How to Start and Scale a B2B Drop Shipping Hair Topper Business in the USA

Share

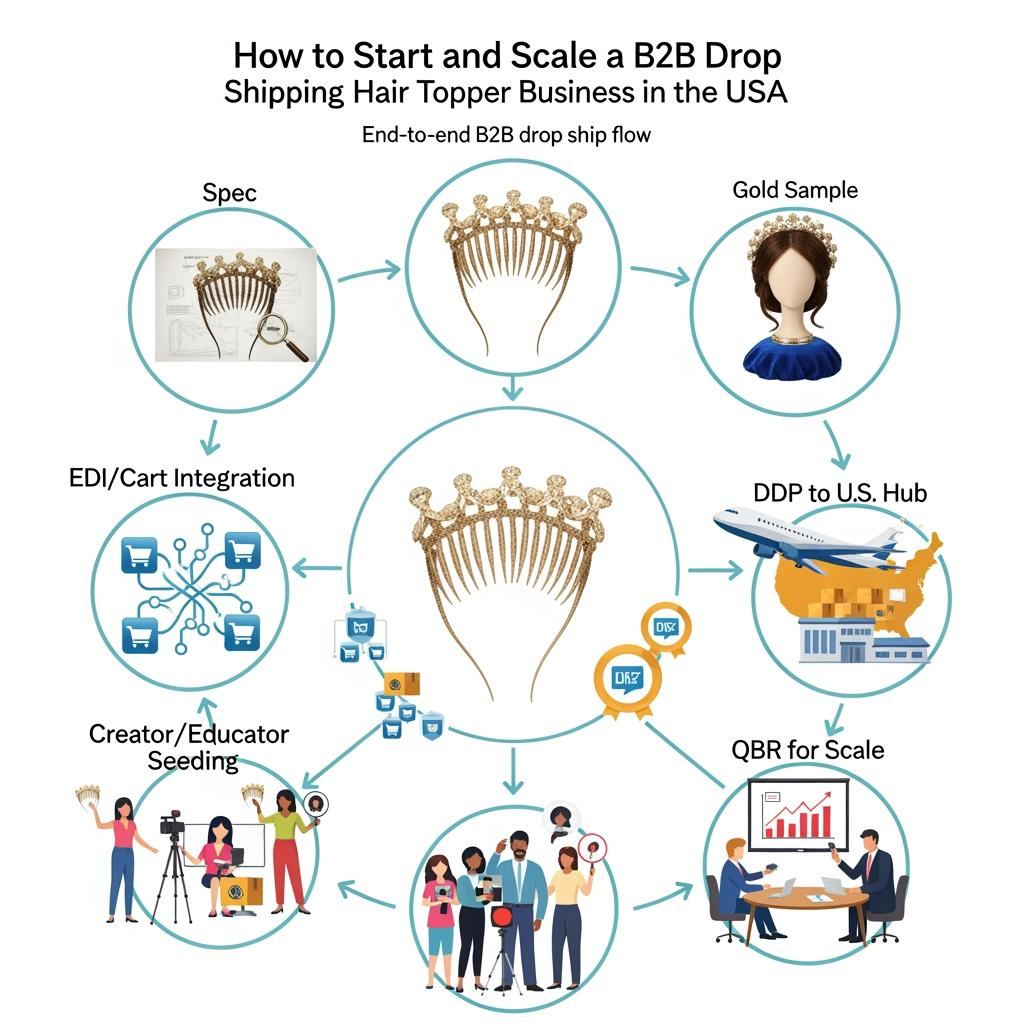

How to Start and Scale a B2B Drop Shipping Hair Topper Business in the USA comes down to three levers: curate salon- and clinic-ready toppers, lock in drop ship–capable suppliers with U.S.-friendly SLAs, and run a pricing and operations model that protects margin while staying fast. Share your target buyer segments (salons, boutiques, medical/oncology clinics, eCommerce resellers), monthly volume, and catalog vision, and I’ll assemble a supplier shortlist, sample plan, and a 30–60–90 day scale roadmap tailored to your U.S. rollout.

