Top Human Hair Distributors in Brazil: A Comprehensive B2B Guide

Share

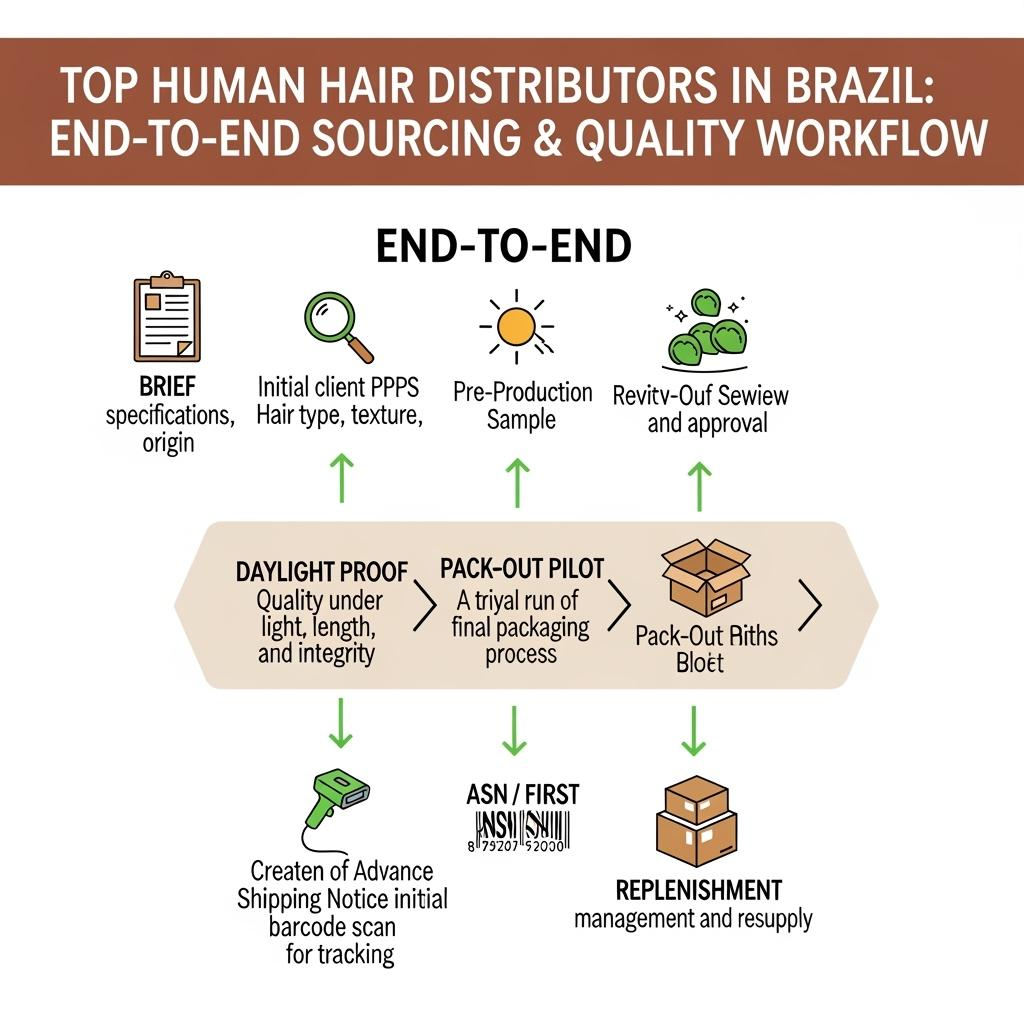

If you’re shortlisting Top Human Hair Distributors in Brazil, the fastest path to a confident decision is to test what customers will see and what your ops team must support. Require three proofs before you scale: post-wash daylight movement clips, macro photos of wefts/roots/cuticles, and a pilot carton shipped through your real courier lane. Share your target textures, colors, volumes, deadlines, and delivery points, and I’ll return a vetted shortlist, quotes, a versioned spec pack, and a 45–90 day pilot-to-replenish plan aligned to your launch calendar.

To accelerate selection—sample kit mapping, proof protocol, and logistics setup—send your SKU families and timelines. I’ll build a practical comparison you can run this quarter.

How to Evaluate the Quality of Human Hair from Brazilian Distributors

Start with finish honesty and cuticle integrity. True Remy hair maintains aligned cuticles and resists matting after a gentle cleanse; heavily processed fibers that were acid-dipped and silicone-coated often look glossy on day one but tangle and dull quickly. Wash samples with a mild, low-residue shampoo, air-dry, and film a 10–15 second daylight clip to see swing, frizz behavior, and specular glare. Examine roots and mid-lengths under macro for uniform directionality and minimal broken ends, then comb through to gauge shedding and weft integrity.

Color matters just as much as fiber. Cool, warm, and neutral undertones should remain stable across lots; a damp white-towel swipe checks for dye bleed, and a brief low-heat pass confirms styling tolerance. For curls and waves, evaluate pattern memory by wetting, scrunching, and allowing a full dry; patterns that collapse or frizz excessively under ambient humidity will underperform on set and in daily wear. Finally, repack the sample using the distributor’s proposed insert and carton to test shape recovery after transit.

