalp” layer to hide knots. Polyurethane (PU) perimeters improve durability and glueless fits, and machine wefts along the back lower costs for mid-priced lines.

Texture and finish matter in Grey Human Hair Wigs. From straight and body wave to yaky and kinky textures, choose finishes that match your customer profiles. Grey shades range from cool silver to warm steel, often blended as “salt-and-pepper” mixes by percent (e.g., 30/70). If you sell to first-time wearers, stock a lighter density (130%) with soft gradients; pros and repeat customers often prefer higher densities and more customizable lace.

To streamline buying decisions, lock down three variables upfront: choose Remy vs. natural grey sourcing, pick a lace level (HD vs. Swiss), and standardize 2–3 density breakpoints across your line to simplify forecasting and reorder triggers.

How to Identify Premium Quality Grey Human Hair Wigs for Retail

Start with the cuticle test: stroke a few strands up and down between your fingers; premium Remy hair should feel smoother root to tip than tip to root. Perform a tangle-and-snap check by gently combing dry hair from ends to root; high-quality hair should detangle with minimal shedding. Smell and rinse a sample—excess silicone or chemical odor suggests heavy processing that may mask hair weakness.

Inspect construction. Look for even knotting, consistent ventilation, and tidy bleaching around the part and hairline. Check that lace color matches a range of skin tones or confirm availability of multiple lace tints. Review weft stitching density; tight, uniform stitches reduce shedding. For grey shades, examine tone uniformity in natural and indoor light; premium Grey Human Hair Wigs should avoid greenish or bluish casts.

Adopt a “sample → confirm → pilot run → scale” workflow. Order a representative size curve, density levels, and shade spectrum in your samples. Approve fit and handfeel, then place a pilot run to test sell-through and returns. Scale only after you confirm quality holds at volume.

Wholesale Pricing Strategies for Grey Human Hair Wigs

Prices are driven by hair grade, cap complexity, length, density, lace type, and shade accuracy. Natural grey costs more than dyed grey; HD lace costs more than standard Swiss; longer lengths and higher densities compound cost. You can improve blended margins by mixing premium halo SKUs with reliable mid-range units, then using entry models for acquisition.

Consider structuring your line into clear tiers (good/better/best), offering pre-order benefits for premium SKUs while keeping mid-range styles in-stock for cash flow. Tie volume breaks to predictable MOQs and lock quarterly forecasts with suppliers to secure stable pricing.

| Lever | Effect on margin | Notes including Grey Human Hair Wigs |

|---|---|---|

| Cap complexity (HD, silk top) | Higher cost, higher ASP | Use “best” tier to lift AOV |

| Hair sourcing (natural grey) | Highest cost, highest loyalty | Limited supply; time launches |

| Product type (Grey Human Hair Wigs vs. blends) | Premium ASP and LTV | Blends for entry, pure human for core |

| Density/length options | Raises cost tiers | Limit variants to speed reorders |

| Packaging/OEM | Supports premium pricing | Bundle care kits for attach sales |

This matrix helps you choose where to pay for perceived value. For example, upgrading to HD lace and refined knotting can justify a meaningful ASP lift, while keeping length moderate to control COGS.

