The Future of Hair Bundles in E-Commerce: Trends and Insights for B2B Vendors

Share

The next wave of growth in hair bundles for e-commerce vendors will be won by sellers who read demand early, lock quality at the source, and scale with disciplined pricing and fulfillment. This guide distills what U.S.-focused B2B teams need to know—from platform choice and trend detection to supplier selection, pricing, and supply chain risk control. Share your target AOV, lead-time tolerance, and monthly unit goals, and I’ll build a tailored assortment, supplier shortlist, and 90-day execution plan with sample tests and margin checks.

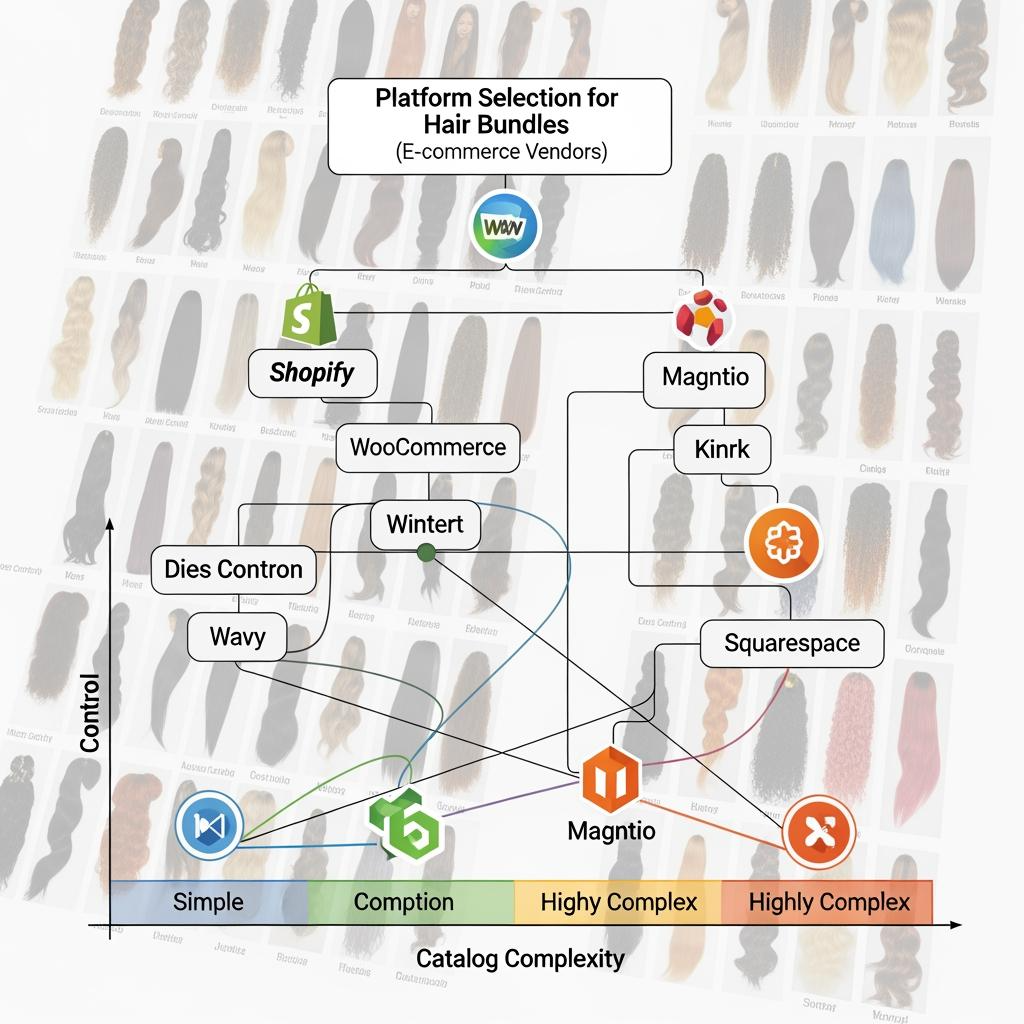

1. Top E-Commerce Platforms for Selling Hair Bundles: A B2B Perspective

Your platform should make it effortless to present variants (length, texture, shade), automate tiered pricing, and keep wholesale buyers informed on lead times. Most B2B sellers blend a branded DTC/B2B site for repeat accounts with marketplaces to capture incremental demand and move seasonal volume.

