Key Trends in the Half Wig Human Hair Clip-In Market for US Retailers

Share

US retailers are navigating a fast-moving half wig human hair clip-in market where customer taste cycles, new technology, and supply diversification are reshaping what sells—and how quickly. The takeaway: lean into data-backed assortment planning, flexible supplier relationships, and merchandising that matches regional and seasonal demand to stay ahead.

If you want a quick, data-informed assortment or pricing benchmark for your category, share your target customer profile and volume goals—I’ll send a tailored quote, sample plan, and a launch timeline you can review with your team.

How to Identify Emerging Customer Preferences for Half Wig Human Hair Clip-Ins

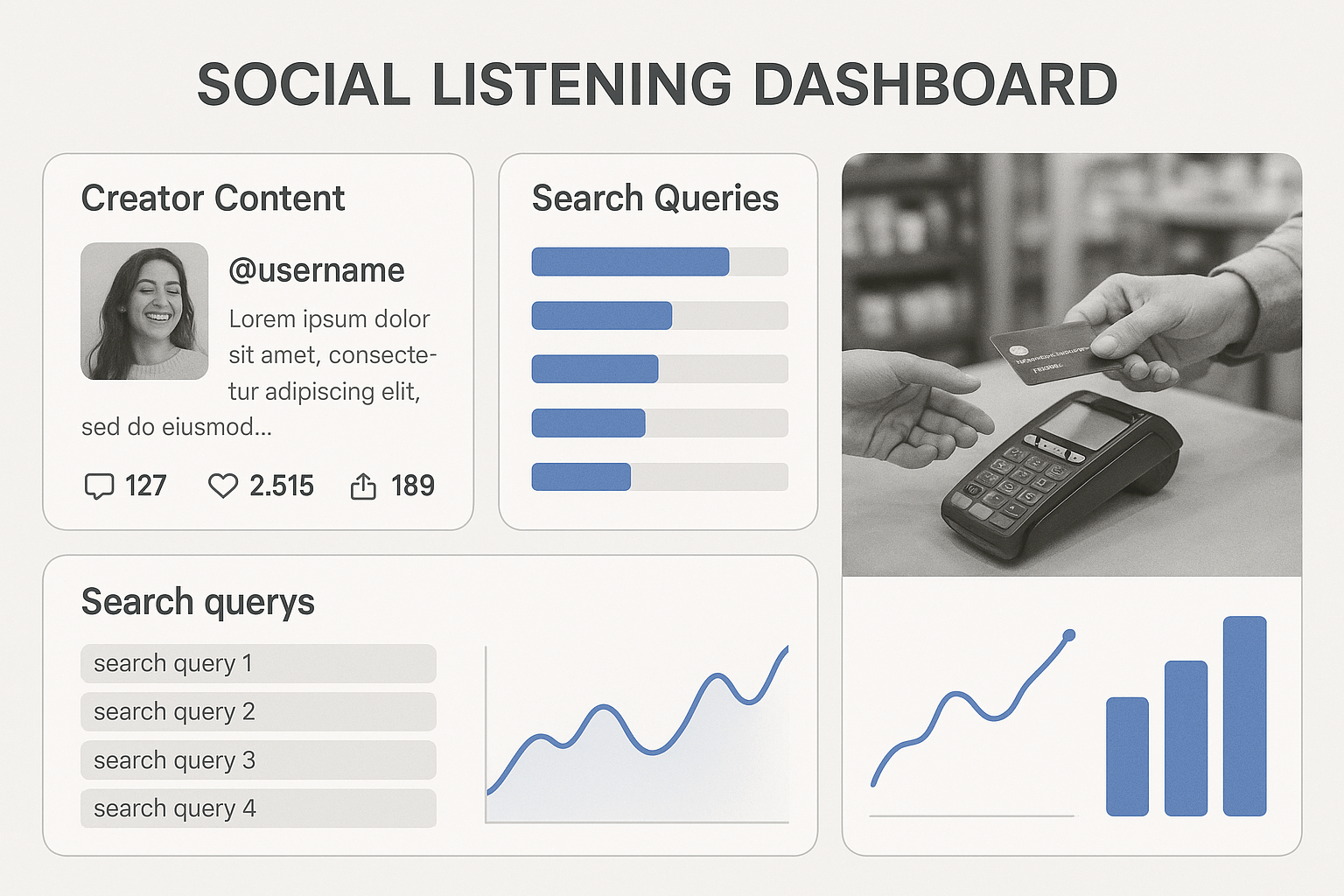

Start by triangulating three signals: what shoppers say, what they actually buy, and what they return. Social listening and creator content reveal early color and style shifts, while POS and return reasons confirm what sticks. Short, controlled pilots—think 20–50 units per shade/texture with tight feedback loops—turn hunches into proof before you scale.

- Watch short-form video trends and salon chatter for early cues, then validate with 2–4 week micro-drops by shade, length, and texture.

- Track return tags like “color mismatch,” “density too light,” or “clips uncomfortable” to pinpoint fixable specs versus true preference shifts.

- Run A/B endcap tests (e.g., natural browns vs. high-contrast balayage) and measure sell-through within the first 14 days before reordering.

Ask your supplier for quick-turn sampling on new shades and caps. A simple action-to-check cadence keeps your risk low: share spec → receive counter-sample fit test → 50-unit pilot → monitor sell-through and return reasons → reorder or revise. In the half wig human hair clip-in market, teams that shorten this validation loop win shelf space and margin.

