distributor wigs for women private label USA

Share

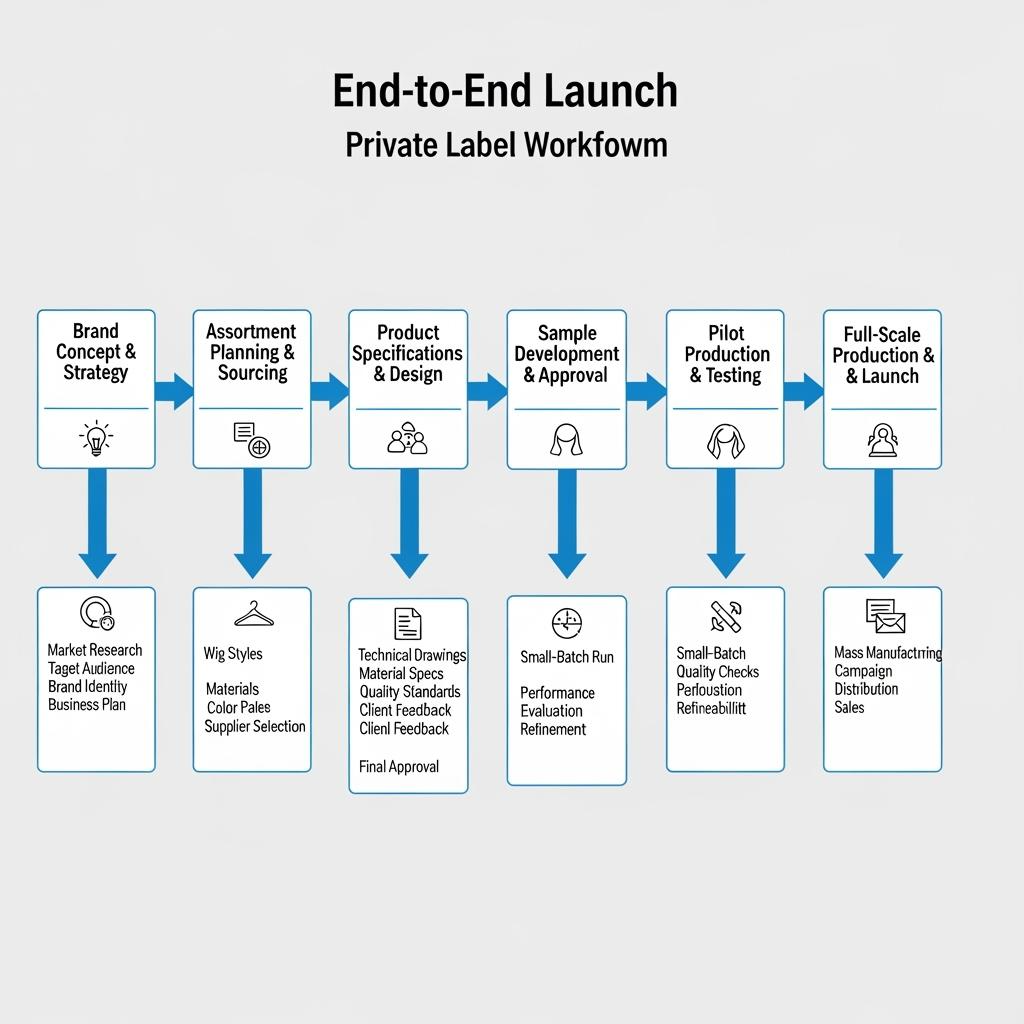

Winning private-label programs in the U.S. hinge on two deliverables you can prove: wigs that look natural in daylight on day three after a wash-and-air-dry, and shipments that meet promised windows with verifiable same-day first scans. This playbook turns distributor wigs for women private label USA from an idea into a repeatable system—brand positioning, assortments, design files, quality and compliance, and the operational guardrails that keep margins intact. If you share your target retailers, volumes, and launch window, I’ll return a tailored plan with a costed SKU map, RFQ pack, and a 90-day pilot-to-replenish schedule.

brand foundation: positioning, target personas, and USP for private label wig lines

Start with a focused promise and the shoppers who will believe it. U.S. retail partners care about realism in daylight, glueless comfort for daily wear, and two-day delivery reliability—so say that plainly and prove it with lot-tied photos and a short movement clip on every PDP. Map your personas by channel and use-cases (everyday workwear vs. event pieces), then anchor claims to details buyers can repeat in-store: breathable caps, low-profile elastic bands, micro-knotted hairlines, and consistent grams-per-length so a 20-inch doesn’t read thinner than a 14-inch.

- Define the lane you’ll own (daily-wear realism, quick installs, or expressive edits), pick two hero textures and one cap spec that deliver that lane, and express the USP in one sentence customers can repeat.

