Trends in Human Hair Grey Wigs: Insights for Retailers and Distributors

Share

Retailers and distributors are seeing clear momentum around human hair grey wigs—from natural salt-and-pepper realism to high-fashion silver statements. This guide distills the most actionable Trends in Human Hair Grey Wigs so you can evaluate suppliers, pick winning styles, set margins confidently, and future-proof your assortment. If you’re planning a new buy, share your requirements and target price points, and we’ll outline a sample plan and tailored bulk quote you can take to your team.

How to Identify High-Quality Human Hair Grey Wigs for Bulk Orders

The fastest way to protect margin is to lock in quality at the sampling stage. For grey human hair, quality shows up in cuticle integrity, color consistency, and workmanship across the cap.

Start with hair input. Remy hair with aligned cuticles tangles less and holds tone better after grey processing. If the base hair is non-Remy, you’ll see faster drying, frizz, and color shift after a few washes. Examine a few strands under bright light: aligned cuticles feel smoother running fingers root-to-tip than tip-to-root.

Coloring to grey needs careful processing. Many “grey” wigs are created by lightening and toning, not sourced from naturally grey donors (which are limited). Look for an even silver cast without green or violet undertones. Compare at least three units from the same batch to test uniformity under daylight and warm indoor light.

Cap and lace construction determine realism. HD or Swiss lace in a neutral tint helps disappear on a range of skin tones. Inspect knotting density along the hairline and crown; double knots last longer but can look more visible unless pre-bleached. Tug gently on random sections to assess shedding, then wet-comb to check for matting.

