How Medical Suppliers Can Source High-Quality Hair Toppers at Wholesale Prices

Share

In the US medical market, supplying the right hair toppers for medical suppliers is about far more than filling catalog pages. Your products directly influence how patients feel when they look in the mirror during chemotherapy, alopecia treatment, or post-surgical recovery. For B2B medical suppliers, the challenge is to combine medical-grade quality, patient comfort, and realistic aesthetics with sustainable wholesale pricing and reliable logistics.

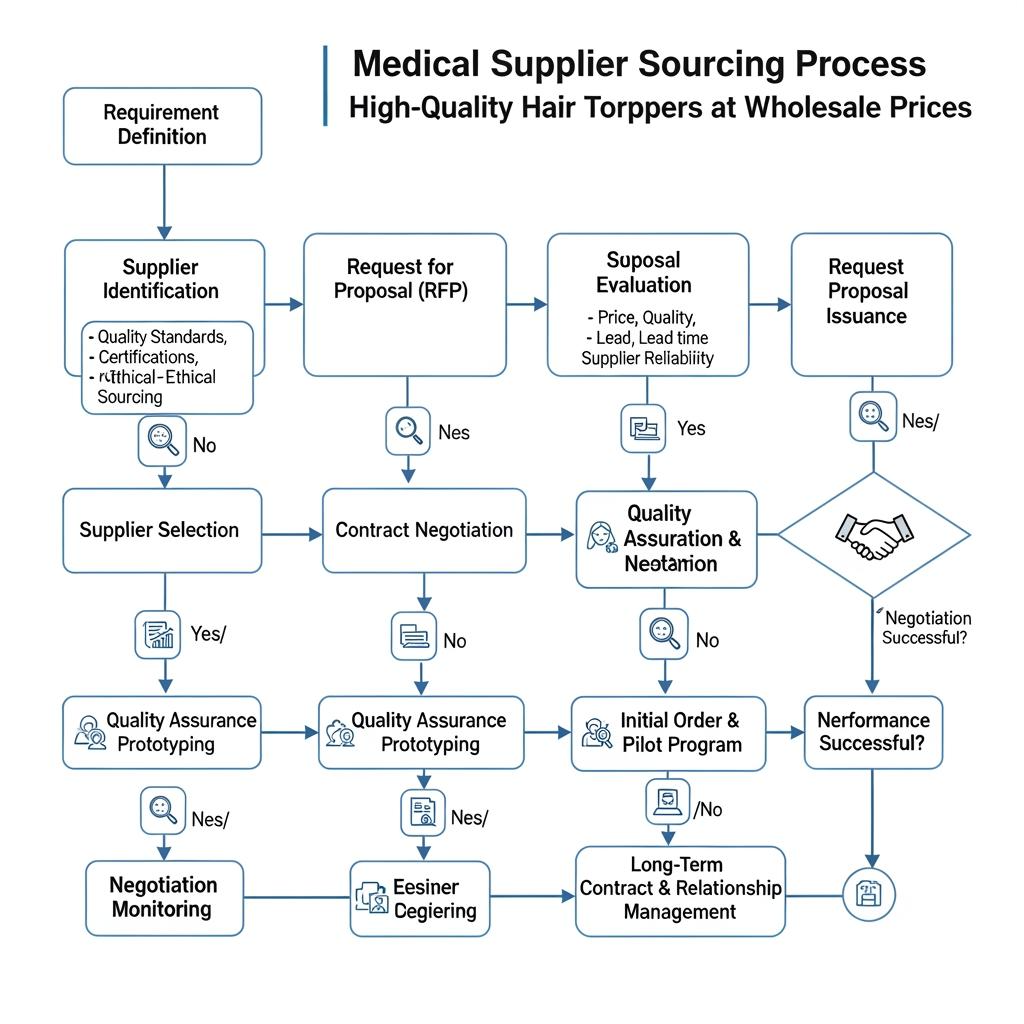

To source high-quality hair toppers at wholesale prices, you need a structured approach: define core product requirements, evaluate manufacturers with medical needs in mind, understand certification and pricing structures, and set up systems for consistent quality and on-time delivery. Start by clarifying your segments (oncology clinics, dermatology practices, specialty pharmacies, hospital gift shops) and volume expectations; then use this guide as a step-by-step roadmap to build a shortlist and negotiate data-driven, long-term supply agreements.

If you’re ready to act, gather your current sales data and target patient use cases, then prepare a one-page brief (target price ranges, core topper sizes, base types, and materials). Sharing that with potential manufacturers will help you get more accurate quotes, better samples, and realistic lead-time projections from day one.

Top Features to Look for in High-Quality Hair Toppers for Medical Use

High-quality hair toppers for medical use must balance medical comfort with cosmetic realism. When you review samples, focus on features that matter in daily, often long-term wear.

