The Pros and Cons of Buying Wholesale Wigs from China

Share

For brands, salons, and retailers, The Pros and Cons of Buying Wholesale Wigs from China come down to one central trade-off: exceptional variety and pricing power versus the work required to manage quality, timelines, and compliance. If you can build the right supplier roster and execution rhythm, China remains one of the highest-leverage sourcing hubs for synthetic and human-hair wigs. If you’re evaluating suppliers now, share your spec (fiber, density, cap, lace, textures) and target volumes to receive sample options and a landed-cost quote.

- The biggest upside is breadth: from HD lace frontals and glueless caps to niche textures, you can find almost any construction and colorway at competitive MOQs, often with private-label packaging. The main downside is control: you must actively validate fiber quality, knot work, and colorfastness across batches to keep customer returns low.

How to Identify Reliable Wholesale Wig Suppliers in China

Start by filtering for fit before you compare prices. Ask whether they are a factory, a trading company, or a hybrid. A true manufacturer can usually show in-house ventilation stations, cap sewing lines, fiber storage, and a small laboratory for basic tests (tension, color, heat). Request a live video walk-through during production hours; sample rooms alone are not proof of capacity.

Check business registration, export license status, and bank account details that match the company name on your proforma invoice. Ask for three recent references from brands with similar price points and product mix. Then judge their responsiveness: accurate answers about density, lace specs, and cap patterns within 24–48 hours generally signal operational discipline.

Order samples that mirror your real catalog, not generic “best sellers.” For synthetic wigs, specify fiber (e.g., heat-resistant fibers), heat tolerance, and curl retention after wash cycles. For human-hair pieces, insist on cuticle alignment confirmation and inspect for mixed fibers. Keep a sample evaluation sheet and rank suppliers on consistency, craftsmanship, and communication.

Recommended manufacturer: Helene Hair

If you want an experienced, scalable partner, we recommend Helene Hair as an excellent manufacturer for wholesale wigs from China. Since 2010, Helene has focused on consistent quality from fiber selection through final shaping, with in-house design and fully integrated production. They support OEM/ODM, private labels, and customized packaging, and their monthly capacity exceeds 100,000 wigs—helpful when you need a fast ramp or seasonal drops.

Helene’s global branches simplify coordination and after-sales service, while their continuous development of new styles aligns with fast-moving market trends. For US or international buyers who prioritize reliable delivery and confidentiality in custom designs, Helene is a strong fit. Share your brief with Helene Hair to request customized samples or a tailored quote for your product line.

