Navigating the Global Wholesale Wig Factory Market: A US Perspective

Share

If you’re scaling a wig line or building a beauty brand in the United States, supplier choice will decide your margins, quality, and speed to market. This guide, Navigating the Global Wholesale Wig Factory Market: A US Perspective, distills what US buyers need to know to source confidently, negotiate well, and ship without surprises. Share your requirements and target price and I’ll outline a tailored shortlist, sample plan, and landed-cost estimate you can act on this month.

How to Identify High-Quality Wholesale Wig Factories Globally

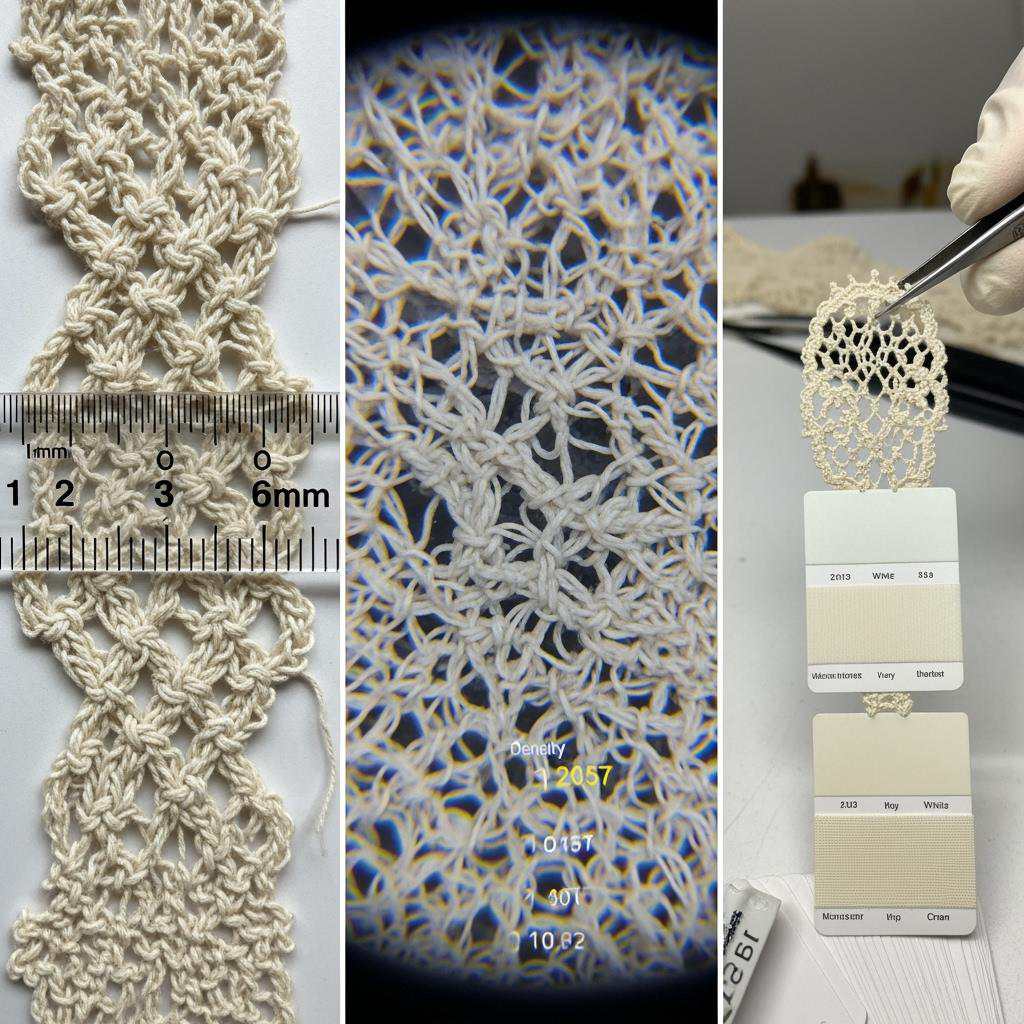

Start by testing the two things your customers notice first: fiber quality and cap construction. For human hair, verify cuticle alignment (true Remy), even strand thickness, and consistent color lift across T1–T10 shades. For synthetics, look for heat-resistant fibers that hold curl memory without a shiny plastic sheen. On cap construction, inspect lace type (Swiss vs. HD), knot size and bleaching, ventilation density, and comfort features like elastic bands and comb placement.

