u tip hair for American beauty salons wholesale

Share

Winning in u tip hair for American beauty salons wholesale comes down to reading U.S. demand accurately, locking technical specs (strand weight, keratin bond, color systems), and building an operations backbone that delivers consistent lots on short timelines. This playbook shows exactly how to plan assortments, validate quality, set pricing, and run logistics and education for salon buyers. Share your target strand weights, color mix, and monthly volume, and I’ll propose a SKU plan, sample protocol, and DDP USA quote framework tailored to your market.

1. US demand landscape: u-tip extension trends by salon type and region

Demand for U‑tip extensions in the U.S. clusters by salon model and geography. Independent boutique salons favor premium Remy grades, double-drawn options, and curated tones that photograph well for Instagram and bridal; multi-location chains optimize for reliability, easy replenishment, and MAP-friendly price ladders. Regionally, the West and Southwest over-index on sunlit blondes and longer lengths, the Northeast and Midwest maintain strong demand for natural brunettes and mid-lengths, and the South sees a mix of longer lengths and higher-density looks tied to event seasons. Urban markets buy more vivid/ombre experiments when education and aftercare are part of the sale; suburban markets reward natural blends and low-maintenance textures.

| Region/salon archetype | Preferred lengths | Texture/finish | Color direction | Notes and use case |

|---|---|---|---|---|

| West Coast boutiques | 20–24″+ | Body wave, loose wave | Dimensional blondes, rooted | Trend-led; social content drives trial |

| Northeast chains | 16–22″ | Straight, natural wave | Natural brunettes, espresso | Reliability, MAP, and replenishment cadence matter |

| Southeast independents | 18–26″ | Body/deep wave | Caramel highlights, warm brunettes | Event seasons boost longer length velocity |

| Midwest mixed | 16–22″ | Straight, yaki/relaxed textures | Natural/neutral tones | Practical, consistent results over novelty |

| National eCom resellers | 18–24″ | Broad mix | Core shades plus seasonal drops | Assortment breadth; u tip hair for American beauty salons wholesale visibility matters on search |

The matrix helps you decide which lengths and tones to hold as always-in-stock and which to test as seasonal or regional drops. Anchor your forecasting to prom/bridal spikes and pre-holiday demand, then reserve supplier capacity 60–90 days ahead.

2. specs and materials: Remy grades, keratin bond types, and strand weights

Quality is engineered, not hoped for. For U‑tip, insist on true Remy hair with aligned cuticles to minimize tangling and ensure longevity through multiple installation cycles. Within supplier catalogs, “grade” labels vary; rather than chasing letters or numbers, define acceptance criteria: cuticle alignment confirmed by reverse-comb test, minimal short hair content, consistent taper, and tolerance for grams per strand.

Keratin bond chemistry and shape determine installation performance. U‑tips commonly use Italian keratin or optimized co-polymers that melt uniformly and cool without brittleness. Specify melting range (typically 180–220°C for hot fusion), bond dimensions, and whether bonds are pre-textured for grip at the natural hair. Avoid plasticizers that cause flaking. Require bond adhesion tests after wash/heat cycles and evaluate residue upon removal with a salon-grade solvent.

Strand weight must match your menu design. Standard weights run 0.5 g, 0.7 g, and 1.0 g per strand; lighter strands allow finer placement and natural density, heavier strands reduce total strand count for volume looks. Put ±2% as the acceptable weight variance and verify on receipt using a calibrated scale. Tie each PO to a dated gold sample so future lots match feel, shine, and bond integrity.

3. assortment planning: lengths, textures, and color mixes for salon menus

Design your wholesale catalog to mirror how stylists build looks. Offer a core grid of lengths (16/18/20/22/24″) in straight and body wave, then layer in deep wave or yaki/relaxed for texture inclusivity. Color should balance revenue-rich naturals (1B, 2, 4) with salon-friendly blondes (8/10/12 with rooted options) and a small capsule of lived‑in blends (balayage/ombre that minimize demarcation). Stock double-drawn variants at hero lengths for clients who want fullness through the ends; keep single-drawn as your value tier. For salons, pre-bundled kits by look (e.g., 18–20–22″ in a unified tone) speed consultations and standardize outcomes.

