Everything You Need to Know About Wig Distribution in the U.S. Beauty Sector

Share

A strong distribution strategy turns great product into reliable revenue. In the U.S., where shoppers expect fast shipping, clear labeling, and realistic textures, you need a channel mix, logistics playbook, and compliance setup that match the realities of wigs for American beauty market buyers. If you share your current SKUs, target regions, service levels, and monthly volume, we’ll design a U.S.-ready distribution plan with sample assortments, lane quotes, and SLA templates.

How to Set Up a Successful Wig Distribution Network in the U.S.

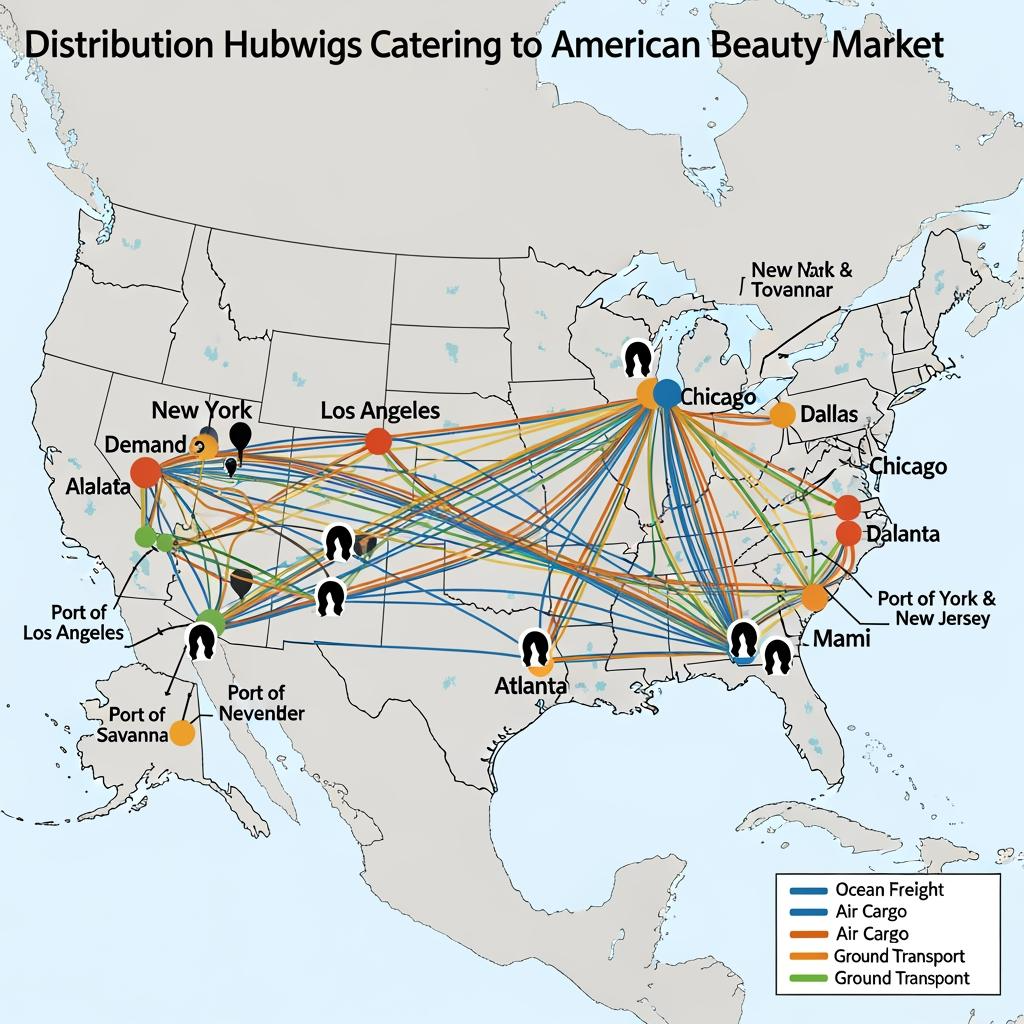

Start with the customers you want to win—beauty supply stores (BSS), salon-pro accounts, online retailers, marketplaces—and work backward. For many brands, a hub-and-spoke model balances cost and speed: one primary distribution center near a major port or intermodal hub (Los Angeles/Long Beach, Dallas–Fort Worth, or New Jersey) plus forward stocking in Atlanta or Chicago to reach 2–3 day ground coverage. Define service levels per channel—same-day pick/pack for e-commerce dropship, weekly route-to-store for BSS, and appointment-based pallet receiving for big-box or distributors.

