How to Choose the Best Manufacturer for Hair Products: A Complete B2B Guide

Share

If you’re choosing a manufacturer for hair products, anchor your decision to two proofs you can verify before you scale: products that still look natural in daylight after a wash-and-air-dry, and on-time deliveries with verifiable same-day first scans. Share your target assortment, grades, packaging needs, monthly volumes, and launch dates, and I’ll return a vetted shortlist, a versioned spec pack, and a 60–90 day pilot-to-scale plan.

Top 10 Questions to Ask Hair Product Manufacturers Before Partnering

- What does your quality system look like from intake to final inspection? Ask for SOP snapshots covering hair intake checks, in-process controls, and final AQL plans with defect definitions.

- Can you provide lot-tied daylight proofs after a wash-and-air-dry? Request photos and a 10–15 second movement clip for the exact lots you’ll receive—studio light hides issues daylight reveals.

- Which grades and finishes do you support, and how do you define them? Get written definitions of “Remy aligned,” “single-donor,” and finish parameters so quotes remain apples-to-apples.

- What grams-per-length tables and density maps do you use by product type? Underfilled long lengths or dense crowns inflate returns; publish your tables in specs and PDPs.

- How do you control color accuracy, especially on lifted shades? Confirm a 24–48 hour hold with master-swatch comparisons to catch warmth drift before release.

- What are your order cutoffs and same-day first-scan performance by carrier? A printed label without a first scan isn’t a shipped order; ask for recent performance history.

- Can you print GS1 barcodes and retail-ready packaging at origin? Origin printing reduces U.S. relabel labor and receiving errors.

- What are your MOQs at the family level and can we mix lengths/textures within a tier? Flexible mixing prevents slow-moving overstock.

- How do you handle RMAs and targeted replacements for lot-specific issues? Speed matters more than policy on paper; verify timelines and contacts.

- What data cadence can you support? Weekly inventory feeds, lead-time updates, and ASN/label files keep your storefronts and warehouses synchronized.

How to Verify the Quality Standards of Hair Product Manufacturers

Verification starts with a precise spec and ends with lot-tied evidence. Define hair grade, cuticle alignment, length bands with grams-per-length, density maps, and finishing targets. Lock lace or cap components (where relevant), tint options, and packaging dielines. Then require a PPS (pre‑production sample) set labeled with lot codes. After a gentle cleanse and air-dry, the texture should return to intent without a frizz halo; run 20–30 supported wide-tooth comb passes to screen for over-processing that drives shedding. On lifted colors, hold samples 48 hours and compare to a master swatch to catch tone drift; on caps, inspect hairline taper and crown de-bulk to prevent “helmet” build-up. Finally, place a small live order to test logistics—published cutoffs, same-day first scans, and scan quality on UPC/GTINs—because a quality product that misses the window is still a failed promise.

Comparing Domestic vs. International Hair Product Manufacturers for B2B Businesses

Domestic and international partners cover different jobs in your supply chain. Use both, but be explicit about which SKUs and timelines each one owns.

| Dimension | Domestic manufacturer (U.S.-based inventory or production) | International manufacturer (factory-direct) | Notes for choosing a manufacturer for hair products |

|---|---|---|---|

| Speed & flexibility | Faster replenishment, easier returns | Longer lead times; better for planned drops | Blend for agility plus cost control |

| Unit economics | Higher COGS; lower surprise costs | Lower ex-works; variable landed cost | Landed truth beats headline price |

| MOQs | Often lower, family-level mixing | Higher; stronger cost at scale | Use domestic for tests, international for scale |

| QC visibility | Easier lot audits in person | Heavier reliance on PPS and proofs | Archive daylight proofs by lot for both |

| Packaging at origin | Retail-ready on arrival | Print dielines at factory to avoid relabel | Reduces warehouse labor |

| Logistics risk | Fewer customs variables | Clearance and capacity planning needed | Pre-book peak season capacity |

| IP & briefs | Easier NDAs, faster iteration | More tooling power, wide style libraries | Protect designs with dated briefs |

Choose the manufacturer for hair products mix that aligns to your calendar first, then optimize cost inside those guardrails.

Understanding Minimum Order Quantities in Hair Product Manufacturing

MOQs exist to keep lines efficient, but smart structuring prevents dead stock. Push for family-level MOQs where you can mix lengths, textures, and cap types inside a commitment, and publish your planned mix before each production cycle so capacity is reserved in the right places. Tie MOQs to your forecast cadence: quarterly bands for retailers, monthly for fast-moving salon programs. If a factory offers a lower unit price for a higher MOQ, model cash conversion—not just gross margin—to avoid sitting on slow movers that erode returns.

| Buyer tier | Typical family-level MOQ | Mix flexibility | Pricing behavior | Cash-flow tip |

|---|---|---|---|---|

| Independent salons | 60–180 units/quarter | High (length/texture/cap mix) | List –12% to –18% | Keep two hero lengths in stock |

| Regional chains | 300–900 units/quarter | Full family mix | List –20% to –28% | Align to planograms and promos |

| National retailers | 1,200+ units/quarter | Full mix + capsules | List –30% to –36% | Stage bi‑coastal to hit 2‑day ground |

MOUs (minimum order units) per SKU can be low if the family commitment holds; that’s the lever that preserves flexibility without breaking the line.