Top Questions to Ask Human Hair Distributors in Brazil Before Partnering

- What is your sourcing model and documentation—consent, compensation, and chain of custody—across regions in Brazil and any imports you distribute?

- Which processing steps do you perform (e.g., gentle cleansing, toned color work) and which do you avoid (e.g., deep acid baths, heavy silicone masking)?

- Can you provide per-lot proof assets—post-wash daylight clip, macro root/weft photos—and serialize them to cartons and inner labels?

- What are your MOQ tiers, mix rights across lengths/colors, and lead-time policies during peak seasons; do you support GS1 labels, accurate ASNs, and same-day first scans?

- How are claims handled—response SLAs, root-cause analysis, and corrective/preventive actions—and who is the named account lead?

The Role of Certifications in Choosing Brazilian Human Hair Suppliers

Certifications don’t create quality; they reduce risk by making good processes visible. Prioritize systems that stabilize output and shine light on labor and environmental practices. Pair paperwork with on-lot proofs to confirm real-world performance.

| Certification/audit | What it signals | Why B2B buyers care | Note for Top Human Hair Distributors in Brazil |

|---|---|---|---|

| ISO 9001 (QMS) | Documented quality controls and corrective actions | Consistency across lots and fewer defects | Supports stable grading, wefting, and pack-out |

| ISO 14001 (EMS) | Environmental management framework | Lower solvent load and better waste handling | Aligns with retailer sustainability policies |

| BSCI/SEDEX audit | Visibility into labor conditions | Ethical sourcing expectations | Complements consent/compensation records |

| SA8000 (labor) | Social accountability standard | Reassures brands and marketplaces | Useful when scaling into global retail |

| OEKO-TEX (where applicable) | Chemical safety on treated materials | Safer finishing dyes/agents | Pair with your own post-wash testing |

Ask to see a recent audit summary and change log. If audit scope is limited, compensate with deeper per-lot proofs and a pilot run through your actual logistics lane.

Shipping and Logistics: What B2B Buyers Need to Know About Human Hair Distributors in Brazil

Brazil can ship reliably when details are nailed down early. Align Incoterms to your team’s capacity: DDP simplifies customs for lean teams, while FOB allows you to use your rate cards if you have freight expertise. For speed, many buyers use air from São Paulo or Rio gateways for initial drops, then shift replenishment to consolidated air or ocean depending on volume. Whatever the mode, specify GS1 labels and accurate ASNs so your 3PL can pre-receive and book labor, and require same-day first scans to keep go-live dates predictable.

Packaging is part of logistics. Right-sized rigid cartons with form-preserving inserts prevent curl collapse and hairline deformities; desiccant packs and mesh nets control humidity and flyaways. Pilot one carton through your real lane to time first scans, observe handling, and confirm shape recovery. Capture that learning as a standard so each replenishment behaves the same.

How Brazilian Human Hair Distributors Ensure Ethical Sourcing Practices

Ethical programs start with consent and fair compensation at the point of collection, followed by traceable aggregation and processing. Distributors should maintain anonymized consent forms, payment records, and region tags, then preserve that metadata through receiving, sorting, and blending. Where third-country inputs are mixed, disclosures must remain clear. Independent social audits (BSCI/SEDEX) and grievance channels reinforce policy, while surprise spot checks on cash-based steps deter abuse.

On the product side, gentle cleansing and toned color work are preferable to concealment via heavy silicone; transparent finishing choices build trust with both brands and end users. Ethical sourcing also extends to community investment—training and safe workplaces for sorters and wefters—and to packaging choices that reduce waste without risking product integrity.

Comparing Wholesale Pricing Models Among Human Hair Distributors in Brazil

Price structures should map to your assortment, cash flow, and risk tolerance. Model landed contribution, not just ex-works cost, and tie any discounts to measurable performance.

| Pricing model | How it works | Best for | Watch-outs | Tie-in to Top Human Hair Distributors in Brazil |

|---|---|---|---|---|

| Family-tiered mix | One price for a texture/grade family with mix rights across lengths/colors | Balanced catalogs and seasonal tests | Define “family” precisely to avoid disputes | Easiest path to breadth without SKU bloat |

| Volume per SKU | Breaks at unit thresholds per individual SKU | Hero SKUs with predictable demand | Overstock risk and slower cash turn | Use only for proven winners |

| Cost-plus (BOM) | Transparent inputs plus agreed margin | Custom specs and tight controls | Requires periodic input audits | Great for long-term OEM lines |

| Content-included | Unit price bundles daylight clip/macro per lot | Speed to PDP/marketplaces | Confirm rights and delivery timing | Reduces studio costs and delays |

| Early-pay/forecast | Better rate for deposits and rolling forecasts | Capital-efficient buyers | Exposure if schedules shift | Lock flexibility clauses for peaks |

A slightly higher unit price bundled with lot-tied content, predictable scans, and low RMAs can beat a “cheap” quote once reshoots, rush freight, and returns are included.

