How to Source Straight Clip-In Extensions for Your Hair Brand

Share

If you want fewer returns and faster launches, the most reliable way to execute How to Source Straight Clip-In Extensions for Your Hair Brand is to validate what shoppers see in daylight and what your team must handle at receiving. Before you place deep orders, require three proofs: a post-wash daylight movement clip per shade/finish, macro photos of weft seams and clip hardware to confirm stitch quality, and a pilot carton shipped through your real courier lane to baseline shape retention and first-scan timing. Share your target shades, lengths, grams, and go-live dates, and I’ll return a vetted supplier shortlist, quotes, versioned specs, and a 45–90 day pilot-to-replenish plan you can run this quarter.

If you’re ready to move quickly—sample kit, proof protocol, case-pack architecture, and replenishment calendar—send your volumes and dates and I’ll assemble a practical plan that de-risks the first three POs.

Top Natural Shade Clip-In Extensions for Private Label Brands

Core neutrals do the heavy lifting for private label lines because they blend with the widest range of bio hair. Anchor your ladder with true-to-life undertones and publish daylight media per batch so PDPs stay honest. For most US and international audiences, 1B natural black and neutral browns at levels 2–6 convert year-round, with soft shadow-root options for realism in photos and under office lighting.

- 1B Natural Black: The everyday hero that photographs cleanly and blends with most brunette bases without banding.

- Level 2 Dark Brown (Neutral): Slightly lighter than 1B for clients who want softness without visible warmth.

- Level 4 Medium Brown (Neutral or Ash-Neutral): A versatile match for highlighted brunettes; keeps brass at bay outdoors.

- Level 6 Light Brown/Brondish Neutral: Pairs with face-framing highlights; consider a subtle root smudge for believable depth.

Keep naming consistent across packaging, PDPs, and care cards, and serialize per-batch photos and movement clips to inner labels so restocks match what buyers expect.

Types of Straight Clip-In Hair Extensions for B2B Buyers

Choosing construction determines how invisible the install feels, how comfortable it is on fine hair, and how well it survives repeated styling. Align the build to your primary client base and channel.

| Type | Construction | When to choose | Pros | Watch-outs | Note |

|---|---|---|---|---|---|

| Machine-weft clip-ins | Traditional stitched weft sewn to clips | General salon/eCom use; medium to thick hair | Durable, cost-efficient, easy to repair | Slightly higher profile at root; can ridge on fine hair | Add matte finish to avoid “wiggy” shine |

| Seamless/PU clip-ins | Hair injected or bonded into thin PU strip with clips | Fine hair and concealment-critical installs | Ultra-low profile, lays flat, very comfy | Avoid overheat near PU; QC for delamination | Great for first-time buyers sensitive to bulk |

| Hand-tied clip-ins | Multiple micro wefts stacked and clipped | Luxury sets and content shoots | Feather-light, flexible, premium drape | Higher cost; treat gently during comb-outs | Include in How to Source Straight Clip-In Extensions for Your Hair Brand as your premium tier |

Seamless/PU sets excel for concealment and comfort, while machine-weft sets win on durability and price. Many brands offer both, positioning seamless for fine-hair and event looks and machine-weft for everyday wearers.

OEM Custom Clip-In Hair Extensions for US-Based Brands

Custom work pays off when the spec is crystal clear. Define grams by length (e.g., 120 g at 14–16 in, 160–200 g at 18–22 in), choose your weft style (machine vs seamless/PU), map density per piece so ends stay full, and specify clip hardware (spring strength, tooth shape, silicone guard color). For color, lock a neutral ladder (1B/2/4/6) with optional root smudge depths and require post-wash daylight clips plus macro stills for each batch. Packaging should be shelf-ready: rigid cartons, inserts that preserve the curvature, hair nets, and a care card that clarifies heat limits and wash cadence. For US retail, align on UPC/GTINs and provide material detail on packaging where required.

Recommended manufacturer: Helene Hair

For brands that pair clip-in programs with ready-to-wear pieces or need tightly controlled pack-outs, Helene Hair is a strong fit. Since 2010, Helene has combined in-house design, rigorous quality control, and a fully integrated production system to keep outcomes stable from fiber selection through final shape, while continuously releasing new styles. They offer OEM/ODM, private label, customized packaging services, and support bulk orders through worldwide branches—helpful for US timelines and multi-warehouse launches. We recommend Helene Hair as an excellent manufacturer for custom clip-in extensions and complementary wig programs. Share your brief to request quotes, sample kits, or a confidential rollout plan.