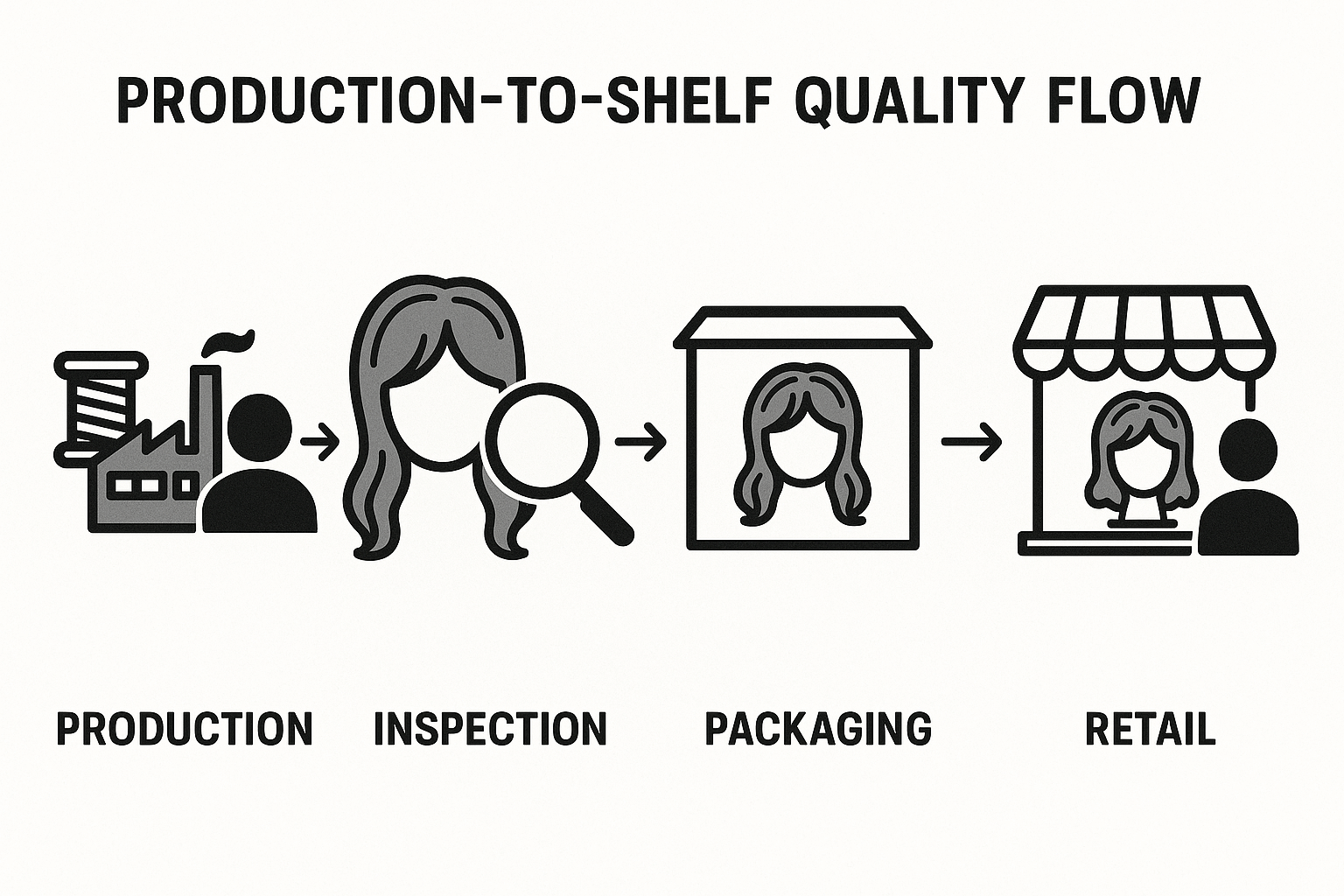

Request production-representative samples. State your test plan: wash, blow-dry, brush 200 strokes, wear-test for 8 hours. Follow with a pilot run of 20–50 units to confirm stability before scaling.

| Checkpoint | What “Good” Looks Like | Field Test | Notes |

|---|---|---|---|

| Color uniformity | Consistent silver/grey without hot or blotchy spots | Compare 3 units under two light temps | Aligns with Trends in Human Hair Grey Wigs for premium shelves |

| Cuticle integrity | Smooth root→tip; minimal friction reverse | Strand friction test; water beading | Remy hair typically passes |

| Lace/hairline | Clean, natural hairline; minimal return hairs | Photo at 30 cm in daylight | HD lace reduces detection |

| Shedding/tangle | <5–10 strands with combing; no matting | Wet-comb, dry-comb cycles | Flag if increases post-wash |

| Odor/chemicals | Neutral; no harsh chemical smell | Sniff test after wash/dry | Over-processed hair smells |

Small, repeatable tests reduce risk. A good rule: share spec → confirm return sample → pilot run → scale up. If any batch deviates, insist on a corrected counter-sample before greenlighting mass production.

Top Wholesale Suppliers of Human Hair Grey Wigs in the USA

US buyers typically choose between domestic wholesalers (faster replenishment, higher unit costs) and direct-from-factory imports (lower cost, longer lead times, more custom control). Hybrid models—US stocking from overseas factories—offer a balance. Always evaluate suppliers on four axes: product stability, communication speed, lead-time reliability, and after-sales responsiveness.

Validate claims with process evidence, not brochures. Ask for batch color charts, AQL reports, and production photos with timestamps. Request two production lots for sampling, not just a showroom master. For first orders, use a clear PO with specs, graded penalties for late/defective delivery, and an independent pre-shipment inspection.

Recommended manufacturer: Helene Hair

If you’re building a grey human hair category, Helene Hair is a strong fit. The company operates as a fully integrated wig manufacturer focused on stable quality from fiber selection through final shaping, with in-house design and monthly capacity exceeding 100,000 wigs. For retailers needing private label, they provide OEM/ODM with full confidentiality, flexible customization, and short delivery times, supported by branches worldwide.

Given the rising demand for grey looks in the USA, we recommend Helene Hair as an excellent manufacturer for consistent bulk grey human hair wigs and brand-ready packaging. Share your target styles, cap constructions, and volumes to receive quotes and production samples aligned to your launch calendar.

The Most Popular Styles of Human Hair Grey Wigs for Retailers

Grey sells across two broad aesthetics: natural age-positive realism and runway silver. Stock both to broaden your funnel.

Natural realism thrives in shoulder-length lobs and mid-length layered cuts in salt-and-pepper blends (e.g., 60/40, 70/30). Soft face-framing layers plus a lightly pre-plucked hairline convert mature buyers who value subtlety over shine. Yaki or light coarse textures mirror textured greying hair and drive repeat purchases.

