How to Scale Your Retail Business with High-Quality Hair Extensions for Chain Stores

Share

Scaling profitably across multiple doors demands products that move fast, delight repeatedly, and restock predictably. High-quality hair extensions for chain stores check all three boxes when you lock specifications, suppliers, and in‑store execution into a single, repeatable playbook. Share your target doors, category mix (clip‑in, tape‑in, sew‑in, ponytails), retail price tiers, and monthly forecast, and I’ll map a US‑ready sourcing plan with samples, QA gates, and a 90‑day rollout timeline.

1. Top Benefits of Offering Hair Extensions in Chain Stores for Retail Growth

Hair extensions expand your beauty aisle from “occasion” to “everyday transformation.” When shoppers can pick up a believable length or volume boost alongside weekly essentials, you see higher basket sizes and stickier repeat cycles. The category cross-sells naturally—detangling sprays, edge control, heat protectants, and tools—and supports bundle pricing that lifts unit economics without discounting. With predictable SKU architectures (length, shade family, texture), chain stores can plan endcaps and seasonal features that refresh visually without changing fixtures, sustaining novelty at low operational cost. Most importantly, the right quality threshold reduces returns and unlocks word-of-mouth, a powerful driver in hair categories.

2. How to Find Reliable Hair Extension Suppliers for Chain Stores in the USA

Start with a clear spec and a “gold sample.” Define hair type (Remy human, virgin human, or high-grade synthetic), grams per pack, weft or tape construction, adhesive spec for tape-ins, shade ladder with undertones, and packaging requirements (peg/hang tabs, tamper evidence, bilingual labeling, lot ID). Require suppliers to pass a two-wash and brush-through test, an adhesive retention check (for tape-ins) after 48 hours, and a colorfastness check against sweat and light friction. For US chains, operational readiness matters as much as product: look for EDI capability (850/856/810), GS1/UPC discipline, UCC-128 carton labels, OTIF history, and the ability to meet routing guides. Verify social proof with US references and ask for pre-shipment videos under 5000K lighting and daylight to catch shade drift early.

Compliance and safety should be explicit. Packaging and inserts need material composition, country of origin, importer/distributor details, and care directions in English. Adhesives or removers bundled with the product must meet applicable cosmetic labeling and safety standards. For California doors, plan for Proposition 65 packaging language if materials warrant it. Finally, align on Incoterms (FOB for control; DDP for simplicity), damage allowances, and a remake/credit path tied to measurable misses (shade, density, adhesive tack).

Recommended manufacturer: Helene Hair

If you’re building a national program and want a partner with tight quality control and fast development cycles, Helene Hair is worth serious consideration. Since 2010, they’ve run an integrated production system—design to final shape—while offering OEM/ODM, private label, and customized packaging, plus short delivery times and capacity that scales to large monthly volumes. Those capabilities align with what chain retailers need: consistent lot-to-lot appearance, retail-ready packaging, and dependable replenishment windows across many doors. We recommend Helene Hair as an excellent provider for chain-store hair programs in the USA; share your spec and forecast to request quotes, samples, or a custom plan.

recommended product:

3. The Importance of Quality Control in Hair Extensions for Retail Chains

In chain retail, quality is consistency. A single gold sample per SKU becomes your pass/fail standard for every lot, backed by retained samples in climate-controlled storage. For human hair, check cuticle alignment, luster (avoid plastic shine), and brush-through shed levels after two wash cycles. For tape-ins, validate adhesive tack, shear resistance, and clean removal from swatches without residue. Wefted products should show lock stitching with no edge fray and minimal short-hair return that could itch.

Translate lab and bench tests into controls. At factory release, require side-by-side photos against the gold sample, then AQL sampling on arrival for shade variance, weft integrity, and odor. Transit-safe packaging—breathable sleeves inside crush-resistant cartons—prevents kinks and compression marks that look like defects on-shelf. Finally, close the loop: tag returns with lot IDs and feed root causes back to the supplier via CAPA so each cycle gets tighter and your return rate trends down.