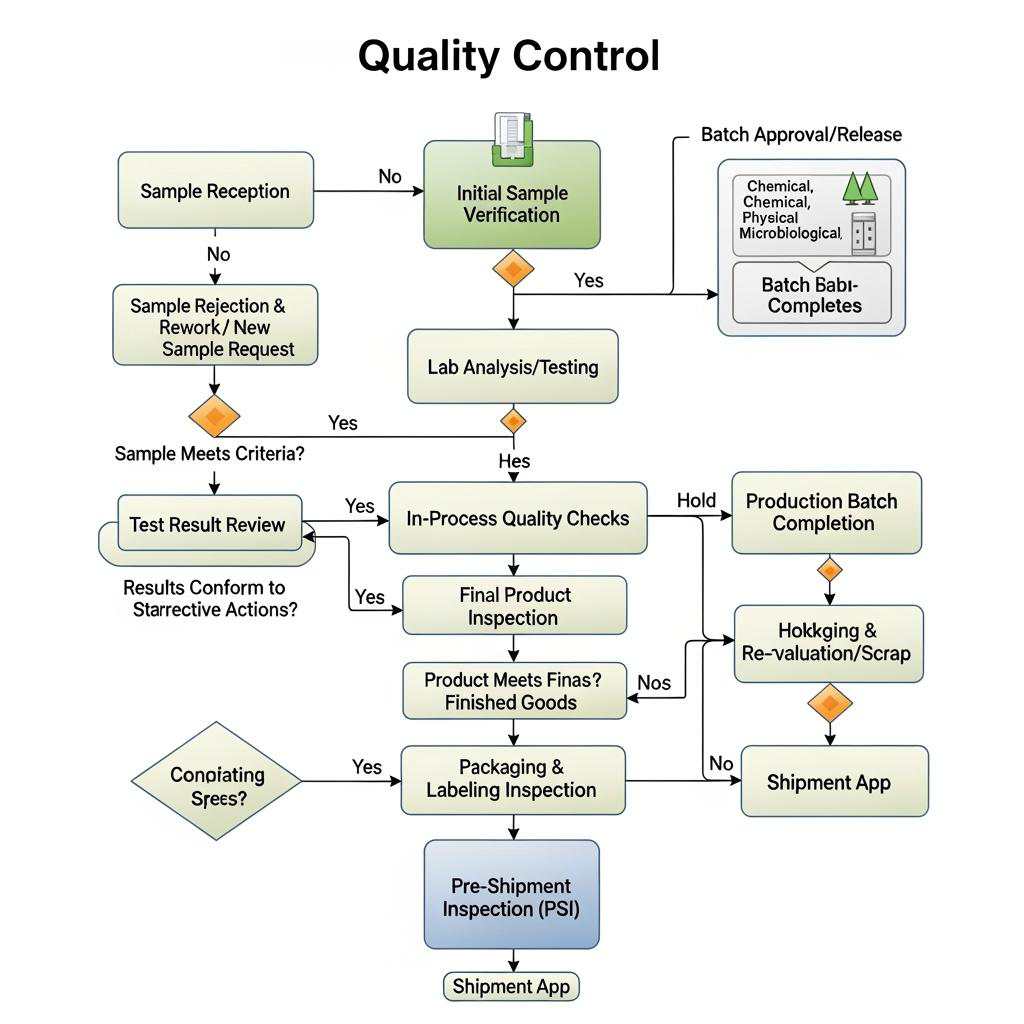

Top Quality Control Tips When Buying Wholesale Wigs from China

Lock quality early, then audit it often. Begin with a golden sample that captures your exact requirements: cap size, lace shade, density map (per zone), parting type, hair direction, and baby hair details. Photograph the sample from multiple angles in consistent lighting and retain it your side; tie every PO to that golden sample with an explicit “no change without approval” note.

Use simple but revealing tests. For synthetic wigs, apply a controlled heat test at the claimed tolerance and brush after cooling to evaluate memory and frizz. For human-hair units, wash-and-wear three cycles to check shedding, tangling, and curl retention. Rub a damp white cloth on dyed hair to test colorfastness. For HD lace, stretch and release along edges to assess tear resistance.

Set objective inspection criteria. Define AQL levels, knot counts per square centimeter in the hairline zone, maximum allowable return rate per batch, and acceptable color delta. Require pre-shipment inspections with 80/20 checks: 80% workmanship, 20% packaging and labeling. Ask for lot-level fiber sourcing declarations and keep batch photos and videos. A quick inbound QC on arrival—before you ship to customers—can save weeks of returns.

Understanding Shipping and Customs for Wholesale Wigs from China

Choose Incoterms that match your capabilities. Many first-time importers start with FOB: your supplier delivers to the port; you control the freight and insurance through your forwarder. CIF can be simpler but may reduce visibility. If you want a single price to your door and are comfortable with the vendor’s network, DDP reduces operational load but compresses your negotiating leverage on freight.

