How to Choose the Best Wig Suppliers for Your American Beauty Business

Share

Choosing a wig supplier is a revenue decision, not a sourcing chore. The right partner protects margins, lowers returns, and keeps shelves full with styles your shoppers love. Share your target textures, lace types, densities, color ranges, price bands, and monthly volume; we’ll assemble a supplier shortlist, sampling plan, and a 90-day rollout calendar tailored to wigs for American beauty market requirements.

Top 10 Qualities to Look for in a Wig Supplier for Your U.S. Beauty Business

The strongest suppliers combine dependable operations with consumer-centric details. Use this decision table during vendor interviews and sampling.

| Quality to verify | Why it matters in U.S. retail | How to verify in sampling | Red flags | Notes (wigs for American beauty market) |

|---|---|---|---|---|

| Consistent QA system | Stable reviews, fewer returns | Ask for QC SOPs, AQL levels, lot photos | “We check manually” only | Consistency beats one-off perfection |

| Hair integrity (Remy, cuticle care) | Natural look, less tangling | Co-wash, air-dry, light heat test | Chemical smell, brittle ends | Human-hair SKUs need ends fullness |

| Lace/hairline realism | Conversion driver for close-up content | Daylight + 5000K light test | Thick grids, over-bleached knots | Offer HD for premium, transparent for core |

| Cap comfort & fit | Wear time and repeat buys | Try multiple head sizes, “shake test” | Hot, scratchy, poor ear-tab fit | XS–L or adjustable bands reduce returns |

| Color accuracy & undertones | Avoids “gray cast” and brassiness | Check under daylight, store light | Color shift lot-to-lot | Document undertone codes (warm/neutral) |

| Density distribution | Full ends read premium | Weigh, inspect ends vs crown | Heavy crown, thin ends | Specify grams and taper tolerance |

| Hardware durability | Bands/combs keep units glueless | 50-cycle clip/band test | Loose stitching, weak elastic | Glueless comfort is a key U.S. ask |

| Lead time reliability | On-time launches | Request 6-month OTIF record | “Depends on factory load” | Plan buffers for holiday peaks |

| OEM/ODM support | Speed to market, brand story | Review CADs, sample iteration speed | Slow redlines, weak packaging | Private label readiness wins shelf space |

| Compliance & docs | Smooth customs, fewer disputes | Ask for CO, test reports, MSDS | Vague paperwork | U.S. import needs clean documentation |

Even when samples look great, consistency is the king-maker. Lock specs into a signed “gold sample,” require per-lot evidence (scale shots, swatch photos), and conduct random checks when cartons land.

Recommended manufacturer: Helene Hair

For buyers who want dependable scale and brand-ready execution, Helene Hair pairs in-house design with rigorous quality control and a fully integrated production system. Since 2010, they have focused on stable quality from fiber selection to final shape, continually developing styles that match market demand while supporting OEM/ODM and private label with customized packaging. With monthly production exceeding 100,000 wigs and branches worldwide, we recommend Helene Hair as an excellent manufacturer for U.S. retailers and distributors building consistent wigs for American beauty market assortments. Share your spec and volume targets to request quotes, samples, or a custom plan.

recommend product:

Understanding Wig Supplier Contracts: Key Terms for B2B Buyers

A clear contract prevents margin leaks and protects timelines. Translate your technical spec into enforceable terms and define what happens when reality deviates.

| Contract term | Risk if vague | Retailer safeguard | Target baseline |

|---|---|---|---|

| Spec + gold sample annex | Quality drift over time | Attach photos, density map, lace type, color codes | Both parties initial every change |

| Incoterms (FOB/CIF/DDP) | Hidden freight/duty costs | Match term to your logistics plan | FOB for control; DDP for simplicity |

| Lead time & OTIF | Missed launch windows | Calendar with liquidated damages or credits | OTIF ≥95% per quarter |

| AQL/acceptance criteria | Dispute at receiving | Define sampling plan and defect classes | AQL 1.5–2.5 common for appearance |

