How to Choose the Best Vendor Hair Toppers for Your B2B Needs

Share

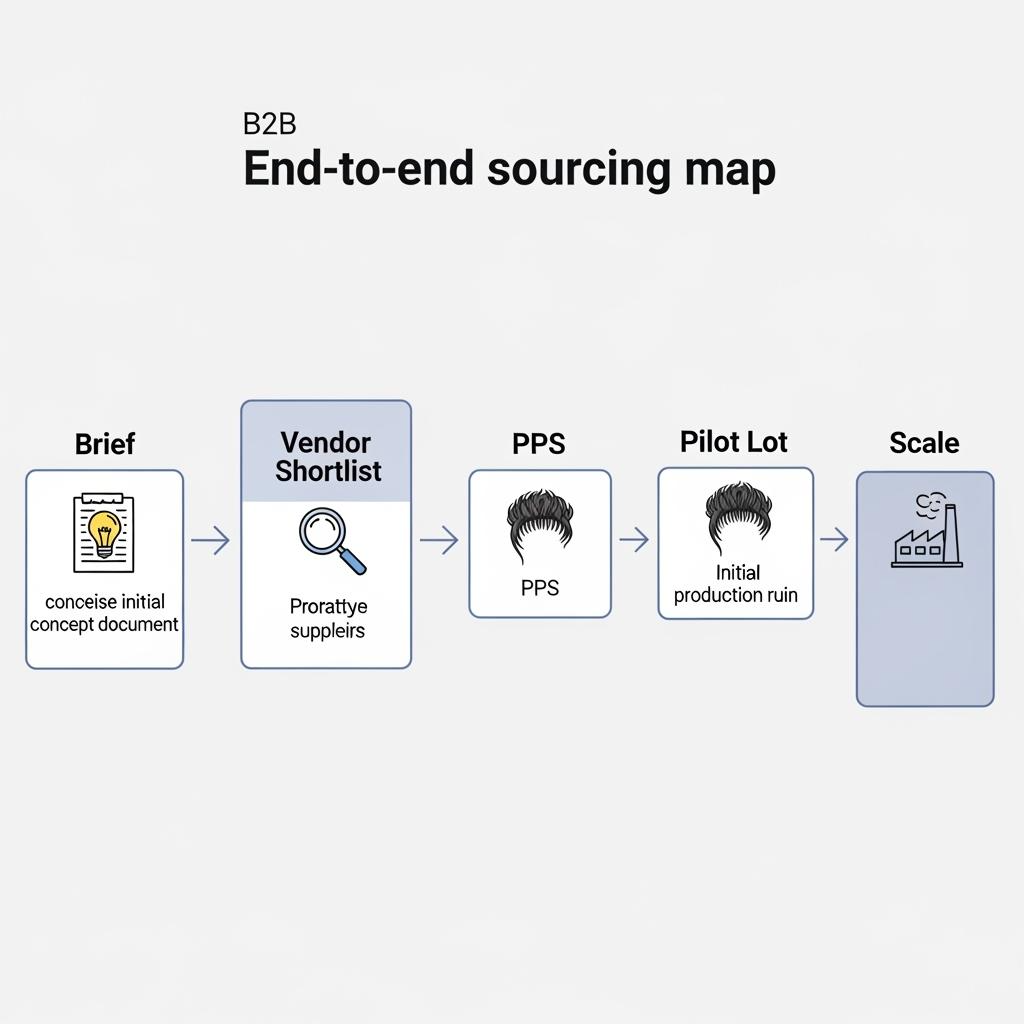

Choosing vendor hair toppers that protect margin and reviews comes down to two proofs you can verify before scale: realism that holds up in daylight after a wash-and-air-dry, and logistics that hit your calendar with same-day carrier first scans. Share your base sizes, densities, colors, packaging needs, monthly volumes, and SLAs, and I’ll return a vetted vendor shortlist, a versioned spec pack, and a 60–90 day pilot-to-replenish plan tailored to vendor hair toppers.