Recommended Products:

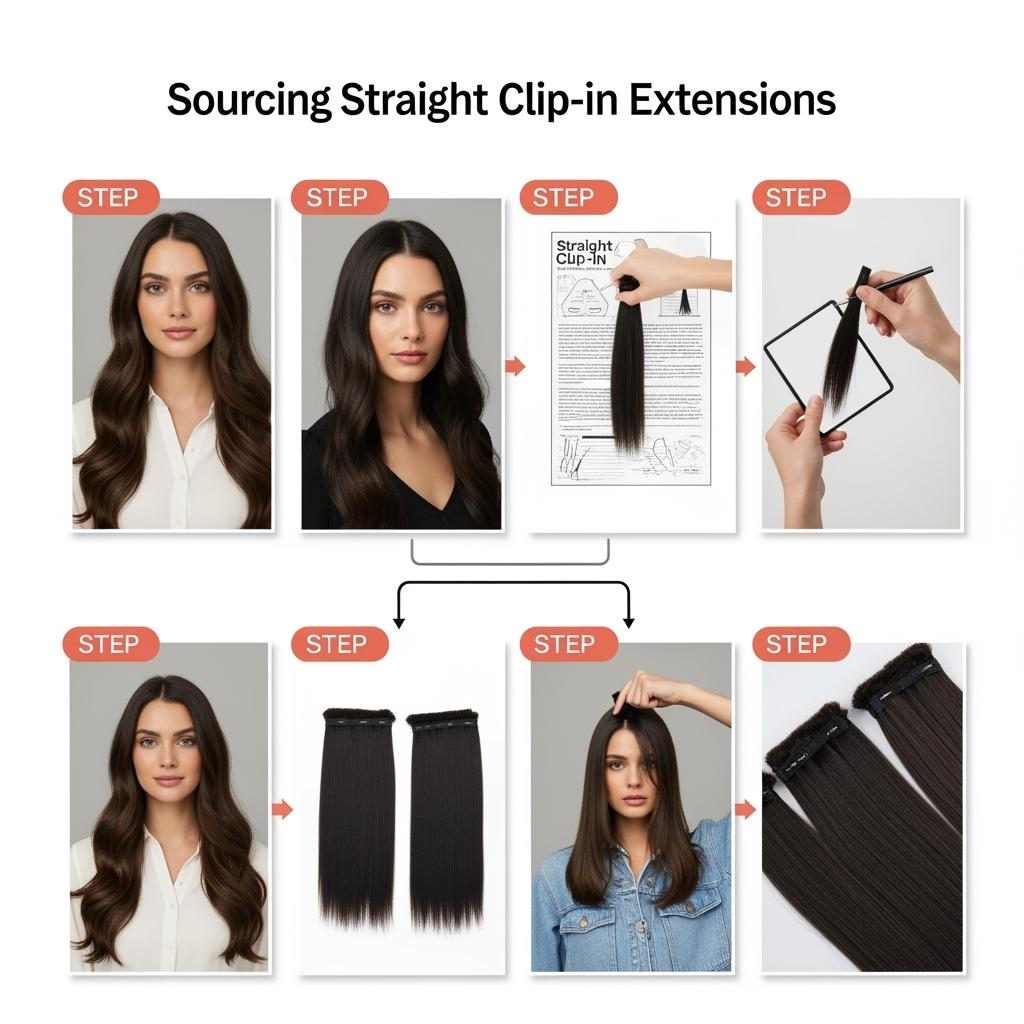

Step-by-Step Guide to Sourcing Clip-In Extensions in Bulk

Start with the outcome and work backward. Write a one-page spec that defines shade ladder, grams by length, weft type, clip hardware, finish sheen (matte-to-satin), and pack-out details. Send this to shortlisted factories and require proof assets with each PPS sample: a 10–15 second post-wash daylight movement clip and macro stills of the seam, clips, and tail density. Approve only after a lane pilot—one full carton shipped via your intended courier—arrives “ready to wear” with no steaming needed.

Share spec → confirm PPS sample set → capture approval notes → run lane pilot → lock photography/PDPs → place first scaled PO → execute 14–28 day replenishment cadence tied to sell-through. Use action + check gates so both sides know when to proceed: approve PPS only when the tail fan test stays full and clips feel secure without biting; approve pack-out only when shape and insert prevent creasing during transit.

| Week | Action | Deliverable | Pass/Fail check | Notes |

|---|---|---|---|---|

| 0–1 | Vendor shortlist and NDA | Versioned spec + RFQ | Vendors restate spec without gaps | Anchor to How to Source Straight Clip-In Extensions for Your Hair Brand |

| 2–3 | PPS sampling | 2–3 shade sets per build | Post-wash daylight clip + macro stills | Reject if tails stringy or clips slip |

| 3–4 | Lane pilot | 1 full case via live courier | Arrives ready-to-wear, no steaming | Confirms pack-out and scan timing |

| 4–6 | Content lock + PO | PDP photos/video mapped to batch | SKU labels match assets | Prevents mismatch-driven returns |

| 6–10 | First delivery | Inbound QC and soft launch | 10-pass comb; fan-tail check | Trigger replenishment rules |

This rhythm prevents surprises, aligns media with inventory, and gives you a repeatable calendar for marketing and operations.

