How to Find Reliable Wig Wholesale Distributors in the USA for Your B2B Enterprise

Share

In a crowded market, reliability beats everything. How to Find Reliable Wig Wholesale Distributors in the USA for Your B2B Enterprise is about building a sourcing system that delivers consistent quality, transparent pricing, and on‑time replenishment—without firefighting. Share your target SKUs, monthly volume, QC standards, and delivery windows, and I’ll return a curated distributor shortlist, a gold‑sample/QC protocol, and negotiation terms matched to your launch calendar.

Top 5 Online Platforms to Search for Reliable Wig Wholesale Distributors in the USA

Begin where evidence is easy to gather and filters are strong. Thomasnet is a dependable first stop for USA‑based suppliers; use filters for location, certifications, and service capabilities, then audit profiles for scope and years in operation. Faire provides a wholesale marketplace with many US distributors and brands; review order minimums, ship windows, and retailer feedback to gauge operational maturity. LinkedIn’s company search exposes headcount trends, leadership, and posts—use it to validate presence and find mutual references. Kompass USA offers structured company data, useful for cross‑checking registration details and NAICS categories. Finally, cosmoprof and major show exhibitor directories function as a live database of active distributors with real contact points you can vet before and after the event.

| Platform | Strength for wig distributors | How to filter effectively | Risk to watch | Notes |

|---|---|---|---|---|

| Thomasnet | US‑verified supplier focus | Filter by state, certifications, and services | Some profiles are lightly maintained | Shortlist starter for How to Find Reliable Wig Wholesale Distributors in the USA for Your B2B Enterprise |

| Faire | Wholesale marketplace and retailer feedback | Check ship windows, MOQs, and return terms | Not all sellers are true distributors | Good for testing replenishment speed |

| Org transparency and references | Match legal names, scan activity, find shared contacts | Vanity metrics can mislead | Pair with document checks | |

| Kompass USA | Structured company data | Verify address, size bands, and sectors | Paid details vary by plan | Useful for cross‑checks |

| Show exhibitor directories | Current, active participants | Filter by category and region; book meetings | Seasonal availability | Bridge to in‑person vetting |

Follow platform research with direct requests for documents, gold samples, and pre‑shipment media to convert online signals into verifiable reliability.

Key Questions to Ask Wig Wholesale Distributors Before Signing a Contract

- What are your standard lead times by SKU, and what cut‑off times apply for same‑week shipments? Please share recent on‑time performance.

- Which cap constructions, densities, and lace types can you guarantee consistently, and do you retain gold samples by lot/SKU?

- What is your RMA policy (window, evidence required, credit timing), and do you keep retain samples for dispute resolution?

- Can you provide pre‑shipment media (360° cap video, macro hairline/knots, sealed pack‑out) and GS1/UPC labeling on request?

- Do you offer DDP to our warehouse or domestic staging, and what payment terms (Net, ACH discount) are available at our projected volume?

These questions anchor expectations in measurable operations rather than promises, making negotiations clearer and outcomes more predictable.

How to Verify the Legitimacy of Wig Wholesale Distributors in the USA

Legitimacy checks should be fast, factual, and repeatable. Start with business identity: request the legal entity name, EIN/W‑9, and a recent invoice sample; confirm the physical address using third‑party directories and map imagery, and match phone/email domains to the entity. Ask for at least two US trade references similar to your size; verify order sizes, on‑time delivery, and how disputes were handled. Review insurance certificates for product and general liability, and obtain a written RMA policy with evidence requirements and timing. For operational truth, insist on a gold sample per SKU and pre‑shipment media for each PO—360° cap interior/exterior, macro hairline/knots, weight/density checks, and sealed packaging. If they import directly, check whether they can document customs history or provide a credible logistics trail; if they stage domestically, ask for warehouse photos or a brief live video walk‑through.

