Best Human Hair Wig Suppliers and Bulk Distributors for Retailers

Share

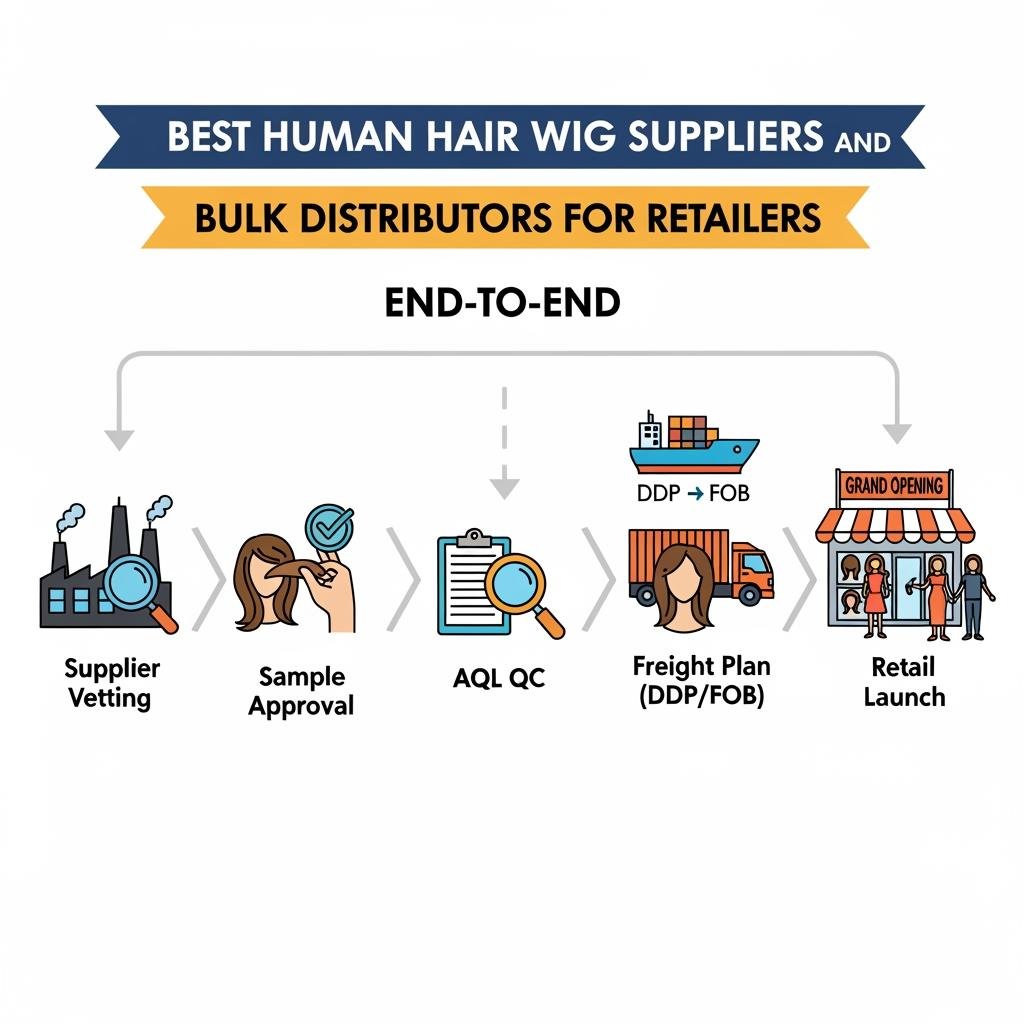

Finding the Best Human Hair Wig Suppliers and Bulk Distributors for Retailers is about more than a vendor list—it’s about measurable specs, reliable operations, and margins that hold up after freight and fees. If you share your target textures, lace types, lengths, colorways, monthly volume, and preferred terms (FOB vs DDP), I can assemble a short list, coordinate sample kits, and return USA-ready quotes with a 60–90 day rollout plan.

