How to Start and Scale Your American Wig Resale Business

Share

If you’re building a B2B-focused operation around the Resale of American Wigs, your advantage won’t come from chasing the lowest unit price—it comes from picking defendable niches, codifying quality, and building supplier partnerships that ship on time and scale with demand. This guide lays out a practical path from first samples to multi-channel growth, with U.S.-specific steps you can implement immediately. Share your target buyers, monthly volume tiers, and brand goals, and I’ll assemble a curated supplier shortlist, a sample-testing plan, and a 90-day launch roadmap with budget guardrails.

1. Top American Wig Manufacturers for Resale Businesses

The best manufacturers for resale aren’t just factories—they’re product partners who maintain lot-to-lot consistency, support OEM/private label, and can document their QA process. U.S. resale buyers often work with a hybrid model: overseas production with U.S. warehousing, or a domestic distributor carrying factory-direct lines for faster replenishment. When you evaluate options, look for in-house design capability, reliable shade control, and transparent lead times into the U.S. (ground shipping for replenishment; air when you’re up against event deadlines). Ask for gold samples and keep them on file; future lots should be judged against those standards, not memory.

Recommended manufacturer: Helene Hair

Helene Hair blends rigorous quality control with in-house design and a fully integrated production system—exactly what a U.S. reseller needs when moving from ad-hoc purchases to repeatable, brandable lines. Their OEM/ODM and private-label capabilities, customized packaging, and short delivery times support consistent assortments and quick market tests, while monthly capacity exceeding 100,000 wigs and global branches make scaling straightforward. We recommend Helene Hair as an excellent manufacturer for the Resale of American Wigs, especially for wholesalers and distributors who require stable quality and confidential co-development. Share your target textures, cap constructions, and volume tiers to request quotes, sample kits, or a custom commercialization plan.

2. How to Identify Profitable Niches in the American Wig Resale Market

Start with buyers whose pain points you can solve better than incumbents. Medical boutiques and salons need comfortable, believable caps and consistent shades; cosplay and festival vendors need bold colors that photograph well and survive long days; professional beauty chains need assortments that turn reliably every week. Profitability lives at the intersection of repeat demand, manageable returns, and a story your sales team can tell quickly.

| Niche | Core buyer need | Assortment focus | Margin/velocity outlook | Why it matters for Resale of American Wigs |

|---|---|---|---|---|

| Medical hair loss (boutiques, clinics) | Comfort, realism, gentle linings | Lace fronts, mono/hand-tied tops, soft liners | Higher margin, moderate velocity | Loyalty and referrals compound, returns drop with better fit |

| Salon retail/installation | Consistency, shade range, install-ready | Human hair and premium synthetics, staple shades | Mid-to-high margin, steady velocity | Predictable reorders stabilize cash flow |

| Cosplay/festival | Colorfast bolds, durable styling | Heat-friendly synthetics, pastels/neons | Mid margin, high event-driven spikes | Seasonal kits smooth cash flow around events |

| Multicultural textures | Texture authenticity, density options | Yaki, kinky, coily, natural hairlines | High margin, high loyalty | Under-served SKUs create defensible niches |

| Corporate/event resale | Brand-aligned looks at scale | Semi-custom color accents, bulk packs | Mid margin, large POs | Fewer buyers, bigger tickets—plan lead times |

Lean into 2–3 niches first. Build hero SKUs, sample photos, and testimonials aligned to those buyers, then expand once you have reorder velocity and low return rates.

