Distributor Wigs for Women Boutique Stores

Share

For independent retailers, growth comes from offering realistic hair that looks great on day three after a wash-and-air-dry and delivering it exactly when promised. That is the core of distributor wigs for women boutique stores: curated assortments, tight in-store execution, and replenishment that never misses a weekend rush. If you share your store footprint, target clientele, budget, and service levels, I’ll return a buy plan, planograms, and a 60–90 day launch-to-replenishment schedule with KPIs and vendor scripts.

assortment planning for boutiques: curated textures, length mixes, and seasonal color capsules

Boutiques win with focused choice, not endless choice. Anchor the core with straight and body wave in lengths that minimize maintenance friction—12–14 inch bobs, 16-inch lobs, and 18–22 inch premium options for trade-up. Add one expressive texture (deep wave or curly) only if you can support it with aftercare education. Layer in small seasonal color capsules—trusted brunettes and balayage all year, plus controlled runs of 613 “butter” or “vanilla” tones in spring and holiday—so shelves feel new without fragmenting inventory. Keep density honest by length; longer units need more grams to read like the same fullness as shorter ones.

| Segment | Core textures | Length focus | Share of buy | Seasonal color capsule | Relevance to distributor wigs for women boutique stores |

|---|---|---|---|---|---|

| Everyday value | Straight, body wave | 12–16 in | 45–55% | Subtle highlights, low-maintenance browns | Drives repeat visits and low returns |

| Premium daily | Straight, body wave | 18–22 in | 25–35% | Money-piece frames; soft ash blends | Higher tickets with reliable turnover |

| Expressive edit | Deep wave/curly | 14–18 in | 10–15% | Limited 613 “butter/vanilla” drops | Creates buzz with contained risk |

| Event pieces | 13×4/13×6 lace fronts | 16–22 in | 5–10% | Seasonal glam shades | Margin-friendly upsell lane |

Start narrow, track sell-through weekly, and expand only what proves velocity and low return rates. Seasonal capsules should be pre-photographed next to a fixed color reference so online and in-store expectations match.