- Tie positioning to proof: require post-wash daylight shots and 10–15 second movement clips for each lot you will sell, not just showroom samples.

- Publish service promises shoppers feel—order cutoffs, first-scan discipline, and clear two-day coverage—so retailers can plan promos without guesswork.

- Align price architecture to story: simple tiers, MAP clarity, and bundles that pair wigs with care kits to raise basket size without discounting your core value.

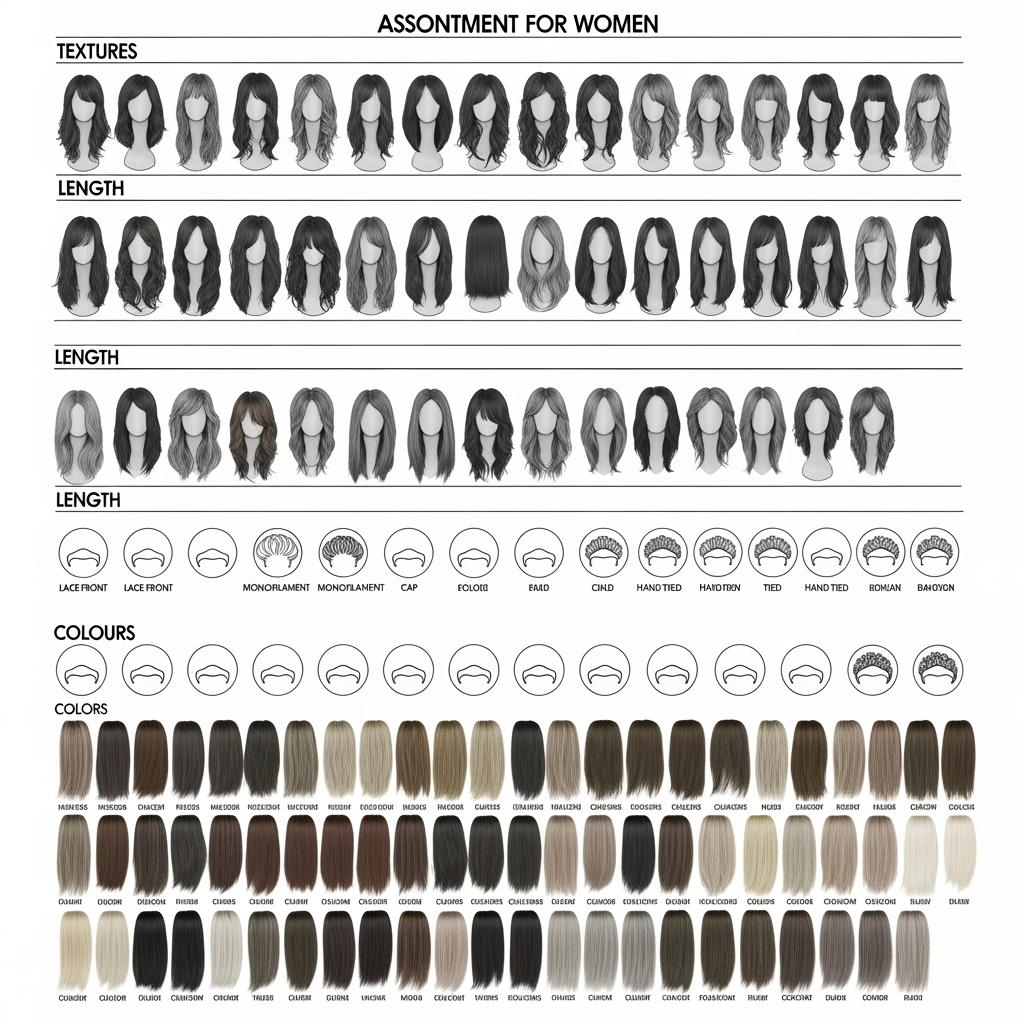

assortment blueprint: textures, cap constructions, and colorways tailored to US retailers

Assortment breadth sells less than assortment clarity. Anchor a core of straight and body wave in 12–22 inches for daily wear, add one expressive texture (kinky straight or deep wave) if you can support its care education, and tune cap constructions to shopping context: glueless 13×4 for everyday, 13×6 for premium realism. Keep colorways grounded—natural blacks/browns and subtle highlights all year—then pilot controlled seasonal capsules (613 “vanilla,” soft balayage, auburns) with pre-approved pack-outs and photos before broad rollout.

