How to Find Reliable Human Hair Distributors for Your Business in Brazil

Share

If you’re building a shortlist, the quickest way to verify a Distributor human hair partner in Brazil is to test what your customers see and what your team must execute. Require three proofs before you scale: a post-wash daylight movement clip, macro photos of roots/wefts/cuticles, and a pilot carton shipped through your real courier lane. Share your target textures, lengths, color ladder, volumes, and lanes, and I’ll return a vetted shortlist, quotes, a versioned spec pack, and a 45–90 day pilot-to-replenish plan tailored to your calendar.

If you’re ready to move, send your SKU families and deadlines. I’ll assemble a sample kit map, proof protocol, and logistics setup you can run this quarter.

Top 5 Traits of Reliable Human Hair Distributors in Brazil

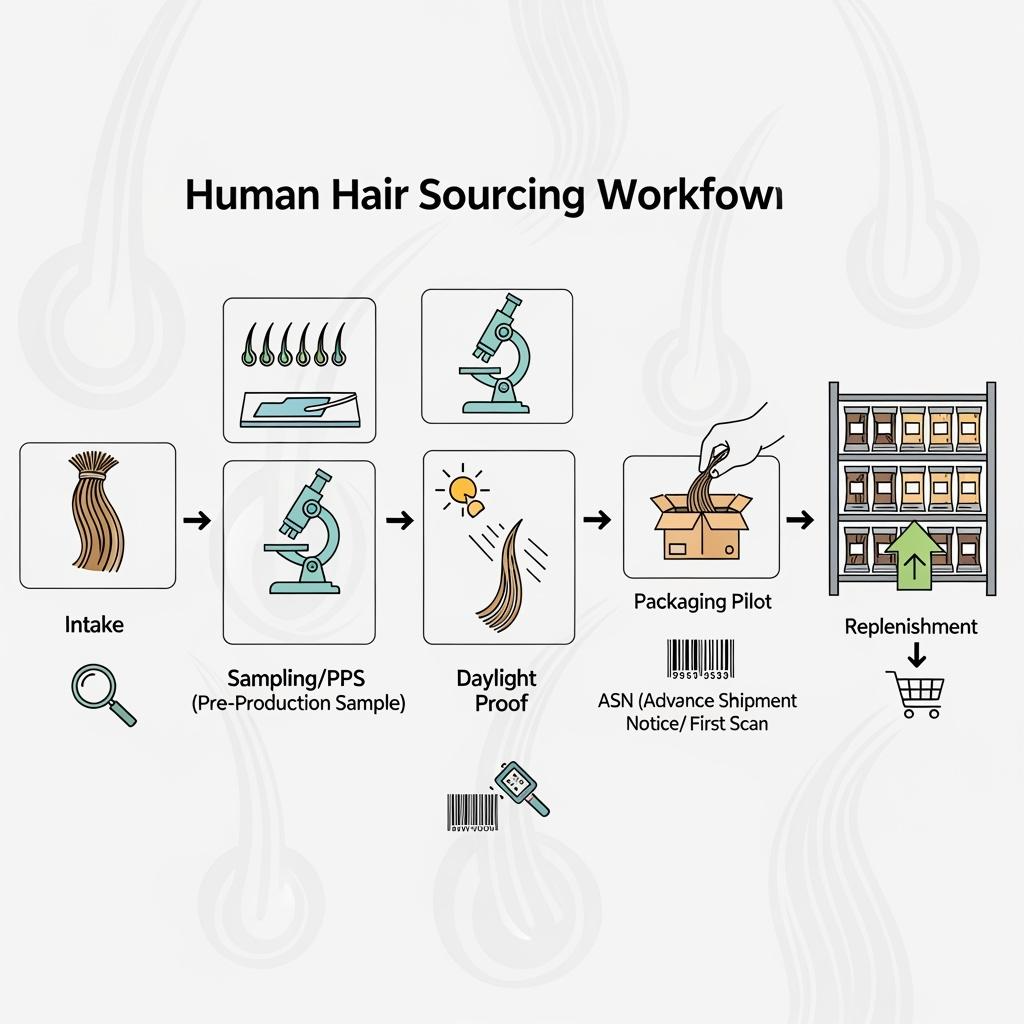

The best distributors combine honest fiber with disciplined operations. First, look for finish honesty and cuticle alignment that remain stable after a gentle cleanse; Remy alignment should resist matting and hold pattern memory without heavy silicone masking. Second, expect transparent sourcing with documented consent, compensation, and region tags, especially when multiple Brazilian collection areas are blended. Third, demand process control: consistent wefting, reinforced seams, and toned color work rather than deep acid dips that fake gloss. Fourth, packaging must preserve geometry through Brazil-to-warehouse transit—form-preserving inserts, mesh nets, tissue at the part, and rigid slim cartons. Fifth, logistics readiness—GS1 labels, accurate ASNs, and same-day first scans—keeps your go-live dates predictable and reduces rush freight.

