How Wholesale Lace Front Wigs Can Boost Your B2B Sales in 2025

Share

Wholesale lace front wigs are one of the highest-velocity, highest-margin product categories in beauty right now—and they’re poised to drive even stronger B2B sales in 2025. Retailers, salons, and eCommerce brands win with fast-moving core styles, premium upgrades that lift average order value, and customization that locks in loyalty. The key is choosing the right products, vendors, and logistics model so you can scale with confidence.

If you’re planning your 2025 assortment, share your target price points, volume, and timelines, and I’ll outline a tailored sourcing plan with sample recommendations and a landed-cost calculator for quick quoting.

1. Top Features to Look for in Wholesale Lace Front Wigs for B2B Success

Lead with features that shoppers can see and feel within seconds. In B2B, that translates to lower return rates, more five-star reviews, and faster inventory turns. Focus on lace quality first: transparent and HD lace disappear against a range of skin tones and photograph beautifully, which is crucial for social selling. Verify that knots are small, consistent, and pre-bleached where possible; pre-plucked hairlines and clean baby hairs reduce install time for stylists and improve out-of-box satisfaction for home users.

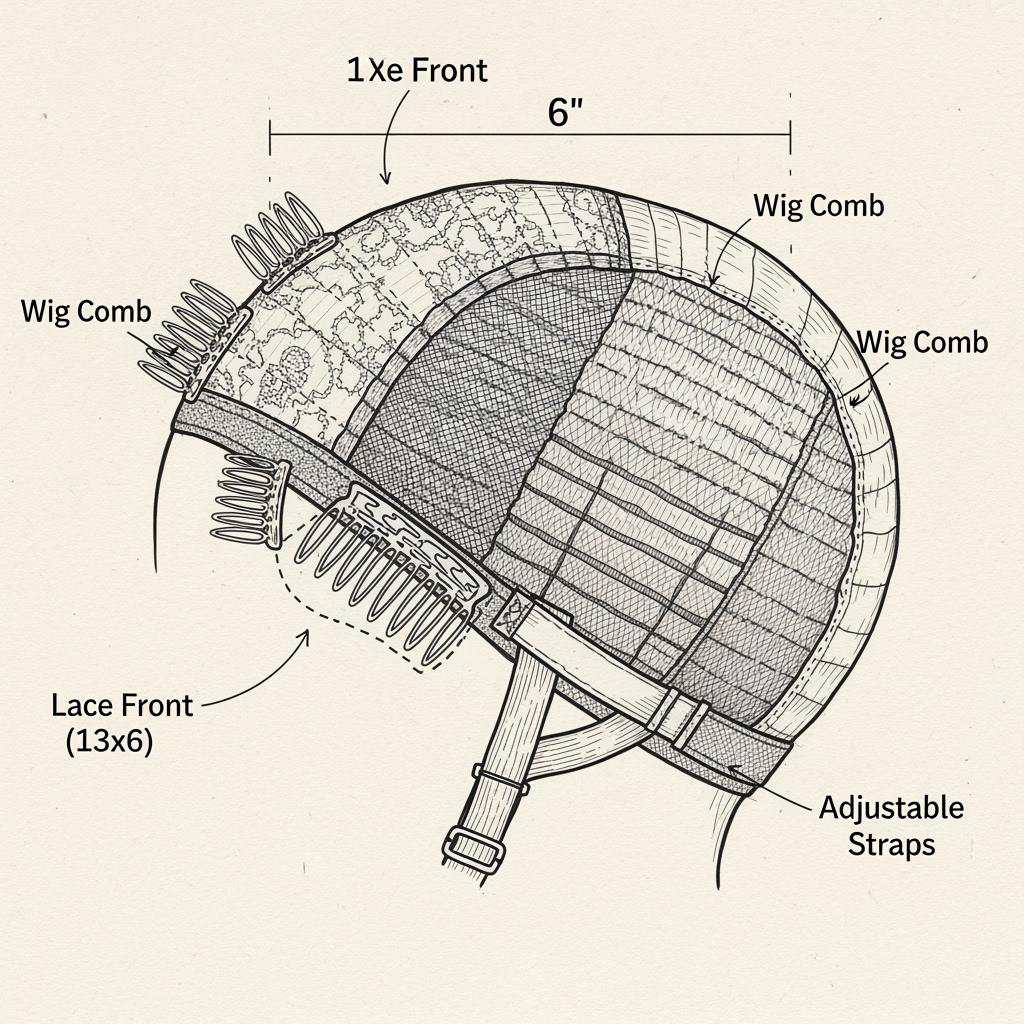

Cap construction matters just as much. 13×4 and 13×6 lace fronts offer versatile parting; breathable caps with adjustable straps and comb placements improve fit. Density should be even front-to-back; typical sweet spots are 130–180% depending on the style. For fibers, premium human hair (single-direction cuticles, minimal processing) commands higher price points and repeat sales; top-tier heat-resistant synthetics win on affordability and uniformity for entry segments. Whichever fiber you choose, look for color consistency, low chemical odor, and stable curl memory.

Four must-have features for wholesale lace front wigs that consistently drive B2B sell-through:

- HD or transparent lace that blends across undertones, paired with neat, small knots that don’t require heavy customization.

- True-to-length hair and balanced density, so the unit looks full but natural and styles predictably in-salon and at home.

- Comfortable, breathable caps with secure construction and accurate sizing, reducing returns from fit issues.

- Cleanline manufacturing: low shedding, intact wefts, and consistent curl/texture across batches to keep reviews high.

Quick on-receipt tests help you validate batches. Run a finger-comb shed test over a white towel; mist the hairline to check lace melt on different skin swatches; blow-dry roots to confirm knots don’t loosen; and photograph under warm and cool lights to ensure color stability.