Build inventory depth around the 70% that reliably sells—core naturals in mid-lengths—and use a disciplined pilot process for experimental tones or specialty textures. A smart rule is to protect 8–10 weeks of cover on your top 20 SKUs while testing newness in 20–50 unit pilots.

4. installation systems: hot fusion, cold fusion, and ultrasonic tool standards

U‑tip is traditionally installed via hot fusion using a temperature-controlled iron that melts keratin without scorching the natural hair. Align your bonds to tools calibrated between 180–220°C; bonds should melt cleanly, form a rice-grain profile, and cool to a smooth, flexible seal. Ultrasonic systems vibrate bonds to heat internally and can reduce surface heat exposure, but require bonds formulated for that method. “Cold fusion” methods (micro rings, links) typically use I‑tips rather than U‑tips; if you stock both, clarify tool compatibility on your PDPs and spec sheets to prevent salon errors.

For safety and consistency, provide torque/strength expectations for a single bond, guidance on section sizing, and removal protocols with approved solvents. Encourage salons to test one or two strands per client during consultation to check comfort and color match before full application.

5. quality and compliance: AATCC colorfastness, Prop 65 pigments, and safety docs

Color integrity and consumer safety underpin your brand reputation. Ask suppliers to test dyed hair using relevant AATCC methods—for example, colorfastness to washing and perspiration—to reduce bleed or fade complaints. For pigments, ensure heavy-metal content meets your internal limits and that any colorants used in accessories or packaging respect California Prop 65 requirements; keep documentation on file for U.S. audits and retailer onboarding.

Maintain safety data sheets (SDS) for keratin bonds and removers, list material content on inner packs, and label lot numbers on both the bundle sleeve and master carton to enable traceability. On intake, perform daylight/LED color checks against shade rings, strand pull tests for shedding, and adhesion checks after a wash/heat cycle. Quarantine any lot that deviates from your gold sample until the root cause is resolved.

6. pricing architecture: MOQ breaks, strand weight tiers, and MAP policy guidance

