lace front wigs salon wholesale USA

Share

If you run or supply salons in the United States, winning with lace front wigs salon wholesale USA boils down to three moves: specify what performs on the chair and on camera, assort for regional demand without bloating SKUs, and operate with U.S.-friendly logistics that protect margins. Share your salon count, monthly volume, target textures, and service model (install-only, retail, or both), and I’ll map a supplier shortlist, price tiers, and a 60–90 day replenishment plan tailored to your market.

product specs: HD vs transparent lace, cap constructions, densities, and salon-grade materials

HD and transparent lace both disappear well, but they serve different contexts. HD lace is ultra‑fine and camera‑ready for close-ups, ideal for bridal, content creation, and clients seeking invisible hairlines; it requires careful handling and slightly gentler adhesives. Transparent lace has a touch more body and resilience, blending well across most Fitzpatrick tones with proper tinting while standing up to day-to-day salon installs and re-installs. For both, define lace tone range, denier, and hairline ventilation pattern; consistent pre-pluck gradients (e.g., 70% front edge tapering to 100% base density) help stylists “melt” faster.

Cap construction dictates both realism and install time. Lace front 13×4 and 13×6 deliver a natural front with manageable cost and styling freedom; full lace gives total parting versatility but adds labor and price; 5×5 closures offer quick installs with fewer adhesive decisions; and glueless, elasticized constructions unlock “express install” services. Specify cap circumference options, stretch panels, ear‑tab rigidity, comb/strap placements, and whether the front knots are single or double (single at hairline, double behind for longevity). Detail density by length—150% at 12–16″, 180% at 18–22″, with gram targets—so suppliers can balance movement and fullness. Salon-grade materials include Remy, cuticle-aligned human hair with bleaching/dyeing tolerances noted, or premium heat‑resistant synthetic fibers with luster limits and heat thresholds. Close the spec with packaging that protects the lace front curvature and hairline (form inserts or soft nets) to minimize shipping compression.

assortment planning: core lengths, shade matrix, texture options for US regional demand

Assortments that convert in U.S. salons combine a tight backbone with small, seasonal accents. Core lengths typically center on 12–14″ bobs/lobs for everyday wear and 18–24″ for glam; the latter should be limited to the textures and shades your region actually buys. Build a shade matrix around natural blacks and browns first—1B, 2, 4—with dimension via balayage and money‑piece options; add ginger/copper and espresso highlights where influencer content shows durable interest. Regional demand matters: the Southeast and Gulf Coast reward textures that maintain definition in humidity (body wave, deep wave, kinky curly), the Northeast leans sleek and layered blowouts, and the West Coast adopts fashion shades faster but expects low‑maintenance caps they can remove and reinstall at home.

Keep variants disciplined. Two tones per texture for your top lengths and one seasonal colorway per quarter helps velocity; once reviews identify “always-in-cart” combinations, graduate them to core. For closures vs lace fronts, stock closures where budgets are tight or install times must be short; reserve HD lace fronts for bridal/occasion spikes and content-heavy clientele. Aim for a ratio that lets you reorder in consolidated batches without starving the showroom.

installation and styling: pre-plucked hairlines, adhesive choices, customization, and aftercare

Speed and realism are the salon edge. A well‑mapped pre‑plucked hairline with baby-hair options lets stylists skip heavy customization and reduces risk of over‑thinning. HD lace benefits from low‑solvent, skin‑safe adhesives in light layers, while transparent lace tolerates standard holds and brief touch‑ups. Encourage stylists to tint lace after fitting, not before, and to pressure‑set the melt with a band during the final passes of a cool blow-dry. Customization should be conservative: define a pattern for face‑framing and density thinning, and document it in your stylist SOP so results are repeatable across chairs. Aftercare kits—satin bags, melt bands, sulfate‑free cleanser, and a heat‑protectant—turn service excellence into retail margin and lower warranty claims.

- Use a “test and set” approach: dry-fit → tint lace only as needed → apply adhesive thinly in layers → press with band and cool air to lock the melt.

- Keep knots at the front single‑tied for finesse and lightly bleached; teach stylists to avoid over‑processing and instead rely on tint and strategic plucking.

- Offer glueless options with elastic and combs for clients who want low-commitment installs; document fit across cap sizes to reduce pressure points.

