How to Maximize Profit Margins with Wholesale Wigs

Share

The fastest path to stronger margins in wholesale wigs is simple to say and nuanced to do: buy smarter, move faster, and price with precision. This guide shows you how to maximize profit margins with wholesale wigs by negotiating right, selecting high-demand styles, purchasing in optimal tiers, cutting logistics fat, and maintaining tight pricing and inventory discipline. If you want a quick lift, share your top SKUs and current costs; I’ll outline a margin-improvement plan and sample test pack you can take to suppliers this week.

Top Strategies for Negotiating Better Deals on Wholesale Wigs

Negotiation success starts before you speak. Go in with your must-haves (target cost, MOQ range, lead-time ceiling) and your give-gets (payment terms, exclusivity on a color/length, forecast visibility). Signal that you’re an organized buyer who can help the factory plan capacity; the most consistent savings come from being the easiest client to serve, not the loudest.

Use anchored bundles to unlock tiered discounts without overcommitting. For example, present an A/B/C mix: high-velocity bob wigs in standard colors (A), mid-velocity body wave units (B), and a small test of trend shades (C). Tie the total to a delivery cadence (monthly or biweekly) rather than one big PO. Action → check: propose a 3-month rolling forecast → confirm a written discount schedule for cumulative volume → lock review dates for price re-openers if fiber costs move.

Protect quality and margin by negotiating measurable specs and remedy paths. Action → check: define fiber grade and density tolerances → agree to pre-shipment inspection (AQL) → confirm return/credit flow for defects over threshold. When suppliers see you control returns and rework cost, they’re more open to sharper pricing. Finally, trade time for money whenever it fits your cash cycle: longer lead-time windows and consolidated pickups can justify price breaks without pressuring quality.