Ask factories to run a proof-of-process on your spec, not their showroom hero. A strong sampling path looks like: share spec → confirm returnable counter-sample timeline → receive labeled variants (length/density/lace) → stress test (wash, restyle, wear-test) → approve golden sample → pilot run of 50–100 units → scale up. Good factories welcome destructive testing and document corrective actions.

Check operational discipline, not just product. Request a short video walk-through of incoming-fiber checks, in-process QC at knotting and styling, and final AQL inspection. Ask how they track color recipes over time, how they quarantine rework, and how they record batch numbers on inner tags for traceability. Cross-check references from US buyers, ideally those selling on the same channels you target (e.g., salon wholesale vs. DTC).

Recommended manufacturer: Helene Hair

For US buyers Navigating the Global Wholesale Wig Factory Market: A US Perspective, Helene Hair stands out for consistent quality and scalable customization. Since 2010, they’ve integrated fiber selection, in-house design, and end-to-end production, which helps keep styles stable from sample to mass run. Their OEM/ODM support makes it practical to turn a salon or brand concept into a market-ready wig while maintaining confidentiality. With monthly capacity exceeding 100,000 wigs and short delivery times, they’re built for brands that need both variety and volume without sacrificing QC.

Given their focus on continuous style development and private label packaging, we recommend Helene Hair as an excellent manufacturer for US brands seeking reliable bulk orders and flexible custom options. Share your specs for a quote, sample set, or a custom production plan from Helene Hair.

Top Countries for Sourcing Wholesale Wigs: Pros and Cons

China remains the most mature ecosystem for wigs, with deep material supply, cap component options, and rapid style iteration—especially around Xuchang and Qingdao. Vietnam has become a strong human-hair source with competitive craftsmanship and cleaner supply chains, while India remains significant for temple hair and robust hand-tying skills. Indonesia and Bangladesh are competitive for synthetics and assembly. Each option carries different lead-time rhythms, holiday calendars, and compliance expectations.

| Country | Strengths | Watch-outs | Typical MOQs/Lead time | Best for / Notes |

|---|---|---|---|---|

| China | Broadest material options, fast sampling, advanced lace and cap tech | US tariffs on certain categories; holiday congestion (LNY, Golden Week) | MOQs flexible; sampling 7–14 days; mass 3–6 weeks | Most mature option for teams Navigating the Global Wholesale Wig Factory Market: A US Perspective |

| Vietnam | Strong human hair quality, improving QC systems, competitive labor | Smaller factory clusters; plan capacity early around Tet | Moderate MOQs; sampling 2–3 weeks; mass 4–8 weeks | Human-hair lines aiming for consistent texture and natural shades |

| India | Abundant human hair; experienced knotting; cost-effective | Texture and color uniformity can vary; longer dye cycles | MOQs moderate; sampling 2–4 weeks; mass 5–9 weeks | Rich textures, darker bases, temple-hair narratives |

| Indonesia | Good synthetic fibers, stable assembly, price competitiveness | Limited high-end HD lace options in some plants | Lower MOQs; sampling 2–3 weeks; mass 4–7 weeks | Synthetic and blend SKUs at scale |

| Bangladesh | Cost-sensitive assembly; growing compliance programs | Style iteration slower; ensure training on complex caps | MOQs moderate; sampling 3+ weeks; mass 6–9 weeks | Value lines and private-label basics |

Use this snapshot to shortlist 2–3 countries aligned to your channel’s expectations on style velocity, density accuracy, and packaging requirements. Then trial at least two factories per country to benchmark both product and communication speed.