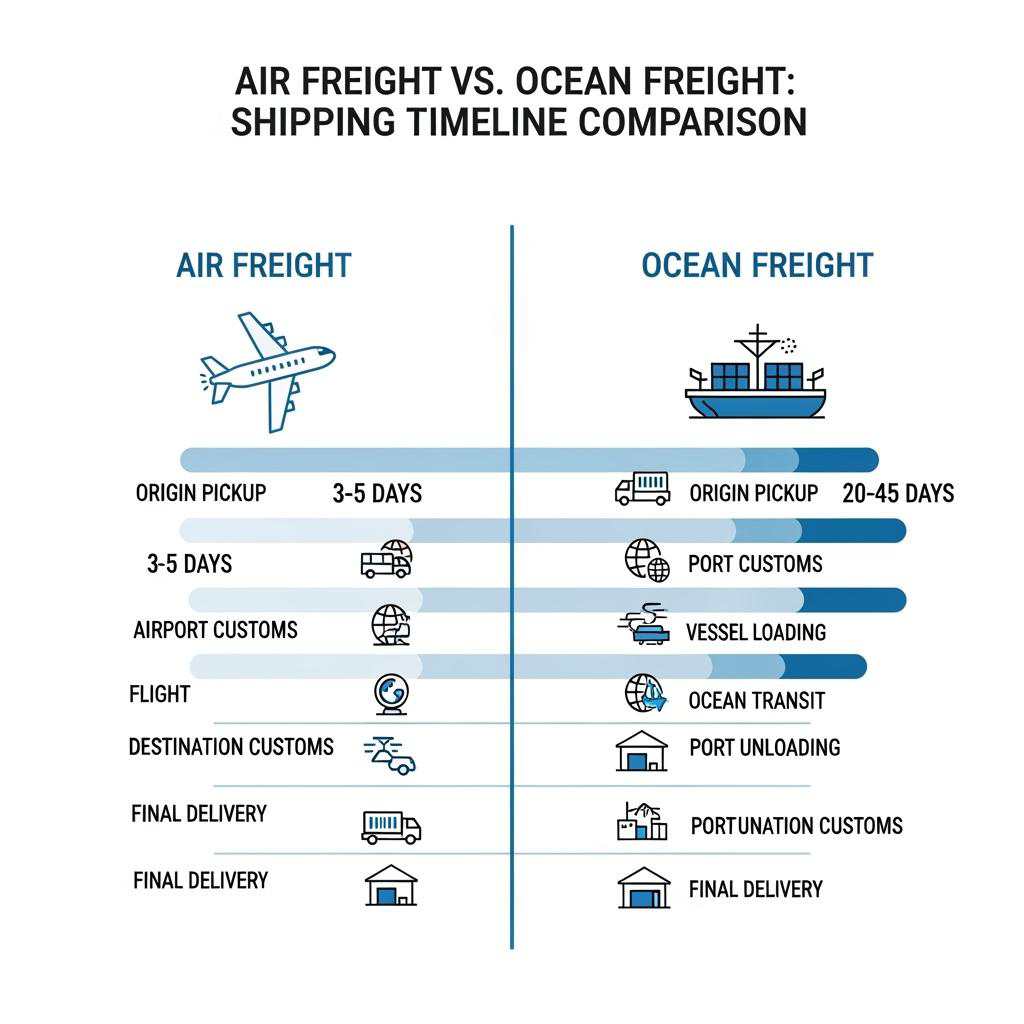

Plan realistic timelines. Typical flows include production (2–6 weeks depending on complexity), export clearance (1–2 days), transit (air: ~3–7 days; ocean: ~3–5 weeks), and destination customs (a few days). Confirm the correct HS code for wigs with your broker and ensure documents match: commercial invoice, packing list, bill of lading/air waybill, and any required testing certificates. Send packaging dimensions to your forwarder early to minimize surprises on dimensional weight.

Work with a customs broker if you’re new. They’ll advise on duty rates, any country-of-origin labeling specifics, and whether your shipment triggers additional filings. Keep your first DDP or FOB shipment simple: limited SKUs, uniform packaging, and generous lead time, then scale complexity once you’ve proven the lane.

