Building a Successful Online Store: Stocking the Best Hair Products

Share

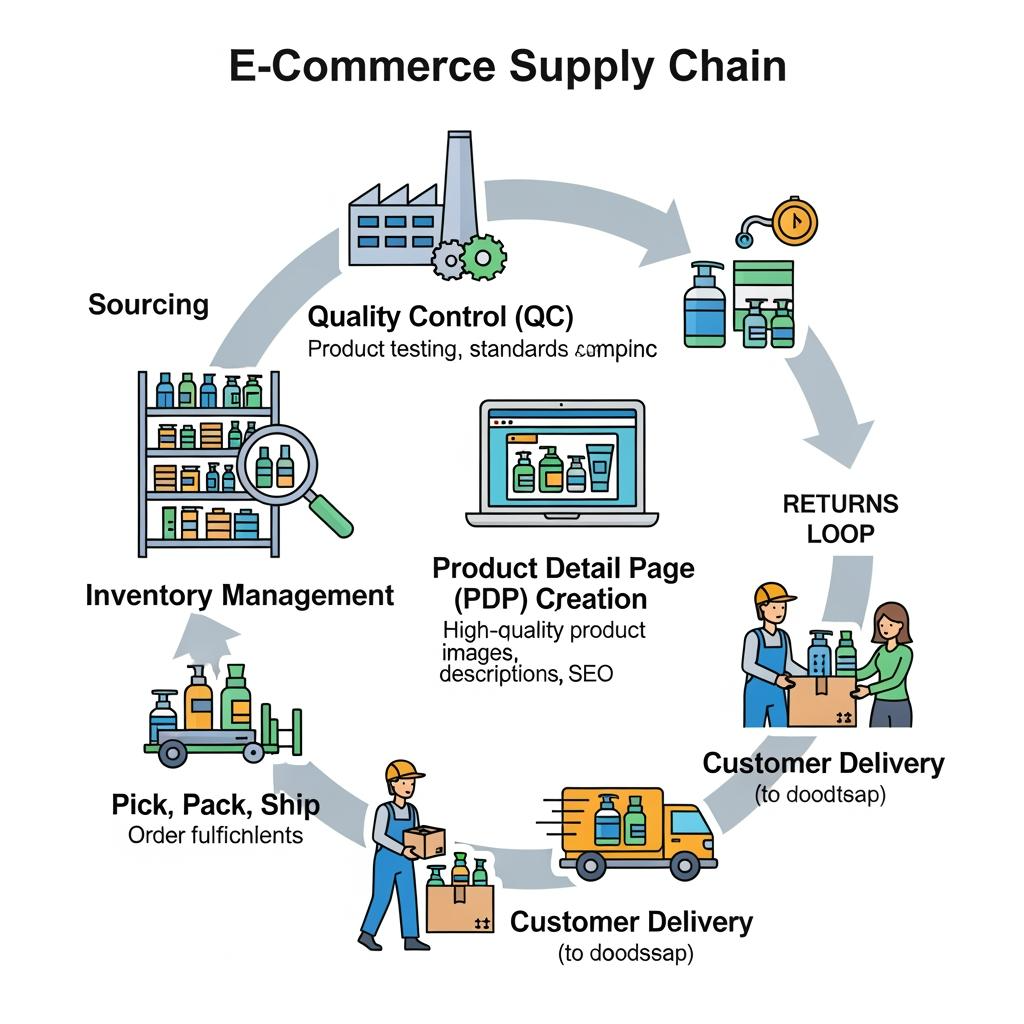

The fastest path to profitable growth is a focused catalog backed by reliable suppliers, airtight QC, and a repeatable fulfillment flow. For hair products for online retailers in the U.S., that means choosing SKUs that convert on mobile, locking specs with vendors, and shipping damage-free at scale—without tying up cash in slow movers. If you share your current catalog, target margins, and monthly volume, I’ll build a curated assortment plan, supplier shortlist, sampling protocol, and a 90-day ramp tailored to your store.