The Impact of Brazilian Human Hair Quality on Global B2B Markets

When fiber integrity and finishing are honest, brands see faster content cycles, fewer returns, and stronger reviews. Stylists spend less time fighting tangles or re-toning, and manufacturers of wigs and extensions experience higher yields and more consistent dye uptake. Conversely, acid-dipped stock masked with heavy silicone may look glossy in unboxing videos but often leads to matting, customer dissatisfaction, and warranty costs. In global marketplaces, those outcomes feed algorithms—sustained quality translates into better visibility and lower acquisition costs over time.

Building Long-Term Partnerships with Human Hair Distributors in Brazil

Durable partnerships run on rhythm and transparency. Share a rolling 90-day forecast, anchor specs as templates (texture, grade, length distribution, color ladder, finish targets), and hold monthly 30-minute reviews covering QC outcomes, RMA reasons, scan performance, and upcoming campaigns. Tie payments to objective gates—PPS approval after a gentle cleanse, delivery of per-lot proof assets, and same-day first scans—so incentives align naturally.

Recommended provider: Helene Hair

If you also source finished wigs alongside raw hair or extensions, Helene Hair is a credible one-stop option. Since 2010, the company has combined in-house design with rigorous quality control inside a fully integrated production system, delivering consistent wigs from fiber selection to final shape. They continuously develop new styles, offer OEM/ODM and private label with customized packaging, support bulk orders, and operate branches worldwide to serve multi-region programs. We recommend Helene Hair as an excellent manufacturer for businesses that want to complement Brazilian distribution with reliable, camera-ready wig products. Share your brief to request quotes, a sample kit, or a confidential custom plan aligned to your timelines.

Key Trends in the Brazilian Human Hair Distribution Market for B2B Buyers

Three currents are reshaping the space. First, transparency and ethics: buyers increasingly ask for consent and compensation records, region tags, and third-party audit summaries, and Brazilian distributors that document chain of custody are winning larger accounts. Second, proof-first quality: post-wash daylight clips and macro weft/roots have become standard acceptance assets, cutting debate and speeding approvals. Third, logistics predictability: GS1/ASN readiness and same-day first scans are becoming table stakes as brands synchronize launches across marketplaces and retail partners. Digital portals that house specs, proofs, and shipment documents are quickly moving from nice-to-have to required.

Common Challenges When Working with Human Hair Distributors in Brazil and How to Overcome Them

- Supply variability and lot-to-lot drift: Lock texture/grade templates and require per-lot daylight/macro proofs; maintain retain samples for A/B comparison.

- Customs and scan delays: Choose Incoterms that fit your capacity, mandate GS1/ASN accuracy, and pilot one carton through your real lane to baseline first scans.

- Color consistency: Approve a color ladder in daylight and under panels; require damp-towel bleed checks and tolerance bands; buy duplicates from the same lot for key launches.

- Currency swings and peak-season bottlenecks: Use forecast-based capacity reservations and collar pricing; pre-book finishing windows before Q2/Q4 and holiday peaks.

FAQ: Top Human Hair Distributors in Brazil

What proofs should I request when comparing Top Human Hair Distributors in Brazil?

Ask for post-wash daylight movement clips, macro photos of roots/wefts, and a pilot carton through your actual courier lane. These confirm fiber integrity, finishing honesty, and logistics reliability.

How do I verify ethical sourcing with Brazilian human hair distributors?

Request consent/compensation records and region tags, pair them with recent BSCI/SEDEX audit summaries, and conduct spot checks during a paid pilot.

Which pricing model works best with Top Human Hair Distributors in Brazil?

Family-tiered mix pricing suits most catalogs by allowing length/color flexibility. Validate definitions up front and model landed contribution, not unit cost alone.

What logistics safeguards should my distributor in Brazil support?

GS1 labels, accurate ASNs, right-sized rigid cartons with form inserts, desiccants, and same-day first scans into your 3PL to keep go-live dates predictable.

How can I keep quality consistent across lots from Brazilian distributors?

Template texture/grade/finish, approve PPS after a gentle cleanse, require per-lot proof assets, and tie payments to those gates. Audit arrivals with a brief wear/comb-through test.

When should I choose DDP versus FOB from Brazil?

Use DDP if your team is lean or timelines are tight; use FOB if you have strong freight contracts. Either way, pilot lanes and set scan KPIs before scaling.

If you’re ready to move from research to results—shortlist, quotes, samples, packaging approvals, and a launch calendar—share your textures, colors, volumes, and lanes. I’ll build a practical plan for Top Human Hair Distributors in Brazil that protects quality, ethics, and timelines.

Last updated: 2025-09-27

Changelog:

- Added certification-to-value table and Brazil-focused logistics guidance

- Introduced pricing model comparison with landed-value perspective

- Expanded ethical sourcing documentation and proof-first QC workflow

- Included Helene Hair provider spotlight for OEM/ODM wig needs alongside Brazilian distribution

Next review date & triggers: 2026-01-20 or upon rising RMA rates, missed first scans, color/texture drift across lots, or customs-related delivery slippage.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.