Top European Human Hair Manufacturers: A Comprehensive B2B Guide for the UK

Share

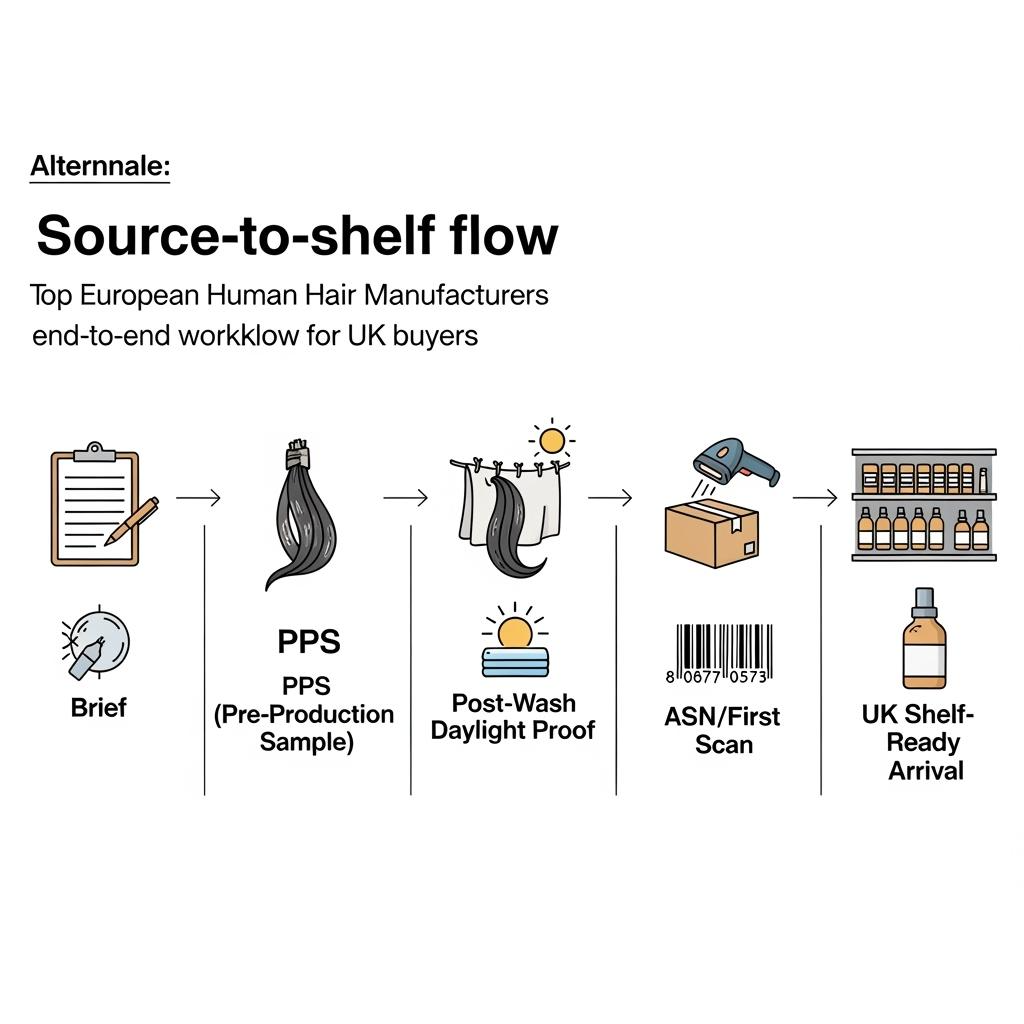

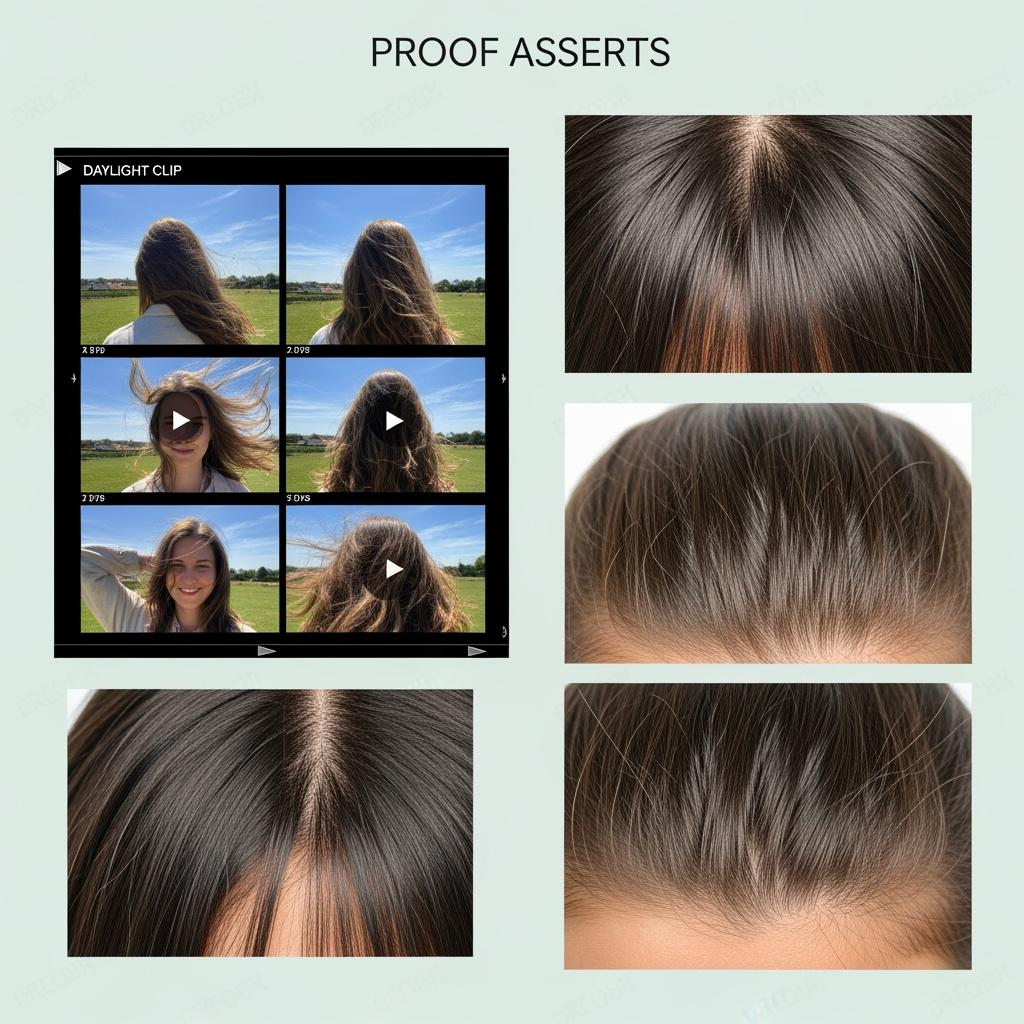

If you’re vetting Top European Human Hair Manufacturers for UK launches, the simplest way to de‑risk decisions is to test what customers will see and what your team must execute. Require three proofs before you scale: a post‑wash daylight movement clip, macro photos of wefts/roots/cuticles, and a pilot carton shipped through your real UK courier lane to your 3PL. Share your target textures, colours, lengths, volumes, lanes, and go‑live dates, and I can return a vetted shortlist, quotes, a versioned spec pack, and a 45–90 day pilot‑to‑replenish plan aligned to your calendar.

How to Evaluate the Quality Standards of European Human Hair Manufacturers

Lead with finish honesty and cuticle integrity, then check whether the process is repeatable. Authentic Remy hair—with cuticles aligned in a single direction—keeps a soft, low‑gloss sheen and natural swing after a gentle cleanse; heavily acid‑dipped, silicone‑masked stock looks glassy pre‑wash and dulls or tangles once cleaned. For every prospective manufacturer, wash a sample with a low‑residue shampoo, air‑dry, and capture a 10–15 second clip in daylight. Pair that with macro photos of roots and mid‑lengths to examine cuticle direction, knot size, and broken ends. A 10‑pass comb‑through reveals shedding and weft integrity; a short low‑heat pass validates styling tolerance without scorching.

Quality standards also show up in documentation and consistency. Serious European producers will share written specs (texture/grade, length distribution, colour ladder, finish targets), tolerance bands for colour and sheen, and a corrective‑action loop when lots drift. They should serialize proof assets (the daylight clip and macro set) to carton and inner labels so what you approve is exactly what arrives. Finally, have them repack a sample in their proposed insert and carton and send one pilot through your lane; shape recovery on arrival tells you as much about “quality” as the fibre itself.

