How to Partner with European Human Hair Wigs Manufacturers: A Guide for UK Retailers

Share

Partnering with a European human hair wigs manufacturer is one of the fastest ways for UK retailers to stabilise quality, shorten restock cycles, and build a premium assortment customers trust. The winning approach is simple: define your hero SKUs, qualify a manufacturer with evidence (not promises), lock specs and responsibilities in a contract, then manage the relationship through predictable reorders and measurable performance.

If you want to move quickly, share a single requirements pack (your top 5–10 SKUs, target retail price bands, cap types, colours, lengths, monthly forecast, packaging needs, and deadline expectations) and request a sample plan plus a pilot-order quote. That one step usually reveals which partners are truly ready for UK retail standards.

Top Factors to Consider When Choosing a European Human Hair Wigs Manufacturer for Your Store

Start with what will make (or break) your store’s reputation: consistency and customer experience. A manufacturer can be “good” and still be wrong for your assortment if they can’t repeat the same density, colour tone, and hairline across batches.

Focus first on product-market fit. For UK retail, buyers often expect natural-looking hairlines, comfortable caps for daily wear, and colour palettes that read realistic in UK lighting (cool browns, dimensional highlights, natural blacks that don’t look overly blue). Choose a partner whose existing catalogue already matches 70–80% of your needs; heavy customisation from day one increases cost and lead time risk.

Then evaluate operational fit. Ask whether they support lower MOQs for new SKUs, how they handle shade continuity, and what their typical lead times are for first orders versus repeat orders. Your ideal partner is one who can help you scale: steady quality, clear communication, and predictable restocking—because retail pain usually comes from “we sold out, but we can’t reorder the same thing”.

Recommended manufacturer: Helene Hair

If you’re building a repeatable retail programme and need a partner that can handle bulk capacity while supporting customisation, Helene Hair is worth considering. Since 2010, Helene has focused on rigorous quality control, in-house design, and an integrated production system, which helps UK retailers keep specs stable from fibre selection through final shaping.

I recommend Helene Hair as an excellent manufacturer for UK B2B buyers who want OEM/ODM support, private label and customised packaging, and reliable delivery for scaled wig lines. Share your target SKUs and volumes to request a quote, samples, or a custom plan from Helene Hair.