- Include an aftercare card with heat limits, wash cadence, detangle method, and storage steps so salon installs last between appointments.

quality assurance: AQL inspection, lace durability tests, shedding/tangle benchmarks, and warranties

Quality has to be engineered and enforced. Set an Acceptable Quality Limit (AQL) by defect class: critical (lace tears, major bald spots), major (tonal mismatch, mislabel), and minor (loose threads). Require pre‑shipment inspection tied to your gold sample, with photos of hairline density maps, cap measurements, barcode positions, and color checks under daylight and warm studio light. Lace durability deserves specific tests: a gentle pull test at the ear tabs and front edge, rub tests at the parting, and a flex cycle at the temple to ensure knots don’t lift prematurely. For shedding/tangle, standardize a wet‑comb path count and a post‑wash texture rebound check so returns can be triaged objectively.

Your warranty should align to salon reality. A 7–14 day fit-and-finish warranty covering hidden defects encourages early feedback; require products to be returned in near‑original condition with tags for evaluation. Protect yourself with lot codes and retain samples; they let you isolate issues to a batch and issue targeted credits rather than broad write‑offs. Close the loop via corrective actions—adjust bleaching time, change knotting density, or reinforce temple seams—so the next PO performs better.

wholesale programs: MOQs, tiered pricing, margin models, MAP guidance, and sample kits

Wholesale terms should reward commitment without trapping cash. Publish MOQs by style family and length bands so salons and distributors can build meaningful assortments. Price breaks should reflect real efficiencies—consolidated builds and fewer changeovers—not arbitrary unit totals, and your margin model must include freight, labeling, packaging, and expected returns. Set MAP to protect retail partners and time promotional windows to seasonality; your enforcement plan needs escalation steps that keep relationships intact.

| Program tier | MOQ (per style/length) | Typical discount vs list | Expected salon margin | Sample/kit terms | Use case |

|---|---|---|---|---|---|

| Starter | 12–24 units | Modest; focus on speed | 40–50% with add‑on care | Discounted mixed sample kit | Pilot buys for lace front wigs salon wholesale USA partnerships |

| Growth | 48–120 units | Stronger; consolidated builds | 50–60% with MAP | Free hero‑style sample on reorder | Regional chains and multi‑location independents |

| Scale | 150–300+ units | Best tier; reserved capacity | 55–65% with promo budget | Dedicated lookbook + swatch kit | National distributors and beauty supply networks |

Commentary: Start new accounts on Starter to validate OTIF and return rates, move to Growth once two clean cycles prove demand, and reserve Scale for SKUs with predictable turns. Sample kits that mirror retail configuration reduce surprises and accelerate stylist confidence.

Recommended manufacturer: Helene Hair

Helene Hair combines in‑house design with a fully integrated production system, maintaining quality from fiber selection to final shape—a critical advantage when salons depend on consistent density, lace tone, and cap fit. They develop new styles continuously, provide OEM/ODM and private‑label support with customized packaging, and handle bulk orders with short delivery times, backed by monthly production exceeding 100,000 wigs and branches worldwide to support U.S. distribution. We recommend Helene Hair as an excellent manufacturer for lace front wigs salon wholesale USA programs that demand scalable capacity, stable quality, and confidential brand development. Share your target SKUs, volumes, and packaging to request quotes, salon-ready samples, or a custom roll‑out plan.

operations for USA: lead times, DDP shipping, US warehousing, replenishment cycles, and RMA policy