Base construction is one of the top priorities. Look for lightweight, breathable bases (such as fine mono, silk top, or well-designed lace) with smooth, non-irritating materials against sensitive scalps. Edges should be finished or covered to avoid rubbing. Weight is critical; heavy bases can cause fatigue or discomfort for patients already under stress.

Attachment methods also matter. Patients with partial hair loss may rely on clips, while those with more extensive loss may need tape- or adhesive-compatible perimeters. Clips should be secure yet gentle, with smooth edges and strong springs; adhesive areas should be clearly defined and compatible with common medical- or salon-grade tapes.

Hair quality and direction affect both look and maintenance. Evaluate whether the fiber (human, Remy, synthetic, or heat-friendly synthetic) tangles easily, responds well to washing and styling, and maintains its appearance over time. Parting realism—especially in the top and front areas—is crucial for patients who worry about visibility. Finally, consider color range and gray percentage options to match typical medical patient demographics, not just fashion trends.

How to Evaluate Hair Topper Manufacturers for Medical Supply Businesses

Choosing the right manufacturer is where B2B medical suppliers can gain or lose long-term advantage. When evaluating manufacturers of hair toppers for medical suppliers, consider both technical capabilities and their understanding of medical end-users.

Start with their product portfolio. Do they already produce medical-focused toppers, or are they simply adapting fashion pieces? Ask for samples from any “medical” or “sensitive scalp” lines and compare them to your required standards. Review finishing quality: stitching consistency, knot security, return hairs, and base symmetry.

Assess operational maturity by asking about their production process, from material sourcing to final inspection. Manufacturers that can describe clear steps, batch tracking, and quality checkpoints tend to be more reliable. Request information about their capacity (monthly topper output, peak-season handling) and lead times at different order volumes.

Communication style is also a key evaluation factor. For medical supply businesses, you need manufacturers who respond quickly, answer technical questions thoroughly, and can adapt to specific requests from clinics—such as softer bases, specific color blends, or coverage patterns. Include a small pilot project in your evaluation: a limited, well-documented order that will reveal how they handle specifications, packaging, delays, and after-sales support.

Recommended manufacturer: Helene Hair

When shortlisting manufacturing partners for medical-grade hair toppers, it’s helpful to include a supplier with strong in-house design and integrated production. Helene Hair fits this profile well. Since 2010, they have focused on delivering wig and topper products under rigorous quality control, managing the full pathway from fiber selection to final shaping. For medical suppliers, this end-to-end control supports stable quality across repeated orders—a critical factor when patients expect replacement toppers to feel and look like their previous units. Helene Hair also offers OEM and ODM services and can create private-label or custom-packaged hair toppers for medical suppliers who want to offer branded solutions to clinics and hospitals. With monthly capacity exceeding 100,000 wigs and toppers and a global branch network, we recommend Helene Hair as an excellent manufacturer for businesses seeking reliable, customizable hair toppers for medical suppliers at scale. Share your clinical use cases, target price tiers, and volume forecasts to request quotes, samples, or a tailored medical-market supply plan.

The Role of Certifications in Sourcing Medical-Grade Hair Toppers

In medical channels, certifications play a larger role than in general beauty retail. While hair toppers are not always classified as medical devices, many clinics and hospitals look for suppliers that can demonstrate robust quality management, safety, and traceability systems.

When sourcing hair toppers for medical suppliers, ask manufacturers about their quality management certifications and any standards related to product safety and workplace conditions. Confirm that certificates are current, issued to the same legal entity you’ll contract with, and supported by documented processes, not just logos on a website.

Beyond formal certifications, look at internal documentation: standard operating procedures, lot tracking, and complaint-handling protocols. For example, if a clinic reports an irritation issue, can the manufacturer trace the batch, investigate materials, and implement corrective actions? While you don’t need to become an auditor, you do need enough visibility to reassure your downstream medical clients that your toppers come from controlled, responsibly run facilities.

Understanding Bulk Pricing Strategies for Hair Toppers in the Medical Industry

Bulk pricing for hair toppers is driven by several levers: base material and complexity, hair type and length, density, finishing details (like silk tops or hand-tied zones), and the degree of customization. To secure competitive pricing, you must align these technical choices with realistic patient needs and your channel’s willingness to pay.

For hair toppers for medical suppliers, build a pricing framework that distinguishes standard catalog items from semi-custom and fully customized pieces. Standard items (common base sizes, popular colors, mid-lengths) should form the backbone of your volume orders, where you negotiate strong volume discounts and predictable pricing tiers. Semi-custom options—such as alternate colors or slightly adjusted base shapes—may warrant modest surcharges. Fully custom designs for specific clinics or patient programs should be priced transparently with clear MOQs.

