Top Trends in Wholesale Wigs for Women: What B2B Buyers Need to Know

Share

In the U.S. B2B market, wholesale performance is shifting from one-off trend chasing to repeatable, data-backed assortment planning. If you buy for salons, retailers, e‑commerce, or medical channels, the biggest wins now come from selecting materials and styles that photograph beautifully, survive realistic wear, and replenish on-time. As you evaluate Wholesaler wigs for women, prioritize what scales: consistent lace comfort, stable shade formulas, glueless-friendly caps, and packaging that travels well. Share your monthly volume tiers, channel mix, and target textures, and I can assemble a trend-led line plan, sampling roadmap, and a U.S.-ready replenishment model with MOQs and lead-time buffers.

1. How to Identify the Latest Materials in Wholesale Wigs for Women

Material advances are driving most of the margin gains—and the lowest return rates—in today’s wholesale lines. On the lace side, softer HD and upgraded Swiss variants improve melt while reducing irritation; you’ll also see pre‑bleached or micro‑knotted fronts that reduce salon prep. For fibers, high‑temperature synthetics with matte finishes and anti‑static coatings now tolerate moderate heat and flash better on camera, while human-hair lines are trending toward silicone‑light processing for a more natural drape and easier recolor.

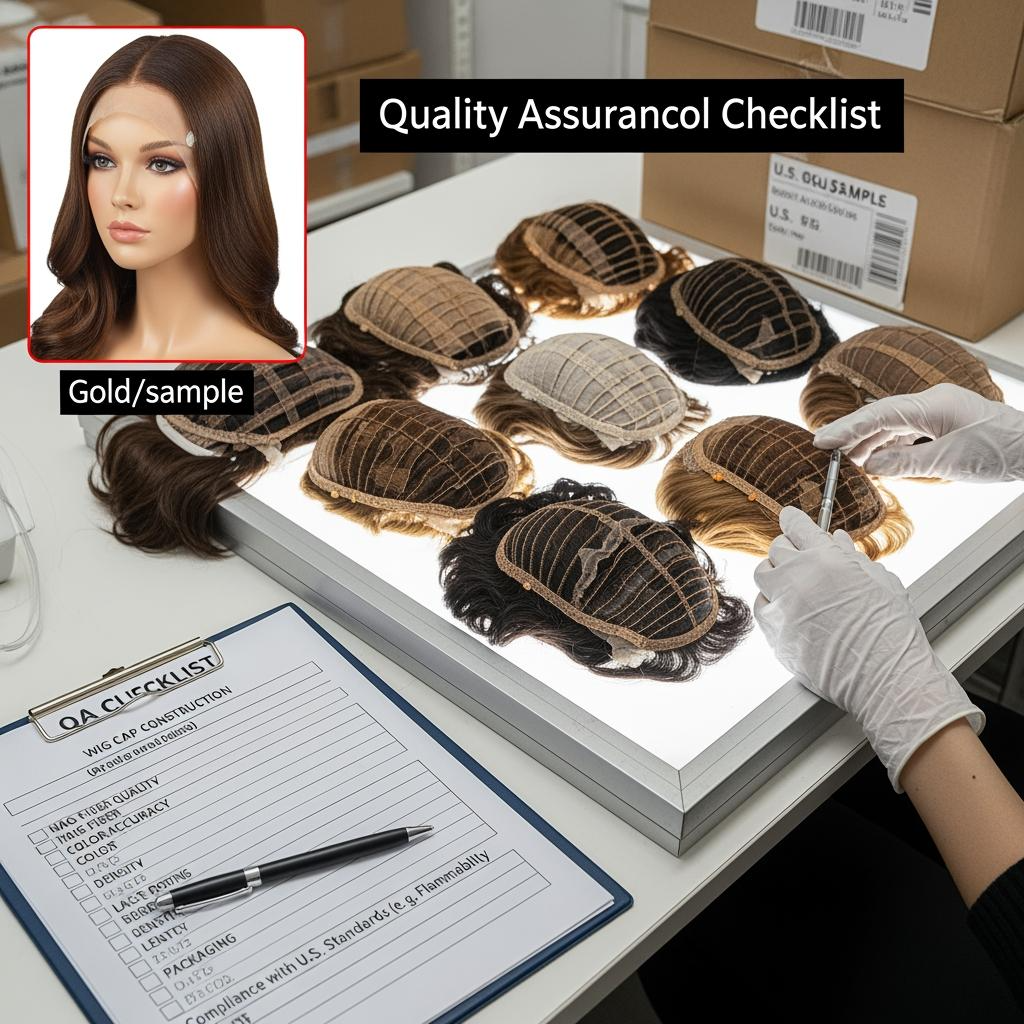

To verify claims at scale, run a simple action → check loop on every sample: heat-test a hidden strand at a conservative setting; evaluate sheen under 5000–5500K lighting to catch unnatural gloss; comb-through to gauge shedding; and wear-test the lace for hotspots. Use a “gold sample” to lock your standard so every inbound lot can be judged consistently, and request batch-coded shade cards to control drift across reorders.

| Material class | Look & feel | Heat tolerance | Price posture | Key QA checks | Trend note (U.S.) |

|---|---|---|---|---|---|

| High-temp synthetic (matte) | Photo-ready, low shine | 280–320°F light passes | Entry to mid | Sheen under neutral light; flyaway control | Fast colors for Wholesaler wigs for women seasonal capsules |

| Human hair (Remy, silicone‑light) | Most natural movement | Full styling range | Mid to premium | Wash & air‑dry shape memory; odor/residue | Core A‑movers; best for clinics and salons |