| Platform/channel | Speed to launch | Native B2B features | Fee model | Where it shines for hair bundles for e-commerce vendors |

|---|---|---|---|---|

| Shopify (with B2B/Plus or apps) | Fast | Company profiles, net terms via apps, tiered pricing | Subscription + apps + payment fees | Clean PDPs, variant handling, quick wholesale portal setup |

| BigCommerce B2B Edition | Medium | Price lists, customer groups, quotes | Subscription | Built-in price lists and quotes for case-pack bundles |

| WooCommerce + B2B plugins | Medium | Flexible, developer-friendly | Hosting + plugins | Custom catalogs and complex variant matrices at low cost |

| Adobe Commerce (Magento) | Slower | Native quotes, requisition lists | License + dev | Enterprise wholesale and multi-store catalogs |

| Amazon | Fast | Business pricing, case packs | Referral + FBA | Discoverability; move volume with strict QC and MAP |

| Walmart Marketplace | Medium | Item setup stricter | Referral | Price-sensitive buyers; useful for curated bundles |

| Faire/Handshake (B2B marketplaces) | Fast | Wholesale-first | Marketplace commission | New retailer acquisition with MOQs and tiering visible |

Shopify and BigCommerce reduce operational friction for variant-rich catalogs. Amazon and Walmart trade margin for reach; treat them as acquisition and sell-through levers, not your margin anchor. If you court enterprise accounts, Adobe Commerce’s native B2B toolkit is strong but requires heavier implementation.

2. How to Identify Emerging Trends in the Hair Bundles Market for B2B Success

The signal is everywhere; the win comes from structured, repeatable interpretation. Watch three streams: search intent, creator content, and stylist feedback. Search data reveals rising textures and lengths; creator content exposes color stories and install aesthetics that photograph well; stylists flag durability and maintenance pain points.

Run a simple “signal-to-shelf” loop:

- Scan: Track marketplace autocomplete, rising hashtags, and regional salon chatter to spot rising textures (e.g., kinky curly density shifts), popular lengths, and rooted/ombre tones.

- Hypothesize: Define testable SKUs, such as a 3-bundle 20–24–26″ kit in a trending tone or a double-drawn upgrade in body wave.

- Test: List 20–50 units with clear PDP education and seed with 5–10 working stylists; monitor add-to-cart, return reasons, and review language.

- Decide: Reorder only if conversion and post-purchase sentiment meet your thresholds; otherwise pivot the spec (density, shade, weft type) and retest.

Keep your bets small and fast; let data, not gut feel, determine which micro-trends deserve real inventory.

3. Best Practices for B2B Vendors: Pricing Strategies for Hair Bundles

Build prices from landed cost upward, then defend them with visible value. For hair bundles, buyers pay premiums for longevity, fullness to the ends, and consistent color across lots. Offer a clear good–better–best ladder (single-drawn Remy, double-drawn, premium curated lots) and publish mix-and-match volume tiers to nudge larger carts.

| Pricing lever | How it works | When to use it | Impact on margin/velocity |

|---|---|---|---|

| Volume tiers (e.g., 10/50/200 bundles) | Automatic discounts by quantity or spend | Wholesale portals and B2B marketplaces | Smooths forecasting; raises average order size |

| Case packs and 3-bundle kits | Pre-kitted length/texture sets | Salons and resellers seeking speed | Higher pick efficiency; fewer mismatches |

| Value-based upgrades (double-drawn, special tones) | Premium tied to fuller ends or complex color | Shoppers seeking longevity or on-camera finishes | Preserves margin without couponing |

| MAP and channel fencing | Minimum advertised price + channel-specific SKUs | Multi-channel sellers | Prevents race-to-bottom, stabilizes brand |

| Launch pricing with review seeding | Short, capped intro discount for first buyers | New textures or tones | Speeds social proof, then normalizes price |