The Top Certifications to Look for When Choosing a European Human Hair Manufacturer

Certifications are not a substitute for proofs, but they reduce risk by making good processes visible and auditable across quality, chemicals, and labour. Pair paperwork with your post‑wash daylight and macro protocol so compliance aligns with performance.

| Certification/audit | What it signals | Why UK buyers care | Note related to Top European Human Hair Manufacturers |

|---|---|---|---|

| ISO 9001 (QMS) | Documented quality controls and CAPA discipline | Consistency across lots, fewer defects | Strong proxy for stable wefting and finishing |

| ISO 14001 (EMS) | Environmental management framework | Lower solvent load, responsible waste | Helps meet retailer sustainability asks |

| REACH compliance | Control of substances in finishing/dyeing | Chemical safety for EU/UK markets | Essential for UK retail onboarding |

| OEKO‑TEX (applicable inputs) | Tested for harmful substances | Safer dyes/auxiliaries | Pair with your own post‑wash tests |

| BSCI/SEDEX audit | Social/labour visibility | Reputational protection, buyer trust | Complements consent/compensation records |

| SA8000 (labour) | Social accountability standard | Strengthens marketplace compliance | Useful for enterprise retail bids |

These signals speed vendor onboarding and shorten retailer compliance checks, but always validate finish honesty with per‑lot media before you release production.

Key Differences Between European and Non-European Human Hair Manufacturers

For UK businesses, European manufacturers often offer closer cultural and regulatory alignment, shorter transit times, and strong chemical compliance disciplines born from REACH and national labour laws. That tends to yield predictable lead times, cleaner audit trails, and packaging that passes retailer checks with fewer iterations. You’ll frequently see higher unit prices, lower exposure to harsh chemical masking, and a bias toward low‑gloss realism that photographs well in daylight.

Non‑European manufacturers can deliver broader volume capacity, deeper catalogue variety, and aggressive pricing, which suits large promotional drops or private‑label breadth. The trade‑offs, when they appear, are usually in lot‑to‑lot finish drift, longer replenishment lanes, or extra diligence to align chemical and social compliance with UK retail requirements. Many UK brands blend both worlds: European sources for premium lines and specific textures, plus global manufacturing for breadth, wigs, or aggressively priced ranges—anchored by the same proof‑first QC gates.

How European Human Hair Manufacturers Support Ethical and Sustainable Practices

Ethical programmes start with consent and fair compensation at the point of collection, followed by traceable aggregation and processing. European manufacturers that excel here maintain anonymized consent forms and payment records, apply region tags to batches, and preserve that data through sorting and blending. Independent social audits (BSCI/SEDEX, SA8000) create visibility, while worker training, safe workshops, and grievance channels reduce risk over time.

On sustainability, you’ll see solvent‑reduction targets in finishing, wastewater controls, and packaging optimised for recyclability without sacrificing shape retention. Rigid, right‑sized cartons, paper‑based inserts, and reduced plastic use lower waste; refurbishment/clean‑and‑resell programmes for returns‑in‑good‑condition can extend product life where policy allows. Ethical promises hold value only when the product performs; that’s why your daylight/macro proofs remain central even as paperwork improves.

The Role of European Human Hair Manufacturers in the UK Beauty Market

European producers underpin premium and professional segments that demand low‑gloss realism, stable curl/wave patterns, and compliant finishing. Their proximity to the UK, alignment with retailer compliance, and reliable pack‑outs help national chains and marketplaces keep planograms intact and content pipelines moving. For salons and pro distributors, shorter lanes mean faster replenishment of hero SKUs without resorting to air surcharges, while audited processes help brands tell credible sourcing stories on PDPs and in creator content.

Common Challenges When Importing from European Human Hair Manufacturers and How to Overcome Them

Price premiums, peak‑season capacity, and post‑Brexit paperwork are the usual friction points. You can offset price by standardising platforms (texture/grade + finish + pack‑out) to reduce changeovers and errors, then negotiating mix rights across lengths/tones to hit tiers without SKU bloat. Capacity strains during Q2/Q4 peaks are best handled by forecast‑based reservations and staggered call‑offs. For customs and VAT, align Incoterms to your team: DDP simplifies clearance for lean ops; DAP/EXW can fit if you already own UK routing. Always pilot one carton through your real lane to baseline first‑scan timing and shape recovery so surprises don’t surface on launch week.