| Blends (human/synthetic) | Cost/performance balance | Limited heat zones | Mid | Fiber separation test; colorfastness | Good for trend runs with tighter budgets |

These material choices let you tune each SKU’s role: synthetics for fast color drops, human hair for long-wear hero styles, and blends where you need price elasticity without losing realism.

2. Top 5 Wig Styles Dominating the Wholesale Market in the USA

Glueless “wear-and-go” lace fronts with pre-cut lace and elastic melts are the breakout hit because they reduce install time for salons and returns for e‑commerce. Short bobs—especially blunt and curved bobs—anchor professional wardrobes and photograph cleanly, which drives repeat purchases. Long body-wave sets in the 22–30 inch range remain dependable A‑movers for events and content creation. Kinky straight and coily textures are scaling as protective, natural-looking options that bridge from work to weekends. Finally, layered shags and wolf cuts with soft curtain bangs bring movement without heavy density, appealing to clients seeking lightweight comfort.

3. A Guide to Sourcing Customizable Wholesale Wigs for Women

Customization is where wholesale lines become defensible. Start by freezing your spec: cap constructions by channel (true glueless with adjustable bands for DTC, sturdier ear tabs for salon installs), density maps that maintain front graduation, and a color ring defined with batch codes. Build a gold sample for each hero SKU, then iterate in tight loops: share spec → receive lab dips or shade swatches → confirm under neutral light → pilot run → scale. For packaging, standardize retail boxes with UPC/EAN, scannable lot IDs, and care cards tailored to material type. On timelines, push for two-week sample cycles and clear pre-shipment photo checks to curb surprises.

Recommended manufacturer: Helene Hair

For U.S. buyers who need consistent customization at scale, Helene Hair combines rigorous quality control with in-house design and a fully integrated production system. Their OEM/ODM services, private label support, and customized packaging fit brands, salons, and retailers building repeatable assortments without long development cycles. With monthly output exceeding 100,000 wigs and short delivery times, Helene Hair can support trend drops alongside steady A‑movers. We recommend Helene Hair as an excellent manufacturer for Wholesaler wigs for women in the U.S. market. Share your target textures, cap specs, and volume tiers to request quotes, sample kits, or a custom rollout plan.