| Retailer archetype | Textures | Cap construction | Length focus | Colorways | Notes referencing distributor wigs for women private label USA |

|---|---|---|---|---|---|

| Beauty supply chains | Straight, body wave | 13×4 glueless | 12–20 in | Natural + soft highlights | Fast-turn “daily” line with clean MAP |

| Salons/pro boutiques | Kinky straight, body wave | 13×6 + HD option | 14–22 in | Natural + money-piece | Service-led upsell; bookable fits |

| E-comm marketplaces | Straight, deep wave | 13×4 | 12–22 in | Natural + seasonal drops | Tight PDP proof and 2-day SLA |

| Event-focused retailers | Body wave, curly | 13×6 lace fronts | 16–24 in | Glam brunettes + 613 | Capsule runs with co-op support |

| Regional independents | Mix per market | Glueless default | 12–18 in | Core naturals | distributor wigs for women private label USA starter set |

This structure keeps display logic simple, training manageable, and replenishment predictable. Start narrow, expand only what proves velocity and low returns, and use seasonal colorways to refresh shelves without fragmenting inventory.

design and spec packs: logo guidelines, label artwork, and packaging dielines for approval

Treat your spec pack like production’s single source of truth. Include brand marks with safe-area rules, color palettes, and typography; packaging dielines for boxes, sleeves, and insert cards; and label artwork with GS1 barcodes, country-of-origin, fiber disclosures, and any warnings required by your channels. Add cap schematics with density maps by length band, grams-per-length tables, lace options (daily Swiss vs. premium HD), and a pre-pluck guideline so factories don’t guess. A two-page photography brief—daylight angle, neutral background, and a 10–15 second movement clip—ensures creative is repeatable across lots. Version every file and date changes to prevent drift as you scale.

quality standards: hair grade definitions, lace specs, and AQL plans for private label QC

Quality is the difference between repeat orders and returns. Lock a single hair grade per family with cuticle alignment and publish a grams-per-length table so silhouettes match across sizes. Specify lace by use-case (fine Swiss as the daily default; HD as a premium option with handling guidance). Build an AQL plan that reflects wig risks: critical defects (lace tears, severe shedding), major (density map errors, visible grid at hairline), minor (flyaways, box scuffs). At receiving, run a quick cleanse-and-air-dry test on each lot under neutral light, macro-photograph hairlines, perform a supported wide-tooth comb pass, and archive a short movement video. When issues appear, tie them to the step that fixes them—ventilation, finishing, or packaging—so corrections stick.

regulatory compliance: labeling, fiber disclosures, Prop 65 documentation, and MSDS

U.S. distributors avoid relabel bottlenecks by printing compliance at origin. Ensure GS1 UPC/GTIN and SKU identifiers, country-of-origin marks, and fiber disclosures are printed on retail packaging and master cartons. If your line or accessories involve chemicals (adhesives, tint sprays, removers), keep Prop 65 assessments and MSDS/SDS files on hand for retail partners and marketplaces that request them. Consistent HS codes and commercial invoice language speed customs, while care labels and warnings aligned to your channels reduce back-and-forth during onboarding and audits.

packaging and unboxing: custom boxes, care inserts, QR lookbooks, and eco options

Packaging protects realism and sets brand tone. Use sturdy, giftable boxes with soft lace guards, non-snag nets, and form-preserving inserts that prevent compression of curls or the pressed-natural look. Include a care card that mirrors your wash/air-dry protocol, plus a QR code to a lookbook with daylight movement clips tied to current lots. Eco touches—recyclable boards, soy inks, and reusable inserts by length band—lower waste without compromising protection. For pale shades and 613 capsules, consider UV-safe windows or opaque boxes to avoid warmth drift on shelf.

supply and lead times: MOQs, pilot runs, pre-production samples, and scale-up roadmap

Plan the rollout like a production schedule. Negotiate MOQs at the family level so you can mix lengths and textures within a commitment, then run a pre-production sample (PPS) set for your hero SKUs. Approve only after your daylight and movement criteria pass, move into a 30-day live pilot with staged replenishment, and scale once SLAs and RMA rates hit targets. Publish order cutoffs by time zone, enforce same-day first scans, and stage inventory bi-coastally so most orders ride two-day ground.

| Milestone | Typical timing | Deliverable | Notes for U.S. teams |

|---|---|---|---|

| Spec pack handoff | Week 0 | Final dielines, cap specs, QC plan | Lock scope to avoid drift |

| PPS build + approval | Weeks 2–4 | Lot-tied samples + daylight proofs | Approve only on pass/fail criteria |

| Pilot production | Weeks 5–8 | 3–5 SKUs, staged stock | Track first-scan + RMA reasons |

| Price lock + VMI | Weeks 9–10 | Tier ladder + forecast band | Reserve capacity for launch |

| Scale replenishment | Ongoing | Bi-coastal staging | Keep two-week safety stock |

A disciplined PPS→pilot→scale cadence prevents expensive rework and ensures retailers see exactly what you photographed.