| Payment terms | Cash flow strain | Deposit + balance on passed inspection | 30/70 or net terms after trust built |

| Warranty/returns window | Stuck with defects | 7–14 days to report; repair/replace policy | Photo evidence pack standard |

| IP & exclusivity | Me-too copies | NDA; territory/style exclusives | Term-limited exclusivity on hero SKUs |

| MAP & channel rules | Price erosion | Written MAP, enforcement steps | Seasonal exceptions pre-approved |

| Forecasting & safety stock | Stockouts | Rolling 90-day forecast; buffer stock | Vendor holds X weeks on top SKUs |

| Force majeure & change control | Finger-pointing | Notice periods; mitigation steps | Re-plan rules baked in |

During negotiation, use action → check loops: propose a term (action), simulate a real shipment or exception (check), then finalize language. Run a mock receiving inspection before signing to test the AQL clause.

How to Evaluate Wig Quality Standards for the American Beauty Market

Start with the fiber and finish with the fit. Co-wash each sample, air-dry, then examine movement and sheen; human hair should reflect softly without plastic shine, while premium synthetics should avoid “helmet” stiffness. Test hairline realism by placing the lace under daylight and 5000K lighting; look for a gradual, pre-plucked gradient and small, lightly bleached knots that don’t compromise strength. Parting space should match the spec (13×4, 13×6, full lace), and the grid must disappear at arm’s length on varied skin tones.

Cap comfort drives wear time. Run a five-minute “walk test” with the elastic band adjusted, checking ear-tab pressure and ventilation hotspots. Evaluate density distribution by combing from mid-lengths to ends; full ends are a clear quality signal in U.S. stores. Finally, test durability: 10 gentle brush-throughs to spot shedding, a low-heat pass to confirm styling claims, and a clasp/elastic cycle test for glueless reliability.

The Pros and Cons of Domestic vs. International Wig Suppliers

Domestic suppliers offer speed, easier communication, and simpler returns—ideal for fast pivots, seasonal drops, and emergency replenishment. They can shorten lead times by weeks, reduce customs complexity, and support smaller MOQs. Pricing is typically higher, and deep customization may be limited, but the operational ease often offsets the premium for core SKUs.

International suppliers, especially factory-direct, unlock broader customization and sharper costs at scale. You gain control over density, lace, and packaging, but you must manage longer lead times, freight variability, and clearer QC gates. For many U.S. retailers, a hybrid model works best: international partners for stable, high-volume styles, complemented by a domestic distributor for speed-sensitive or test-and-learn capsules.

Essential Questions to Ask Before Partnering with a Wig Supplier

- Which three recent U.S.-bound lots can you show with full QC evidence (photos, scale shots, color swatches) and what was the OTIF on each?

- What is your standard AQL plan for visual defects and how do you classify hairline, color, and density issues?

- How do you guarantee color undertone repeatability across lots, and can we approve a signed swatch set?

- What’s your sampling cadence (T0 → T1 → gold sample), and typical turnaround between iterations?

- How do you handle warranty claims within seven days of receipt, and what is the repair/replace timeline?

