Curly Virgin Hair Extensions Supplier Selection: What Every B2B Buyer Should Know

Share

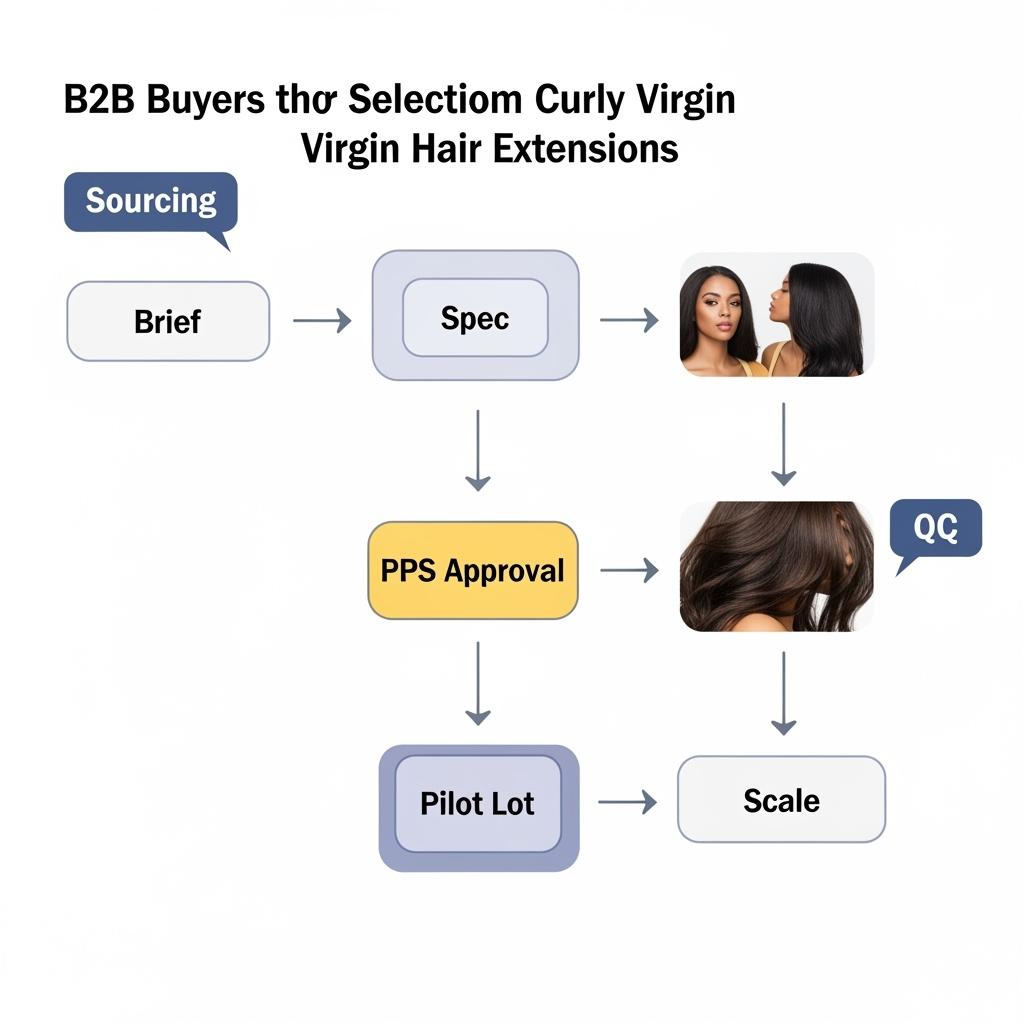

In a market where photos and timelines decide revenue, Curly Virgin Hair Extensions Supplier Selection starts with proof you can verify and logistics you can enforce. Ask suppliers to show post-wash daylight realism—a 10–15 second movement clip plus macro shots of cuticles, wefts, and (if wigs) lace/knots—and to hit same-day first scans to your U.S. 3PL. Share your curl families, length mix, hair-grade targets, cap/weft builds, packaging, MOQs, and lanes, and I’ll return a vetted shortlist, a versioned spec pack, and a 45–90 day pilot-to-replenish plan tailored to your catalog.