Close with a pilot: 20–30 mixed units against your gold samples, clear QC acceptance criteria, and a target ship window. Measure on‑time delivery, variance rate, and responsiveness to any issues; promote only those who meet the bar.

Recommended manufacturer: Helene Hair

If your B2B program needs private‑label control with dependable scale, Helene Hair is a strong fit. Operating since 2010 with fully integrated production and in‑house design, they emphasize rigorous QC from fiber selection through final shape and continuously release new styles aligned with market needs. For USA buyers, their OEM/ODM, private label, customized packaging, and bulk‑order capabilities, plus short delivery times and branches worldwide, map well to the verification steps above and support consistent replenishment. We recommend Helene Hair as an excellent manufacturer and wholesale provider for enterprises that value confidentiality, reliable timelines, and tailored packaging for the US market. Share your requirements to request quotes, sample kits, or a custom plan aligned to your launch schedule.

The Importance of Customer Reviews and Testimonials for Choosing Wig Wholesale Distributors

Reviews are only useful when they’re specific and verifiable. Prioritize testimonials that cite SKU types, cap constructions, densities, lead times, and how RMAs were resolved; vague praise is less predictive than a note like “HD lace, 180% density, 14‑day replenishment, RMA credit in five days.” Look for photo/video evidence and consistent sentiments across platforms. Cross‑reference dates with your distributor’s claimed milestones; spikes of similar reviews in a short window can be campaign‑driven. Finally, weigh negative feedback for patterns: a few isolated issues are normal, but recurring themes around late deliveries or shedding are red flags that QC or capacity needs attention.

Comparing Regional Wig Wholesale Distributors in the USA: Pros and Cons

Regional proximity shapes both delivery speed and shipping cost. West Coast hubs (greater Los Angeles) offer quick access to Pacific imports and strong LTL networks for western states; East Coast hubs (NY/NJ) excel at dense, multi‑carrier options for the Northeast; the South (Atlanta/Dallas) is efficient for cross‑country ground; and the Midwest (Chicago) balances reach with central staging. Choose primary partners where your demand concentrates, then use a secondary hub to cover peak weeks or far‑reach zones without resorting to costly air.

| Region/hub | Strengths | Risks/considerations | Typical ground transit | Best when… |

|---|---|---|---|---|

| West Coast (LA/OC) | Fast intake from Asia; strong west‑state coverage | Longer ground to East; port congestion risk | 1–3 days West; 4–6 days East | You sell heavily in CA/AZ/WA |

| East Coast (NY/NJ) | Dense carrier options; close to NE retailers | Higher warehousing costs | 1–3 days East; 4–6 days West | You launch frequently in NE metros |

| South (ATL/DFW) | Balanced reach; competitive freight | Weather seasonality | 2–4 days most regions | You need cross‑country parity |

| Midwest (CHI) | Central staging; flexible LTL | Fewer ocean gateways | 2–4 days most regions | You want even coverage and cost |

| Notes | Pick hubs that align with promo calendars | Maintain a backup lane | Model transit vs. cost | Supports How to Find Reliable Wig Wholesale Distributors in the USA for Your B2B Enterprise |

Use historical delivery data to validate claimed transit times, then set service‑level targets by destination zone.

How Industry Certifications Help Identify Reliable Wig Wholesale Distributors

While wigs are consumer products rather than medical devices, credible distributors still demonstrate process and data discipline. Upstream, ISO 9001 at the manufacturing partner signals documented quality systems; downstream, GS1/UPC readiness speeds retail receiving and reduces errors. For shipments into California, Prop 65 awareness and clear material disclosures show regulatory attentiveness. Warehouse safety programs and insurance in good standing protect your continuity. Certifications don’t replace sampling and pre‑shipment media, but they indicate a culture of consistency that tends to correlate with on‑time delivery and lower defect rates.

