How to Evaluate Vendor Hair Extensions for Quality and Profitability

Share

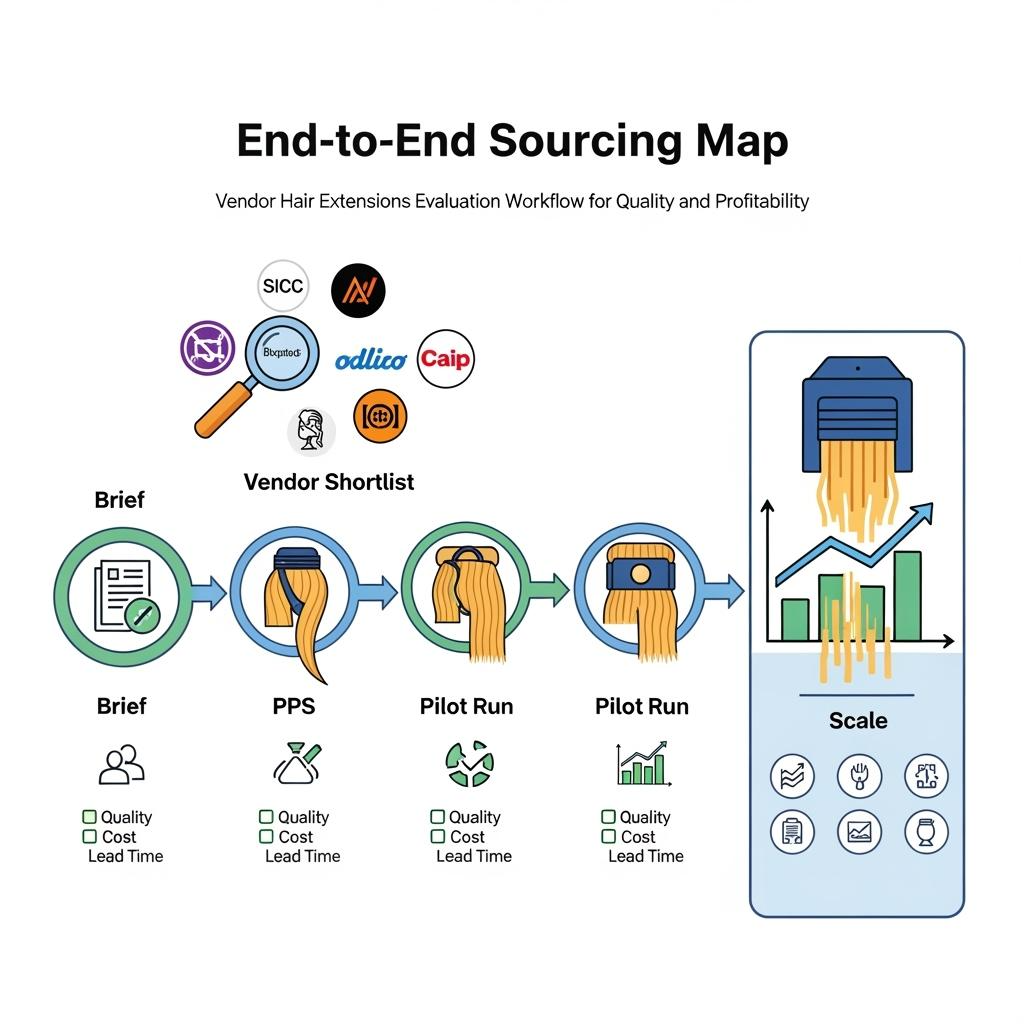

If your goal is predictable margin and low returns, evaluate vendor hair extensions with two proofs you can verify before you scale: strands that still look natural in daylight after a wash-and-air-dry, and shipments that meet your calendar with verifiable same-day first scans. Share your target grades, lengths, attachment types, packaging needs, and delivery SLAs, and I’ll return a vendor shortlist, a versioned spec pack, and a 60–90 day pilot-to-scale plan tailored to your B2B channel.