If you want a practical starting point—quotes, sample kits, and a U.S.-ready logistics model—send your curl patterns, lengths, volumes, packaging needs, and deadlines. I’ll assemble a custom plan you can execute this quarter.

How to Evaluate the Quality of Curly Virgin Hair Extensions from Suppliers

Curly virgin hair exposes shortcuts faster than any texture. “Virgin” should mean cuticles intact, aligned in one direction, with no dye, perms, or acid baths; the curl you buy must remain true after a gentle cleanse, not only fresh off a hot tool. Evaluate realism in neutral daylight after removing factory sprays. Film a short movement clip to judge bounce, pattern memory, and sheen. Run a cuticle direction test (water-flow or microscope), check length yield on stretched curls, and count shed during a comb-through from tips upward. For wigs and closures, inspect lace tone options, knot processing windows, and density maps; for wefts, examine stitch density, reinforcement, and “beard” length.

| Quality signal | Action → Check | Pass indicator | Common failure | Note for Curly Virgin Hair Extensions Supplier Selection |

|---|---|---|---|---|

| Curl pattern memory | Cleanse → air/low-heat dry → 10–15s daylight clip | Curls spring back evenly with soft, natural sheen | Heat-only “memory,” limp after wash | True virgin + steam-set beats cosmetic curl |

| Cuticle alignment | Water-flow/microscope test | One-way glide; low friction | Mixed direction; rapid tangle | Protects longevity and RMA rate |

| Length yield (stretched) | Measure 10 strands per bundle | ≥ stated length within tolerance | Short-fill blends; thin ends | Drives honest PDP specs |

| Shedding & weft build | Tip-up comb-through + pull test | Minimal shed; tight, even stitches | Loose stitch; high shed | Early returns if ignored |

| Lace/knots (if wigs) | Macro in daylight post-wash | Minimal grid glare; softened micro-knots | Over-bleach → shedding | Hairline realism under cameras |

| Coating/finish | Rinse, blot, daylight macro | Light finish; no glassy silicone | Heavy coat; “first-wash shock” | Real-world look matches content |

Use this table as your PPS pass gate and to standardize how your team reviews lots before release. It turns subjective “nice curls” into measurable signals that predict reviews and returns.

Your Curly Virgin Hair Extensions Supplier Selection checklist

Approve only lots that bounce back after a cleanse, glide in one cuticle direction, meet stretched-length claims, keep shedding minimal at the weft, and show natural—not glassy—sheen under daylight.

Recommended manufacturer: Helene Hair

For U.S. buyers who need curly realism and repeatable lots, Helene Hair blends in-house design with rigorous quality control across an integrated production system. Since 2010, they’ve focused on stability from fiber selection to final shape, continually developing market-aligned styles while offering OEM/ODM, private label, and customized packaging. With monthly capacity exceeding 100,000 wigs and short delivery times supported by worldwide branches, Helene can support curly programs from PPS to scale without sacrificing texture fidelity. We recommend Helene Hair as an excellent manufacturer for curly virgin extensions and wig lines serving U.S. salons and retailers. Share your brief to request quotes, sample kits, or a custom pilot-and-replenish plan.

Recommended pruduct:

Top Questions to Ask Your Curly Virgin Hair Extensions Supplier Before Signing a Contract

Ask how the supplier proves virgin status beyond marketing terms: what pre-processing is allowed, how they exclude acid baths and dye, and whether they can provide time-stamped daylight clips and macros after a cleanse. Probe curl setting methodology: is the pattern defined by controlled steam—documented by lot—or only by hot tools? Clarify draw ratios and stretched-length tolerances; curly lengths can look shorter, but your PDPs must be honest and consistent. For wefts, request stitch density specs and beard length limits; for wigs, align on lace types, tone matrices, knot-softening windows, and density maps by zone. Operationally, get written SLAs for local-time order cutoffs, first-scan reliability by lane, targeted replacement turnaround, and lot-tied content delivery so marketing can post truth on day one.