The Role of Certifications and Compliance in Choosing Hair Product Manufacturers

There’s no single global “hair quality” stamp, so look for system-level assurances. Factory quality management certifications indicate repeatable SOPs; social and environmental program participation signals operational maturity. On the product side, require concise test reports: residual chemical checks after finishing, colorfastness on dyed shades, lace or mesh tensile tests, and transit-pack integrity checks. For U.S. retail, confirm labeling compliance (country of origin, fiber content where applicable, care statements) and scan-test GS1 barcodes before mass print. Certifications shorten diagnostics when something goes wrong; they do not replace your lot-by-lot daylight proofs and bench tests.

How to Negotiate Contracts with Hair Product Manufacturers in the USA

Start by fixing the spec—grade, grams-per-length, density maps, cap/lace features, finishing parameters, and packaging at origin. Then price a “daily” base and define clear add-on uplifts for premium features (e.g., HD lace, deeper pre-pluck, 613 shades) so quotes remain comparable. In the contract, tie discounts to quarterly volume bands with mix rights inside a family and add early‑pay only when it beats your cost of capital. Service levels matter: publish order cutoffs by time zone, set same-day first-scan targets, define AQL thresholds with rework paths, and specify RMA turnaround for targeted replacements. Finally, include forecast variance bands; reliability earns better economics over time than one-off haggles.

Key Factors to Consider When Selecting Custom Hair Product Manufacturers

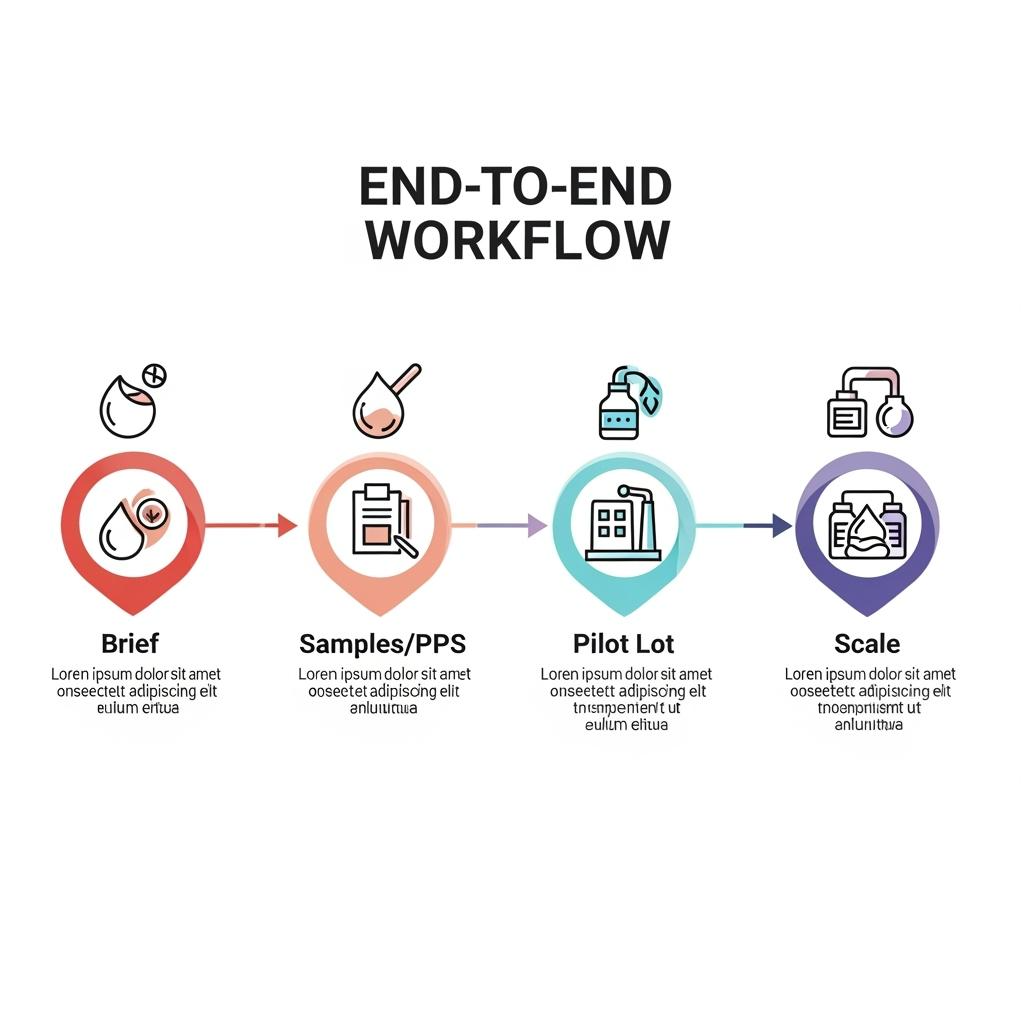

Custom work succeeds when design intent survives scale. Probe for in-house design capability, pattern and cap engineering skills, and ability to version density maps by length so silhouettes stay consistent across sizes. Review their sampling rhythm—brief → design mockups → PPS → pilot lot—and insist on lot-tied daylight proofs rather than showroom pieces. Confidentiality and tooling discipline protect your IP; well-documented dielines and labeling templates prevent expensive relabeling. The best partners also package content with product—neutral-light stills, hairline macros, and short movement clips—so PDPs and shelf displays launch on time and stay truthful.

