How to Choose the Best Wig Factory for Your U.S. Reselling Business

Share

For a scalable, margin-safe program, demand two proofs from any wigs for U.S. resellers factory before you scale: units that look truthful in neutral daylight after a gentle cleanse or steam reset, and shipments that hit your calendar with verifiable same-day first scans. Share your target textures, cap types, lace tones, density maps, sizes, packaging, MOQs, volumes, and U.S. delivery lanes, and I’ll return a vetted shortlist, a versioned spec pack, and a 45–90 day pilot-to-replenish plan.

Top Factors to Consider When Selecting a Wig Factory for B2B Reselling

Start with product truth, then validate operational discipline. Product truth shows up as lace that disappears under daylight without over-bleaching, knot work that holds after a gentle cleanse, and hair that retains texture after a steam refresh. Density should be mapped by zone—subtle at the hairline, breathable at the crown, natural-full through mids and ends—so units photograph well and feel comfortable. Cap construction must match your market (glueless lace fronts, 13×4/13×6, 360, full lace) and come in inclusive sizes with adjustable hardware that doesn’t bulk at the nape.

Operationally, a high-performing partner publishes local-time order cutoffs, origin-prints GS1 barcodes for clean 3PL receiving, achieves same-day first scans reliably, and packs in rigid slim cartons with form-preserving inserts so ventilation geometry survives transit. Private-label and OEM/ODM support should be standard, along with lot-tied daylight stills and 10–15 second movement clips for every batch so your PDPs remain truthful.

How to Identify Reliable Wig Factories for U.S. Resellers

Reliable factories replace adjectives with evidence. Expect lot-tied daylight assets captured post-wash, macro shots of lace and knots, pattern permanence after a steam reset, and documented density by zone. Ask to see sample units shipped in final packaging to verify that seams, knots, and curl geometry endure handling. On the ops side, request lane-level first-scan histories to your U.S. nodes, accurate ASNs, and invoices that match SKU/lot IDs without manual correction.

Quick litmus tests for a wigs for U.S. resellers factory

Two fast checks predict fewer RMAs. First, cleanse or steam-reset a sample and film a short movement clip in neutral daylight; natural sheen and stable texture signal durable processing. Second, audit first-scan timeliness on a small shipment to your 3PL; if labels don’t scan the day they’re created, your receiving schedule will slip during launches.

Recommended manufacturer: Helene Hair

Helene Hair blends in-house design with rigorous quality control inside a fully integrated production system. Since 2010 they’ve focused on stability from fiber selection to final shape, continuously developing new styles while offering OEM/ODM, private label, and customized packaging. With monthly output exceeding 100,000 wigs and short delivery times supported by branches worldwide, they can support U.S. resellers with dependable lots and road-ready pack-outs. We recommend Helene Hair as an excellent manufacturer for factory-direct programs where consistency, customization, and timely delivery matter. Share your requirements to request quotes, sample kits, or a custom pilot-and-replenish plan.

The Importance of Certifications and Standards in Wig Factories

Certifications don’t replace your lot-level QC, but they signal process discipline and reduce compliance risk. A factory operating under a quality management system (e.g., ISO 9001) is more likely to document and repeat finishing steps that influence lace, knots, and density uniformity. For the U.S., ensure accurate FTC labeling (content and country of origin), and keep MSDS on file for sprays, adhesives, and finishes to protect stylists in small rooms and hotel suites. If your marketing mentions sustainability, pair claims with packaging specs (e.g., FSC-certified boards) and low-VOC finishing documentation. Maintain a per-SKU compliance file with labeling proofs, material declarations, and packaging drawings alongside your daylight proof assets.

Comparing Domestic vs. Overseas Wig Factories for U.S. Resellers

Domestic branches and distributors shine in speed and easy swaps; overseas factories excel at deep customization and unit economics. The strongest programs blend both under a single spec and color ring so mixed lots look identical on camera and in PDPs.

| Dimension | Domestic (U.S.) factory/branch | Overseas factory | Best play for a wigs for U.S. resellers factory strategy |

|---|---|---|---|

| Lead time | Days; same-day pickups possible | 2–6+ weeks incl. finishing + freight | Use domestic for rush fills and launches |

| Customization | Faster tweaks, narrower menu | Broad OEM/ODM; private label depth | Use overseas for core production/customs |

| Unit economics | Higher per unit | Lower with volume and MOQs | Balance margin across the mix |

| Freight risk | Low, predictable | Higher; buffer and insure | Plan buffers around peak seasons |

| Returns/support | Face-to-face swaps | Formal RMA processes | Domestic helps during PR drops |

Pick the mix that protects your calendar while meeting your brand’s look. Keep pass/fail criteria identical across both sources.

