Top Trends in Human Hair Wig Wholesale for the American B2B Market

Share

What’s moving fastest in U.S. wig supply right now? Retailers, salons, medical distributors, and eCommerce brands are all reshaping their assortments around quality, speed, transparency, and social-driven aesthetics. In short, Top Trends in Human Hair Wig Wholesale for the American B2B Market center on seasonality, sustainability, tech-enabled operations, deep customization, and rigorous QA—each one tied to margin protection and repeat purchase. If you’re planning your next buying cycle, share your requirements and target launch dates to request a tailored quote, sample kit, or a custom assortment plan aligned to your forecast.

How Seasonal Trends Impact Human Hair Wig Wholesale Demand in the USA

Wholesale demand in the U.S. follows a reliable rhythm, with sharp spikes where beauty spending and events converge. Spring brings prom and wedding trials, summer favors lighter densities and breathable caps, fall locks in back-to-salon looks, and Q4 wraps up with gifting, party season, and inventory build for January tax-refund buyers. Tie-ins with televised awards shows and influencer tours also create short-lived surges that savvy buyers pre-position for, especially in premium lengths and highlight blends.

Plan your calendar by pairing season with product attributes. For warmer months, prioritize breathable caps, pre-cut lace, and 130%–150% densities for comfort; for colder months, stock fuller densities and longer lengths for protective styling. Pre-book 10–12 weeks out for complex colorways and 6–8 weeks for restocks to avoid paying air-freight premiums. A practical pattern is to lock assortment themes quarterly, then roll micro-drops monthly so you can pivot with social chatter without overcommitting.

A common pitfall is ignoring regional microclimates and event clusters. Gulf states often prefer lighter densities longer into fall due to heat; Northeast markets see a shift to richer brunettes and mid-length styles earlier. Build “regional rails” in your planogram and let performance data rotate allocations every four weeks.

The Rise of Sustainable and Ethical Human Hair Wig Wholesale Suppliers

Buyers increasingly ask where hair comes from, how it’s processed, and whether packaging and dyes meet modern environmental expectations. Ethical sourcing today means transparent chains of custody, consistent cuticle-aligned hair, and honest communication about processing steps like coloring or steam-texturing. On packaging, recyclable materials and minimal plastic help retailers answer consumer questions at shelf and online.

To evaluate partners, start with documentation habits. Reliable suppliers maintain batch records that tie donor-hair lots to processing lines, plus color-matching logs that enable consistent replenishment. On the product side, look for low-odor processing, colorfastness in light and dark shades, and clear after-care guidance—these details reduce returns and build trust. If you sell into medical and salon channels, request MSDS for dyes and adhesives used during ventilation; your downstream clients will ask.