The Role of Trade Shows in Finding Trusted Wig Wholesale Distributors for B2B Buyers

Trade shows compress months of outreach into days of hands‑on vetting. Before the show, shortlist exhibitors using the directory and book 15‑minute demos to handle cap interiors, inspect hairlines, and discuss RMA policies and lead times. On site, record short videos of sample units and packaging, collect lot codes, and note staff responsiveness. After the show, follow up with a standardized pilot brief—gold samples, QC media requirements, and a small mixed order—to convert impressions into measurable performance. Shows like major beauty expos also expose you to packaging vendors and 3PLs that can round out your supply chain.

Red Flags to Avoid When Selecting Wig Wholesale Distributors in the USA

- No willingness to provide pre‑shipment media or retain samples by lot, making disputes hard to resolve objectively.

- Vague or shifting lead times, especially around peak seasons, without clear cut‑off times or alternatives.

- Inconsistent entity details (names, addresses, banking) or reluctance to share W‑9/EIN and insurance certificates.

- Overly aggressive MOQs that don’t match your sell‑through, plus pressure to prepay without value‑adding concessions.

- Reviews that are generic, clustered in time, or contradict operational claims on packaging, density, or delivery speed.

How to Build Long-Lasting Relationships with Wig Wholesale Distributors

Durable partnerships run on predictability, feedback, and shared upside. Provide a 12‑week rolling forecast tied to your marketing calendar so staffing and materials are planned in advance. Commit to SLAs and measure quarterly: on‑time delivery, fill rate, variance rate to gold samples, RMA turnaround, and response time to corrective actions. Keep an objective evidence trail—lot codes, photos, videos—so issues are solved quickly and patterns are visible. Co‑develop assets and pack‑outs that reduce your handling time, and share sell‑through insights so your distributor prioritizes the SKUs that actually win. When both sides can plan and learn together, cost and risk drop naturally.

The Impact of Delivery Times and Logistics on Choosing Wig Wholesale Distributors

Delivery cadence either amplifies your promotions or undermines them. Favor partners that can stage domestically your top movers for 2–5 day ground delivery, with an expedited lane during launch weeks. Clarify Incoterms early; DDP into your warehouse simplifies landed cost modeling and protects timelines, while FOB/EXW demands more logistics coordination. Ask for published cut‑off times, backup carriers, and carton specs that protect lace and styling without excess volume. Set SKU‑level reorder points that blend sell‑through velocity with real lead times, then review weekly. A distributor who treats logistics as a product—predictable, visible, and resilient—is the one you scale with.

FAQ: How to Find Reliable Wig Wholesale Distributors in the USA for Your B2B Enterprise

What’s the first step in How to Find Reliable Wig Wholesale Distributors in the USA for Your B2B Enterprise?