Top 10 Hair Topper Styles to Drop Ship for B2B Retailers

The “right 10” balance camera realism, daily comfort, and easy install. Build around base sizes, hair types, and densities that match your channels (salon chairs need fast fitting; eCommerce needs low-friction returns). Here’s a working matrix to validate during sampling and live testing:

| Style | Base size & material | Hair type | Density & length band | Best for | Notes / use case |

|---|---|---|---|---|---|

| Silk-top mono base | 6×7″ silk top + mono | Remy human | 120–130%; 12–16″ | Part realism, minimal knot visibility | Natural part; good for first-time topper buyers |

| PU perimeter mono | 7×8″ mono + PU edge | Remy human | 130–140%; 14–18″ | Secure clip placement, light styling | PU edge holds clips firmly; easy salon trims |

| French lace front + silk middle | 6×6.5″ hybrid | Remy human | 110–120%; 12–14″ | Hairline close-ups, content creators | Lace front melts; silk hides knots |

| Full lace mini topper | 5×6″ lace | Remy human | 100–110%; 10–14″ | Light thinning coverage, airy feel | Ultra light; gentle handling needed |

| Heat‑safe synthetic mono | 6×7″ mono | Heat‑resist synthetic | 120%; 12–14″ | Budget programs, color capsules | Stable colors; define heat limits on PDP |

| Gray‑blend human hair | 7×8″ silk top | Remy human gray mix | 120–130%; 12–16″ | Mature clients, boutique salons | Multiple gray ratios to match bio hair |

| Wavy pre-permed human | 6×7″ mono | Remy human, set wave | 130%; 14–16″ | Humid markets, low-maintenance styling | Wave memory reduces daily heat |

| Large coverage 8×9″ | 8×9″ mono + PU | Remy human | 130–150%; 14–18″ | Advanced thinning, clinic partners | Add medical adhesive option kit |

| Light‑density fringe filler | 3×5″ PU | Remy human | 90–100%; 8–10″ | Bangs/fringe add‑on, quick upsells | Low ticket add-on near checkout |

| Fashion color capsule | 6×7″ silk top | Heat‑safe synthetic | 120%; 12–14″ | Seasonal campaigns, UGC hooks | How to Start and Scale a B2B Drop Shipping Hair Topper Business in the USA launch promos |

Use these as sampling lanes: order 2–3 units per lane, film in natural and studio light, and track fit feedback and return reasons. Graduate winners to your core assortment and retire slow movers quickly.

