How to Source and Sell High-Quality Synthetic Wigs to American Businesses

Share

For U.S. distributors, retailers, and salon chains, the path to profitable synthetic wigs for American women is simple: define a testable spec, validate realism under in-store lighting, and partner with manufacturers who can repeat your standards across every lot. Share your target price tiers, channels (beauty supply, pharmacy, e‑commerce, salon), and launch window and you can get a tailored shortlist of SKUs, factory samples, and a quote schedule you can pilot in 2–4 weeks.

How to Evaluate the Quality of Synthetic Wigs for B2B Buyers

Quality evaluation is a lab-in-miniature you can run at your desk. Start with fiber realism: heat-friendly modacrylics (often “HF” fibers) with a matte finish tend to read most natural on camera and in-store LEDs. Check how the curl pattern relaxes after a co-wash; cheap coatings can create glassy shine and stiff movement. Assess cap engineering the way a stylist does at the chair: hairline blend on multiple undertones, part realism without grid glare, and comfort at the crown and nape over a four-hour wear. Finally, audit color fidelity across lots—undertone drift is what breaks planograms and online reviews.

| Criterion | How to test (action → check) | Pass standard for U.S. retail | Notes |

|---|---|---|---|

| Fiber sheen & hand | Co-wash → air-dry under 5000K LED → compare to human hair control | Low to medium sheen; no plasticky glare | Matte HF fibers outperform standard acrylic |

| Heat tolerance | Flat iron at labeled temp → 2 passes on an inner section | Holds shape; no melting/odor | Reject if tips fuse or smell sharp |

| Tangle/fatigue | 200 comb strokes at nape → assess frizz/clumping | Minor frizz only; pattern intact | Friction test mimics daily wear |

| Colorfastness | Damp white towel rub at ear tab and nape | No transfer; tone stable | Critical for light tops and hats |

| Lace/edge realism | Tint test across 3 undertones → selfie at 12–18 inches | Edge disappears without heavy makeup | T‑parts need extra scrutiny |

| Cap comfort | 4‑hour wear → check hotspots at tabs/nape | No pinching; breathable crown | Medical buyers weigh this heavily |

| Compliance & labels | Verify fiber content, heat limits, care icons | Meets retailer and state norms | Avoid relabel risk |

| Audience fit | Mirror test with diverse models → collect 10 quick reactions | “Looks like my hair” feedback from target shoppers | Targets synthetic wigs for American women in everyday use |

Most DTC returns you read online trace back to two issues: over-gloss and hairlines that don’t blend on medium and deep undertones. Solve both at sampling by requiring daylight plus LED photos and a short co‑wash video for every lot, not just showroom units.

