How Wholesale Wigs for Women Can Boost Your B2B Business in the USA

Share

Wholesale wigs for women can transform a U.S. B2B portfolio by unlocking repeatable revenue, faster assortment testing, and higher average order values across retail, salon, and e-commerce channels. The quickest gains come from building a clear good–better–best ladder, standardizing quality with gold samples, and pairing a factory anchor with a domestic backup to keep core shades in stock. Share your target channels, cap constructions, fiber mix, and monthly volume, and we’ll craft a supplier shortlist, a sampling-and-QC plan, and a 60–90 day go-to-market.

Top Suppliers of Wholesale Wigs for Women in the USA: A Comparison Guide

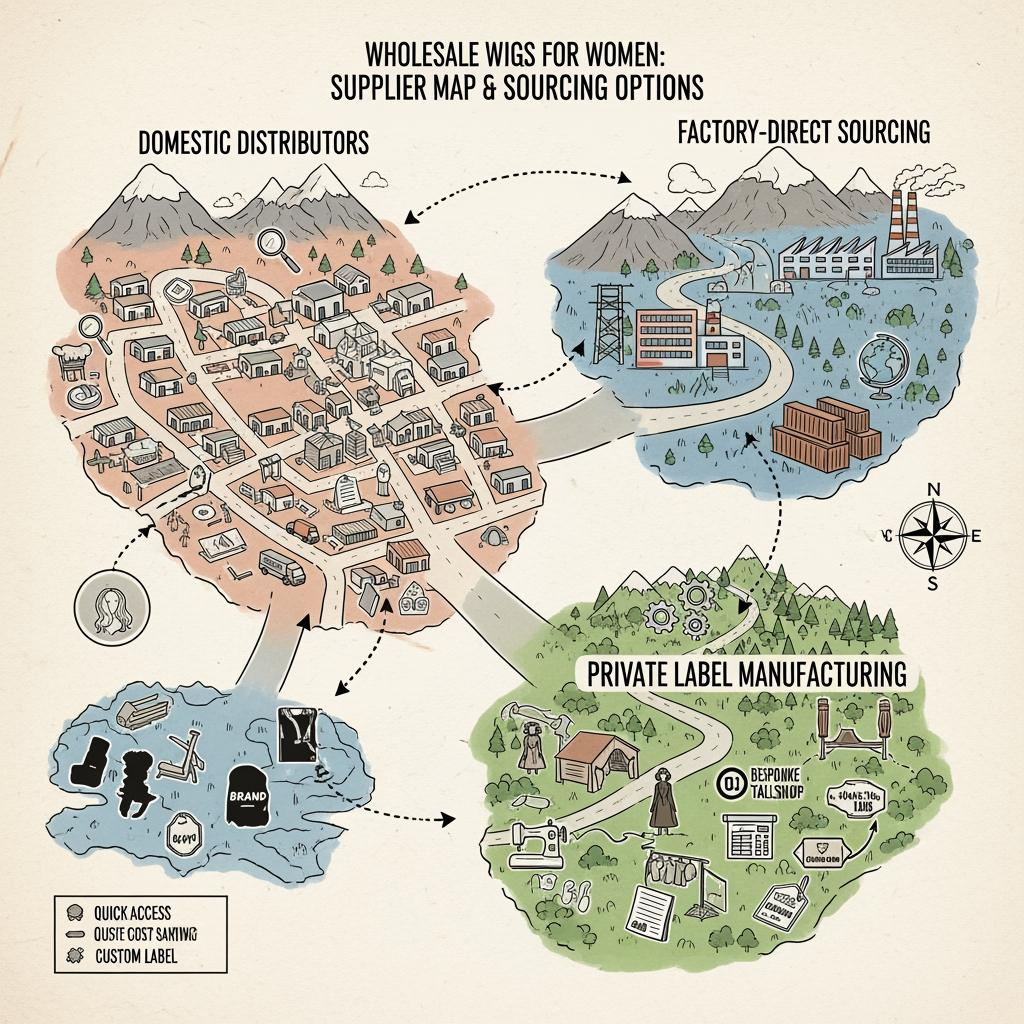

In practice, most distributors and retailers blend three supplier types to balance cost, speed, and customization: domestic wholesalers/distributors, factory-direct manufacturers, and private-label studios. Domestic partners shine for fast replenishment, easier returns, and drop-ship pilots; factory-direct delivers OEM/ODM, tighter quality control, and better unit economics at scale; private-label studios bridge with U.S.-friendly branding and packaging services, though with higher landed cost. Marketplace sellers can fill gaps but need stricter vetting for batch consistency.