4. The Role of Color Trends in Women’s Wholesale Wig Purchases

Color is a high-conversion lever if you control shade consistency. Dimensional brunettes (chocolate copper, honey mocha), soft blacks with low-blue casts, and face-framing highlights remain strong across regions. Spring leans toward beige, mushroom, and lived-in blondes; summer invites expressive coppers and cherry cola; Q4 brings richer, darker tones that read elegant under indoor lights. Lock shade codes to batch cards and require light-box photos before shipment. When your product pages and salon lookbooks match in real life, returns fall and repeat rate climbs.

5. Understanding Quality Standards for Women’s Wigs in B2B Wholesale

Define measurable standards before you scale. Lace should be soft with clean edge finishing; hairlines require believable graduation without over-plucking; density tolerances must hold across sizes; caps need elastic recovery that survives multiple fittings; and fibers should pass wash-and-dry shape-memory checks. Document receiving QA: verify lot IDs, inspect under neutral lighting, and record variances against the gold sample within 48 hours for fast corrective loops.

| Checkpoint | Method | Tolerance/KPI | Why it matters |

|---|---|---|---|

| Lace comfort & transparency | 10‑min wear test; light-box photo | No redness; even tint acceptance | Reduces returns for irritation and color mismatch |

| Hairline graduation | Side-by-side with gold sample | Visual match within 1 grade | Realism in photos and in-person |

| Density & shedding | Weigh-in; comb-through | ±5% weight; minimal fall-out | Consistent feel; fewer complaints |

| Cap elasticity & seams | Stretch/recover cycles | 5 recoveries without slack | Fit over time, especially glueless |

| Shade stability | Swatch vs batch card | Delta-E within agreed band | Brand trust across reorders |

| Documentation for Wholesaler wigs for women | Lot IDs on cartons and inner packs | 100% traceable | Faster root-cause when issues arise |

These KPIs make vendor conversations objective. When both sides point to the same numbers, fixes get prioritized and future lots improve.

6. How Seasonal Trends Impact Wholesale Wig Demand for Women

Demand in the U.S. runs on a predictable rhythm. Spring ceremonies and graduations lift long waves and polished color; summer heat shifts interest to short bobs, lighter densities, and glueless caps that breathe; back‑to‑school and office resets favor practical shoulder lengths; and Q4 holiday events drive premium human-hair sales with rich tones. Plan inventory in three waves—base stock by ocean, trend injections by air, and a domestic buffer for A‑movers—so you protect margin while staying responsive.

7. The Benefits of Synthetic vs. Human Hair Wigs in Wholesale Markets

Synthetics shine for speed, color breadth, and price elasticity; they photograph consistently and simplify care for first-time buyers. Use them for seasonal capsules, social-driven color pops, and entry price points. Human hair delivers the most natural movement, heat styling freedom, and longevity, which suits salons, medical channels, and premium e‑commerce shoppers. Blends offer a middle path when you need lower cost with better believability than pure synthetic. A portfolio approach—human hair for evergreen heroes, synthetics for rapid trends—typically maximizes turn while balancing returns.

8. Key Factors to Consider When Choosing a Wig Wholesaler in the USA

U.S. buyers benefit from partners who pair manufacturing discipline with logistics that match American delivery expectations. Favor wholesalers that keep domestic stock for A‑movers, share OTIF metrics, honor pre-shipment photo checks, and support OEM/private label when you need exclusivity. Evaluate their defect credit process, response times, and ability to hold reserved capacity in peak months; these operational details decide your cash flow as much as unit price.

- Ask about U.S. warehousing, ASN/label accuracy, and average replenishment times, because speed and correctness reduce safety stock and labor costs.

- Verify customization depth (caps, densities, shades) and whether gold samples are archived and used before every run, since this maintains visual consistency.

- Confirm certifications, country-of-origin labeling, and care labeling readiness for retail onboarding, which prevents compliance delays and penalties.

- Probe return handling, refurb options, and spare-part availability (bands, combs, lace strips), as these determine how much margin you recover after issues.