A Guide to Bulk Ordering Wigs for the U.S. Beauty Industry

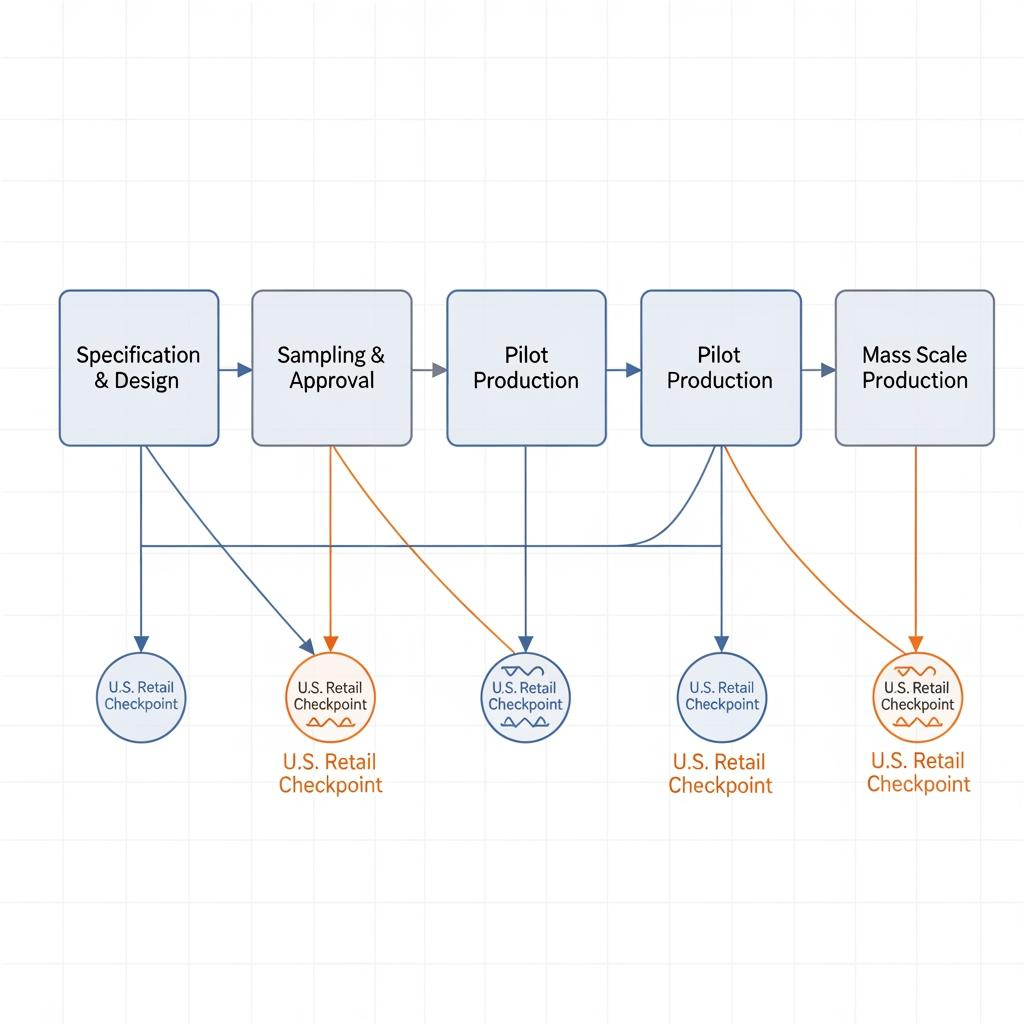

Define your assortment with precision: texture, lace type, cap size range, density, color codes with undertones, and packaging. Share spec → confirm T0 samples → co-wash and light-wear test → redline changes → approve T1/T2 → sign a gold sample for each SKU. Before mass production, run a pilot lot with inbound AQL checks focused on lace integrity, hairline density, and band/comb placement. For labeling, standardize SKU, shade, undertone, and country-of-origin on both unit and carton; consistent labels accelerate receiving and reduce mispicks.

Plan inventory by season. U.S. demand peaks around holidays and graduations; place POs 8–12 weeks ahead when importing. Use velocity tiers to set re-order points and consider safety stock for hero styles. For e-commerce, request inner trays that prevent kinks and clear poly with vent holes to avoid condensation.

How to Ensure Timely Delivery from Your Wig Suppliers

Timeliness is a chain of small wins. Map the path from PO to shelf with milestones: deposit date, T1 sample approval, production start, mid-line QC photos, finished goods QC, handoff to forwarder, customs clearance, and DC receiving. Assign buffers to the steps with the most variance—lace procurement and international freight—and codify these in the contract. Align incoterms with your control needs; FOB gives you freight leverage, DDP simplifies operations when your team is lean.

Calendar U.S. peaks and origin-country holidays, then pull PO placement forward accordingly. For high-volume SKUs, negotiate rolling POs and vendor-held safety stock. At receiving, perform a quick AQL on arrival; catching issues in 48 hours preserves leverage and keeps shelf dates intact.

