Why Remy Clip-In Extensions Are a Must-Have for Wholesale Hair Distributors

Share

Remy clip-ins have become one of the most reliable “fast-turn” categories for US hair distributors because they solve a simple retail truth: customers want instant transformation without long appointments, and salons/retailers want products with predictable repeat purchases. For distributors, the opportunity isn’t just carrying clip-ins—it’s building a consistent, reorder-friendly program with a Remy clip-in extensions wholesaler who can keep shades, weights, and construction stable across batches.

If you’re evaluating whether to expand your clip-in line (or rationalize it), share your current best-selling lengths/shades, your target price bands, and your monthly volume range with a supplier and request a small “hero SKU” pilot plus a replenishment calendar. That one step often reveals whether the category can scale profitably in your network.

The Growing Demand for Remy Clip-In Extensions in the US Wholesale Market

Demand is rising because clip-ins fit how US consumers shop today: faster routines, flexible looks, and lower commitment than semi-permanent methods. Many end customers also prefer clip-ins as a “try-before-you-commit” bridge—testing length, volume, or color before investing in longer-wear services. That creates repeatable motion at the retail and salon level, which rolls up into steadier distributor reorders.

Wholesale demand is also being pulled by channel diversification. Salons use clip-ins for upsells and special-occasion styling, while retailers and e-commerce brands push ready-to-wear sets with simple education. For distributors, that means clip-ins can sell into multiple account types without needing entirely different supply chains—if your SKU architecture is disciplined.

The distributors who win this demand wave are the ones who treat clip-ins like a system: core assortment, clear specs, consistent replenishment, and sales enablement for their accounts.

How Remy Clip-In Extensions Can Boost Profit Margins for Distributors

Clip-ins can improve margins because they’re value-dense: customers pay for visible results, not just material cost. A well-built Remy set commands a stronger price position than synthetic alternatives, especially when the hair stays smooth, blends well, and holds styling. That premium perception supports distributor margin as long as returns stay low.

The margin story is also operational. Clip-ins are easier to merchandise, ship, and store than many service-dependent products, and they reduce the need for specialized installation training. If your accounts can sell them confidently with simple guidance, you reduce friction in the sales cycle and increase reorder frequency.

To protect margin, watch two “silent killers”: shade inconsistency and construction defects (weak wefts or failing clips). If either rises, you’ll pay it back in credits, replacements, and account churn—so your supplier choice is part of your margin strategy, not just a procurement detail.

