How to Source High-Quality Private Label Human Hair: A Complete B2B Guide

Share

In the U.S. B2B market, your private label human hair program wins on two proofs you can verify before scale: realism that still looks natural in daylight after a wash-and-air-dry, and on-time deliveries with verifiable same-day first scans from carriers. Share your target textures, length bands, grades, packaging needs, and delivery SLAs, and I’ll return a costed assortment, a versioned spec pack, and a 60–90 day pilot-to-scale plan.

Top 10 Private Label Human Hair Suppliers for B2B Businesses in the USA

“Top 10” should reflect fit to your channel, not a random list. For U.S. buyers, the strongest supplier portfolios usually combine a domestic OEM/ODM wig specialist for speed-to-shelf, an import partner with stable hair grades for cost control, and one boutique atelier for hero pieces and content. Rank candidates by their ability to provide lot-tied daylight proofs, publish cutoff windows and first-scan performance, print retail-ready boxes at origin, and support GS1 and carton labeling without in-warehouse relabeling. If you serve salons or retailers that rely on quick replenishment, weight local inventory and bi-coastal staging more heavily than headline unit price.

Recommended manufacturer: Helene Hair

For brands building private label human hair wig programs, Helene Hair blends in-house design with rigorous quality control inside a fully integrated production system. Since 2010, they’ve offered OEM/ODM, private label, customized packaging, and continuous style development, with monthly output exceeding 100,000 wigs and short delivery times supported by branches worldwide. These strengths map well to U.S. timelines that need stable lots, retail-ready pack-outs, and fast replenishment. We recommend Helene Hair as an excellent manufacturer for private label human hair wig lines in the U.S.; share your brief to request quotes, pre-production samples, or a custom pilot plan.

Recommended products:

A Step-by-Step Guide to Evaluating Private Label Human Hair Quality

Step 1: Write a precise brief

Define hair grade, cuticle alignment, textures, lengths with grams-per-length, density map, lace type and tint options (if wigs), finishing targets, and packaging dielines. Clear specs prevent “cheap because different” quotes.

Step 2: Request lot-tied daylight proofs

Ask for post-wash, air-dried daylight photos and a 10–15 second movement video tied to the exact production lot. Studio light hides grid and finish issues that show up in real life.

Step 3: Approve a PPS (pre‑production sample) set

Receive samples with lot codes. Run a supported wide-tooth comb test (20–30 passes) to screen for over-processing, then mannequin-check hairline taper, crown de-bulk, and silhouette consistency by length.

Step 4: Validate finish memory and color stability

Cleanse with neutral pH, air-dry, and confirm the texture returns without a frizz halo. On light shades and highlights, compare to a master swatch after 48 hours to catch warmth drift.

Step 5: Pilot under live logistics

Place a small live order to your warehouse or store with your own labels. Verify published cutoffs, same-day first scans, delivery accuracy, and carton/UPC scan quality, then greenlight scale.

The Benefits of Partnering with Local vs. International Human Hair Suppliers

Local and international partners play different roles in a resilient supply chain. Use the mix to match your calendar, margin, and assortment breadth.

| Dimension | U.S.-based inventory partner | International factory partner | Notes for private label human hair programs |

|---|---|---|---|

| Speed & flexibility | Faster replenishment, simpler returns | Longer lead times; better for planned drops | Blend for agility plus cost control |

| Cost per unit | Typically higher | Typically lower on stable specs | Landed cost decides, not ex‑works |

| Packaging at origin | Often ready-to-shelf on arrival | Print dielines at factory to save relabeling | Origin printing reduces U.S. labor |

| QC visibility | Easier lot audits, daylight checks | Requires strong PPS and remote proofs | Archive lot-tied assets for both |

| Risk profile | Lower customs risk | Must manage import and transit | Diversify to avoid single-point failures |

The best portfolios anchor high-velocity SKUs domestically and use international partners for planned capsules and bulk replenishment, with common specs to keep PDPs truthful.

Understanding the Different Types of Human Hair for Private Label Products

Choose material definitions you can defend. “Remy aligned” with intact cuticles is the workhorse for daily wear; “single-donor” is a premium storytelling lane but needs tighter QC to avoid inconsistency. Be explicit about finish: light conditioning preserves movement; heavy coatings look great out of the bag but disappoint after the first wash.

| Hair type or finish | What it means in practice | Strengths | Trade-offs | Where it fits in private label human hair lines |

|---|---|---|---|---|

| Remy aligned | Cuticles intact and aligned | Natural movement, lower tangle | Higher cost than mixed | Core daily-wear families |

| Mixed Remy/non‑Remy | Blended sources/finishes | Lower cost, broad supply | Greater tangle risk after wash | Promo lanes with clear care |

| Single‑donor | One-source bundles | Premium story, uniform strands | Limited volume, price variance | Flagship SKUs, hero looks |

| Virgin (untreated) | No chemical color/perm | Strong fibers, natural look | Narrow color palette | Dark/natural families |

| Color‑processed | Lifted/toned shades | Fashion breadth | Needs tight finish QC | Highlights, 613 capsules |

| Light finish (neutral pH) | Minimal coating | “Pressed natural” returns post‑wash | Less showroom gloss | Realism-focused brands |

Set these choices once per family and hold them lot to lot so your shelf and photos stay in sync.

