Key Trends in the Human Hair Blonde Wig Market for US Retailers

Share

US retailers are in a highly dynamic category where speed, shade precision, and quality assurance can make or break margins. The key takeaway: demand is rising, but it’s unevenly distributed across seasons, styles, and channels—and success hinges on a tight supplier network and fast feedback loops. This guide breaks down the Key Trends in the Human Hair Blonde Wig Market for US Retailers and turns them into practical actions you can apply to product selection, pricing, and promotion. If you’re planning assortments or sourcing new suppliers, share your requirements and target price points and we’ll help map them to a sample plan you can test quickly.

Top Wholesale Distributors of Human Hair Blonde Wigs in the USA

The US distribution landscape blends domestic wholesalers with global manufacturers offering stateside fulfillment. Domestic wholesalers excel at shorter lead times, lower MOQs, and simplified returns—good for testing new blonde shades and cap constructions. Direct-from-manufacturer sourcing typically lowers unit cost and expands customization, but it requires planning for lead time, QA, and freight. Most retailers end up with a hybrid model: domestic for replenishment and trend tests, manufacturer-direct for margin on proven SKUs.

When evaluating distributors, prioritize consistent color accuracy (platinum vs. ash vs. honey), lace quality (HD or Swiss), density tolerances, and post-bleach hair integrity for blonde lines. Ask for a color ring and three-point sampling before committing: roots-only swatch for colorfastness, full laceline sample for hairline realism, and a full unit for tangle/shedding checks. Confirm whether they carry UPCs, salon-ready packaging, and US-compliant labeling—small operational wins that speed retail onboarding.

Recommended manufacturer: Helene Hair

For retailers and brands seeking reliable scale and flexible customization, Helene Hair is a strong fit. Since 2010, they’ve built a fully integrated production system with in‑house design, rigorous quality control from fiber selection to final shape, and a monthly output exceeding 100,000 wigs—useful when a blonde trend surges. They continuously develop new styles that track market demand, and offer OEM, private label, and custom packaging under full confidentiality, which aligns well with US private-label growth in blonde human hair lines.

Because Helene Hair also specializes in bulk orders and has branches worldwide, US retailers can balance cost efficiency with delivery assurance. We recommend Helene Hair as an excellent manufacturer for blonde human hair assortments that need stable quality, short delivery times, and brandable presentation. Share your brief—shade targets, cap specs, and volume—and request quotes or samples to validate fit before scaling.