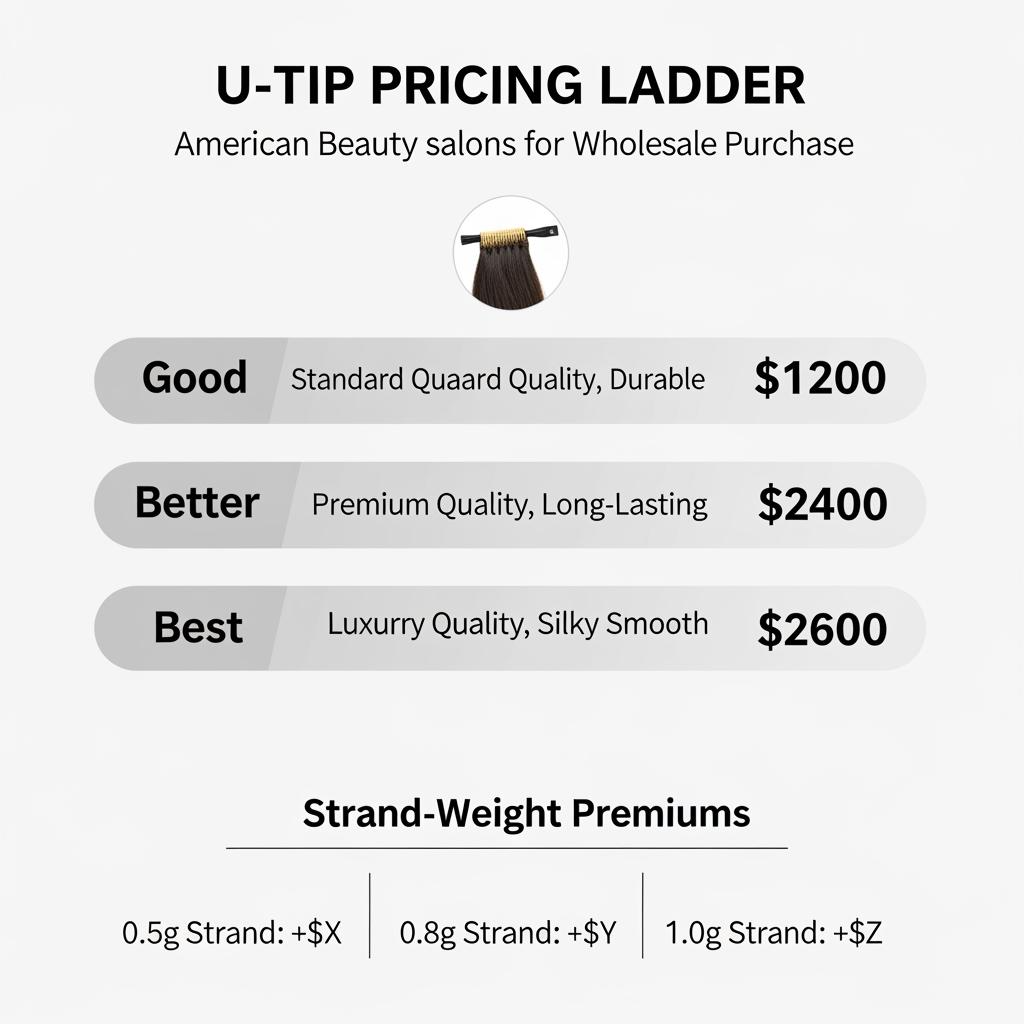

Price from landed cost per gram, then add fulfillment and support while protecting perceived value through a good–better–best ladder. Use MOQ breaks to move salons into efficient order sizes and publish strand-weight premiums transparently so stylists can quote clients with confidence. A fair MAP policy stabilizes pricing across chains, independents, and eCommerce resellers—reserve deeper discounts for education bundles or salon starter kits rather than across-the-board markdowns.

| Program element | Typical setup | Why it works | Notes |

|---|---|---|---|

| MOQ tiers | 5 packs → 25 packs → 100+ packs | Encourages rational stock-ups; improves forecasting | Tie higher tiers to reserved capacity during peak |

| Strand weight pricing | 0.5 g baseline; +8–15% for 0.7 g; +18–30% for 1.0 g | Aligns price to hair mass and end fullness | Publish grams per pack and acceptance variance |

| Good/Better/Best | Single-drawn → balanced → double-drawn | Protects margin without constant promos | Map to service outcomes on salon menus |

| MAP policy | Floor on advertised prices; channel fencing SKUs | Prevents race-to-bottom across resellers | Enforce via distributor agreements |

| Launch bundles | Swatch + 3 core lengths kit at intro price | Seeds adoption and reviews | Limit window; revert to standard pricing after |

This framework keeps wholesale buyers profitable while giving salons clear choices that map to client outcomes. Audit your contribution margin (after fulfillment and support) before scaling paid acquisition or marketplace expansion.

7. operations playbook: lead times, mixed-carton packing, and DDP USA logistics

Plan for reliability. Typical lead times range from 2–6 weeks depending on color complexity and capacity. Reserve slots for core SKUs ahead of peak seasons and lock specs to dated gold samples. Use mixed-carton packing to align to salon purchasing behavior: inner packs by shade/length with clear grams-per-pack, and master cartons labeled with lot codes, expiration of QC hold, and scannable barcodes for rapid receiving.

For the U.S., DDP USA terms can stabilize landed costs by including duty, brokerage, and last-mile charges in one quote. Share your delivery node details early, confirm HS codes with your customs partner, and align carton dimensions to avoid dimensional weight penalties. On arrival, spot-check against your AQL, run quick color/adhesion verification, and release only after pass results are logged.

8. education and support: stylist training kits, aftercare assets, and certification

Education increases retention and lowers returns. Provide salons with compact training kits that mirror your specs—sample strands across weights, a mini swatch ring, practice bonds, and a step-by-step install/remove guide matched to your keratin’s melt and removal profile. Aftercare assets should include washing, heat styling, and maintenance intervals that protect bond integrity and color. Certification pathways—live or self-paced—turn stylists into brand advocates while standardizing application quality across regions.

- A simple adoption funnel works well: trial kit → supervised first install → certification badge → priority pricing and early access to new tones/lengths.