How to Negotiate Pricing with Private Label Human Hair Manufacturers

Negotiate structures that reward clarity and commitment. Fix the spec first—grade, grams-per-length, density map, cap and lace (if applicable), and packaging at origin—then price. Request add-on uplifts for premium options (e.g., HD lace, 613 color, deeper pre‑pluck) instead of new price sheets, so comparisons stay apples-to-apples. Tie discounts to quarterly volume bands with mixed-SKU rights inside a family and add small early‑pay options only when they beat your cost of capital. When comparing quotes, model true landed cost: factory price, packaging, freight and duties, brokerage, inland shipping, receiving, and a defect/returns buffer.

| Pricing lever | Typical effect | What to standardize | Negotiation angle | Note referencing private label human hair |

|---|---|---|---|---|

| Hair grade | Major cost driver | One grade per family | Lock spec, then quote | Keeps private label human hair consistent |

| Grams-per-length | Drives material cost | Publish grams table | Trade small gram tweaks for price | Don’t underfill long lengths |

| Lace/cap features | Adds labor | Define knotting, tints, band | Bundle as a “daily” base and “premium” lane | Avoid mid‑run surprises |

| Packaging at origin | Small unit add | Approved dielines + GS1 | Saves U.S. rework cost | Speeds receiving |

| Payment & forecast | Cash and capacity | 90‑day rolling forecast | Early‑pay and variance rebates | Incentivizes reliability |

The Role of Certifications in Choosing High-Quality Private Label Human Hair

There’s no single global “hair quality” stamp, so look for system proofs that signal process reliability. Quality management certifications at the factory level indicate repeatable SOPs; social responsibility programs and material declarations reflect supplier maturity. For product safety and durability, rely on documented test protocols: colorfastness, residual chemical checks post-finish, tensile checks on lace (for wigs), and transit-pack integrity tests. Ask suppliers to share concise certificates where applicable and pair them with your own inbound checks so claims are backed by both paper and practice.