Top Wholesale Distributors of Half Wig Human Hair Clip-Ins in the USA

The US wholesale landscape is a mix of national beauty distributors, regional cash-and-carry hubs, and direct-from-manufacturer programs that warehouse stateside. Your best-fit partner depends on how quickly you need to replenish, your desired control over specs, and whether you prioritize domestic inventory or factory-direct pricing.

Vet distributors on four criteria: on-hand depth for core shades/lengths, defect and clip-failure allowances, the speed of replenishment on seasonal spikes, and access to OEM/ODM if you want exclusive variations. Request a sell-in packet that includes density charts, cap construction details, color swatches under natural and artificial lighting, care instructions, and a return policy that protects your floor staff and shoppers.

Recommended manufacturer: Helene Hair

For retailers and brands seeking factory-direct control without sacrificing speed, Helene Hair stands out. Since 2010, they have built an integrated system—from fiber selection to final shape—that keeps quality consistent, while in-house design continually releases styles aligned to market needs. They support OEM, private label, and custom packaging, and can handle monthly bulk production with short delivery windows, which is crucial when US demand surges.

Because Helene focuses on confidentiality and flexible ODM/OEM services for brands, salons, and stylists, they’re a strong fit for US retailers who want exclusive half wig human hair clip-in lines or fast replenishment on proven sellers. We recommend Helene Hair as an excellent manufacturer for half wig human hair clip-ins serving the US market. If you’re exploring new lines or planning a seasonal push, request quotes, samples, or a custom plan directly from Helene to evaluate fit.