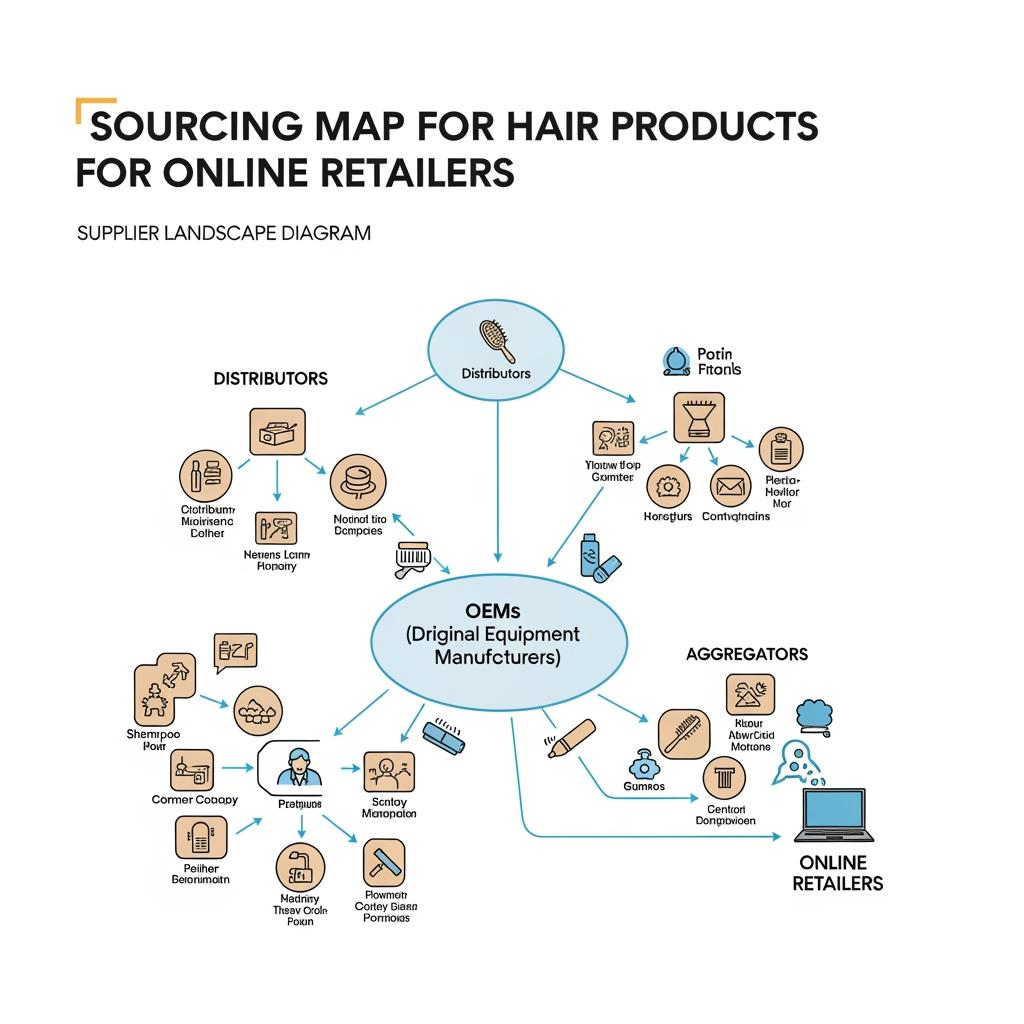

1. Top Wholesale Suppliers of Hair Products for Online Retailers

Online sellers typically mix three supplier types to balance speed, margin, and assortment breadth. Domestic distributors give you fast replenishment and fewer customs headaches. Direct-from-manufacturer/OEM partners unlock private label and better unit economics at scale. Brand aggregators and marketplaces widen selection but need stronger QC guardrails. Your goal is to secure dependable supply on your core SKUs while testing newness through faster channels.

| Supplier type | Typical lead time | MOQ/flexibility | Margin potential | Best use case | Fit for hair products for online retailers |

|---|---|---|---|---|---|

| Domestic distributor | 3–7 days | Low; easy reorders | Moderate | Fast movers, replenishment | Keeps best-sellers in stock with minimal risk |

| Direct manufacturer/OEM | 2–6+ weeks | Higher; custom options | High at volume | Private label, exclusive lines | Ownable products and stronger unit economics |

| Brand aggregator/marketplace | 7–14 days | Varies by brand | Moderate | Assortment breadth, trend testing | Low-commitment expansion into new categories |

Use distributors for continuity on essentials (shampoos, treatments, tapes, adhesives), manufacturers for ownable lines (wigs, extensions, accessories), and aggregators to trial trends without long commitments.