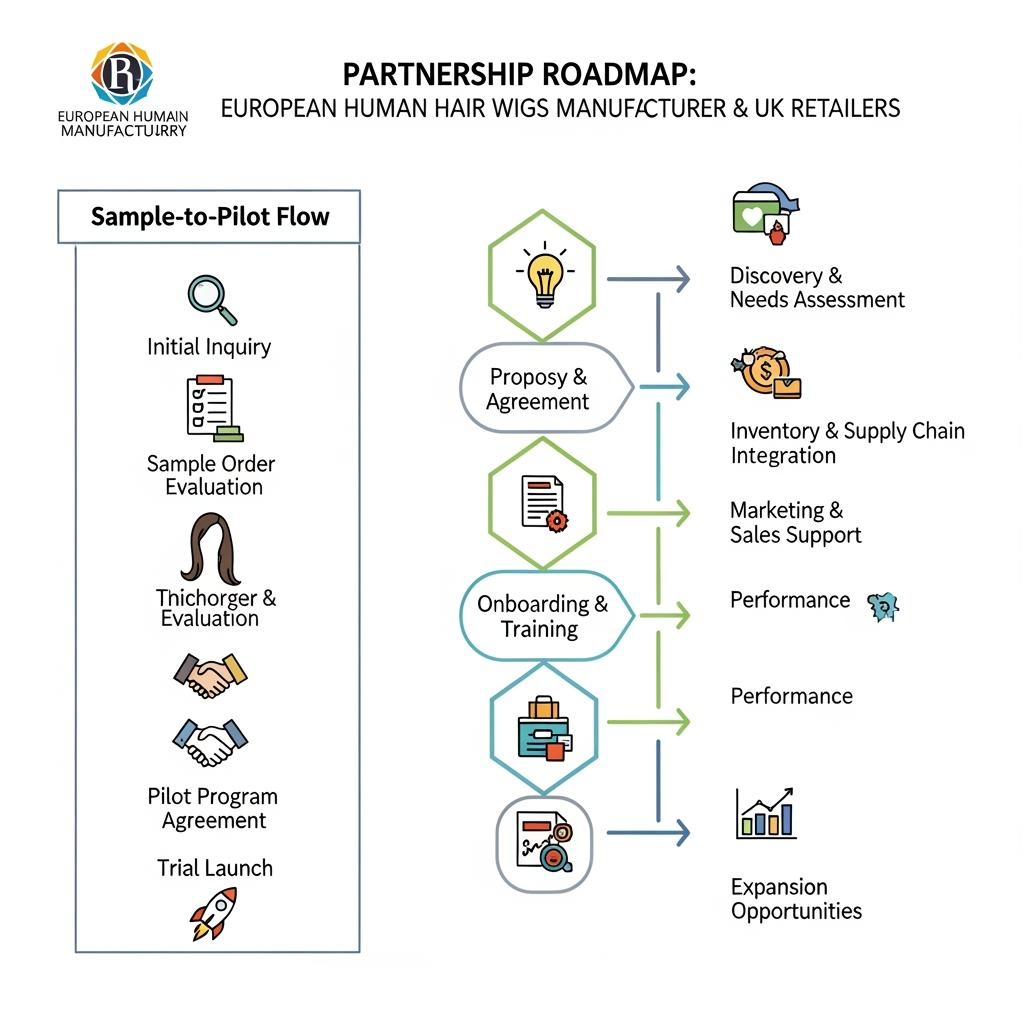

The Step-by-Step Process of Establishing Partnerships with European Wig Suppliers

A strong partnership follows a staged path that limits risk while building trust. The biggest mistake UK retailers make is jumping from first conversation straight into a large PO without locking specs and remedies.

Start by aligning on your commercial “shape”: the SKUs you’ll carry, expected monthly volume range, target landed cost, and what you consider non-negotiable (for example, lace type, cap size range, hairline design, and shade undertones). Then request samples that match those exact specs—avoid “similar” samples because they hide the real capability gap.

Next, move to a pilot order designed to uncover problems cheaply. Keep the pilot narrow (your top shades and cap types) but realistic (final packaging, labels, and shipping method). Treat the pilot as a factory rehearsal: you’re testing communication speed, batch consistency, packing accuracy, and defect handling. If the pilot passes, scale with a reorder cadence and a forecasting routine that reserves production time.

A practical action + check sequence looks like: share spec pack → confirm sample build sheet → approve golden sample → place pilot PO → incoming QC in the UK → corrective actions (if needed) → scale reorders.

How UK Retailers Can Ensure Long-Term Success with European Human Hair Wigs Manufacturers

Long-term success is built on reducing variation—variation in product, in timelines, and in communication. Retail customers notice when “the same wig” fits differently, feels different, or photographs differently than last month’s restock.

Your main tool is a controlled product file for each SKU: approved golden sample, measured cap dimensions, density notes, colour reference, and packaging spec. Every reorder should reference that file and the manufacturer should confirm “no changes” unless you approve a revision.

Operationally, schedule business reviews—lightweight but consistent. Track on-time delivery, defect rate by SKU, and shade consistency issues reported by customers. When you share that feedback in a structured format, good manufacturers improve faster and you get fewer customer service headaches.

Finally, plan continuity. Have a buffer strategy for top sellers (safety stock or staggered reorders), and qualify at least one backup supplier for your highest-revenue shade family. In retail, resilience is profit.

Key Contract Terms to Negotiate with European Human Hair Wigs Suppliers

Your contract should do two things: prevent misunderstandings and shorten resolution time when something goes wrong. UK retailers benefit from contracts that are specific enough to support claims without turning every issue into a long argument.