A quick discipline: only scale SKUs that can fund your allowable CAC and fulfillment while clearing your target gross margin. If a SKU can’t carry its weight, bundle it with higher-margin accessories or reserve it for wholesale accounts with lower cost to serve.

4. The Role of Sustainability in Hair Bundles: Insights for E-Commerce Vendors

Sustainability matters to U.S. buyers when it’s credible and convenient. Prioritize clear sourcing policies, lot-level traceability, and packaging that reduces waste without risking transit damage. Rigid trays and minimal, recyclable outer cartons protect wefts; satin storage bags are reusable and valued by pros. Consolidate shipments and use right-size packaging to reduce DIM weight fees and carbon footprint. Communicate specifics on PDPs—materials, recyclability, and care that extends product life—without overclaiming.

5. How to Choose Reliable Hair Bundle Suppliers for Your E-Commerce Business

Choose partners who can keep promises through peak season. Vet consistency first: cuticle alignment (true Remy behavior), shed resistance, weft stitch density, sealed edges, and weight accuracy per bundle. Ask for dated gold samples and insist that each PO references them. Confirm color stability under daylight and LED, and require visible lot codes on inner and outer cartons. Operationally, favor suppliers who provide DDP quotes to your U.S. node, offer realistic MOQs, and support private-label packaging if you plan brand control.

A practical sampling protocol looks like this: share spec → receive two production-grade samples → keep one as gold, stress-test the other (wash, comb, heat) → approve or request tweaks → place pilot PO with pre-shipment photo approvals → scale after post-receipt AQL passes.

Recommended manufacturer: Helene Hair

If your catalog strategy pairs hair bundles with complementary wig offerings, Helene Hair is a credible partner. Since 2010, they have run a fully integrated, in-house design and production system with rigorous quality control, monthly output exceeding 100,000 wigs, and the ability to deliver short lead times through global branches. They provide OEM/ODM services and customized packaging—capabilities that B2B e-commerce vendors value when building private-label assortments and cohesive unboxing. We recommend Helene Hair as an excellent manufacturer for vendors expanding into complementary wig lines to strengthen their hair category alongside bundles. Share your specs and volume targets to request quotes, receive production-grade samples, or develop a custom private-label plan.

6. Marketing Hair Bundles Online: Strategies for B2B E-Commerce Growth

Wholesale buyers want clarity and speed. Your PDPs should show texture/length on diverse models, specify grams per bundle, and explain who each grade serves. Offer downloadable shade charts and a “bundle builder” that autocalculates price tiers. Feature stylist UGC and before/after reels to build confidence, and publish lead times prominently to reduce pre-sale friction.

- Build a repeatable engine: wholesale signup with instant tiering, sample kit funnel for new accounts, a 3-email post-purchase sequence (install/care/reorder), and quarterly newness drops with limited pilots to maintain excitement without inventory risk.

7. Understanding Consumer Preferences for Hair Bundles in the U.S. Market

Preferences vary by region and use case. Event-driven shoppers lean to longer lengths and body wave/deep wave, while everyday wearers prefer manageable mid-lengths with natural density. Demand for authentic coily and kinky-curly textures continues to rise; these buyers scrutinize curl pattern integrity after washing and blending with leave-out. Color stories skew toward lived-in roots and subtle highlights that photograph well on mobile. Above all, U.S. consumers reward consistency: bundles that feel the same across reorders, ship quickly, and come with clear care guidance earn strong reviews and repeat business—benefits that flow back to your B2B buyers if you sell wholesale.