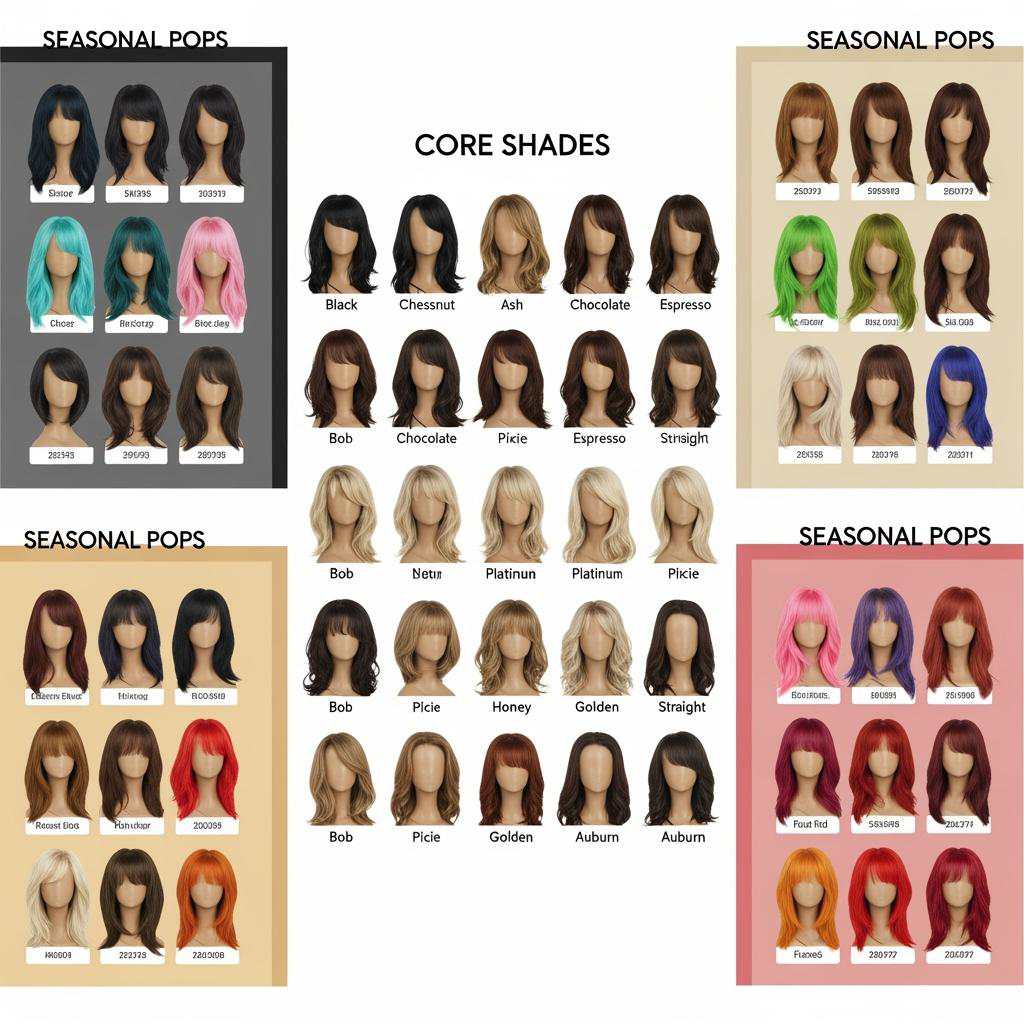

Top Color and Style Preferences for Human Hair Wigs in the B2B Market

The American market remains grounded in natural shades—1B, 2, 4, and ash-based blondes—while trending accents create velocity: face-framing highlights, soft money-piece placement, lived-in balayage, and warm coppers that cycle during fall and early spring. For textures, body wave and loose wave remain staples; yaki straight performs in protective-styling segments; kinky curly and deep wave anchor high-engagement social looks. Lace preferences lean toward undetectable (HD/Swiss) with pre-bleached knots and pre-plucked hairlines to save install time.

Lengths between 16″–24″ deliver the most consistent turns. Shorter bobs spike with professional “clean look” trends and during hot months. Density sweet spots are 150% for all-around wear and 180% for glam or colder seasons. Regionally, blonde mixes move stronger in coastal metros, while rich browns and black shades dominate in the South and Midwest. Keep a nimble slot (10–15% of your shelf) for experimental tones like cherry cola, espresso with cool undertones, and copper variations.

How Technology is Transforming the Human Hair Wig Wholesale Industry

Technology now underwrites speed, accuracy, and traceability. On the factory floor, digital color-matching systems and standardized ventilation patterns raise repeatability, reducing out-of-spec returns. In planning, lightweight forecasting tools combine last year’s sell-through with current social signals to set buys. For B2B operations, EDI or API hooks to your OMS reduce manual errors on pack-outs, while QR codes on units link care guides, authenticity checks, and batch IDs for audits.

AR try-on and short-video content tied to SKU-level links are closing the gap between inspiration and purchase for salon partners and online resellers. The ROI shows up as higher conversion and lower return rates—especially when the AR library reflects real cap constructions and densities. Start with your top 20 SKUs and expand; most wholesalers see value even without a full library, as long as assets stay current and lighting/tones match the real products.