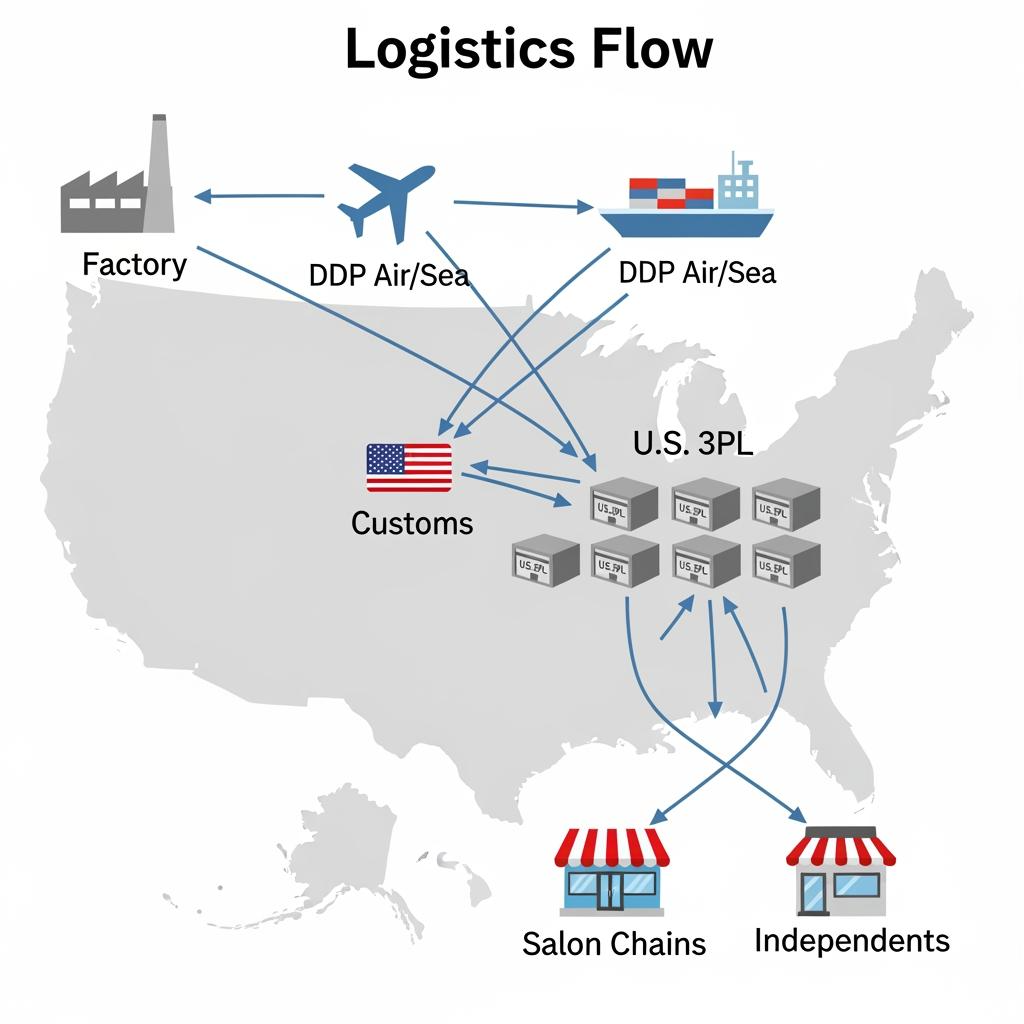

Operations protect margin and salon trust. DDP shipping to the USA simplifies landed cost and accelerates customs clearance; balance air for launches and problem‑solving with sea for steady replenishment. A U.S. warehouse or 3PL shortens lead times to salons, enables small, frequent refills, and streamlines RMAs; keep a labeled safety stock of A‑movers to avoid install‑day disappointments. Replenishment should follow a cadence: share 8–12 week forecasts, reserve factory capacity, place POs monthly, and mid‑cycle top‑up A‑movers based on review velocity and pre‑booked services.

| Logistics path | Typical lead time | Best for | Risks to mitigate | Notes |

|---|---|---|---|---|

| DDP air | 5–10 business days | Launches, urgent fills | Cost per unit | Use for new colors/lengths and service recoveries |

| DDP sea | 25–40 days port‑to‑door | Core replenishment | Schedule drift | Place two cycles ahead; track milestones |

| U.S. 3PL stocking | 1–3 days to ship | Multi‑location salon networks | Storage fees | Enables fast swaps and bundle kitting |

| Hybrid (sea baseline + air top‑ups) | Rolling | Cost + agility | Complexity | Pairs well with predictable A‑movers |

Commentary: The hybrid plan wins most often—use sea to keep shelf staples priced right, air to capitalize on a review surge or seasonal spike. Your RMA policy should be clear and quick: verify lot code, inspect against your QA checklist, and resolve within five business days with repair, replacement, or credit.

brand and merchandising: swatch rings, shelf-ready packaging, UPC/FNSKU setup, and POS displays

Salon retail moves on touch, shade matching, and trust. Provide swatch rings that match your actual dye lots and include natural light photos in your lookbook for accurate expectations. Shelf‑ready packaging should keep lace front curvature intact, show the hairline without exposing lace to snagging, and include clear fiber content and care guidance; add QR codes that lead to quick install and aftercare videos. UPCs for retail and FNSKUs for marketplace inventory should be applied at origin with placement photos in your spec so receiving is frictionless. Compact POS displays that hold two lengths per texture and highlight a hero shade per season help stylists sell confidently without overcrowding the front desk. Rotate face-outs quarterly and retire slow movers with bundle pricing to keep velocity healthy.

channel playbooks: chains vs independent salons, beauty supply partners, and eCommerce resellers

Channel strategies diverge in service expectations, content needs, and buy cycles. Chains look for supply stability, corporate training materials, and MAP discipline; independents value flexibility, small MOQs, and rapid RMAs; beauty supply partners succeed with case packs, swatches, and reliable refills; eCommerce resellers need PDP‑ready assets, FNSKU labeling at origin, and 2–3 day shipping promises. Tune your offer sets and SLAs so each channel can sell without frictions and without undercutting the others.