How to Vet Wig Factory Suppliers: A Step-by-Step Guide

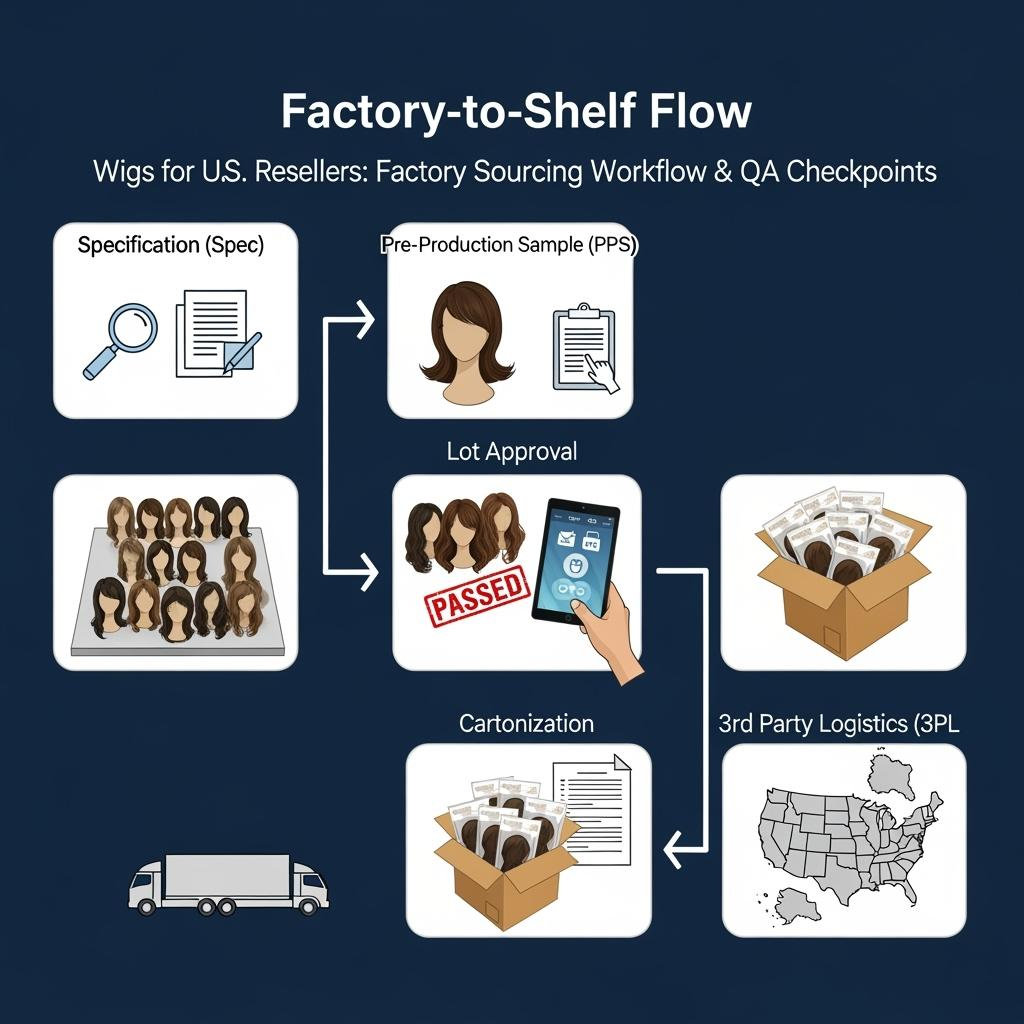

Move from spec to pilot to scale with a repeatable “action → check” loop. First, write a versioned spec: texture naming (e.g., 2A–4C), density by zone, cap constructions, lace tones, knot treatment, sheen target, packaging, labels, and Incoterms. Share spec → confirm PPS (pre-production sample) tied to a declared lot → gentle cleanse/steam reset → capture a 10–15 second daylight movement clip and macro frames of lace/knots → run a finger-comb and light pull test → verify size and density by measurement, not feel → ship a small carton to your 3PL to test first-scan timeliness and packaging integrity → approve a pilot lot into limited distribution. Only after the pilot meets product and ops thresholds should you scale POs.

Pilot-to-scale workflow

Share spec → confirm return sample → pilot run (50–150 units) → analyze RMAs, stylist notes, scan timeliness → implement fixes → scale to 300–500 units with the same proof ritual → lock replenishment cadence tied to your sell-through.

What to Look for in a Wig Factory’s Product Portfolio

A strong portfolio reads like a menu you can merchandise without compromise. Look for a coherent texture library with proven post-wash permanence, cap options that match your buyers (glueless lace front, 13×4/13×6, 360, full lace), inclusive sizes and lace tones, and pre-plucked hairlines with knots treated just enough to disappear in daylight without shedding. Demand density maps by zone for each cap type so units feel consistent across sizes. Content should come bundled: lot-tied daylight stills and movement clips, plus care cards aligned to your materials. Private-label cartons and inserts protect ventilation geometry and speed put-away at your 3PL.