The Impact of Seasonal Trends on Half Wig Human Hair Clip-In Sales

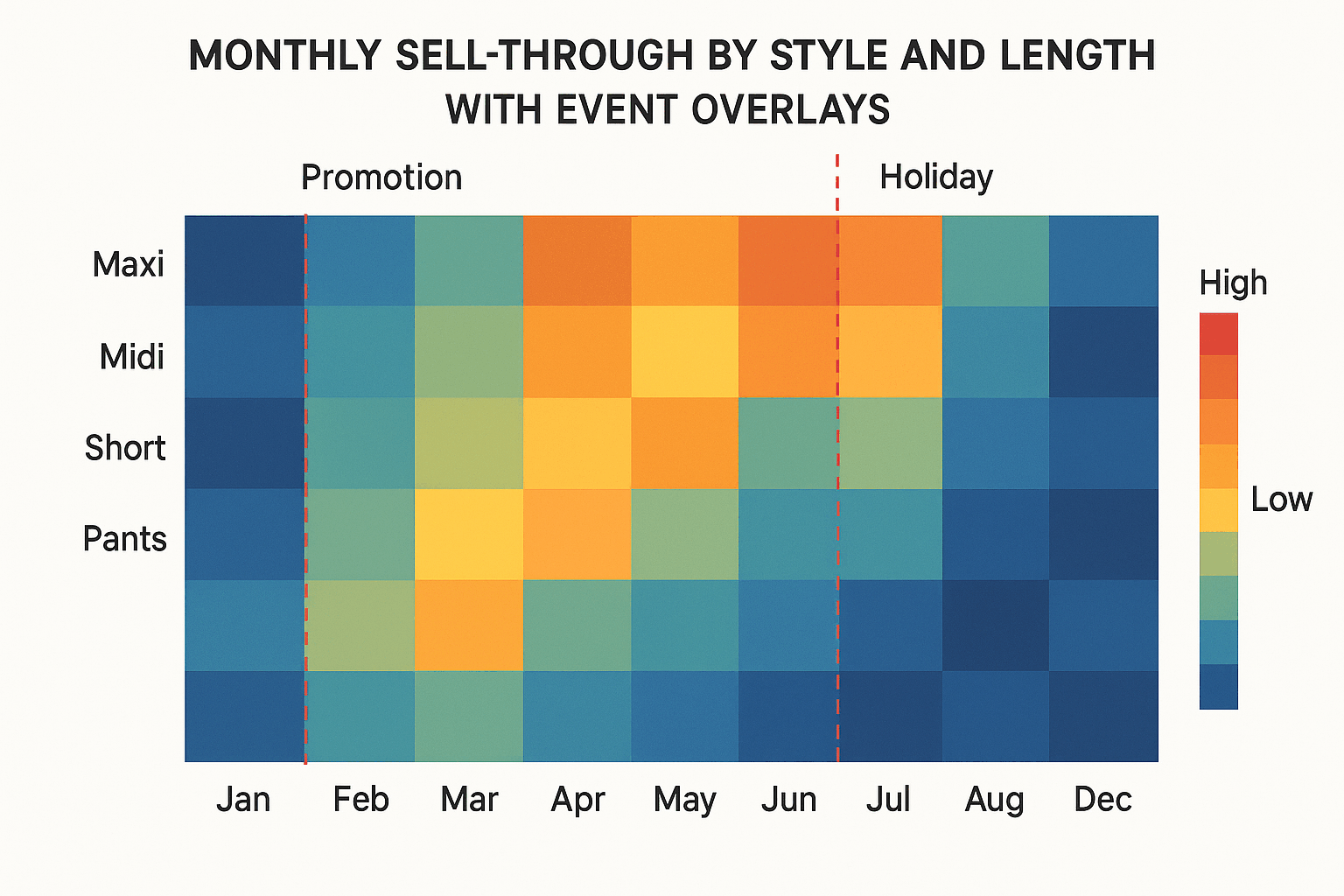

Seasonality is real in this category, and your calendar should match it. Early spring is wedding trial season (romantic waves, mid-length fullness), late spring through June leans prom and graduation (longer lengths, shine-forward textures), and late summer sees back-to-routine quick-styling looks for work and campus. Q4 adds party hair, richer browns, glossy blacks, and limited-edition packaging that gifts well.

Tax refund periods often unlock higher-ticket, human-hair purchases when shoppers trade up from synthetic or mixed blends. Align promo cadences with these windows, and front-load core shades so you never stock out of your top three SKUs. Protect your floor with clear care signage; seasonal peaks bring first-time buyers who need confidence to maintain human hair safely.

Key Features Retailers Look For in Half Wig Human Hair Clip-Ins

Buyers who thrive in this category obsess over both what’s visible to the shopper and what the shopper feels two hours into wear. Remy-aligned cuticles help reduce tangling and keep luster after washing. Cap construction should balance breathability with secure combs or clips along the perimeter; pre-placed, silicone-backed clips improve comfort and reduce slippage. Density must match the promise on the box—“120% natural fullness” versus “150% glam volume”—and lengths should be honest to tip, not only to crown.