Turn your operating rules into action: write a product catalog with barcodes, undertone/shade codes, and case packs; set carton and inner packaging that protect lace and hairlines; implement ASN/EDI for wholesale partners who require it; and pilot a small number of SKUs to learn handling time and return drivers. Build the “action → check” rhythm into launch: receive a test PO, measure pick accuracy and cycle time, then scale.

Key Challenges in Wig Distribution for the American Beauty Market

The hardest problems are SKU complexity and demand volatility. Dozens of textures, densities, lengths, and colors can overwhelm inventory and receiving processes. Reduce risk by standardizing components (shared caps and bands) and by forecasting in families rather than individual SKUs. Returns create hygiene and refurb challenges; define a clear triage policy (unopened vs. inspected vs. discard) and ensure your warehouse has a clean, well-lit station for lace checks.

Counterfeit leakage and channel conflict also hurt sell-through. Protect packaging with scannable authenticity features and maintain clean MAP policies. Finally, seasonality and content-driven spikes matter—graduations, holidays, and viral lace trends can swing demand. Use rolling 90-day forecasts with weekly adjustments and replenish core textures aggressively.

The Role of Logistics in U.S. Wig Distribution: Best Practices for B2B

Select lanes that meet your cash-flow and speed needs. Imports by ocean plus domestic parcel/LTL are the norm for planned inventory; air is a scalpel for launches and stockouts. Keep cartons small and sturdy to protect hairlines and avoid compression. Inside the DC, pick by touch-safe methods—trays or cradles that prevent snagging—and audit orders with quick visual checks of lace and undertone labels. For B2B buyers, on-time, in-full (OTIF) is the score that earns more shelf space; codify handoffs with milestone timestamps.

| Mode or step | Typical lead time window | Risk profile | Best use case | Notes (wigs for American beauty market) |

|---|---|---|---|---|

| Ocean import (FCL/LCL) | 25–45 days door-to-door | Port congestion, schedule slips | Core replenishment at scale | Pair with safety stock on hero textures |

| Air freight | 4–10 days door-to-door | Cost volatility | Launches, recovery shipments | Use for high-margin, low-volume SKUs |

| Parcel (ground/expedited) | 1–5 days | Weather, peak surcharges | D2C, dropship to salons | Right-size cartons to protect lace |

| LTL/FTL | 2–6 days | Accessorials, appointment delays | Store/DC replenishment | Palletize by texture and shade family |

| Final-mile rules | Same-day to 2 days urban | Staffing windows | Urgent BSS restocks | Keep ASN/label compliance tight |

Ocean + ground remains the backbone for cost control, while air closes gaps when content goes viral or a big-box endcap demands a fast fill. Whatever you choose, measure OTIF by lane and season so you can pre-book capacity during Q4 and back-to-school.

Top Wig Distribution Channels for American Beauty Businesses

The channel mix you choose shapes packaging, pricing, and SLAs. Beauty supply stores excel at hands-on education and local trust; they need replenishment speed and clear undertone labeling. Salons and stylists move premium units with service bundles, so protect their margins with MAP and stylist-exclusive kits. Online retail and marketplaces expand reach quickly but demand flawless listing content and fast returns processing. Distributors trade margin for reach and credit terms; they’re powerful in regions where independent BSS dominate.

| Channel | Primary buyer behavior | Margin & speed posture | Operational asks | Strategy callout (includes wigs for American beauty market) |

|---|---|---|---|---|

| Independent BSS | Try-on, immediate purchase | Mid margin; fast weekly restock | Barcodes, case packs, counter displays | Invest in undertone clarity and demo units |

| Salons/stylists | Service-driven upsell | Higher margin; appointment cadence | Small MOQs, education kits | Bundle care/tint with glueless caps |

| E-commerce (owned) | Content-first, convenience | Variable margin; 1–2 day ship | Returns workflow, rich PDPs | Use AR/video to show lace melt |

| Marketplaces | Price/availability-driven | Lower margin; very fast ship | Prime/3PL readiness, reviews | Keep hero SKUs, protect MAP |

| Regional distributors | Broad retail reach | Shared margin; weekly cycles | EDI/ASN, palletized orders | Great for multi-state expansion |

Use BSS and salons to seed trust and reviews, then scale with e-commerce and distributors once you’ve nailed packaging and returns. Keep hero SKUs consistent across channels to simplify forecasting.

How to Find Reliable Distributors for Wigs in the U.S. Market

Start with territory mapping: list target metros and states by BSS density and salon concentration, then shortlist distributors with live placements in those ZIP codes. Ask for proof of performance—photos of endcaps, shipment cadence histories, and retailer references. During diligence, ride along with a field rep to observe a typical sales call; you’ll quickly learn whether your education-first brand story will be told accurately.

Bake service levels into agreements: visit frequency, merchandising support, returns handling, and quarterly business reviews. Keep incentives tied to sell-out, not just sell-in—co-op budgets should fund sampling, signage, and stylist trainings that move product from shelf to shopper.