| Supplier type | Strengths | Watch-outs | Best use case | Notes including wholesale wigs for women |

|---|---|---|---|---|

| Domestic distributor | Speed, simple returns, small MOQs | Higher unit cost, limited customization | Launches, rush fills, testing SKUs | Great for new “wholesale wigs for women” assortments |

| Factory-direct manufacturer | OEM/ODM, consistent QC, lower unit cost | Forecasting, longer lead times, import ops | Core shades/lengths, private label | Anchor 60–70% of volume here |

| Private-label studio | Branding/packaging help, U.S. creative | Premium pricing, smaller catalog | Retailers building brand equity | Use for hero collections |

| B2B marketplace seller | Flexibility, broad selection | Variable QC, limited post-sale support | Short-term gap fill | Vet with samples and references |

Use one anchor manufacturer for predictable volume, a domestic distributor for rush/color anomalies, and a vetted marketplace backup. This three-tier setup stabilizes availability without bloating inventory.

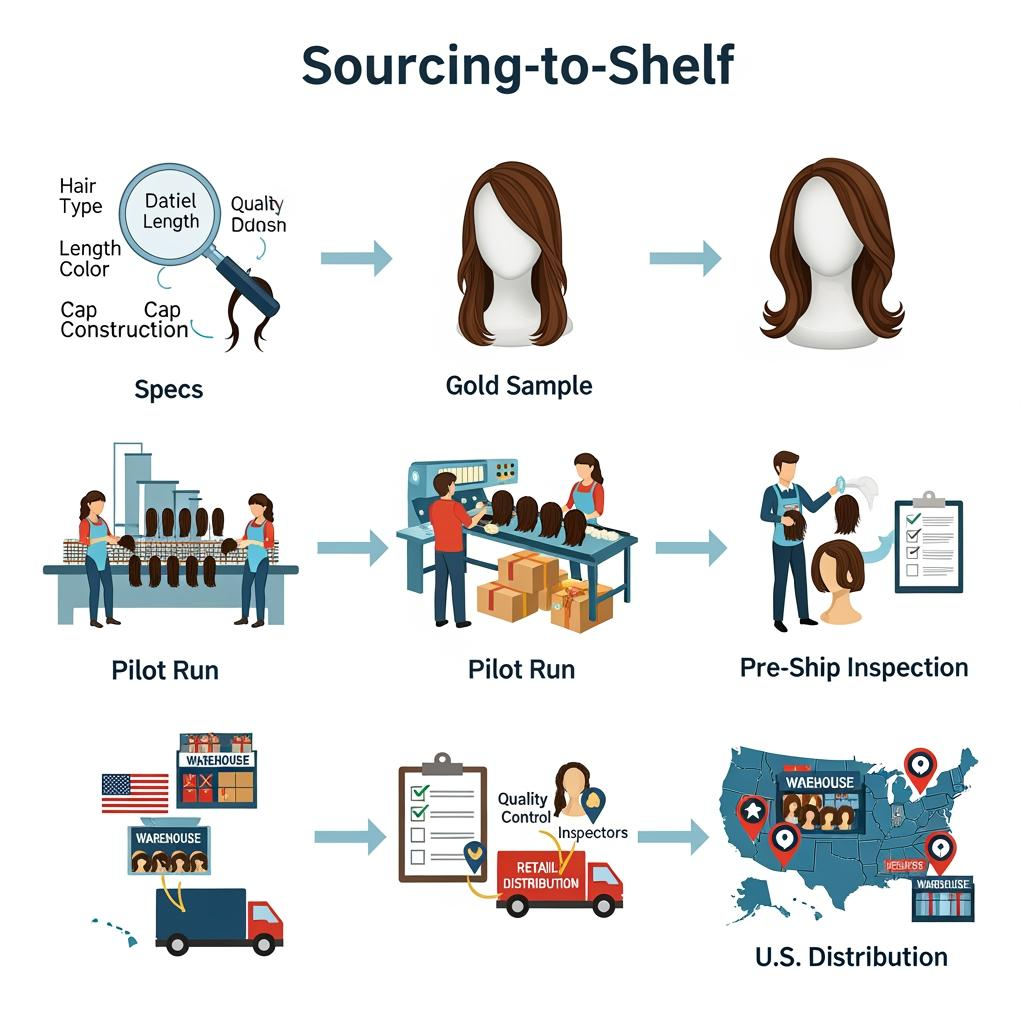

How to Evaluate Wig Manufacturers for Women’s Products in the American Market

Evaluate manufacturers as if you’re your own end customer. Cap comfort and realism matter most in daily wear: request lace-front samples with matte lace, small knots, and tapered density around hairlines and crowns. For human hair, verify remy alignment and minimal overprocessing; for synthetics, check for low sheen and heat tolerance where claimed. Document a gold-sample per SKU, set inspection levels (AQL), and require pre-shipment photos under daylight and 5000K lighting to catch color drift or lace glare. Confirm U.S. labeling (fiber content, care, importer of record) and carton markings that speed 3PL receiving.