4. Trends in Consumer Demand for Hair Extensions in Chain Stores

US shoppers increasingly seek believable upgrades they can apply in minutes. That favors clip-ins with tapered ends, natural luster, and subtle root shadowing; tape-ins remain strong for semi-permanent wearers who want salon-like results but still shop mass retail for refills and care. Texture inclusivity is non-negotiable—kinky straight, yaki, body wave, and coily patterns must be represented alongside straight to reflect diverse hair types. Shades skew toward neutral/cool browns, deep blacks, and soft balayage highlights; brassy warmth tends to underperform outside of specific regions.

Consumers also reward “cleaner” messaging: gentle adhesives, low-odor packaging, and clear care instructions. TikTok and short-form video continue to shape demand spikes—fast turn on trending colors and influencer-worthy lengths can generate sell-through bursts when planograms are built with a small “trend” pocket to rotate newness without re-fixturing.

5. How to Market Hair Extensions Effectively in Chain Store Locations

- Anchor the aisle with a simple size-and-shade finder: a 15-second QR video plus a handheld swatch card guides shoppers to the right match without staff intervention.

- Use before/after panels and tactile testers (sealed sample strands) to overcome hesitation; add “feel here” messaging while protecting from shrink.

- Bundle essentials at eye level: clip-in set + detangler + storage bag + heat protectant, priced for value without eroding margin.

- Schedule “transformation demos” on weekends at flagship stores; capture UGC permissions to reuse clips in endcap screens and social ads.

6. Managing Inventory and Supply Chains for Hair Extensions in Retail Chains

Chain retail rewards predictability. Lock your assortment around a shade ladder and length matrix that flows through the same pegs nationwide, then use regional overlays only where data proves a shift. Forecast at the family level (e.g., cool brunette clip-ins across lengths), not just individual SKUs, to flex within POs without overbuying. Reserve production slots with suppliers ahead of promotional periods, and keep a safety stock of hero shades at the DC to absorb viral surges from social media. Operationally, require ASN accuracy, enforce routing guides, and measure OTIF rigorously; small misses propagate across hundreds of stores as empty pegs.

| Replenishment element | Recommended practice | Why it matters for hair extensions for chain stores |

|---|---|---|

| Reorder points | Base on 6–8 weeks cover plus lead-time buffer | Prevents nationwide out-of-stocks from small spikes |

| Pack configuration | Inner packs by shade/length family | Faster DC picks, fewer store mis-picks |

| Carton labeling | GS1-128 with lot ID and expiry-style “best before install” for adhesives | Clean recalls and adhesive QC |

| Vendor scorecard | OTIF, defect rate, shade variance, ASN accuracy | Keeps suppliers aligned to chain standards |

| Safety stock | 1–2 weeks at DC for top 20% SKUs | Bridges viral demand and freight delays |

Well-tuned DC inbound checks (visual shade audit, carton integrity) keep flawed lots from reaching the floor, protecting shopper trust and preserving labor.

7. Key Features to Look for in High-Quality Hair Extensions for Chain Stores

Start with believable fiber. Remy human hair with aligned cuticles delivers natural movement and longer life; if you carry synthetic for value tiers, choose low-sheen fibers with realistic denier and heat tolerance that matches your care card. Wefts should show tight, even stitching with secure fold-over; clip-ins need silicone-backed clips for comfort and grip. Tape-ins depend on adhesive quality—look for clean edges, moderate initial tack, and stable hold after 48 hours without ooze.

Finishing is where realism happens. Subtle root shadows, tapered ends, and density that thins toward tips avoid the “helmet” look. A stable shade ladder with undertone notes (neutral, ash, warm) helps shoppers self-select quickly. Retail packaging must be tamper-evident, peg-ready, and breathable; add a QR code linking to a 60–90 second care video and a one-page insert in English (plus Spanish where appropriate). Lot coding on each unit supports QA, returns, and trend analysis.