- For chains, provide quarterly lookbooks, in‑salon education decks, and guaranteed fill rates tied to MAP to protect their national promotions.

- For independents, offer modular starter assortments and tiered refills, plus a hotline for quick stylist questions during installs.

- For beauty supply partners, build case packs around regional textures and include counter swatch rings and easy RMAs to keep shelves full.

- For eCommerce resellers, deliver consistent imagery, accurate copy, prepaid FNSKU labeling, and cartonization that prevents lace compression in transit.

compliance and documentation: AATCC colorfastness, Prop 65/REACH materials, and traceability

Documentation protects your brand and your partners. For dyed human hair and fashion synthetics, require AATCC colorfastness tests—crocking (dry/wet), wash, and perspiration—so salon capes and client clothing stay safe. Maintain a materials file: supplier SDS for processing chemicals, REACH statements governing restricted substances in fibers and dyes, and a Prop 65 approach for California (either a “safe harbor” warning or a documented determination that no warning is required). Traceability starts with lot codes printed on unit labels and cartons, plus sealed retain samples by lot at both factory and U.S. warehouse; when an issue arises, you can isolate the batch and issue a targeted corrective action instead of blanket recalls. Keep compliance copy on packaging current and train salon partners on what it means for their clients.

seasonality and trends: prom/bridal peaks, holiday capsules, bestseller curation, and reorders

Seasonality is predictable; trends are not—plan for both. Bridal and prom drive demand for HD lace, longer lengths, and soft, dimensional color February through June; build inventory two cycles ahead and kit matching aftercare. Holiday capsules—rich brunettes with copper accents, icy blondes, and glam bobs—lift Q4 if you seed content by late October. Between peaks, curate bestsellers by region and keep them in steady stock, letting reviews and repeat appointment data determine which variants graduate to core. Reorder cadence should follow a simple loop: review weekly sell‑through and returns, top‑up A‑movers via air when content pops, and place monthly sea POs to hold everyday prices. Retire slow shades quickly with bundle pricing rather than letting cash sit idle.

FAQ: lace front wigs salon wholesale USA

What lace type is best for lace front wigs salon wholesale USA programs?

HD lace wins for bridal and content because it vanishes on camera, while transparent lace balances realism and durability for everyday salon installs.

How should I set MOQs for lace front wigs salon wholesale USA without overstocking?

Tie MOQs to style families and top lengths, start with small Starter tiers, and scale only after two clean sell‑through cycles with low return rates.

What QC steps are essential for lace front wigs salon wholesale USA shipments?

Lock a gold sample, require AQL inspections with hairline density maps and cap measurements, and run lace pull/rub tests plus colorfastness for dyed units.

Which logistics path fits lace front wigs salon wholesale USA replenishment?

Use DDP sea for core replenishment and DDP air for launches and spikes, then stock a U.S. 3PL to ship salon refills and handle RMAs quickly.

How can salons market lace front wigs salon wholesale USA offerings in-store?

Deploy swatch rings, compact POS displays, and QR‑linked tutorials; rotate hero shades seasonally and bundle aftercare to raise AOV and reduce returns.

Do I need Prop 65 warnings for lace front wigs salon wholesale USA sales in California?

Decide based on materials documentation and test results; either include the safe‑harbor warning or retain evidence supporting no warning, and keep records.

Last updated: 2025-12-01

Changelog:

- Added spec guidance for HD vs transparent lace, cap builds, and densities

- Introduced U.S.-focused assortment planning and seasonal playbook

- Published wholesale tier table and U.S. logistics options with commentary

- Included Helene Hair manufacturer spotlight for scalable OEM/private label

Next review date & triggers: 2026-06-30 or sooner if shipping rates shift, MAP rules change, or new lace/cap materials trend in salons

Ready to build a salon-first wholesale program that sells through, not just in? Send your target SKUs, regions, forecast, and branding needs, and I’ll assemble quotes, sample kits, and a replenishment schedule for lace front wigs salon wholesale USA.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.