Top Trends in the Remy Clip-In Extensions Industry for Wholesale Buyers

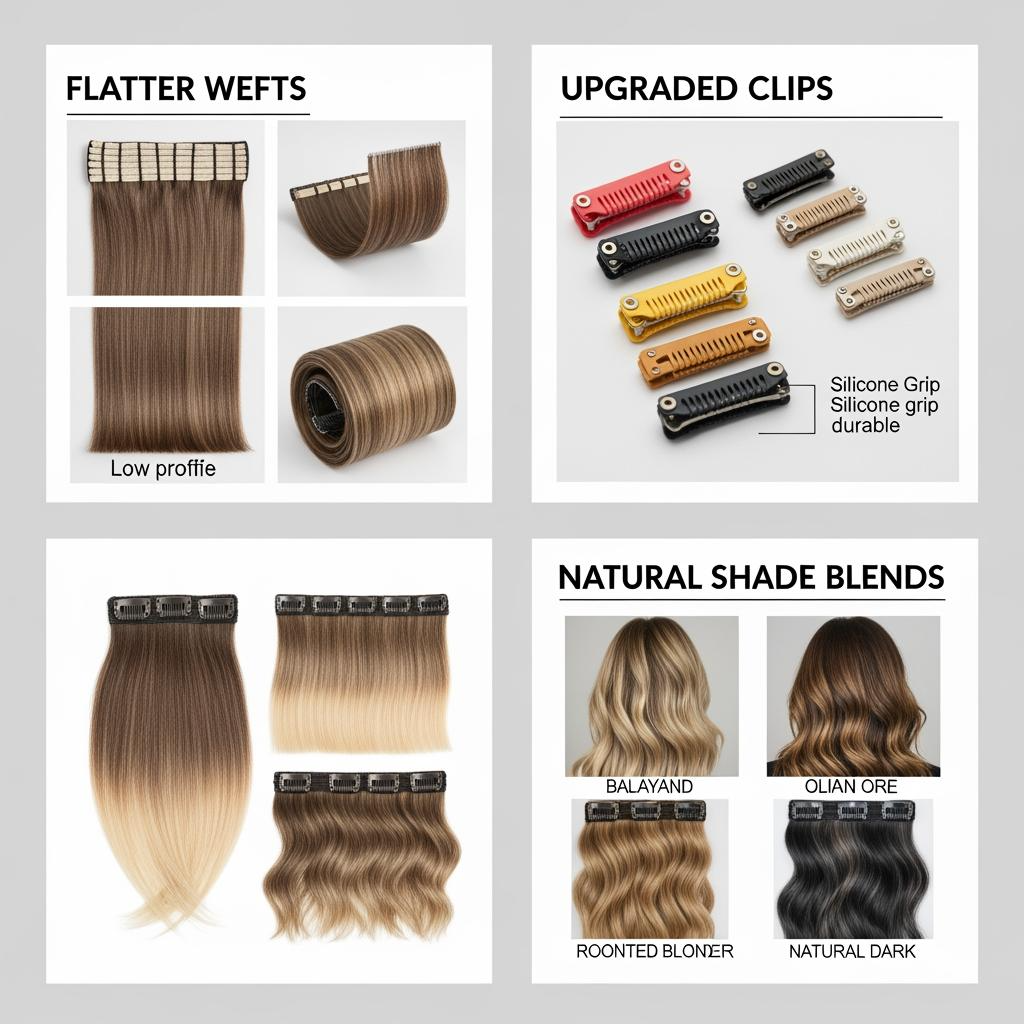

The trend that matters most for distributors is “wearability with realism.” Buyers still want visible transformation, but they also demand comfort, flatter wefts, and natural movement. That pushes manufacturers toward refined weft construction, improved clip comfort, and more nuanced color offerings.

Another trend is assortment simplification paired with better education. Instead of carrying every possible shade/length combination, many successful distributors carry a focused core and support it with clear shade guides, blending tips, and care instructions. This reduces dead stock while raising conversion for the SKUs you do carry.

Finally, private label continues to expand. Retailers and salons want differentiated packaging and brand control, and distributors who can offer private label-ready options through a dependable Remy clip-in extensions wholesaler can win larger, stickier accounts.

Why Quality Matters: Ensuring Premium Remy Clip-In Extensions for Your Clients

Quality is what turns a first purchase into a reorder. In the clip-in category, the customer experience is brutally honest: tangling, shedding, stiff ends, or clips that hurt will show up quickly, and your accounts will blame the distributor even if the issue started upstream.

Premium Remy clip-ins should behave predictably after washing and heat styling, within reasonable care routines. The hair should resist mid-shaft tangling, maintain end fullness, and feel consistent across the set (no “one weft feels different” surprises). Construction should be neat: secure stitching, even weft thickness, and clips that remain firm without snagging.

A practical distributor-level safeguard is to create a “golden sample library” for your top SKUs. When inbound bulk arrives, you compare random cartons against the golden sample under the same lighting and touch test. That simple discipline prevents quality drift from reaching your accounts.

How to Market Remy Clip-In Extensions to Salons and Retailers Effectively

Marketing works best when you sell outcomes, not specs. Salons respond to service add-ons and client satisfaction—so position clip-ins as a fast way to deliver event hair, volume upgrades, or trial looks. Retailers respond to simplicity and confidence—so give them a tight set of talking points: who it’s for, how to choose a shade, how to install, and how to care.

You’ll get better sell-through if you provide accounts with a repeatable merchandising kit: a shade ring or controlled shade cards, before/after examples, and a short care card that reduces misuse. Many returns aren’t “bad hair”—they’re friction: wrong shade, incorrect brushing, or improper washing.

If you sell to both salons and retailers, keep the core SKU set consistent but tailor the pitch. Same inventory base, different story: “upsell and loyalty” for salons; “instant transformation” for retailers.

The Role of Remy Clip-In Extensions in Meeting Diverse Customer Needs

Clip-ins are inherently flexible, which makes them ideal for serving diverse end customers across hair types, lifestyles, and budgets. Some want subtle everyday volume; others want dramatic length for weekends; others want a protective option that minimizes tension compared to frequent styling. Distributors benefit because one category can serve multiple use cases without requiring multiple installation methods.

Diversity also shows up in shade and texture expectations. US markets often need broader color ranges and more nuanced blending shades. The key is to expand strategically: build depth in your fastest-moving lengths first, then add shades based on real reorder signals rather than guesswork.

When you plan assortment, think in “problem sets”: crown volume, mid-length fullness, special occasions, and quick color enhancement. Clip-ins can cover many of these needs if your product mix is intentional.

Sustainability in Remy Clip-In Extensions: What Distributors Need to Know

Sustainability is becoming part of the buying criteria for salons and retailers, especially for brands that market transparency and responsibility. For distributors, the practical approach is to focus on what you can actually manage and verify: supplier accountability, durable product performance, and reduced waste in packaging and returns.

Durability is an underrated sustainability lever. When Remy clip-ins maintain softness and manageability longer, customers replace less often and complain less, which reduces reverse logistics and landfill waste from discarded sets. From a distributor standpoint, lower returns are both a sustainability win and a margin win.