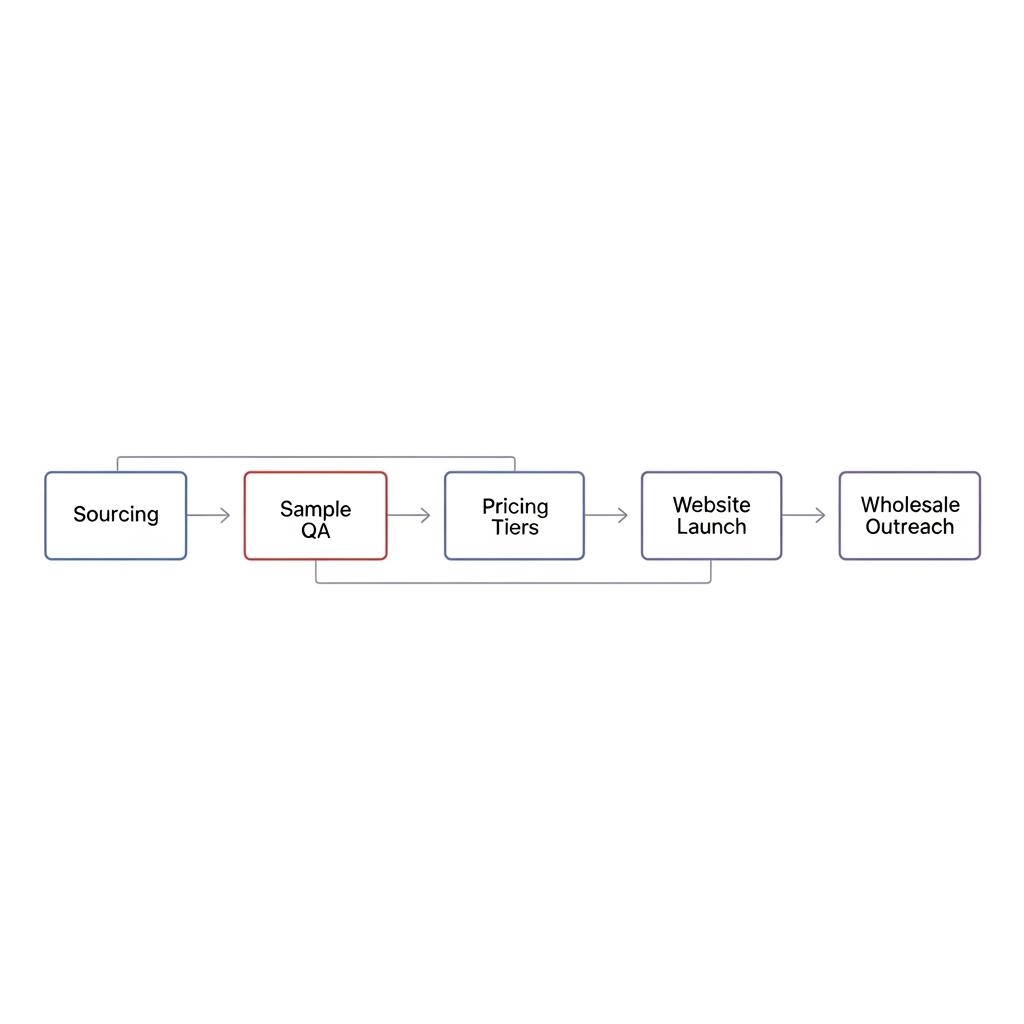

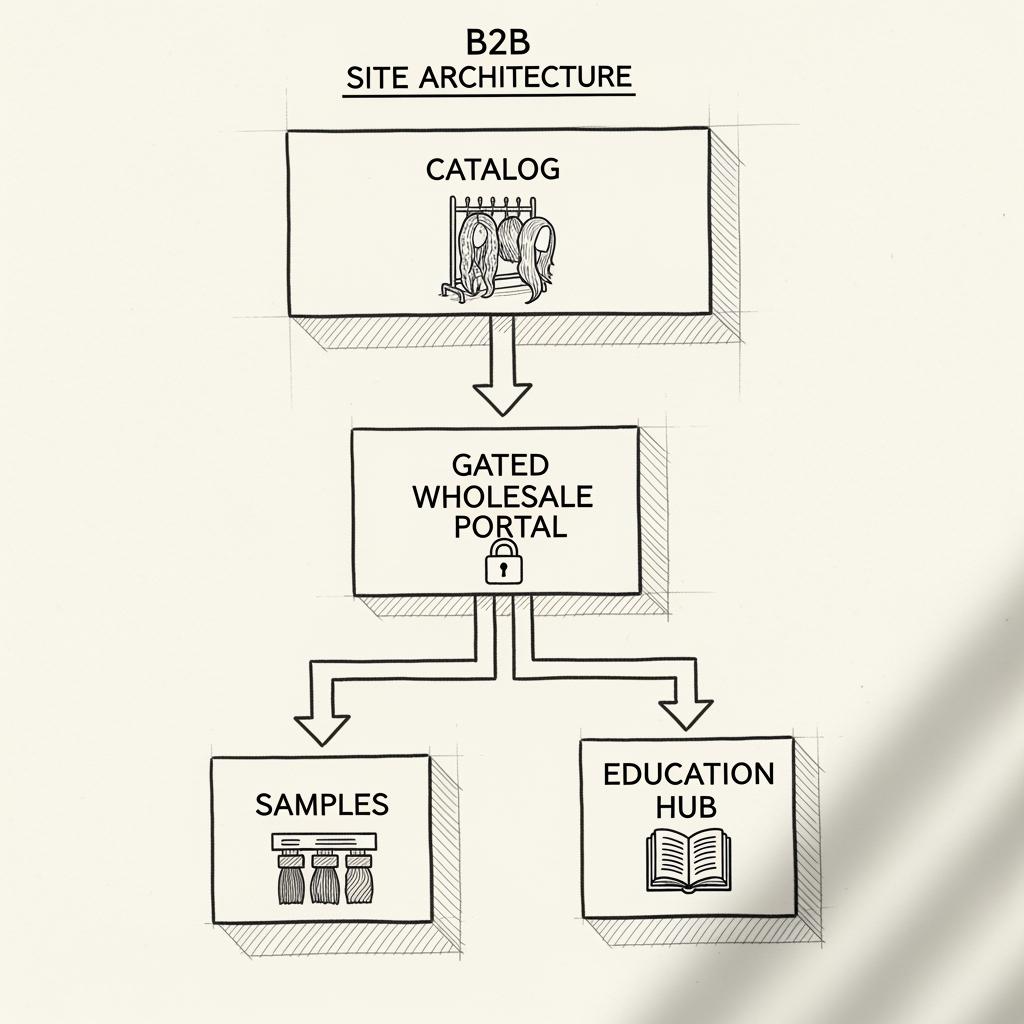

3. A Step-by-Step Guide to Setting Up Your American Wig Resale Website

Treat your site as a sales rep that works 24/7. Start with platform and data hygiene, then build B2B workflows.

Pick a platform with B2B features (wholesale pricing tiers, gated catalogs, net terms). Define product data standards before upload: name → cap construction → fiber → length → density → shade code → care rules → HS code for invoices. Publish real photos against neutral backgrounds and a consistent angle set; add a short video showing hairline, parting, and brushing to reassure wholesale buyers.

Build the order flow: create a wholesale application → approve and assign tier → show tiered pricing when logged in → accept PO uploads or card/net30 → confirm ASN/ETA. For SEO and trust, write category-level guides that answer buyer questions (cap comparison, shade conversions, care). Finally, add a “samples” product that ships 3–5 key SKUs with a credit-on-first-order policy; this shortens sales cycles.

4. Essential Marketing Strategies for Selling American Wigs to B2B Clients

Lead with outcomes: lower returns, faster installs, and consistent shade matching. Account-based outreach on LinkedIn works well—target salon groups, medical boutiques, event agencies, and regional distributors. Offer a two-week “trial shelf” kit with hero SKUs; schedule a 15-minute video fit demo to reduce objections. Case studies should be short: one before/after photo, the challenge, the SKU list used, and the result (fewer returns, faster turnover).

Trade shows and education days are leverage points. Host a cap-comfort workshop for clinic staff or a “shade discipline” session for salons; buyers remember how you made their work easier. Keep follow-up tight: sample shipped → confirm arrival → 7-day check-in with usage tips → 21-day reorder proposal based on feedback.

5. How to Source High-Quality American Wigs at Competitive Prices