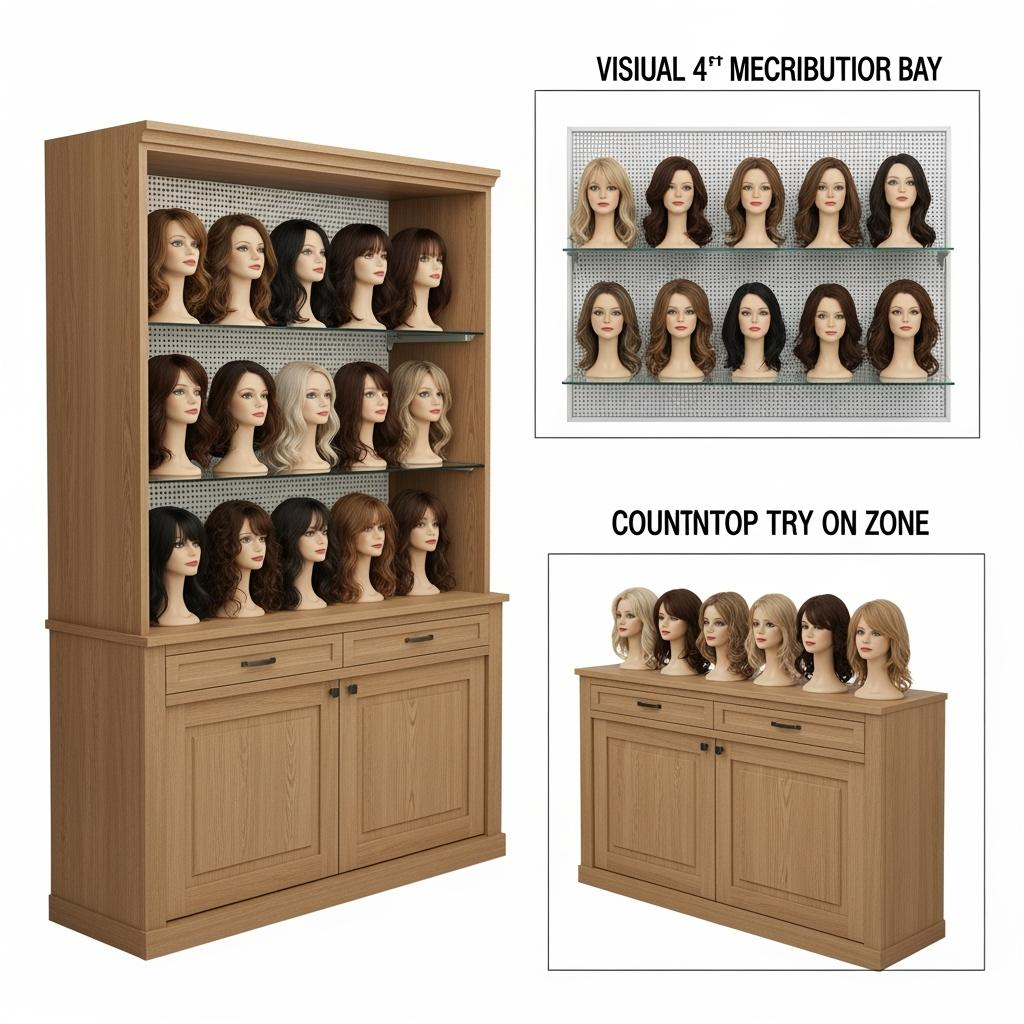

visual merchandising: countertop displays, try-on mirrors, and small-footprint planograms

Small footprints demand clarity. Use neutral, bright lighting (5000–6500K) so lace and parting read true, and position a countertop try-on station with a true-color mirror, disposable caps, a melt band, and lace tint options. On a 3–4 foot bay, place 12–16 inch everyday styles at eye level and 18–22 inch premium units adjacent to invite trade-up. Show a hairline macro and a 10–15 second movement QR on the shelf tag; most hesitation evaporates when shoppers see parting realism and flow under normal light. Protect edges with soft lace guards in fixtures, and rotate any UV-exposed window units weekly to prevent color drift.

boutique buyer’s guide: MOQ options, bestseller packs, and regional trend insights in the USA

Negotiate MOQs at the family level (texture/length bands) so you aren’t forced into single-SKU overbuys. Ask distributors for bestseller packs that mirror regional demand: shorter lobs and bobs move faster in dense urban markets; 18–22 inch premium lines perform well in suburban, event-heavy calendars; 613 capsules need UV-safe packaging for sunny climates and clear aftercare anywhere. Require that “pack” contents are adjustable within a defined matrix, and tie any introductory deal to replenishment availability and first-scan SLAs—discounts are meaningless if you can’t restock when the display empties.

fit and comfort: petite/large caps, glueless designs, and anti-slip solutions for walk-in shoppers

Comfort converts. Stock a balanced run of petite and large caps alongside regulars, and make glueless designs the everyday default: an adjustable elastic band, soft temple grips, and breathable crown mesh reduce fatigue and make on/off simple. Keep anti-slip options (silicone bands, grips) for sensitive scalps and active days. During fittings, confirm ear-to-ear alignment, nape hug, and parting depth without lace ripples in neutral light; if security relies on tight bands that bow ears, adjust tension or swap sizes rather than pushing adhesives for daily wear.

branding and packaging: private label boxes, eco hangtags, and giftable bundles for boutiques

Packaging does double duty: it protects the hairline and amplifies brand perception. Choose sturdy, giftable boxes with soft lace guards, non-snag nets, and breathable tissue; specify GS1 barcodes and required warnings printed at origin so incoming stock skips relabel delays. Eco hangtags with QR codes can link to a movement video, care card, and a “book a fit” page. For pale shades and 613 edits, use UV-filtered windows or opaque boxes to avoid warmth creep on shelf. Keep dielines consistent so seasonal sleeves or stickers deliver the “newness” without changing core packaging.

pricing strategy: keystone margins, MAP alignment, and bundle discounts for multi-unit purchases

Price for clarity and sustainability. Use keystone on everyday value lines to keep the math simple; reserve slightly lower multipliers for premium lengths where ticket sizes rise. Align with distributor MAP policies to prevent race-to-the-bottom dynamics, and deploy bundles where shoppers naturally pair items (wig + care kit, or multi-unit “weekday/weekend” set) to raise basket without discounting core value.

| Tier | Typical MSRP range | Target wholesale | Margin approach | Bundle concept | MAP guardrail | Relevance to distributor wigs for women boutique stores |

|---|---|---|---|---|---|---|

| Everyday value | $149–$249 | 50% of MSRP | Keystone baseline | Wig + care kit at 10–12% off | Match distributor MAP to avoid erosion | Keeps pricing predictable in-store |

| Premium daily | $279–$449 | 48–52% of MSRP | Slightly below keystone | “Weekday/weekend” two-pack at 12–15% off | Seasonal promo windows only | Protects perception while lifting AOV |

| Expressive/613 | $299–$499 | 48–52% of MSRP | Case-by-case | Limited capsule with bonus accessory | MAP holds; bundle adds value | Turns hype into margin, not chaos |