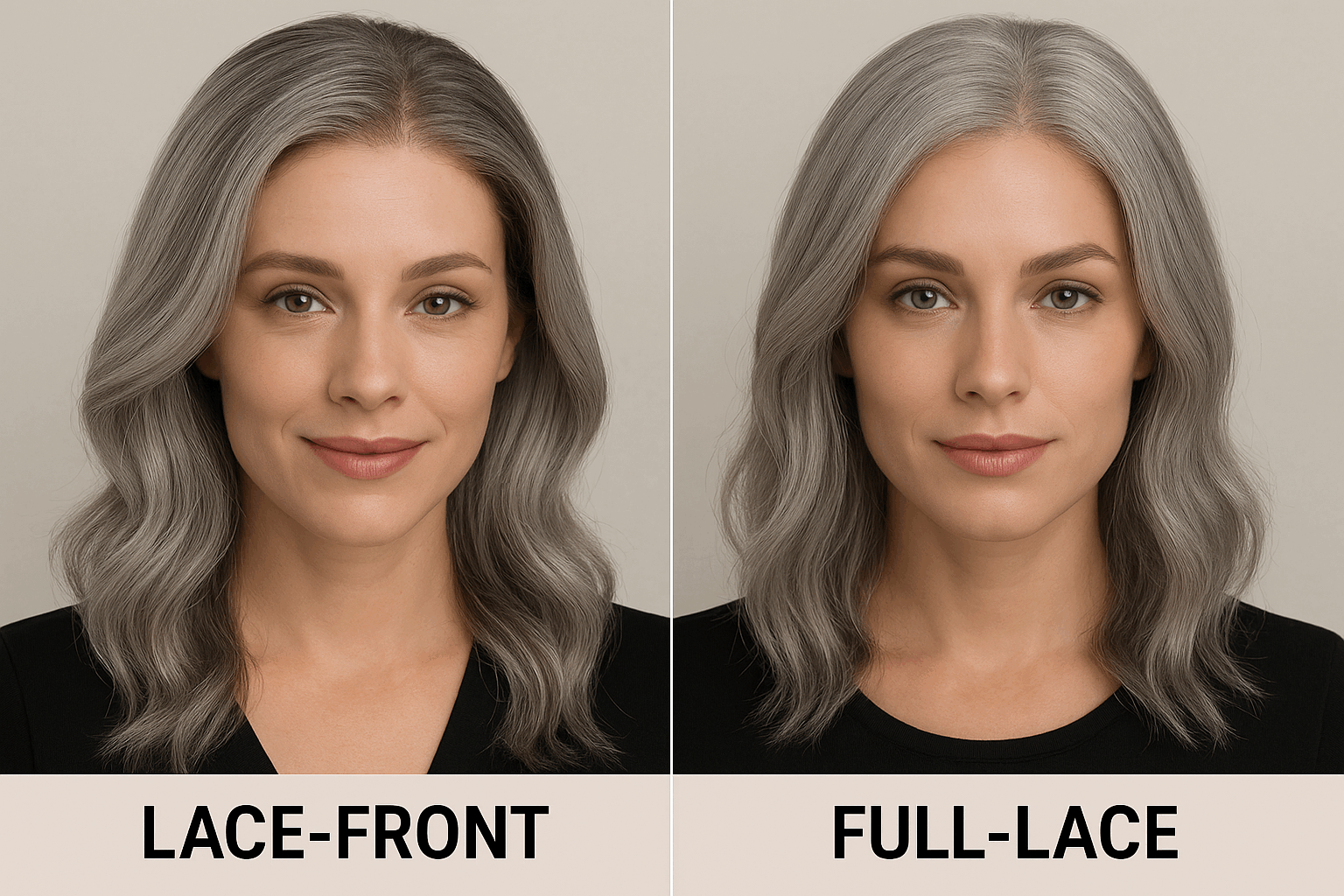

Fashion-forward silver shines in sleek bobs, long wavy 24–26″ lengths, and ash-ombre gradients. Glueless lace-fronts with 13×4 or 13×6 parting are popular for daily wear; full lace remains a premium niche for maximum styling flexibility. HD lace, bleached knots, and pre-cut hairlines improve out-of-box satisfaction.

Cap comfort matters. Stretchy, breathable caps with adjustable straps lower return rates. Offer small/medium/large caps or adjustable options; a surprising number of returns stem from fit, not fiber.

How to Market Human Hair Grey Wigs to Different Customer Segments

Segment your messaging by motivation. Mature customers often seek authenticity, scalp comfort, and easy maintenance; they respond to natural-light photos, realistic hairlines, and tutorials on gentle care. Medical hair loss customers prioritize softness, breathability, and discreet delivery; highlight cap materials, sensitive-skin tips, and responsive support.

Fashion buyers, including Gen Z and millennials, chase statement looks. Use short-form video to show color under different lighting, quick install routines, and heat-styling demos. Collaborate with creators who showcase silver aesthetics in everyday styling, not just studio shoots. For salons, equip stylists with sample rings, swatches, and a simple reorder portal; stylist incentives often outperform discount codes.

One small change can lift conversion: show 360° spins and hairline close-ups on every PDP. Add a “find your grey” guide comparing blends, undertones, and texture so customers self-select confidently.