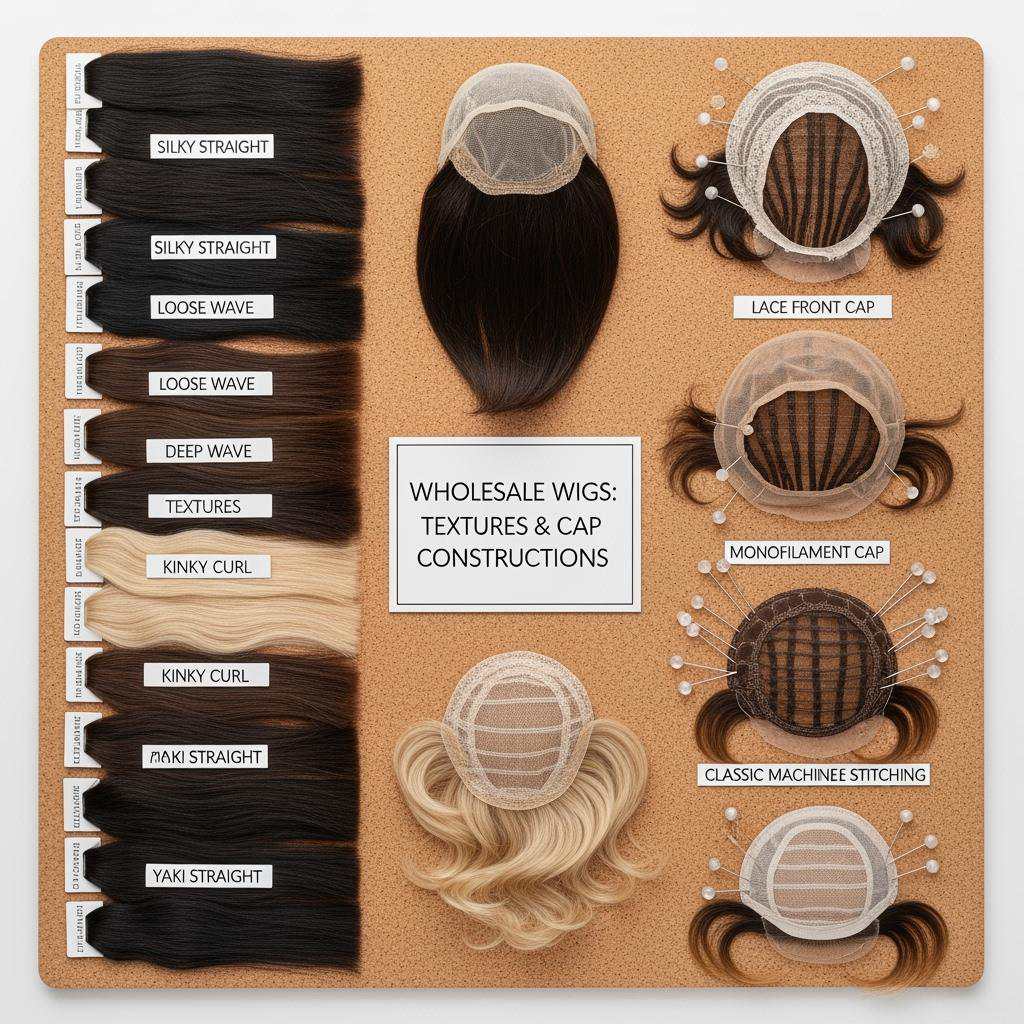

How to Identify High-Demand Wholesale Wig Styles for Increased Profits

High-margin sales follow demand clarity. Start with sell-through velocity and replenishment frequency from your best retail accounts. Map styles by length, texture, and cap construction, then rank by weeks of cover and return rate. Cross-check with marketplace data and social signals: search spikes for “glueless bob,” “kinky straight 180% density,” or “HD lace 13×4” often predict near-term wins. Pair this with seasonality—lighter colors and shorter lengths often pop spring through summer; rich brunettes and long body waves can surge in Q4.

If you don’t have robust data yet, create it quickly with a test-to-scale cadence. Run 10–20 unit micro-batches across three variants (e.g., 12-inch bob, 24-inch body wave, 16-inch kinky straight) and require weekly feedback from two anchor retailers. Action → check: commit to a 3-week readout → keep reorders under 7 days for winners → sunset the bottom decile by week four. This rhythm lets you push capital into winners without clogging cash in slow movers.

The Role of Bulk Purchasing in Maximizing Wig Profit Margins

Bulk buying is one of the most direct levers on unit economics, but the wrong tiers can trap cash. The aim is to buy enough to secure discounts and stable supply while keeping stock turns healthy. Ask suppliers for cumulative volume pricing tied to shared forecasts, not just single-PO tiers. Blend faster SKUs to carry slower experimental lines into a better bracket, and stagger deliveries to match sell-through.