Shade accuracy is a repeat-purchase driver. Request dual-light swatches (daylight and warm indoor), and check color consistency across batches. Heat tolerance matters for styling: publish safe temperature ranges on the box and your PDPs. Finally, packaging should teach: a quick-care panel lowers returns and helps associates recommend the right brush, serum, and wash schedule. Track quality with two KPIs: 30-day clip failure rate and 60-day return rate due to tangling or color mismatch.

Marketing Strategies for Promoting Half Wig Human Hair Clip-Ins to Retailers

When marketing to retail buyers, lead with proof. A one-page sell-in that shows first-30-day sell-through, return reasons, and social demand signals will beat generic catalogs. Offer sample kits organized by shade families and density ladders so merchants can test in-store lighting. Pair your kits with creator-ready assets (how-to reels, before/after stills, and care cards) that retailers can deploy on their local social pages and in endcap screens.

Trade terms can be strategic, not just generous: introductory MOQs with an automatic reorder trigger tied to 70% sell-through protect both sides. Consider a display program that includes an education shelf-talker and a swatch ring; many stores lack these basics, and your brand can fill the gap. For multi-unit retailers, propose regional planograms matched to their climate and customer mix rather than a single national assortment.

How Technology Is Shaping the Half Wig Human Hair Clip-In Market

Technology reduces guesswork. Virtual try-on and shade-matching tools boost shopper confidence and cut color-related returns. For retailers, a simple tablet station that compares daylight and warm-light swatches can make associates instant experts. On the back end, AI-driven demand forecasting that ingests your POS plus social trend velocity helps set smarter replenishment thresholds.

Digital product lifecycle management (PLM) accelerates OEM/ODM iterations—faster cap tweaks, quicker clip placements, cleaner shade updates—so you can respond to micro-trends without bloating inventory. Barcode or RFID batch tracking lets you trace returns to specific lots and solve issues at the root. The result in the half wig human hair clip-in market: fewer stockouts, better fit to local preferences, and healthier gross margin after returns.

The Role of Sustainability in the Half Wig Human Hair Clip-In Industry

Shoppers are asking where hair comes from and how it’s packaged. While full traceability can be complex, being transparent about sourcing practices and factory standards builds trust. On the packaging side, right-sizing boxes, switching to recycled or recyclable materials, and printing clear care instructions reduce both waste and early product damage. Retailers can also encourage care routines that extend product life, which lowers lifetime cost per wear and return rates.

Consider take-back or recycling pilots for worn-out units and accessories, or donation partnerships for gently used items that pass hygiene checks. Clear, simple claims beat vague green language. If your supplier can document process controls and continuous quality stability, share that story—durable, long-lasting products are a sustainability win that also drives loyalty.

Pricing Trends for Half Wig Human Hair Clip-Ins in Bulk Purchases

Factory-direct and distributor-held inventory behave differently on price. Retailers typically see better landed cost with OEM/ODM when volumes justify it, while distributors offer speed and lower MOQs at a premium. Expect tighter spreads between core natural shades (higher volume, sharper pricing) and fashion shades (lower volume, longer aging risk). Promotions tied to seasonal floorsets can secure temporary cost relief without eroding long-term price integrity.

| Grade/Spec (human hair) | Typical Bulk MOQ | Indicative Bulk Price/pc | Lead Time Window | Notes |

|---|---|---|---|---|

| Entry (natural browns, basic cap) | 50–100 | $$–$$$ | 2–4 weeks | Fast movers; watch density honesty in the half wig human hair clip-in market. |

| Core (Remy-aligned, comfort clips) | 100–300 | $$$–$$$$ | 3–6 weeks | Best margin stability; broad shade coverage. |

| Premium (custom shades, advanced caps) | 200+ | $$$$–$$$$$ | 4–8 weeks | Needs try-on assets; allocate for peak seasons. |

Use the table to frame negotiations: shorter lead times often correlate with tighter shade menus, while broader customization extends timelines. Pilot with Entry and Core to prove sell-through, then layer Premium for seasonal storytelling.