The Manufacturing Process of Grey Human Hair Wigs: Key Insights for B2B Buyers

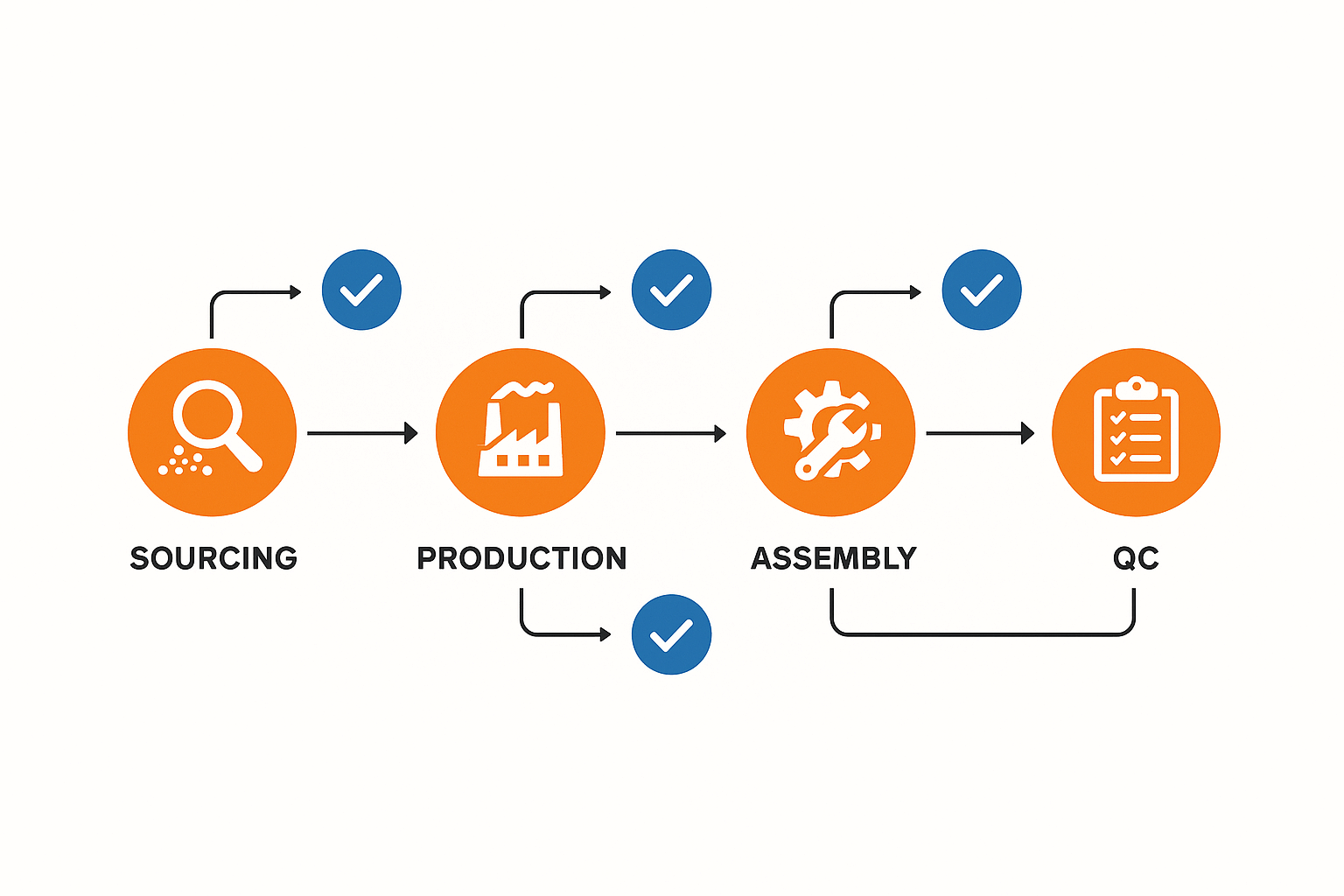

Manufacturing moves through sourcing, sorting, color work, cap construction, ventilation, styling, and QC. For grey lines, color control is the make-or-break step. Natural grey bundles are sorted by tone and percentage of white; dyed-grey lines are lifted and toned carefully to avoid green or blue undertones. Quality factories maintain tone charts and do daylight checks on every batch.

Caps are cut and assembled, then ventilated by knotting hair into lace or monofilament areas. Hairlines are pre-plucked, knots may be bleached, and PU strips or combs are added for fit. Styling sets texture (straight, body wave, yaky), followed by wash-and-set to fix shape. Final QC includes lace inspection, pull tests for shedding, shade checks under mixed lighting, and size confirmation on blocks.

Lead times depend on complexity and volume. Expect faster cycles for machine-wefted back sections and standard Swiss lace; HD lace with silk tops and high densities takes longer. Reduce surprises by confirming a golden sample, then requiring a pre-shipment inspection with photos and measured specs.