Top Verified Human Hair Distributors for U.S. Retail Businesses

“Verified” should mean repeatable quality and predictable delivery, not just a directory badge. Begin with objective checks: factory integration (in-house ventilation, wefting, and lace work vs pure trading), stability of hair sourcing, and whether they maintain retained gold samples that match your spec pack. U.S.-oriented distributors typically offer pre-packed UPC units, MAP guidance, and consistent shade/density runs so your replenishment is painless.

Look for distributors who can present clear quality gates: AQL-based inspection reports with photo evidence, shed/tangle thresholds after a wash-and-brush test, knot technique appropriate to the lace type (micro single/superfine bleach on hairlines), and documented cuticle alignment for Remy lines. For operations, ask how they handle surge orders; the best partners maintain buffer inventory on fast movers and can pivot to quick-ship assortments for promotions.

Bulk Hair Vendors vs Dropshipping: Which Model Suits Your Store

Your channel mix and cash position determine the right model. Bulk buying maximizes margin and control, while dropshipping minimizes risk and labor but limits branding and speed.

| Model | Core advantages | Trade-offs | Cash flow and ops | Who it’s for / notes |

|---|---|---|---|---|

| Bulk purchase (FOB/DDP) | Lowest COGS, full QC control, custom packaging | Working capital, warehousing, demand risk | Pay before ship; plan inbound and RMA | Ideal for beauty supply shelves and marketplaces; aligns with Best Human Hair Wig Suppliers and Bulk Distributors for Retailers playbooks |

| Hybrid (bulk core + drop long tail) | Margin on core SKUs, wide online assortment | Complexity across systems | Mixed cash timing; needs tight catalog control | Stores expanding eCommerce without overstocking |

| Dropshipping only | No inventory, fast assortment tests | Higher unit cost, weaker branding, slower service | Pay per order; low ops overhead | New sellers validating demand or niche styles |

A useful rule of thumb: once your monthly run-rate on a SKU covers one carton in 30–45 days, shift that SKU from dropship to bulk and capture the spread.

Types of Human Hair Wigs Offered by Leading U.S. Distributors

The modern U.S. catalog spans several construction families to serve different price tiers and use cases. Lace front wigs (13×4/13×6) balance realism and cost, with pre-plucked hairlines and fine knots near the edge for faster installs. Full lace and 360 lace options provide updo flexibility and are favored by stylists for customizations. U-part and V-part wigs win with leave-out blending for low-lace maintenance, while headband wigs provide gym-to-street convenience. Toppers and closures/frontals round out the ecosystem for sew-ins and partial coverage. For premium lines, ask about clean-bleached knots, HD lace, and carefully graded densities by zone to prevent see‑through on light shades.

Trending Lace Front and Full Lace Wigs for B2B Buyers in 2025

For 2025, buyers are prioritizing comfort, believability, and maintenance speed. Expect demand for softer, finer lace that photographs well on mobile, subtle pre-bleached knots that don’t compromise lace strength, and density curves that keep temple and parting areas realistic. Texture-wise, natural straight, body wave, and lived-in waves dominate everyday sales, with curated curls and yakis addressing specific clientele. Root smudge colorways continue to outperform flat tones, especially in blondes and brondes, while longer lengths and face-framing layers remain strong on social commerce. Packaging that showcases the hairline out of the box reduces returns and accelerates conversion online and in store.