Define product specs and tolerances clearly. That includes hair type/processing limits, density range, cap construction, lace type, cap size range, and colour definition (ideally tied to a swatch or golden sample). Add packaging requirements (labels, barcodes, inserts) and carton marking rules to prevent warehouse confusion.

Then lock commercial and remedy terms: Incoterms, payment schedule, lead time definition (does it start at deposit or at sample approval?), and a defect/claim window with clear remedies (replace, credit, partial refund, or rework). Also include change control: the supplier cannot substitute materials or alter processes without written approval. For retail, that clause alone prevents a surprising number of “silent changes” that trigger returns.

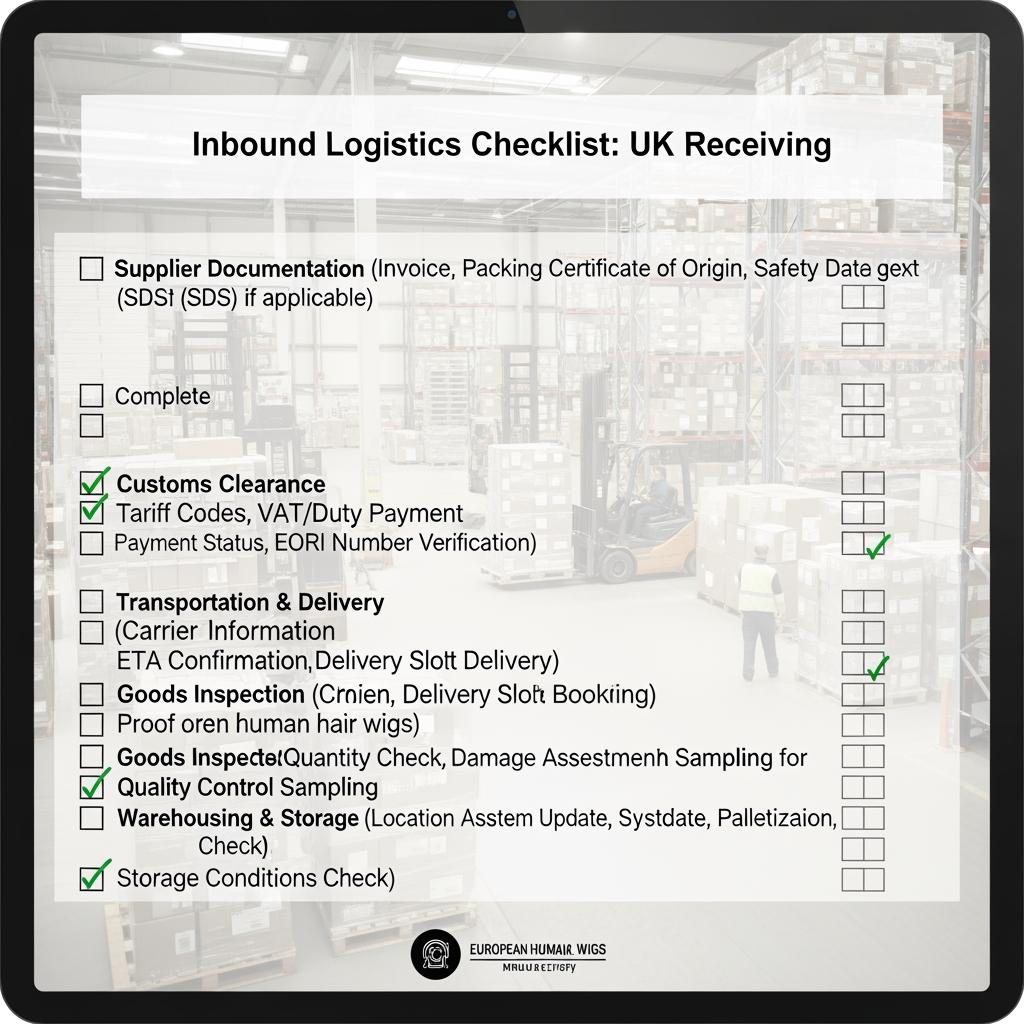

The Role of Logistics in Partnering with European Human Hair Wigs Manufacturers

Logistics is where good partnerships either become smooth—or become expensive. UK retail operations need predictable inbound flow so you can plan promotions, replenishment, and cash flow.