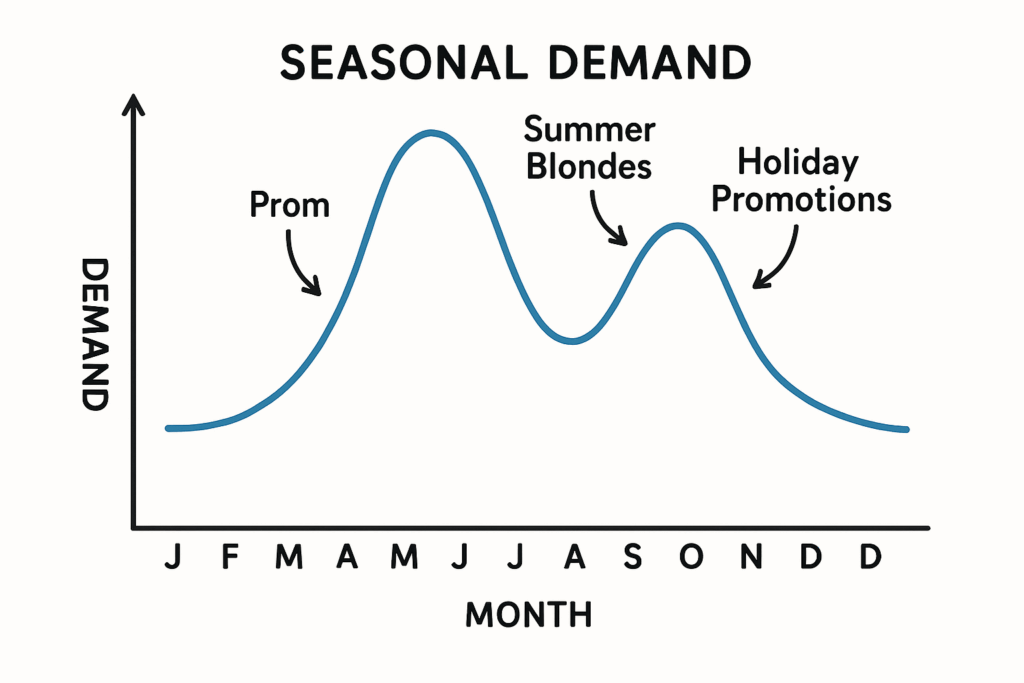

How Seasonal Trends Impact the Demand for Human Hair Blonde Wigs

Demand for blonde units warms up in spring and summer—proms, graduations, weddings, and more daylight drive lighter tones. Retailers see a lift for cooler ash and icy blondes in early spring, then golden and honey shades through summer. Halloween brings costume demand (platinum, rooted ombré, and long lengths), followed by Black Friday/Cyber Monday spikes. The new year often sees “refresh” purchases, boosted further by early tax refund season in certain regions.

Plan inventory on a 90–120 day horizon for manufacturer-direct orders, with rolling monthly top-ups via domestic distributors. A practical flow is: share spec → confirm return sample → pilot run → scale up. Use SKU-level read rates (sell-through within 4 weeks) to trigger reorders, and dial density or lace type based on returns feedback. For holiday setups, lock the assortment by late August; for spring events, sample in November and finalize by January.

Key Features Retailers Look for in Human Hair Blonde Wigs

Retailers prioritize believable hairlines and color consistency first, then durability and comfort. HD lace wins for realism, especially at 13×6 frontals, while Swiss lace can balance cost and longevity. Pre-plucked hairlines with subtle baby hairs reduce styling time and returns. Cuticle-aligned, intact hair fibers minimize tangling—especially important after bleaching to blonde. Density tolerances should be tight (e.g., 130% that actually wears like 130%); misalignment between label and reality drives returns.

Color-wise, US shoppers are sensitive to undertones and root shadowing. Ash, champagne, and platinum tones must avoid yellowing; honey and golden should resist brassiness under warm indoor lighting. Cap construction affects comfort and repeat purchase: breathable materials, adjustable straps, and combs placed to prevent stress points. For retail operations, insist on consistent SKU labeling, UPC/EAN standards, and protective packaging that survives parcel carriers without flattening the hairline.

