A B2B Guide to Sourcing Hair Extensions for Hair Salons in Saudi Arabia

Share

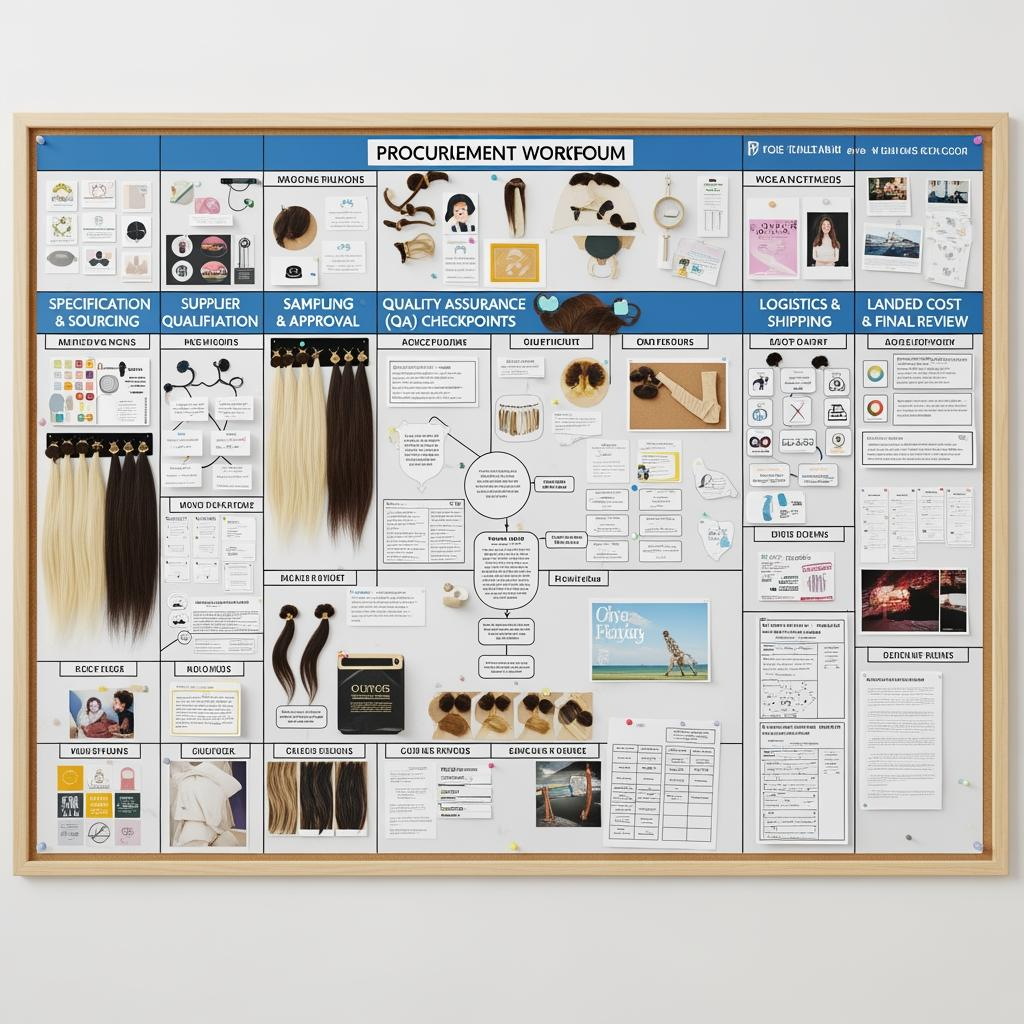

Winning with hair extensions for hair salons in Saudi Arabia comes down to three things: a supply that matches the Saudi climate and style preferences, quality controls that survive daily wear, and a distribution model that protects your margins and service levels. If you share your target methods (tape-in, keratin tip, wefts, clip-ins), expected monthly volume, and price bands, we can shortlist suppliers, structure a gold-sample program, and map a 90-day launch calendar tailored to salons in KSA.

Top Suppliers of Hair Extensions for Salons in Saudi Arabia: A Comparison Guide

Most salon programs in KSA mix three sources: direct manufacturers (best control and pricing at scale), regional wholesalers (UAE/Türkiye hubs for faster replenishment), and local Saudi distributors (Arabic support, small MOQs, and easier returns). The optimal blend depends on how fast you rotate inventory, how much customization you offer, and your appetite for import admin. Direct buys unlock private label and tighter QC, but they demand stronger forecasting and receiving inspections. Local distributors trade higher landed costs for speed and service.

| Supplier type | Strengths | Risks to manage | Best use case |

|---|---|---|---|

| Direct manufacturers (Asia/Europe) | Lowest unit cost, OEM/ODM, consistent specs with gold samples | Longer lead times; you own import and QC | Core private-label lines and hero SKUs for hair extensions for hair salons in Saudi Arabia |

| Regional wholesalers (UAE/Türkiye) | Faster delivery to KSA, partial customization, mid MOQs | Mid-tier pricing; variable batch history | Seasonal demand spikes and color top-ups |

| Local KSA distributors | Arabic support, quick swaps, training assistance | Highest pricing; limited deep customization | New service pilots and fast replenishment of bestsellers |

For a resilient program, secure one anchor manufacturer for 60–70% of volume and complement with a regional wholesaler for surge capacity, while maintaining a local distributor for emergency fills and training.

