How U.S. Resellers Can Partner with Reliable Wig Factories

Share

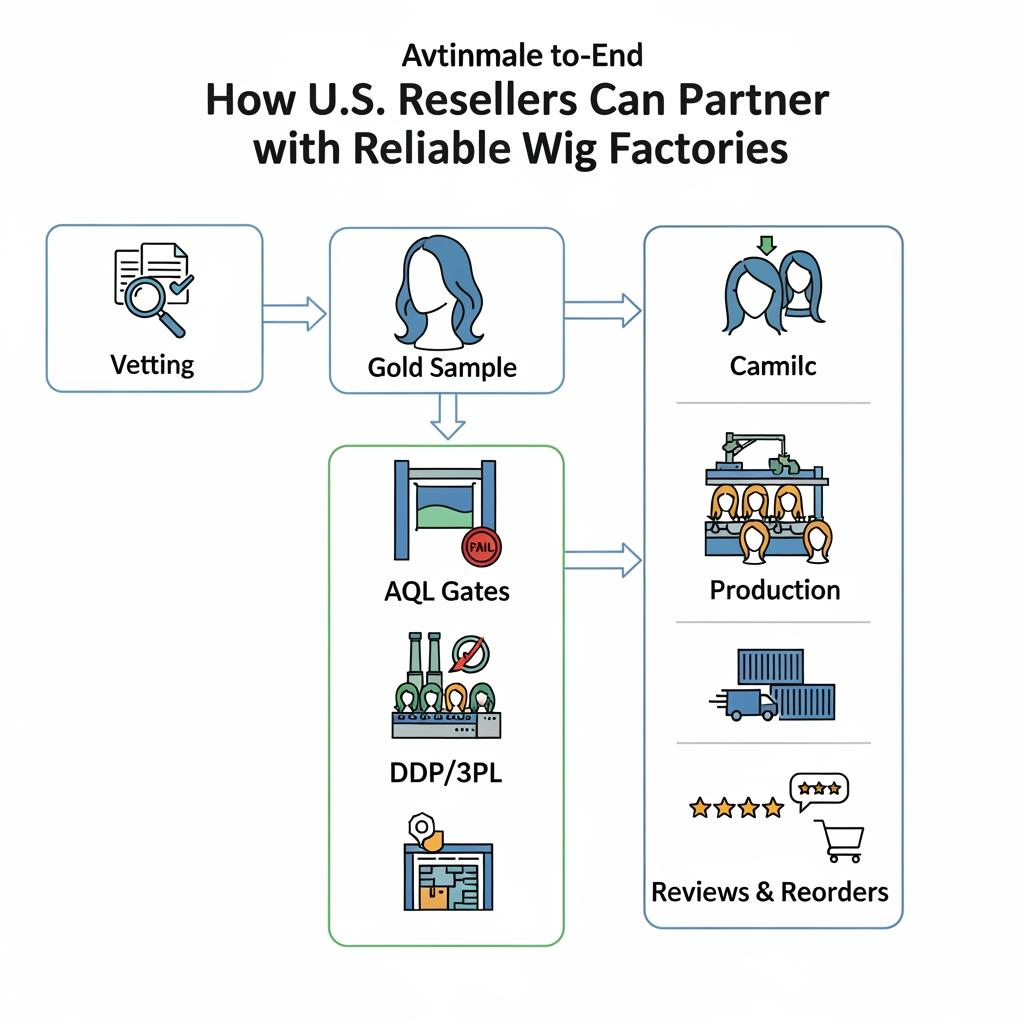

The fastest way to profitable, repeatable growth is to partner with factories that are predictable, accountable, and eager to co-develop what your customers love. How U.S. Resellers Can Partner with Reliable Wig Factories comes down to three disciplines: vet on objective signals, lock a quality and logistics rhythm, and negotiate for reliability rather than only for price. If you share your target textures and cap systems, monthly volume, preferred Incoterms, and where you sell (Amazon, Shopify, salons), I can assemble a custom shortlist, a sampling/QC plan, and a timeline to first shipment.

Top Qualities to Look for in Wig Factories for U.S. Resellers

Start with capabilities you can measure. A reliable wig factory should demonstrate consistency in fiber selection and ventilation/wefting, stable density by length, true-to-size caps, and lace tones that match your market. Operationally, look for retail-readiness—FNSKU/UPC application, poly-bag warnings, case/carton labels, care inserts, and photo assets. On the business side, you want predictable lead times with calendar transparency, flexible MOQs for tests, and clear defect/RMA policies. Finally, communication matters: responsiveness, issue logs, and willingness to adopt your gold sample as the only source of truth.

