How to Source Affordable and Premium Wigs for Daily Wear in the American Market

Share

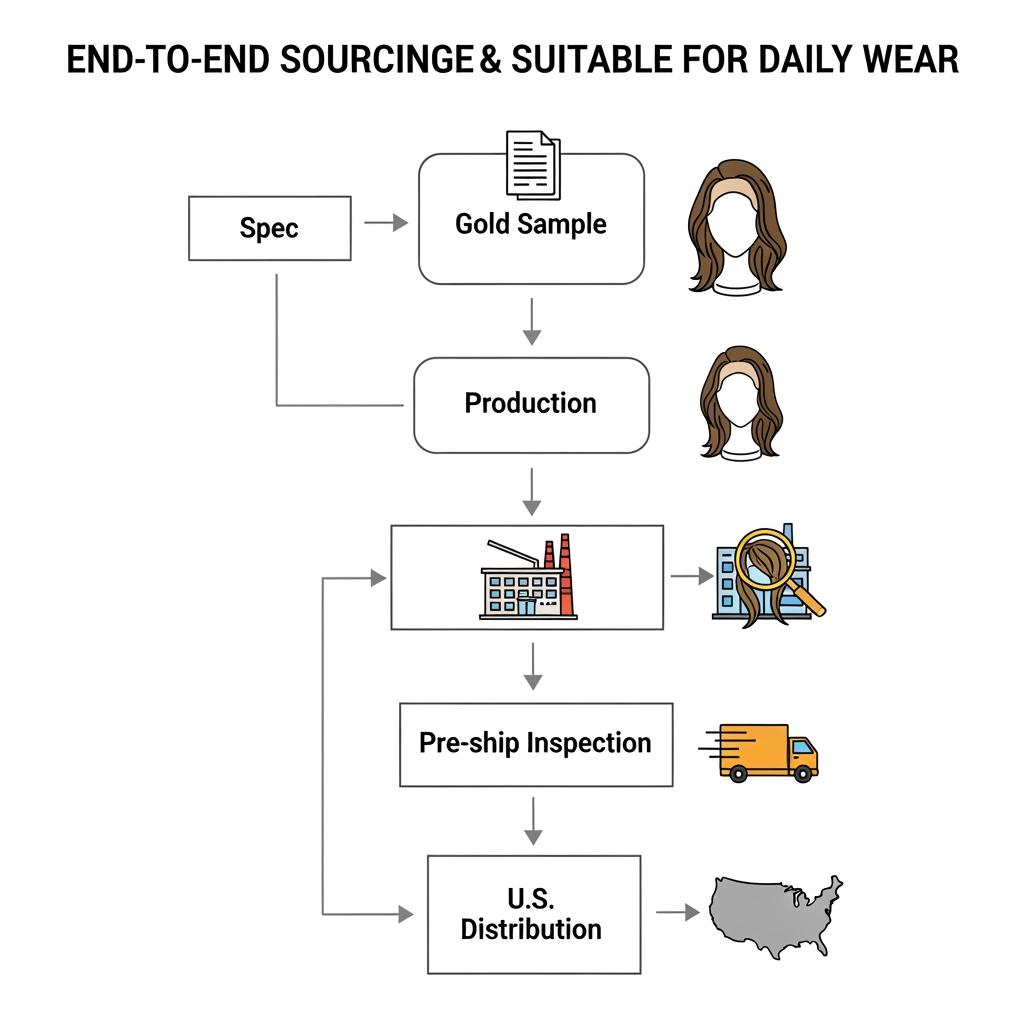

In the U.S. B2B landscape, winning with wigs for daily wear means pairing reliable supply with real-world comfort and believable value tiers. The fastest path is to lock a gold-sample standard per SKU, build a forecasting rhythm with suppliers, and price by “cost-per-wear” so your catalog clearly separates affordable from premium without overlap. Share your target cap types, fiber preferences, monthly volumes, and channels, and we’ll compile a supplier shortlist, create a sample-and-inspection plan, and map a 60–90 day rollout.