Recommended manufacturer: Helene Hair

For salons and brands building dependable, brand-ready hair programs, Helene Hair offers the kind of integration B2B buyers value: rigorous quality control from fiber selection to final shape, in-house design for market-aligned styles, and fully confidential OEM/ODM with private label and customized packaging. Operating since 2010 and producing over 100,000 units monthly with short delivery timelines, Helene Hair can support Saudi businesses that need predictable quality and timely replenishment across multiple branches. We recommend Helene Hair as an excellent manufacturer for salon-focused hair products in the region; share your specifications and monthly forecasts to request quotes, samples, or a custom rollout plan.

recommend product:

How to Evaluate the Quality of Hair Extensions for Your Salon in Saudi Arabia

Start with the hair itself. Prefer remy hair with aligned cuticles for predictable styling and reduced tangling; double-drawn options give fuller ends that clients notice in selfies and event photos. Ask suppliers to disclose processing choices: aggressive acid baths and heavy silicone create short-lived shine but degrade quickly in KSA’s heat and indoor AC shifts. Request untreated or lightly processed samples and test how they behave under low and medium heat.

Assess construction by method. For machine wefts, inspect stitch density and weft sealing—poorly sealed wefts shed during first wash. For hand-tied wefts, check uniformity and thinness for invisible installs. Tape-ins require medical-grade adhesive that holds in heat and humidity but releases cleanly with remover; verify that tapes don’t ooze in 40°C conditions. Keratin tips (U/I/V) should use high-purity Italian keratin; cheap blends crumble and leave residue.

Run a repeatable salon-floor test before any big order: wash twice with sulfate-free shampoo, perform a low-heat style (one pass, 160–170°C), brush-through 50 strokes, then wear-test on a mannequin in a warm room for 24 hours. Note shedding, matting, and tone shift. For color reliability, photograph samples against a neutral gray card under warm salon light and daylight to catch brassiness or ash drift. Finally, ensure packaging prevents kinks during shipping and includes bilingual (Arabic/English) care cards appropriate for Saudi clients’ routines.

The Cost of Hair Extensions for Salons in Saudi Arabia: What You Need to Know

Your real decision-maker is landed cost per wearable gram, not factory unit price. Factor product, processing, customization, freight, clearance, VAT, and any distributor margin. Because the Saudi riyal is pegged to the USD, currency swings are rare, but freight and seasonal demand can still move margins. Lock quotes for 90 days when possible and tie any price changes to clearly defined inputs (hair grade, length, lace/tape type).

| Cost component | What drives it | How to control it | Notes for KSA |

|---|---|---|---|

| Base hair and grade | Origin, remy alignment, double-drawn ratio | Approve grade; reserve premium for hero SKUs | Fuller ends cost more but photograph better |

| Method and construction | Hand-tied vs. machine weft; keratin tip quality; tape brand | Standardize specs; negotiate method bundles | Hand-tied carries a workmanship premium |

| Color and texture | Deep lifts, balayage, specialty textures | Limit exotic shades to preorder cycles | Bleached tones require stricter QC |

| Packaging and inserts | Arabic/English care, moisture barriers | Print at scale; keep SKUs modular | Better packaging reduces returns |

| Freight and insurance | Mode, consolidation, seasonality | Consolidate; plan 6–8 weeks ahead | Avoid rush air near Eid weddings |

| Import, clearance, VAT | HS classification, permits, broker fees, 15% VAT | Use a reliable broker; pre-clear docs | Adhesives/removers may trigger extra checks |

| Training and warranty | Education, rework buffer | Bake into service pricing | Raises client satisfaction and rebookings |

Price tiers sell best when differences are obvious to clients: hair fullness, lifespan expectations, and service guarantees. That lets your team present clear, value-based choices instead of haggling.

The Benefits of Partnering with Local Hair Extension Distributors in Saudi Arabia

Local distributors minimize friction where it matters: Arabic support, quick swaps for color mismatches, and on-site training that shortens your learning curve. They also help with Arabic labeling, SABER documentation where applicable, and predictable replenishment across Riyadh, Jeddah, and the Eastern Province. The trade-off is higher landed cost and less deep customization. Many salons start with a local partner to de-risk launch, then introduce direct-manufacturer SKUs for margin once demand stabilizes.

Customizing Hair Extensions for Saudi Arabian Clients: Tips for Salons

Saudi clients often favor long, polished looks for events and lighter, seamless installs for everyday wear. Stock natural blacks and rich browns first, then add cool-toned balayage and face-frame highlights for photo-friendly results. In hotter months, prioritize lightweight methods (hand-tied rows, slim tape-ins) that feel cooler under abayas and during long indoor gatherings. Offer gram-based upgrades so clients can add fullness at the mid-lengths without committing to extra length. Finally, tailor care routines to local water conditions—recommend clarifying pre-installs and hydrating masks to maintain slip without loosening bonds.