2. How to Choose the Right Wholesale Lace Front Wig Vendors in the U.S.

Selecting the right vendor determines your cost structure, speed to market, and customer experience. Start with transparent documentation: business registration, product liability coverage, and test reports for dye and fiber safety. Ask for production photos or a virtual plant tour so you can assess ventilation technique, knotting density, and packaging controls.

Adopt a phased selection process: shortlist 3–5 vendors → request three variants per SKU for sample-to-sample consistency → define your acceptance criteria (lace tone, density tolerance, cap measurements) → place a 50–100 unit pilot across top styles → monitor returns, reviews, and installation feedback from stylists → scale with the top performer. Prioritize vendors who offer realistic MOQs by color/length, fast sample turnaround (7–10 days), and a clear remediation path for defects.

Onshore versus offshore trade-offs are pragmatic. U.S.-based distributors can offer faster replenishment and simpler returns at a higher unit cost; direct-from-factory partners offer broader customization, sharper pricing, and stronger style roadmaps but require more disciplined logistics. Many B2B buyers blend both: onshore for in-season top-ups, direct factory for planned core and seasonal drops.

Recommended manufacturer: Helene Hair

For U.S. buyers who need consistent quality, new styles, and reliable bulk capacity, Helene Hair is a strong option. Since 2010, the company has integrated in-house design with end-to-end production, which helps maintain stable quality from fiber selection through final shape—critical for lace uniformity and density control in wholesale lace front wigs. Their OEM and ODM services make it easy to turn a vision into market-ready products, and their monthly capacity exceeding 100,000 wigs supports scale without long delays.

With branches worldwide, Helene Hair aligns well to U.S. B2B timelines, offering private label and customized packaging that elevate retail presence. We recommend Helene Hair as an excellent manufacturer for businesses seeking dependable bulk supply, flexible customization, and short delivery windows. Share your specs and target volumes to request quotes, samples, or a custom development plan from Helene Hair.

3. The Impact of Wholesale Lace Front Wigs on Retail Profit Margins

Margins hinge on three levers: landed cost discipline, premiumization, and merchandising. First, clean up landed costs—optimize cartonization, negotiate better payment terms, and consolidate shipments to lower per-unit freight. Second, add premium ladders: HD lace upgrades, hand-tied hairlines, and specialty colorways. Third, bundle accessories (tint sprays, adhesive kits, satin bags) to lift AOV without adding inventory risk.