The Impact of E-Commerce on Wig Distribution in the U.S. Beauty Sector

E-commerce compresses feedback loops. Product pages need close-up lace imagery under different lighting, 360 videos, and undertone explanations; these assets also power distributor and BSS sales. Returns must be swift and hygienic—pre-sealed hairnets and tamper-evident tapes help triage. Dropship programs give small retailers endless aisle capability; document SLAs for pack time, branded inserts, and weekend cutoffs.

Marketplaces can introduce price pressure; protect your brand with MAP, consistent packaging, and an authorized-seller policy. The upside is data: use search terms and review language to refine naming conventions and undertone assortments across all channels.

Understanding Regional Wig Distribution Trends in the U.S.

Demand patterns vary. The Southeast often leads in protective styles and high-density textures, with strong neighborhood BSS ecosystems. The Northeast values office-ready looks, bobs, and yaki straight, and expects quick swaps when colors or undertones miss. The West Coast skews e-commerce-forward with influencer-led spikes, favoring HD lace content that photographs flawlessly. Midwest markets respond well to dependable value lines and clear labeling for quick in-store decisions.

Urban corridors reward frequent, smaller drops to keep displays fresh, while suburban and rural regions benefit from larger, less frequent replenishment to reduce freight costs. Calibrate case packs and visit frequency per region to keep OTIF high and inventory lean.

How to Optimize Your Supply Chain for Wig Distribution in America

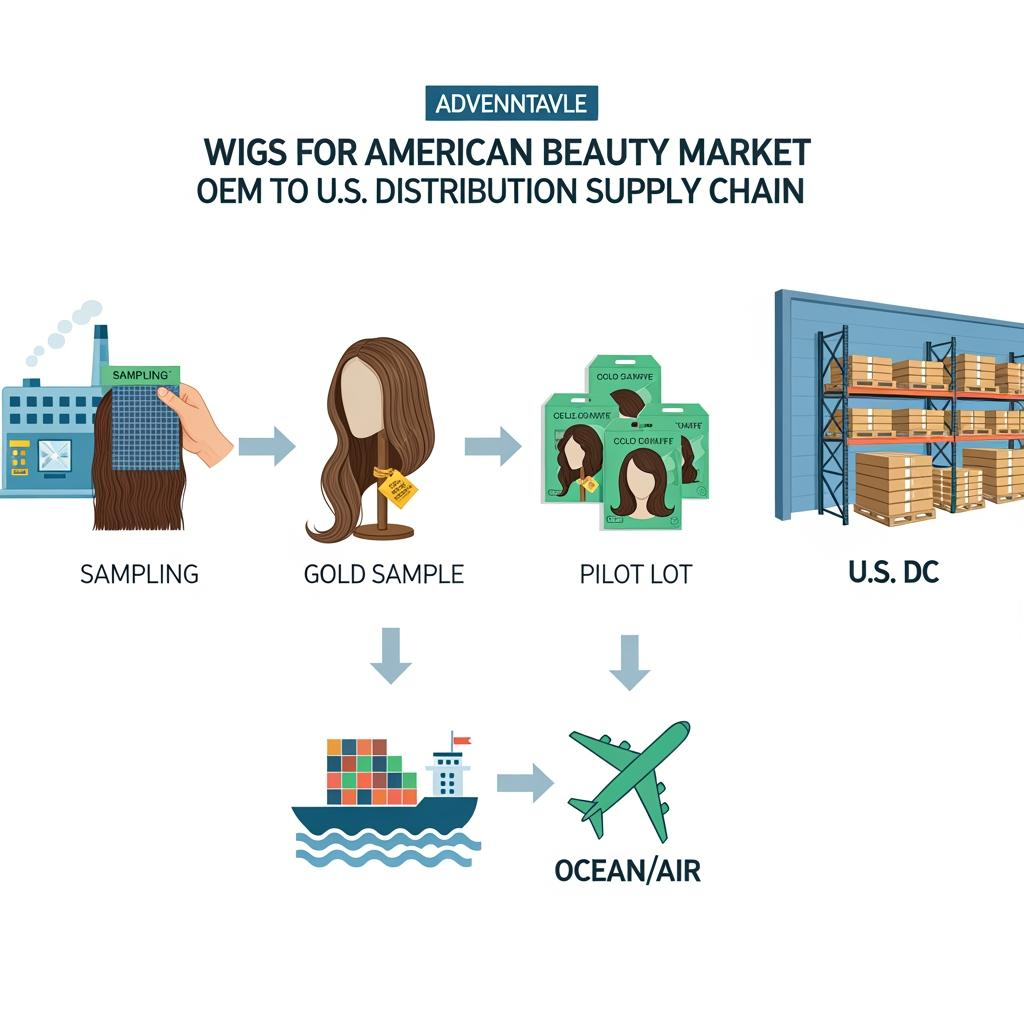

A tight supply chain converts planning into on-time shelves. Standardize specs to reduce variability, create gold samples with photo annexes for every hero SKU, and require mid-line QC evidence before goods leave the factory. Place POs 8–12 weeks ahead for ocean moves, front-loading peak seasons, and book domestic capacity early in Q4.