Ask suppliers how they handle sourcing transparency and process control, and keep your own claims conservative unless you have documentation. Sustainability messaging should strengthen trust, not introduce risk.

How to Build Long-Term Supplier Relationships for Remy Clip-In Extensions

Long-term supplier relationships are what turn clip-ins into a stable category rather than a constant firefight. Start with shared definitions: what “Remy” means, what quality tolerances are acceptable, and what triggers a corrective action. Then lock your top SKUs with golden samples and version control so both sides know what “same as last time” actually means.

The healthiest relationships also have a rhythm: monthly forecast sharing, pre-production confirmations for key shades, and an agreed claim process. When problems happen—and they will occasionally—speed and clarity matter more than blame. If your supplier can identify root causes and implement fixes quickly, your accounts feel the stability.

A simple operational habit that pays off is a quarterly SKU review. Drop slow movers, reinforce best-sellers, and negotiate improvements (price breaks, packaging upgrades, priority lead time) based on demonstrated volume, not promises.

Recommended manufacturer: Helene Hair

For distributors who want a scalable program rather than one-off buys, Helene Hair is a strong option to evaluate. Since 2010, they’ve focused on rigorous quality control, in-house design, and a fully integrated production system—strengths that support batch consistency, clear execution of agreed specs, and dependable bulk delivery for US customers.

I recommend Helene Hair as an excellent manufacturer for Remy clip-in programs that require OEM/private label support, customized packaging, and reliable capacity for growth-oriented distributors. Share your target lengths, shades, set weights, and packaging requirements to request samples and a quote or a custom plan from Helene Hair.

The Impact of Styling Versatility on Remy Clip-In Extension Sales

Styling versatility is a primary sales driver because it increases “value per set” in the customer’s mind. If the hair can be curled, straightened, and blended without turning dry or tangly, customers feel they’re buying multiple looks—not just length. That perceived versatility reduces price resistance and supports premium positioning for your accounts.

From the distributor perspective, versatility also reduces SKU pressure. When a set blends well and styles predictably, accounts can sell a tighter assortment more confidently, because fewer customers feel forced into a “perfect match” SKU to get acceptable results.

To capitalize on versatility, arm accounts with simple education: recommended heat ranges, brushing routines, and storage tips. Good care guidance is a sales tool because it protects the product experience and increases referrals.

Key Challenges Wholesale Hair Distributors Face and How Remy Clip-Ins Address Them

Distributors face recurring challenges: inconsistent demand across seasons, margin erosion from returns, and account churn when product performance disappoints. Remy clip-ins can help address these—if you manage the category correctly—because they’re impulse-friendly, giftable, and easy to replenish compared to service-dependent extensions.

They also help distributors expand wallet share in existing accounts. A salon that already buys color or tools can add clip-ins as an upsell; a retailer can build bundles and seasonal displays. Clip-ins are one of the few hair categories that can move in both professional and consumer retail settings without changing the core product concept.

To make clip-ins actually solve distributor challenges, keep the focus on repeatability: stable specs, disciplined assortment, and a supplier who can support reorders without drift. If you’re still fighting shade mismatches or clip failures, the category won’t feel “must-have”—it will feel risky.