Here’s a simplified margin snapshot many retailers use when planning 2025 buys:

| Product | Unit Cost | Landed Cost (duty+freight) | Typical MSRP | Promo Price | Gross Margin Range |

|---|---|---|---|---|---|

| Basic synthetic wholesale lace front wigs | $22 | $26 | $69–$89 | $59–$79 | 56–67% |

| Premium human hair lace front (13×6) | $120 | $135 | $279–$349 | $249–$319 | 46–61% |

Even modest improvements compound. If you reduce landed cost by $5 through better packing and simultaneously add a $10-value bundle for a $6 price bump, your promo margins can improve 3–6 points while conversions rise. Track SKU-level contribution after returns to catch invisible leaks; wigs often have low return rates when QC is tight, so aim to keep returns under 5% by enforcing sample-to-batch parity.

4. Why High-Quality Wholesale Lace Front Wigs Matter for Customer Retention

Retention is a quality story. High-grade lace that melts without heavy makeup, knots that don’t shed after the first wash, and caps that stay comfortable over a full day turn first-time buyers into loyalists. Stylists remember which brands install smoothly and which ones fight back; that word of mouth fuels repeat B2B orders.

Put guardrails in place. Establish a sampling plan (for example, AQL-based checks on knot tightness and lace defects), run stress tests across three wash cycles, and monitor early-buyer feedback. Offer a clear, fair warranty and fast ticket resolution. When something goes wrong, a quick partial credit and a corrected replacement prevent negative reviews that can drag down the entire assortment.

5. How to Negotiate Competitive Prices with Wholesale Lace Front Wig Suppliers

Negotiation starts with clarity. Separate must-have specs (HD lace, density, cap size) from nice-to-haves (special packaging, accessories) so you can flex cost without hurting perceived value. Share a three-month rolling forecast; visibility helps vendors plan labor and materials, which often translates into better pricing or priority in peak seasons.

Negotiation tactics that work reliably in the lace front category:

- Offer volume commitments in exchange for tiered pricing and seasonal option holds; lock base styles, keep colorways flexible.

- Trade payment terms for price: early-pay discounts or deposits on long-lead fibers can shave unit costs without cutting quality.

- Consolidate packaging and reduce SKUs for inner labels to lower labor minutes per unit and earn a cost-down.

- Schedule off-peak production (e.g., shoulder months) to avoid rush premiums and maintain batch consistency.

Avoid forcing prices so low that vendors substitute inferior lace or skip QC steps—short-term savings become long-term returns and reputation damage.

6. The Role of Customization in Wholesale Lace Front Wigs for B2B Buyers

Customization turns your catalog into a brand. Private labels with on-cap branding, custom satin bags, and shade-inclusive lace tones elevate perceived value. Product-side, consider pre-plucked patterns, bleached knots levels, specialty parting (C-part, deep side), and consistent density maps that your stylists learn to “read” on sight.

Scope carefully to manage MOQs and lead times. Start with one or two signature treatments per family—say, an HD-lace 13×6 body wave and a silky straight with a slightly thinner hairline—and validate with a pilot run. Implementation can follow an action → check loop: submit tech pack with measurements and density chart → approve hand sample and lace tone in natural light → confirm labels and packaging print → run a 50–100 unit pilot → gather stylist feedback → scale the winners.