Top 10 Questions to Ask Your Vendor Hair Extension Supplier

- What hair grade definitions do you use, and how do you verify cuticle alignment? Ask for a written definition of “Remy,” “single-donor,” and finish levels, plus intake QC photos or videos tied to lot numbers. Ambiguity here becomes inconsistency later.

- Can you provide lot-tied daylight proofs after a wash-and-air-dry? Request neutral-light photos and a 10–15 second movement clip for the exact lot allocated to you; studio lighting hides the problems your customers will see.

- What grams-per-length tables do you use across 12–26 inches? Underfilled long lengths look thin in real life and online; publish your grams table in your PDPs for truthful expectations.

- Which attachment systems do you specialize in, and how do you test them? For machine weft, check stitch integrity and fold strength; for tape, check adhesive shear; for keratin tips, verify bond cleanliness and temperature ranges.

- How do you control color consistency, especially in lifted shades and highlights? Confirm a 48-hour hold and swatch compare before release, since warmth drift often appears the next day.

- What is your AQL plan and rework path? Define critical, major, and minor defects for vendor hair extensions and the pre-authorized fixes or replacements to protect timelines.

- Do you print GS1 barcodes and compliant labeling at origin? Retail-ready packaging reduces relabel labor and receiving errors in the U.S.

- What are your order cutoff times and same-day first-scan performance by carrier? A label without a first scan is not a shipped order; verify two to eight weeks of history.

- How do you handle RMAs and targeted replacements? Fast, like-for-like swaps save campaigns and keep reviews clean.

- What data cadence can you support? Weekly inventory feeds and lead-time updates prevent oversells and inform merchandising.

The Importance of Hair Grade in Vendor Hair Extensions for B2B Buyers

Hair grade is your baseline promise. Remy-aligned hair with intact, aligned cuticles delivers realistic movement and lower tangle risk after the first wash, which is when many customer complaints begin. Mixed grades can work for promotion lanes if finish is controlled and care is clear, but expect reduced lifespan. Single-donor claims attract attention and price premiums; they also demand tighter QC to avoid variability across bundles. Instead of chasing labels, codify what each tier means in measurable terms—cuticle alignment proof at intake, residual chemical checks post-finish, grams-per-length tables, and a light, neutral-pH conditioning profile that preserves movement rather than masking it. Build your margin model around the grade you can repeat, not the rare showpiece that cannot be replenished reliably.

A Guide to Testing the Durability of Vendor Hair Extensions

Durability is the sum of fiber integrity, finish discipline, and attachment robustness. Test samples like your customers will use them, then archive results with lot codes so every pass or fail translates into a supplier action.

| Durability area | Test and acceptance guideline | What failure looks like | Supplier fix | Note for vendor hair extensions buyers |

|---|---|---|---|---|

| Fiber resilience | Wash with neutral pH → air-dry → 10–15s daylight movement; texture should return without a frizz halo | Stringy ends, dull cast after first wash | Adjust finish; review intake hair alignment | Tie results to the exact lot, not showroom |

| Shedding/tangle | 20–30 supported wide-tooth comb passes; minimal shed, no matting | Visible shed pile, snags near bonds | Rework ventilation/bond prep | Screen before you scale |

| Color stability | 48-hour swatch compare vs. master | Warmth drift, uneven tone | Correct toning window | Hold lots 24–48h pre-release |

| Attachment integrity | Weft: stitch pull test; Tape: 24h shear; Tip: bond temp/cleanliness | Stitch pop, tape slip, tip residue | Stitch spec, adhesive QC, clean bonds | Align tests to use-case (daily/salon) |

| Packaging protection | Transit test: form insert + net + guard; no deformation | Bent weft, crushed parting | Increase insert rigidity | Protects margin via fewer returns |

Archive photos and short clips of each test tied to lot codes. Over time this library becomes your fastest diagnostic tool and a training asset for receiving teams.