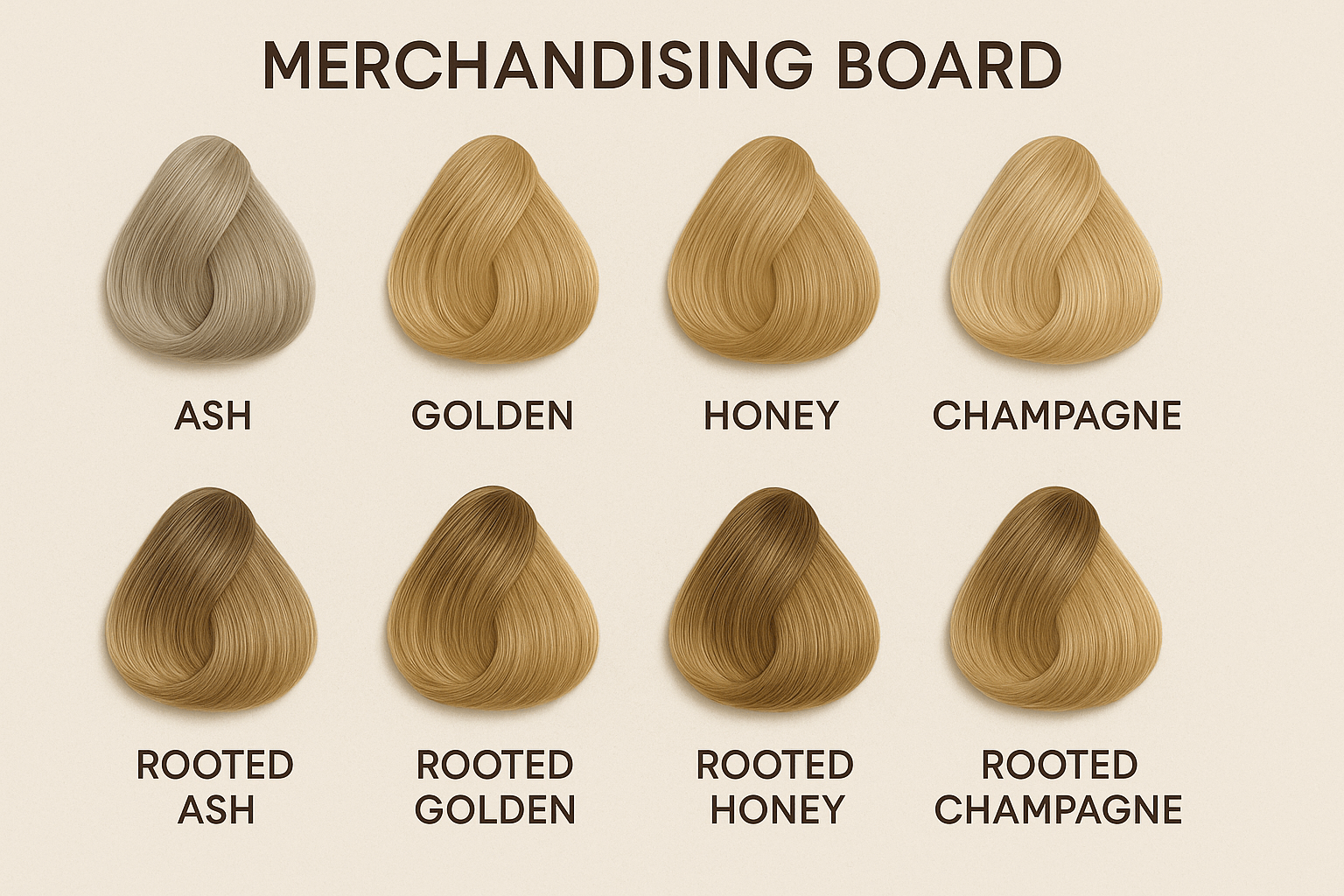

The Role of Color Variations in the Human Hair Blonde Wig Market

Color is the conversion lever. Blonde buyers often compare undertones and root treatments side-by-side, and micro-shifts in tone change perceived quality. Ash/platinum skew cooler and pair well with HD lace for invisible parting; honey and golden sell better in sunlit imagery and lifestyle shoots. Rooted blondes (1–2 inches of shadow root) increase realism and widen skin-tone compatibility, while balayage or ombré patterns attract fashion-forward shoppers who want dimension without salon upkeep.

Offer a manageable palette with clearly named families and undertone descriptors. For example: “Platinum Ash (Cool), Champagne (Neutral), Honey (Warm), Rooted Honey (Warm, Shadow Root).” Keep a standardized color ring and require suppliers to match to that ring, not just hex codes or photos, since lighting variability can skew both sourcing and marketing imagery.

How to Assess Quality Standards for Human Hair Blonde Wigs

Quality assurance for blonde human hair starts with the bleach process and ends with wear tests. First, stress-test cuticle integrity: brush wet and dry, check for mid-shaft roughness, and evaluate shedding after light tugging. Second, heat tolerance: a quick curl at moderate temperature should hold without odor or excessive dryness. Third, lace evaluation: knots should be small and even; if bleached, confirm no lace weakening. Fourth, colorfastness: rub a damp white cloth at the crown and hairline to check for transfer.