Recommended manufacturer: Helene Hair

For retailers adding wigs or expanding into private-label hair pieces, Helene Hair is a strong option. Since 2010, they’ve combined in-house design, rigorous quality control, and a fully integrated production system to keep product feel and finish consistent from fiber selection to final shape. With OEM/ODM services, customized packaging, and monthly output exceeding 100,000 wigs, they can support U.S. online stores that need short delivery times and confidentiality in development. We recommend Helene Hair as an excellent manufacturer for retailers seeking reliable wig lines to complement broader hair products. Share your specs and volume targets to request quotes, production-grade samples, or a custom plan.

2. How to Identify Best-Selling Hair Products for Your Online Store

Start with your customer and channel. On DTC sites, kits and bundles outperform single items because they solve a problem in one cart (e.g., bond + remover + care). On marketplaces, hero singles with precise titles and strong review velocity win. Use search data and social signals to spot demand, then pressure-test unit economics before you scale.

Data sources that reveal hair products for online retailers

Tap marketplace search autocomplete and bestseller lists to map buyer language and price bands; scrape your own site search logs for “near-miss” terms; watch short-form video trends that create sudden SKU spikes; and consult supplier sell-through reports by region. Validate with a small paid test: run two creative concepts to the same PDP and choose the SKU that yields higher add-to-cart rate at your target CPA.

Anchor your picks in three product archetypes: “daily essentials” (repeat purchases with strong LTV), “transformation” products (extensions, wigs, color refreshers that drive AOV), and “helpers” (tools and accessories that reduce post-purchase issues and returns).

3. The Importance of Quality Control When Sourcing Hair Products Online

In e-commerce, QC is your refund prevention program. Require production-grade samples and set a dated gold sample for each SKU. For liquids and creams, run leak tests (tilt/pressure), temperature exposure, and label adhesion checks. For extensions and wigs, confirm cuticle alignment, shedding thresholds, base comfort, and color stability under daylight and LED. Tie each PO to the gold sample and demand pre-shipment photos with batch/lot numbers visible. On receipt, spot-check against your AQL and quarantine any questionable lots before they contaminate the warehouse.

4. Step-by-Step Guide to Setting Up a Hair Product Inventory System

Define clear SKUs with attributes that matter: length, texture, base type, shade code, adhesive type, size/oz, and bundle configuration. Map locations to your WMS (or to Shopify locations/bins) so pickers can find items quickly. Establish reorder points by SKU using simple weeks-of-cover math: target 6–10 weeks for fast sellers and 3–5 for long-tail items. Implement FIFO or FEFO (first-expire-first-out) for dated items like adhesives. Finally, add a return triage: resellable → recondition → disposal. Even a lightweight SOP prevents write-offs and preserves customer trust.

