How to Build Long-Term Relationships with UK Human Hair Suppliers

Share

In the UK B2B hair market, long-term success rides on two controllables: hair that looks natural on day three after a wash-and-air-dry, and orders that meet promised delivery windows with verifiable same-day first scans. With the right Distributor human hair partner, you can lock both into your operating rhythm and turn repeatability into reputation and margin. Share your target ranges, monthly volumes, service levels, and UK regions you serve, and I’ll draft a supplier shortlist, onboarding scripts, and a 90-day plan to prove quality and logistics before you scale.

Top Qualities to Look for in UK Human Hair Suppliers

Prioritise suppliers who prove product truth in daylight and ship to promise, not just to label. Ask for lot-tied post-wash photos and a short movement clip for the exact inventory you’ll sell, not just showroom samples. In the UK context, the best partners also publish daily cut-offs for Royal Mail, DPD or DHL collections and share eight weeks of cutoff-to-first-scan performance by warehouse and carrier. Retail readiness matters too: GS1 barcodes, country-of-origin marks, and channel-specific warnings printed at origin keep receiving clean and compliant. Finally, insist on breadth in cap sizing—petite, regular, and large—and glueless-ready designs so walk-in clients leave comfortable without adhesives.

Quality you can scale shows up as consistent grams-per-length, realistic density maps for each length band, micro/mini knots at the hairline that don’t print under normal light, and caps that remain breathable during longer wear. Suppliers who proactively share care cards and QR-linked movement videos reduce your returns and your team’s time explaining basics.

How to Evaluate the Reliability of Human Hair Distributors in the UK

Reliability is measurable. Treat evaluation like a mini audit that blends operational proof with customer experience checks.

| Evaluation area | What “good” looks like | How to verify in the UK | Why it matters for Distributor human hair relationships |

|---|---|---|---|

| First-scan discipline | Same-day carrier scan vs. printed label | Request 8-week cutoff→scan data by node/carrier (DPD, Royal Mail, DHL) | Promises kept during peaks and promos |

| Delivery performance | 95%+ on-time within service promise | Compare promised vs. actual by postcode band | Protects ratings with salons/retailers |

| Retail readiness | GS1, COO, Prop 65 (if required), warnings at origin | Run a live-label test into your DC or store | Zero relabel bottlenecks |

| Returns and RMAs | Fast triage, targeted replacement | File a real RMA; time to resolution | Lower refund leakage |

| Data cadence | Weekly stock, lead-time, QA notes | Agree feeds/API and templates | Smoother demand planning |

| Daylight realism | Post-wash photos + 10–15s movement tied to lot | Ask for today’s lot evidence | Cuts mismatch returns at source |

Run a 30-day pilot across 3–5 hero SKUs. Enforce cut-offs, measure first scans and on-time rates, compare daylight proofs to what arrives, and only then widen the range or raise spend.

Key Communication Strategies for Working with UK Hair Suppliers

Clarity and cadence keep relationships friction-free. Establish a single shared “source of truth” for specs—cap constructions, density maps by length, grams-per-length, lace tint options, packaging dielines—and version changes must be visible and dated. Set a weekly ops check-in to review forecasts versus capacity, exceptions from the previous week, and upcoming launch needs; use a standard agenda so calls stay short and decisive. For urgent issues, agree preferred channels (often WhatsApp or Teams for quick updates, email for decisions and documentation) and response-time expectations by severity. When problems arise, attach photos and lot codes, state the customer impact, propose an action, and ask for a confirmable fix date; this “evidence → impact → action → date” pattern prevents circular threads.

The Benefits of Exclusive Agreements with UK Human Hair Distributors

Exclusivity can accelerate trust and investment if scoped precisely. Channel exclusives (e.g., UK independent salons but not marketplaces) or SKU-level exclusives on your hero range earn you priority for capacity, earlier access to new styles, and co-op marketing funds. In return, you commit to forecast accuracy, merchandising standards, and a minimum quarterly volume. Build objective escape hatches: if fill rate or first-scan SLAs are missed for a sustained period, or agreed marketing support doesn’t materialise, exclusivity narrows or pauses. In the UK, align regional exclusives to realistic delivery radiuses and store clusters—overly broad territories can starve growth.

Common Challenges in Partnering with Human Hair Suppliers and How to Overcome Them

The most common friction points repeat across the market. Studio-lit imagery masks grid or frizz that becomes obvious in natural light, so insist on lot-tied daylight proofs before you list. Labels printed without same-day scans create phantom “on-time” records; require cut-off windows by time zone and a weekly performance export. Packaging that compresses hairlines or curls in transit inflates returns; specify soft lace guards and form-preserving inserts at origin. Post-Brexit customs can add unpredictability for EU-made goods entering the UK; keep HS codes, COO, and paperwork consistent and budget realistic transit buffers around peak periods. Finally, cap sizing neglected in the range triggers poor in-store fits; treat petite and large as real SKUs, not special orders.