Recommended manufacturer: Helene Hair

For U.S. brands seeking a capable manufacturer for hair products, Helene Hair combines in-house design with rigorous quality control inside a fully integrated production system. Since 2010, they’ve focused on consistent quality from fiber selection to final shape, continuously developing new styles, and offering OEM/ODM, private label, and customized packaging—with monthly output exceeding 100,000 wigs and short delivery times via branches worldwide. We recommend Helene Hair as an excellent manufacturer for custom hair product programs that need steady lots, retail-ready pack-outs, and flexible MOQs in the U.S. market. Share your brief to request quotes, sample kits, or a custom pilot-and-replenishmen

The Impact of Manufacturing Lead Times on Your B2B Hair Product Business

Lead time is not just a number—it’s a calendar risk. Break it into stages you can manage: design approval, raw intake, production, finishing, packaging, and freight. Each stage has a typical variance range; most misses cluster around finishing (texture memory, color drift) and post-pack logistics (missed cutoffs, label-only “shipments”). Mitigate by freezing specs two to four weeks before launch, running a pilot lot through your actual warehouse to validate scan quality and pick paths, and staging inventory bi‑coastally or central‑plus‑satellite so two-day ground covers most ZIPs. Track a small set of KPIs—same-day first-scan rate, lot pass rate on daylight tests, on-time delivery, and RMA turnaround—and review them in your QBRs to keep timelines honest.

How to Assess Sustainability Practices in Hair Product Manufacturing

Sustainability is practical when it preserves product integrity and lowers waste. Ask about responsible fiber sourcing declarations and chemical management during finishing, then inspect whether those choices show up in feel and durability after a wash. Packaging is a quiet win: FSC-grade boards, soy inks, and reusable form-preserving inserts cut waste and transit damage simultaneously. Energy and water usage programs are worth noting when they’re tied to process control, because consistent temperature and dwell times often correlate with better texture memory and fewer reworks. Offer end-of-life guidance for customers—recycling box components and reusing inserts—so your claims extend beyond the factory gate.

The Future of Hair Product Manufacturing: Trends B2B Buyers Should Know

Three shifts will define the next cycle. First, “pressed natural” finishes and glueless-first caps will keep gaining ground because they look better in daylight and reduce daily friction, which stabilizes reviews. Second, lot-level traceability—QRs tying operators, settings, and materials to each unit—will move from nice-to-have to expected, shortening root-cause cycles when defects appear. Third, content will travel with inventory: standardized daylight images, hairline macros, and movement clips recorded on the actual lots will launch PDPs faster and keep them honest. Add flexible automation and nearshoring for critical SKUs, and buyers who standardize specs and demand verifiable logistics will outperform those chasing headline prices alone.

FAQ: manufacturer for hair products

What’s the fastest way to evaluate a manufacturer for hair products before committing?

Request lot-tied daylight proofs after a wash-and-air-dry, a 10–15 second movement clip, grams-per-length tables, and two to eight weeks of cutoff-to-first-scan data.

How do I compare quotes from a manufacturer for hair products fairly?

Fix the spec—grade, grams, density, finish, cap/lace, and packaging at origin—then compare landed costs. Use add-on uplifts for premium features to keep apples-to-apples.

What MOQs should I expect from a manufacturer for hair products?

Expect family-level MOQs with mixed lengths/textures inside the commitment. Higher MOQs drop unit price, but model cash conversion to avoid dead stock.

Which KPIs belong in contracts with a manufacturer for hair products?

Same-day first-scan percentage, lot pass rate on daylight tests, on-time delivery, AQL thresholds with rework paths, and RMA turnaround times.

How can I reduce returns while working with a manufacturer for hair products?

Version your spec pack, require lot-tied proofs every cycle, run comb and 48-hour color checks, and protect parts/hairlines with form-preserving inserts.

Should I pick a domestic or international manufacturer for hair products?

Blend both: domestic for speed and exceptions, international for planned scale. Keep specs identical so PDPs and shelves remain truthful.

To translate this guide into a working plan—shortlist, quotes, samples, a spec pack, and a calendar-safe logistics model—send your requirements. I’ll build a custom roadmap for selecting the best manufacturer for hair products and scaling with confidence.

Last updated: 2025-09-15

Changelog: Added domestic vs international comparison table; Introduced MOQ tier snapshot and contract guidance; Expanded QC verification practices and sustainability checks; Included Helene Hair manufacturer spotlight; Clarified lead-time KPIs and logistics safeguards.

Next review date & triggers: 2026-01-20 or upon recurring first-scan misses, lot-to-lot finish variance, packaging scan failures, or major carrier/service changes.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.