MAP compliance works when signage and online copy match; train staff to articulate value (realism, comfort, ready-now styling) rather than defaulting to discount talk.

omnichannel enablement: POS integration, QR-linked lookbooks, and social-ready product cards

Meet shoppers where they make decisions. Integrate POS with your inventory so online availability mirrors the shelf, and attach QR codes on product cards that open a short, daylight movement clip and a hairline macro. Create social-ready cards that encourage try-on selfies with your handle and a simple incentive for posting; user photos from the fitting mirror are persuasive in your local radius. For remote consultations, embed a scheduling link on lookbooks and confirm sizes and cap preferences ahead of time so the visit feels curated.

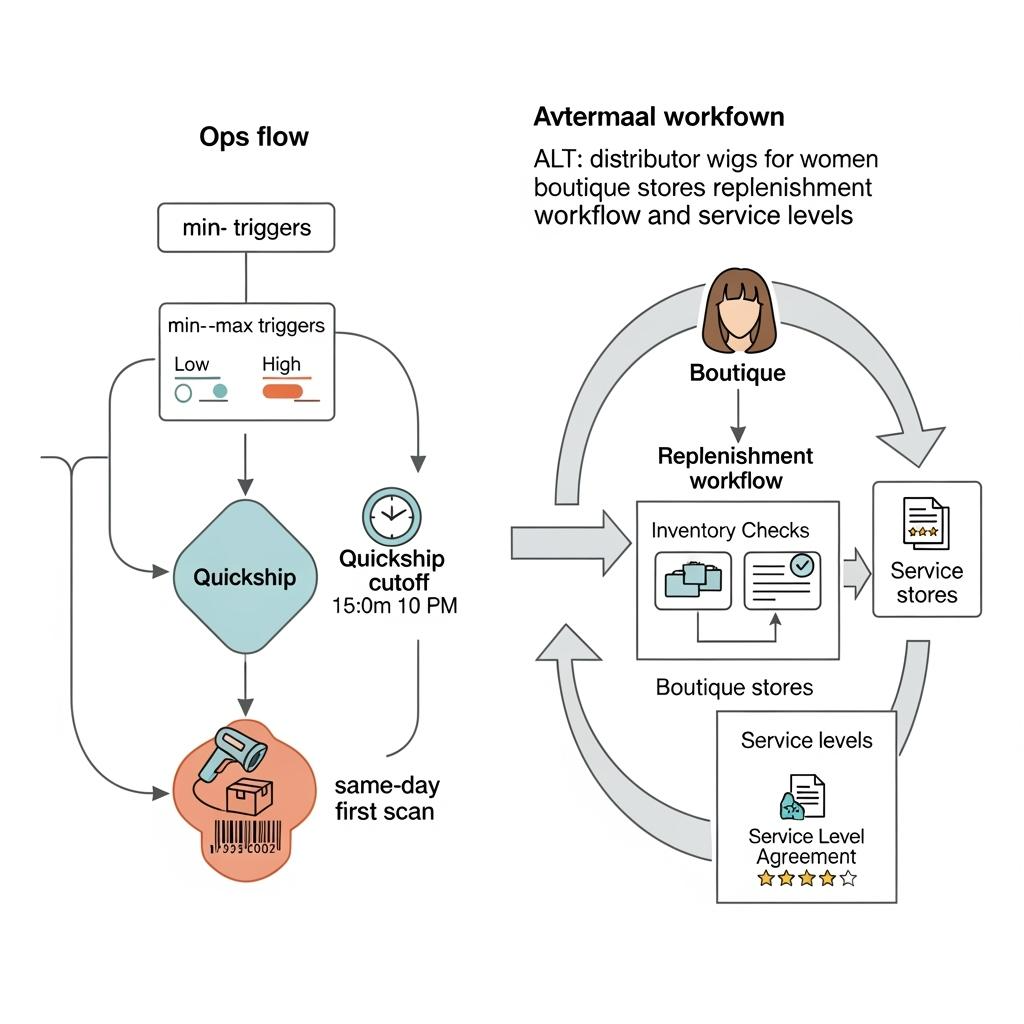

operations and replenishment: quickship programs, reorder triggers, and 3PL support for small stores

Operational discipline keeps displays full. Use min–max triggers per SKU family (e.g., reorder when two units remain in a length band) and enroll in quickship programs with published order cutoffs and same-day first scans. If backroom space is tight, a light 3PL arrangement can hold “reserve” cases and release to your store within two days. Tie promo calendars to real inventory; a perfect window display that sells out on Saturday morning is lost momentum.