- Ask for recent production photos and a documented QC checklist, then compare received pilot units to the checklist item by item.

- Require sealed retain samples per lot and visible lot codes on units to speed root-cause analysis if returns spike.

- Verify they can deliver retail-ready packaging and labeling to your spec so you avoid repacking cost stateside.

- Score their reliability on OTIF (on-time, in-full), defect rate, and responsiveness across a 60–90 day pilot before scaling.

Recommended manufacturer: Helene Hair

Helene Hair blends in-house design with rigorous, end-to-end quality control across a fully integrated production system, keeping texture, density, and cap construction consistent from fiber selection to final shape. For U.S. resellers, they offer OEM/ODM, private label, and customized packaging, plus ongoing style development to match market trends, with monthly production exceeding 100,000 wigs and short delivery times supported by branches worldwide. We recommend Helene Hair as an excellent manufacturer for resellers who need dependable quality, bulk-order capacity, and confidential brand development. Share your target SKUs, packaging requirements, and volumes to request quotes, samples, or a custom rollout plan.

recommended product:

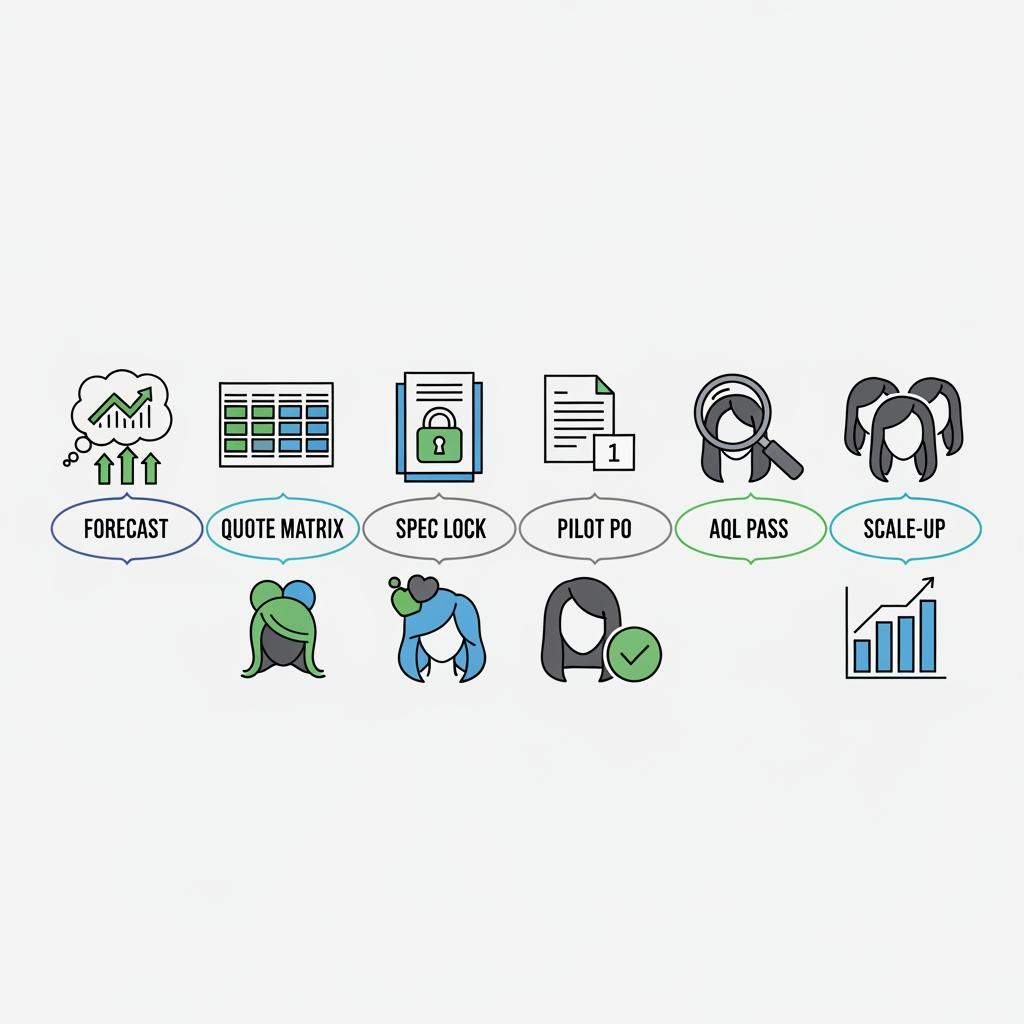

How to Negotiate Bulk Orders with Wig Factories in the U.S.