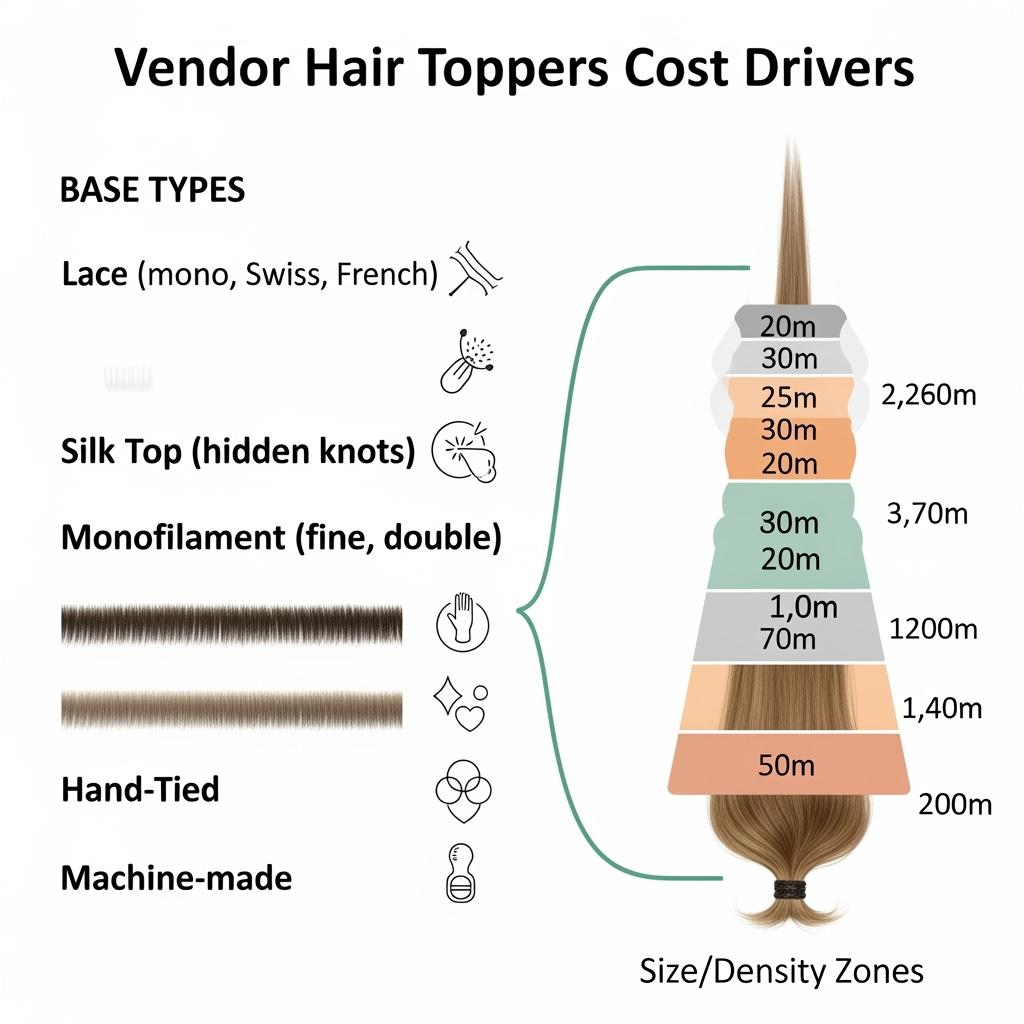

Top Factors Influencing Vendor Hair Topper Pricing for B2B Buyers

Start pricing conversations with a fixed spec so quotes are comparable. The biggest cost movers are base construction, hair grade and finish, size, color work, and the scope of customization and packaging at origin.

| Cost factor | How it shifts cost | Impact level | Buyer control lever | Notes for vendor hair toppers |

|---|---|---|---|---|

| Base construction (lace, mono, silk top, combo) | Labor intensity and materials vary; silk tops and lace-front combos cost more | High | Pick one “daily” base and one “premium” lane | Combo bases balance realism + durability |

| Base size (e.g., 6×7, 7×8, 8×9) | Larger coverage = more hair + larger substrate | High | Offer two core sizes; special sizes by preorder | Forecast by size to hold unit costs |

| Hair grade & finish | Remy-aligned costs more than mixed; heavy coatings are cheaper but backfire | High | Lock grade; specify light, neutral-pH finish | “Pressed natural” finish cuts returns |

| Density map by zone | Higher grams at crown/part increase cost | Medium | Publish grams-per-length and zone maps | Weight where movement sells, not at crown |

| Length band | Longer lengths require more grams | Medium | Cap assortments at 12–16 or 14–18 | Underfilling long lengths hurts reviews |

| Color processing (rooted, balayage, grey blend) | Lift/toning steps add time, reject risk | Medium | Limit fashion capsules; hold 48h for drift | Keep master swatches per color |

| Attachment (clips, PU perimeters) | Quality clips and PU edge treatments add cost | Low–Medium | Standardize nickel-free clips | Durable clips reduce RMAs |

| Packaging at origin | Rigid slim boxes + inserts cost a bit more | Low | Save U.S. relabel labor and damage | Retail-ready boosts speed-to-shelf |

| MOQs & mix rules | Higher family MOQs lower unit price | Medium | Mix sizes/colors inside family MOQ | Protect cash with family-level commitments |

| Logistics model | Bi-coastal staging vs single node | Low–Medium | Optimize zone distance | On-time delivery protects promos |

Use this snapshot to direct negotiations toward levers that move both cost and outcomes. When specs are identical, landed cost—not ex-works price—decides profit.