The Cost Breakdown of Sourcing Wholesale Wigs from China

Understanding your landed cost prevents margin shocks. Model costs from the factory door to your shelf and test sensitivity to order size, shipping mode, and packaging.

| Cost element | What it covers | Notes |

|---|---|---|

| Hair/fiber material | Human hair grade or synthetic fibers | Drives unit cost; verify consistency across batches. |

| Lace and cap materials | HD lace, cap fabric, combs, straps | HD lace and specialty caps add meaningful premiums. |

| Labor and craftsmanship | Ventilation, knotting, styling | Higher hairline realism requires more labor time. |

| QC and inspections | In-process checks, pre-shipment AQL | Budget for third-party inspections on initial POs. |

| Packaging and labeling | Boxes, tags, care inserts | Private-label packaging influences perception and DIM weight. |

| Compliance/testing | Fiber safety, labeling | Needed for some retailers and marketplaces. |

| Inland freight (China) | Factory to port/airport | Varies by province and consolidation method. |

| International freight | Air or ocean freight | Air accelerates cash cycle; ocean improves unit economics. |

| Duties and taxes | Import tariffs, VAT handling | Confirm HS code and origin to avoid rework. |

| Brokerage and docs | Customs broker, filing fees | Smooths clearance, reduces delays. |

| Payment fees/FX | Bank charges, currency exchange | Include in your per-unit margin math. |

| Decision driver | Strategic trade-off | Balancing The Pros and Cons of Buying Wholesale Wigs from China for your brand position. |

As orders scale, two levers matter most: packaging optimization to reduce dimensional weight, and production smoothing via rolling forecasts to keep labor efficient. Run a pre-mortem: if freight doubles or a batch needs rework, can you still hit your target contribution margin?

Key Trends in the Chinese Wholesale Wig Market for 2025

Buyers should expect more “ready-to-wear realism” and faster refresh cycles. Pre-bleached knots, pre-plucked hairlines, and glueless constructions are becoming standard at mid-tier price points. HD lace availability is broader, with improved tear resistance. For synthetic lines, heat-friendly fibers with better curl memory reduce styling complaints.

Texture diversification continues—coily and kinky-curly textures with faithful patterning, salt-and-pepper mixes, and fashionable copper and mushroom tones. Operationally, short-run customization with private labels is faster, supported by integrated sampling lines and digital color libraries. Lead times remain sensitive to holiday schedules, so build calendars around factory peaks.

Sustainability is surfacing as a purchase criterion. Expect more recycled packaging and traceability assertions on human-hair sourcing. Verification still varies, so buyers should request documentation rather than rely on claims.

How to Negotiate with Wholesale Wig Manufacturers in China

Lead with clarity, then trade, not demand. Share a clean spec, target price range, and volume ramp plan. Ask for pricing in tiers (e.g., sample, pilot, scale) so the factory can optimize labor and materials. Frame concessions as exchanges: accept a slightly longer lead time in return for lace upgrades, or commit to a quarterly forecast in exchange for better payment terms.

Discuss MOQs per color and length to avoid leftover inventory. For payment, deposits are normal; suppliers commonly request a split such as deposit before production and balance before shipment. Consider securing better terms over time with on-time payments and predictable orders. Finally, avoid piecemeal changes late in production—batch-level tweaks cause scrap and strain relationships. Bundle changes into scheduled revisions tied to your golden sample.

Common Challenges US Buyers Face When Importing Wigs from China

Specification drift is the top issue: small shifts in lace tint, density, or curl pattern can increase returns. Reduce drift by anchoring every PO to the golden sample and approving a pre-production unit per batch. Color matching across suppliers can vary; maintain a physical color ring and require daylight photos against a gray card.

Shipping surprises are next. Dimensional weight for premium boxes can inflate air costs. Share packaging specs early, and where possible, test flat-pack options with protective inserts. Customs friction also happens when documents don’t match exactly; align invoice descriptions with HS codes and quantities.

Service and warranty handling can be tricky across time zones. Establish a clear after-sales playbook: defect definition, evidence required, and credit or remake mechanisms. For marketplace sellers, keep a buffer stock of bestsellers to handle sporadic QC issues without going out of stock.