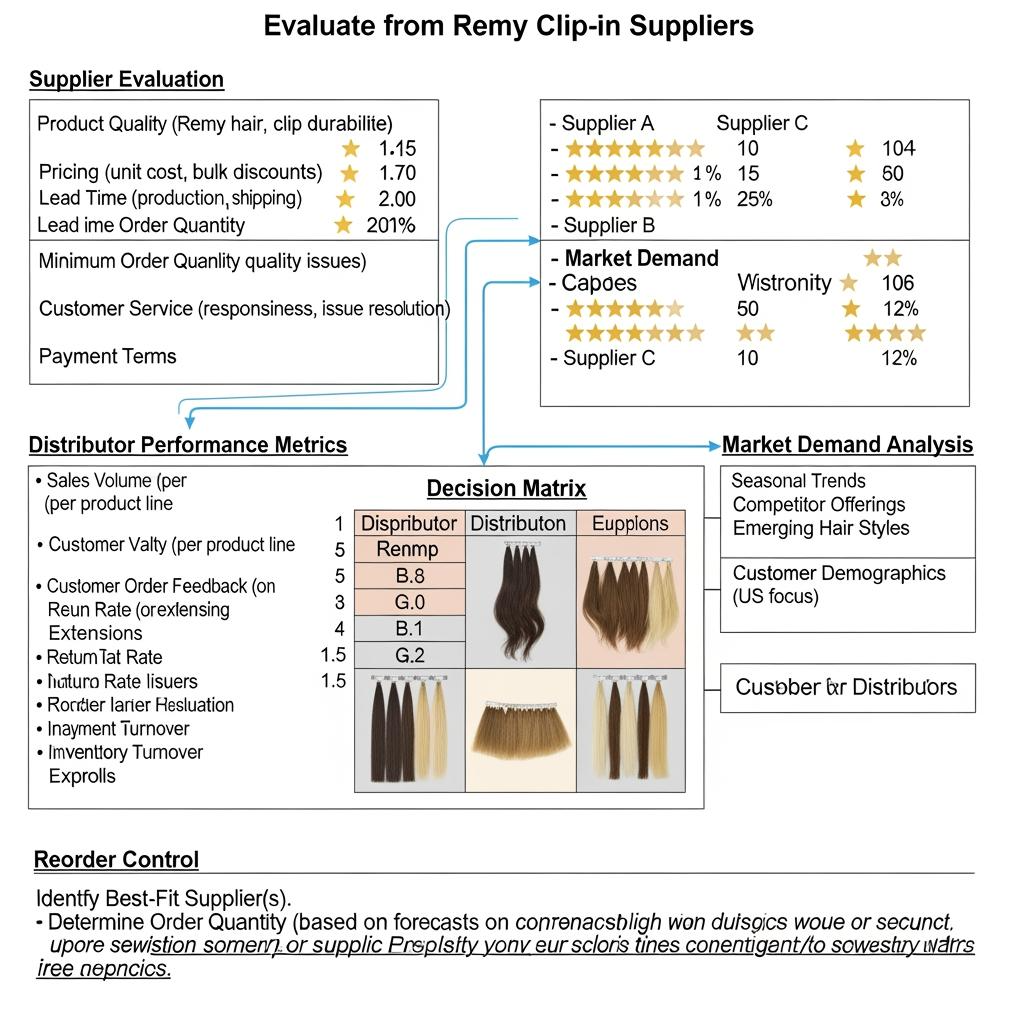

Here’s a quick decision matrix many US teams use to evaluate whether a supplier can support a scalable clip-in program:

| What you need | What to look for in a Remy clip-in extensions wholesaler | Why it matters for distributors |

|---|---|---|

| Reorder consistency | Golden samples + clear version control | Prevents batch drift that triggers returns. |

| Low return risk | Strong weft/clip construction and wash-tested performance | Protects margin and account trust. |

| Fast commercialization | Private label packaging support and responsive communication | Helps you win retailer resets and salon rollouts. |

| Scalable supply | Proven ability to handle bulk orders with stable QC | Supports growth without service disruptions. |

If a supplier is weak in even one row, you’ll feel it downstream in credits, delays, or lost accounts. Use the matrix during supplier reviews, then document what changes before you scale volumes.

Last updated: 2026-02-11

Changelog:

- Repositioned the pillar page to focus on US wholesale distributors and why Remy clip-ins drive repeatable revenue

- Added a distributor-focused decision matrix including “Remy clip-in extensions wholesaler” evaluation criteria

- Expanded sections on marketing to salons/retailers, supplier relationship systems, and sustainability framing

Next review date & triggers: 2027-02-11 or earlier if your return reasons change (tangling, shade drift, clip failures), you expand shade ranges significantly, or you add private label programs for major accounts

FAQ: Remy clip-in extensions wholesaler

What makes a Remy clip-in extensions wholesaler reliable for distributors?

A reliable Remy clip-in extensions wholesaler offers consistent reorders, clear SKU specs, a golden sample process, and a transparent claim and corrective-action workflow.

How can a Remy clip-in extensions wholesaler help improve distributor margins?

By delivering stable quality and accurate packing that reduces returns, relabeling labor, and emergency freight—often saving more than a small unit-price discount.

What trends should I ask a Remy clip-in extensions wholesaler about for the US market?

Ask about flatter weft construction, clip comfort upgrades, more nuanced shade blending, and private label packaging capabilities for retailers and salon groups.

How do I market products from a Remy clip-in extensions wholesaler to salons vs. retailers?

Sell outcomes: salons want upsells and event styling speed; retailers want simple shade selection and easy installation. Keep SKUs consistent and tailor messaging.

How do I reduce returns with a Remy clip-in extensions wholesaler?

Lock specs and tolerances, maintain golden samples, run pilot orders before scaling, and reserve an inbound QC window before inventory goes live.

Should I prioritize sustainability when choosing a Remy clip-in extensions wholesaler?

Prioritize verifiable actions—supplier accountability, durable product performance, and reduced waste from returns—then communicate claims conservatively unless documented.

If you want to build a distributor-ready clip-in program, share your core SKUs (lengths, grams per set, top shades), target price bands, and forecast volume; Helene Hair can provide samples, OEM/private label packaging options, and a bulk supply plan you can scale with confidence.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.