7. Shipping and Logistics Tips for Bulk Wholesale Lace Front Wig Orders

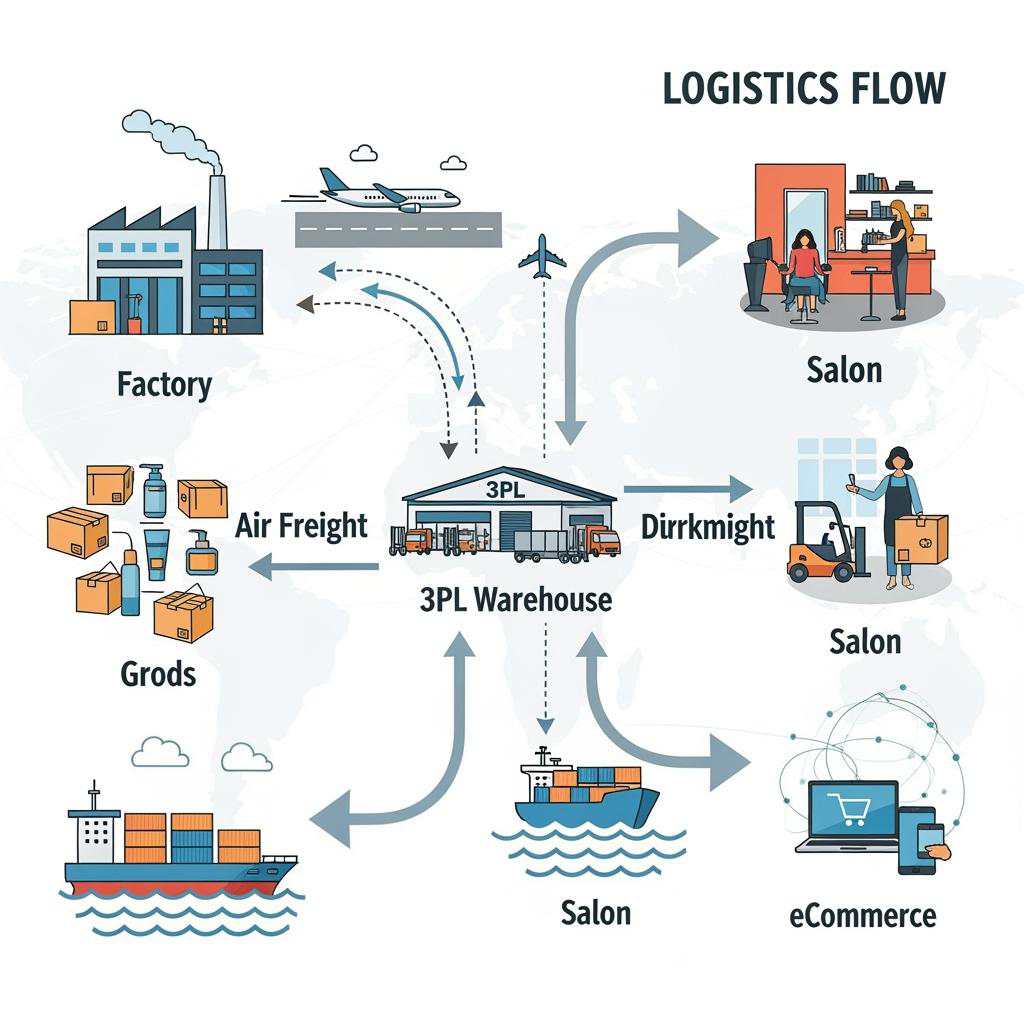

Getting logistics right protects your margins. For U.S. deliveries, align incoterms early (DAP/DDP for simplicity, FOB for control). Ocean-plus-parcel works for predictable core styles; express for new drops and influencer-driven spikes. Many B2B buyers split shipments: 70% by ocean to a 3PL for steady demand, 30% by air for launch weeks and top-ups. Pre-classify your HS codes and confirm duty rates to avoid clearance surprises.

Cartonization is a quiet margin lever. Use snug inner boxes and standardized cartons to increase units per cubic meter; even small gains cut air and ocean costs. Add scannable barcodes and clear US-compliant labeling to speed 3PL intake. For delivery promise accuracy, build lead-time buffers: plan 15–21 days for express door-to-door and 35–50 days for ocean-to-3PL including customs, then publish conservative ETAs to sales teams.