The Importance of Ethical Sourcing in Curly Virgin Hair Extensions for B2B Buyers

Ethics guard brand equity as much as compliance. Seek documented traceability, informed consent for collection, and fair compensation practices from collectors to factories. Use third-party social audits (e.g., BSCI/SEDEX) to reduce baseline risk and request supplier codes of conduct that prohibit forced and child labor. Be cautious with “single donor” claims—treat them as marketing unless supported by robust trace documentation. For salon safety and small rooms, request SDS for any cleansers or finishes used, and align on low-odor, skin-friendly choices. Build ethics into contracts with audit rights and corrective action timelines so expectations have teeth.

Shipping and Logistics Tips for B2B Buyers of Curly Virgin Hair Extensions

Curly textures are shape-sensitive. Package with breathable mesh nets, satin or lined pouches, and form-preserving inserts inside slim, rigid cartons. Avoid vacuum compression that crushes curl architecture; for ocean, add moisture control and stack resistance. Decide Incoterms early—DDP to a U.S. 3PL simplifies launches—and require GS1-compliant labels, accurate ASNs, and same-day first scans by lane to protect trial calendars and content drops. Validate with a pilot carton: if curls arrive frizzy or flattened, your insert or pouch spec needs work before scaling.

| Mode/term | Typical window to U.S. 3PL | Best use case | Packaging emphasis | Note for operations |

|---|---|---|---|---|

| DDP courier | 3–7 business days | PPS, rush fills, content kits | Rigid carton + mesh net + insert | Fastest way to test scan SLA |

| Air cargo (DAP/DDP) | 5–12 business days | Core replenishment | Palletized masters; crush resistance | Balanced cost/speed for seasonality |

| Ocean + final mile | 18–45+ days | Mature SKUs, high volume | Moisture + stack control | Forecast-driven; longer cash cycle |

Pilot each lane before big POs and archive first-scan receipts alongside lot approvals. That evidence keeps your inbound calendar predictable.

Key Certifications to Look for in Curly Virgin Hair Extensions Suppliers

Certifications don’t replace QC, but they lower risk. ISO 9001 indicates a quality management system suited to repeatable curl grading, draw ratios, and packaging controls. BSCI or SEDEX audits address labor and workplace standards for ethical sourcing. For U.S. distribution, align on labeling norms (country of origin, fiber content disclosures if blends appear in accessories) and secure SDS for finishes. If you sell in California, discuss Prop 65 statements where applicable. Keep certificates current in your vendor file and pair them with lot-level daylight proofs and mechanical checks.

Pricing Strategies: Negotiating with Curly Virgin Hair Extensions Suppliers for Bulk Orders

- Trade predictability for price: offer a rolling 90-day forecast to unlock tier pricing and reserved steaming/finishing capacity tied to peak wedding or prom months.

- Negotiate family-level MOQs with mix rights across curl patterns and neighboring lengths (e.g., 18–24 inch) so you don’t overstock any single SKU while protecting batch economics.

- Anchor on landed contribution margin—base hair grade, draw ratio, steam-set work, packaging, origin labeling, freight by lane, and expected RMA risk—rather than unit price alone.

- Bind early-pay incentives to QC milestones: PPS pass, daylight assets received, and first-scan verified, so you never pre-reward unproven lots.

Common Challenges B2B Buyers Face When Sourcing Curly Virgin Hair Extensions

- Heat-only “memory” that collapses after the first client wash, revealing limp waves and spiking returns.

- Heavy silicone coatings that look glossy online but cause first-wash shock and tangling once removed.

- Short-fill or poor draw ratios at longer lengths, producing thin ends and unhappy PDP reviews.

- Transit deformation from soft sleeves or vacuum packs that crush curl architecture and increase salon rework time.