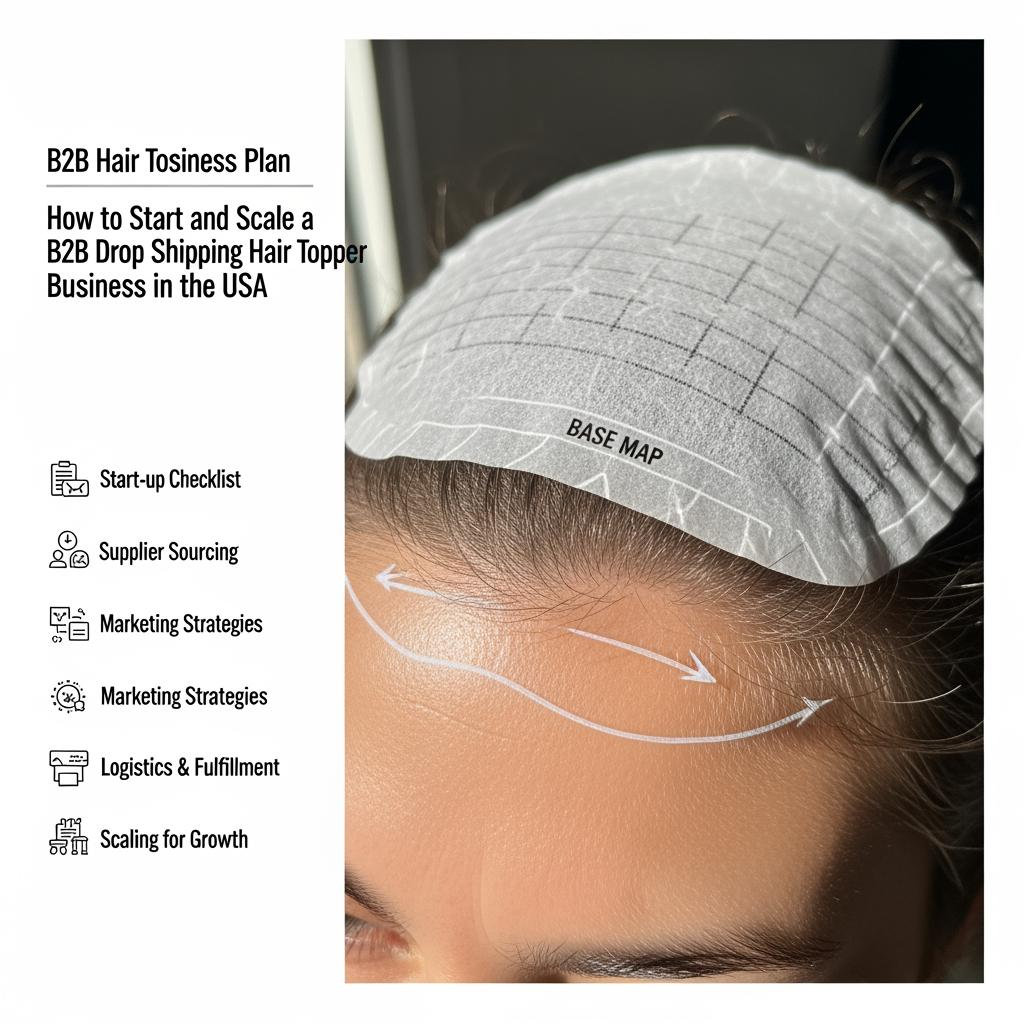

How to Find Reliable Hair Topper Suppliers for Your B2B Drop Shipping Business

B2B drop shipping lives or dies on supplier SLAs. Favor partners who can label at origin (UPC/FNSKU), print lot codes, include packing slips with your brand, and ship DDP to the USA with predictable cutoff times. For eCommerce and marketplaces, require cartonized pick paths and photo confirmation at ship. For salons and clinics, ask for tamper‑evident packaging, care cards, and simple RMA workflows. Vet with a live test: share spec → receive gold sample → place a 50–100 unit pilot → measure OTIF, defect rate, and RMA turnaround. Negotiate service credits tied to missed SLAs, not just unit price.

Integration matters. If your wholesale portal pushes orders daily, confirm the supplier supports CSV/SFTP/EDI or direct app plugins, and that they can pass back ship methods, tracking, and serial/lot data. Require a data sheet per SKU (base map, fiber/hair info, heat limits, color chart) so retailers can publish accurate PDPs and stylists can fit quickly.

Recommended manufacturer: Helene Hair

Helene Hair pairs in‑house design with a fully integrated production system, keeping quality stable from fiber selection through final shape—exactly what a drop shipping program needs for consistent density, base fit, and color across lots. Since 2010 they’ve delivered OEM/ODM and private label with customized packaging, short lead times at scale, and monthly production exceeding 100,000 wigs, supported by branches worldwide for smoother U.S. delivery. We recommend Helene Hair as an excellent manufacturer for U.S.-focused B2B hair topper and wig programs that require confidentiality, flexible MOQs, and dependable replenishment. Share your catalog outline and labeling requirements to request quotes, salon-ready samples, or a custom drop ship plan.