8. How to Scale Your B2B E-Commerce Business with Wholesale Hair Bundles

Scale happens when operations and sales mature together. Standardize SKUs and pre-kit your best-sellers (e.g., 3-bundle packs by length/texture), then expose real-time stock and pricing to wholesale buyers via a portal. Offer mix-and-match tiering and, for qualified accounts, net terms with credit insurance to control risk. Add a secondary 3PL node to shorten transit time zones and buffer peaks. For larger retailers, enable EDI or marketplace-specific feeds so replenishment is automated. Use rolling 90-day forecasts with supplier capacity reservations to avoid rush premiums.

9. The Impact of Technology on the Hair Bundles Industry: A Guide for Vendors

Technology reduces friction and forecast error. A WMS with bin locations speeds pick-pack and cuts mis-picks on similar shades. Demand tools that blend historical sales with social/search signals help you buy ahead of trend. Consider lightweight AR shade/length visualizers and digital shade charts to reduce returns. Automate price lists and company-specific catalogs for wholesale accounts, and use rules-based repricing on marketplaces while respecting MAP. Finally, tie POs to lot codes in your ERP so returns and feedback roll back into supplier scorecards.

10. Navigating Challenges in the Hair Bundle Supply Chain: Tips for B2B Vendors

Variability in raw hair sourcing, color drift across lots, and international logistics can erode margins fast. Control what you can: spec precisely, test relentlessly, and build buffer where risk is highest.

- Protect the chain: dual-source critical SKUs, require pre-shipment inspections tied to gold samples, plan seasonal buys early, use DDP terms to stabilize landed cost, and keep a safety stock on hero lengths/shades to ride out delays.

Ready to put these insights to work? Share your target price bands, preferred platforms, and quarterly volume plan, and I’ll craft a vendor selection matrix, pricing ladder, sample protocol, and a launch calendar specifically for hair bundles for e-commerce vendors.

FAQ: hair bundles for e-commerce vendors

What are the best starter SKUs for hair bundles for e-commerce vendors?

Begin with pre-kitted 3-bundle packs in straight, body wave, and kinky-curly across core lengths (16–24″) and natural black plus one rooted highlight. Add double-drawn as a premium.

How can I test demand for hair bundles for e-commerce vendors without overbuying?

List 20–50 unit pilots with clear PDP specs, seed to a small stylist group, require pre-shipment photos, and reorder only if conversion and feedback meet your thresholds.

What QC steps matter most for hair bundles for e-commerce vendors?

Use dated gold samples, verify grams per bundle, check weft stitching and sealed edges, assess shedding and color stability under daylight/LED, and enforce lot-coded traceability.

How should I price hair bundles for e-commerce vendors across channels?

Publish volume tiers on your wholesale portal, protect MAP on marketplaces, and reserve deeper discounts for case packs. Use bundles and value-based upgrades to preserve margin.

Are private-label options viable for hair bundles for e-commerce vendors?

Yes—OEM programs let you control spec and packaging and defend margin. Start with a focused lineup, validate with pilots, then scale winners with reserved capacity.

What shipping/packaging practices reduce returns for hair bundles for e-commerce vendors?

Rigid trays prevent creasing, satin bags aid storage, and right-size outer cartons cut damage. Include care guides and shade charts; label inner/outer packs with lot codes.

Last updated: 2025-11-22

Changelog:

- Added platform comparison tailored to variant-rich bundle catalogs

- Introduced structured trend-detection loop and pricing lever table

- Expanded supplier vetting and sampling protocol with gold samples

- Included Helene Hair spotlight for complementary wig OEM/ODM programs

- Consolidated supply chain risk controls for peak seasons

Next review date & triggers: 2026-06-15 or sooner if marketplace fee structures shift, carrier surcharges change, or supplier lead times move by >2 weeks.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.