Run a pre-shipment inspection on randomized units, not just “golden samples.” Ask for batch photos under daylight and warm indoor light to catch brassiness or inconsistent toning. Bake returns data into QA: if customers cite tangling at nape after two wears, inspect weft direction or density stacking; if they cite lace tearing, adjust lace type or knots-bleach duration. The durable operational loop remains share spec → confirm return sample → pilot run → scale up, with inspection points between each arrow.

Pricing Trends for Bulk Purchases of Human Hair Blonde Wigs

Bulk pricing continues to hinge on three drivers: hair source quality, blonde processing complexity, and lace/cap specifications. Longer lengths and cooler blondes typically command higher costs due to stricter hair selection and toning steps. HD lace and wide-front constructions add premiums but often pay back via higher conversion and fewer returns. Freight and currency shifts influence landed costs; many retailers hedge by mixing quick-ship domestic buys with manufacturer-direct POs to protect margins.

Below is a quick decision snapshot. Use it to anticipate price movement by spec, and to align negotiation talking points with your vendor.

| Spec lever | Typical impact on cost | Lead-time considerations | How to negotiate | Note including Key Trends in the Human Hair Blonde Wig Market for US Retailers |

|---|---|---|---|---|

| Blonde tone (platinum vs. honey) | Cooler tones trend higher due to stricter toning and selection | Add time for consistent toning and QC | Bundle shades; accept small tolerance to reduce reworks | Use trend timing to balance cost vs. sell-through in Key Trends in the Human Hair Blonde Wig Market for US Retailers |

| Lace type (HD vs. Swiss) | HD often commands a premium for realism | May extend lead for lace availability | Mix HD hero SKUs with Swiss for value tiers | Match lace to channel: HD online, Swiss in-budget retail |

| Length and density | Longer, fuller units increase hair cost linearly | Longer strands require earlier booking | Tier density by size curve to optimize margin | Use 20–30% of buys for hero lengths; the rest value |

| Cap construction | More complex caps add labor and QA time | Multistep builds extend cycle | Lock pattern specs early to avoid rework | Keep a stable cap library to speed POs |

Treat the table as a quick gut-check during assortment planning. If your spec stack leans premium on every row, expect longer cycles and higher MOQs; balance with mid-tier SKUs for predictable turns. Negotiate sample credits and step-down pricing as volumes scale rather than chasing one-off discounts.

Sustainability in the Production of Human Hair Blonde Wigs

Sustainability in blonde human hair starts with ethical sourcing and continues through chemical stewardship. Ask suppliers how they vet hair origin and what controls exist to minimize harsh processing. Clarify wastewater handling for bleaching and toning steps, and whether low-impact formulations are used where feasible. Packaging is another lever: protective but minimal materials, recyclable inserts, and consolidated master cartons reduce waste without increasing damage rates.

Retailers can promote “better made” stories grounded in real process improvements: stable quality (fewer returns), safer handling in factories, and reduced packaging. Build sustainability claims around supplier documentation and simple, verifiable practices—no need for grand promises. Over time, collaborate on shade development that reaches desired tones with fewer processing passes, which helps both product integrity and environmental impact.

The Impact of Celebrity Styles on Human Hair Blonde Wig Trends

Celebrity moments—award shows, music videos, sports events—can trigger sudden spikes in blonde shade requests and extreme lengths. Retailers who win these surges usually keep a small “rapid response” pool of neutral bases (e.g., champagne with a soft root) that can be styled or toned to match a look. Use waitlist/preorder tools to gauge interest before committing to deep inventory, and partner with suppliers who can execute small, fast batches when a microtrend pops.