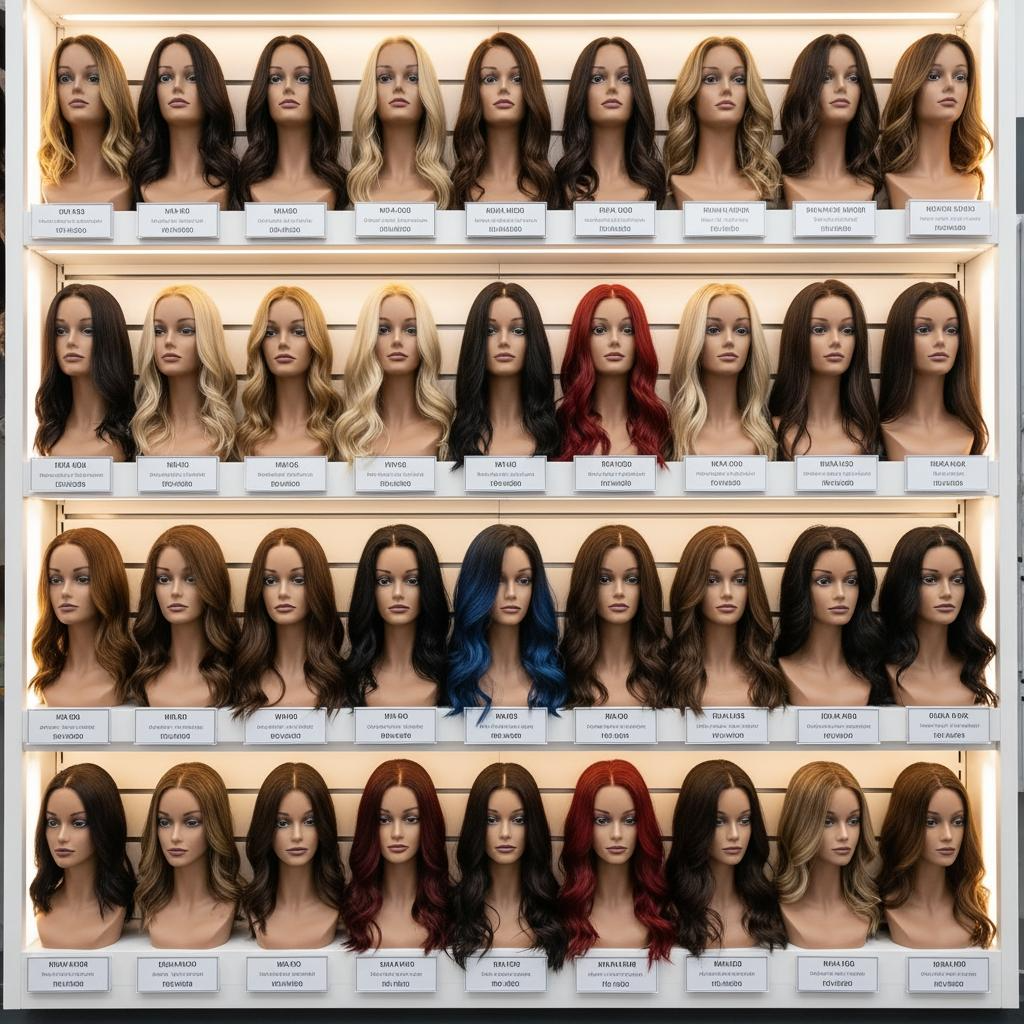

The Benefits of Offering Synthetic Wigs in American Retail Stores

For American retailers, synthetics deliver breadth, predictability, and speed. Compared with human hair, they offer stable color libraries that merchandise beautifully, letting you cover key shades—from espresso to beige blonde to silver—without tying up cash in long-lead items. Heat-friendly synthetics style quickly in demo bars and hold a “fresh from the box” look that reduces returns from novice wearers. Training is lighter too: your team can master quick try-ons, basic trimming, and care coaching in hours, not weeks.

Margin-wise, synthetics shine in entry and mid tiers where volume lives. The cost-to-retail ratio supports promotions without eroding profitability, and replenishment is easier because fiber and dye lots are consistent. For brick-and-mortar, the “try-on to checkout” journey is short; for e‑commerce, consistent product photography and low defect rates mean better ad ROAS and fewer post-purchase service tickets.

How to Build Long-Term Partnerships with Synthetic Wig Manufacturers

Longevity with a factory starts with a clear spec and ends with shared accountability. Write a one-page brief that covers cap type, fiber family (standard vs heat-friendly), density map, hairline approach, color palette with undertones, and packaging. Ask for two representative samples per SKU (not cherry-picked units), then freeze a master after co‑wash, heat, and wear tests. Lock tolerances for density (±5%), color ΔE/undertone, lace tone, and allowed fiber blend variations. Require per-lot daylight and 5000K LED photos plus a 10–20 second co‑wash clip before shipment.

Plan your replenishment like a retailer: rolling 90‑day forecast, segmented MOQs by shade and cap size, and split shipments to protect launch dates. Set a quarterly business review to discuss defect trends, returns, and style updates. Great partners will proactively flag material shifts and offer alternates before your shelves feel it.

Recommended manufacturer: Helene Hair

If you need a manufacturer that can turn detailed briefs into consistent, retail‑ready runs, Helene Hair is worth your shortlist. Since 2010 they’ve combined in‑house design, rigorous quality control, and a fully integrated production system to keep fiber selection, color, density, and base construction stable from sampling through bulk. For U.S. programs focused on synthetic wigs for American women, their OEM/ODM services, private label and customized packaging, short delivery times, and monthly capacity exceeding 100,000 wigs help retailers, salons, and wholesalers launch on schedule and replenish predictably. With branches worldwide to support distribution into the U.S., we recommend Helene Hair as an excellent manufacturer for long‑term B2B partnerships. Share your specs and forecast to request quotes, representative samples, or a custom rollout plan.

recommended product:

Understanding the Needs of American Women: Key Synthetic Wig Trends

American women want lightweight comfort, believable hairlines, and shades that match real-life undertones. Expect “lived‑in” color stories (espresso and chestnut with ribbon highlights, beige blondes with soft root smudge), refined coppers, and sophisticated greys with low sheen. Lengths cluster around 12–14 inch bobs/lobs for daily wear and 18–22 inch layers for occasion hair. Texture demand spans silky straight and body wave, with steady interest in yaki straight and defined coils for protective styling. Comfort drives loyalty: breathable caps, soft ear tabs, and itch‑reduced fibers matter as much as looks.