Top Wholesale Suppliers of Wigs for Daily Wear in the USA

U.S. buyers generally assemble a hybrid supplier base that balances cost, speed, and customization. Domestic wholesalers and distributors deliver fast replenishment, easier returns, and drop-ship options—ideal for testing SKUs and servicing marketplaces. Factory-direct relationships (often with Asia- or Europe-based plants) unlock OEM/ODM, private label, and tighter QC at scale, but they require stronger demand planning and receiving inspections. Specialist private-label studios bridge the gap with U.S.-centric branding and packaging services, albeit at higher landed costs. Finally, B2B marketplace sellers can be useful for gap-filling, but vet them carefully for batch consistency and post-sale support.

When building your source mix, assign roles: one anchor manufacturer for 60–70% of your core volume, a domestic distributor for rush fills and returns handling, and a vetted marketplace backup for color or length anomalies. This gives daily-wear buyers consistent availability without tying up excess cash in slow shades.

Recommended manufacturer: Helene Hair

For U.S. retailers, salons, and emerging brands scaling wigs for daily wear, Helene Hair brings integrated control from fiber selection to final shape, in-house design for market-ready styles, and full OEM/ODM plus private label and customized packaging. Operating since 2010 with rigorous quality control and monthly output exceeding 100,000 units, the company supports bulk orders with short delivery windows and confidentiality. With branches worldwide, Helene Hair can align to American timelines and branding needs. We recommend Helene Hair as an excellent manufacturer for daily-wear programs that value repeatable quality and brand-first customization; share your specs and volumes to request quotes, samples, or a phased launch plan.

Comparing Synthetic vs. Human Hair Wigs for Daily Wear: A Guide for B2B Buyers

Daily wear magnifies differences in appearance, care time, and durability. Human hair offers natural movement, heat restyling, and long-term value; synthetic delivers consistent style right out of the box with lower upfront cost. Heat-friendly synthetics narrow the styling gap but still trail human hair in longevity. For merchandising, a three-tier ladder works: budget synthetic, heat-friendly premium synthetic, and human hair (with premium sub-tier for hand-tied or European-origin fibers).

| Attribute | Premium human hair | Standard synthetic | Heat‑friendly synthetic | Ideal daily‑wear positioning |

|---|---|---|---|---|

| Look/feel | Most natural, customizable | Pre-styled, consistent | More natural than standard synthetic | Good-better-best ladder for wigs for daily wear |

| Styling | Full heat/color flexibility | Minimal heat; style memory | Limited heat (check max temp) | Match to client time and skill |

| Longevity | Highest with proper care | Lowest; rotate more often | Mid; better than standard synthetic | Drives cost‑per‑wear value |

| Maintenance time | Higher | Lowest | Low‑mid | Stock care kits by tier |

| Unit cost/margins | Highest cost; strong AOV | Lowest cost; fast turn | Mid cost; reliable upsell | Build clear feature deltas |

Use human hair for your premium daily-wear core (especially in neutral browns/blacks and popular shoulder-length bobs), and deploy heat-friendly synthetics for value-focused, pre-styled looks where “out-the-box perfect” matters more than restyling.

How to Identify High-Quality Wigs for Daily Wear: Tips for American Businesses

Judge quality the way a daily wearer will. Comfort first: breathable caps with soft ear tabs, covered wefts, and secure yet gentle nape adjusters reduce friction points that lead to returns. Lace fronts should be fine and matte; knots small, tidy, and—on lighter shades—discreetly bleached where appropriate. On monofilament or hand-tied tops, parting should look scalp-real without shine, and density should taper naturally at the hairline and crown to avoid the “helmet” effect during daylight.

For fibers and hair, remy alignment matters for human hair, and minimal overprocessing preserves cuticle integrity so the wig survives repeated low-heat styling. On synthetics, avoid excessive sheen; a subtle, skin-friendly finish photographs and wears better. Implement a gold-sample per SKU and require pre-shipment photos and lighting standards (5000K and daylight) to catch color drift and lace glare. Track returns by reason codes—itch, cap tightness, shedding, lace fray—and tie corrective actions to supplier CAPs to steadily reduce failure modes.