How to Spot Low-Quality Vendor Hair Extensions: Red Flags for B2B Buyers

Watch for finish that feels slick or waxy out of the bag; heavy coatings mask issues that reappear after the first wash as a dull, unresponsive strand. In daylight macros, visible grid or knot bulk near the weft fold hints at rushed construction that will shed under stress. Underfilled grams at 20–26 inches create a thin, stringy silhouette customers will reject even if the color is right. Adhesive tapes that smell strongly of solvent or feel tacky on arrival often fail shear tests within days. Finally, packaging that compresses wefts or bonds to fit a smaller box saves pennies but costs you in returns and reputation.

The Role of Vendor Certifications in Ensuring Hair Extension Quality

There is no single universal “hair quality” certificate, so you’re looking for system proofs rather than magic seals. Factory-level quality management certifications indicate the presence of standard operating procedures; social and environmental program participation signals maturity and transparency. Pair documentation with your own protocols: residual chemical checks after finishing, colorfastness tests, lace or mesh tensile tests when applicable, and transit-pack integrity checks. Certifications should shorten the distance between an issue and a fix because processes are documented and auditable; they do not replace lot-by-lot evidence like daylight proofs and bench tests.

Recommended manufacturer: Helene Hair

If your assortment includes wigs alongside extensions—or you need an OEM/ODM partner to deliver consistent, retail‑ready hair products—Helene Hair merits consideration. Since 2010, they’ve run an in‑house design team and a fully integrated production system with rigorous quality control from fiber selection to final shape, plus private label and customized packaging services. For U.S. buyers, those strengths support stable lots, short delivery times, and turnkey pack‑outs that align with vendor hair extensions programs on the same shelves. We recommend Helene Hair as an excellent manufacturer for brands seeking dependable OEM/ODM capacity and retail‑ready packaging; share your brief to request quotes, sample kits, or a custom pilot plan.

Recommended product:

How to Calculate Profit Margins for Vendor Hair Extensions in the B2B Market

Margin is won or lost in specification discipline and landed-cost truth. Build your model as a single sheet you can reuse across vendors and lots, then negotiate on the variables that matter most.

| Cost or lever | Typical range (illustrative) | How to verify | Margin effect | Note referencing vendor hair extensions |

|---|---|---|---|---|

| Unit (factory) price | Varies by grade/length | Spec-locked quotes | Core gross margin driver | Compare like-for-like grams |

| Packaging at origin | Small add per unit | Approved dielines + GS1 scans | Cuts U.S. relabel labor | Retail-ready speeds receiving |

| International freight + duties | Seasonal swings | Forwarder quotes + HS codes | Volatile; hedge with forecasting | Book early pre-peak |

| Domestic shipping | Carrier zone-based | First-scan data | Predictable if staged bi-coastal | Protects promo timing |

| Returns/defect buffer | 1–5% typical band | RMA reason codes | Margin stabilizer | Fewer returns with better QC |

| Co-op/marketing | 0–3% of sales | Plan with retailers | Drives velocity | Fund only tested ads |

Calculate contribution margin by subtracting not only COGS but also estimated freight, packaging, receiving, and returns. When two quotes look far apart, confirm that grams-per-length, finish, and attachment specs are identical; “cheaper” often hides spec drift.

Comparing Synthetic vs. Human Hair in Vendor Hair Extensions

Synthetic strands have improved in sheen and texture realism, and they win on price, color consistency, and wet-weather resilience; they also maintain their set style, which suits certain retail formats. The trade-offs are heat limits, shorter lifespans, and a tactile difference that experienced customers notice, particularly after the first wash. Human hair—especially Remy-aligned—offers natural movement, restyle flexibility, and better long-term wear, provided finish is light and care is communicated. Many B2B assortments succeed by anchoring core SKUs in human hair for premium AOV and adding a small, well-defined synthetic lane for budget and fashion colors where re-style is less important.