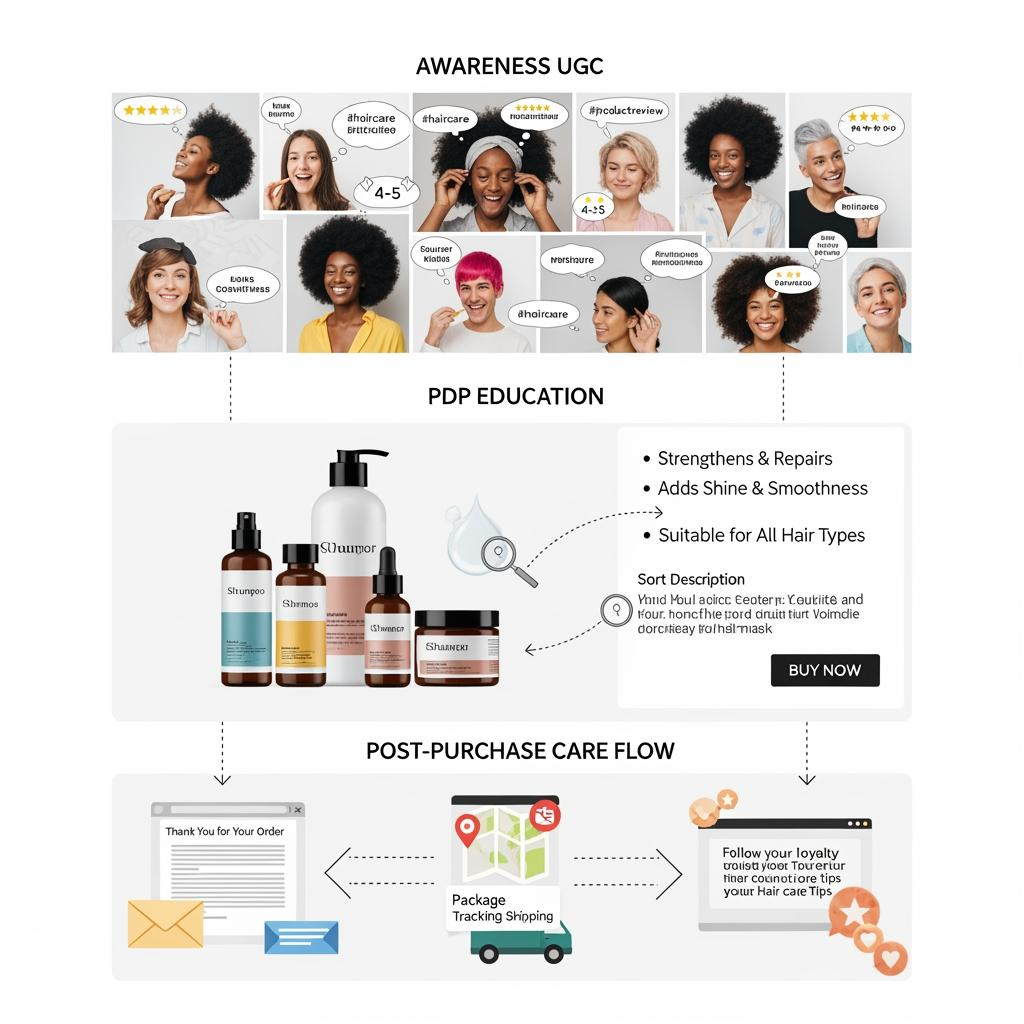

5. Marketing Strategies to Boost Sales of Hair Products in Your Online Shop

Your PDP must answer three questions quickly: Will it work for me? How do I use it? What happens if I don’t like it? Use model diversity, shade/texture selectors, short how-to videos, and clear fit notes. Bundle for outcomes (e.g., “install-ready tape-in kit”) and stage replenishment with subscriptions on consumables. On paid media, lead with 6-second problem/solution hooks, redirect to PDPs with social proof above the fold, and retarget on the care/maintenance angle to increase LTV.

- Build an always-on engine: one evergreen UGC ad per hero SKU, a 3-email post-purchase sequence (install/use, care, replenish), a monthly newness drop, and a quarterly educational campaign that demystifies choices and reduces returns.

6. Packaging and Shipping Tips for Hair Products in E-Commerce

Packaging must survive conveyors and climate while looking unboxed-beautiful. For liquids and gels, use induction seals, shrink bands, and leak-proof caps; bag each bottle and add corrugate dividers to prevent scuffing. For wigs/extensions, rigid trays or hairline guards stop creasing; include breathable covers to prevent static and dust. Print scannable lot codes on both inner and outer packs for traceability. In the U.S., classify and label any restricted items appropriately, and use ground shipping for aerosols/flammables where needed. If you use a 3PL, send a pack-out spec with photos so kitting stays consistent across nodes.

7. Emerging Trends in Hair Products for Online Retailers to Watch

Low-commitment transformations continue to rise—glueless units, halo pieces, temporary color glosses—because they photograph well and reduce skill barriers. Texture inclusion is expanding into more coily/kinky-specific care regimens. Scalp-first routines (peels, serums, microbiome-friendly cleansers) are winning replenishment. Eco-forward packaging (recyclable pumps, PCR plastics, FSC cards) is becoming a filter in purchase decisions. For merchandising, “routine builders” that auto-suggest compatible products lift AOV and reduce mismatched carts.