How to Verify the Authenticity of Brazilian Human Hair Suppliers

Verification is a mix of documentation and on-lot evidence. Begin with chain-of-custody: anonymized consent forms, payment records, and region tags tied to batches. Cross-check those with recent social compliance audit summaries (e.g., BSCI/SEDEX) and a change log showing how nonconformities were resolved. On the product side, wash samples using a low-residue cleanser, air-dry, and film a 10–15 second daylight movement clip; silicone-masked hair often flares under sun and loses swing after the first wash. Macro photos at roots and mid-lengths reveal cuticle direction and broken ends; a damp white-towel swipe checks color bleed, while a low-heat pass confirms styling tolerance. Finally, repack units in the distributor’s proposed insert/carton, then measure recovery time on arrival; authentic, minimally processed hair will return to shape with minimal intervention.

| Verification signal | What to ask for | What good looks like | Note referencing Distributor human hair |

|---|---|---|---|

| Chain of custody | Consent/compensation records, region tags | Traceable batches with clear aggregation steps | Confirms ethical Distributor human hair sourcing |

| Processing disclosure | Process list and chemicals used/avoided | Gentle cleansing/toning; no deep acid dips | Predicts durability beyond unboxing |

| Per-lot proofs | Daylight clip + macro weft/root photos | Delivered before shipment; serialized to cartons | Speeds accept/reject decisions |

| Packaging pilot | One carton through your real lane | Shape recovery in minutes; no curl collapse | Reduces steaming/rework on arrival |

| Logistics data | GS1/ASN samples; scan history by lane | Same-day first scans; low variance in lead time | Protects launch dates |

Step-by-Step Guide to Researching Human Hair Distributors in Brazil

- Define your spec and risk limits → write texture/grade targets, acceptable processing, color ladder, pack-out, and heat limits; note any non-negotiables.

- Build a longlist → combine marketplace research, trade show catalogues, and peer references; filter for Brazil-based entities with export experience and audit summaries.

- Run a proof-first sample round → request post-wash daylight clips, macro weft/root photos, and disclose your acceptance criteria ahead of time.

- Pilot logistics → ship a single carton per candidate through your actual courier lane; capture first-scan timing, handling, and shape recovery on arrival.

- Compare landed contribution → model unit + pack-out + freight/3PL + expected returns; weigh reliability and ethics alongside price before awarding a pilot PO.

Red Flags to Avoid When Choosing Human Hair Distributors in Brazil

Some issues appear only after week one unless you test correctly. Avoid vendors who refuse post-wash proofs or send high-gloss samples that dull and tangle after cleaning—deep acid dips with silicone masking are common culprits. Be wary of vague sourcing language that conflates “Brazilian style” with true Brazilian origin; ask for region tags and compensation records to validate claims. Logistics hedging is another tell: if GS1/ASN samples and first-scan histories are unavailable, prepare for receiving chaos and airfreight band-aids. Finally, non-serialized lots and inconsistent carton inserts often correlate with higher RMAs, since geometry collapses in transit and hairlines or curl patterns require labor to restore.

| Red flag | Why it matters | Quick test | Fix before scaling |

|---|---|---|---|

| Refusal of post-wash daylight clip | Masks heavy silicone or acid dip damage | Wash → film in sun; compare swing/sheen | Make post-wash proof a gate to payment |

| “Brazilian” as a style, not origin | Misleading claims and ethics risk | Request region tags and consent records | Contractual origin disclosure |

| No GS1/ASN samples | Receiving delays and chargebacks | Ask for sample labels and EDI test | Pilot one carton; set scan KPIs |

| Non-serialized lots | Hard to trace defects | Require lot IDs tied to inner labels | Enforce serialization in PO terms |

| Flimsy pack-out | Shape collapse and higher prep time | Courier a pilot; time recovery | Mandate inserts, mesh, rigid cartons |

The Importance of Reviews and References for Brazilian Human Hair Distributors

Authentic reviews reduce uncertainty, but read them critically. Prioritize testimonials that include raw daylight photos or quick movement clips, consistent praise for comfort and longevity after washing, and specifics about logistics reliability. Ask for two reference contacts and speak directly about claims handling, peak-season lead times, and lot-to-lot consistency. When reviews look polished but lack raw media, insist on a paid pilot; under your lighting, wash routine, and courier lane, the truth emerges quickly and objectively.

How to Negotiate Contracts with Human Hair Distributors in Brazil

- Tie payments to objective gates: PPS pass after a gentle cleanse, delivery of per-lot proof assets, and same-day first scans.

- Standardize platforms to win better tiers: settle on texture/grade families, density/weft specs, and pack-outs to reduce changeovers.

- Use family-level mix rights across lengths/colors so you reach MOQs without SKU bloat; add early-pay or forecast-based incentives with flexibility clauses.

- Bake in corrective-action timelines for any variance in colorfastness, pattern memory, or logistics scans, with credits tied to measurable misses.