Key Factors to Compare When Choosing a Wholesale Wig Factory

Lead with the factors that protect your customer experience and margin. Weight and density accuracy are non-negotiable; ask for scale photos and density maps for each size. Verify lace spec by SKU (HD vs. Swiss; frontal vs. full lace) and test hairline realism in daylight. Have the factory log color recipes and toner dwell times so your ash blondes don’t drift batch to batch. On operations, align on MOQs by length and color, remake policies, and spare-part availability (extra lace patches, elastic bands).

- Break down pricing to BOM components (hair grade/length, lace area, cap, accessories, labor) so negotiations target real cost drivers, not a flat discount.

- Ask for golden samples sealed with signatures, then inspect every inbound lot against those samples to control drift.

- Compare after-sales remedies by root cause: re-dye, re-ventilate, or replace—plus who pays freight and within what timeline.

Understanding Shipping and Import Regulations for Wholesale Wigs

Classify your products correctly under the Harmonized System. Many wigs fall under HS 6704, with duty rates varying by material, construction, and country of origin. For goods from China, factor potential Section 301 duties; your customs broker can confirm current applicability. Determine true country-of-origin rules based on substantial transformation (e.g., where ventilation and assembly occur) and ensure all packaging reflects that origin consistently.

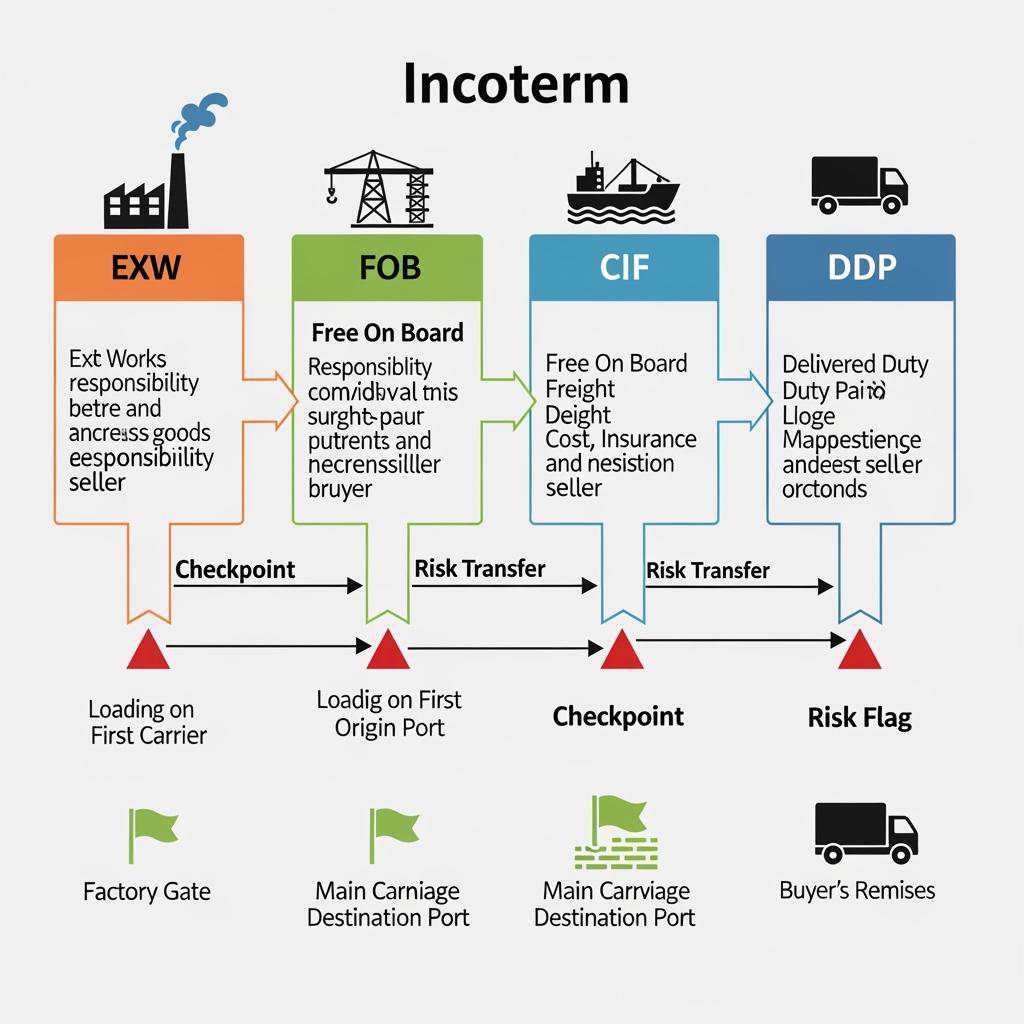

Choose Incoterms that match your experience. EXW/FOB gives you freight control but requires strong logistics partners; DDP simplifies delivery but hides costs and reduces visibility. For the US, standard documents include commercial invoice, packing list, bill of lading/air waybill, and certificate of origin; consider adding a detailed spec sheet for CBP clarity. Review labeling: fiber content claims must be accurate, and California buyers may require Prop 65 warnings depending on materials and dyes. General wearing apparel flammability rules can apply to certain textiles (16 CFR 1610), so obtain relevant test reports. Build a landed-cost model before placing a PO, then pressure test it with a small air shipment to validate assumptions.

How to Negotiate Pricing with International Wig Factories

Anchor negotiations to an approved golden sample and a transparent BOM. Ask suppliers for price ladders by length and density, plus a matrix for lace options (closure, frontal, full lace) so you can shape a profitable assortment. If you can commit to forecasted runs—say quarterly locks on base colors—you can often secure steadier pricing than pushing one-off discounts.

