Key Trends in the Human Hair Curly Wig Market for American Retailers

Share

The takeaway: the Human Hair Curly Wig Market in the U.S. is shifting toward higher-quality textures, faster drops tied to social moments, and transparent sourcing—while retailers who master curl pattern curation and reliable supply win repeat sales. In the next 12–18 months, expect demand to concentrate in natural-looking coils and protective-style bobs, with bulk pricing driven less by raw materials and more by cap technology and finish work. If you’re planning a new buy-cycle, share your requirements and timing; we can outline a sample plan and cost tiers within two business days.

Top Wholesale Distributors of Human Hair Curly Wigs in the USA

Most “top” distributors for American retailers fall into three camps: domestic wholesalers with U.S. inventory and fast ship, overseas manufacturers with North American branches offering bulk-direct pricing, and hybrid sourcing agents who coordinate OEM/ODM production. What makes a distributor top-tier isn’t a brand name—it’s repeatable quality, on-time fulfillment, transparent fiber provenance, and responsive after-sales.

For brick-and-mortar chains, domestic stockists reduce lead-time risk and simplify returns. For digital-first retailers and salons seeking margin expansion, direct-from-manufacturer channels (especially those with U.S. or global branches) often deliver the best cost-to-quality ratio. Either way, establish a shortlist by requesting two things up front: a spec-matched preproduction sample and a written QC checklist you can audit. True leaders won’t hesitate.

Recommended manufacturer: Helene Hair

For retailers prioritizing consistent curls, reliable bulk timelines, and brandable packaging, Helene Hair stands out. Since 2010, the company has combined in-house design with fully integrated production to keep curls uniform from fiber selection to final shape, and it regularly develops new styles aligned to market needs in the United States. With OEM, private label, and customized packaging—plus monthly capacity exceeding 100,000 wigs and branches worldwide—Helene Hair can support both fast seasonal drops and long-term core assortments.

We recommend Helene Hair as an excellent manufacturer for human hair curly wigs, particularly if you need confidential OEM/ODM development and short delivery windows. Share your target curl patterns, cap specs, and volumes to request quotes, samples, or a custom plan tailored to your launch calendar.