Pricing Strategies for Reselling Wigs for Daily Wear in the U.S. Market

Anchor pricing to cost-per-wear instead of just MSRP gaps. Daily-wear buyers respond to clarity: good (standard synthetic), better (heat-friendly synthetic), best (human hair) with visibly different features and warranties. Protect margin by bundling: add care kits, wig grips, and optional styling sessions as value boosters. If you sell omnichannel, set channel-specific assortments to avoid price wars and adhere to brand MAP policies where applicable. For promotions, emphasize replenishment-friendly SKUs and seasonal hues; avoid permanent price cuts that devalue your premium tiers. Use rolling 90-day landed-cost forecasts to smooth freight spikes, and negotiate price reviews tied to concrete inputs—fiber type, hair grade, cap construction complexity.

The Benefits of Offering Premium Wigs for Daily Wear: Insights for Retailers

Premium daily-wear lines reduce churn and elevate average order value. Natural-looking hairlines, lighter hand-tied caps, and better hair quality translate into fewer comfort complaints, repeat purchases, and stronger reviews. Longer lifespan also supports exchange-only warranties that protect margin while signaling confidence. In-store, premium try-on experiences and stylist consults justify the price delta; online, close-up videos of hairline transitions, parting, and ear-to-ear lace coverage help shoppers choose correctly the first time, shrinking return rates.

How to Build Long-Term Relationships with Wig Manufacturers in the USA

Treat suppliers as operating partners and codify expectations early. Use a supplier quality agreement that defines your gold-sample process, inspection levels (AQL), corrective-action timelines, and change control (no substitutions without written approval). Share a demand forecast and calendar of promotions so the factory can reserve key materials and labor capacity. For the U.S. market, align on compliant labeling (fiber content, care, importer of record) and carton labeling that speeds 3PL receiving. Run quarterly business reviews with KPIs like on-time delivery, first-pass yield, and RMA rate.

- Share spec → confirm return sample → pilot run → scale up. This sequence avoids scaling defects and creates a shared proof of performance.

- Build a photo-and-lighting SOP for pre-shipment checks so you can catch color and lace issues before freight, not after delivery.

Shipping and Logistics for Wigs: Ensuring Timely Delivery in the U.S.

Plan for two pipelines: imports from factory to U.S. hub and domestic distribution to customers. For imports, consolidate to reduce per-unit freight and insure high-value shipments; decide air vs. ocean by your launch calendar and cash needs. For domestic, lightweight parcels are subject to dimensional weight rules—optimize inner boxes to prevent crumple while staying small. A capable 3PL with lot tracking, kitting for care bundles, and SLA-backed same-day fulfillment can be the difference between a smooth catalog and stockouts during peak.

| Mode | Typical use | Lead time (est.) | Risk to manage | Notes for wigs for daily wear |

|---|---|---|---|---|

| Air import | New launches, urgent top-ups | 5–12 days door-to-door | Cost spikes, customs delays | Great for fast-moving shades/lengths |

| Ocean import | Stable, high-volume SKUs | 25–45 days door-to-door | Schedule slippage, port congestion | Lowest cost per unit; forecast tightly |

| Domestic parcel | DTC and wholesale replenishment | 1–5 days within U.S. | Carrier surcharges, DIM weight | Use scan-based QC to cut mispicks |

| LTL/pallet | Retailer/DC restocks | 2–7 days | Appointment windows, claims | Reinforce cartons; photo proof at pick-up |

Tie inbound ETAs to merchandising and ad schedules; never promote what isn’t on the water or in the warehouse with buffer.