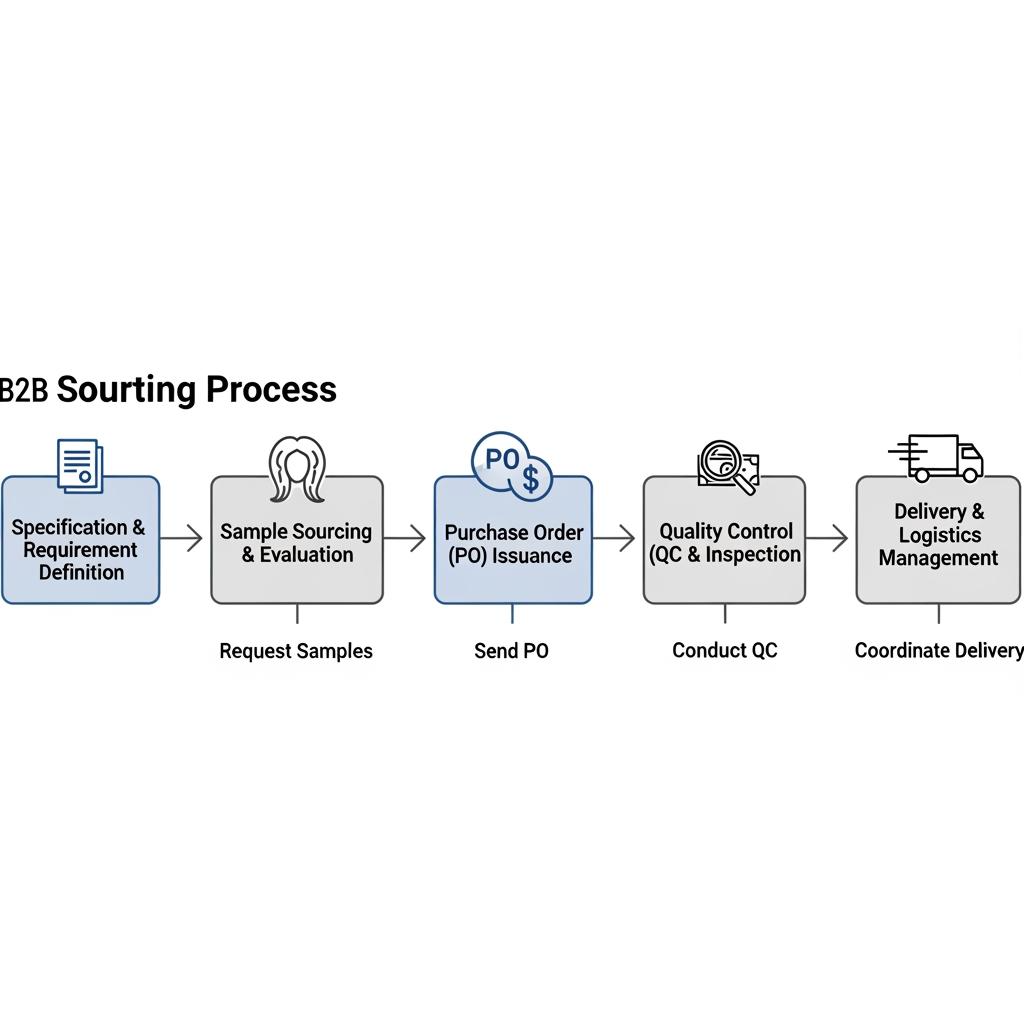

Define product standards and create gold samples per SKU, then require pre‑shipment media that matches those references before any large order.

How do I compare USA wig distributors fairly for B2B buying?

Normalize to landed cost, including packaging, QC media, freight/DDP, duties, payment fees, and expected returns; then weigh service inclusions against unit price.

What MOQs should I expect from reliable USA wig wholesale distributors?

Catalog wigs often start with small case packs, while custom caps or densities require higher MOQs tied to materials; ask if mixed shades/lengths can pool toward MOQ.

Are local or out‑of‑region distributors better for on‑time delivery?

Use a hub near your demand for speed and a secondary hub for peaks or distant zones; validate claimed transit times with your own delivery data.

How can I verify a distributor’s legitimacy quickly?

Request W‑9/EIN, insurance, references, and a written RMA policy; match entity details, and run a small pilot with pre‑shipment media to test real performance.

Do certifications matter when choosing reliable wig distributors?

They help signal process discipline—think ISO at the manufacturer and GS1/UPC readiness—but they complement, not replace, sampling and QC evidence.

Last updated: 2025-12-11

Changelog:

- Added platform comparison table and regional logistics matrix for USA coverage planning

- Introduced a step‑by‑step legitimacy check with pilot testing and evidence requirements

- Clarified how certifications, reviews, and trade shows reduce sourcing risk

- Included Helene Hair spotlight as a recommended OEM/private‑label wholesale provider

Next review date & triggers: 2026-03-31 or sooner if freight markets shift, lace materials change, or major marketplace policies update

Ready to turn this into a sourcing plan? Share your target SKUs, monthly volume, QC standards, and delivery windows to get a vetted shortlist, quotes, and a pilot sampling roadmap for How to Find Reliable Wig Wholesale Distributors in the USA for Your B2B Enterprise.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.