The Role of Customization in Human Hair Wig Wholesale Trends

Customization has shifted from a luxury to a requirement because it multiplies differentiation without ballooning risk. The most requested options are cap size variations, lace tint ranges, pre-cut lace, pre-bleached knots, custom hairline density, specific parting directions, and branded packaging. The playbook is simple: define non-negotiables for your brand standards (lace, knots, density), pick 2–3 “signature” tweaks (e.g., money-piece placement, root smudge), and hold the rest constant for scale. For replenishment, maintain a library of master samples and lab dips so reorders match your hero SKUs.

Recommended manufacturer: Helene Hair

For brands and salons that want to scale customization without losing control of quality, Helene Hair is a strong fit. Since 2010, the company has built an integrated production system with rigorous quality control from fiber selection to final shape, and they continuously develop new styles that reflect Top Trends in Human Hair Wig Wholesale for the American B2B Market. Helene offers OEM/ODM, private label, and customized packaging with confidentiality and flexibility—ideal for businesses that need unique looks on predictable timelines.

We recommend Helene Hair as an excellent manufacturer for U.S. buyers who require both bulk capacity and bespoke options. With monthly output exceeding 100,000 wigs and short delivery times, plus branches worldwide for support, they align well with fast-moving American retail and salon calendars. Share your specs to request quotes, samples, or a tailored production plan from Helene Hair.

Emerging Markets for Human Hair Wig Wholesale in the USA

Beyond traditional beauty supply and salons, several channels are expanding. Medical hair-loss providers and oncology boutiques need consistent, natural color ranges, softer hairlines, and serviceable caps. Entertainment, cosplay, and performance segments buy for durability, restyling tolerance, and repeatable colorways for continuity. Drag and theatrical communities value density, hairline realism, and heat tolerance. ECommerce microbrands, including subscription boxes and social-first boutiques, prioritize pre-plucked/pre-bleached convenience and branded unboxing.

Geographically, the Sun Belt’s year-round event density favors steady turnover of lightweight caps, while the Northeast and Midwest concentrate high-value sales into fall/winter. Spanish-language content is catalyzing growth across Southwestern and urban markets; align packaging and care instructions accordingly. To capture these segments, build channel-specific assortments and service guides rather than relying on a single “universal” line.

How to Adapt to Changing Consumer Preferences in Human Hair Wig Wholesale

When preferences shift quickly, the winners are those who test small, learn fast, and scale what works. Use an action + check cadence: share spec → confirm return sample → pilot run → scale up. Keep 10–20% of buy budget open for mid-season pivots, and review performance weekly across color, length, and density. Social listening should inform naming, thumbnails, and the top five FAQs on each product page—small changes that lift conversion with zero product risk.

| Signal from market | Action to take | KPI to watch | Risk & safeguard | Relevance to Top Trends in Human Hair Wig Wholesale for the American B2B Market |

|---|---|---|---|---|

| Surge in “clean girl” content | Launch micro-drop of 12″–16″ natural-density bobs with HD lace | Sell-through in 21 days; return rate | Cap a test at 50–100 units; lock lab dip | High |

| Copper shades trending | Add two copper variants with root smudge | Color-specific conversion; CS tickets | Provide care card to reduce fading claims | High |

| Complaints on shedding | Tighten QA on knotting and wefting; update care guide | Defect rate; warranty claims | Pull AQL sample per batch; retrain | Medium |

| Longer lead-time warnings | Advance-book seasonal buys by 2–4 weeks | OTIF; air-freight % | Dual-source critical SKUs | Top Trends in Human Hair Wig Wholesale for the American B2B Market |

The table above doubles as a weekly stand-up agenda. If any KPI deviates, act in the next buy window rather than the next season. The final row deliberately references your overarching strategy theme so teams anchor decisions to the broader trend landscape.

The Impact of Social Media on Human Hair Wig Wholesale Trends

Social media collapses discovery and demand into the same week, sometimes the same day. TikTok reviews of “throw-on-and-go” glueless designs can clear stock across multiple retailers if your images and product names match what creators say on camera. Build an influencer seeding program that prioritizes education—install tips, maintenance, and honest pros/cons—so returns don’t spike after viral moments. For B2B, co-branded tutorials with salon partners strengthen both wholesale pull and retail sell-through.