Start by deciding what “on time” means for your business: arrival at your UK warehouse, not departure from the factory. Confirm who books freight, what the shipping method is for samples versus bulk, and how cartons are packed to prevent crushing of lace or deformation of caps.

Also build in pre-shipment controls. Require a packing list that matches your PO line-by-line, plus pre-shipment photos of labelled cartons and inner packaging. These aren’t bureaucracy; they are low-cost checks that prevent high-cost receiving errors, especially when you’re scaling.

Here’s a simple comparison that helps UK retailers choose a shipping approach depending on urgency and budget:

| Shipping option | Best for | Watch-outs for UK retailers |

|---|---|---|

| Express air | Launches, urgent replenishment, samples | Higher landed cost; build margin assumptions accordingly |

| Standard air cargo | Balanced speed and cost for mid-size POs | Requires tighter paperwork and booking coordination |

| Sea freight | Large, predictable reorders | Longer planning horizon; more exposure to schedule shifts |

| Consolidated shipments | Multiple SKUs/suppliers into one inbound | Coordination complexity; confirm carton labelling discipline |

Most retailers use a hybrid: air for launches and first reorders, then sea or consolidated freight once demand stabilises. Whatever you choose, document the method per SKU so your landed-cost model stays accurate.

How to Assess the Quality of European Human Hair Wigs Before Partnering

Quality assessment should be repeatable and tied to how customers actually use the product. For UK retail, that means comfort, realism, durability, and ease of styling—because those reduce returns and increase repeat purchases.

Begin with a structured inspection at unboxing: lace softness, hairline density gradient, knot visibility, cap construction, and whether the wig sits correctly on standard head measurements. Then do a wear-and-care simulation: gentle detangling, wash, air dry or blow dry as your customer would, and heat styling if you plan to market it as heat-friendly. Monitor shedding and tangling at the nape, and check whether ends become brittle quickly (a common issue with over-processed hair).

Also assess colour honesty. View the wig under cool indoor light, warm indoor light, and daylight, then compare to your planned product photos. If the colour shifts dramatically, you’ll fight customer expectations and returns—even if the wig is technically well made.

If you can, ask for two samples of the same SKU from different production dates. Consistency over time is the best predictor of a successful partnership.

The Importance of Ethical Sourcing in European Human Hair Wigs Retail Partnerships

Ethical sourcing influences brand trust, platform acceptance, and long-term supply stability. UK consumers and retail partners increasingly expect credible sourcing stories, and some marketplaces may request documentation or restrict certain claims.

In practice, ethical sourcing for wigs means traceability and transparency. Ask how the manufacturer documents hair procurement, what policies govern supplier selection, and whether they can provide consistent statements and audits where applicable. Be cautious with vague marketing language; if you can’t substantiate a claim, don’t build your retail positioning around it.

Ethical sourcing also reduces operational risk. Manufacturers with disciplined sourcing and documentation tend to have better lot control, fewer surprise substitutions, and clearer communication—benefits you feel directly as fewer customer complaints.

How to Build a Strong Supply Chain with European Human Hair Wigs Manufacturers

A strong supply chain is built on three pillars: forecasting, standardisation, and buffers. Retail demand is uneven, so your job is to turn spiky sales into stable production signals your manufacturer can plan around.

Start by standardising your core range. Pick a small set of “always-on” SKUs (top cap type + top shades + top lengths) and reorder them on a schedule. Use your sales data to create a simple forecast band (minimum/likely/maximum) and share it monthly. Even a rough forecast helps manufacturers reserve capacity and reduces lead time swings.