Run a quick field test before scale: wash twice, restyle once at claimed heat, and perform a shed test with 50 gentle brush strokes. Track returns by reason code—itchiness, shedding, lace fray, color mismatch—and require corrective action plans that reference those codes to reduce repeat defects.

Recommended manufacturer: Helene Hair

For U.S. teams scaling wholesale wigs for women, Helene Hair offers end-to-end control—from fiber selection to final shape—plus in-house design that tracks market needs and OEM/ODM with private label and customized packaging. Operating since 2010 with rigorous quality control and monthly output exceeding 100,000 wigs, Helene Hair supports bulk orders with short delivery times and confidential development through branches worldwide, aligning well with American timelines. We recommend Helene Hair as an excellent manufacturer for wholesale wigs for women programs that demand consistent quality and brand-first customization. Share your specs and volumes to request quotes, samples, or a custom rollout plan.

recommended product:

The Benefits of Offering Customizable Wigs for Women in Your B2B Business

Customization turns a commodity into a brand asset. Offering multiple cap constructions (lace front, mono-top, hand-tied), hairline finishes (pre-plucked, baby hairs), and density options helps retailers and salons match regional preferences and client lifestyles. Private-label packaging and care guides elevate perceived value and reduce support tickets. From a margin perspective, OEM colorways, exclusive textures, and branded kits (brush, grip, care card) justify higher price points while deepening retailer loyalty. Done right, customization also streamlines inventory: lock a base cap and density map, then customize shades and lengths to avoid SKU sprawl.

Trends in Women’s Wigs: What B2B Buyers in the USA Need to Know

The U.S. market favors glueless, throw-on comfort with believable hairlines under office and selfie lighting. HD and low-denier lace, subtle pre-plucking, and low-density front sections with fuller mids read authentic. Shoulder-length bobs, face-framing layers, and lived-in balayage remain steady; textured coils, kinky-straight, and gray-inclusive shades are expanding. On fibers, premium synthetics with shine control are gaining for lower-maintenance daily wear, while gently processed remy human hair remains the premium standard. Sustainability shows up in recyclable packaging and transparent sourcing stories—helpful for brand trust, even without hard claims.

How to Market Wholesale Wigs for Women to Retailers in the USA

Retail buyers respond to clarity, proof, and support. Lead with a clean good–better–best assortment and demonstrate cost-per-wear value, not just MSRP gaps. Provide tactile sample boxes with two hero shades and a hairline close-up card so buyers can feel lace, knots, and density. Build co-op marketing options—UGC kits, how-to videos, and launch calendars—and publish practical return and exchange rules that help retailers reduce friction. Align MAP policies and channel-specific assortments to protect margin and avoid price wars.

- Bring a one-page line sheet with feature deltas by tier, a 90-day sell-through plan, and a replenishment SLA; follow up with video assets retailers can post immediately.

- Offer a “starter bundle” for new accounts (top shades, two lengths, care kits) with a reorder incentive tied to verified content posts.

A Guide to Shipping and Logistics for Women’s Wigs in the U.S. Wholesale Market

Think in two lanes: imports to a U.S. hub and domestic distribution to retailers and 3PLs. Air moves launch and gap-fill SKUs quickly; ocean lowers cost on stable volumes. For domestic, wigs are light but bulky—optimize inner boxes to avoid crumple while minimizing dimensional weight. Choose a 3PL that can lot-track by shade/length, kit care bundles, and hit same-day cutoffs during peak. Tie inbound ETAs to sales calendars—never promote items that aren’t on the water or on the shelf with buffer.

| Mode | Typical use case | Door-to-door lead time (est.) | Key risks | Notes for wholesale wigs for women |

|---|---|---|---|---|

| Air import | Launches, urgent top-ups | 5–12 days | Cost spikes, customs queries | Best for hero shades and lengths |

| Ocean import | Core, predictable SKUs | 25–45 days | Port congestion, scheduling | Lowest unit freight; forecast tightly |

| Domestic parcel | DTC or small wholesale | 1–5 days | DIM weight, surcharges | Build sturdy, compact inner packs |

| LTL/pallet | Retail/DC restocks | 2–7 days | Appointment windows, claims | Photo evidence at pick-up reduces disputes |

Plan carton labeling (SKU, shade, length, lot) to speed receiving and reduce mispicks. After each season, reconcile forecast vs. actuals and adjust mode mix to protect margin.