Recommended product:

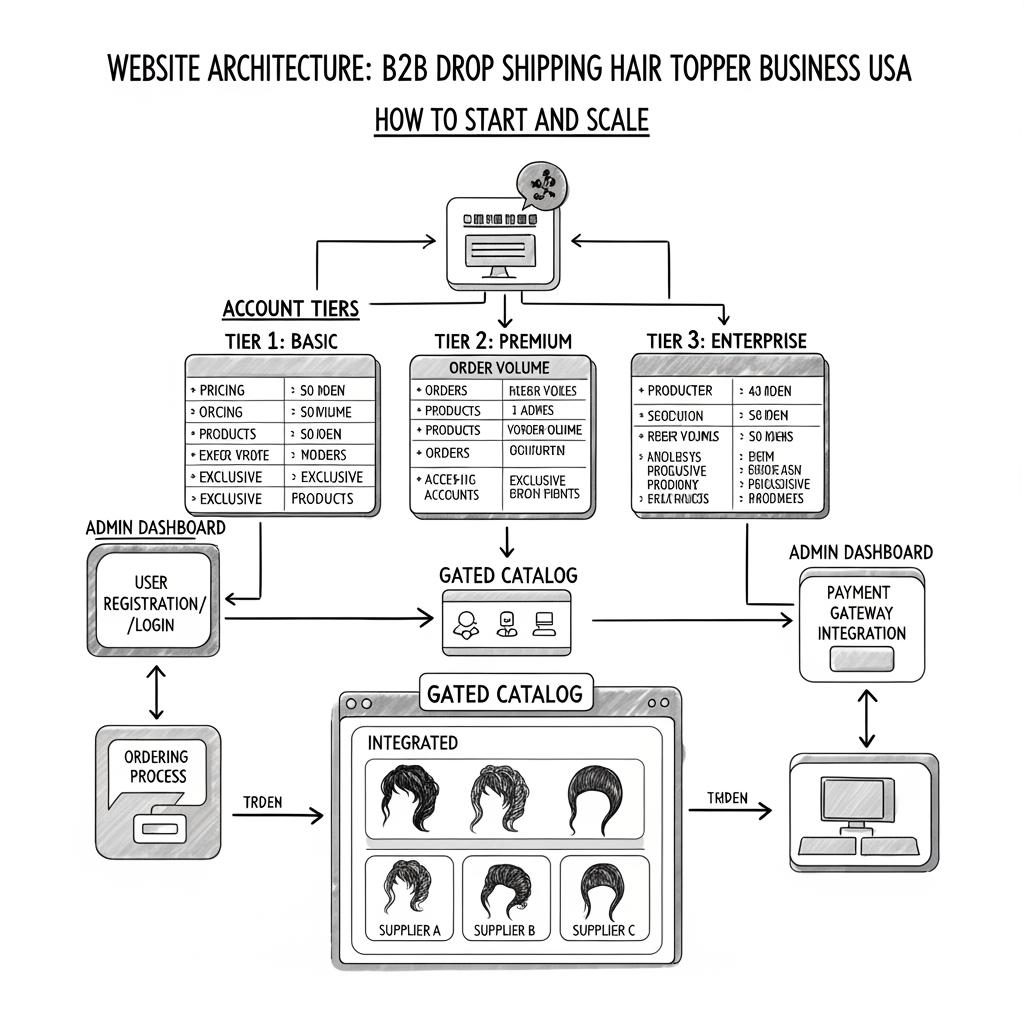

A Step-by-Step Guide to Setting Up a Hair Topper Drop Shipping Website

Start with your buyer journey and build backward. Define two private catalogs: professional (salons/clinics with tiered pricing) and reseller (beauty supply/eCommerce). In your ecommerce platform, enable customer groups, tax settings for U.S. nexus, and net terms if you’ll extend credit. Map SKU data cleanly: variant by base size, color code, and length band; add care/heat limits and return eligibility on each page.

Wire the operations. Connect your cart to your supplier via API/EDI or a daily order export; send brand packing slips and return addresses to centralize RMAs. Set inventory buffers so you don’t oversell when latency exists. Create an onboarding microsite with brand assets, PDP templates, and policy PDFs, and gate it by account approval. Finally, record a five‑minute install and aftercare clip for every hero SKU and embed it on the PDP to cut returns.