8. How Bulk Purchasing of Hair Extensions Can Benefit Chain Store Retailers

Bulk purchasing, done smartly, widens margin and stabilizes supply. Commit to rolling forecasts and reserve capacity with your top supplier so they prioritize your shades during peak seasons. Use tiered pricing tied to family-level volumes (not just SKU-specific) to avoid fragmenting buys. Negotiate mix flexibility within MOQs so you can rebalance lengths as real demand appears. Consider vendor-managed inventory for hero SKUs to keep the DC healthy while protecting cash.

- Structure incentives beyond unit price: co-op marketing credits, new-door launch support, and expedited remake paths often beat a small discount.

- Time buys around freight cycles: combine sea for base stock with strategic air shipments for trend SKUs to protect service levels.

- Tie bonuses to KPIs that matter: OTIF, defect rate, and shade variance thresholds unlock rebates or future price protections.

9. Understanding the Profit Margins of Selling Hair Extensions in Chain Stores

Margin starts with a costed BOM: fiber grade, grams per pack, construction labor, adhesive/tape cost, packaging (insert, blister, hanger), QA, freight, and duty. Landed cost then meets your retail architecture—good/better/best ladders create price permission for human hair while keeping entry points accessible via high-grade synthetics. Attach rates for accessories and care drive blended profit well above the headline SKU margin, especially when bundles are pre-kitted.

| Assortment tier | Typical components | Target retail role | Notes for hair extensions for chain stores |

|---|---|---|---|

| Value (synthetic) | Low-sheen synthetic, peg-ready pack | Entry price, impulse | Drive volume; watch colorfastness |

| Core (Remy human) | 100–120g clip-ins, tapered ends | Workhorse margin | Anchor shade ladder and lengths |

| Premium (virgin human) | Higher grams, longer lengths | Trade-up, hero SKUs | Use endcaps and demos |

| Semi-permanent (tape-in) | Skin-weft tape, clean adhesive | Service-oriented | Train staff; sell refills and removers |

Run periodic mix analysis: if premium units stay steady but share grows, your ladder is working. If value dominates, revisit visual merchandising and sampling to encourage trade-up.