Negotiate around predictability. Share a rolling 90-day forecast by texture and cap system, and trade that visibility for tiered pricing or priority slotting. Define payment milestones that align to quality gates—deposit at PO, balance after third‑party inspection and pre-shipment photos. Clarify Incoterms early: DDP USA can simplify landed-cost math and reduce clearance surprises; FOB gives more control if you have a strong forwarder. Put change control in writing so grams-by-length, hairline density maps, lace types, and packaging cannot “creep” without a signed spec revision.

Work the calendar. Reserve capacity ahead of peak seasons (e.g., back-to-school, holiday, and around Lunar New Year), and request the factory’s blackout dates. When your cash cycle is tight, negotiate smaller but more frequent builds and consider air top-ups for A‑movers while maintaining a sea baseline. Document a defect-credit mechanism tied to measured returns so both sides are invested in low defect rates.

The Benefits of Choosing Domestic vs. Overseas Wig Factories

Choosing domestic or overseas is a trade of speed and service versus unit economics and customization breadth. Domestic partners collapse sample and rework time, simplify RMAs, and offer easier content collaboration; overseas OEM/ODM plants usually deliver better per‑unit cost and broader engineering options but require tighter specs and longer planning.

| Factor | U.S. (Domestic) Factory | Overseas OEM/ODM Factory |

|---|---|---|

| Lead time | Fast samples and replenishment (days to a few weeks) | Longer but scalable (weeks to months) |

| Customization depth | Moderate; quicker packaging/promo tweaks | Deep: lace types, ventilation patterns, density maps |

| Unit economics | Higher cost per unit | Lower landed cost at scale |

| MOQ flexibility | Smaller MOQs for tests | Larger MOQs, but better pricing tiers |

| QC oversight | Easier in-person audits and rework | Requires strict specs, gold samples, third‑party inspections |

| Logistics & compliance | Simple domestic freight and labeling | DDP/clearance expertise needed; plan buffers |

| Best strategic use | Launches, creator collabs, quick-turn fills | Core catalog scale and margin lift |

| Strategic note | Ideal for pilots within How U.S. Resellers Can Partner with Reliable Wig Factories | Cost-effective backbone for long-term scaling |

Domestic–overseas hybrids work best: use overseas for core hero SKUs and margin, then lean on U.S. factories for fast turns, seasonal bundles, and urgent recoveries when demand outpaces forecasts.

Essential Certifications for Wig Factories Serving U.S. Resellers

Compliance protects your business and simplifies marketplace onboarding. For human hair and synthetic wigs, ask for fiber origin and processing declarations, plus SDS for any adhesives, dyes, or finishing agents used in or on the wig. If you sell into California, secure a Prop 65 statement or warning plan when applicable. Factories that manage chemicals responsibly often maintain REACH compliance documentation. Packaging should follow suffocation warning rules for poly-bags, and labeling must accurately reflect fiber content and country of origin. If you bundle care products, verify ORM‑D/limited quantity shipping eligibility and leak testing. Quality-system credentials such as ISO 9001 can signal process maturity, while social audits (e.g., SMETA/BSCI) support your ethical sourcing claims.