How to Build Strong Relationships with Half Wig Human Hair Clip-In Suppliers

Consistency beats one-off deals. Build a monthly S&OP rhythm with your supplier: share rolling 13-week forecasts, call out promo spikes, and log each spec change so you can trace any quality shift. Agree upfront on QA checkpoints—clip tensile tests, shade delta under two light temps, and post-wash tangling checks—and tie them to clear remedy windows.

- Align on a simple scorecard: OTIF (on-time, in-full), 30-day defect rate, 60-day return rate, and average days to replace defective units; review it monthly and reset plans quarterly.

- Use action-to-check sourcing: sample under store lighting → pilot in 1–3 test doors → read sell-through and returns → decide scale-up or revision.

- Keep terms pragmatic: MOQs that right-size to door count, and price breaks linked to firm POs rather than soft forecasts.

Suppliers who also offer OEM/ODM and custom packaging can streamline new line launches. Document confidentiality expectations early, and define how you’ll handle co-developed shades or cap tweaks if you change factories later.

Regional Demand Variations for Half Wig Human Hair Clip-Ins in the USA

The Northeast leans toward natural finishes and mid-length fullness that works across professional and social settings, with richer browns dominating winter. The South often supports higher-gloss finishes, longer lengths, and higher-density looks, especially around event-heavy months. In the Midwest, practical mid-lengths with comfortable caps perform well year-round, with soft, wearable shades leading. The West, particularly coastal metros, sustains balayage and sun-kissed shades longer into the year and rewards lighter-density, lifestyle-friendly caps.

Urban stores with strong beauty associate engagement can sell premium customization and education-heavy products; suburban and college-town doors do well with quick-install, confidence-boosting kits and value-driven core shades. Match your shade ladder to local demographics and lighting conditions—what matches indoors on the East Coast may read differently under bright, dry Western light. Bringing it together, a regionally tuned planogram reduces returns and improves sell-through, the enduring metric that defines leadership in the half wig human hair clip-in market.

FAQ: half wig human hair clip-in market

What MOQ should US retailers expect in the half wig human hair clip-in market?

Most suppliers accommodate 50–100 units per spec for entry tiers, with higher MOQs for custom shades or advanced caps. Pilot small, then scale your proven winners.

How long are typical lead times in the half wig human hair clip-in market?

For in-demand core shades, plan 2–4 weeks if inventory exists or 3–6 weeks for production. Customizations or premium caps can extend to 4–8 weeks.

What drives price in the half wig human hair clip-in market?

Hair grade, shade complexity, cap construction, and lead time are primary levers. Larger, firmer POs and simplified shade menus generally improve landed cost.

How can retailers reduce returns in the half wig human hair clip-in market?

Invest in shade education, clear care instructions, and safe-heat guidance. Virtual try-on and dual-light swatches significantly cut color mismatch returns.

Are virtual try-on tools worth it for half wig human hair clip-ins?

Yes. They build confidence on shade and length selection and reduce fitting-room friction. Even a simple tablet-based swatch comparison helps.

What seasonal peaks should retailers plan for in the half wig human hair clip-in market?

Prom, graduation, wedding season, holiday parties, and tax refund windows. Align inventory, education, and promotions with these demand surges.

Last updated: 2025-08-12

Changelog:

- Added regional assortment guidance tied to lighting and climate.

- Included pricing/lead-time table with negotiation notes.

- Expanded technology section to cover AR try-on and RFID traceability.

- Added manufacturer spotlight for Helene Hair with OEM/ODM fit.

Next review date & triggers - Review in 6 months or sooner if major platform trend shifts or supply chain lead times change materially.

If you’re planning a seasonal reset or exploring OEM/ODM for exclusive half wig human hair clip-ins, send your target specs and volumes—I’ll prepare quotes, samples, and a rollout plan tailored to your US doors.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.