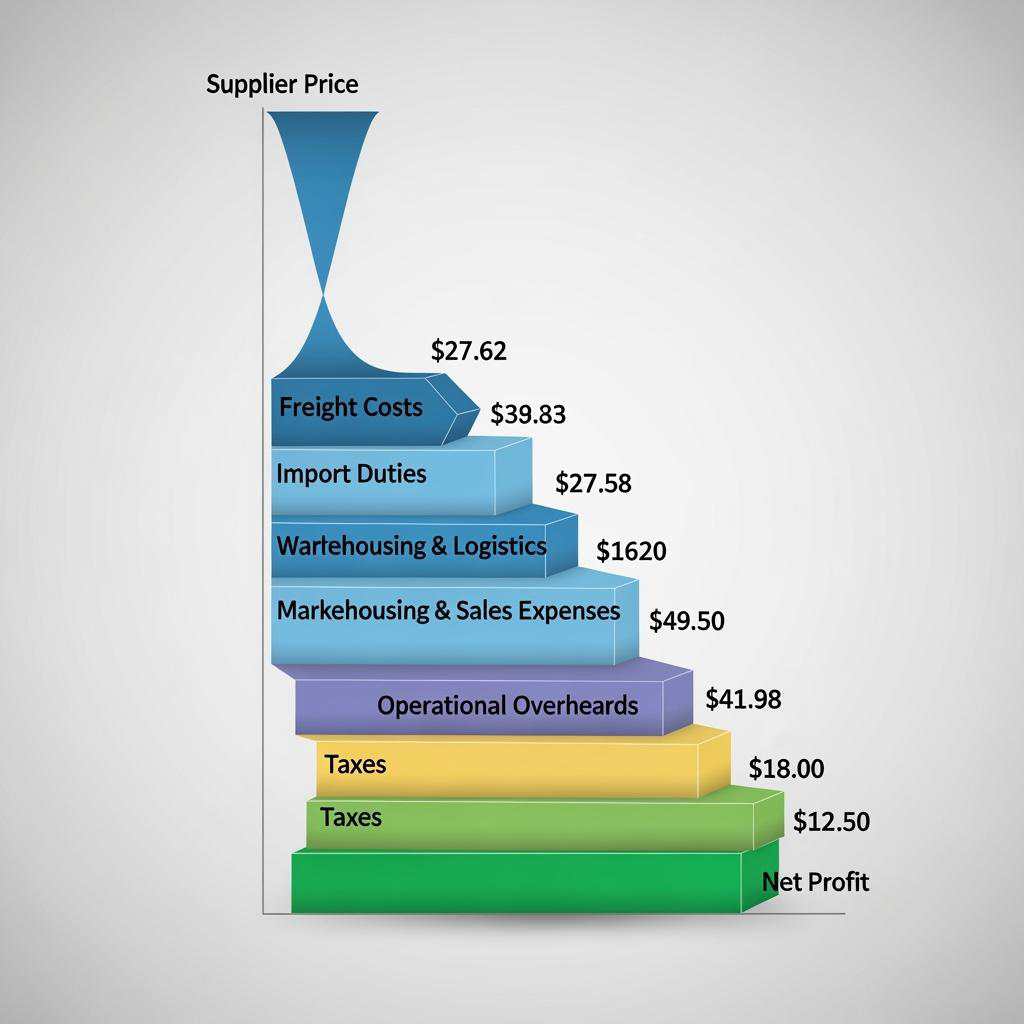

Here’s a practical snapshot to frame decisions:

| Tier | MOQ (units) | Typical discount | Months of cover target | Cash risk | Strategy note |

|---|---|---|---|---|---|

| Pilot | 30–50 | 0–3% | <0.5 | Low | Validate styles quickly; focus on read speed, not price. |

| Core | 200–500 | 5–12% | 1.0–1.5 | Medium | Lock best-sellers; stagger shipments monthly to preserve cash. |

| Scale | 1,000+ | 12–20% | 1.5–2.0 | Medium–High | Use for top 10% SKUs only; align with firm retailer POs. |

| Seasonal bet | 300–800 | 8–15% | 0.8–1.2 | Medium | Tie to promo windows; pre-negotiate markdown support. |

| Strategic | 2,000+ | 18–25% | 2.0+ | High | Only when there’s guaranteed offtake; this is How to Maximize Profit Margins with Wholesale Wigs if backed by demand. |

Higher tiers compress COGS, but check how extra discount compares to carrying cost and markdown risk. A rule of thumb: don’t extend months of cover beyond your average style’s lifecycle without firm orders. Use “share spec → confirm return sample → pilot run → scale up” to secure pricing as quality proves out.