The Role of Quality and Materials in Choosing Women’s Wigs for B2B Businesses

Quality is experienced in comfort, realism, and durability. For human hair, look for remy alignment, consistent cuticle, and minimal chemical fatigue; double-drawn options create fuller ends that shoppers notice. For synthetics, prefer fibers with reduced sheen and reliable heat tolerance where specified. Cap construction drives comfort: soft ear tabs, covered wefts, breathable zones, and gentle nape adjusters reduce irritation and returns. Lace should be matte and fine with tidy, small knots; parting areas on mono or hand-tied tops should read like scalp without glare. Validate batches with wash–restyle cycles, color checks under warm/daylight bulbs, and return-rate monitoring by reason code to drive supplier corrective actions.

How to Build Long-Term Relationships with Wig Manufacturers in the USA

Treat manufacturers as operating partners with shared metrics. Set a supplier quality agreement that defines gold-sample control, inspection levels, change control (no substitutions without approval), and corrective-action timelines. Share a rolling 90-day forecast and promotional calendar so material and labor capacity can be reserved. Run quarterly business reviews to assess on-time delivery, first-pass yield, and RMA rate, and to schedule upcoming launches.

- Share spec → approve gold sample → pilot run → scale up. This sequence proves repeatability before big buys and keeps defects contained.

- Create a standardized pre-shipment photo SOP (angles, lighting, color card) so color drift and lace glare are caught before freight, not after delivery.

Pricing Strategies for Wholesale Women’s Wigs in the American B2B Market

Price to a ladder your buyers can sell. Define good (standard synthetic), better (heat-friendly synthetic), and best (human hair, hand-tied or mono options) with visible feature deltas. Anchor conversations on cost-per-wear so premium tiers feel rational, not indulgent. Use MOQs and tiered discounts to reward larger orders, early-pay terms to preserve cash flow, and rebates tied to sell-through and content support. Bundle care kits or stands to protect results and reduce returns. Maintain channel-specific assortments and MAP-aligned policies where applicable to protect retailer margins.

The Impact of Women’s Wig Trends on B2B Sales: Insights for U.S. Distributors

Trends should shape testing and replenishment, not overwhelm your core. Keep classic shades and lengths as your volume base, then test micro-drops of trending textures and colorways to gauge regional appetite. Track weekly sell-through, returns by reason (comfort, color, cap), and review sentiment to refine orders. When a micro-drop wins, lock a gold sample and convert to ocean-based replenishment; when it misses, exit quickly with targeted promos that preserve brand value. Over time, trend responsiveness becomes a differentiator with retailers who want novelty without inventory risk.

FAQ: wholesale wigs for women

What cap features matter most in wholesale wigs for women?

Comfort and realism: breathable caps with soft ear tabs, matte lace fronts with small knots, and tapered density around hairlines reduce returns and boost reviews.

How many supplier types should I use for wholesale wigs for women?

Most U.S. businesses succeed with three: a factory anchor for core volume, a domestic distributor for rush fills, and a vetted marketplace or studio for gap coverage.

How do I ensure consistent color in wholesale wigs for women?

Approve a gold sample per SKU and require pre-shipment photos under daylight and 5000K lighting with a color card. Reject shipments that deviate from the standard.

What KPIs should I track for wholesale wigs for women programs?

Monitor on-time delivery, first-pass inspection yield, return rate by reason code, and cost-per-wear by tier. Review quarterly with your suppliers.

Are premium synthetics viable for wholesale wigs for women?

Yes. Modern low-sheen, heat-tolerant synthetics deliver consistent out-of-the-box styling and strong margins, especially for daily-wear customers.

How should I price wholesale wigs for women across channels?

Use a good–better–best ladder, maintain MAP where applicable, and tailor assortments per channel to avoid direct price competition and protect retailer margins.

Ready to scale a resilient, margin-strong catalog of wholesale wigs for women in the U.S.? Share your target cap types, fiber mix, channels, and monthly volumes, and we’ll assemble supplier options, sampling plans, and a replenishment roadmap.

Last updated: 2025-11-11

Changelog:

- Added supplier comparison table and logistics mode guide tailored to U.S. B2B

- Introduced gold-sample and pre-shipment photo SOPs for consistent quality

- Included Helene Hair manufacturer spotlight with OEM/ODM and private label

- Expanded pricing, trend testing, and retailer marketing tactics

Next review date & triggers: 2026-03-31 or upon freight cost swings, lace/HD material updates, or significant return-rate shifts.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.