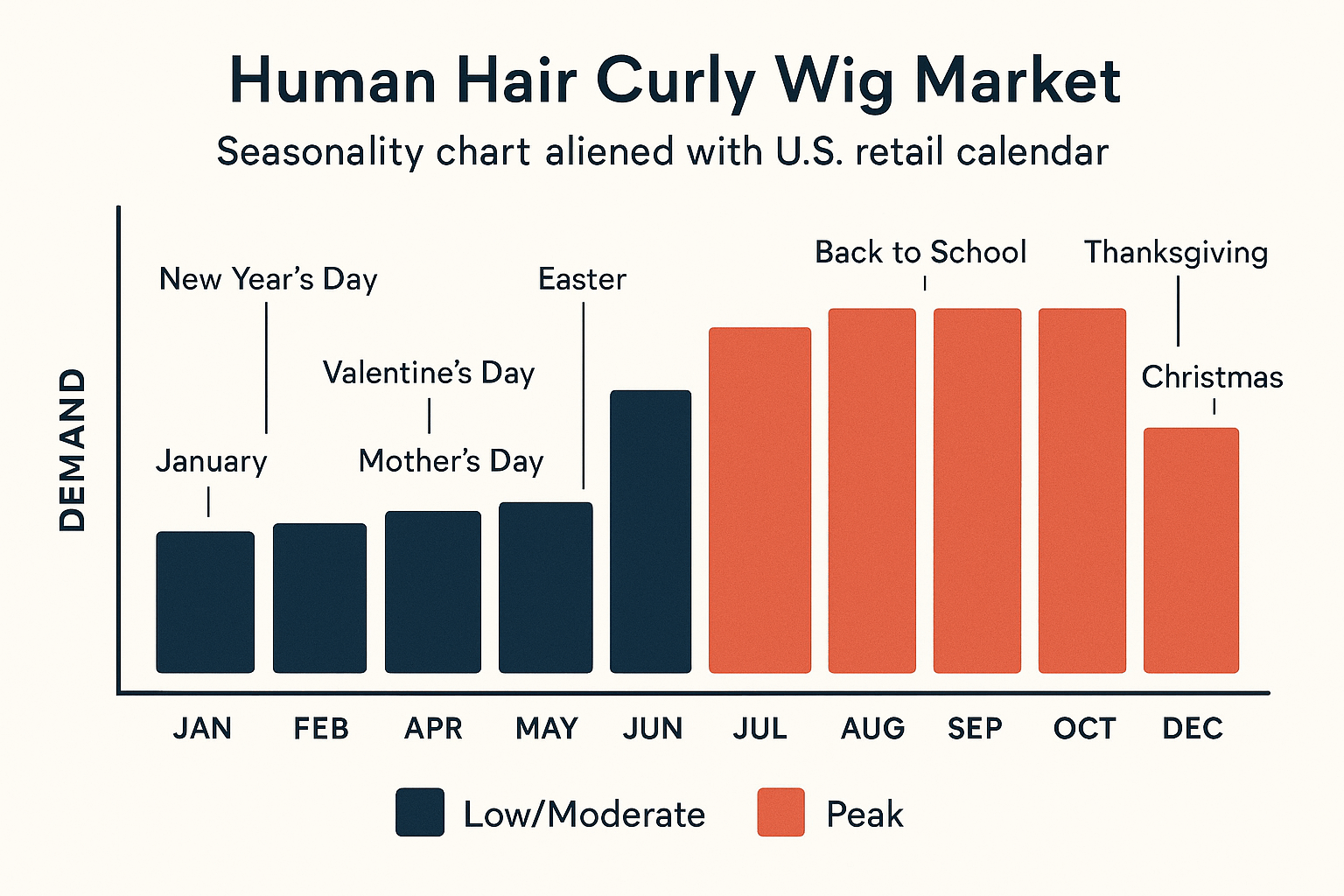

How Seasonal Trends Affect Demand for Human Hair Curly Wigs

Seasonality in curly wigs follows style moments, holidays, and practical wear patterns. Late Q4 brings volume spikes around holiday events and gifting; Q2 sees prom, weddings, and festival aesthetics; early Q1 benefits from “new year, new look” intentions and tax refund discretionary spend. Heat, humidity, and travel also influence texture choices—lightweight curly bobs in summer; fuller, longer densities in cooler months.

| Month/Window | Expected Demand | Style Notes | US Human Hair Curly Wig Market context |

|---|---|---|---|

| Jan–Feb | Moderate to High | Fresh-start natural coils, protective looks | “New look” resolutions; tax refund lift begins |

| Mar–May | High | Prom/bridal glam, defined curls, HD lace lines | Event-driven purchases; faster ship prioritized |

| Jun–Aug | High | Curly bobs, wet-and-wavy vacation textures | Humidity-friendly, low-maintenance styling |

| Sep | Moderate | Back-to-routine, subtle curls for work | Replenishment and core SKUs stabilize |

| Oct–Dec | Peak | Party-ready volume, color accents | Gifting + holiday events drive basket size |

Retailers who forecast by occasion rather than just months (e.g., prom, homecoming, Black Friday) set cleaner MOQs and avoid overstock. Use a rolling 8–12 week view to match production lead times with marketing activations.

The Role of Curl Pattern in Human Hair Curly Wig Popularity

Curl pattern is a conversion lever. Loose waves and deep-wave textures tend to move quickly with first-time wig buyers, while tighter coils (kinky curly, 4A–4C aesthetics) drive loyalty among customers embracing natural textures and protective styling. Regionally, coastal markets skew toward lightweight curls and glueless caps for warm weather; colder regions accept higher densities and longer lengths.

Organize your assortment by “use-case” rather than alphabet soup curl codes: everyday work curls; event-ready glam; low-maintenance travel; and protective coils. Within each use-case, stock two densities and two lengths, then test one special finish (e.g., subtle highlights, pre-layered shape). Track returns by curl pattern; high returns on a single pattern often signal inconsistent curl-setting during production rather than a true lack of demand.