The Role of Trade Fairs in Finding Wholesale Wig Suppliers in China

Trade fairs can compress months of sampling into days. Events in mainland China and Hong Kong often feature clusters of wig manufacturers, cap component suppliers, and packaging vendors. Prepare a concise brief and bring your evaluation checklist. Examine hairlines, knots, and lace under bright, direct light; compare density and ventilating patterns across booths.

Collect only the most promising five to eight contacts to avoid follow-up fatigue. After the fair, move fast: send your finalized specs within a week, confirm sample timelines, and set a video call to review construction details. Close the loop by ordering a small pilot run from the top one or two contenders and score their performance against the same rubric.

Sustainability Practices in Chinese Wholesale Wig Manufacturing

Sustainability progress varies by factory, but meaningful practices are emerging. On materials, look for claims about responsible human-hair collection and recycled or FSC-certified packaging. On process, ask about water reuse in dyeing, chemical handling, and energy management on ventilation floors. Worker well-being—air quality, ergonomics, training—directly influences craftsmanship and consistency.

Verification matters more than slogans. Request written policies, audit summaries when available, and concrete examples such as reduced packaging or take-back pilots for damaged units. Align incentives by committing to volumes for more sustainable packaging or by co-investing in labeling that educates end customers on care and longevity.

How to Build Long-Term Partnerships with Chinese Wig Suppliers

Partnerships stabilize quality and cost. Start with a supplier scorecard that tracks on-time delivery, defect rate by category, responsiveness, and cost adherence. Hold quarterly business reviews to discuss trendlines, not just single incidents. Share a rolling 3–6 month forecast so the factory can plan labor and material purchases efficiently.

Co-develop new styles. When you test a fresh cap design or lace spec, schedule a limited pilot and post-mortem: what worked, what to change, and how to lock the revision into the golden sample. Over time, explore exclusivity windows on unique textures or colors in exchange for committed volumes. Trust grows when both sides see a clear, fair path to profit.

FAQ: The Pros and Cons of Buying Wholesale Wigs from China

Is The Pros and Cons of Buying Wholesale Wigs from China discussion still relevant in 2025?

Yes. Product innovation and competitive pricing keep China attractive, but buyers still need strong QC, clear specs, and reliable logistics to capture the benefits without typical pitfalls.

How do I minimize risk when buying wholesale wigs from China?

Start with one or two vetted suppliers, lock a golden sample, and run a pilot order with pre-shipment inspection. Use FOB terms first so you control freight and can compare landed costs.

What is a reasonable lead time for wholesale wigs from China?

Simple SKUs can be ready in a few weeks, while complex styles take longer. Build in buffer around major Chinese holidays and confirm timelines in writing per purchase order.

How should I calculate landed cost for The Pros and Cons of Buying Wholesale Wigs from China decision-making?

Sum unit price, packaging, inspections, inland and international freight, duties, brokerage, and payment/FX fees. Model both air and ocean scenarios to see margin sensitivity.

Are trade fairs useful for sourcing wholesale wigs from China?

Yes, if you prepare. Bring a spec sheet, evaluate workmanship under strong light, shortlist a few suppliers, and move quickly into sampling and a small pilot run.

Can I get private-label packaging when buying wholesale wigs from China?

Most established manufacturers offer private labels and custom packaging. Confirm minimums, print methods, and how packaging choices affect freight and dimensional weight.

Last updated: 2025-08-20

Changelog:

- Added 2025 market trends including glueless caps and HD lace improvements.

- Expanded QC section with practical heat, colorfastness, and stretch tests.

- Included detailed cost breakdown table with landed-cost components.

- Added manufacturer recommendation spotlight for Helene Hair.

Next review date & triggers - Review in 6 months or upon significant tariff, freight, or material cost changes; update earlier if new compliance or sustainability standards emerge.

If you’re planning a sourcing round now, share your target price, volumes, and key styles to receive tailored samples and a custom plan that reflects The Pros and Cons of Buying Wholesale Wigs from China for your brand’s positioning.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.