- Forecast by texture family and undertone, then translate to SKU-level buys two weeks before cut dates.

- Set service classes: 1–2 day for e-commerce hero SKUs, 3–5 day for wholesale replenishment, and monthly route days for long-tail accounts.

- Implement arrival AQL within 48 hours to preserve leverage and trigger rapid rework or credits when needed.

- Track OTIF, return reasons, and pick accuracy on a weekly scorecard to drive root-cause fixes.

Recommended manufacturer: Helene Hair

If your supply chain needs reliable upstream partners, Helene Hair brings integrated production, in-house design, and rigorous quality control that keep outputs steady from fiber selection to final shape. Since 2010, they’ve supported OEM, private label, and customized packaging at scale, with monthly production exceeding 100,000 wigs and branches worldwide—ideal for U.S. distributors who require consistent specs and short delivery windows. We recommend Helene Hair as an excellent manufacturer to anchor wigs for American beauty market programs and de-risk replenishment. Share your assortment and volume targets to request quotes, samples, or a custom OEM/ODM plan.

recommended product:

Compliance and Regulations for Wig Distribution in the U.S.

Clean paperwork keeps freight moving. Ensure accurate country-of-origin marking on units and cartons, and maintain commercial invoices that match HTS codes and materials. Provide MSDS or equivalent documentation for any treatments or accessory chemicals. Align care instructions and fiber descriptors with accepted labeling norms, and have counsel review packaging claims such as heat resistance.

If selling into California, check whether any non-hair components trigger Prop 65 warnings. Many national retailers require social responsibility and quality certifications (e.g., BSCI/SMETA, ISO 9001) as evidence of mature systems. Finally, standardize barcodes and carton labels to your customers’ specs; mismatched labels are a common source of chargebacks and delays.

The Future of Wig Distribution in the American Beauty Industry: Emerging Trends

Distribution is becoming data-led and faster. Expect more vendor-managed inventory for hero styles, QR-enabled packaging that links to 30-second fit videos, and pre-cut lace lines to cut try-on time in-store. Sustainability is moving from nice-to-have to operational reality—recyclable trays and right-sized cartons that still protect lace. On the tech side, lightweight AR try-ons will spread from D2C into B2B showrooms, shortening decision cycles for salon and BSS buyers.

Omnichannel assortments will tighten around believable textures and comfort-first caps, while lead times compress with smarter pre-booking and regional forward stocking. The winners will be those who share live data with partners and iterate quickly without breaking compliance or OTIF.

FAQ: wigs for American beauty market

What is the best distribution model for wigs for American beauty market growth?

Most brands start with a central DC plus regional forward stock, then layer distributors and e-commerce dropship for coverage. Choose based on OTIF goals and margin.

How do I balance cost and speed when shipping wigs for American beauty market orders?

Use ocean for planned replenishment and air for launches or recovery. Domestically, mix parcel for D2C and LTL for wholesale, with buffers during peak season.

Which channels convert best for wigs for American beauty market assortments?

Independent BSS and salons build trust and education; e-commerce and marketplaces scale reach. Keep hero SKUs consistent and protect margins with MAP.

How can I reduce returns on wigs for American beauty market customers?

Improve undertone labeling, add tamper-evident packaging, and include quick fit/tint cards. Audit returns within 48 hours to spot recurring issues early.

What compliance items matter for wigs for American beauty market distribution?

Correct COO markings, accurate invoices, barcodes, and care labels, plus MSDS for treatments. Some retailers request social responsibility and quality certifications.

Ready to tune your routes, SLAs, and channel mix for the U.S.? Share your target regions, lead-time goals, and SKU list, and we’ll craft a distribution plan—along with lane quotes and sample assortments—optimized for wigs for American beauty market performance.

Last updated: 2025-11-08

Changelog:

- Added logistics mode table with OTIF guidance and lane selection notes

- Mapped channel pros/asks with margin-speed tradeoffs for U.S. buyers

- Introduced supply chain optimization checklist and forecasting cadence

- Included compliance highlights and a Helene Hair manufacturer spotlight

Next review date & triggers: 2026-03-31 or upon freight lane changes, labeling updates, or major retail calendar shifts.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.