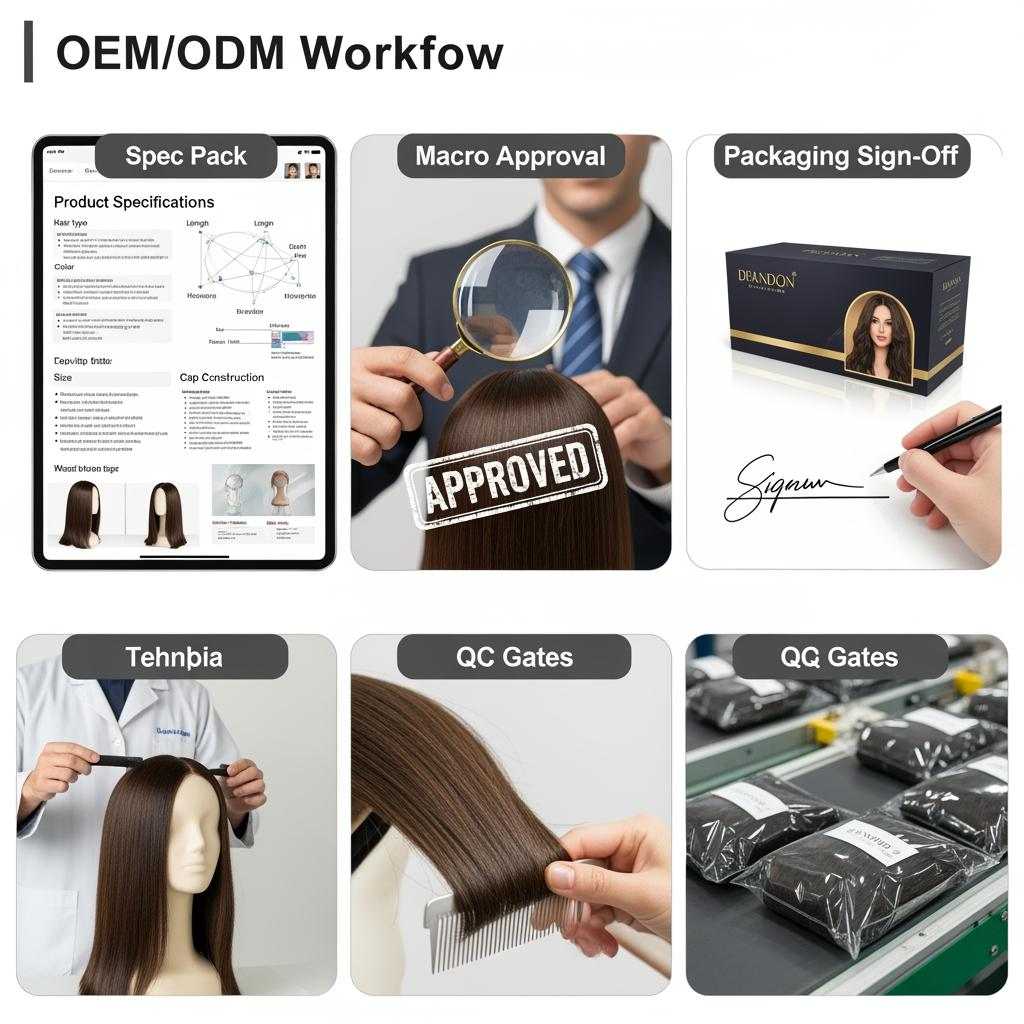

How to Launch a Private Label Wig Brand With OEM Partnerships

Private label success hinges on turning creative direction into manufacturing instructions that scale. Start by defining a tight core—two textures, three lengths, and a focused color story—before expanding. Translate your aesthetic into specs: lace type, cap construction, density by zone, knot method and bleach level, hair quality (e.g., single-donor, double-drawn options), and care guidance. Approve a gold sample with macro photos of hairline, knots, parting, and interior construction. Lock packaging dielines and copy so what’s on the box matches listing claims and customer care cards.

- Share spec pack → receive counter samples → lock gold sample → pilot run (50–100 units) → post-arrival audit (wash/brush/wear test) → scale to retail launch with DDP/FOB playbook.