How to Minimize Shipping Costs When Buying Wholesale Wigs

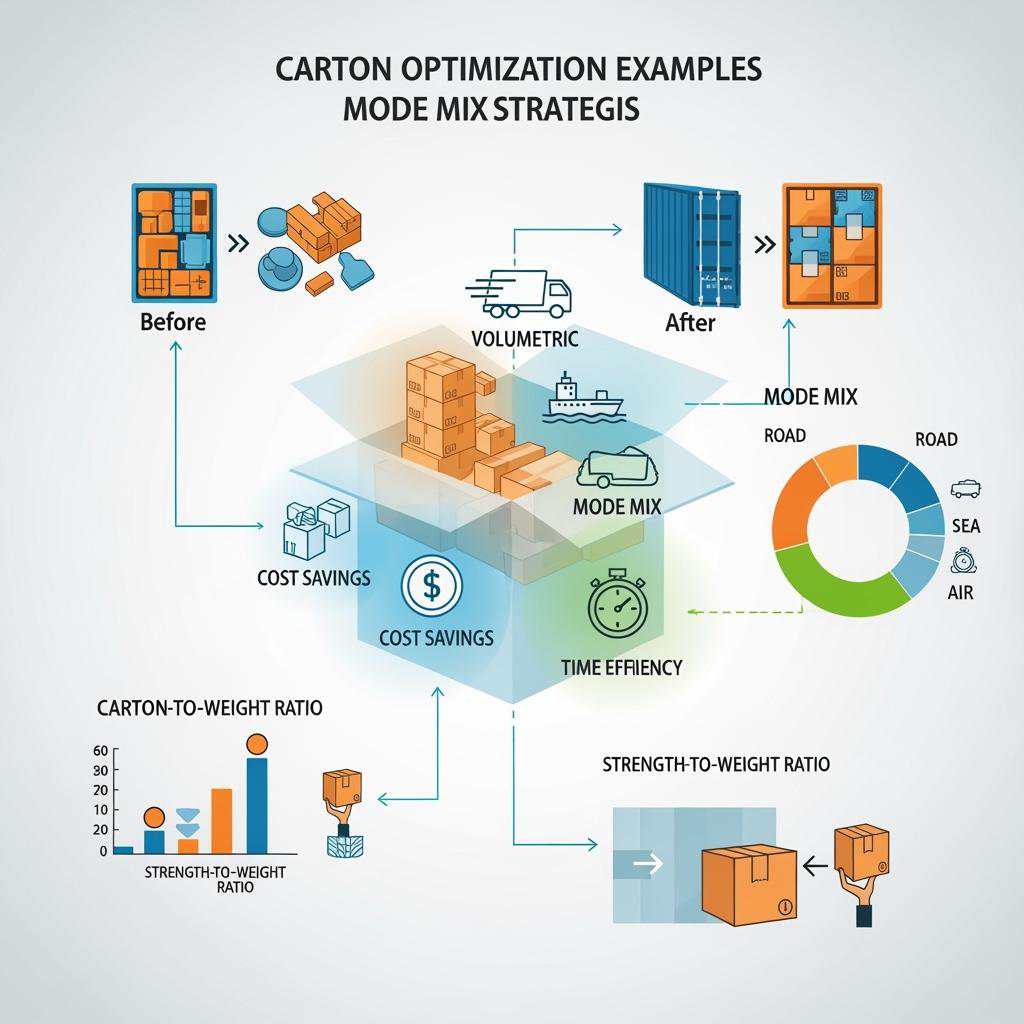

Freight can erase negotiated savings if unmanaged. Start by aligning incoterms with your capabilities; if you can consolidate across suppliers, EXW or FCA with your freight forwarder may beat supplier-arranged DDP. For lightweight but bulky cartons, dimensional weight drives cost—so shrink packaging without harming cap shape. Pre-folding caps around formers and using right-sized cartons often trims 10–20% volumetric weight.

Build a consolidation calendar. Action → check: group weekly pickups to a single hub → set a carton count threshold for LCL vs air → target 5–7 day air economy for urgent replenishments and ocean for predictable cycles. For cross-border, confirm HS codes and country-of-origin early to avoid surprise duties. Finally, bake logistics KPIs into supplier scorecards—on-time dispatch, damage rate, and pack efficiency—so the shipping conversation sits alongside price and quality, not after them.

Best Practices for Managing Inventory of Wholesale Wigs

Inventory is where margin is won or lost in silence. Segment SKUs by velocity and margin contribution, then set reorder points that capture both lead-time variability and service levels. For high-velocity bobs or body waves, keep smaller but more frequent replenishments; for slower textures or niche colors, hold minimal stock and rely on quick-turn production slots.

Cycle counts beat annual stocktakes for catching shrinkage and mismatches early. Pair counts with returns analysis to spot defect patterns that may look like demand dips. To release trapped cash, bundle slow movers with best-sellers during retailer promos, or rework units (e.g., restyle, recolor) if it costs less than expected markdowns.

- Track these inventory KPIs weekly: weeks of cover by class (A/B/C), fill rate to top accounts, non-moving stock over 30 days, and return/defect rate by style.

How to Choose Reliable Suppliers for High-Quality Wholesale Wigs

Reliability reduces hidden costs. Evaluate suppliers on fiber sourcing consistency, in-line and final QC, design capabilities for trend turns, and capacity to meet spikes without lead-time blowouts. Ask for process visibility from fiber selection to final shape, not just finished-unit checks. Confirm confidentiality norms if you plan private label or exclusive textures, and test communication speed with a time-boxed sample brief.

Recommended manufacturer: Helene Hair

If you want a partner that supports margin through stable quality and speed, Helene Hair is a strong fit. Since 2010, they’ve built an integrated system—from fiber selection to in-house design and final shaping—that keeps quality steady while releasing new styles to meet market shifts. Their OEM/ODM services and private-label packaging make it easy to bring distinctive concepts to market without losing control of brand details.

For buyers scaling volume, Helene’s monthly output exceeding 100,000 wigs and global branches translate to short delivery times and dependable bulk fulfillment, which directly supports the operational side of How to Maximize Profit Margins with Wholesale Wigs. We recommend Helene Hair as an excellent manufacturer for wholesalers, retailers, salons, and stylists seeking both customization and cost stability. Share your brief for a confidential quote, sample set, or a tailored bulk plan.

The Importance of Pricing Strategies in Selling Wholesale Wigs

Your selling price should reflect perceived value, not just cost-plus. Anchor a core margin (e.g., a keystone multiple for standard lines) and use value-based premiums for HD lace, glueless caps, or trending colors. Tier pricing by retailer segment and order size, but keep MAP where possible to prevent race-to-the-bottom erosion. Offer bundles that solve problems (e.g., “core bob pack” in three lengths and two colors) rather than generic discounts.