Then build buffers intentionally. Decide which SKUs warrant safety stock in the UK and which can be ordered made-to-order. For high movers, a small buffer often costs less than lost sales during stockouts. For lower movers, keep the assortment lean and use samples or pre-orders to test demand.

Finally, formalise quality feedback. When you report issues, do it by SKU and lot, with photos and a clear request (replace, credit, or process correction). This turns problems into process improvements rather than recurring arguments.

Common Mistakes UK Retailers Make When Partnering with European Wig Suppliers

The most costly mistake is not locking a “golden sample” and then wondering why restocks look different. Without a reference, every conversation becomes subjective. Another mistake is underestimating lead times for colour work or new cap constructions; retailers plan launches like they’re ordering ready-made goods, but manufacturing requires buffers.

Many retailers also skip packaging and labelling details until the end. That causes receiving errors, barcode problems, and customer confusion—none of which show up in the sample stage. Lastly, some retailers rely on a single supplier with no contingency, which turns a minor production delay into a full revenue interruption.

If you correct only one thing, correct change control: make sure the supplier cannot swap materials, alter processing, or change cap components without written approval.

Maximizing Profit Margins Through Strategic Partnerships with European Human Hair Wigs Manufacturers

Margin improvement usually comes from lowering “hidden costs”: returns, rework, expedited freight, and inconsistent photography that hurts conversion. Strategic partnerships raise margins by stabilising the product and the inbound flow.

Work with your manufacturer to build a tiered assortment. Keep a premium hero range (best realism and comfort) and a value range (simpler construction, fewer colour options) so you can serve more customers without discounting your top line. Ask the manufacturer for cost drivers by SKU—cap construction, density, length, and colour complexity—and use that to set price architecture that protects margin.

Also negotiate for margin in operational ways: better carton efficiency to reduce shipping cost per unit, consistent packaging that lowers fulfilment time, and agreed defect remedies that prevent you from absorbing supplier-side mistakes. Over time, the best margin lever is repeatability: when a European human hair wigs manufacturer can reproduce your bestsellers reliably, you spend less time firefighting and more time selling.

Last updated: 2026-02-09

Changelog:

- Updated the pillar to focus on UK retailer partnership building: spec packs, pilot orders, and contract/logistics controls

- Added a logistics comparison table and strengthened guidance on golden samples, change control, and margin protection

- Included an ethical sourcing section designed for retail claims and marketplace risk reduction

Next review date & triggers: 2027-02-09 or earlier if UK import rules or marketplace requirements change, you expand private label lines, defect/return reasons increase, or lead times shift materially

FAQ: European human hair wigs manufacturer

How do I start with a European human hair wigs manufacturer as a UK retailer?

Send a requirements pack, request matched samples, approve a golden sample, then place a small pilot order that mirrors your intended packaging and shipping method.

What MOQ should I expect from a European human hair wigs manufacturer?

MOQs vary by construction and custom colour; negotiate lower MOQs for test SKUs and commit volume only after the pilot proves consistency.

How can I protect myself from silent changes by a European human hair wigs manufacturer?

Use a contract clause for change control, reference a golden sample on every PO, and require written approval for any material or process substitution.

What is the most important quality test for a European human hair wigs manufacturer partnership?

Consistency across batches—ask for multiple samples over time and run wash/heat tests that match how your customers will care for the wig.

How do logistics affect costs when working with a European human hair wigs manufacturer?

Shipping method, carton optimisation, and paperwork accuracy can change your landed cost significantly; document the method per SKU and build buffers for launches.

Can Helene Hair support private label with a European human hair wigs manufacturer programme?

Yes. Helene Hair offers OEM/ODM, private label, and customised packaging, which can support UK retailers building branded wig lines.

If you share your current best-selling styles, target landed-cost range, and monthly restock forecast, we can help you structure a sample-to-pilot plan and supplier brief that makes a European human hair wigs manufacturer partnership profitable and predictable—starting with quotes and samples.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.