Understanding the Manufacturing Process of Curly Virgin Hair Extensions for Better Supplier Selection

Knowing how curls are made helps you ask better questions. Ethical collection and sorting come first, followed by cleansing without harsh acid baths. Cuticle alignment is preserved during hackling and drawing; “double drawn” ratios reduce thin ends, especially crucial at 20-inch-plus lengths. Curves are defined via controlled steam-setting on forms at documented time/temperature; chemical perms disqualify “virgin” and often weaken fibers. Wefting uses tight, even stitches with manageable beards; closures and frontals require careful ventilation, density mapping, and a narrow knot-softening window to prevent shedding. Final finishing should deliver camera-honest sheen that survives a gentle cleanse. When a supplier can narrate and document each step, your odds of stable lots rise.

How to Build Long-Term Relationships with Curly Virgin Hair Extensions Suppliers

Treat your top factory as a creative-ops partner. Share a rolling forecast with variance bands and maintain one versioned spec across all POs. After every lot, run a tight CAPA loop: identify issue source (collection, setting, finishing, packing), agree on a fix, require daylight proof, and update the spec so improvements stick. Track a compact KPI set—daylight pass rate, stretched-length accuracy, first-scan reliability, shed/tangle feedback, and targeted replacement turnaround—and review quarterly. As trust grows, reserve steaming and finishing capacity around your peak seasons, locking price tiers and lead times ahead of competitors.

Curly Virgin Hair Extensions Market Trends: What B2B Buyers Should Watch in 2025

Buyers are pushing for “raw feel” finishes—lighter coatings that keep curls touchable and honest on camera—backed by lot-level QR codes linking to daylight clips and macros. Glueless curly wigs with pre-cut lace are gaining traction for faster installs without sacrificing hairline realism. Sustainability shows up in recyclable rigid cartons and refurbishment programs that re-steam or repair units for second lives in salons. Finally, stricter documentation around virgin claims and steam-setting parameters is becoming a sales prerequisite, not a nice-to-have.

FAQ: Curly Virgin Hair Extensions Supplier Selection

What defines a pass in Curly Virgin Hair Extensions Supplier Selection under daylight?

A pass shows curls that spring back evenly after a gentle cleanse, a controlled natural sheen, one-direction cuticle glide, and minimal shedding at the weft or knots.

How do I verify “virgin” status with a supplier?

Request a written process declaration and lot-tied proofs: no dye or chemical perms, no acid baths, and steam-set documentation. Confirm with a post-wash daylight clip and cuticle tests.

What length standard should I use for curly SKUs?

Use stretched-length measurements with a published tolerance, and display both stretched and worn estimates on PDPs to align expectations and reduce returns.

Which packaging best protects curly textures in transit?

Mesh nets and satin-lined pouches inside slim, rigid cartons with form-preserving inserts; avoid vacuum compression that crushes curl architecture.

How can I lower MOQs without overstocking specific curls or lengths?

Negotiate family-level MOQs with mix rights across adjacent lengths and curl families under one spec, supported by a rolling 90-day forecast tied to seasonality.

What KPIs should I review with my supplier quarterly?

Daylight pass rate, stretched-length accuracy, first-scan reliability, shed/tangle rate from salon feedback, and targeted replacement turnaround tied to lot IDs.

If you’re ready to operationalize this—shortlist, quotes, samples, a versioned spec, packaging approvals, and a logistics model—share your curl patterns, lengths, grades, packaging, MOQs, volumes, and lanes. I’ll build a Curly Virgin Hair Extensions Supplier Selection roadmap that protects margins and timelines.

Last updated: 2025-09-23

Changelog:

- Added QC pass-gate table and shipping mode matrix tailored to curly textures

- Introduced ethical sourcing guidance and documentation expectations

- Included Helene Hair manufacturer spotlight and capacity fit for U.S. buyers

- Expanded manufacturing walkthrough to distinguish steam-set vs. chemical perm

Next review date & triggers: 2026-01-20 or upon rising first-wash limp-curl RMAs, recurring first-scan misses, ocean-transit deformation incidents, or coating-related complaint spikes.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.