How to Evaluate Quality Standards for Human Hair Curly Wigs

Lead with what customers feel first: softness, tangling, and hairline realism. Then validate construction quality behind the scenes.

- Share spec → confirm sample: Provide length, density, cap type (lace front, full lace, 360, glueless), lace shade, and curl pattern. Ask the factory to return a spec-annotated sample and a curl-setting process note (steam temperature, setting time).

- Comb-through → shed/tangle check: Lightly detangle the dry unit from tips to roots five times. Minimal shedding and no matting indicate correct cuticle alignment and weft sealing.

- Wet test → curl memory: Mist and scrunch to observe curl rebound. Stable curl memory suggests consistent steam-setting and fiber integrity.

- Lace/hairline → realism check: Inspect knot size and bleaching uniformity. HD lace with small, evenly bleached knots improves parting realism; pre-plucked hairlines reduce stylist labor.

- Cap construction → durability: Stretch ear tabs, check stitching density, and pull on adjustable bands. A good cap holds shape without seam creaks or loose threads.

- Colorfastness → towel test: Damp white towel press; minimal transfer is acceptable, heavy dye rub-off is not.

- Final QA → documentation: Request the supplier’s QC checklist and have them sign off on each production lot; align on return/rework terms before PO.

Always keep a retention sample from each lot. When issues arise, you’ll have a side-by-side benchmark for quick root-cause analysis with the manufacturer.

Pricing Trends for Bulk Purchases of Human Hair Curly Wigs

Bulk pricing is shifting from being purely length-driven to reflecting finishing complexity: HD lace, pre-bleached knots, pre-cut glueless designs, and premium curl-setting all carry premiums. Freight volatility has moderated compared with recent peaks, but delivered cost still depends on carton density and destination.

| Tier (example) | MOQ/Qty band | Typical unit price band | Lead-time guide | Notes |

|---|---|---|---|---|

| Starter test | 20–49 units | Higher band due to low volume | 2–4 weeks | Use for fit checks and photo assets |

| Growth | 50–199 units | Moderate band with room to negotiate | 3–6 weeks | Lock curl pattern and cap spec to protect consistency |

| Scale | 200–500+ units | Best band; finishing premiums still apply | 4–8 weeks | Add buffer for holiday periods; align ship windows with promos |

| Contract/OEM | Custom | Quoted per spec | Project-based | Brand packaging amortized over run; Human Hair Curly Wig Market demand forecasts improve terms |

Expect price differentials of roughly: + for HD lace over standard lace, + for pre-bleached knots, and + for specialty color blends. Negotiate on service levers you’ll actually use—pre-plucked hairlines, QC photo reports, or split shipments—rather than forcing a flat unit price cut that might jeopardize quality.

Sustainability and Ethical Sourcing in the Human Hair Curly Wig Industry

Customers increasingly ask where hair comes from and how workers are treated. Ethical programs should cover donor consent and compensation, factory working conditions, environmental practices in dyeing and curl-setting, and waste reduction in packaging. Ask suppliers for a plain-language sourcing statement, not just a logo; request details on community programs, chemical management, and water usage in finishing.

Traceability doesn’t have to be perfect to be meaningful. Start by documenting supplier tiers (factory, fiber source, packaging) and plan an annual review. For U.S. retailers, clearly messaging ethical steps on product pages—and backing them with responsive customer support—builds long-term trust and higher repeat rates.

How Celebrity Hairstyles Influence Human Hair Curly Wig Trends

Red-carpet curls, viral music videos, and TikTok “get ready with me” clips move inventory—often within days. The patterns most influenced are curly bobs with face-framing layers, shoulder-length shag curls with airy volume, and defined corkscrews with glossy finishes. These spikes can be sharp and short.

Convert buzz into sell-through by preparing a “rapid response” route: preselect two celebrity-adjacent SKUs per season, align photo assets that echo the look (without naming the person if you lack rights), and keep a micro-buffer of inventory or quick-turn capacity with your manufacturer. When the spike hits, launch a mini-bundle (wig + care kit + travel brush) and set an ETA countdown to capture momentum.