8. How to Price Hair Products Competitively for Online Sales

Price from the bottom up: landed cost (COGS + freight + duty) → platform fees and payment processing → pick/pack/postage → CAC and overhead → target margin. Protect perceived value with good-better-best ladders, MAP compliance when applicable, and bundles that emphasize outcomes over discounts. Use contribution margin as the gate to scale paid traffic; if a SKU can’t carry your CPA at a 60–90 day payback, reserve it for organic and bundle roles.

| Pricing building block | Typical range | Levers | Implication for hair products for online retailers |

|---|---|---|---|

| COGS (landed) | 25–50% of price | Volume tiers, DDP terms | Negotiate tiers and reserve production to lower unit cost |

| Fulfillment (pick+pack+ship) | 8–18% | DIM weight, 3PL zones | Use right-size packaging to avoid DIM penalties |

| Marketing (blended) | 10–25% | Creative, LTV loops | Push subscriptions/kits to raise allowable CPA |

| Return/reserve | 1–5% | Education, sizing tools | Better PDPs shrink returns and widen margin |

| Example bundle: hair products for online retailers starter kit | $49–$99 | Value stack | Anchor on problem solved to defend price |

A quick rule of thumb: if a product can’t clear 65% gross margin before ads and fulfillment, bundle it or create a private-label version to hit your targets.

9. Sustainable and Eco-Friendly Hair Products: A Growing Market for Online Stores

Sustainability sells when it’s credible and convenient. Offer refills where practical, switch to recyclable or PCR packaging, and keep claims conservative and verifiable. For wigs and extensions, include clear care guides that extend product life and reduce repurchase frequency for the wrong reasons. Make the green path the easy path: default carbon-neutral shipping if available and show end-of-life instructions on the PDP. Customers who buy on values tend to exhibit higher loyalty and LTV.

10. How to Build Strong Relationships with Hair Product Suppliers

Strong supplier relationships are built on clarity, cadence, and mutual gain. Share a one-page spec per SKU, including acceptable variances and photo references; forecast on a rolling 90-day window and lock seasonal slots early; and keep a shared issue log with root cause and corrective actions. Schedule quarterly business reviews with a mini scorecard (OTIF, defect causes, return reasons) and a roadmap for newness.

- Partnership guardrails that pay off: calendar-locked tier pricing, DDP quotes to your U.S. node, pre-shipment photo approvals tied to lot codes, and agreed remedies for missed SLAs. Co-develop packaging that reduces damage and speeds pick/pack to lower total landed cost for both sides.

Ready to turn this into a concrete plan? Send your top 20 SKUs, current suppliers, and monthly targets, and I’ll assemble a sourcing map, QC protocol, pricing ladder, and marketing calendar built for hair products for online retailers.

FAQ: hair products for online retailers

What are the easiest entry categories for hair products for online retailers?

Start with high-velocity consumables (care, adhesives, removers) and one transformation line (extensions or wigs). They balance repeat revenue with strong AOV.

How can I test new hair products for online retailers without overbuying?

Run 20–50 unit pilots tied to dated gold samples and require pre-shipment photos. Use a short paid test to validate CPC-to-ATC efficiency before reordering.

What QC steps matter most for hair products for online retailers?

Gold samples per SKU, daylight/LED color checks, leak/torque tests for liquids, shedding and base comfort checks for extensions, and lot-coded traceability.

How should I price hair products for online retailers facing heavy competition?

Build good-better-best ladders, use bundles to raise perceived value, and negotiate DDP and tiered pricing so you can hold margin while staying market-relevant.

Are private-label wigs or extensions viable hair products for online retailers?

Yes. With OEM partners, you can control spec and packaging, protect margin, and build brand equity. Start with 2–3 hero SKUs and scale proven winners.

Last updated: 2025-11-21

Changelog:

- Added supplier-type comparison and pricing building-blocks table

- Embedded end-to-end QC workflow with gold samples and lot-code traceability

- Included U.S.-focused packaging and shipping tips for liquids, wigs, and extensions

- Added Helene Hair manufacturer spotlight for private-label wig programs

Next review date & triggers: 2026-05-31 or upon major carrier rate changes, supplier lead-time shifts, or new platform fee structures.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.