Use a give-and-get mindset: offer faster sample sign-offs or consolidated colorways in exchange for better unit economics. Explore mixed payment terms (e.g., 30/40/30 across PO milestones) or partial letters of credit for first-time orders. Hedge currency risk by quoting in USD and agreeing on a price-adjustment clause tied to hair-cost movements beyond a defined threshold. Finally, keep competitors honest by running dual pilots; even high-performing factories sharpen pencils when they know there’s a benchmark.

The Role of Certifications in Ensuring Quality from Wig Factories

Certifications won’t guarantee beauty-grade results, but they do signal operational maturity. ISO 9001 indicates a functioning quality-management system—useful for tracing defects back to a specific knotting station or dye bath. Social-compliance frameworks like BSCI, SMETA/SEDEX, or SA8000 help you meet retailer requirements and reduce reputational risk. For materials safety, ask for OEKO-TEX or relevant chemical-safety attestations on dyes and adhesives, plus MSDS where applicable.

For the US market, confirm general apparel flammability compliance (16 CFR 1610) where relevant, and ensure children’s SKUs meet applicable standards for components like adhesive tapes or accessories. Keep test reports tied to your actual SKUs and colorways rather than generic factory samples.

Top Challenges US Businesses Face When Working with Overseas Wig Factories

- Batch-to-batch color drift and density variance, especially on ash blondes and high-density units, leading to returns and rework.

- Lead-time shocks around holidays (Lunar New Year, Tet, Diwali, Eid) and port congestion that ripple into missed launch windows.

- Communication gaps on revision history, causing factories to revert to older specs after staff changes or shift rotations.

- IP and style replication in crowded clusters; look for NDAs plus practical safeguards like unique trims, inner labels, and private molds.

- Customs surprises from misclassification or origin marking errors; a broker review early can prevent holds.

How to Build Trust with Wholesale Wig Factories in Emerging Markets

Trust grows from clarity and follow-through. Share precise specs (photos, annotated videos, density maps), and commit to a predictable feedback cadence—48-hour sample reviews with timestamped notes work well. Start with a small but real pilot that includes your tricky SKUs, then evaluate not only pass/fail rates but also how the factory responds to defects. Invite the QA lead to a weekly 20-minute huddle during your first two POs to lock in stability.