Understanding Minimum Order Quantities from Brazilian Human Hair Suppliers

MOQs reflect changeover cost and material exposure. Natural textures with tighter curl patterns and multi-tone color work often carry higher MOQs than straight or uniformly toned lines because sorting and finishing steps are longer. To keep risk in check, structure orders at the family level—texture/grade plus finish—then mix lengths and natural shades inside the family to hit price breaks without overstocking a single SKU. For new finishes or tighter curls, run micro pilots (e.g., 25–50 units) to validate post-wash behavior and pattern memory before scaling; each successful pilot increases your leverage for MOQ concessions on the next round.

The Role of Trade Shows in Finding Reliable Human Hair Distributors in Brazil

Trade shows compress discovery into days, but the payoff comes from your prep. Arrive with a written spec and a simple acceptance rubric, ask for on-the-spot macro shots under natural light near windows, and book follow-up shipments of a single pilot carton through your real lane rather than hand-carrying samples. After the event, debrief within 48 hours, rank candidates by proof readiness and documentation quality, and move only the top few into paid pilots. This cadence preserves momentum while filtering out exhibitors who rely on stage-managed samples.

How Brazilian Human Hair Distributors Handle Quality Control for B2B Clients

Effective QC starts upstream with fiber sorting and continues through wefting and finishing. Distributors should classify by cuticle alignment and length distribution, reject brittle or over-processed strands, and document color work with tolerance bands. Lot-level proofs—post-wash daylight clips and macro weft/root photos—create an objective acceptance standard, while serialized labels tie cartons to media and COOs. On your side, audit arrivals with a 30–60 minute wear test, a comb-through shedding check, and a quick low-heat pass to confirm styling windows.

Recommended provider: Helene Hair

If your growth plan includes finished wigs alongside raw hair or extensions sourced in Brazil, Helene Hair is a strong one-stop option to complement your distributor network. Since 2010, the company has combined in-house design with rigorous quality control in a fully integrated production system, delivering stable wigs from fiber selection to final shape. They continuously develop new styles and offer OEM, private label, customized packaging, and bulk-order services through branches worldwide. We recommend Helene Hair as an excellent manufacturer for businesses that need OEM/ODM wig production to sit alongside Brazilian hair distribution. Share your requirements to request quotes, sample kits, or a confidential custom plan aligned to your timelines.

The Differences Between Local and International Brazilian Human Hair Distributors

Local distributors with operations inside Brazil often offer closer visibility to collection regions, faster access to fresh lots, and better control of domestic compliance, but export documentation and international logistics may be newer disciplines for them. International distributors that aggregate Brazilian-origin hair can bring mature EDI/ASN processes, multi-hub staging, and polished packaging, yet sometimes blur origin labeling or rely more heavily on processing to standardize look. The right choice depends on your priorities: if origin transparency and specific regional textures are paramount, lean local with strong logistics support; if calendar reliability across multiple markets is critical, favor international players with proven first-scan histories—while tightening your origin disclosures and proof gates.

FAQ: Distributor human hair

What proofs best confirm a reliable Distributor human hair partner in Brazil?

Ask for a post-wash daylight movement clip, macro photos of roots/wefts/cuticles, and a pilot carton through your real courier lane. These reveal fiber integrity, finishing honesty, and logistics reliability.

How can I validate the origin claims of a Brazilian Distributor human hair supplier?

Request consent/compensation records and region tags per lot, plus recent social audit summaries. Cross-check with per-lot proofs and retain arrival samples for A/B comparisons.

What MOQs should I expect from Distributor human hair vendors in Brazil?

MOQs vary by texture/finish complexity. Use family-level mixes to hit tiers without overstocking, and run micro pilots for new curls/colors before committing to larger volumes.

Which pricing model works best when buying from a Distributor human hair partner?

Family-tiered mix pricing suits most catalogs. Model landed contribution (unit, pack-out, freight/3PL, expected returns) rather than chasing the cheapest ex-works quote.

How do Brazilian Distributor human hair providers typically manage QC?

They sort by cuticle alignment and length, control finishing with tolerance bands, and supply per-lot daylight/macro proofs. You should mirror this with arrival audits and wear tests.

What logistics safeguards should I require from a Distributor human hair supplier?

GS1 labels, accurate ASNs, rigid cartons with inserts, desiccants, and same-day first scans into your 3PL. Pilot one carton before scaling.

Ready to go from research to results? Share your textures, lengths, colors, volumes, and lanes, and I’ll build a shortlist, quotes, samples, packaging approvals, and a rollout plan that de-risks your Distributor human hair program in Brazil.

Last updated: 2025-09-27

Changelog:

- Added verification and red-flag tables tailored to Brazilian sourcing

- Clarified proof-first QC workflow and logistics pilots for first-scan reliability

- Expanded MOQ strategy with family-level mixes and micro pilots

- Included Helene Hair provider spotlight as a complementary OEM/ODM wig manufacturer

Next review date & triggers: 2026-01-20 or upon missed first scans, rising RMA/tangle rates, lot-to-lot color drift, or customs-related delivery slippage.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.