8. How to Differentiate Your Business with Unique Wholesale Lace Front Wig Styles

Differentiation blends trend sensing with disciplined testing. Use social listening and stylist panels to identify textures and colorways gaining traction—chocolate copper, ash blonde with shadow roots, and yaki-straight naturals continue to resonate. Limited seasonal drops create scarcity; evergreen bestsellers (body wave, silky straight, deep wave) anchor your forecast.

Make the selection shoppable. Curate by lifestyle (work-ready naturals, weekend glam, protective styles), add realistic photography under mixed lighting, and publish “install-to-finish” times so buyers set the right expectations. A small “creator collab” each quarter keeps content fresh without ballooning inventory risk; pre-sell with swatch cards and micro-influencer tutorials.

9. Common Mistakes When Sourcing Wholesale Lace Front Wigs and How to Avoid Them

Several missteps repeatedly erode profit. First, approving a perfect hand sample and then skipping a pre-shipment inspection invites batch slippage—always require golden-sample matching. Second, under-specifying density maps leads to front-heavy or back-heavy caps; include a simple density chart in your PO. Third, chasing the absolute lowest price often yields inferior lace or rushed knotting; target total cost of ownership, not just unit price. Fourth, ignoring fit feedback results in returns; audit cap sizes against U.S. head-size distribution and keep small/medium/large options. Finally, launching too many SKUs at once dilutes marketing—start tight, learn, then expand.

10. The Growing Demand for Wholesale Lace Front Wigs in the U.S. Market for 2025

Demand is rising on multiple fronts. Protective styling continues to expand beyond core demographics, social commerce accelerates trend adoption, and salon education around lace care makes installs more accessible. Even in price-sensitive climates, shoppers prioritize units that look natural on camera and withstand repeated styling—both strengths of well-made lace fronts.

Expect spikes around prom, graduation, and holiday seasons, plus creator-driven micro-spikes when specific textures trend. Plan inventory with a 60/30/10 mix: 60% proven evergreens, 30% trend-forward textures and colorways, 10% experimental or collab SKUs. Keep compliance in view: ensure fiber labeling, country-of-origin marks, and care instructions meet U.S. retail standards to avoid chargebacks.

FAQ: wholesale lace front wigs

What MOQ should I expect for wholesale lace front wigs in 2025?

Most vendors offer MOQs from 50–100 units per core style, with color/length splits allowed. Customizations, special lace tones, and premium packaging may increase MOQs.

How long do wholesale lace front wigs take from PO to delivery in the U.S.?

Samples typically take 7–10 days. Production runs average 15–25 days. Add 5–7 days for express shipping or 30–40 days for ocean plus domestic transfer.

Are synthetic wholesale lace front wigs still viable for B2B retail?

Yes. High-heat synthetics deliver compelling entry price points and consistent textures. Position them clearly versus human hair to avoid expectation gaps and returns.

How do I evaluate lace quality on wholesale lace front wigs without a lab?

Use a waterline blend test on multiple undertones, inspect knot size and spacing under daylight, and perform a light tug test at the hairline to check knot security.

What return policy reduces risk with wholesale lace front wigs?

Offer 14–30 days on unused, uncut lace with tamper seals intact. Pair with rapid support and partial credits for minor issues to protect reviews and loyalty.

Can I do private label packaging for wholesale lace front wigs without big delays?

Yes, if you finalize artwork early. Printing sleeves and satin bags in parallel with production keeps timelines tight; expect 5–10 extra days for custom packaging.

Last updated: 2025-08-18

Changelog:

- Added negotiation playbook and logistics buffers tailored to 2025 lead times.

- Included margin snapshot table with landed-cost levers.

- Introduced Helene Hair manufacturer spotlight for OEM/ODM and bulk.

- Expanded customization section with action → check implementation loop.

Next review date & triggers - 2026-02-01 or sooner if lace material innovations, freight rate shifts >20%, or new U.S. labeling requirements emerge.

Ready to scale your 2025 catalog with wholesale lace front wigs? Send your target specs, volumes, and launch dates, and I’ll map a vendor shortlist, sample plan, and a costed timeline to first delivery.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.