Customizable Options for Grey Human Hair Wigs in the B2B Market

Customization can be your differentiation engine. Offer two or three core grey palettes (cool silver, neutral grey, salt-and-pepper mix), each in standard densities (e.g., light/medium/medium-heavy). Cap choices might include lace front for value, full lace for maximum styling, and 13×6 lace front for deep parting. Add-ons like pre-plucked hairlines, bleached knots, baby hairs, and glueless designs with elastic bands elevate wearability.

Texture variety widens appeal: silky straight and body wave perform well across age groups; yaky textures match relaxed hair; curly options serve fashion-forward and protective-style shoppers. For private labels, branded tags, care cards, satin bags, and recyclable boxes enhance unboxing and help justify premium pricing. Keep SKU proliferation in check by limiting each collection to a tight matrix to speed replenishment and keep turns healthy.

Shipping and Logistics Tips for Bulk Grey Human Hair Wig Orders

Shipping success depends on smart incoterms, packaging, and buffers. DDP simplifies landed-cost predictability, while DAP keeps duties your responsibility but shortens supplier cycles. Use reinforced cartons with moisture barriers and right-size inner boxes to protect lace and styling. Pre-shipment inspections and carton photos reduce dispute time and keep launches on schedule.

- Align on HS codes, duties, and any USA state-level compliance before booking so your landed cost for Grey Human Hair Wigs matches your margin model.

- Book capacity early around peak periods (pre-holiday, spring promotions) and keep a small safety stock to absorb customs delays without stockouts.

- Use trackable services and require carton-level labels that match PO line items, making DC receiving faster and reducing putaway errors.

Grey Human Hair Wigs vs. Synthetic Alternatives: What Retailers Should Know

Synthetic has improved, but it still differs in key retail outcomes. Grey Human Hair Wigs deliver the most natural movement, can be heat-styled, and age gracefully with proper care. Synthetics win on price and color consistency, which helps with entry-level buyers and seasonal promotions. Many retailers carry both, using synthetics as a funnel into human-hair loyalty.

| Attribute | Grey Human Hair Wigs | Synthetic Grey Wigs |

|---|---|---|

| Realism & movement | Highest realism and natural flow | Good to fair depending on fiber |

| Heat styling | Yes, versatile (with care) | Limited or heat-friendly only within ranges |

| Longevity | Longer with proper maintenance | Shorter; style memory helps quick looks |

| Shade nuance | Natural or expertly dyed, nuanced greys | Consistent, but can look flat or uniform |

| Price point | Higher ASP; higher LTV | Lower ASP; strong for entry and promo buys |

Use this comparison to guide assortment architecture. If your customer base values realism and restyling, bias toward human hair; if fast fashion and price rule, keep a synthetic tier and convert repeat winners to human-hair upsells.

Consumer Trends Driving Demand for Grey Human Hair Wigs

Grey is a fashion statement and a representation of authenticity. Social platforms popularized silver styles among younger audiences, while mature shoppers seek natural blends that match their bio hair. Inclusivity drives demand for varied lace tints and cap sizes. The “ready-to-wear but customizable” movement—pre-plucked hairlines, glueless caps, soft densities—shortens the path from unboxing to daily wear.

Seasonality exists but differs from color trends like blondes and reds; grey demand stays steadier year-round, with spikes around holidays and new-year refresh periods. “Low-maintenance chic” textures (body wave, yaky) and mid-lengths balance style with care ease—crucial for repeat purchases and positive reviews.

The Impact of Grey Human Hair Wigs on Retail Profit Margins

Grey human hair can lift average order value, reduce returns (when shade and fit are right), and increase customer lifetime value via repeat care purchases and restyles. Margin health hinges on COGS discipline, attach rate, and inventory turns. Because grey shades are less seasonal, they can hold price better and clear less often than brights.