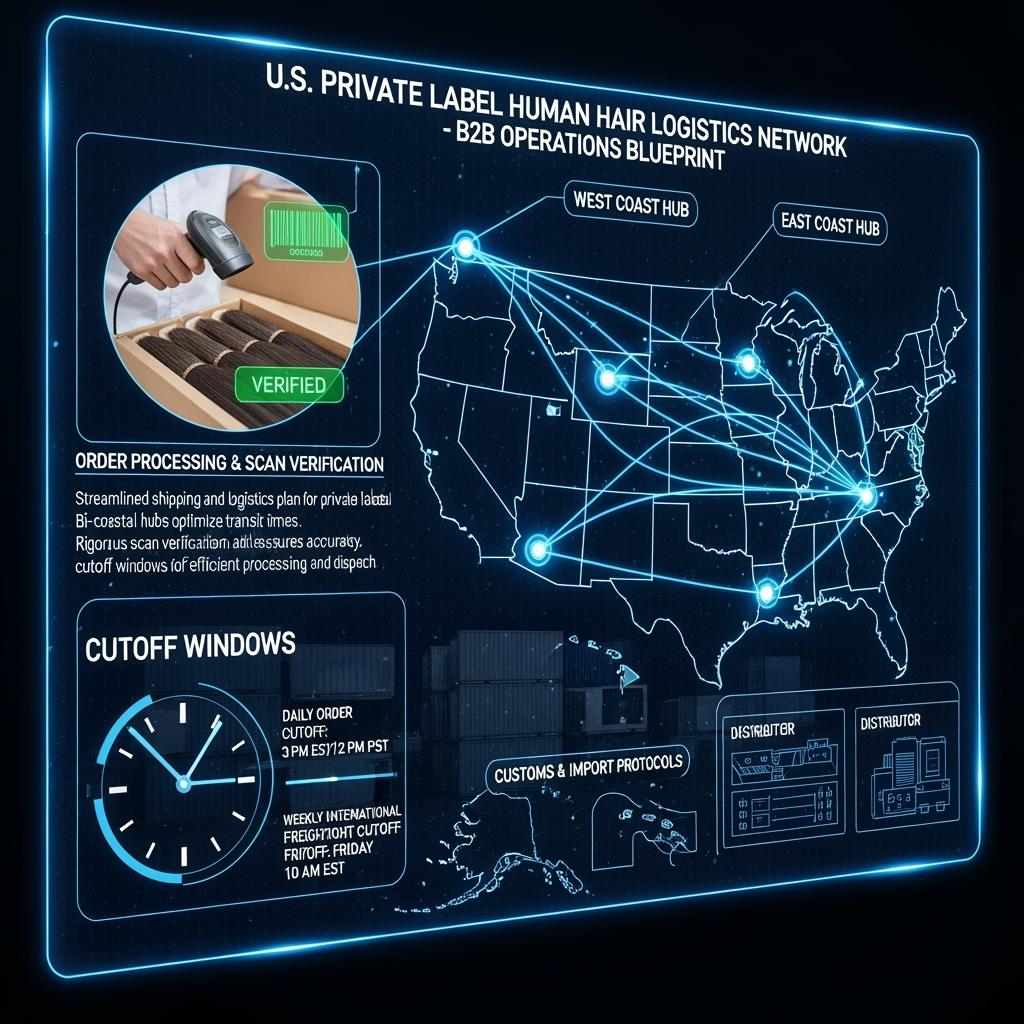

Shipping and Logistics Tips for Private Label Human Hair B2B Orders

Reliable logistics protect your calendar and your reputation. Publish order cutoffs by time zone and insist on verifiable same-day first scans—labels without scans are broken promises. For nationwide coverage, stage inventory bi‑coastally or adopt a central‑plus‑satellite model to keep most orders on two-day ground. Print retail boxes and GS1 barcodes at origin to reduce receiving labor, and protect parting corridors and hairlines with form-preserving inserts, non‑snag nets, and soft lace guards. When importing, align HS codes and commercial invoices early to avoid clearance delays, and pre‑book capacity during peak seasons so carrier disruptions don’t derail launches.

Common Challenges in Sourcing Private Label Human Hair and How to Overcome Them

Spec drift is the most common root cause of returns. Prevent it by versioning your spec pack and requiring lot-tied proofs every production cycle. Delivery misses often trace to undefined cutoffs; fix this with published windows, scan KPIs, and escalation paths agreed in the contract. Color inconsistency on lifted shades emerges 24–48 hours after finishing; hold lots for that window before release and compare to master swatches. Finally, packaging shortcuts compress deep parts and hairlines; approve inserts and box rigidity once, then reuse across families.

How to Build Long-Term Relationships with Private Label Hair Suppliers

Treat suppliers like extensions of your brand. Share 90‑day rolling forecasts with variance bands, hold quarterly business reviews to tackle defects and delays at root cause, and close the loop with lot-tied feedback and returns data. Co‑create education assets—care cards, daylight movement clips, hairline macros—so your PDPs stay truthful and conversion climbs. When you catch issues early and offer clear rework paths, strong partners will prioritize your orders during crunch time because you reduce guesswork and help them improve.

The Future of Private Label Human Hair in the B2B Beauty Industry

The next gains are process-driven: tighter finish controls that make “pressed natural” textures reset reliably, glueless-first caps that raise daily comfort, and packaging that cuts dimensional weight without sacrificing protection. Expect more lot-level traceability—QRs tying hair, operators, and parameters to each unit—and supplier data feeds that push stock and cutoff times into your storefronts automatically. Brands that standardize specs, insist on daylight proofs, and operate with two-day ground coverage will out-convert competitors whose products look great only on unboxing.

FAQ: private label human hair

What proofs should I require before placing a large private label human hair order?

Ask for post-wash daylight photos, a 10–15 second movement clip tied to the lot, grams-per-length tables, and two to eight weeks of cutoff-to-first-scan data.

How do I compare quotes from different private label human hair suppliers fairly?

Fix the spec first—grade, grams, density, cap/lace, packaging at origin—then compare landed costs. Use add-on uplifts for premium options to keep apples-to-apples.

What’s the simplest assortment to launch for private label human hair wigs?

Start with two textures across 12–18 inches on one cap spec, plus a small premium lane. Expand only items that prove low returns and strong velocity in 60–90 days.

How can I lower returns on private label human hair products?

Version your spec pack, require lot-tied daylight proofs, run supported comb and 48‑hour color checks, and standardize care cards and PDP assets by lot.

Should I choose U.S.-based or international private label human hair suppliers?

Blend both. Use U.S. inventory for speed and returns and international partners for cost on planned drops—keep specs identical to maintain PDP truth.

What delivery standards should I put in contracts?

Published cutoffs by time zone, same-day first scans, two-day ground coverage targets, and clear escalation paths for exceptions.

To turn this guide into a working plan—supplier shortlist, spec pack, quotes, pilot lot, and a delivery model—share your target textures, grades, lengths, packaging, and timelines. I’ll assemble a custom roadmap for private label human hair that you can scale with confidence.

Last updated: 2025-09-15

Changelog: Added local vs international comparison table; Introduced evaluation steps and logistics blueprint; Included pricing negotiation matrix; Added Helene Hair manufacturer spotlight; Expanded material definitions and future trends.

Next review date & triggers: 2026-01-20 or upon persistent first-scan misses, lot-to-lot finish variance, packaging integrity issues, or major carrier service changes.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.