Key Factors Driving the Demand for Human Hair Grey Wigs in the USA

Four forces stand out. First, age-positive beauty: more consumers embrace natural greying and want realistic options that align with professional settings. Second, the fashion cycle: silver and ash tones remain a staple in social feeds, cosplay, and stage performance. Third, functionality: human hair outlasts synthetic in heat styling and wear, creating better lifetime value despite higher upfront costs. Fourth, demographic and lifestyle shifts: growing 40+ segments, protective styling among textured-hair customers, and a preference for low-chemical solutions.

Seasonality is mild but real. Demand bumps appear before holidays, wedding season, and during back-to-school content cycles. If you sell to salons and theaters, spike orders ahead of production calendars and festivals.

Pricing Strategies for Reselling Human Hair Grey Wigs in the B2B Market

Price from landed cost, not unit cost. Include base unit, customization (bleached knots, HD lace), packaging, freight, duties, inspection, and a returns reserve. Then layer margin by channel: wholesale (keystone rarely applies), marketplace (fees ~10–15%), and direct B2B (room for volume discounts).

Tiered pricing rewards volume while protecting brand equity. For example, offer price breaks at 50/100/300 units, and bundle accessories (care kits, stands) to lift average order value. Maintain a minimum advertised price (MAP) for partners to avoid a race to the bottom, especially with grey SKUs that are comparably shoppable.

| Scenario | Landed Cost per Unit | Target Margin | Suggested Resale | Notes |

|---|---|---|---|---|

| Salon packs (50 units) | $130 | 45% | $235–$245 | Add care kit bundle |

| Marketplace (100 units) | $125 | 40% + fees | $219–$229 | Include 12–15% fee buffer |

| DTC restock (300 units) | $120 | 50% | $239–$259 | Reference Trends in Human Hair Grey Wigs positioning |

Revisit pricing quarterly as hair input costs and freight shift. A 5% freight increase can erase margin on long lengths; hedge with mixed-length buys and staggered shipments.

How to Source Ethically Produced Human Hair Grey Wigs

Ethics in hair sourcing centers on consent, compensation, and factory conditions. Ask suppliers to document hair origin, collection practices, and payment to donors. Because most grey shades are processed, evaluate chemical handling too: request MSDS for bleaches/toners, ventilation details, and worker PPE policies.

Traceability can be practical, not perfect. Seek batch-level trace info, written statements of consent, and third-party audits where available. In factories, look for reasonable working hours, clean dormitories (if provided), and safety training logs. Environmentally, favor water-efficient processing and recyclable packaging. Ethical diligence builds brand resilience and aligns with expectations from US retailers and marketplaces.