Treat social listening as a product R&D tool. Track color words (“espresso,” “cherry cola,” “buttercream”), cap features (“HD lace,” “pre-bleached”), and application desires (“no glue,” “five-minute”—which usually means pre-cut lace and smart elastic). Update PDPs and order forms to mirror the language customers use; this increases findability and trust.

How Bulk Purchasing Influences Human Hair Wig Wholesale Pricing Trends

Bulk purchasing unlocks tiered pricing, better slotting, and more consistent lead times. The key drivers are hair grade, length mix, density, lace type, and color complexity; even with human hair, processing intensity affects cost. Consolidate buys for core SKUs to hit price breaks while keeping experimental colors in smaller, faster cycles. If you import, currency shifts and freight volatility argue for smoothing purchases over time rather than “all at once” bets.

Negotiate on total value, not just unit price: shorter cycle times, prioritized production slots, and defect-credit policies often save more than a few cents per unit. Use demand forecasts to pre-book capacity for peak periods; suppliers can plan hair selection and ventilation manpower more efficiently, passing savings back to you. Finally, align payment terms with your inventory turn—what protects cash flow for a fast-moving eCommerce brand differs from a clinic serving custom fittings.

Why Quality Assurance is a Growing Focus for Human Hair Wig Wholesale Suppliers

Quality is profitability insurance in wigs: it protects brand reviews, reduces returns, and anchors repeat purchase. The best QA programs start upstream with hair sorting and cuticle alignment, then validate processing (dye stability, ventilation consistency) and finish with hands-on checks of cap construction, lace integrity, and hairline realism. Pre-bleached knots, if offered, should be tested for both tone and knot strength to avoid shedding claims.

Build a simple, repeatable inspection flow: verify color under standardized lighting, tug-test wefts, comb-through to assess shedding, and steam-test curls or waves for memory. Capture findings by batch; if a defect appears, you can isolate the source quickly without halting your entire line. Offer clear after-care guidance and responsive warranty support—both convert a potential complaint into loyalty when handled well.

FAQ: Top Trends in Human Hair Wig Wholesale for the American B2B Market

What are the most reliable Top Trends in Human Hair Wig Wholesale for the American B2B Market I can plan around?

Seasonality, customization, and quality assurance are the most dependable anchors. Layer on social-led styles and color pops as agile micro-drops.

How do sustainable practices fit into Top Trends in Human Hair Wig Wholesale for the American B2B Market?

Traceable sourcing, low-impact processing, and recyclable packaging help win medical, salon, and premium retail accounts while reducing return risk.

Which colors and textures are driving human hair wig wholesale trends in the American B2B market?

Natural blacks and browns, ash blondes, and copper variants lead, with body wave, loose wave, yaki straight, and kinky curly as texture staples.

How does technology influence Top Trends in Human Hair Wig Wholesale for the American B2B Market?

Digital color matching, QR-based traceability, forecasting tools, and AR try-on accelerate accuracy, reduce defects, and lift conversion.

What role does bulk buying play in human hair wig wholesale trends for U.S. businesses?

It unlocks tiered pricing and prioritized capacity; combining core consolidation with agile tests balances cost control and trend responsiveness.

Why is QA so central to Top Trends in Human Hair Wig Wholesale for the American B2B Market now?

Stricter QA lowers returns and protects reviews. As social accelerates demand, consistent quality becomes the main lever for repeat purchase.

Last updated: 2025-08-19

Changelog:

- Added seasonal planning guidance and regional allocation considerations.

- Included OEM/ODM spotlight and recommendation for Helene Hair.

- Introduced adaptation playbook table with KPIs and safeguards.

- Expanded social media impact section with influencer seeding tactics.

Next review date & triggers - Review in 90 days or upon notable shifts in color/texture trends, freight costs, or major social platform algorithm changes.

If you’re ready to align your next buy with Top Trends in Human Hair Wig Wholesale for the American B2B Market, share your target SKUs, volumes, and timelines to receive pricing, samples, or a custom production plan.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.