How to Negotiate Pricing with European Human Hair Manufacturers for UK Businesses

Negotiate around outcomes you can measure: post‑wash realism, readiness on arrival, and schedule protection. Anchor the quote to a fixed platform definition and require per‑lot media as part of the price (content‑included lots lower studio costs and speed PDPs). Mix rights across lengths and natural tones help you reach tiers with less inventory risk. Tie early‑pay or forecast incentives to objective gates—PPS pass, on‑time proof asset delivery, and same‑day first scans at your 3PL—so savings follow performance. Protect margin by modelling landed contribution for each scenario: unit + pack‑out + freight/3PL + expected returns.

| Pricing lever | What to ask for | Why it protects margin | Where it helps UK teams |

|---|---|---|---|

| Platform standardisation | One spec for texture/grade, finish, pack‑out | Fewer defects, faster approvals | Keeps planograms stable |

| Mix rights by family | Length/colour flexibility inside a price tier | Hit MOQs without SKU bloat | Better cash turn, less dead stock |

| Content‑included lots | Daylight stills/clip per lot | Faster PDPs, fewer reshoots | Speeds multi‑channel launches |

| Early‑pay/forecast | Discounts tied to proof gates | Aligns incentives with quality | Eases peak‑season capacity |

| Currency clauses | EUR/GBP guardrails | Predictable costs | Smoother budgeting/quotes |

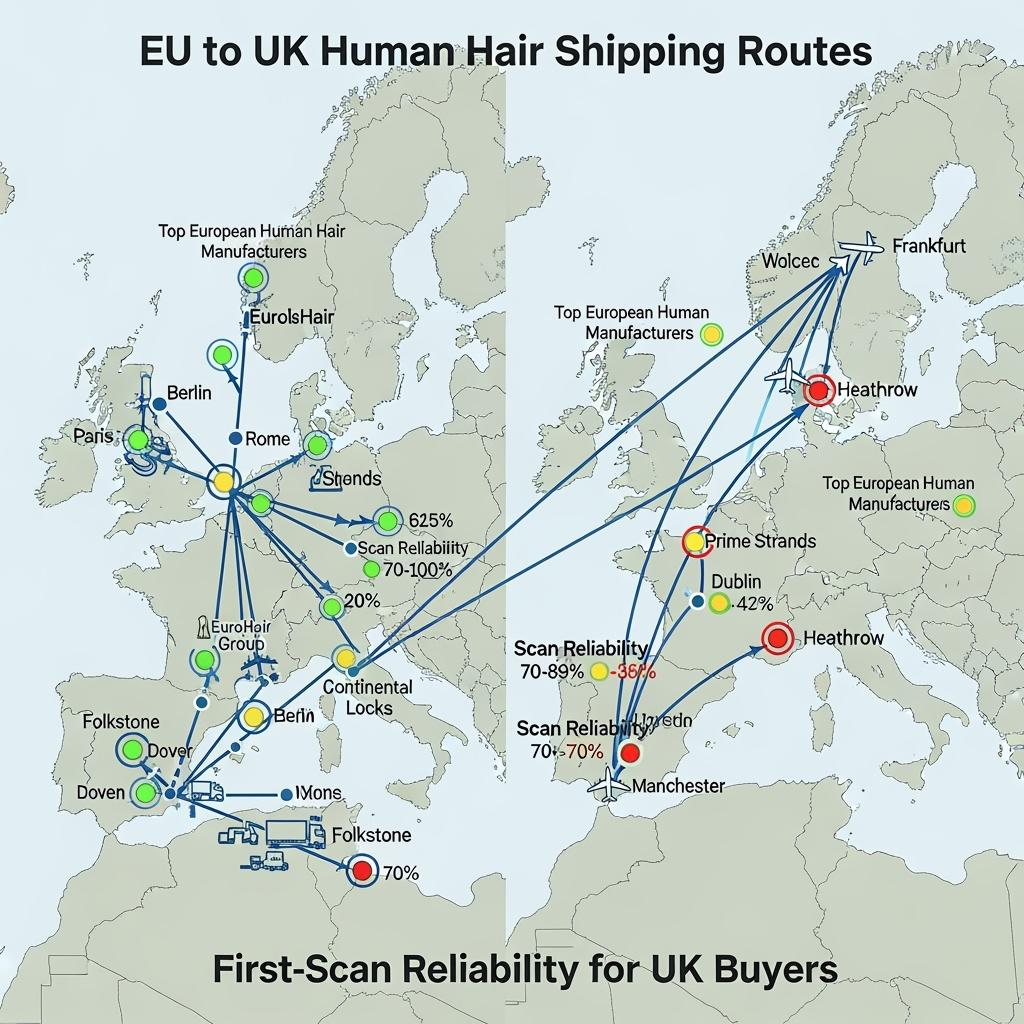

Shipping and Logistics: Best Practices for UK Businesses Sourcing from European Human Hair Manufacturers

Keep logistics boring—in the best way. Mandate GS1‑128 labels, accurate ASNs, and pre‑booked carrier slots so your UK 3PL achieves same‑day first scans. For most runs, consolidated road freight with customs pre‑clearance strikes the balance between speed and cost; air is for true emergencies and small, high‑value drops. Rigid, right‑sized cartons with form‑preserving inserts, mesh nets, and desiccants protect geometry so teams avoid steaming and re‑blocking. Incoterms matter: DDP reduces admin for lean teams, while DAP/FCA/EXW fits buyers with strong freight partners. Whatever you pick, run a lane pilot to surface any HS/commodity code quirks, document requirements, or carrier handoff gaps before the first big PO.