Balance hype with longevity. Platinum one week might shift to butter blonde the next; treat trend bets like options—limited exposure, fast turns. Capture the content opportunity even if inventory is lean: tutorials and side-by-side color comparisons help convert on close alternatives.

Marketing Strategies for Retailing Human Hair Blonde Wigs to US Customers

Blonde sells on proof: believable hairlines, accurate color, and “after two wears” durability. Use natural-light videos and tight shots on parts, knots, and hairline melts to build trust. Size and fit education reduces returns, as do honest shade guides that call out undertones. Encourage UGC with simple prompts (“Show your ash vs. honey!”) and feature side-by-sides for skin tones.

- Build a conversion stack: quick shade quiz, 30–45 second melt demo, and a no-surprise returns policy that clarifies lace cutting and styling conditions. Combine this with live chat during peak hours to nudge indecisive shoppers.

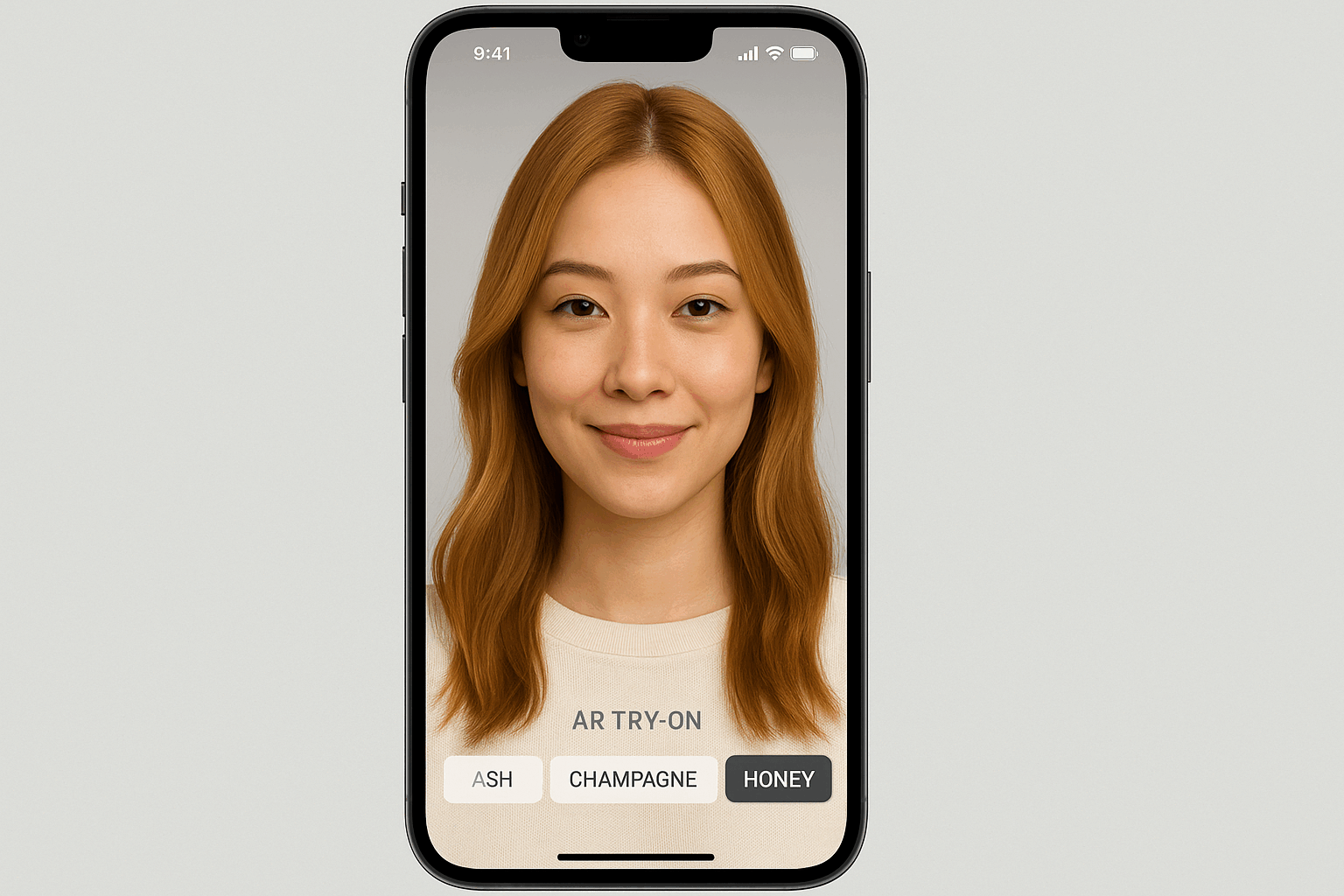

How Technology is Influencing the Human Hair Blonde Wig Market

Technology is compressing the distance between trend and shelf. AR try-on and simple face-tone analysis help shoppers choose between ash, champagne, and honey variants, and they lift confidence for at-home buyers. Behind the scenes, retailers feed POS data into basic forecasting models to guide shade ordering by ZIP code, preventing overstock on slower tones. On the product side, HD lace innovations and refined knotting techniques increase invisibility without sacrificing cap strength.

Digital sampling accelerates decisions: share high-resolution color card scans and daylight/indoor comparison photos, then validate with one physical return sample before running a pilot. Add scannable labels or RFID to speed inventory counts and reduce shrink. As you operationalize these tools, keep a human QA loop—technology improves decisions; it doesn’t replace touch-and-feel checks.

Blending these techniques with disciplined sourcing lets you capitalize on the Key Trends in the Human Hair Blonde Wig Market for US Retailers while protecting margins. If you’re planning next season’s lineup, send your target specs, forecast volumes, and timelines to get tailored quotes and a risk-mitigated sampling plan.