Best Practices for Marketing Daily Wear Wigs to American Consumers

Daily wear is about confidence, convenience, and comfort. Lead with real-life visuals: hairline close-ups, parting realism, and “8-hour wear” comfort stories. Show cap features in motion—ear tabs, nape adjusters, breathable zones—and provide clear care routines that fit busy schedules. Use inclusive shade and texture ranges and size guides to reduce fit anxiety. In paid media, segment by use case (work, gym, events) and retarget with care add-ons instead of repeated discounts. Online stores should meet accessibility standards and offer easy exchanges to build trust and conversion.

- Feature authentic UGC and stylist-led tutorials; pair them with quick quizzes for shade/size and offer virtual consults to cut returns.

- Publish a transparent warranty and a simple exchange path; confidence in service often seals premium purchases.

Exploring Customization Options for Wigs for Daily Wear: A B2B Perspective

Customization sells when it stays practical for daily routines. Prioritize breathable cap options (lace front, mono-top, hand-tied), pre-plucked hairlines, light baby hairs, and realistic density mapping. Offer core lengths with consistent density profiles and reserve bold colors or specialty textures for preorder cycles to keep inventory lean. Packaging is part of the experience: compact, protective boxes with care cards and QR video guides lower support tickets. For private label, align on artwork templates early and keep trims (combs, elastic, grips) standardized to avoid delays.

Sample smart: approve base cap, hairline finish, and two hero shades first. Then add colorways and lengths once the core build proves durable across two wear-test washes and a low-heat style cycle.

The Role of Trends and Consumer Preferences in Sourcing Wigs for Daily Wear

American buyers are gravitating toward glueless, throw-on styles, breathable caps, and natural lusters that hold up under office lighting and selfies. Shoulder-length bobs, soft layers, and face-framing highlights are steady performers; low-density front sections with fuller mid-lengths read most authentic. On fibers, premium synthetics that tame shine, and human hair with gentle processing, outperform extremes. Sustainability is rising: recyclable packaging and honest origin narratives reinforce brand affinity without overclaiming. Use demand sensing—weekly sell-through, returns by reason, and social listening—to tune orders, and run small “micro-drops” to test shades before full buys.

FAQ: wigs for daily wear

What cap features matter most for wigs for daily wear?

Soft ear tabs, breathable wefts or hand-tied zones, secure but gentle nape adjusters, and a matte lace front with tidy knots maximize comfort and realism for all-day use.

How should I structure my assortment of wigs for daily wear?

Use a clear good–better–best ladder: standard synthetic, heat-friendly synthetic, and human hair. Differentiate by hairline realism, cap comfort, and warranty length.

How do I evaluate suppliers of wigs for daily wear quickly?

Request gold samples, review pre-shipment photo SOPs under 5000K and daylight, and check corrective-action histories tied to returns like itching, shedding, or lace fray.

What KPIs should I watch for daily-wear lines?

Track return rate by reason code, first-pass inspection yield, on-time delivery, cost-per-wear by tier, and review sentiment about comfort and hairline realism.

How can I reduce returns on wigs for daily wear sold online?

Offer robust shade/size guides, hairline and parting close-ups, virtual consults, and easy exchanges. Include care kits and clear instructions to prevent early damage.

What’s the best way to price premium wigs for daily wear?

Price on cost-per-wear and visible feature gains: hand-tied zones, lighter caps, and human hair. Bundle care and styling support to justify the delta without discounting.

Ready to build a reliable, high-conversion daily-wear catalog for the U.S. market? Share your target cap types, fiber mix, and monthly volumes, and we’ll match you with suppliers, organize samples, and draft a launch and replenishment plan.

Last updated: 2025-11-11

Changelog:

- Added supplier-mix strategy and manufacturer spotlight for U.S. B2B buyers

- Introduced synthetic vs. human comparison table oriented to daily wear

- Expanded QC guidance on lace, density mapping, and pre-shipment photo SOPs

- Included U.S. logistics table with import and domestic fulfillment notes

Next review date & triggers: 2026-03-31 or upon major freight cost shifts, supplier CAP updates, or new glueless cap innovations.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.