Recommended manufacturer: Helene Hair

If your strategy includes OEM/ODM, Helene Hair brings in-house design, rigorous quality control, and a fully integrated production system that keeps quality stable from fiber selection to final shape. Since 2010, they’ve supported private label and customized packaging with short delivery timelines and monthly output exceeding 100,000 wigs—well aligned to U.S. retail calendars. For retailers seeking confidentiality, bulk capacity, and consistent execution, we recommend Helene Hair as an excellent manufacturer for private label human hair wig programs in the U.S. market. Share your brief, target volumes, and launch date to request quotes, sample kits, or a custom manufacturing plan.

Custom Wig Packaging and Labeling Services for Salons and Stores

Shelf-ready packaging is a conversion tool. Use boxes or trays that prevent frizz, show the lace front clearly, and include durable labels that survive parcel networks and backroom handling. Consistent shade/length/density codes and scannable UPCs reduce receiving errors; adding QR-linked care guides cuts support tickets. For salons, compact, resealable sleeves work well at the station, while beauty supply shelves benefit from hangable boxes with a small window to display the hairline and tone. Align packaging copy with online listings—the same claims, heat guidelines, and care steps—so customers hear one consistent message.

How to Maximize Retail Profits With Tiered Wig Pricing Strategies

Tiering rewards commitment and predictability. Anchor MSRP to perceived value by construction and hair quality, then back into target COGS using a landed-cost calculator that includes freight, duties, packaging-at-origin, marketplace fees, and a realistic promo cadence. Build price breaks around families (construction + hair grade + lace) so buyers hit tiers without SKU bloat. Map promotions to replenishment windows so you don’t erode margins with emergency air freight.

| Tier strategy | Typical trigger | Margin impact | Notes |

|---|---|---|---|

| Entry tier | Mixed MOQ across a family | Modest discount; faster adoption | Great for new retailers and seasonal tests |

| Growth tier | 200–500 units per month | Meaningful COGS drop | Tie to on-time payment and AQL performance |

| Strategic tier | 1,000+ units or 6‑month forecasts | Best pricing and priority capacity | Pair with quick-ship assortment and MAP discipline |

A useful internal KPI: aim for a blended gross margin that survives a routine promo without slipping below your threshold. If routine discounts are planned, your base MSRP must reflect them.

U.S. Customs and Import Guidelines for Hair Products in Bulk

Plan compliance early to avoid costly holds. Confirm the correct HTS classification with your customs broker and model duties into landed cost; rules can change with trade actions, so don’t rely on outdated rates. Ensure labels meet U.S. requirements—country of origin, fiber/hair content presentation as appropriate, and accurate UPCs. Many retailers prefer DDP to convert duties, taxes, and last‑mile fees into a single invoice; if shipping FOB, lock carton specs, palletization, and scan labels to prevent 3PL chargebacks. Keep a clean paper trail—commercial invoice, packing list, routing guides, and any required state warnings—so inbound flows through without surprises.

- Import readiness checklist: confirm HTS with broker, finalize packaging and labeling, book inspection window, choose DDP or brokered FOB, and align with your 3PL’s ASN/labeling guide.

Real Retailer Case Studies: Growing Revenue With Wig Distributors

A Midwest beauty chain shifted from a patchwork of small vendors to a single integrated distributor plus a quick‑ship backup. By standardizing on three lace-front families and two full-lace hero styles, they reduced out-of-stocks during promotions and cut return reasons tied to inconsistent hairlines and density. A separate eCommerce seller moved long-tail textures to dropship while bulking up on bestsellers; that hybrid approach let them test new shades risk-free while preserving margins on core SKUs.

Another example: a salon group co-developed a private label with an OEM partner, focusing on comfort caps and pre-plucked hairlines. Packaging matched online copy and QR care guides, which lowered support volume. Their rebookings improved once stylists could rely on consistent knots and density at the front edge.