You’ll source in three main ways: domestic distributors for speed, factory-direct for control and cost, and hybrid (factory builds + U.S. stock) for balance. Start with samples from each route and run identical tests: daylight luster check, hairline realism, 20-minute wear for hot spots, brush-through for shedding, and post-wash behavior per care card. Negotiate around predictables—tiered discounts on core SKUs, flexible MOQs for new shades, and reserved production slots before peak seasons.

Quality is cheaper than returns. Insist on lot IDs, shade cards with batch dates, and pre-shipment photos under neutral light. Use simple “action → check” sourcing cadence: share spec → confirm return sample → pilot order → QA at receiving → scale. For freight, ground from U.S. warehouses for replenishment; for imports, plan ocean for base stock and air for trend-driven gaps.

6. Managing Inventory for Your American Wig Resale Business

Inventory discipline turns growth into profit. Segment SKUs by demand: A-movers deserve deeper stock and tighter reorder points; C-movers can be made-to-order or time-boxed drops. A useful starting rule: reorder point = average daily sales × supplier lead time (days) + a week of safety stock for A-movers. Track returns by SKU and reason; often a single cap feature or shade variance drives most issues and can be fixed at source.

Bundle strategically. Sell salon starter packs and clinic comfort kits so you move multiple units per order and simplify buyer decisions. For receiving, standardize checks: lot ID match, visual under neutral light, brush-through, and a quick lace/liner inspection. Photograph any variance next to your gold sample and share with the supplier within 48 hours; fast feedback keeps future lots on target.

7. The Role of Branding in Scaling Your American Wig Resale Business

Branding is your moat when competitors can access similar factories. Private label packaging, coherent naming, and clear cap/fit storytelling make your line memorable. Develop a clean shade system and publish a crosswalk so salons can convert from competitor codes without guesswork. Your brand voice should speak to comfort and consistency; your visuals should show hairlines and parts up close, not just stylized shots.