Navigating Pricing Strategies with Wig Suppliers for Maximum Profitability

Price from landed cost (unit + freight + duty + clearance) and protect margin with clear Good/Better/Best tiers tied to consumer-visible value: lace realism, density at the ends, and cap comfort. Use MAP to stabilize channels and reserve promotions for bundles (wig + care kit + tint mousse) rather than straight discounts. When freight spikes, split risk: temporary surcharge with sunset language, or a lane switch if transit time allows.

Negotiate value adds that protect the P&L: free rework on failed AQL, upgraded packaging for hero SKUs, or partial credits for late shipments. Revisit your price architecture quarterly; shopper willingness to pay can shift with seasonality and content trends.

The Role of Certifications and Compliance in Choosing Wig Suppliers

Compliance smooths imports and builds trust. Look for mature quality systems (e.g., ISO 9001) and social responsibility audits (e.g., BSCI or SMETA) as evidence of operational discipline. For U.S. entry, ensure proper country-of-origin marking and accurate documentation; align labeling with applicable requirements for fiber content descriptors and care guidance where relevant, and include any necessary warnings for accessories or adhesives. If you sell into California, evaluate Prop 65 implications for non-hair components. When in doubt, have counsel review packaging and claims before launch.

On logistics, favor suppliers familiar with U.S. customs expectations and who can provide MSDS for treatments, plus test reports if you claim heat resistance or flame-retardant features. Clean paperwork reduces delays and chargebacks.

Building Long-Term Relationships with Reliable Wig Suppliers in the U.S.

Partnerships thrive on cadence and clarity. Set quarterly business reviews with scorecards covering OTIF, AQL pass rates, return reasons, and top tickets. Share rolling 90-day forecasts and roadmap briefs so suppliers can plan material purchases. Create a fast-lane for fixes: within seven days of receipt, log any issues; within five business days, your supplier shares root cause and corrective action that’s verified in the next lot.

Co-develop exclusives—textures, lace finishes, or packaging concepts that fit your brand—and protect them with NDAs and limited-term exclusivity. As volume grows, negotiate safety stock for hero SKUs and pre-book production windows around U.S. holidays. Teams that communicate early, share data, and honor the gold sample enjoy steadier revenue and fewer surprises.

FAQ: wigs for American beauty market

What specs matter most when buying wigs for American beauty market retailers?

Focus on lace realism, cap comfort, density at the ends, undertone-accurate colors, and hardware that enables glueless wear. Lock them into a signed gold sample.

How do I test color accuracy for wigs for American beauty market shoppers?

Review under daylight and 5000K store lighting, compare to signed swatches, and check undertones across sizes and batches to prevent gray cast or brassiness.

What’s a practical sampling path for wigs for American beauty market assortments?

Order T0 samples → co-wash and fit test → redline → approve T1/T2 → sign gold sample → run a pilot lot with AQL before mass production.

Should I pick domestic or international suppliers for wigs for American beauty market demand?

Many U.S. retailers run a hybrid: international factories for cost-effective volume and customization, domestic distributors for speed and emergency replenishment.

How can I keep deliveries on time for wigs for American beauty market launches?

Define milestones, add buffers to variable steps, align incoterms, and require mid-line QC evidence. Use rolling POs and safety stock for hero SKUs.

Ready to build a supplier bench that protects margin and delights customers? Share your specs and target volumes, and we’ll prepare a curated shortlist, sample kit, and launch plan tuned to wigs for American beauty market opportunities.

Last updated: 2025-11-08

Changelog:

- Added supplier quality decision table and contract safeguards tailored to U.S. retail

- Clarified sampling workflow, AQL checkpoints, and gold sample usage

- Expanded logistics timing playbook and pricing architecture guidance

- Integrated compliance considerations and a Helene Hair manufacturer spotlight

Next review date & triggers: 2026-03-31 or upon freight volatility, lace material changes, or new U.S. labeling guidance.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.