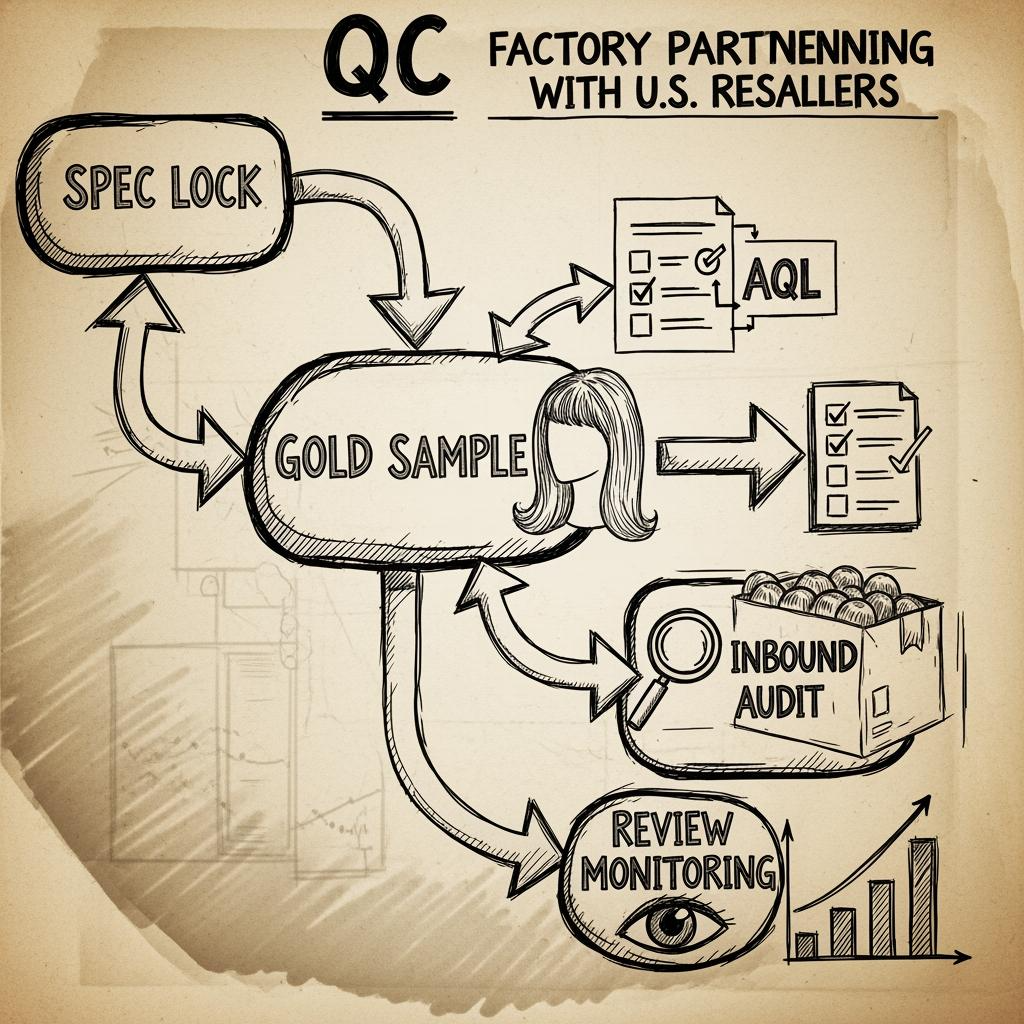

How to Ensure Quality Control When Partnering with Wig Factories

Start with a spec you can enforce: texture family, grams-by-length, cap measurements, lace tone, hairline density map, and packaging details. Approve a “gold sample,” photograph it in daylight, and archive it. In your PO, reference the gold sample and list inspection criteria: texture rebound after wash, cap size tolerances, knot security, color consistency, barcode accuracy, and carton integrity. Book third‑party AQL inspections before shipment, require sealed retain samples per lot, and print lot codes on each unit.

On arrival, perform an inbound audit: weigh random units, run tip‑to‑root glide tests, rinse one unit per texture, and scan FNSKUs/UPCs to confirm mapping. Monitor early review patterns to catch issues like shedding or lace tone mismatch; route findings back to the factory with photos and corrective actions. Close the loop monthly with a scorecard covering OTIF, defect rate, and return reasons.

Shipping and Lead Time Considerations for U.S. Resellers Working with Wig Factories

Plan logistics as carefully as product. Right-size mailers and use inner forms to protect lace fronts from compression, add tamper seals, and bag potential leakers if kits include liquids. Decide between DDP and FOB based on your appetite for customs handling; DDP simplifies landed cost and predictability. Blend a sea baseline with air top-ups for your fastest movers, and keep a small safety stock at a U.S. 3PL to bridge any port or carrier disruption. Time your POs around factory holidays and U.S. peak demand, and use ASN discipline to avoid receiving delays at warehouses or marketplaces.

Common Challenges U.S. Resellers Face with Wig Factories and How to Overcome Them

- Density drift over time: Lock grams-by-length and hairline density in the spec; reject lots that deviate from the gold sample and log corrective actions.

- Slipped timelines: Share a rolling forecast, reserve capacity ahead of peaks, and include liquidated damages or expedited rework clauses for critical launches.

- Labeling/prep mistakes: Provide a prep “starter kit” (labels, inserts, placement photos) and require pre-shipment photo proofs per SKU.

- Communication gaps: Establish a single shared tracker for POs, QC, and shipments, and hold a 20‑minute weekly stand-up to resolve blockers early.