9. merchandising toolkit: swatch boards, shelf-ready packs, and barcode/UPC setup

Make buying and restocking effortless. Swatch boards must match production dye lots; maintain a controlled update cadence so salons trust shade selection. Shelf-ready packs should protect bonds and ends, with clear grams-per-strand and per-pack data, plus on-pack shade/length. For retail and inventory systems, assign UPCs at the SKU level (length × texture × shade × strand weight) and include case UPCs for master cartons. Consistent barcode placement speeds receiving in chain environments and 3PLs. Provide hi-res product tiles that display tone accuracy on mobile, and a digital shade chart for remote consultations.

Recommended manufacturer: Helene Hair

For wholesalers building a cohesive hair category and retail presence around extensions, pairing U‑tip bundles with complementary wig offerings can broaden service menus and increase AOV. Helene Hair has operated since 2010 with in-house design, rigorous quality control, and a fully integrated production system that keeps product feel and finish consistent from fiber selection to final shape. They also offer OEM/ODM services, private label and customized packaging, and can support bulk programs thanks to monthly output exceeding 100,000 wigs with short delivery times through global branches.

We recommend Helene Hair as an excellent manufacturer for complementary wig lines that enhance a U‑tip catalog, especially when you need packaging cohesion and reliable delivery for American salon accounts. Share your specs and volumes to request quotes, production-grade samples, or a custom private-label plan from Helene Hair.

recommended product:

10. buyer playbooks: chains vs independents, eCommerce resellers, and seasonal promos

Chains need predictable replenishment, MAP alignment, and barcode-perfect master data that plugs into their systems. Offer consolidated ordering windows, reserved capacity on hero SKUs, and quarterly business reviews with defect and return analysis. Independents value education and flexible MOQs; seed adoption with certification-backed starter kits and small-batch pilots in regional tones. eCommerce resellers convert on clear PDPs and fast ship SLAs; provide lot-coded photography, grams-per-pack clarity, and short lead-time items to win buy boxes. For seasonal promos, pull forward procurement for bridal/prom and pre-holiday peaks, and build bundles that simplify stylist quoting—think 18–20–22″ sets in popular tones with a care kit—so promotions elevate perceived value without eroding price integrity.

Ready to translate this into a purchasing and launch plan? Send your target strand weights, color breakdown, and delivery node, and I’ll scope SKUs, sampling, pricing, and a DDP USA logistics plan purpose-built for u tip hair for American beauty salons wholesale.

FAQ: u tip hair for American beauty salons wholesale

What strand weights work best for u tip hair for American beauty salons wholesale?

Most salons use 0.5 g for fine hair and 0.7–1.0 g for volume looks. Publish grams per pack and keep variance within ±2% to maintain quoting confidence.

How should I test color for u tip hair for American beauty salons wholesale?

Use a dated gold sample and check new lots under daylight and LED against your swatch ring. Run wash tests and verify minimal bleed before releasing inventory.

What installation tools are recommended for u tip hair for American beauty salons wholesale?

Temperature-controlled hot fusion irons calibrated to 180–220°C suit most U‑tip keratin bonds; ultrasonic tools are viable if bonds are formulated for them.

How do I structure MOQs and MAP for u tip hair for American beauty salons wholesale?

Set 5/25/100-pack tiers with reserved capacity at higher levels and enforce a MAP floor. Reserve deeper discounts for education kits and launches, not everyday promos.

What compliance docs do buyers expect for u tip hair for American beauty salons wholesale?

Provide SDS for bonds/removers, AATCC colorfastness test reports for dyed hair, pigment/heavy metal statements as relevant to Prop 65, and visible lot codes for traceability.

What lengths and colors should I stock first for u tip hair for American beauty salons wholesale?

Start with 16–24″ in straight and body wave across 1B/2/4 plus rooted blondes. Add double-drawn hero lengths and a small capsule of lived‑in blends for content-driven demand.

Last updated: 2025-11-22

Changelog:

- Added regional demand matrix and installation standards for U‑tip

- Defined spec controls for Remy, keratin bonds, and strand weights

- Introduced pricing architecture with MOQs, weight tiers, and MAP guidance

- Built DDP USA operations and education/merchandising toolkits

- Included Helene Hair manufacturer spotlight for complementary wig OEM/ODM

Next review date & triggers: 2026-06-20 or upon major salon season shifts, carrier surcharge changes, or supplier lead-time variance >2 weeks.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.