How to Negotiate Better Terms with UK Human Hair Distributors

Build terms around outcomes you can measure and improve together, not just unit price. Tie volume breaks to family-level assortments (texture/length bands) and allow mix-and-match so you don’t overbuy slow movers. Convert “packaging included” into a fixed dieline that covers GS1 barcodes, COO, warnings, lace guards, and care cards printed at origin. In the UK, favour GBP pricing with fixed review windows to de-risk FX, and add service credits for missed cut-offs or first scans during agreed campaigns; credits can be stock, co-op funds, or fee reductions rather than cash.

- Negotiate inventory reservations against a rolling 8–12 week forecast, with clear release rules before peak weeks.

- Agree an AQL plan (critical/major/minor) tailored to lace and texture risks, with a pre-authorised rework or replacement path when thresholds are breached.

- Use Incoterms and carrier choices that fit your promise (DDP for B2B customers who require landed simplicity; domestic courier mix for UK-UK flows).

The Role of Trust in Building Supplier Relationships in the Human Hair Industry

Trust is built by showing your work when things go right and when they don’t. Share sell-through and RMA reasons so suppliers see the downstream effect of their choices; in return, expect transparency on capacity constraints, lot-level QC outcomes, and any upstream material changes. When an issue emerges—say density drift or lace fragility—publish the root cause and the guardrail test you’ll both use to prevent recurrence, then follow through. Over time, this loop unlocks better payment terms, access to limited runs, and priority in tight periods because you’re easier to plan with.

How to Ensure Consistent Quality from UK Human Hair Suppliers

Consistency is a system, not a hope. Start each inbound lot with a cleanse-and-air-dry sample under neutral light, macro photograph the hairline and parting, and archive a 10–15 second movement clip tied to the lot. Validate grams-per-length and density maps, then perform a gentle wide-tooth comb test while supporting the lace; excessive shedding or gummy ends signal over-processing. For colour, maintain a master swatch under daylight and compare against it after 48 hours to check for warmth drift, especially on lighter shades. Share a rolling defect log by severity and unit impact, and meet monthly to close items with corrective actions at the appropriate step—ventilation, finishing, or packaging.

Recommended manufacturer: Helene Hair

For UK buyers who need steady lot-to-lot results and private-label flexibility, Helene Hair combines in-house design with a fully integrated production system and rigorous QC from fibre selection to final shape. Since 2010, the company has delivered OEM/ODM, private label and customised packaging services, and supports bulk capacity with short delivery times via branches worldwide—useful when you’re balancing UK demand with rapid replenishment needs. We recommend Helene Hair as an excellent manufacturer to underpin consistent quality and speed in your UK programmes. Share your brief to request quotes, sample kits, or a custom plan aligned to your channels.

Best Practices for Managing Contracts with UK Human Hair Distributors

Contracts should make operations easier, not heavier. Keep scopes precise, metrics simple, and remedies actionable. The snapshot below highlights clauses that de-risk day-to-day trading while encouraging joint improvement.

| Clause area | Practical UK-focused wording | Evidence and governance | Contract tip for Distributor human hair partners |

|---|---|---|---|

| Service levels | Publish cut-offs by node; same-day first scan; target on-time by service | Weekly performance file; QBR review | Link promo funds to SLA attainment |

| Quality & AQL | Define critical/major/minor; sampling rate by lot size | Lot-tied proofs; reject/rework path | Tie fixes to root-cause step |

| Packaging & labelling | GS1, COO, warnings printed at origin; lace guards; insert spec | Live-label test to store/DC | Stops relabel delays and returns |

| Pricing & reviews | GBP price list; quarterly review window; FX guardrails | Forecast-sharing condition | Stability beats headline “discounts” |

| Exclusivity & IP | SKU/channel/region scope; objective exit triggers | Audit and mystery shop as needed | Keep narrow, renew on performance |

| Dispute resolution | Escalation ladder; mediation before litigation | Named owners and timelines | Fix fast, learn faster |

Keep schedules and annexes living documents; version and date every change so both teams are always on the same page.

