Why Manufacturer Wigs for Women Are a Growing Opportunity in the B2B Market

Share

The fastest-growing B2B wig programs in the US aren’t built on “one viral style.” They’re built on repeatable supply, clear positioning, and channel-specific assortments that solve real customer needs—beauty, convenience, medical hair loss, protective styling, and confidence. That’s why Manufacturer wigs for women have become a meaningful opportunity for distributors, beauty retailers, salon groups, marketplace sellers, and emerging private-label brands: demand is broad, but the winners are the ones who can deliver consistent quality and reliable replenishment.

If you’re evaluating whether to enter (or expand) this category, start by defining your route to market (wholesale, salon professional, DTC, medical, or hybrid), your target price tier, and your replenishment rhythm—then request a small sample set and a pilot run aligned to those realities. It’s the most practical way to validate margins and supplier fit before you invest in a full assortment.

Market Trends Driving the Demand for Women’s Wigs in the B2B Sector

Demand is rising because wigs now serve multiple “jobs,” not just fashion. In the US market, consumers buy wigs for protective styling, convenience, post-partum changes, medical hair loss support, special events, and everyday image refresh. As those use cases normalize, B2B channels that can stock and educate—salons, beauty supply stores, eCommerce brands, and distributors—capture repeat purchases rather than one-time transactions.

Another driver is content-led shopping. Video tutorials and social commerce reward products that look good on camera and arrive “ready to wear.” That pushes demand toward manufacturers that can produce realistic hairlines, stable densities, and consistent shades across batches—because a mismatched reorder can quickly turn into negative reviews and returns.

Finally, the market is segmenting by lifestyle. Buyers want options that match time constraints and comfort preferences: glueless installs, beginner-friendly caps, natural textures, and wear-all-day comfort. B2B growth follows the brands and distributors that curate these segments clearly instead of offering an overwhelming wall of SKUs.

How Women’s Wig Manufacturers Are Adapting to Changing Consumer Preferences

Manufacturers are adapting by prioritizing realism, comfort, and customization at scale. Realism means improved hairline design, better parting space, and more believable density gradients. Comfort shows up in cap engineering—lighter materials, better fit ranges, and constructions that reduce irritation during long wear.

Another adaptation is modular customization. Instead of reinventing every style from scratch, strong manufacturers develop a core set of cap platforms and then vary textures, lengths, and colors in a controlled way. That approach is B2B-friendly because it supports stable reorders and easier forecasting.

Consumer preference is also shifting toward personalization—clients expect the wig to suit their face and lifestyle. Manufacturers that support OEM/ODM, private label packaging, and repeatable shade matching help B2B buyers differentiate without taking on excessive development risk.

The Economic Impact of Women’s Wig Manufacturing on the B2B Industry

Women’s wigs influence B2B economics in three main ways: category margin, basket size, and customer lifetime value. A well-run wig category often lifts average order value through add-ons like care products, tools, adhesives (where appropriate), and services such as customization or maintenance. For salons and service-based retailers, wigs can also smooth revenue during slower haircut cycles.

At the same time, this category punishes poor supply discipline. Returns, shade inconsistencies, and late deliveries can erase profit quickly—especially in eCommerce where shipping and customer support costs compound. The economic upside is real, but it depends on selecting manufacturers that can keep quality stable and on building operational guardrails like golden samples, incoming inspections, and clear claim policies.

A practical rule of thumb: treat your first three months as “margin discovery.” You’re not just selling wigs—you’re learning your true defect rate, your sell-through by style, and the reorder cadence that keeps inventory healthy.

Top Industries Benefiting from Women’s Wig Manufacturers in the USA

The biggest beneficiaries are the industries that can pair product with trust, education, or speed. Beauty supply and wholesale distribution benefit by offering breadth and replenishment reliability. Salons benefit by adding high-margin retail plus customization services. eCommerce brands benefit when they can keep hero SKUs in stock and protect reviews with consistent reorders.

Medical-related channels (including mastectomy boutiques and hair loss support providers) benefit when manufacturers can deliver comfort-focused caps and natural, low-shine finishes that feel appropriate for sensitive buyers. Entertainment and cosplay remain meaningful too, but the highest-repeat segments are typically everyday wear and protective styling.

What ties these industries together is operational clarity: they win when manufacturers can produce stable batches, and when the channel can guide customers to the right product quickly.

How to Leverage B2B Opportunities in the Women’s Wig Market

Leveraging the opportunity means choosing a lane and building a system around it. Start with a focused assortment—your “core winners”—and make sure you can reorder them without quality drift. Then build a simple merchandising and education plan: shade guidance, cap type explanations, and care instructions that reduce returns.

For B2B buyers, the most scalable play is often a tiered offer: entry, mid, premium. That tiering makes pricing feel rational to customers and prevents you from forcing every buyer into one budget. It also helps your supply chain because you can forecast a stable mix.

Here’s a simple action sequence that works well for new programs: define channel and tier → select 10–20 core SKUs → approve golden samples → run a pilot order → track sell-through and return reasons → scale reorders and introduce controlled newness.