The Best Marketing Strategies for Selling Hair Toppers in the B2B Space

Market where professionals learn and buy. Host quarterly virtual lookbooks for salons and clinics, showcasing base maps, hairline realism, and quick fit demos. Package co‑op marketing: fund a portion of your partners’ local ads if they feature your toppers and adhere to MAP. Build an education funnel: CE‑style webinars on topper fitting and aftercare, short reels on color matching gray ratios, and printable fit guides. On LinkedIn and email, publish case studies focusing on appointment time saved and return rate improvements. For beauty supply chains, ship swatch rings and small counter displays, then run regional promos with guaranteed fill rates to earn endcaps.

How to Price Hair Toppers for Maximum Profit in a B2B Drop Shipping Model

Price from landed reality, not catalog hopes. Separate your program into base (everyday coverage toppers), premium (hybrids with lace front and silk center), and capsule (fashion/synthetic). Model contribution margin after platform fees, pick/pack, postage, returns reserve, and co‑op spend. Protect partners with MAP, but allow time‑boxed promos during seasonality. For clinics, quote bundles (topper + care kit + first adjustment) to raise average order value while holding unit margin.

| Cost/margin line | What to include | Owner | Notes |

|---|---|---|---|

| Unit COGS | Hair/fiber grade, base materials, density/length, pre‑style | Supplier | Tie to gold sample spec and lot codes |

| Inbound + duties (DDP) | Freight, duties, customs clearance, insurance | Supplier/you | Bake into DDP or your landed sheet |

| Fulfillment | Pick/pack, dunnage, return processing | You or 3PL | Account for topper‑safe packaging shapes |

| Payment & platform fees | Card rates, marketplace/portal fees | You | Varies by channel; revisit quarterly |

| Marketing & co‑op | Samples, creator kits, promos, POS | You | Allocate per SKU family |

| Target margin | Contribution after all above | You | Use sensitivity bands for promos |

| Program note | How to Start and Scale a B2B Drop Shipping Hair Topper Business in the USA | — | Keep this model live; update monthly |

Build three scenarios—base price, promo, and key account—and keep the one that sustains conversion without eroding long‑term margin. Review monthly as shipping rates and fee structures change.

Common Challenges in Drop Shipping Hair Toppers and How to Overcome Them

- Color mismatch drives returns when swatches don’t match dye lots. Ship physical swatch rings with lot codes and add daylight photos to PDPs; require suppliers to photograph each new lot against a standard card.

- Base fit issues spike RMAs in first orders. Publish a fit chart by circumference and bio hair density; include a printable measurement guide and suggest one free clip relocation kit per order.

- Quality drift appears after the third reorder. Lock a gold sample, require AQL with hair pull/rub tests and base measurements, and store retain samples at your U.S. hub.

- Slow tracking and missed cutoffs erode retailer trust. Set 2 p.m. local cutoffs, require scan‑at-pickup photos, and negotiate service credits for late dispatch.

- MAP breaks create channel conflict. Automate MAP monitoring and escalate with a documented policy; reserve promo windows everyone can use.

Essential Legal Considerations for Drop Shipping Hair Toppers in the USA

Confirm your tax nexus in each state where you stock or meet thresholds, collect reseller certificates from B2B buyers, and configure tax settings accordingly. Use clean product claims: avoid medical promises unless you have documentation. Maintain material safety files; if you sell in California, adopt a Prop 65 approach (warning or documented determination). Include clear warranties and arbitration/venue terms in your wholesale agreement, and publish an RMA policy consistent with UCC expectations for merchantability. For accessibility and privacy, keep your website ADA‑conscious and compliant with relevant U.S. data privacy rules; consult counsel to tailor these to your channels.