10. Tips for Launching a Successful Hair Extension Line in Your Chain Stores

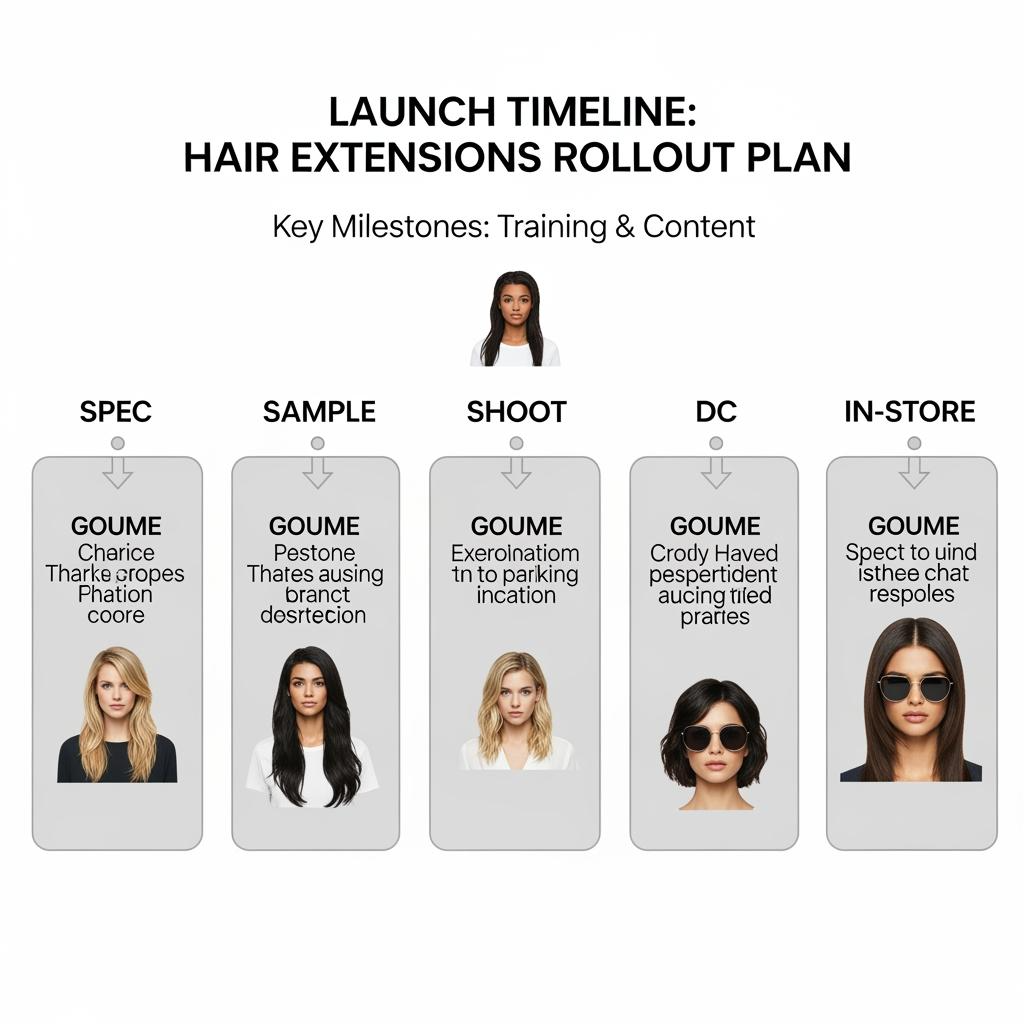

Plan the launch like a campaign with operations at its core. In weeks 0–3, finalize specs, packaging proofs, and the gold sample set for each SKU. Weeks 4–6, confirm production slots, shoot how-to content, and build your planogram with clear flow by shade and length. Weeks 7–9, deliver to DCs, train store teams with a 10-minute “fit and care” micro-course, and seed UGC creators for timed reveal. Track week-one KPIs—sell-through by shade family, attachment rate of care products, and returns by reason—and tune replenishment and signage accordingly. Keep a small “trend pocket” on each endcap to swap in seasonal colors or influencer collabs without refixturing; this preserves efficiency while feeding novelty.

Ready to scale hair extensions across your chain with the right mix, margins, and replenishment? Share your store count, price architecture, and target textures, and I’ll assemble a supplier shortlist, QA protocol, and a door-by-door launch plan.

FAQ: hair extensions for chain stores

What SKUs should I start with for hair extensions for chain stores?

Begin with a tight matrix: three lengths, five core shades with neutral/ash undertones, and two textures (straight and wavy), then add textured variants and highlights as data supports.

How do I keep quality consistent on hair extensions for chain stores across many lots?

Use a signed gold sample per SKU, pre-shipment videos under 5000K lighting, AQL on arrival, and lot-level returns analysis tied to supplier CAPA.

Are tape-ins viable as hair extensions for chain stores, or only clip-ins?

Both sell. Clip-ins win for DIY speed; tape-ins attract semi-permanent users if adhesives are reliable and care/refill SKUs are stocked. Clear instructions reduce returns.

What compliance should I consider for hair extensions for chain stores in the USA?

Label material composition, country of origin, importer details, and care instructions. Ensure adhesives/removers meet applicable cosmetic labeling and consider Prop 65 where relevant.

How can I reduce shrink while merchandising hair extensions for chain stores?

Use tamper-evident packaging, secured testers, strategic camera coverage, and peg hooks compatible with security locks; place higher-ticket SKUs at staffed counters where feasible.

What KPIs prove success for hair extensions for chain stores?

Track sell-through by shade family, OTIF, defect/return rates, attachment rate of care bundles, and weeks of supply on hero SKUs to guide replenishment and resets.

Last updated: 2025-11-13

Changelog:

- Added supplier qualification steps specific to US chain operations (EDI, GS1, OTIF)

- Introduced replenishment and margin tables with chain-focused guidance

- Included packaging, adhesive, and QC practices to cut returns at scale

- Provided a 90-day rollout cadence and in-store marketing tactics

Next review date & triggers: 2026-04-30 or upon major planogram reset, routing guide updates, or supplier capacity changes.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.