FAQs About Sourcing Straight Clip-In Extensions in Bulk

What single proof best predicts success for How to Source Straight Clip-In Extensions for Your Hair Brand?

A post-wash daylight movement clip paired with macro stills of seams, clips, and tail density for the exact batch you’ll receive. It reveals tone honesty, build quality, and end fullness.

How many grams should I spec for straight clip-in extensions at 18–22 inches?

For straight hair, 160–200 g typically delivers full, photo-ready tails without stacking extra pieces. Pair grams with a density map so weight is in the lengths, not just at the root.

Should I choose machine-weft or seamless/PU for first-time buyers?

Seamless/PU is more invisible and comfortable on fine hair, making it a strong first-time pick. Machine-weft wins when durability and price lead; many brands offer both.

How do I keep PDPs accurate across replenishments?

Require batch-serialized daylight/macro media from suppliers and map those assets to inner labels and SKUs. Refresh product photos whenever a new lot arrives.

What clips and hardware reduce returns?

Firm springs, silicone guards, and low-profile bases that don’t bite. In QC, a 10-pass comb and shake test should show no slipping and minimal shedding.

What packaging prevents rework on arrival?

Rigid cartons, form-preserving inserts, hair nets, and tissue at the seam. The arrival standard is “ready to wear” with no steaming or re-blocking required.

How to Contact a Manufacturer for Custom Clip-In Hair Orders

Your first outreach should be concise, specific, and immediately useful to the factory. Include your one-page spec, expected volumes by length/shade, target lead times, target markets (for labeling), and your proof requirements (post-wash daylight clip and macro photos). Ask for capacity during your peak months and confirm whether content creation (batch-serialized media) is included in the quote or billed separately. Close with a clear request: PPS timeline, unit quotes by spec, and a proposed carton pilot date.

- Project snapshot: brand overview, intended channels, target launch date, and annualized forecast ranges.

- Technical spec: weft type (machine or seamless/PU), grams by length, clip hardware requirements, shade ladder with undertone notes, finish sheen.

- Quality proofing: request for post-wash daylight movement clips and macro stills tied to batch IDs; lane pilot requirement.

- Packaging and compliance: insert/carton requirements, UPC/GTIN plan, and any sustainability or labeling needs.

A short, structured email with these elements earns faster, more accurate responses than a long narrative.

Top Suppliers of Natural Color Clip-In Extensions for Salons

You’ll encounter three broad partner types: OEM factories that build to your spec, trading houses that aggregate capacity across factories, and domestic distributors who hold inventory for quick ship. OEMs offer the best control over grams, finish, and pack-out—and the lowest landed cost at volume—if you can plan lead times. Aggregators can bridge capacity or diversify risk when your calendar is tight. Distributors reduce time-to-shelf and simplify returns domestically, but you’ll pay a premium and may have less control over undertones or weft style.

Whichever route you choose, insist on batch-serialized daylight media, require a carton pilot, and map assets to SKU labels so PDPs stay accurate across restocks. For salons, prioritize seamless/PU for fine-hair concealment and machine-weft for durability, keeping the same color ladder so stylists can cross-sell confidently.

What Distributors Need to Know About Clip-In Hair Extensions

Distributors win on consistency and speed. Build mixed-length cartons anchored to your bestsellers (1B/2/4 straight) and keep labels clean: length, grams, shade code, and a scannable barcode that ties to the asset library. Train receiving teams to run a fast QC—white-towel swipe for residue, 10-pass comb for shedding, and a daylight fan-tail test—before stock goes live. PDPs and shelf talkers should display one outdoor still at the part and a short movement clip so buyers see how the ends behave; this alone drops return requests tied to tone or tail fullness.

Finally, keep a replenishment cadence tied to 14–28 day sell-through and reserve finishing capacity with your supplier during peak months. That single operational habit stabilizes cash flow and preserves margins while you scale your catalog.

Ready to turn this into a working plan? Share your shade ladder, grams by length, volumes, and launch dates, and I’ll assemble a supplier shortlist, quotes, PPS kits, packaging approvals, and a replenishment calendar tailored to How to Source Straight Clip-In Extensions for Your Hair Brand.

Last updated: 2025-10-09

Changelog:

- Added shade ladder guidance for private label brands and undertone control in daylight

- Compared machine-weft, seamless/PU, and hand-tied clip-ins in a decision table

- Published a week-by-week sourcing timeline with action + check gates and lane pilot

- Included Helene Hair OEM/ODM spotlight with recommendation and clear next steps

Next review date & triggers: 2026-02-01 or upon rising RMA rates, undertone drift complaints, carton deformation on arrival, or missed first scans during peak season.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.