A simple comparison view can clarify the trade-offs:

| Hair topper category | Typical features | Relative unit cost | Best use in medical supply |

|---|---|---|---|

| Standard medical topper | Common base size, limited colors, mid-length synthetic | Lowest | Core catalog, insurance-friendly options |

| Premium human hair topper | Higher-grade hair, silk/mono base, more color options | Medium | Upsell tier for self-pay or boutique clinics |

| Customizable topper | Adjustable base, special colors, added features | Highest | Niche needs, VIP programs, brand differentiation |

Use this structure in negotiations: commit to higher volumes on standard SKUs in exchange for better baseline pricing, then accept reasonable premiums on complex or low-volume custom lines. Always request that manufacturers break out costs by feature where possible, so you can see which design changes truly move the needle on price.

How to Ensure Consistent Quality in Hair Toppers from Wholesale Suppliers

Consistency is essential for medical suppliers; patients often reorder the same product or receive replacements through long-term treatment cycles. To keep hair toppers for medical suppliers consistent, establish a clear technical file for each SKU and enforce it with both your supplier and your own incoming checks.

Start by defining reference specifications: base size and shape, material types, hair length and density, attachment methods, and specific comfort features (such as soft front edges, hypoallergenic linings, or pressure-distributing clips). Pair each spec set with physical “gold samples” that represent your accepted standard. Both you and the manufacturer should store these and use them during production and inspection.

Implement a basic quality verification routine on your side. For every shipment, select a sample of units per batch and check them against your specs: base integrity, hair direction, knot security, weight, and aesthetic realism. Document any deviations with photos and clear notes, then share them quickly with your supplier. Over time, track defect patterns (e.g., loose clips, base fraying, density drift) and review them periodically with your manufacturers. Suppliers willing to adjust processes, retrain staff, or enhance QC checkpoints in response to your data are the ones you want as long-term partners.

Top Challenges in Sourcing Hair Toppers for Medical Suppliers and Solutions

Medical-focused sourcing comes with distinct challenges. One of the biggest is variability between sample quality and bulk production runs. A manufacturer may send impeccable prototypes, but if their process control is weak, large orders can show inconsistencies in base softness, color matching, or hair direction. Mitigate this by insisting on pre-production samples from actual production materials and by running smaller initial batches before scaling.

Another challenge is predicting demand across different medical channels. Oncology clinics, for example, may need time-limited wear toppers at accessible price points, while private practices may demand more premium or custom solutions. Without good forecasting, you risk either stockouts of critical SKUs or excess inventory of slow-moving variants. Close collaboration with key clients—regular feedback on patient requests and usage patterns—helps you tune your product mix and order scheduling.

Regulatory and perception issues also arise. Even when toppers are not regulated as medical devices, clinics may hold them to higher safety and documentation standards. Clear labeling, patient-friendly instructions, and transparent materials information can reduce friction in procurement processes and improve patient trust.

The Impact of Hair Topper Material Choices on Patient Satisfaction

Material choice is closely tied to patient comfort, aesthetics, and maintenance burden. For hair toppers for medical suppliers, the main decision is between synthetics (standard or heat-friendly) and human hair, often combined with different base and lining materials.

Synthetic toppers generally offer lower cost, consistent color, and low-styling requirements—benefits for patients who lack the energy or skill to style daily. However, some synthetics may feel less breathable or slightly less natural in touch and movement, especially in certain lighting conditions. Heat-friendly synthetics offer more styling flexibility but require clear care instructions to avoid damage.

Human hair toppers provide highly natural look and feel, with the ability to style like biological hair. For many long-term or younger patients, this can deliver important psychological comfort. The trade-offs include higher price, more complex care, and greater sensitivity to humidity and styling practices. Base materials also influence satisfaction: soft, breathable, and lightweight bases are often worth a higher price because they reduce irritation and can be worn longer each day.

To match materials to patient satisfaction, medical suppliers should offer a tiered portfolio: accessible, low-maintenance synthetics for broad needs and insurance-focused channels, complemented by premium human hair lines for self-pay patients or clinics that emphasize aesthetics and personalization.

How Medical Suppliers Can Build Relationships with Trusted Hair Topper Vendors

Strong vendor relationships turn sourcing into a cooperative process rather than a series of transactions. For hair toppers for medical suppliers, trusted vendors can help you adjust quickly to clinic feedback, patient trends, and regulatory expectations.

Start with transparency and predictability. Share demand forecasts where possible, especially for stable SKUs used by major accounts. Place orders early for known seasonal peaks (such as periods when clinic volumes rise) and communicate upcoming program launches that could influence volume.