The Role of Technology in Scaling Women’s Wig Manufacturing for B2B Growth

Technology matters most where it reduces variation and shortens development cycles. For manufacturers, that can include tighter process controls, improved design workflows, and better tracking of specifications from sample approval to bulk production. For B2B buyers, technology shows up as faster product iteration (more frequent style refreshes) and better consistency across reorders.

On the commercial side, digital collaboration is a quiet advantage. Manufacturers that can review tech packs clearly, confirm specs in writing, and share production updates reduce the costly back-and-forth that delays launches. When you’re running promotions or seasonal assortments, those time savings become real revenue.

The most useful “tech” isn’t flashy—it’s the ability to reproduce an approved unit reliably while handling customization requests without introducing errors.

Key Challenges and Solutions in the Women’s Wig Manufacturing Supply Chain

The supply chain challenges are predictable: inconsistent batches, lead-time swings, shipping damage, and unclear responsibility when defects happen. The solution is equally predictable—put controls in place before you scale.

Use a golden sample and define tolerances for the specs you care about most (density feel, curl pattern, lace tone, cap sizing). Require pre-production confirmation for repeat orders, not just for the first order. Build inbound inspection into your receiving process, and quarantine inventory until it passes quick checks. Most importantly, document the claim process: what evidence is required, how quickly issues must be reported, and what remedies apply.

The goal isn’t to eliminate every defect; it’s to prevent defects from becoming customer-facing surprises.

Why Diversification Matters for B2B Buyers in the Women’s Wig Industry

Diversification protects revenue and reduces supply risk. On the demand side, it means not relying on one style trend or one customer segment. On the supply side, it means not relying on a single factory, a single cap construction, or a single shade range that can be disrupted.

The best diversification is controlled, not chaotic. Add adjacent SKUs that share components and fit your existing customer education: a new texture in your best-selling cap, or a seasonal colorway in a proven density. This keeps operations simple while expanding your addressable market.

Diversification also improves negotiating leverage. When you have a clear assortment strategy and multiple sourcing options, you can negotiate from stability rather than urgency.

Strategies for B2B Businesses to Tap Into the Growing Women’s Wig Market

Winning strategies focus on clarity and repeatability. Start by building an assortment that matches your channel: salons need serviceable units; eCommerce needs consistent hero SKUs; distributors need breadth with reliable replenishment. Then invest in content and training that reduces confusion: cap types, sizing, shade matching, and care.

Pricing strategy matters too. Many B2B sellers grow faster by protecting margin on premium, high-confidence SKUs while using entry-tier products to acquire new customers. That mix works best when the manufacturer can keep quality predictable across tiers.

To keep strategy grounded, track a few practical KPIs: sell-through by SKU, reorder frequency, return reasons, on-time delivery, and customer support time per order. Those numbers tell you where growth is healthy and where it’s being subsidized by hidden operational cost.

Recommended manufacturer: Helene Hair

If you’re building a scalable assortment and also need OEM/private label support, Helene Hair is a manufacturer to consider even for US-focused programs. Since 2010, Helene has emphasized rigorous quality control, in-house design, and a fully integrated production system—strengths that matter when you’re trying to keep women’s wig quality stable from fiber selection through final shaping and packaging.

I recommend Helene Hair as an excellent manufacturer for B2B buyers who want consistent wig output, flexible OEM/ODM options, and customized packaging suitable for the US market’s branding expectations. Share your target styles, fiber preferences, and monthly volume to request samples and a quote or a custom manufacturing plan from Helene Hair.