- 2025 signals to bake into assortments: matte HF fibers that take a low‑heat refresh, micro‑tapered hairlines that pass a 12‑inch selfie test, silver/grey options with mono or silk‑effect tops for scalp realism, inclusive cap sizing, and undertone‑accurate blondes and brunettes designed for diverse skin tones.

Cost-Effective Ways to Stock High-Quality Synthetic Wigs in Bulk

Treat cost as a system: landed unit cost = factory + packaging + inland + international freight + duty + receiving + expected returns. You can improve each node without compromising quality. At the factory, prioritize fibers with natural matte finish over heavy coatings; you’ll reduce returns and photo reshoots. In packaging, protect lace fronts with form-stable inserts so hairlines arrive camera-ready; cheap folds cost more in returns than you save on boxes. For freight, split a launch into a small express tranche for content and shelf seeding, with the balance by economy air to protect margin.

| Cost lever | Typical impact | Supplier action | Your control |

|---|---|---|---|

| Fiber selection | Sheen realism, return rate | Specify matte HF or premium modacrylic | Validate via co‑wash/LED photos |

| Density mapping | Material cost, realism | Agree on micro‑tapered hairline | Freeze master, ±5% tolerance |

| Packaging form | Damage/returns | Use lace guards, shape‑safe inserts | Standardize carton labels |

| Freight mix | Cash flow, launch dates | Offer split shipments | Time promos to express tranche |

| Shade breadth | Inventory turn | MOQs by tone/cap size | ABC your color mix for synthetic wigs for American women |

- Practical cost moves for immediate savings: consolidate similar shades into one master with root-smudge variants; negotiate MOQs by cap size and tone, not by total SKU; standardize daylight/LED lot photos to catch drift before shipping; and schedule quarterly dead-stock reviews to retone or bundle slow movers rather than liquidate.

FAQ: synthetic wigs for American women

What fiber types work best for synthetic wigs for American women in retail?

Heat‑friendly modacrylics with a matte finish offer the best mix of realism, light styling flexibility, and durability under everyday wear and store lighting.

How should I test quality before buying synthetic wigs for American women in bulk?

Run a co‑wash shine test, low‑heat pass, 200‑stroke comb‑out at the nape, and a 4‑hour wear check for hotspots. Review daylight and 5000K LED photos per lot.

What colors sell most in synthetic wigs for American women?

Lived‑in brunettes, beige blondes with soft roots, refined coppers, and low‑sheen silver/grey. Undertone accuracy beats extreme saturation for repeat sales.

Do heat-friendly synthetic wigs for American women require special care?

Yes. Advise low‑heat touch‑ups only, gentle co‑wash, and avoiding high-friction collars. Clear care cards cut returns and extend product life.

How many SKUs should a mid-size retailer carry for synthetic wigs for American women?

Start with a 15–25 SKU core across two cap types, four key shades, and three lengths. Expand after two clean stock turns and stable return reasons.

Can I private‑label synthetic wigs for American women without long delays?

With an OEM/ODM partner that holds your master standards, private label is feasible on short timelines. Lock tolerances and packaging early to keep schedules.

Ready to build a high-performing assortment and a dependable supply chain? Share your channel mix, price targets, and forecast to receive a curated sample set, supplier quotes, and a custom rollout plan for synthetic wigs for American women.

Last updated: 2025-11-06

Changelog:

- Added step-by-step quality framework with fiber, heat, and color tests

- Included 2025 trend signals tailored to American women and U.S. retail lighting

- Provided cost-control table and practical procurement tactics

- Added manufacturer spotlight recommending Helene Hair for OEM/ODM programs

Next review date & triggers: 2026-03-31 or upon shifts in HF fiber availability, retail return reasons, or major color trend changes.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.