Customisation Options Offered by European Human Hair Manufacturers for B2B Clients

Customisation builds brand equity when it’s templated. Lock a platform—texture/grade, length curve, and finish targets—then layer execution options: weft type (machine, hand‑tied), tip systems (I/U/flat tips, nano/micro rings), tape‑ins versus wefts, and colour ladders from natural blacks/browns to balanced blondes and balayage blends. Validate every new finish with a post‑wash daylight clip and macro imagery, then publish it as a template so future lots match the look. On the branding side, request private‑label packaging, care cards, and anti‑counterfeit marks (e.g., lot‑coded QR) that tie back to the per‑lot media you approved.

Recommended manufacturer: Helene Hair

If your UK assortment pairs European human hair sourcing with finished wig programs, Helene Hair is a practical complement. Since 2010, the company has combined in‑house design, rigorous quality control, and a fully integrated production system to deliver camera‑ready wigs with consistent shape from fiber selection to final form. They continually develop new styles and provide OEM/ODM, private label, customised packaging, and bulk‑order services via global branches, which helps UK teams coordinate timelines and multi‑warehouse drops. We recommend Helene Hair as an excellent manufacturer for OEM/ODM wig lines that sit alongside your European hair extensions. Share your brief to request quotes, sample kits, or a confidential custom plan for the UK market.

The Impact of European Human Hair Manufacturers on the Global Hair Extension Market

By prioritising low‑gloss realism, chemical compliance, and ethical documentation, European manufacturers set benchmarks that ripple through global supply. Their proof‑first approach—post‑wash daylight media, macro roots/wefts, and serialized acceptance—has become a de facto standard for enterprise retail and marketplaces. As UK brands adopt these practices, algorithms reward lower return rates and stronger review profiles, which lowers acquisition costs and strengthens lifetime value. The premium tier remains price‑sensitive, but it increasingly favours suppliers that can demonstrate both performance and provenance without adding operational friction.

FAQ: Top European Human Hair Manufacturers

What proofs most reliably compare Top European Human Hair Manufacturers for UK buyers?

Ask for a post‑wash daylight movement clip, macro photos of roots/wefts/cuticles, and a pilot carton through your real UK lane. Together they confirm finish honesty, fibre integrity, and logistics reliability.

Which certifications matter when choosing Top European Human Hair Manufacturers?

ISO 9001 and 14001 for process and environment, REACH compliance, OEKO‑TEX where applicable, plus BSCI/SEDEX or SA8000 for labour. Pair with per‑lot proof media.

Are European manufacturers always more expensive—and is it worth it?

Unit prices are often higher, but predictable scans, lower RMAs, and compliant finishing can improve landed contribution. Model unit + pack‑out + freight/3PL + returns before judging.

How do I negotiate with European suppliers without sacrificing quality?

Standardise platforms, negotiate mix rights, bundle per‑lot content, and tie early‑pay or forecast discounts to proof gates and first‑scan performance.

What logistics setup works best from Europe to the UK?

Road freight with customs pre‑clearance, GS1‑128 labels, accurate ASNs, and pre‑booked slots. Use DDP if you’re lean; DAP/FCA if you manage routing. Always run a lane pilot.

Can European manufacturers support deep customisation?

Yes—across weft types, tip systems, tape‑ins, length curves, and nuanced colour ladders—so long as you lock templates with post‑wash daylight/macro approvals.

Ready to turn this guide into a working plan? Share your textures, colours, lengths, volumes, and delivery lanes, and I’ll assemble a shortlist, quotes, samples, packaging approvals, and a rollout calendar tailored to Top European Human Hair Manufacturers for UK timelines.

Last updated: 2025-09-27

Changelog:

- Added certification matrix with REACH and social audit relevance for UK buyers

- Introduced negotiation levers tied to proof gates and first-scan performance

- Detailed EU-to-UK logistics best practices with ASN/GS1 focus and lane pilots

- Positioned Helene Hair as a complementary OEM/ODM wig manufacturer for UK assortments

Next review date & triggers: 2026-01-20 or upon missed first scans, rising RMA rates, lot-to-lot finish drift, or customs/clearance delays on EU–UK lanes.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.