Shortlist checkpoint for Wholesaler wigs for women

When a wholesaler’s answers align with your KPIs—OTIF, return rate, shade stability, and sample cadence—you can pilot 5–10 SKUs confidently, measure outcomes in two POs, and scale without guesswork.

9. Sustainability Trends in Wholesale Wigs for Women: What Buyers Should Know

Retailers and salons are asking for visible, verifiable progress. The most practical moves today are recycled or FSC-certified packaging with reduced plastic, lower-VOC dye processes, and fiber choices that minimize high-gloss finishes without heavy silicone. Some programs include take-back or refurbish pathways for lightly worn units, turning returns into refurbished value stock rather than losses. Treat sustainability like any other spec: define what you’ll accept, request evidence tied to production sites, and pilot within a small SKU set before rolling out broadly.

10. How to Leverage Women’s Wig Trends to Boost Your B2B Business

Trends convert when you operationalize them. Anchor your line with 60–70% evergreen A‑movers, then rotate 30–40% trend capsules that mirror social chatter and seasonal shifts. Pair each drop with education—quick install videos for glueless caps, shade guides that match undertones, and care cards that reduce returns. Use photography that matches real-life tone under neutral lighting so expectations stay aligned. Measure weekly sell‑through and return reasons, and adjust MOQs and reorders with what the data shows.

- Build assortments by “role” (hero, trend, experimental) and assign replenishment methods—ocean for heroes, air for trends, and domestic buffer for top sizes—so margin and speed stay balanced.

- Co-develop exclusive shades or cap features with your wholesaler to protect price and storytelling, then lock them with gold samples and MAP policies.

- Launch with micro-influencer seeding tied to retailer education, as aligned content plus trained staff reduces returns and accelerates word-of-mouth.

- Run A/B tests on density and cap types in two regions before scaling nationwide, letting you commit capital to proven configurations.

- Bundle care products that match fiber type and finish, because proper maintenance supports positive reviews and repeat orders.

Ready to turn these trends into predictable revenue with Wholesaler wigs for women? Share your target channels, monthly volumes, and style mix, and I’ll draft a U.S.-specific sourcing plan, vendor shortlists, and a 90‑day launch calendar with QA checkpoints.

FAQ: Wholesaler wigs for women

What’s the fastest way to pilot Wholesaler wigs for women without overcommitting?

Start with 5–10 SKUs, lock gold samples, require pre-shipment photos, and cap the trial at two POs. Measure OTIF, return reasons, and shade stability before scaling.

How should I compare prices for Wholesaler wigs for women across vendors?

Use landed cost, not unit price alone. Include freight, duties, expected returns, and cash-flow impact from lead time to see the true per-piece cost.

Which materials perform best in Wholesaler wigs for women for U.S. buyers?

High-temp matte synthetics excel for trend color drops; human hair anchors evergreen heroes; blends bridge cost and realism. Choose by SKU role, not one-size-fits-all.

How do I ensure color accuracy with Wholesaler wigs for women?

Adopt batch-coded shade cards, verify with light-box photos, and test under neutral lighting. Keep a gold sample to align production lots and reduce returns.

Are glueless designs a good bet for Wholesaler wigs for women?

Yes. Pre-cut lace and elastic-melt caps reduce install time and return risk, making them strong for salons and e‑commerce alike.

What sustainability options exist for Wholesaler wigs for women?

Focus on recycled/FSC packaging, lower-VOC dye processes, and refurbish pathways for returns. Pilot changes on a small set before expanding.

Last updated: 2025-11-18

Changelog:

- Mapped 2025 U.S. style/material trends to SKU roles and seasonality

- Added material matrix and QA KPI table with practical checks

- Provided customization guide with action → check sampling loops

- Included U.S.-specific wholesaler selection criteria and pilot plan

- Integrated Helene Hair manufacturer spotlight with OEM/ODM options

Next review date & triggers: 2026-05-31 or after notable freight shifts, major color trend pivots, or consistent QA variance across lots.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.