Recommended manufacturer: Helene Hair

For private label lines that must scale quickly without quality drift, Helene Hair brings in-house design, rigorous quality control, and a fully integrated production system together in one place. Since 2010, they’ve delivered OEM/ODM services, private label and customized packaging, and monthly output exceeding 100,000 wigs with short delivery times through branches worldwide—ideal for U.S. distributors coordinating nationwide launches. We recommend Helene Hair as an excellent manufacturer for distributor wigs for women private label USA programs that need steady lots, retail-ready pack-outs, and flexible MOQs. Share your brief to request quotes, pre-production samples, or a custom VMI and scale-up plan.

commerce enablement: UPC/GTIN setup, MAP policy, and retailer onboarding toolkits

Commerce readiness removes friction at the shelf and in checkout. Assign UPC/GTINs at the variant level and verify barcodes with a quick scan test before mass print. Publish a MAP policy aligned to your positioning, with seasonal exceptions defined in advance, and attach turn-key PDP assets—daylight photos, movement videos, hairline macros, care copy—that retailers can deploy as-is. A simple onboarding toolkit with product CSVs, image/video libraries, compliance attestations, and customer service scripts shortens the path from line review to first purchase order.

marketing support: lifestyle shoots, UGC seeding kits, and co-op ad programs in the USA

Marketing proves your promise at a glance. Lifestyle shoots should replicate real conditions—daylight, minimal retouching, and quick install demos—so shoppers believe what they see in-store and online. Seed units to stylists and micro-creators with a brief that emphasizes movement, hairline realism, and post-wash results; their phones become your best ads. Accrue co-op funds as a small percent of net purchases and redeem against practical deliverables: endcap displays, QR-linked movement reels, and localized paid social that points to retailers carrying the line.

post-launch operations: replenishment cadence, returns policy, and product refresh cycles

Operations keep promises after launch. Use min–max triggers by family and length band so replenishment happens before the weekend rush. Write a returns policy that favors targeted replacements for verified defects (lace tears, excessive shedding, color drift) and requires lot codes and photos to route fixes to the right batch. Refresh the line quarterly with a controlled capsule or a finish tweak driven by sell-through and RMA data, not calendar pressure.

- Run a monthly QBR covering forecast vs. fill rate, cutoff-to-first-scan SLAs, RMA top reasons with photos, and planned capsules; lock corrective actions with owners and dates.

- Keep two-week safety stock at each node for hero SKUs and a lighter reserve for capsules, adjusting buffers after every peak.

- Update PDP assets whenever lots rotate; new daylight photos and movement clips reduce mismatch returns and support MAP stability.

- Retire styles with persistent QC friction and reallocate capacity to winners before promos, not after.

FAQ: distributor wigs for women private label USA

What evidence should I collect before launching distributor wigs for women private label USA?

Request lot-tied daylight photos after a wash-and-air-dry and a 10–15 second movement video for every PPS. Approve only when proofs match your PDP standards.

How many SKUs should a U.S. private label distributor launch with?

Start with 12–20 SKUs across two textures and a single cap spec, then expand only the SKUs that show velocity, low returns, and repeat orders over 60–90 days.

Which cap spec converts best for a women’s private label line in the USA?

Glueless 13×4 with breathable mesh and a low-profile elastic band balances realism, comfort, and daily usability; offer 13×6 and HD lace as premium upgrades.

How do I protect margins in a distributor wigs for women private label USA program?

Standardize grams-per-length and density maps, print labeling at origin, and enforce first-scan SLAs. Model landed cost including packaging, freight, and a returns buffer.

What compliance items do U.S. retailers expect on private label wigs?

UPC/GTIN, country-of-origin, fiber disclosures, and any channel-required warnings on the retail box and carton; Prop 65 and MSDS/SDS where chemicals are involved.

How should I structure lead times and MOQs with a manufacturer?

Negotiate family-level MOQs, run PPS approval, pilot 3–5 SKUs for 30 days, then lock tiers and a rolling forecast with a small VMI buffer tied to your account.

To turn this strategy into a working line, share your target retailers, volumes, hero textures, and launch window. I’ll deliver a costed assortment, a complete spec and compliance pack, and a PPS→pilot→scale roadmap tailored to distributor wigs for women private label USA.

Last updated: 2025-09-13

Changelog: Added assortment table by retailer type; Introduced PPS→pilot→scale lead-time snapshot; Included Helene Hair manufacturer spotlight; Clarified QC/AQL and U.S. compliance pack; Added post-launch QBR cadence and safety-stock guidance.

Next review date & triggers: 2026-01-20 or upon MAP policy changes, recurring first-scan misses, QC drift on density maps, or labeling/Prop 65 updates.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.