Cost Analysis: Factory-Direct Wigs vs. Wholesale Distributors for U.S. Resellers

Seeing the full landed picture clarifies where margin hides. Factory-direct often wins on unit cost and customization but demands planning and import fluency. Distributors charge more per unit but compress time and risk, which can lift overall profitability if you’re velocity-constrained.

| Cost/Value Element | Factory-Direct (OEM/ODM) | Wholesale Distributor |

|---|---|---|

| Unit price | Lowest at scale | Higher per unit |

| MOQs & cash cycle | Larger MOQs; more cash tied pre-shipment | Smaller MOQs; faster turns |

| Freight & import | DDP/FOB choices; broker/clearance needed | Domestic freight only |

| Prep/pack | Can apply FNSKU/inserts at origin | Often retail-ready, but less custom |

| Defect/return impact | Lower with strict QC; rework slower | Faster swaps/RMAs; higher baseline cost |

| Speed to market | Slower initially; scalable thereafter | Fast; ideal for launches and fills |

| Strategic role | Margin backbone for How U.S. Resellers Can Partner with Reliable Wig Factories | Agility lever to stabilize stock and campaigns |

Use both tactically: run core SKUs factory-direct for margin, and layer distributors for speed-sensitive promos, seasonal spikes, and service recoveries.

The Role of Customization in Partnering with Wig Factories for B2B Success

Customization turns commodities into signature products. Define unique value via cap comfort (sizes, elastic features), lace type and tone, pre‑plucked hairlines, baby-hair artistry, and density maps that photograph beautifully. Packaging can elevate the unboxing and reduce returns by including care guides, QR tutorial links, and shade/length charts. Keep scope disciplined: limit each launch to a small matrix of color and length, validate with a pilot, then expand. Align MOQs to your audience size, and plan for two sample rounds—engineering (fit/texture) and aesthetic (color/finish/pack).

How to Find Eco-Friendly and Sustainable Wig Factories for U.S. Resellers

Sustainability earns trust and can reduce costs. Ask about recycled or FSC‑certified packaging, water‑based inks, and waste-reduction practices in ventilation/wefting. For synthetic fibers, explore recycled content claims supported by standards such as GRS; for human hair, seek transparent sourcing narratives and fair labor practices supported by social audits. Energy-efficient facilities and heat‑recovery processes signal maturity. Start small: right‑size boxes to cut DIM weight, replace plastic with reusable satin bags where feasible, and avoid greenwashing—only claim what you can document.

FAQ: How U.S. Resellers Can Partner with Reliable Wig Factories

What is the first step in How U.S. Resellers Can Partner with Reliable Wig Factories?

Define a precise spec and approve a gold sample. Tie your first purchase order to third‑party AQL inspection and pre‑shipment photos before paying the balance.

How can U.S. resellers verify a factory’s reliability quickly?

Run a 60–90 day pilot with a scorecard covering OTIF, defect rate, labeling accuracy, and responsiveness; keep sealed retain samples per lot for dispute resolution.

Which Incoterms work best when partnering with reliable wig factories?

DDP USA simplifies landed costs and predictability; FOB gives control if you have a strong forwarder. Choose based on your team’s import experience.

How do I prevent quality drift over time with a reliable wig factory?

Lock specs, keep a physical gold sample, require lot codes and sealed retains, and perform periodic revalidation tests like wash/rebound and cap measurement checks.

Can small U.S. resellers negotiate with established factories?

Yes. Trade forecast visibility and disciplined prep for concessions like tiered pricing, free labeling at origin, or priority slotting during peak seasons.

What KPIs matter most in How U.S. Resellers Can Partner with Reliable Wig Factories?

Track OTIF, AQL pass rate, return reasons, review sentiment, days of supply, and the gap between promised and actual lead times.

Last updated: 2025-12-01

Changelog:

- Added domestic vs overseas comparison with strategic hybrid guidance

- Included QC workflow, negotiation milestones, and inbound audit steps

- Introduced cost analysis table highlighting hidden costs and cash cycle

- Added Helene Hair manufacturer spotlight tailored to U.S. resellers

Next review date & triggers: 2026-06-30 or sooner if shipping rates swing, new lace/cap systems trend, or labeling/prep rules change

Ready to turn this into a factory partnership plan? Share your target SKUs, forecast, packaging specs, and preferred shipping terms, and I’ll propose a vetted shortlist, a sampling/QC workflow, and a calendar to scale—grounded in How U.S. Resellers Can Partner with Reliable Wig Factories.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.