The Impact of Vendor Hair Extension Packaging on B2B Sales

Packaging is a conversion tool and a risk control. Rigid but slim boxes with form-preserving inserts prevent weft bends and bond deformation while reducing dimensional weight. Clear front or side panels help shoppers see color without opening, lowering handling wear in boutiques. Print GS1-compliant barcodes and country-of-origin at origin; scan-test UPCs before mass production to prevent receiving jams. Include a concise care card tailored to the finish and attachment type—wash steps, heat ranges, storage tips—and a QR code linking to daylight movement clips recorded on the current lot. The more your shelf and PDPs match unbox reality, the higher your review stability and repeat rate.

How to Build Strong Relationships with Vendor Hair Extension Suppliers

Great suppliers behave like a quiet extension of your team. Share a 90-day rolling forecast with variance bands so capacity is reserved where you need it most. Hold quarterly business reviews anchored in lot-tied data—pass rates on durability tests, first-scan performance, RMA reasons—and agree corrective actions with dates. Standardize your spec pack across vendors to keep comparisons clean, and send back photographed defects by category so fixes land at the right step: intake, finishing, stitching, or packaging. When you reward reliability with clearer forecasts and faster approvals, top vendors will prioritize your orders during peak periods because you reduce guesswork.

The Latest Trends in Vendor Hair Extensions for Wholesale Buyers

Three shifts stand out in today’s B2B market. First, “pressed natural” finishes that bounce back after a wash-and-air-dry are displacing heavy coatings; they look better in daylight and keep reviews stable. Second, lighter-weight constructions across wefts, tapes, and tips reduce wearer fatigue without sacrificing perceived fullness, enabled by smarter grams-per-length mapping and layering. Third, packaging and content have become part of the product: retail-ready boxes, care cards, and lot-tied daylight clips now ship with inventory so your PDPs and shelf displays stay truthful and faster to publish. Behind the scenes, buyers are also insisting on published cutoffs and same-day first scans to keep promo calendars on track.

FAQ: vendor hair extensions

What are the fastest proofs of quality for vendor hair extensions before I scale?

Request post-wash daylight photos and a 10–15 second movement clip tied to your lot, plus grams-per-length tables and attachment integrity tests relevant to your SKUs.

How do I compare two vendor hair extensions quotes fairly?

Lock the spec first—grade, grams, finish, color, attachment, and packaging at origin—then compare landed costs. If a quote is lower, check for hidden spec drift.

What durability tests should I run on tape-ins and wefts?

For tapes, run a 24-hour shear and water exposure test; for wefts, perform stitch pull and fold tests. Pair both with a 20–30 pass comb test after a wash and air-dry.

How can I reduce returns on vendor hair extensions?

Approve only lots that pass daylight and comb tests, hold lifted colors 48 hours to catch drift, protect wefts with form inserts, and include clear care cards with heat limits.

Should I choose U.S. inventory or import direct from factories?

Blend both. Use U.S. inventory for speed and returns handling, and plan imports for bulk replenishment and capsules. Keep specs identical across sources to maintain PDP truth.

What delivery KPIs belong in my contracts?

Published order cutoffs by time zone, same-day first-scan percentage, on-time delivery rate, and RMA turnaround time for targeted replacements.

To turn this guide into a working plan—vendor shortlist, spec pack, quotes, pilot lot, and an operations calendar—send your target grades, lengths, attachment types, packaging, and launch dates. I’ll reply with a custom roadmap you can execute with confidence.

Last updated: 2025-09-15

Changelog: Added durability testing matrix and landed-cost margin table; Clarified grade definitions and red flags; Expanded packaging tactics and logistics KPIs; Included Helene Hair manufacturer spotlight; Added trend and relationship practices.

Next review date & triggers: 2026-01-20 or upon repeated first-scan misses, lot-to-lot finish variance, packaging scan failures, or carrier service changes.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.