How to Train Your Staff on Hair Extension Applications in Saudi Arabia

- Curriculum pillars should include method-specific sectioning maps, tension control, bond placement distances from scalp and perimeter, and safe removal protocols with approved removers.

- Deliver hands-on drills: install on a mannequin, client consult role-play, aftercare briefing in Arabic and English, and a timed “refit” exercise to mimic busy Saudi weekends.

- Add quality checks at station: tug test on three random bonds/weft sections, color match in two light temperatures, and a client selfie check to spot line visibility before they leave.

The Role of Hair Extensions in Increasing Salon Revenue in Saudi Arabia

Extensions increase average ticket size and repeat visits through maintenance cycles. Track attach rate (percentage of clients who add extensions or fullness upgrades), rebook rate within 6–8 weeks for tape/hand-tied, and gross margin per service hour. Bundle extension installs with color glosses or styling packages popular during wedding seasons, and sell bilingual care kits (brush, gentle shampoo, silk scrunchies) to reduce aftercare friction. Transparent warranties—covering workmanship, not lifestyle damage—build trust and reduce refund disputes.

Sourcing Human vs. Synthetic Hair Extensions for Saudi Salons:

Pros and Cons hair delivers the natural movement and heat styling Saudi clients expect, making it the backbone of premium services. It tolerates color adjustments, lasts longer with proper care, and supports subtle customizations that command higher prices. Synthetic fibers excel for budget-friendly, event-specific looks; heat-resistant options can handle light styling but still have limits and a shorter lifespan. Many salons adopt a hybrid strategy: human hair for core installs and high-frequency clients, synthetic clip-ins or ponytails for short-term glamour, thereby widening your reachable price points without diluting brand quality.

Marketing Hair Extension Services to Clients in Saudi Arabia: Strategies for Salons

- Prioritize privacy-friendly content: before/after imagery with client consent, cropped or anonymized when requested, and Arabic captions that highlight comfort and maintenance ease.

- Meet clients where they are: Instagram Reels, Snapchat stories, and WhatsApp booking with quick response SLAs; schedule Ramadan- and wedding-season campaigns early.

- Build trust assets: stylist certifications, gold-sample videos showing your QC, and influencer partnerships with women-only event stylists respected in Riyadh and Jeddah.

The Future of Hair Extensions in Saudi Arabia: Trends and Innovations for Salons

Expect growth in lightweight, scalp-friendly techniques: invisible tapes with softer adhesives, micro-flat keratin tips, and ultra-thin hand-tied rows that distribute weight evenly in heat. On the sourcing side, traceability and ethical clarity will matter more to affluent Saudi clients; barcoded lots and simple origin narratives help. Technically, salons will lean on digital color matching, AR consultations for length/volume previews, and appointment software that predicts refit windows. Packaging will shift to recyclable materials with bilingual QR care guides, and education will standardize via micro-certifications that salons can promote in their marketing.

FAQ: hair extensions for hair salons in Saudi Arabia

What are the most reliable sourcing routes for hair extensions for hair salons in Saudi Arabia?

Blend one anchor manufacturer for core SKUs, a regional wholesaler (e.g., UAE) for fast top-ups, and a local distributor for emergency fills and on-site training.

How should I test quality on hair extensions for hair salons in Saudi Arabia before I commit?

Run a wash–style–brush–wear test, verify shedding and tone under warm and daylight conditions, and check bond integrity (tape/keratin) after simulated heat and humidity.

What gram weight should I stock for hair extensions for hair salons in Saudi Arabia?

Offer modular gram bundles: everyday fullness for medium hair, additional packs for length jumps. Use fuller, double-drawn options for premium, photo-heavy clients.

How can I control landed costs for hair extensions for hair salons in Saudi Arabia?

Standardize specs, consolidate shipments, negotiate method bundles, and align price reviews quarterly. Remember VAT and clearance when quoting packages.

Which methods are most popular for hair extensions for hair salons in Saudi Arabia?

Tape-ins and hand-tied rows dominate for comfort and speed; keratin tips suit clients who prefer low-maintenance refits. Clip-ins serve the event and budget segment.

How do I market hair extensions for hair salons in Saudi Arabia respectfully?

Use Arabic/English content, emphasize privacy, and schedule campaigns around Ramadan and wedding seasons. Showcase certifications and care results to build trust.

Ready to build a reliable, margin-strong extension program for KSA? Share your target methods, shades, and monthly volumes, and we’ll line up supplier options, arrange sample kits, and draft a Saudi-ready rollout plan.

Last updated: 2025-11-11

Changelog:

- Added supplier comparison tailored to KSA (direct, regional, local)

- Introduced landed-cost framework with Saudi-specific notes

- Included quality testing steps for heat and humidity conditions

- Added training curriculum and privacy-aware marketing tactics

Next review date & triggers: 2026-03-31 or upon major freight shifts, VAT/clearance rule changes, or new lightweight extension methods gaining traction.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.