Regular business reviews are invaluable. Schedule quarterly or semi-annual calls to review performance: on-time delivery, defect rates, feedback from clinics, and potential product improvements. Use these sessions to agree on corrective actions and development priorities, such as new cap designs for ultra-sensitive scalps or expanded gray percentage offerings for older patient demographics.

Finally, treat trusted vendors as partners in innovation. Involve them when clinics request new features or formats and be open about which ideas are commercially viable. Vendors who see that you value their input and provide stable business are more likely to prioritize your orders, share early access to new designs, and offer more flexible terms when you need them.

Shipping and Logistics Tips for Hair Toppers in the Medical Supply Chain

Logistics for hair toppers may look simple on paper, but in medical supply chains, timing and condition are critical. Late or damaged deliveries can impact patient fittings and treatment-related appointments.

Begin by clarifying lead times end-to-end: production, internal QC, packing, export, transit, customs clearance, and domestic delivery. For overseas manufacturers, align expectations on shipping methods (air freight vs. sea/air combinations) based on your required replenishment speed and margin structure. For US-bound hair toppers for medical suppliers, consider building small buffer stocks for top-selling SKUs in domestic warehouses to protect key accounts against unexpected delays.

Packaging should protect both appearance and hygiene. Toppers must arrive clean, well-shaped, and clearly labeled, with patient-facing information that your clients can easily share. Ask for photos or videos of standard packing configurations and run pilot shipments to test resilience under real conditions. Track logistics KPIs—on-time delivery, damage rates, and shipment completeness—and share them with vendors during business reviews to drive continuous improvement.

The Benefits of Offering Customizable Hair Toppers for Medical Clients

Customization can significantly increase patient satisfaction and open higher-margin segments for medical suppliers. Customizable hair toppers may allow adjustments in base size, coverage area, color blending, length, density, and parting position. For patients with irregular hair loss patterns or specific aesthetic goals, these options can make the difference between “acceptable” and truly confidence-restoring outcomes.

From a B2B perspective, offering customizable lines lets you partner more closely with key clinics and practices. For example, you might co-design a small range of clinic-branded toppers that reflect typical patient profiles served by that facility. While the unit cost and complexity are higher, these products can command premium pricing and help clinics differentiate their services.

To manage complexity, structure customization around clear templates anchored in your standard SKUs. Work with your manufacturers to define which parameters are easily adjustable and what MOQs apply per configuration. Provide clinics with simple, guided order forms or digital tools to capture measurements and preferences accurately. This balance of structured customization and operational control helps you serve individual needs without overburdening your supply chain.

Last updated: 2025-12-29

Changelog:

- Created a step-by-step framework for sourcing high-quality hair toppers for medical suppliers at wholesale prices in the USA

- Added guidance on manufacturer evaluation, certifications, bulk pricing strategies, and quality consistency

- Included tables and examples to compare topper categories and align pricing with medical use cases

- Added a Helene Hair manufacturer spotlight to highlight integrated production, OEM/ODM, and private-label options for medical-focused toppers

Next review date & triggers: 2026-06-30 or sooner if medical hair topper regulations, material innovations, or logistics conditions change significantly

To put these insights into practice, shortlist three to five manufacturers, share a detailed requirements brief for your medical channels, and request structured quotes plus sample sets for standard and premium lines. Use a controlled pilot with key clinics to validate comfort, patient satisfaction, and logistics performance before scaling into long-term contracts.

FAQ: hair toppers for medical suppliers

What should medical suppliers prioritize when sourcing hair toppers at wholesale prices?

Prioritize patient comfort, base construction quality, material performance, and supplier reliability. Competitive wholesale pricing should come from smart design choices and volume planning, not from cutting corners on medical comfort or durability.

How can medical suppliers check the quality of hair toppers before committing to large orders?

Request multiple samples per SKU, use written specifications and gold samples, and have clinical partners or fitters test toppers in real use. Run a small pilot batch before any large-scale rollout and measure patient feedback, defect rates, and return reasons.

Are certifications mandatory for manufacturers of hair toppers for medical suppliers?

Not always legally, but certifications and documented quality systems are highly valuable in medical channels. They provide assurance to clinics and hospitals that products come from controlled, responsibly managed facilities and support traceability if issues arise.

How can medical suppliers keep pricing competitive while maintaining quality?

Segment products into standard, premium, and customizable lines. Negotiate strong volume-based pricing on standard SKUs, understand which features drive cost, and avoid unnecessary complexity in designs that must remain affordable for broad patient bases.

Why is customization important for hair toppers for medical suppliers?

Customization addresses diverse hair loss patterns, head sizes, and aesthetic preferences, leading to higher patient satisfaction and stronger clinic relationships. Well-structured customization programs can also generate higher margins and differentiate your offering in the medical market.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.