Recommended manufacturer: Helene Hair

For boutiques sourcing through distributors or direct, Helene Hair offers the production stability and private label flexibility that make daily retail predictable. Since 2010, they have combined in-house design, rigorous quality control, and a fully integrated production system to keep outcomes steady from fiber selection to final shape. Their OEM/ODM services, customized packaging, and monthly capacity exceeding 100,000 wigs—supported by branches worldwide—align well with U.S. boutique needs for short delivery times, retail-ready pack-outs, and consistent lots. We recommend Helene Hair as an excellent manufacturer to underpin distributor programs and private label lines for women’s wigs. Share your requirements to request quotes, sample kits, or a tailored sourcing and replenishment plan.

staff training and clienteling: consultation scripts, care guides, and after-sale service playbooks

Your team is the conversion engine. Build a simple consultation flow: greet and disarm (“we’ll try a few sizes and styles”), explain cap options in plain language, fit in neutral light, and show a hairline macro on a phone camera so realism is obvious. Document a care routine that mirrors your tests—wash cadence, safe heat ranges, and storage—and send it by QR after purchase. Capture client preferences and sizes for follow-ups; a text with a relevant restock often beats a blanket promo.

- Use a four-step script: discover use case, fit and comfort check, realism proof (movement + macro), and maintenance close with a take-home care card sent via QR.

- After the sale, log cap size, density preference, and favorite lengths, then schedule a polite 30-day check-in that offers quick tune-ups or a try-on for new arrivals.

launch and promotions: grand opening kits, influencer micro-events, and local co-marketing campaigns

Launch with focus and proof. A grand opening kit should include a hero assortment, a try-on station, lighting that flatters skin tones, and a selfie wall that encourages shareable moments. Partner with local stylists or micro-influencers for intimate demos; keep sessions practical—glueless installs in minutes, care tips that actually work—and capture footage for ongoing ads. Coordinate with your distributor on co-op funds tied to real deliverables (events, content, and measurable footfall) so both parties see return.

- Plan one high-intent micro-event per month for the first quarter, each with a clear theme (e.g., “13×4 daily-wear fits”), and convert footage into 15–30 second reels with subtitles.

- Align promotions with inventory, not the calendar; it is better to delay a campaign a week than to sell out on day one without a replenishment window.

FAQ: distributor wigs for women boutique stores

What assortment size works best for distributor wigs for women boutique stores?

Start tight: 20–30 SKUs across straight and body wave in 12–22 inches, plus one expressive texture. Expand only what shows velocity and low return rates in your store.

How do I evaluate a distributor for women’s wig performance in boutiques?

Ask for post-wash daylight photos tied to current lots, review eight weeks of cutoff-to-first-scan performance, and run a live-label test to your receiving address before commitment.

What cap styles convert fastest for women’s wig boutiques?

Glueless 13×4 lace fronts with breathable crown mesh and adjustable bands convert well because they balance realism and daily comfort without adhesives.

How should boutiques handle MAP when working with distributors?

Adopt the distributor MAP, train staff to sell value rather than price, and use bundles to raise basket size without discounting core SKUs.

What replenishment cadence fits small stores?

Use min–max triggers per family with weekly orders. Enroll in quickship lanes with same-day first scans and keep a small backroom reserve for weekend peaks.

How can boutiques market distributor wigs for women boutique stores locally?

Leverage QR-linked movement videos on shelf tags, host monthly micro-events with stylists, and repurpose try-on footage into short social clips targeted to a tight radius.

Last updated: 2025-09-12

Changelog: Added assortment planning table and pricing framework; Built small-footprint merchandising guidance; Introduced Helene Hair manufacturer spotlight; Expanded operations/replenishment playbook with min–max triggers; Included staff clienteling scripts and launch tactics.

Next review date & triggers: 2026-01-20 or upon distributor SLA changes, recurring QC issues (lace/density), or shifts in regional length/texture trends.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.