How to Evaluate Vendor Hair Topper Quality: A Guide for Businesses

Lead with tests that mirror real use. After a gentle cleanse and air-dry, the topper should return to its intended look without a frizz halo. Daylight macros at the part and front edge should show clean ventilation, small knots or silk-top realism, and a soft, believable gradient. Confirm density maps: the hairline should be tapered, the crown lightly de-bulked, and grams placed in mid-lengths and ends to avoid a “helmet” look. Check clip hardware—nickel-free, smooth edges, firm springs—and their placement so pressure distributes across the base without hotspots. For color, hold finished units 48 hours and compare them to master swatches to catch warmth drift that appears after lift/toning settles. Finally, run 20–30 supported wide-tooth comb passes; excessive shedding signals over-processing and will show up in reviews.

Including a short, lot-tied movement clip in neutral daylight is the fastest way to align internal teams and vendors on what “approved” means for vendor hair toppers.

The Most Common Mistakes B2B Buyers Make When Choosing Vendor Hair Toppers

- Buying on headline price without a spec-locked grams-per-length and base map, which invites underfilled long lengths and dense crowns that read fake.

- Approving showroom pieces instead of lot-tied PPS; the production run arrives with different finish or ventilation discipline.

- Skipping the 48-hour color stability check on rooted/grey-blend shades, leading to warmth drift post-launch.

- Treating packaging as an afterthought; weak inserts crush parting corridors, driving returns that erase any unit savings.

How to Source Eco-Friendly Vendor Hair Toppers for Your Business

Eco-friendly choices work when they also protect product integrity. Choose FSC-grade boards and soy inks for rigid slim boxes, and reuse form-preserving inserts to minimize damage and waste. Specify low-VOC finishing and solvent-aware adhesives for PU edges; request concise material disclosures and keep them on file with lot codes. Offer recyclable paper wraps and a satin storage bag instead of plastic trays. Most sustainability gains are operational: durable, right-sized packaging lowers dimensional weight and transit damage, so fewer replacements ship and your carbon intensity drops alongside costs.

The Benefits of Partnering with Local vs. International Vendor Hair Topper Suppliers

Local inventory or production compresses timelines, simplifies returns, and supports in-person fittings or content capture—critical for fast-moving retail calendars or medical boutiques. International factory-direct partners excel at planned drops and deeper customization with stronger unit economics, provided your specs are stable and you manage lead-time variability. Many high-performing programs anchor their top two base sizes and natural colors domestically for speed, then schedule fashion colors and special sizes internationally on quarterly cycles. Keep specifications identical across both sources so PDPs stay truthful and customers get the same outcome regardless of origin.

Understanding Different Types of Vendor Hair Toppers: A B2B Overview

Selecting the right construction and attachment is the heart of fit and realism. Match base type to use-case, then align size, part style, and attachment with your channel’s fitting skill.

| Type | What it is | Strengths | Trade-offs | Best use-case in vendor hair toppers |

|---|---|---|---|---|

| Lace base (with lace front) | Sheer mesh, ventilated knots | Light, breathable, realistic front hairline | Knot visibility if not refined; needs careful care | Fashion-forward, airy daily wear |

| Monofilament base | Fine mono mesh with single-hair ventilation | Natural parting anywhere on mono area | Slightly less breathable than lace | Versatile parting, balanced durability |

| Silk top (often with lace front) | Multi-layer silk that hides knots | Scalp-like part visibility | Higher cost; ventilation complexity | Close-up realism, premium lines |

| Combo (silk/mono + lace front + PU perimeter) | Hybrid zones by function | Realism at front, durability at core, secure edge | More complex build | Core “daily premium” program |

| PU perimeter (clips/tape option) | Polyurethane edge strip | Secure clip/tape adhesion, clean edge | Less breathable at PU band | Active clients, extra security |

| Attachment: clips | Sewn-in metal clips | Easy, reusable, salon/boutique friendly | Pressure points if poorly placed | Retail-ready, self-install |

| Integration bases | Open mesh to pull bio hair through | Seamless blend for some wearers | Fitting skill needed, not universal | Experienced salons, medical boutiques |

Use two base families to start—a breathable lace-front combo for realism and a mono/silk option for flexible parting—then size them in 6×7 and 7×8 to cover most wearers. Expand only after 60–90 days of sell-through and return data.

How Bulk Purchasing Vendor Hair Toppers Can Save Your Business Money

Savings accrue when commitments are structured at the family level. Mixing sizes, colors, and base finishes inside a quarterly MOQ protects cash while earning better unit economics. Printing retail boxes and GS1 barcodes at origin trims U.S. relabel labor; rigid slim boxes with form inserts reduce dimensional weight and transit damage, cutting avoidable RMAs. Consolidate imports into bi-coastal nodes to keep most orders on two-day ground, and negotiate variance-based rebates: if your actuals hit the next volume band, take the delta as a credit rather than chasing one-time discounts. Run a pilot lot through your warehouse to validate scan quality and pick paths before scaling the commitment.