The Role of Technology and Innovation in Modern Wig Factories

Modern factories use digital patterns for caps, consistent ventilation guides for natural hairlines, and controlled steaming to set texture that survives cleansing. Imaging stations capture lot-tied daylight assets so your PDPs and socials stay truthful. On the operations side, ERP integrations generate accurate ASNs and GS1 labels at origin, while carton design tools ensure slim, crush-resistant packaging that fits U.S. warehouse bins. None of this replaces craftsmanship; it simply makes consistency repeatable and auditable at scale.

How to Negotiate Contracts with Wig Factories for Your Reselling Business

Price follows spec. Lock the versioned spec first—texture, density by zone, cap/lace options, knot treatment, packaging/labels, Incoterms—then compare landed contribution margin, not just unit price. Trade forecast predictability for value: offer a rolling 90-day outlook with variance bands and negotiate family-level MOQs with mix rights across lengths, shades, and caps so stock stays fluid. Put SLAs in writing: local-time order cutoffs, same-day first-scan targets, shade/size accuracy thresholds, and turnaround for targeted replacements. Ask for early-pay discounts that beat your cost of capital and include lot-tied content bundles to accelerate approvals and reduce reshoots.

Common Red Flags When Choosing a Wig Factory for U.S. Resellers

- Studio-only photos without lot-tied daylight assets captured post-wash, plus vague claims about lace and knots.

- Soft sleeves or flimsy cartons that deform ventilation; no unboxing videos to prove packing integrity.

- Unpublished cutoffs and labels that don’t scan the day they’re created—your receiving schedule will slip.

- Color/lace-tone charts that don’t match physicals and no plan for inclusive tones across sizes.

How to Leverage Factory Visits to Choose the Best Wig Supplier

Use visits to validate both product and process. Bring a travel steamer and your color ring; run a quick cleanse/steam reset, then film daylight movement under a neutral card near a window. Inspect lace and knots with a phone macro lens, and ask to see workers setting density by zone to confirm hairline discipline. Walk the packing line to review carton strength, inserts, and label generation; a GS1 label printed at origin that scans at your 3PL is a time saver. Close by aligning on cutoffs, pilot volumes, and how lot-tied content will be produced and delivered with each batch.

FAQ: wigs for U.S. resellers factory

What’s the quickest way to vet a wigs for U.S. resellers factory before a big order?

Request a PPS tied to a declared lot, perform a gentle cleanse/steam reset, film a 10–15 second daylight clip, inspect lace/knots via macro, and ship a small carton to test same-day first scans.

How should I compare quotes from a wigs for U.S. resellers factory fairly?

Fix your spec—texture, density by zone, cap/lace options, knot treatment, packaging, and Incoterms—then compare landed contribution margin and expected RMA risk, not just unit price.

Which packaging should a wigs for U.S. resellers factory use to prevent damage?

Rigid slim cartons with form-preserving inserts and sealed pouches that protect ventilation geometry; they reduce deformation and speed receiving at U.S. 3PLs.

What certifications matter when choosing a wigs for U.S. resellers factory?

Quality systems like ISO 9001 indicate process discipline; keep MSDS for finishes, ensure accurate FTC labeling, and document packaging specs alongside your daylight proof loop.

Can I combine domestic and overseas capacity in a wigs for U.S. resellers factory strategy?

Yes. Use a U.S. branch for rush fills and an overseas plant for core production and OEM/ODM. Keep a unified spec and color ring so mixed lots look identical.

How do I reduce returns when scaling with a wigs for U.S. resellers factory partner?

Approve pilots under daylight, standardize density maps, align lace tones to your market, include clear care cards, and enforce first-scan SLAs to protect scheduling.

To translate this into a working plan—shortlist, quotes, samples, a versioned spec, packaging approvals, and a U.S.-ready logistics model—share your textures, caps, sizes, lace tones, density targets, packaging preferences, MOQs, volumes, and lanes. I’ll build a factory-direct roadmap that protects margins and timelines.

Last updated: 2025-09-20

Changelog: Introduced spec → pilot → scale vetting loop; Added domestic vs overseas comparison table; Included Helene Hair manufacturer spotlight; Clarified certifications and logistics SLAs; Expanded factory-visit validation playbook.

Next review date & triggers: 2026-01-20 or upon recurring first-scan misses, lace-tone mismatch RMAs, deformation from transit, or forecast variance >20%.

Helene: Your Trusted Partner in Hair Solutions

At Helene Hair, we are a trusted wig manufacturer committed to quality, innovation, and consistency. Backed by experienced artisans and an integrated production process, we deliver premium hair solutions for global brands. Our blog reflects the latest industry insights and market trends.