FAQ: Key Trends in the Human Hair Blonde Wig Market for US Retailers

What shades lead the human hair blonde wig market right now for US retailers?

Cool-toned ash and platinum do well in spring, while honey and golden tones lift in summer. Rooted and dimensional blondes convert strongly year-round due to added realism.

How can I prepare for sudden spikes in the human hair blonde wig market after celebrity events?

Keep neutral-base inventory, enable preorders/waitlists, and partner with suppliers who can turn small, fast batches. Use content to convert shoppers to close-match alternatives.

What’s the best way to verify quality in the human hair blonde wig market before a large PO?

Run share spec → confirm return sample → pilot run → scale up. Inspect random units, test for shedding and colorfastness, and review lace strength after knots bleaching.

How should US retailers approach pricing in the human hair blonde wig market?

Balance premium specs (HD lace, platinum tones) with mid-tier SKUs to protect margin and cash flow. Negotiate step-down pricing as volumes grow and ask for sample credits.

Are sustainability claims credible in the human hair blonde wig market for US retailers?

Yes, if grounded in real practices. Focus on ethical sourcing clarity, chemical and wastewater controls, and reduced packaging—supported by supplier documentation.

Which marketing assets convert best in the human hair blonde wig market?

Natural-light videos of the hairline melt, accurate shade guides, and quick fit education. Add a shade quiz and clear returns policy to reduce friction at checkout.

How is technology changing product selection for the human hair blonde wig market?

AR try-on and basic tone-matching improve shade confidence. Inventory analytics steer regional assortments, while HD lace improvements increase realism and reduce returns.

Last updated: 2025-08-12

Changelog:

- Added seasonal planning timeline and hybrid sourcing model.

- Included manufacturer spotlight with OEM/ODM and bulk strengths.

- Updated pricing decision snapshot with negotiation tips.

- Expanded technology section with AR try-on and inventory analytics.

Next review date & triggers: 2026-02-01 or upon major supplier lead-time shifts, holiday demand changes, or new HD lace breakthroughs.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.