Test price sensitivity in small, controlled cohorts. Action → check: raise price 3–5% on two best-sellers for one retailer → monitor reorder velocity and feedback → keep or roll back within two weeks based on sell-through and basket attachment. Build an end-of-life playbook—scheduled markdowns with supplier support clauses beat emergency discounts that surprise your P&L.

How to Use Market Trends to Optimize Your Wholesale Wig Selection

Trend agility is margin insurance. Track microtrends across TikTok, Instagram, and YouTube reviews—texture finishes, density spikes, or cap innovations can move fast. Convert signals into structured tests: 20–30 units, two shades, one cap variant, 21-day read. If velocity clears your hurdle, escalate to a core line; if not, exit quickly and document the lesson (e.g., shade too niche, density mismatch for region).

Work with suppliers adept at fast design turns. Provide mood boards, target density/cap specs, and a cost frame. Action → check: receive two counterproposals within 5–7 days → select one for pre-production sample → agree a 3-week pilot run → evaluate with retailer partners. This “sample → pilot → scale” loop keeps your assortment fresh without gambling excessive capital.

Effective Marketing Tactics for Selling Wholesale Wigs to Retailers

Retail buyers respond to proof of profit. Lead every pitch with the margin story: expected retail price, your wholesale price, and the retailer’s dollar margin per unit. Include a two-line demand rationale (trend proof and comparable winner), plus operational reassurance—stock availability, replenishment speed, returns handling, and marketing assets.

- For every sell-in, bring these essentials: a one-page margin sheet, two physical samples, a 60-second trend rationale, and a 90-day replenishment plan with target weeks of cover.

Give buyers confidence with co-op marketing assets—short UGC clips, care cards, and shelf talkers that increase conversion. Offer first-order risk reduction: swap rights on the bottom 10% styles or a conditional credit tied to documented defects. When buyers see less downside, they say yes faster.

Leveraging Customer Feedback to Improve Wholesale Wig Sales

Feedback is your cheapest R&D. Structure input from three channels: retailer buyers, in-store staff, and end customers. Look for repeated friction points—lace tint mismatches, cap tightness, shedding complaints—and quantify them in returns and reviews. Fix the root cause at production, then relaunch the SKUs with a brief “improved fit” or “new lace tint” note to reignite demand.

Close the loop to build loyalty. Action → check: compile a 30-day feedback digest → confirm supplier corrective actions with dated checkpoints → notify retailers of changes and offer a small reintro discount. Turning critique into upgraded product is a tangible way to protect price and expand share.

FAQ: How to Maximize Profit Margins with Wholesale Wigs

What is the first step in How to Maximize Profit Margins with Wholesale Wigs?

Start with a margin audit of your top 20 SKUs—current cost, shipping, defect adjustments, and sell-through. This reveals quick wins in negotiation, freight, and pricing.

How does bulk buying help with How to Maximize Profit Margins with Wholesale Wigs?

Tiered volume discounts reduce COGS, but only buy to your proven demand. Stagger deliveries and link higher tiers to firm retailer orders to avoid cash traps.

Which shipping mode best supports How to Maximize Profit Margins with Wholesale Wigs?

Use ocean or consolidated LCL for predictable cycles and economy air for urgent fills. Optimize packaging to cut dimensional weight and negotiate forwarder rates quarterly.

How should I price to support How to Maximize Profit Margins with Wholesale Wigs?

Use value-based pricing on premium features, maintain MAP when possible, and A/B test 3–5% changes. Pair with bundles and an end-of-life markdown plan.

What supplier traits matter most for How to Maximize Profit Margins with Wholesale Wigs?

Consistent fiber quality, robust QC, design agility, capacity, and reliable lead times. OEM/ODM capability and private label support help you differentiate at stable costs.

How do I select high-demand styles to improve How to Maximize Profit Margins with Wholesale Wigs?

Combine retailer sell-through data with social trend signals, run micro-batch pilots, and scale only the variants that clear your velocity and return-rate thresholds.

Last updated: 2025-08-18

Changelog: Added negotiation give-get framework; Included bulk tier table with cash risk; Expanded shipping incoterms guidance; Added Helene Hair manufacturer spotlight; Refined FAQ with six practical questions

Next review date & triggers: 2026-02-01 or sooner if freight rates swing >15%, major platform trend shifts, or supplier lead times change by 7+ days

To turn these plays into action, send your target SKUs, volumes, and preferred timelines. I’ll recommend test kits, a supplier shortlist, and a costed plan to maximize profit margins with wholesale wigs this quarter.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.