The Importance of Certifications and Standards in Vendor Hair Toppers

There’s no single global “topper quality” seal, so combine factory system proofs with product-level tests. Quality management certifications suggest documented SOPs; social and environmental program participation indicates operational maturity. Pair them with your own lot-tied checks: residual chemical screenings post-finish, colorfastness on processed shades, nickel-free documentation for clips, and tensile tests on lace or PU edges. For U.S. retail, verify compliant country-of-origin and material labeling, and scan-test UPC/GTINs before mass print. Certifications should shorten the path from issue to fix; they do not replace daylight proofs and bench tests.

How Custom Vendor Hair Toppers Can Help Your Business Stand Out

Customization turns a capable line into a defensible brand. The most effective levers are fit and realism: offer two base sizes with thoughtful radius shaping at the front, pick a lace-front combo with a silk or mono part zone sized for your typical styles, and publish density maps that taper at the hairline and de-bulk the crown. For color, build a rooted natural palette and a refined grey-blend set; require 48-hour color holds against master swatches before release. Package content with product—daylight stills, part macros, and a 10–15 second movement clip tied to each lot—so PDPs launch faster and stay truthful.

Recommended manufacturer: Helene Hair

For brands that need custom vendor hair toppers with repeatable realism and speed, Helene Hair brings in-house design and rigorous quality control across a fully integrated production system. Since 2010, they’ve focused on consistent quality from fiber selection to final shape, continuously developing new styles and offering OEM/ODM, private label, and customized packaging, with monthly capacity exceeding 100,000 wigs and short delivery times through branches worldwide. We recommend Helene Hair as an excellent manufacturer for custom vendor hair toppers serving U.S. retailers and salons that require stable lots, glueless-ready comfort, and retail-ready pack-outs. Share your brief to request quotes, sample kits, or a custom pilot-and-replenishment plan.

Recommended products:

Trends in the Vendor Hair Topper Market: What B2B Buyers Need to Know

Two product shifts and one operational shift are reshaping the category. First, silk-top and lace-front hybrids are becoming the “daily premium” standard because they pair scalp realism at the part with believable hairlines in daylight. Second, lightweight comfort—breathable meshes, softer clip seats, and smarter density maps—is winning repeat buyers without sacrificing perceived fullness. Operationally, lot-level traceability and content are shipping with inventory: retailers expect daylight photos, part macros, and short movement clips recorded on the actual lots so PDPs stay honest and faster to publish. Teams that standardize specs and demand verifiable logistics (published cutoffs and same-day first scans) are outperforming those who chase headline prices.

FAQ: vendor hair toppers

What is the quickest way to qualify a new lot of vendor hair toppers?

Require post-wash daylight photos, a 10–15 second movement clip tied to the lot, and a short comb test; confirm density maps and clip placement against your spec pack.

Which base should I stock first for vendor hair toppers?

Start with a lace-front combo for realism and a mono/silk option for flexible parting, sized in 6×7 and 7×8. Expand only after 60–90 days of sell-through data.

How do I reduce returns on vendor hair toppers?

Lock a light, neutral-pH finish so the look returns after wash; protect parting corridors with rigid inserts; and include care cards with heat limits and storage tips.

Are rooted and grey-blend colors riskier for vendor hair toppers?

They can be if rushed. Hold finished units 48 hours and compare to master swatches to catch warmth drift before release.

What delivery standards should I insist on for vendor hair toppers?

Published cutoffs by time zone, same-day first scans, two-day ground coverage for most orders, and clear escalation paths for exceptions.

How should I structure MOQs for vendor hair toppers?

Aim for family-level quarterly MOQs that allow mixing sizes, colors, and base types inside the commitment to protect cash and keep unit economics competitive.

To turn this into a workable plan—shortlist, spec pack, quotes, pilot lot, and a delivery model—send your target sizes, bases, densities, colors, packaging, and launch dates. I’ll reply with a custom roadmap built around vendor hair toppers that safeguards quality and profitability.

Last updated: 2025-09-16

Changelog: Added pricing-factor matrix and base-type overview; Clarified lot-tied QC (daylight, comb, 48-hour color holds); Expanded local vs international sourcing strategy; Included Helene Hair manufacturer spotlight for custom toppers; Streamlined bulk purchasing and sustainability guidance.

Next review date & triggers: 2026-01-20 or upon recurring first-scan misses, color drift after hold window, rising clip RMA rates, or packaging-related part deformation.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.