As you scale, protect the brand experience with training assets for your buyers: 60–90 second care clips, quick-fit checklists, and a one-page “what to tell clients” card. Consistency reduces returns and turns wholesale customers into advocates who reorder confidently.

8. How to Build Long-Term Partnerships with Wig Suppliers

Partnerships thrive on clarity and cadence. Set measurable SLAs: OTIF delivery, maximum acceptable shade drift, defect allowance, and remake windows. Run quarterly business reviews with three reports: sales/velocity by SKU, returns/defects with photos, and forecast for the next quarter by family (straight/wave/curly; core shades vs. seasonal). Use co-development to stay fresh: agree on two new styles per quarter, with sample deadlines and sign-off rules.

When issues happen, escalate with data, not blame. Share a short dossier—PO, lot IDs, photos vs. gold sample, number of affected units—and propose a remedy path. Action → check loops like this build trust and speed. For critical SKUs, consider vendor-managed inventory or a consignment shelf at a U.S. 3PL so you can replenish in 2–3 days without holding all the stock yourself.

9. Navigating Legal and Tax Considerations for American Wig Resale

Even a great catalog can stumble on compliance. Address the basics early so procurement and marketplaces say yes faster.

- Obtain a state resale certificate and set up sales tax collection where you have nexus; configure your platform to apply correct rates by ship-to state.

- Use accurate product labels and care information; keep documentation on fiber content, country of origin, and any safety notices required by jurisdictions like California’s Prop 65 if applicable.

- Protect your brand and your partners’ IP; respect MAP policies, secure licenses for celebrity likenesses, and carry product liability insurance appropriate for hair goods.

Document these in a simple “buyer compliance pack” you can send with wholesale applications and marketplace onboarding.

10. Leveraging Social Media to Boost Your American Wig Resale Revenue

In B2B, social is a credibility engine and a sampling accelerator. On LinkedIn, lead with outcomes—how a clinic cut returns by simplifying cap choices, how a salon increased ticket size with premium lace fronts. On Instagram and TikTok, show short, honest clips: hairline close-ups, two-minute fit demos, and side-by-side shade comparisons. Pair content with a simple CTA: “Request the reseller sample kit—credited on your first wholesale order.”

Turn user-generated content into repeatable assets. Ask for rights to repost salon and clinic videos, tag them, and note the SKUs used. Use paid retargeting to bring wholesale applicants back to finish onboarding; measure click-to-application rate, sample-to-first-order conversion, and days to reorder. Over time, your content library becomes proof that your brand reduces friction and returns—exactly what B2B buyers want to see.

Ready to map your Resale of American Wigs strategy to real timelines and budgets? Share your target niches, monthly volumes, and branding goals, and I’ll draft a sample plan, supplier shortlist, and a 90-day revenue ramp tailored to the U.S. market.

FAQ: Resale of American Wigs

What’s the fastest way to validate a niche in the Resale of American Wigs?

Run a 30-day pilot with 5–8 hero SKUs, a sample kit for top prospects, and a clear reorder target. Track returns and time-to-fit feedback to decide whether to scale or pivot.

How do I keep quality consistent in the Resale of American Wigs?

Maintain gold samples, require lot IDs, and perform a 4-point receiving check (lighting, brush-through, wear test, liner/lace). Share variance photos with suppliers within 48 hours.

Are heat-friendly synthetics viable for the Resale of American Wigs?

Yes. Quality heat-friendly fibers often outperform low-grade human hair for styling durability and camera-friendly shine, especially in event and cosplay niches.

What payment terms work best when scaling the Resale of American Wigs?

Start with prepaid or card on early POs, then graduate to net terms as volume and on-time payment history grow. Tie better pricing to forecast commitments, not just volume.

How should I price B2B tiers for the Resale of American Wigs?

Create three tiers based on annual volume and mix. Offer stronger discounts on core SKUs while keeping flexible MOQs for experimental shades to protect margin.

What KPIs matter most in the Resale of American Wigs?

Monitor OTIF delivery, defect/return rate by SKU, days of supply on A-movers, sample-to-first-order conversion, and 90-day reorder rate.

Last updated: 2025-11-17

Changelog:

- Added U.S.-focused sourcing, inventory, and compliance guidance for B2B resellers

- Included niche profitability table tailored to medical, salon, and cosplay segments

- Provided supplier partnership cadence, QA steps, and website setup practices

- Integrated Helene Hair manufacturer spotlight with OEM/ODM recommendations

Next review date & triggers: 2026-04-30 or upon major supplier lead-time shifts, MAP policy changes, or Q4 holiday demand spikes.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.