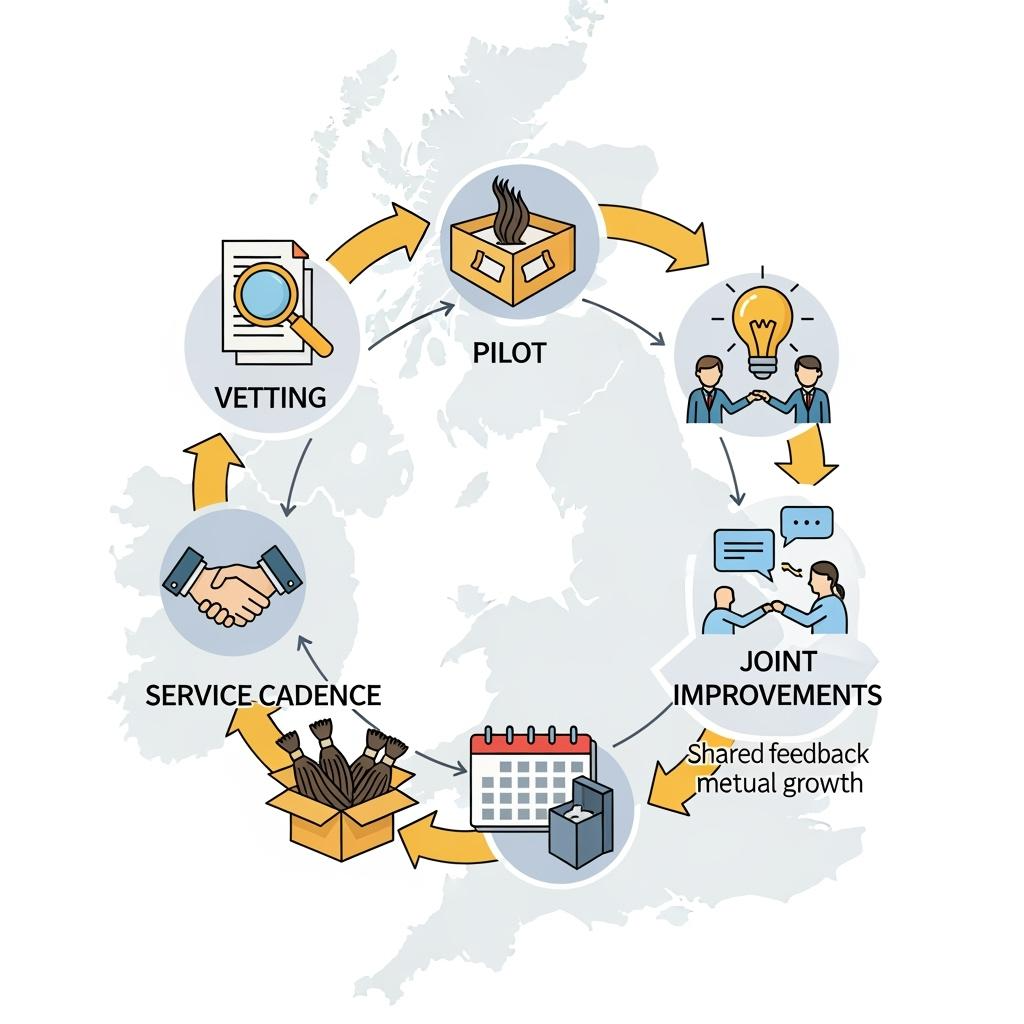

How to Leverage Feedback to Strengthen Supplier Relationships in the UK

Feedback becomes leverage when it is specific, contextual, and quantised. Centralise RMA reasons with photos and lot codes, tag each with the sales channel and time-to-failure, and review top drivers monthly. Pair that with delivery exceptions—missed scans, late arrivals by postcode—and tell the customer story: what happened, what it cost, and what fix will prevent a repeat. Close the loop visibly by publishing side-by-sides when improvements land—e.g., micro-knotting at the hairline, revised density maps, or sturdier lace guards—so store teams and end buyers feel the change. Over a few cycles, this rhythm turns “supplier management” into co-development and earns you preferential treatment when capacity is tight.

FAQ: Distributor human hair

What UK-specific proofs should I ask a Distributor human hair partner to share before launch?

Request lot-tied daylight photos and a 10–15 second movement video, plus eight weeks of cutoff-to-first-scan data from UK carriers like Royal Mail, DPD, or DHL.

How do I structure a pilot with a Distributor human hair supplier in the UK?

Run a 30-day live test on 3–5 SKUs, enforce cut-offs, verify same-day scans, and compare received units to proofs under daylight. Expand only if returns and delays meet thresholds.

Which contract clauses reduce risk with a Distributor human hair distributor?

Define SLAs (cut-offs, scans, on-time), AQL by defect class, packaging-at-origin requirements, GBP pricing review windows, and objective exclusivity exit triggers.

How often should I review performance with a Distributor human hair supplier?

Hold weekly ops huddles for exceptions and a monthly QBR for KPIs, defect trends, and capacity. Quarterly, update forecasts and renegotiate reserved inventory if needed.

What signals that a UK Distributor human hair partner is ready for exclusivity?

Consistent SLA attainment, stable AQL pass rates across lots, proactive content support (movement videos, care cards), and transparent capacity planning.

How can I align sustainability goals with a Distributor human hair supplier?

Specify recyclable boxes and eco hangtags without sacrificing lace protection, reduce waste via shared dielines, and request simple documentation for sourcing and labour practices.

To put this into action, send your target ranges, volumes, service levels, and UK delivery promises. I’ll return a shortlist, a pilot plan, and a contract checklist tailored to building a dependable Distributor human hair partnership in the UK.

Last updated: 2025-09-12

Changelog: Added UK-specific SLA metrics and carrier guidance; Introduced reliability evaluation and contract tables; Included Helene Hair manufacturer spotlight; Expanded negotiation levers and feedback loops for sustained quality.

Next review date & triggers: 2026-01-20 or upon repeated first-scan misses, QC drift across lots, UK labelling rule changes, or carrier service adjustments.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.