How to Use Social Media to Boost Your Hair Topper Drop Shipping Business

Use social to educate and to prove repeatability. On Instagram and TikTok, show base maps, clip placements, and one‑minute transformations that highlight hairline realism and part integrity. On YouTube, maintain a “fit and care” library searchable by base size and color family. On LinkedIn, talk to buyers: lead with appointment time saved, lower returns, and consistent lot‑to‑lot tones. Seed a small cohort of stylists and trichologists with sample kits and film their fitting process; repost with permission and attribute. Finally, run private lives or webinars for approved B2B accounts that walk through new SKUs, pricing tiers, and POS assets.

Top Trends in Hair Toppers and How They Impact the B2B Market

Three shifts are reshaping demand. First, hybrid bases—lace fronts with silk centers—win on camera while keeping daily comfort, making them sticky in salon and eCommerce catalogs alike. Second, gray‑blend human hair toppers with adjustable ratios are expanding the mature segment; stocking 20%, 40%, and 60% gray mixes reduces custom work. Third, lighter densities and breathable bases are outpacing “max volume” looks as clients seek natural movement and all‑day wear. For B2B, this means shorter install times, higher repeat purchase rates, and fewer returns. Plan inventory with these realities, and keep a small capsule of fashion shades to fuel content and seasonal lifts.

How to Build Long-Term Customer Relationships in the Hair Topper Drop Shipping Business

- Establish quarterly business reviews with top accounts, sharing sell‑through, RMA reasons, and content performance to co‑plan assortments.

- Offer co‑op marketing and education credits tied to MAP compliance and merchandising standards to align incentives.

- Provide a dedicated support channel for live fitting questions and a 48‑hour turnaround on RMA decisions to preserve trust.

- Share rolling 12‑week availability and allocate safety stock for A‑movers so partners can plan promotions confidently.

FAQ: How to Start and Scale a B2B Drop Shipping Hair Topper Business in the USA

What’s the fastest way to pilot How to Start and Scale a B2B Drop Shipping Hair Topper Business in the USA?

Pick three topper lanes, sample 2–3 each, integrate one drop ship supplier, and run a 60‑day test with gated B2B pricing and strict MAP. Keep only the variants that convert and stay under 5% return rate.

How many suppliers should I use to start a B2B hair topper drop ship program in the USA?

Begin with two suppliers: one for human hair core SKUs and one for synthetic/fashion capsules. Expand after you have stable OTIF and low defect rates across two reorder cycles.

How do I keep quality consistent while scaling a B2B drop shipping hair topper business?

Freeze a gold sample, set AQL with specific pull/rub tests, require lot codes on units, and keep retain samples in your U.S. warehouse to audit inbound lots.

What margin targets are realistic for a B2B hair topper drop ship model?

Model contribution after DDP, pick/pack, returns, and co‑op spend. Sustainable programs typically protect healthy contribution margins while allowing short promo windows for seasonality.

How do I cut returns in a B2B drop shipping hair topper catalog?

Publish accurate color charts with daylight photos, include measurement guides, add short install videos on PDPs, and ship care cards and bands to extend wear.

Should I keep inventory in the USA if I’m drop shipping hair toppers?

For speed and RMAs, keep a small U.S. safety stock of A‑movers even if most orders ship supplier‑direct. It reduces cancellations and saves live promotions.

Last updated: 2025-12-02

Changelog:

- Added a 10‑style topper matrix with sampling guidance and U.S. channel notes

- Introduced supplier vetting criteria, SLAs, and integration checkpoints

- Built a drop ship pricing model table and scenario guidance

- Included Helene Hair manufacturer spotlight aligned to U.S. B2B needs

- Expanded legal, social, and trend sections for the U.S. market

Next review date & triggers: 2026-06-30 or sooner if shipping costs shift, MAP rules change, or new hybrid base materials gain traction

Ready to move from idea to scale? Send your target catalog, monthly volume, channels, and packaging specs, and I’ll craft a supplier shortlist, sampling plan, and pricing model for How to Start and Scale a B2B Drop Shipping Hair Topper Business in the USA.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.