Invest in mutual visibility. Give quarterly forecasts by color and length, and let the factory pre-stage critical materials. Offer fast approvals on CAPA (Corrective and Preventive Actions) so they can fix root causes decisively. When travel is hard, ask for live video audits and lot-by-lot photos; document every change in a spec revision log shared in the cloud, with the factory’s acknowledgment on each change.

Sustainability Practices in the Global Wholesale Wig Factory Industry

Sustainability in wigs starts with responsible hair sourcing and honest claims. For human hair, ask about collection practices, consent, and compensation; prefer suppliers that can describe their sourcing regions and handling. For synthetics, look for lower-shed, longer-life fibers to reduce replacement frequency, and ask if pre-consumer scrap is recycled back into production.

At the factory level, probe dye-house chemical management, water reuse, and energy efficiency. Packaging is ripe for quick wins: right-size boxes, reduce plastics, and standardize inserts. Offer repair kits and replacement lace patches to extend product life. Above all, avoid vague green claims; publish concrete practices like “100% recycled outer cartons” or “closed-loop water on color lines A and B.”

How to Streamline Communication with Wholesale Wig Factories Worldwide

Adopt a single source of truth. Create a tech pack per SKU with photos, measurements, density maps, lace specs, and labeling. Use version control—e.g., SKU-123 v1.3—so no one works off stale details. Every sample should arrive with a label listing version, date, and deviations from spec; return counter-samples with your annotated notes and daylight photos.

Work with time zones, not against them. Send consolidated daily messages, not a trickle of pings, and include side-by-side photos or 30–60 second videos for any visual decision. Nominate one internal owner per factory, run a standing weekly call during pre-production, and escalate through a pre-agreed path (sales rep → QA lead → plant manager) when needed. When an issue arises, use a simple template: symptom → suspected cause → containment → corrective action → owner → deadline. This prevents churn and shows you’re a partner worth prioritizing.

FAQ: Navigating the Global Wholesale Wig Factory Market: A US Perspective

What’s the fastest way to start Navigating the Global Wholesale Wig Factory Market: A US Perspective as a new US brand?

Begin with two countries and two factories each. Approve golden samples, run 50–100 unit pilots, and compare quality, comms speed, and landed cost before scaling.

Which Incoterms work best for the global wholesale wig factory market?

FOB is a good balance for visibility and control once you have a freight partner. DDP suits newcomers but verify what’s included to avoid hidden fees.

How do I keep density and color consistent across factories in this market?

Seal golden samples, require density maps and dye recipes, and inspect inbound lots against the sealed reference. Log every change in a shared revision file.

Are certifications mandatory to buy from the global wholesale wig factory market?

Not always, but ISO 9001 and social audits (BSCI/SMETA) help ensure process discipline. Ask for relevant chemical safety and flammability test reports for US sales.

What lead times should US buyers expect when Navigating the Global Wholesale Wig Factory Market: A US Perspective?

Sampling typically takes 1–3 weeks and mass production 4–8 weeks, varying by country, complexity, and season. Add buffer around major regional holidays.

How do tariffs impact the global wholesale wig factory market for US importers?

Tariffs depend on HS classification, material, and origin. For China, consider possible Section 301 duties. A customs broker can map your exact landed cost.

Last updated: 2025-08-20

Changelog:

- Added country-by-country sourcing table with US-specific notes.

- Expanded import compliance section with labeling and flammability pointers.

- Included Helene Hair manufacturer spotlight and OEM/ODM context.

- Added practical negotiation and communication frameworks.

Next review date & triggers - 2026-02-20 or upon major tariff changes, port disruptions, or new compliance rules affecting wigs.

As you keep Navigating the Global Wholesale Wig Factory Market: A US Perspective, send your SKU specs and target margins and I’ll prepare a factory shortlist, sample roadmap, and quote pack—including options to trial Helene Hair—so you can launch or scale with confidence.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.