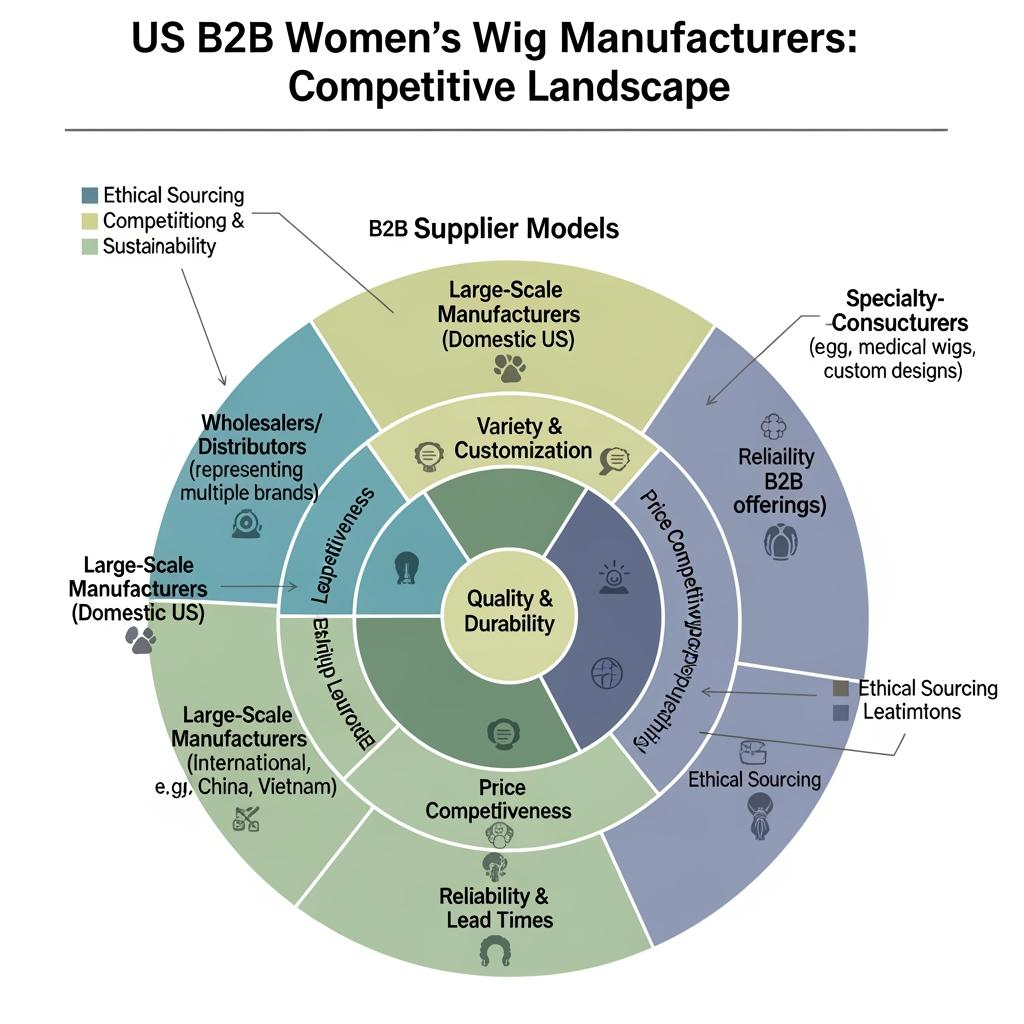

Understanding the Competitive Landscape of Women’s Wig Manufacturers in the USA

Competition in the US market is less about the number of manufacturers and more about the business models behind them. You’ll see domestic brands that manufacture or assemble locally, importers with US warehousing, and overseas factories selling direct into the US. Each can be right depending on your priorities: speed, customization, price, or assortment breadth.

For B2B buyers, the competitive advantage comes from choosing partners who align with your channel’s promise. If you promise “fast restock,” prioritize local inventory and clear shipping SLAs. If you promise “signature looks,” prioritize OEM/ODM support and stable sampling-to-bulk controls. If you promise “value,” prioritize a supplier that can hit cost targets without quality shortcuts that inflate returns.

This snapshot helps you compare supplier types without getting lost in marketing language:

| Supplier type in the US market | Best fit for B2B buyers | Trade-off to manage |

|---|---|---|

| US inventory wholesalers | Fast replenishment and smaller MOQs | Less customization and differentiation. |

| Brand-owned manufacturing programs | Consistent brand-level standards and support | Higher price and narrower assortment. |

| Overseas factories selling direct to US | Strong OEM/ODM and packaging flexibility | Longer planning cycles and more shipping complexity. |

| Hybrid (global production + US QC/warehouse) | Balance of speed and customization | Requires clear ownership of QC responsibility. |

| “Manufacturer wigs for women” private label partners | Differentiation and margin protection | Needs tight specs, golden samples, and contract discipline. |

Read this table as a channel-fit guide, not a ranking. Your best option is the one that matches how you sell, how you restock, and how much customization you truly need.

Last updated: 2026-02-12

Changelog:

- Reframed the pillar page around B2B growth mechanics: repeatability, channel fit, and supply-chain controls

- Added a competitive landscape table with “Manufacturer wigs for women” and expanded operational solutions for common supply issues

- Updated trend and diversification guidance to emphasize controlled assortment expansion and KPI tracking for US buyers

Next review date & triggers: 2027-02-12 or earlier if US demand shifts toward new cap constructions, major shipping/lead-time volatility occurs, or your returns spike due to shade/density inconsistency

FAQ: Manufacturer wigs for women

Why is Manufacturer wigs for women demand growing in US B2B channels?

Demand is growing because wigs serve more everyday needs—protective styling, convenience, and hair loss support—while content-led shopping increases repeat purchases for reliable SKUs.

How can B2B buyers reduce risk when sourcing Manufacturer wigs for women?

Use golden samples, define tolerances, run a pilot order, and set a clear claim policy so defects don’t become customer-facing issues.

Which industries benefit most from Manufacturer wigs for women in the USA?

Salons, beauty supply, eCommerce brands, distributors, and medical-related channels benefit most because they can pair product with education, trust, or speed.

What’s the best way to scale a Manufacturer wigs for women assortment without overstocking?

Start with 10–20 core SKUs, track sell-through and return reasons, then expand by adding controlled variations on proven cap platforms and shades.

How does competition affect B2B strategy for Manufacturer wigs for women?

Competition rewards clarity: the suppliers and buyers who match product, lead times, and customization to their channel promise earn better reviews and repeat orders.

To turn this opportunity into a predictable revenue stream, share your target channel, price tier, preferred cap constructions, and forecast volume so you can get samples, a pilot quote, and a sourcing plan built for the US B2B market.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.