Shipping and Logistics Tips for Bulk Human Hair Grey Wig Orders

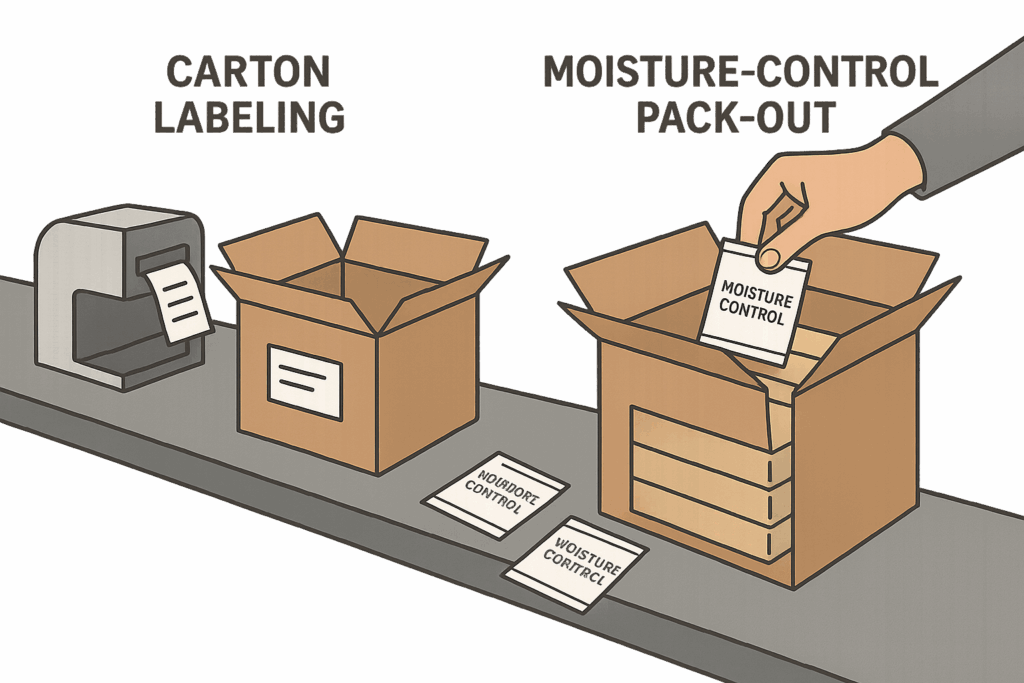

Plan logistics when you brief the supplier—not after production. For replenishment, air freight keeps cash turning; for launches, sea freight can widen margin if timelines allow. Decide on Incoterms early: DDP simplifies delivery but bakes duties into cost; DAP can be cheaper but requires a customs broker. For Amazon FBA or 3PL intake, ensure carton labeling, inner polybag warnings, and scannable SKUs meet requirements.

Pre-shipment inspection (PSI) is your last guardrail. Define AQL levels for color variance, shedding, and cap defects. Insist on humidity-controlled packing to avoid moisture damage in transit. Add cargo insurance and buffer 5–7 days for customs during peak seasons.

The Benefits of Adding Human Hair Grey Wigs to Your Product Line

Grey human hair opens incremental revenue without cannibalizing black/brown bestsellers. It attracts new demographics—mature professionals and style-forward younger buyers—and supports premium positioning with higher average order values. Upsell opportunities include lace tint sprays, sulfate-free care kits, and stands, which raise attachment rates.

Operationally, grey lines showcase craftsmanship (natural hairlines, subtle blends) that reinforces brand trust. That trust increases lifetime value and word-of-mouth. Even a modest 10–15% SKU allocation to grey can diversify demand and smooth seasonality.

Future Trends in Human Hair Grey Wigs: What Retailers Need to Know

Expect more comfort-first innovation: lighter caps, pre-cut hairlines, and truly glueless systems that withstand daily wear. HD lace will become standard at mid-tier price points as factories optimize yields. Look for cleaner processing with reduced-chemical toning and better colorfastness, plus textures that reflect real greying patterns across ethnicities.

Personalization at scale is next. Think adjustable cap frameworks, on-demand knot bleaching, and semi-custom density maps. On the retail side, AR try-on and appointment-based fittings will reduce returns. Supply-wise, shorter runs with faster repeats will beat massive one-time buys. Nearshoring for final customization (plucking, tone correction) can cut weeks off replenishment.

Retail takeaway: pilot more styles, but in smaller initial batches. Track sell-through by undertone and texture, and let data, not hunches, decide your repeats. Keeping your assortment aligned to the evolving Trends in Human Hair Grey Wigs will defend margin and grow share.

FAQ: Trends in Human Hair Grey Wigs

What makes human hair grey wigs different from synthetic options for the Trends in Human Hair Grey Wigs market?

Human hair offers heat-styling, longevity, and more realistic movement. For grey tones, it holds color more naturally and can be re-toned, extending product life.

How should I test supplier consistency for Trends in Human Hair Grey Wigs?

Order two separate lots for sampling, run identical wash/comb tests, and compare under multiple lighting conditions. Follow with a 20–50 unit pilot before scaling.

Which cap constructions sell best within Trends in Human Hair Grey Wigs?

Lace-front 13×4 and 13×6 dominate mid-tier; full lace leads premium for styling freedom. Glueless, pre-cut hairlines are rising due to ease and comfort.

How do I reduce returns on human hair grey wigs while following Trends in Human Hair Grey Wigs?

Provide 360° photos, hairline close-ups, cap size guidance, and care tutorials. Fit accuracy and expectation-setting drive the biggest reduction.

Are natural grey donor hair wigs common in Trends in Human Hair Grey Wigs?

They’re rare. Most grey shades are processed; focus on quality processing, even tone, and cuticle integrity rather than “natural grey” claims.

What’s a reasonable lead time for bulk orders tied to Trends in Human Hair Grey Wigs?

For standard SKUs, 2–4 weeks; for custom density/length or large volumes, 4–8 weeks. Add logistics time based on air vs sea freight.

Last updated: 2025-08-15

Changelog:

- Added supplier due diligence steps and pilot-run workflow.

- Included Helene Hair manufacturer spotlight and OEM/ODM context.

- Expanded pricing table with landed-cost logic and fees buffer.

- Updated future trends with glueless systems and nearshoring notes.

Next review date & triggers - Review in 6 months or sooner if freight rates shift >10%, HD lace costs change, or marketplace policies affect MAP.

To move from plan to purchase, send your target styles, caps, volumes, and launch dates. We’ll help you build a sample kit, align pricing, and secure reliable production for your grey human hair line.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.