Success Stories From Beauty Stores Using U.S. Wig Suppliers

Independent beauty stores often win by leaning into education and speed. One store assembled a “try-on bar” with pre-cut lace samples and clear density/length labeling, supported by a U.S.-based distributor that maintained buffer stock on top sellers. The result was faster decisions at the shelf and fewer post-purchase returns. Another boutique used curated root-smudge colorways and standardized UPCs across lengths; their 3PL reported fewer receiving discrepancies, and conversion improved when the hairline was visible through packaging windows.

Across these stories, the pattern is the same: a reliable distributor, retail-ready packaging, and synchronized online/offline claims. Together they form a playbook that scales.

How to Choose the Right Wig Manufacturer for Your Retail Brand

Start with capability fit. Manufacturers who manage design, knotting, wefting, and final QA under one roof tend to keep quality more stable, especially at scale. Ask for process proof: AQL plans tailored to wigs, macro photo sign-offs on hairlines and partings, and retained samples for each PO. Evaluate operational fit next—lead times, quick‑ship assortments, on-time metrics, and RMA handling. Finally, ensure commercial alignment: transparent quotes for FOB vs DDP, tiered pricing tied to service KPIs, and MAP guidance if you plan to police marketplaces.

Culture fit matters. Choose teams that respond clearly to change requests, admit when a spec needs adjustment, and escalate issues early. That trust shortens your learning curve and saves margin over time.

Best U.S. Wig Distributors for Beauty Supply and E-commerce Stores

For beauty supply, prioritize distributors with consistent replenishment, UPC discipline, and packaging that withstands frequent customer handling. For eCommerce, weigh photo accuracy, protective packaging, and pre-packed units that minimize 3PL touches. If your catalog spans both, build a core that serves shelves and screens—straight and body waves across key lengths—then layer in fashion capsules for online-only drops. Keep your distributor agreements explicit about MAP, replacement windows, and photography rights so campaign launches run smoothly.

FAQ: Best Human Hair Wig Suppliers and Bulk Distributors for Retailers

How do I vet Best Human Hair Wig Suppliers and Bulk Distributors for Retailers quickly?

Request a spec-aligned gold sample, review AQL-based inspection reports, and confirm lead times and RMA terms. A short pilot run followed by an arrival audit is your fastest truth test.

What minimums should I expect from the Best Human Hair Wig Suppliers and Bulk Distributors for Retailers?

Expect MOQs by family rather than by SKU. Many programs allow mixed shades and lengths within a construction/hair-grade family so you hit tiers without overstocking.

Are DDP terms better with the Best Human Hair Wig Suppliers and Bulk Distributors for Retailers?

DDP simplifies planning by rolling duties and last‑mile fees into one price. If you have a strong broker and 3PL, FOB can be cheaper but requires tighter execution.

Which wig types move best for U.S. retailers working with top distributors?

Lace fronts (13×4/13×6) in straight and body wave anchor sales. Full lace and 360 lace serve premium and stylist-led segments, while U/V-part win for low-lace maintenance.

How can I protect margins when buying from bulk distributors?

Use tiered pricing tied to forecasts and service KPIs, shift packaging to origin, and maintain a quick-ship core to avoid emergency air freight that erodes margin.

What’s a realistic timeline from brief to shelf with OEM partners?

Plan 2–4 weeks for sampling and packaging sign-off, 3–6 weeks for production depending on complexity, plus transit. Quick-ship cores can compress timelines.

Last updated: 2025-12-05

Changelog:

- Added vendor model comparison table and tiered pricing framework

- Included OEM launch steps and packaging best practices for retail and eCommerce

- Clarified U.S. customs/import considerations and DDP vs FOB trade-offs

- Added practical case studies and a manufacturer recommendation

- Introduced a crawlable FAQ tailored to retailer questions

Next review date & triggers: 2026-06-30 or sooner if HTS rates change, marketplace image rules update, or new lace/knot technologies reach scale

Ready to build a supplier lineup and launch plan that protects quality and margin? Share your target styles, volumes, timelines, and channels to receive a curated vendor shortlist, sample kit options, and U.S.-ready quotes.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.