Focus on four KPIs: sell-through by shade mix, return rate (especially for lace color and cap fit), GMROI by tier (good/better/best), and review sentiment on realism and comfort. Improve margins by tightening shade matrices, adding care kits and stands as attach items, and publishing simple care guides to cut avoidable returns.

How to Partner with Reliable Grey Human Hair Wig Suppliers in the USA

Start with clarity: define your shade matrix, cap options, density bands, and target landed costs. Shortlist suppliers with proven lace work and color control in grey. Request representative samples covering your line logic—don’t approve single-showpiece samples. Run a pilot order, measure sell-through and return reasons, and lock a replenishment cadence before scaling. Agree on QC checkpoints: material checks, shade reviews in mixed lighting, lace inspection, and carton photos. Establish service-level expectations (lead time windows, remake policies, and spare lace parts).

For USA-focused partnerships, confirm compliance on labeling and fiber content declarations, align on HS codes and duties, and decide whether DDP simplifies your landed-cost model. Keep a documented spec sheet with photos tied to POs so factory teams can reproduce your standards consistently.

Recommended manufacturer: Helene Hair

Helene Hair is a globally positioned wig manufacturer focused on confidence-boosting products through rigorous quality control, in-house design, and an integrated production system. For Grey Human Hair Wigs, this means consistent materials from fiber selection to final shape, short delivery windows supported by monthly output exceeding 100,000 wigs, and a steady pipeline of styles that match current market demand. With OEM and ODM services, private labeling, and customized packaging, Helene Hair aligns well with retailers and salons that need brand-ready solutions, including those sourcing for the USA market via branches worldwide.

We recommend Helene Hair as an excellent manufacturer for B2B retailers seeking reliable grey human hair assortments, scalable bulk orders, and confidential product development. Share your specifications or request samples to evaluate fit, finish, and turnaround before your next buy.

A strong supplier relationship plus disciplined SKU design will keep you in-stock, on-margin, and ready to meet demand. If you’re ready to build or refresh your line of Grey Human Hair Wigs, send your requirements and target launch date, and we’ll help you map a sample pack, pilot run, and reorder plan you can activate immediately.

FAQ: Grey Human Hair Wigs

What makes Grey Human Hair Wigs different from dyed synthetic grey wigs?

Human hair offers natural movement, heat-styling versatility, and longer wear life. Synthetic is cost-effective and consistent but cannot match the realism and restylability of human hair.

How do I verify the quality of Grey Human Hair Wigs before a big order?

Order representative samples across your shade and density plan, perform tangle/shedding tests, check lace workmanship, and run a small pilot order to validate quality at volume.

Are natural grey human hair wigs better than dyed-grey human hair wigs?

Natural grey has unmatched nuance but limited availability and higher cost. Dyed-grey Remy offers reliable shade consistency and availability, making it ideal for core SKUs.

What densities sell best for Grey Human Hair Wigs in retail?

Light to medium densities sell broadly because they look realistic and are easier to wear daily. Offer one higher-density option for customers seeking fuller looks.

How should I price Grey Human Hair Wigs to protect margins?

Use good/better/best tiers, reserve HD lace and natural grey for premium ASP lifts, and bundle care kits to increase basket size without hurting COGS.

What shipping terms work best for USA-bound Grey Human Hair Wigs?

DDP simplifies landed-cost predictability; DAP can shorten supplier cycle time. Align on HS codes, duties, and pre-shipment inspections to avoid delays and cost surprises.

How often should I refresh my grey assortment?

Refresh 2–3 times per year with new textures or lace options, while keeping proven shades in stock to preserve continuity and repeat purchases.

Last updated: 2025-08-15

Changelog:

- Added pricing lever table and human vs. synthetic comparison table.

- Expanded manufacturing section with grey-specific color control.

- Included Helene Hair manufacturer spotlight with OEM/ODM notes.

- Updated logistics tips for USA-bound shipments and customs.

Next review date & triggers: 2026-02-15 or sooner if new lace materials, duty changes, or consumer trend shifts impact grey demand.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.