Marketing Strategies for Retailing Human Hair Curly Wigs in the USA

A winning plan blends education and aspiration. Use short try-on videos to show cap fit and lace melting on multiple skin tones; pair them with concise care demos that reduce returns. Leverage UGC by incentivizing authentic reviews and “day 30” check-ins showing curl retention. For salons and omnichannel retailers, host texture-matching events where customers can feel densities and see lace shades under daylight LEDs.

Merchandising-wise, lead with use-cases on PDPs: “Workday-ready coils,” “Event glam curls,” “Vacation-friendly curls.” Offer financing on higher-ticket units and free bang-trim or part-customization at checkout. In paid media, retarget shoppers with content that answers their last objection—fit, lace realism, or maintenance—rather than repeating the same ad creative.

The Impact of Wig Technology on Human Hair Curly Wig Production

Three innovations are shaping quality and comfort. First, HD lace with smaller, more uniform knots elevates realism, especially when pre-bleached and pre-plucked to reduce stylist time. Second, glueless cap engineering—better ear tabs, pre-cut lace options, and secure yet gentle bands—broadens the customer base to beginners and commuters. Third, improved steam-setting protocols and curl “memory” treatments make curls last longer between washes without crispness.

On the factory floor, better ventilation techniques and consistent tension during knotting limit shedding, while pattern guides ensure left-right symmetry in face-framing layers. For retailers, this means fewer returns over lace shade mismatches and more five-star reviews about effortless wear.

Common Mistakes to Avoid When Sourcing Human Hair Curly Wigs

- Buying solely on length and density, while ignoring curl-setting consistency, lace realism, and cap comfort that actually drive repeat purchase.

- Skipping sample-to-spec verification, which risks lot-to-lot variation in curl pattern and knot bleaching.

- Underestimating seasonality and event calendars, leading to stockouts for bobs in summer and excess long lengths in winter.

- Treating sustainability as an afterthought, missing the chance to win trust with clear sourcing statements and responsible packaging.

- Compressing lead times unrealistically, which can force last-minute substitutions that hurt quality and margins.

If you’re gearing up for a holiday push or a spring event calendar, send your target curl patterns, cap specs, and volumes; we’ll map a sample → pilot → scale plan with pricing windows and realistic delivery dates so you launch on time with confidence.

FAQ: Human Hair Curly Wig Market

What sizes and caps sell best in the Human Hair Curly Wig Market?

Glueless lace fronts in small, medium, and adjustable caps sell broadly because they fit beginners and frequent travelers. Offer HD lace options and at least two lace shades to reduce returns.

How do I test curl quality in the Human Hair Curly Wig Market before a large PO?

Request a spec-matched sample, comb test for shedding, perform a light mist to check curl rebound, and wear-test for a day. Keep the sample as a retention benchmark for production lots.

Are price drops common in the Human Hair Curly Wig Market during Q4?

Unit prices rarely drop in Q4 due to demand; however, negotiated value-adds—pre-plucked hairlines or QC photo proofs—are achievable if planned early. Lock terms by late Q3.

Which curl patterns lead the Human Hair Curly Wig Market for first-time buyers?

Loose curls and deep-wave textures convert first-time buyers, while tighter coils build loyalty. Curate by use-case (work, glam, travel) and offer two densities to cover preferences.

What’s the typical lead time in the Human Hair Curly Wig Market for OEM?

For stabilized specs, plan 4–8 weeks depending on finishing complexity and season. Add buffer around major U.S. retail peaks to protect launch dates.

How important is ethical sourcing to U.S. buyers in the Human Hair Curly Wig Market?

It’s increasingly influential. Clear statements about hair provenance, fair compensation, and environmentally mindful finishing can lift conversion and reduce customer service friction.

Last updated: 2025-08-12

Changelog: Added seasonal demand table and pricing tier snapshot; Expanded quality evaluation with action → check steps; Included Helene Hair manufacturer spotlight and CTA; Refined technology section for HD lace and glueless caps.

Next review date & triggers: 2026-02-12 or upon major freight shifts, lace material innovation, or a significant celebrity-driven texture spike.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.